The global payments platform Paysafe Limited is navigating a pivotal moment. With its integrated merchant solutions, digital wallets, and cash-consumer offerings, Paysafe is impacting industries from e-commerce to iGaming. For example, U.S. online retailers offering Paysafe’s local payment methods are reporting faster checkout and higher conversion rates. Meanwhile, digital banking partnerships in Europe are leveraging Paysafe’s wallet platform to expand into new under-banked segments. Read on for a deep dive into key statistics showing where Paysafe stands and how it’s moving forward.

Editor’s Choice

- Q3 2025 revenue reached $433.8 million, up 2% year-on-year.

- Organic revenue growth in Q3 2025 hit 6%, driven by digital wallets +4% and merchant solutions +7%.

- The company supports 260 payment types across 48 currencies.

- As of Q3 2025, Paysafe employs approximately 3,000 employees globally.

- Full-year 2024 revenue was $1.7048 billion, up 6% over 2023.

- Q2 2025 transaction volume rose by about 10% year-on-year.

Recent Developments

- In revised guidance issued recently, the company projected full-year 2025 revenue in the range of $1.700 billion to $1.710 billion, reflecting a cautious outlook.

- The disposal of a direct-marketing payments-processing business line caused a headwind of $24.1 million in Q3.

- Executives indicated that product rollout timelines (especially the wallet platform) have extended, impacting near-term growth.

- Foreign-exchange effects in Q3 2025 contributed a favourable $11.9 million to revenue and $3.5 million to EBITDA.

- At the same time, interest-income decline from consumer deposits created a ~$3.6 million headwind.

- Paysafe’s recognition in sustainability signals an increasing alignment with ESG frameworks, which may support brand and regulatory positioning.

- The company is positioning its wallet-and-cash-consumer business, such as launches in Latin America, for acceleration into 2026 and beyond.

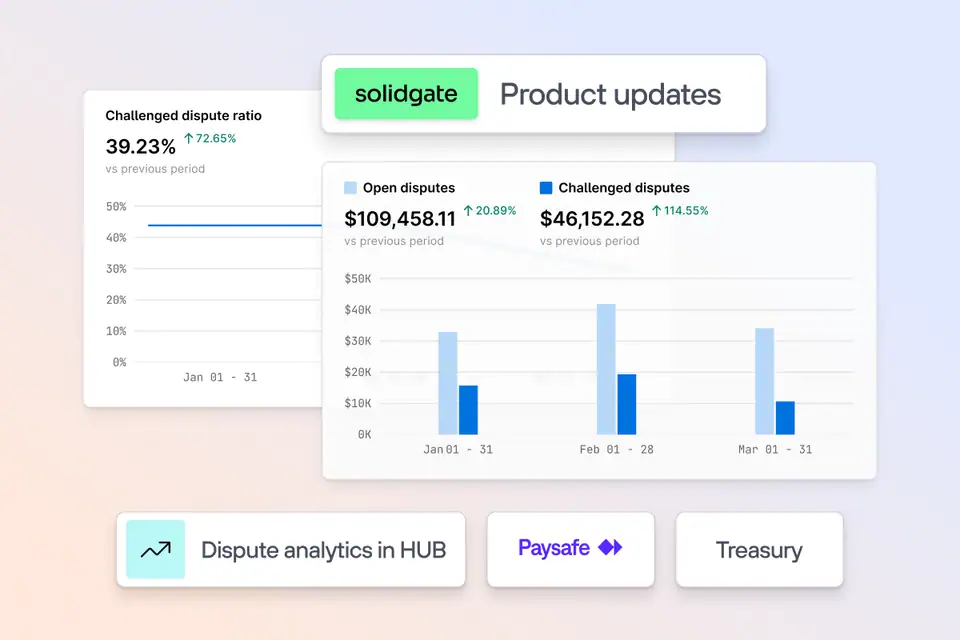

Paysafe Dispute Insights

- Challenged dispute ratio reached 39.23%, marking a 72.65% increase compared to the previous period.

- Open disputes for January 2025 totaled $109,458.11, up 20.89% from the prior month.

- Challenged disputes during the same period amounted to $46,152.28, reflecting a 114.55% surge month-over-month.

- In January 2025, challenged disputes were just under $20,000, while open disputes stood above $30,000.

- In February 2025, open disputes peaked at around $40,000, with challenged disputes near $25,000.

