Stock market participation today continues to shape economic landscapes in the United States and beyond. Today, 62% of Americans report owning stock, unchanged from 2024, finally matching pre‑2008 levels. This resurgence reflects expanding access through online platforms and employer-sponsored retirement plans.

Real‑world impacts are clear: households now directly own 38% of U.S. equities, and mobile trading growth fuels engagement in younger demographics. For financial advisors, these trends guide portfolio outreach, while policymakers monitor shifts in retail investor behavior to shape regulation. Continue exploring the full article to see how participation varies across income, education, geography, and more.

Editor’s Choice

- 62% of Americans report owning stock in 2025, consistent with 2024 and a return to pre‑recession levels.

- Retail inflows into U.S. stocks and ETFs totaled approximately $130–150 billion in early 2025, reflecting levels comparable to or surpassing previous retail enthusiasm peaks.

- U.S. households purchased around $20 billion in equities over a three-month span, which ranks among the top decile of flows over recent years.

- Direct household ownership accounts for 38% of U.S. equities.

- Retail investor flow into S&P 500 stocks hovered between 10% and 13% of total volume in 2025.

- Retail investors now form roughly 20% of the options market, exerting meaningful influence on volatility and trading patterns.

Recent Developments

- Retail trading has contributed tens of billions to global equities in 2025, with Vanda Research estimating that flows have exceeded $40 billion in select months.

- Hedge funds became net sellers in mid-2025, despite market rallies.

- Retail investors executed record‑level dip‑buying, gaining 31% in the Nasdaq 100 versus 7.8% overall returns.

- Stocks have benefited from the revival of the TINA (“there is no alternative”) ethos, with households purchasing at a record pace and the S&P 500 up nearly 20% since early April.

- Corporate buybacks hit $1 trillion, the fastest pace ever, adding liquidity to the equity markets.

- Institutional investors, “smart money”, have ramped up equity exposure, echoing earlier retail enthusiasm.

- Retail investors represent 20% of the options market, highlighting their expanding role in derivatives.

- While equity exposure has increased among households, Federal Reserve data places stock holdings closer to 150–180% of disposable income for affluent investors.

EPS Growth Outlook by Sector

- The S&P 500 is projected to grow earnings by 12.5% in the next 12 months, rising to 14.5% in 2025 and 14.0% in 2026.

- Technology leads all sectors with a 28.0% EPS growth forecast for the next 12 months, followed by 22.5% in 2025 and 17.0% in 2026.

- Communication Services shows strong gains with 25.0% EPS growth expected short term, 15.0% in 2025, and 13.5% in 2026.

- Consumer Discretionary projects 18.0% EPS growth over the next year, with moderate gains of 13.5% in 2025 and 14.5% in 2026.

- Financials forecast 14.0% EPS growth short term, softening to 10.0% in 2025, but recovering to 13.0% in 2026.

- Utilities remain stable with EPS growth of 10.0%, 9.0%, and 9.0% for 2024, 2025, and 2026, respectively.

- Health Care shows modest near-term growth of 8.0%, but jumps to 22.0% in 2025, before easing to 12.5% in 2026.

- Real Estate anticipates EPS growth of 5.5%, 6.5%, and 8.0%, reflecting a slow but steady climb.

- Consumer Staples show similar trends with 5.5% in 2024, 7.0% in 2025, and 9.5% in 2026.

- Materials surge from 5.0% EPS growth now to 21.0% in 2025, and 16.5% in 2026.

- Industrials expect just 4.0% EPS growth in the near term but rebound to 20.5% in 2025 and 16.0% in 2026.

- Energy is the only sector with negative growth in the short term (-22.0%), but is expected to recover to 9.0% in 2025 and 17.5% in 2026.

Stock Market Participation by Country

- In the U.S., 62% of adults reported owning stock in 2025.

- This mirrors pre‑2008 ownership levels, which hovered near 60%.

- Global flows show $50 billion of retail investment entering equity markets through S&P 500 flows.

- Corporate buybacks in the U.S. are fueling demand and underpinning valuations.

- Retail participation in mutual funds rose from 26% in FY19 to 28% in FY25 in India, signaling similar global retail interest.

