Introduction

According to Market.us, Generative AI in Fintech Market size is expected to be worth around USD 6,256 Million by 2033, from USD 865 Million in 2023, growing at a CAGR of 22.5% during the forecast period from 2024 to 2033.

The generative AI in fintech market is witnessing remarkable growth, driven by the increasing demand for personalized financial services and the need for efficient data management systems. The integration of generative AI technologies offers the potential to revolutionize the fintech sector by enhancing customer experience, optimizing operational efficiencies, and generating innovative financial products. However, this market faces challenges, including data privacy concerns, regulatory hurdles, and the need for substantial investment in AI infrastructure. Despite these challenges, the opportunities for leveraging generative AI in fintech are vast, ranging from automating customer interactions to generating complex financial models.

Elevate Your Business Strategy! Purchase the Report for Market-Driven Insights

Generative AI in Fintech Statistics

- By 2032, the Generative AI in Fintech Market is poised to reach USD 6,256 Million, with a growth rate (CAGR) of 22.5% from 2022-2033.

- The Global Generative AI Market is forecasted to be around USD 255.8 Billion by 2033, up from USD 13.5 Billion in 2023, growing at a CAGR of 34.2% from 2024 to 2033.

- The software segment boasted the largest revenue, taking up 70% in 2022.

- North America dominates the generative AI in the fintech market, holding a significant 37% revenue share.

- 82% of financial institutions are delving into or already using Generative AI to boost their operations and services.

- Banks and financial firms might see a 20% rise in customer satisfaction scores by 2024 thanks to Generative AI in customer service and personalization.

- Generative AI’s role in anti-money laundering (AML) and fraud detection could slash false positives by 50% by 2024.

- The precision of credit risk assessment models could be enhanced by up to 25% through Generative AI, aiding in better lending decisions.

- Demand for Generative AI in regulatory compliance and reporting is anticipated to surge by 40% in 2023.

- Financial trading and portfolio management could witness a 10% increase in investment returns by 2024 due to Generative AI.

- Generative AI’s adoption in fintech is expected to spawn over ~1 million new jobs globally by 2025, especially in AI development, data analysis, and financial advisory.

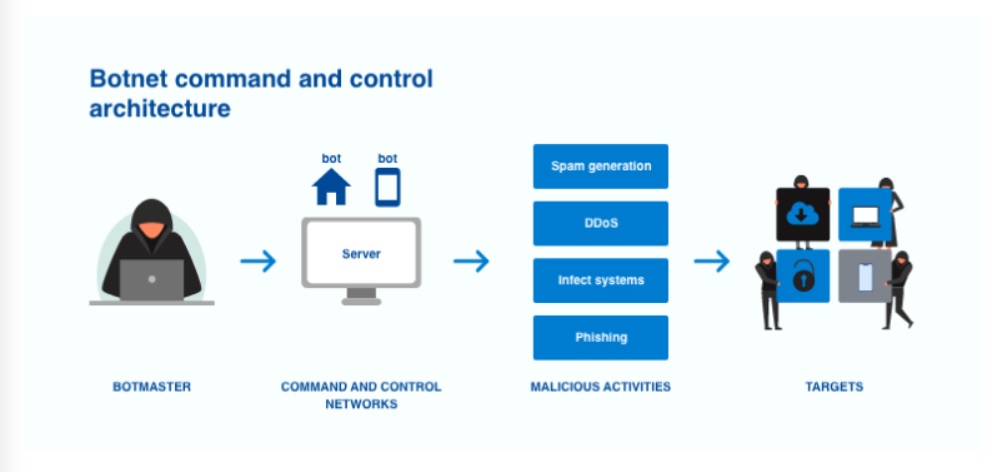

- The fusion of Generative AI with cybersecurity might cut down data breaches and cyber-attacks in the finance sector by 30% by 2024.

- In insurance underwriting and claims processing, Generative AI could slash operational costs by 25% by 2024.

Emerging Trends

- Personalized Financial Advice: AI systems are increasingly capable of analyzing customer data to provide customized financial advice, making personal finance management more accessible.

- Automated Regulatory Compliance: Generative AI aids in navigating the complex web of financial regulations, streamlining compliance processes.

- Enhanced Fraud Detection: AI algorithms excel at identifying fraudulent activities by analyzing transaction patterns in real-time.

- Innovative Financial Products: There’s a surge in AI-generated financial products tailored to specific market niches or customer segments.

- Improved Customer Service: AI-powered chatbots and virtual assistants are providing 24/7 customer service, improving engagement and satisfaction.

Top Use Cases

- Risk Assessment: AI models are transforming how financial institutions assess credit risk, offering more accurate predictions.

- Wealth Management: Generative AI creates personalized investment strategies for individuals, democratizing wealth management services.

- Process Automation: Routine financial operations, such as claims processing and underwriting, are being automated, enhancing efficiency.

- Market Analysis: AI tools analyze vast datasets to forecast market trends, aiding in strategic investment decisions.

- Secure Transactions: AI enhances security protocols, ensuring safer transaction processes for customers and institutions alike.

Major Challenges

- Data Privacy: Managing sensitive financial data while adhering to privacy laws remains a significant hurdle.

- Integration Complexity: Integrating AI into existing financial systems is often complex and resource-intensive.

- Skill Gap: There is a pronounced gap in AI expertise within the financial sector, limiting implementation.

- Regulatory Uncertainty: The evolving regulatory landscape for AI in finance poses compliance risks.

- Reliance on Quality Data: AI’s effectiveness is contingent on access to high-quality, unbiased data, which is not always available.

Market Opportunity

- Emerging Markets: Developing economies present untapped opportunities for AI-driven financial services.

- SME Financial Inclusion: AI can offer tailored financial services to small and medium enterprises, a segment often overlooked by traditional banks.

- Sustainable Investing: There’s growing interest in using AI to identify and develop sustainable investment opportunities.

- Digital Currencies: AI plays a crucial role in managing and securing digital currency transactions and portfolios.

- Financial Literacy: Generative AI has the potential to enhance financial literacy by providing educational content customized to the user’s financial situation.

Conclusion

The integration of generative AI into the fintech sector offers unprecedented opportunities for innovation, efficiency, and customer satisfaction. Despite facing challenges such as data privacy and regulatory compliance, the potential for AI to transform financial services remains vast. As the industry continues to evolve, the adoption of AI technologies is poised to redefine the landscape of financial services, making them more personalized, secure, and accessible to a broader audience. The future of fintech, powered by generative AI, looks promising, marked by continuous growth and the emergence of new, innovative financial products and services.

ABOUT AUTHOR

Kundan Goyal possesses a wealth of experience in Digital Marketing, offering valuable insights to businesses of all sizes. He actively contributes to industry-specific PR, news outlets, and forums, shaping discussions and driving forward-thinking strategies. Outside of work, HE enjoys carrom and has a deep passion for news editing and research. His strength lies in helping companies make informed, strategic decisions and predicting future trends. With his dedication and innovative approach, he is a versatile professional who brings a unique blend of skills and expertise to the ever-evolving digital landscape, enabling businesses to thrive in this dynamic environment.