- March 2025 showed a slight decline, with open disputes at approximately $30,000 and challenged disputes around $10,000.

- These trends highlight rising use of Paysafe’s dispute tools, particularly the HUB analytics dashboard, across Q1.

Key Paysafe Statistics

- For Q3 2025, reported revenue was $433.8 million, compared with $427.1 million in Q3 2024.

- Organic revenue growth in Q3 2025: 6%, despite overall reported growth of 2%.

- Digital Wallets segment revenue in Q3 2025: $205.7 million, up ~8% vs Q3 2024.

- Merchant Solutions segment revenue in Q3 2025: $231.9 million, down ~4% vs Q3 2024.

- As of December 31, 2024, full-year revenue: $1,704.8 million.

- Q2 2025 revenue: ~$428.2 million, representing ~3% reported decline but ~5% organic growth.

- Q4 2024 net income: $33.5 million, compared to a net loss in Q4 2023.

- Net leverage as of Dec 31, 2024: 4.7×, improving from 5.0× at the end of 2023.

Revenue Statistics

- Q3 2025 revenue: $433.8 million (up 2% from Q3 2024).

- Q2 2025 revenue: approx $428.2 million, down ~3% year-on-year (excluding disposal).

- Full-year 2024 revenue: $1.7048 billion, up 6% from 2023.

- Paysafe projects its FY2025 revenue between $1.70 billion and $1.71 billion.

- Adjusted EBITDA margin for 2025 is guided at roughly 27.1% to 27.6%.

- Q3 2025 adjusted EBITDA: $126.6 million, up 7% year-on-year.

- Q4 2024 adjusted EBITDA: $103.3 million, down 15% year-on-year.

- Net income for full-year 2024: $22.2 million, compared to a net loss in 2023.

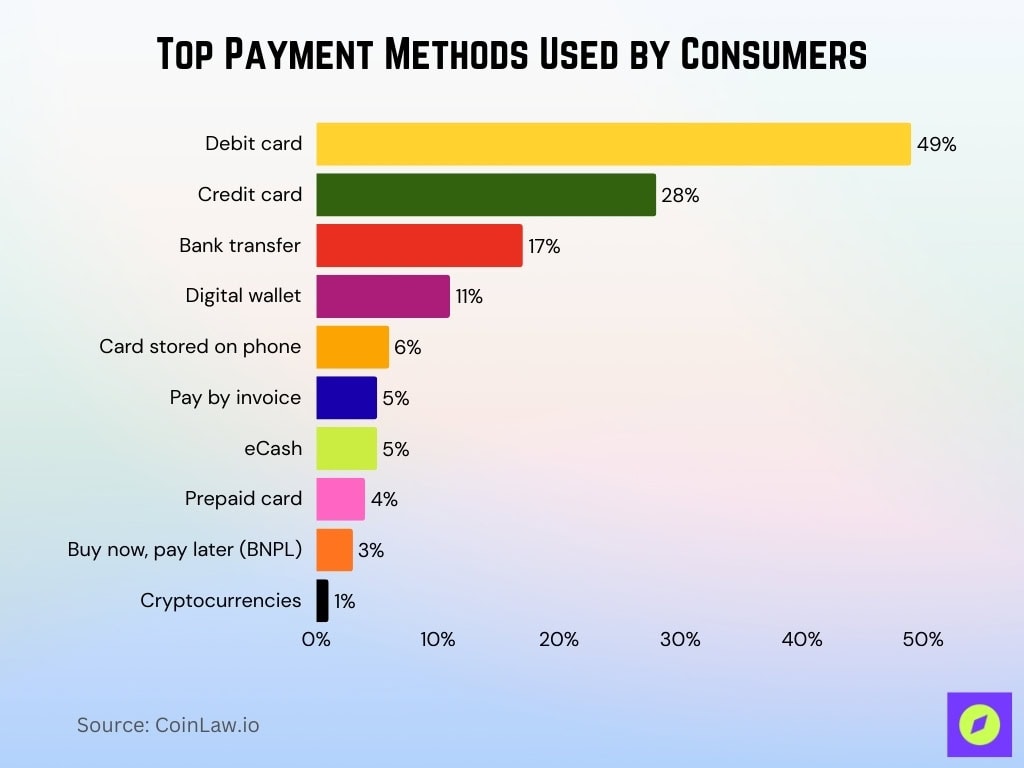

Top Payment Methods Used by Consumers

- 49% of consumers primarily use debit cards for their payments.