- Regions like Asia and Europe reflect rising gender lens investing, though U.S. data remains more focused on equity accounts.

- While global retail equity growth is implied, the U.S. remains the best-documented and fastest‑growing market in retail participation trends.

Demographic Breakdown of Participants

- The average income of new retail investors is $54,000 in 2025, reflecting broadening participation among middle‑income earners.

- 77% of Gen Z investors began investing before age 25.

- 48% of new brokerage accounts were opened by investors from diverse ethnic backgrounds.

- Urban investors represent 66% of new accounts; rural areas account for 19% growth.

- 71% of retail investors have a bachelor’s degree or higher.

- ETF adoption among retail accounts grew 24% year‑over‑year.

- 38% of retail investors favor dividend‑paying stocks for income stability.

- The retail-to-income ratio of stock holdings signals higher participation risk and potential overexposure.

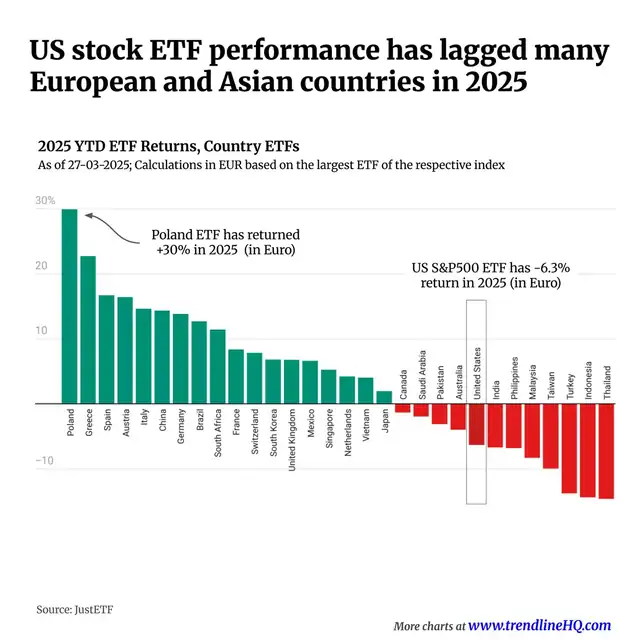

Global ETF Performance Rankings

- Poland leads globally with a +30.0% return, making it the top-performing country ETF so far in 2025.

- Greece and Spain also posted strong gains of +22.0% and +18.0%, respectively, benefiting from robust European market momentum.

- Other major European economies like Italy (+17.0%), Germany (+15.0%), and France (+11.0%) outpaced global peers.

- Emerging markets such as Brazil (+13.0%), South Africa (+12.0%), and Mexico (+8.0%) saw solid inflows and equity growth.

- Asian markets like South Korea (+9.0%), Vietnam (+4.0%), and Singapore (+6.0%) delivered moderate but positive performance.

- In contrast, the US S&P500 ETF is down –6.3%, reflecting one of the weakest performances among major economies.

- Other underperforming countries include India (–7.0%), the Philippines (–8.0%), Malaysia (–9.0%), and Thailand (–12.0%), highlighting regional challenges in Asia.

- Canada (–1.0%), Saudi Arabia (–2.0%), and Sweden (–3.0%) also fell into negative territory but fared better than US markets.

Gender Distribution of Stock Market Participants

- Roughly 70-77% of Gen Z women have started investing, marking one of the highest engagement rates across age cohorts.

- Female investing behavior shows growing price awareness, rising from 60% in 2018 to 75% in 2023.

- Financial confidence among U.S. women under 50 climbed from 48% in 2018 to 61% in 2023.

- Women expect to achieve financial goals at a higher rate today (54%) than in 2018 (51%).

- Gender lens equity funds (GLEFs) held $4.5 billion in AUM as of end‑2024; fixed‑income gender lens assets totaled $58 billion.

- The rise in female participation is supported by widening financial literacy and confidence, narrowing the gender gap in investing.

- Advocacy and educational programs from brokerages and foundations further promote female engagement.

Stock Market Participation by Income Level

- 92% of households in the top 10% income earners own stocks, while just 31% of households in the lower 50% participate.

- Among middle-income Americans, about two-thirds report owning stocks or stock funds.

- For those earning less than $40,000, roughly 25% have some market exposure.

- The wealthiest 1% hold 50% of all stock market wealth, valued at $23.2 trillion as of Q1 2025.

- Households in the bottom half of income tend to own negligible stock wealth, exacerbating inequality.

- Median stock-market wealth for the bottom 50% stands at roughly $12,600, versus $608,000 for the top 10%.

- Retail participation among lower-income households has grown substantially, with surveys suggesting increases of up to 4–5x compared to 2015 levels, driven by mobile trading apps and fractional share access.

Global Equity Performance

- China Large Cap (Hang Seng) led global markets with a +15.3% return in Q1 2025, driven by a rebound in tech and consumer sectors.

- Germany (DAX 40) and Italy (Milano Italia Borsa) both delivered strong gains of +11.3%, reflecting industrial strength and resilient economic data.

- The Swiss Market Index posted a solid +8.6% return, supported by healthcare and financials.

- France (CAC 40) and the UK (FTSE 100) returned +5.6% and +5.0% respectively, showing steady performance in developed European markets.

- Canada (TSX Composite) edged slightly higher with a +0.8% gain, amid stable commodity prices and financial sector support.

- Emerging Markets ex-China slipped –0.7%, weighed down by capital outflows and currency pressures.

- China (SSE Composite) also declined slightly by –0.5%, despite the strong showing from its large-cap peers.

- U.S. Large Caps (S&P 500) dropped –4.6% in Q1, under pressure from earnings revisions and interest rate uncertainty.

- U.S. Tech (Nasdaq-100) underperformed with an –8.3% loss, reflecting a correction in mega-cap growth stocks.

- U.S. Small Caps (Russell 2000) saw one of the steepest drops at –9.8%, as investors pulled back from riskier assets.

- Japan (Nikkei 225) was the worst performer, declining –10.7%, driven by a stronger yen and global demand concerns.

Stock Market Participation by Education Level

- 72.6% of individuals aged 25+ with a bachelor’s degree or higher are part of the labor force as of April 2025.

- Only 56.7% of individuals with a high school diploma or no college were in the labor force.

- While these are labor force stats, they suggest that higher education correlates with financial market engagement.

- Affluent households where heads hold a college degree tend to have significantly higher net worth, often exceeding $200k.

- Financial literacy level strongly drives investment behavior; higher educational attainment corresponds to better investment decisions.

- Individuals with lower income and education are more likely to enter and exit the market swiftly, while those with higher education demonstrate persistent participation.

- Overall, higher educational levels are linked to increased participation and sustained engagement in the stock market.

Stock Market Participation by Generation (Gen Z, Millennials, Gen X, Boomers)

- 77% of Gen Z investors began investing before age 25.

- Younger investors, especially those with below-median incomes, are investing at record rates.

- Globally, 70% of retail investors are younger than 45, indicating strong Millennial and Gen Z participation.

- Older generations, Gen X, and Boomers, continue traditional participation through 401(k)s, IRAs, and pensions.

- The surge among Gen Z reflects a shift in how younger people build wealth, prioritizing market investment over homeownership.

- Younger generations now form the core of retail investing momentum.

Racial and Ethnic Participation in Stock Markets

- Median stock holdings were $67,800 for White families, $24,500 for Hispanic families, and $16,500 for Black families.

- Mean stock holdings show an even wider gap: $568,100 (White), $97,400 (Hispanic), and $80,400 (Black).

- Retirement account medians reflect disparity: $100,000 for White families, $55,600 for Hispanic families, $39,000 for Black families.

- Historically, stock ownership among African Americans and Hispanics hovered around 6–7%, underscoring long-standing gaps.

- This structural disparity underscores the need for targeted policies and financial literacy initiatives to bolster participation equity.

Digital vs. Traditional Participation (Mobile, App, Online Platforms)

- As of early 2025, 38% of U.S. stocks are owned directly by individuals, surpassing mutual fund and ETF holdings.