- 28% rely on credit cards, making it the second most popular method.

- 17% prefer bank transfers as their main form of payment.

- 11% use digital wallets for most of their transactions.

- 6% make payments using a card stored on their phone.

- 5% choose to pay by invoice, often for larger or recurring purchases.

- 5% also use eCash as their main method.

- 4% of people prefer prepaid cards.

- 3% opt for buy now, pay later (BNPL) options.

- Only 1% primarily use cryptocurrencies for payments.

Transaction Volume

- Paysafe processed $152 billion in total transaction volume over the twelve months ending Q3 2025.

- For Q3 2025, Paysafe reported volume growth of about 10% year-on-year.

- Within Q2 2025, volume rose ~10% despite revenue headwinds from disposal.

- Digital Wallets segment transaction volume active users: ~7.2 million (Q2 2025).

- Merchant Solutions segment transaction volume in Q2 2025: ~$35.7 billion, up ~9% year-on-year.

- E-commerce growth within transaction volume exceeded 30% in a recent quarter.

- Effective payment volume growth contributes to backlog and enterprise-deal pipeline up >20% year-to-date.

- Despite segment margin pressure, the volume growth supports long-term scale potential.

Paysafe Regional Performance

- Paysafe operates in 12+ countries, supporting 48 currencies globally.

- Latin America local payment solutions contributed to 6% organic revenue growth in Q3 2025.

- U.S. e-commerce volume grew notably with the start of the U.S. football season, driving 7% adjusted EBITDA growth.

- European digital banking partnerships helped expand wallets with 4% organic growth in digital wallets.

- The company reported total Q3 2025 revenue of $433.8 million, a 2% increase year-over-year.

- FX impact in Q3 provided a favorable £11.9 million revenue boost, but faced a $3.6 million headwind from reduced interest revenue.

- Transactional volume remained strong with an annualized volume of $152 billion in 2024.

- The disposed business caused a headwind of $24.1 million in revenue during Q3 2025.

- Management expects Q4 2025 to deliver the strongest growth across several regions.

- The company employs approximately 3,000 people worldwide to support global operations.

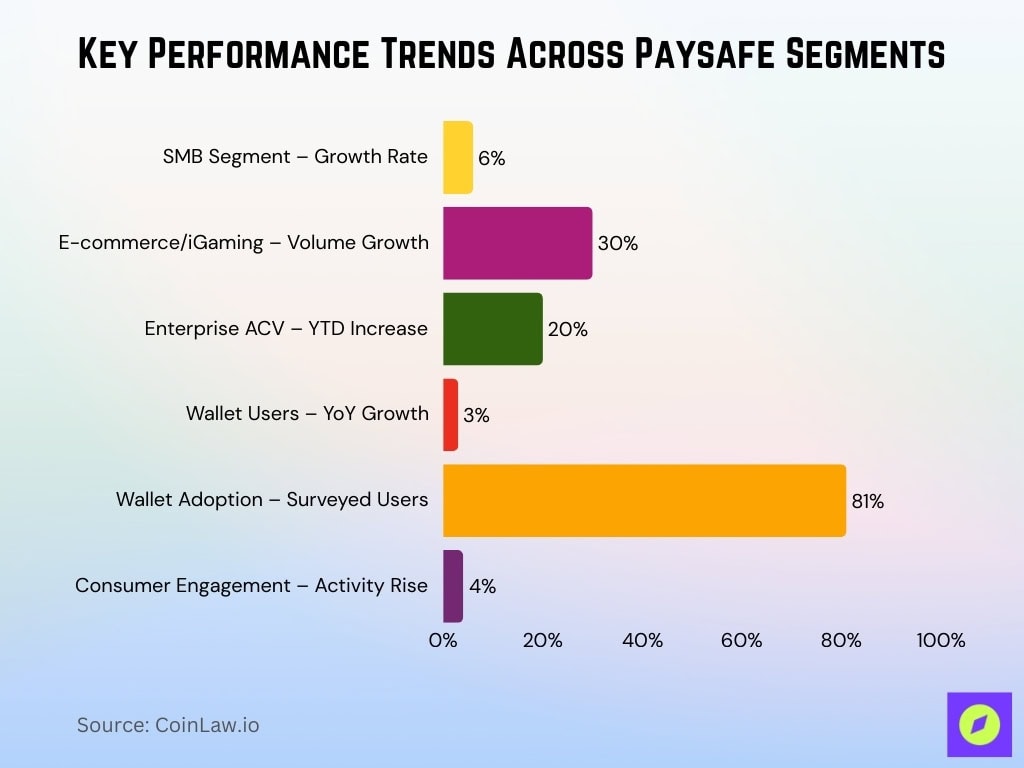

Customer Segments

- SMB (small- and medium-business) segment growth was ~6% in a recent quarter.

- The e-commerce vertical, including iGaming, grew over 30% in transaction volumes.

- Enterprise-level deals’ annual contract value (ACV) was up more than 20% year-to-date.

- The wallet user base was ~7.2 million for the three-month period ended Q2 2025, representing ~3% year-on-year growth.

- Customers surveyed: ~81% said they would use the wallet platform deployed by Paysafe.

- Consumer engagement metrics (transactions per active user) increased by ~4% in a recent period.

- Merchant solutions deal signings and contract values for SMBs increased year-on-year.

Employee and Office Footprint

- As of Q3 2025, Paysafe employs approximately 3,000 employees globally.

- Paysafe operates in 12+ countries globally.

- The company has 29 years of online payment experience.

- Supports 260 payment types in 48 currencies worldwide.

- Expansion in Latin America includes launches like the Peru wallet.

- Employee footprint supports both merchant solutions and consumer digital wallets.

- Aim to improve cost discipline and optimize the operating model for better efficiency.

- Transactional volume annualized at $152 billion in 2024.

- Approximately 3,000 employees support global operations across regions.

Currency and Country Coverage

- Paysafe’s corporate profile states operations in “12+ countries” and a payment-type network covering 260 payment types in 48 currencies.

- A press release reaffirmed the “260 payment types in over 48 currencies” figure when describing its strategic footprint.

- At the 2025 Gamescom show, Paysafe highlighted its ability to handle payouts in over 120 countries and 40+ currencies for gaming clients.

- The Latin America wallet expansion (via PagoEfectivo) demonstrates country-coverage growth, with the wallet form launched in Peru in 2025.

- For US merchants targeting consumers abroad, a currency and country reach of ~50 currencies and 12+ countries supports global scaling with fewer partner integrations.

- The breadth of supported currencies and countries helps mitigate FX and localization friction for cross-border commerce.

- In its Q2 2025 results release, Paysafe reiterated its global payment-type and currency coverage as a market differentiator.

- For context, issuing across 48 currencies means that for US-dollar merchants that local-currency settlement is available to many international buyers, reducing friction at checkout.

Consumer Behavior Insights

- From Paysafe’s consumer survey, 32% of online shoppers said they are using digital wallets more often than a year ago.

- The same survey found 43% of consumers said they would abandon their cart if their preferred payment method wasn’t available.

- For consumers aged 60 and over, 60% said their primary reason for choosing a payment method was perceived security.

- Among younger consumers (e.g., age 18–34), 37% cited transaction speed as an important factor in payment-method choice.

- In the holiday-shopping insight released in November 2025, Paysafe found digital wallets (27%), cash/eCash (27%), and local payment methods (10%) gained traction among U.S. shoppers.

- In gaming-consumer behaviour data, 38% of bettors used digital wallets and 42% used debit cards.

- For U.S. merchants, these behaviour insights imply that payment-method variety, checkout speed, and security reassurance are key levers for conversion.

- The data suggest that younger, digital-native consumers are shifting toward wallets and local methods, while older consumers emphasize trust and security.

- As payment-method expectations evolve, providers like Paysafe that cover cards, wallets, local methods, and global payout reach can better serve diverse consumer segments.

Digital Wallet Usage

- In Q1 2025, Paysafe reported its Digital Wallets segment had approximately 7.3 million active users for the three-month period.

- That same Q1 report noted transactions per active user in the Digital Wallets segment rose 9% year-on-year.

- Average revenue per user (ARPU) for the wallet segment increased ~1% YoY in Q1 2025.

- For the full-year 2024, the global digital-wallet market data estimates ~4.3 billion users globally.

- The shift toward wallet usage is supported by Paysafe’s view that its white-label wallet platform represents a growth driver for 2025.

- For US-based merchants, the rise in wallet usage suggests offering wallet options alongside cards can capture younger consumers and players in digital entertainment segments.

iGaming and Entertainment Sector Stats

- Paysafe supports payouts in 120+ countries and 40+ currencies globally.