- Over the past three months, U.S. households recorded $20 billion in net purchases of individual stocks.

- The rise of mobile and online trading platforms has massively lowered barriers to entry and boosted direct equity participation.

- Younger investors, especially Gen Z and Millennials, are particularly engaged through digital interfaces.

- This shift represents a long-term change in market participation habits and tools.

Geographic Distribution (Urban vs. Rural Participation)

- Brokerage platforms like Robinhood and Fidelity have reported urban dominance in new account openings, though rural adoption has shown notable growth, particularly due to improved mobile access.

- Urban investors remain predominant, but rural participation is growing meaningfully, narrowing the gap.

- Access to digital tools helps rural participants catch up, but urban infrastructure still supports higher rates of investment.

- Financial education and internet access remain key drivers in expanding rural participation.

Barriers to Stock Market Participation

- Financial literacy remains a significant obstacle.

- Access and cost barriers persist.

- Trust and understanding of platforms remain weak for many.

- Lack of financial infrastructure in underserved communities contributes to low participation.

- Socioeconomic inequities, including unbanked status, limit access.

- Cultural and informational gaps exist.

- Behavioral biases can deter new or hesitant investors.

- Policy and technological literacy pose challenges for some investors.

Changes in Stock Market Participation Over Time

- Stock ownership in the U.S. has broadly bounced back to approximately 62% of adults, returning to pre‑2008 recession levels.

- Participation in employment‑based retirement plans grew from 54% in 2010 to 66% in 2024.

- The percentage of 25‑year‑olds with investment accounts increased from 6% in 2015 to 37% in 2024.

- Lower‑income individuals are now five times more likely to invest in markets compared to a decade ago.

- Growth in account openings is noticeable across rural areas.

- Retail-focused ETFs saw $11 billion in inflows in March and approximately $20–22 billion in April 2025.

- Retail flows into equities in the first half of 2025 exceeded pandemic boom levels.

Global Trends in Retail Investor Growth

- Institutional investors anticipate over 50% of private markets flows to come from “retail‑style” vehicles by 2027.

- Retail holdings of government bonds rose from 5% to 11% between 2021 and 2024.

- In Spain, retail held almost 50% of T-bills by mid‑2024.

- Around 45% of Gen Z and millennials began investing in early adulthood, compared to just 15% of Gen X and boomers.

Socioeconomic Impact of Stock Market Participation

- Increased participation helps narrow wealth barriers.

- 70% of retail investors expect stock growth, and 89% view investing as long-term saving.

- Greater participation may rebalance wealth distribution.

- Diversified financial behaviors may reduce dependence on physical assets like housing.

Policy and Regulation Impacting Participation

- Trump Accounts encourage universal investment exposure from birth.

- Regulatory changes, lowering fees, and enabling fractional shares expand access.

- Policies support financial education and simplified platforms.

- Concerns remain about regulation adequacy, especially with retail holdings at 265% of disposable income.

Investment Behavior Differences Among Participants

- Gen Z and millennials lead with tech-savvy, mobile-first approaches.

- Lower-income investors now participate at five times the rate of a decade ago.

- Retail investors purchased $270 billion in equities in H1 2025, with $360 billion expected by year-end.

- 40% plan to invest more in the coming quarter, even while cutting personal spending.

- Hedge funds remain cautious, selling in August 2025 due to fragility.

- High housing costs push younger adults toward equities over real estate.

Conclusion

Stock market participation today reflects a dynamic transformation in who, how, and why Americans invest. 62% of U.S. adults now own stock, a return to pre‑2008 levels, while younger and lower-income investors are entering markets at unprecedented rates. Nevertheless, barriers remain, from financial literacy to trust and infrastructure gaps. Yet, global retail investments continue to grow, and forward‑looking programs like Trump Accounts aim to foster inclusion for the next generation.

Participation behavior is shifting too: many now treat investments as long-term savings, supported by intuitive digital platforms. As policy, education, and technology align, we may see the stock market become a more equitable venue for wealth-building. The data highlights a clear message: investing is no longer a privilege; it’s becoming a mainstream path toward financial resilience.