- Debit cards are used by 42% of bettors in the iGaming segment.

- Digital wallets account for 38% of payment methods among gamers.

- Cash-based and local payments retain meaningful shares, especially for under-banked or younger consumers.

- Paysafe reported 50%+ iGaming expansion, driving double-digit bookings growth in Q3 2025.

- E-commerce and iGaming volumes combined grew by more than 20% in Q3 2025.

- Paysafe’s iGaming merchant volume rose by 8% in Q3 2025.

- Digital wallets generated $190.9 million in iGaming revenue in Q3 2025.

- Players increasingly prefer flexible payment options, with 27% of bettors favoring direct bank transfers, expected to rise further.

Merchant Solutions Data

- In Q1 2025, Paysafe’s Merchant Solutions segment reported revenue of $217.8 million, down ~6% year-on-year.

- In the same period, merchant-solutions adjusted EBITDA for Q1 2025 was approximately $29.4 million, down ~40% YoY.

- Merchant Solutions’ take-rate is much lower than the wallet segment, 0.64% vs 3.2% respectively (Q1 2025).

- Merchant Solutions, which underpin e-commerce merchant processing, continue to benefit from enterprise deals and SMB growth, though margin pressure remains.

- For US-based SMBs, leveraging a merchant portal with 260 payment types may reduce dependency on multiple acquirers and simplify operations via Paysafe’s platform.

- Merchants in the entertainment and iGaming verticals benefit from merchant-solutions integrations that complement wallet and cash-consumer channels.

- While revenue is under pressure in Q1 2025, the strategic focus on enterprise bookings and wallet-driven cross-sell suggests Merchant Solutions remains a core growth lever.

Profitability and Margins

- In Q3 2025, Paysafe Limited reported revenue of $433.8 million, up 2% year-on-year.

- Organic revenue growth for the same quarter was 6%, signaling stronger underlying performance.

- Adjusted EBITDA reached $126.6 million, representing a 7% increase compared to Q3 2024.

- The adjusted EBITDA margin rose to approximately 29.2%, up from ~27.6% in the previous year.

- The company recorded an adjusted net income of $40.3 million, compared with $31.4 million a year earlier, a 37% improvement.

- Despite improved adjusted metrics, the reported net loss in Q3 2025 was $87.7 million, compared to a loss of $13 million in Q3 2024.

- Operating cash flow in Q3 was $69.2 million, down from $81.9 million in the prior year, reflecting higher restructuring and tax payments.

- Unlevered free cash flow for the quarter stood at $83.6 million, compared to $89.9 million the year before.

- As of September 30, 2025, total debt reached $2.5 billion, and net debt was $2.2 billion, underlining leverage considerations.

Partnerships and Strategic Initiatives

- Paysafe announced a multi-year partnership with Endava to advance digital wallets and payment processing.

- Paysafe and Fiserv strengthened their partnership in May 2025 to support SMB growth with fraud protection and new wallet solutions.

- Paysafe won the Sustainable FinTech Award at the Global FinTech Awards 2025 for ESG impact and sustainability.

- Paysafe’s platform supports 260 payment types in 48 currencies globally.

- The Board authorized an additional $70 million to its share repurchase program in Q3 2025.

- Paysafe repurchased 1.5 million shares for $20 million in Q3 2025.

- Strategic cost-discipline and portfolio optimization were key focuses to enhance margin recovery.

- Latin America expansion includes local payment methods targeting under-banked markets.

- Paysafe’s merchant unit volume increased 8% in Q3 2025, driven by e-commerce and iGaming.

- Digital wallets delivered 5% growth in transaction volume, generating $190.9 million in revenue in Q3 2025.

Frequently Asked Questions (FAQs)

$433.8 million.

6%.

260 payment types across 48 currencies.

$87.7 million.

Conclusion

Paysafe stands at a complex inflection point. On the other hand, key metrics reflect solid operational progress. On the other hand, removal of low-margin lines, higher tax and restructuring burdens, and a conservative revenue outlook suggest the journey forward requires discipline and execution. Strategic partnerships with Endava, Fiserv, and others underscore the company’s pivot toward wallet-centric and cross-border growth engines.

For U.S. merchants and global players alike, Paysafe’s broad payment-method coverage, currency/country reach, and evolving product stack create tangible value, provided the company can translate pipeline into scalable profit. With that in mind, the next year will be critical in determining whether Paysafe shifts from improvement to acceleration.