Imagine you’re about to make an online purchase. You select your items, click checkout, and within seconds, your payment is processed. Payment gateways make this convenience possible by making it the backbone of e-commerce, enabling secure and instant transactions. In today’s digital world, the growth of payment gateways is surging, driven by increasing online shopping, mobile payments, and global trade. Understanding the key players and market trends behind this industry is crucial for businesses looking to stay competitive in the digital economy.

Editor’s Choice

- The global payment gateway market is projected to reach $34.49 billion in 2026, growing at a CAGR of 12.78%.

- PayPal processed $1.68 trillion in total payment volume in 2025, up 9.98% year-over-year.

- Stripe’s valuation reached $91.5 billion in 2025, nearing its peak amid AI-driven payment growth.

- Square (Block Inc.) reported accelerating gross payment volume growth of 12% year-over-year in Q3 2025.

- Adyen’s net revenue grew 23% year-over-year in Q3 2025, with low-to-mid 20% growth expected in 2026.

- Mobile payments accounted for over 70% of e-commerce transactions in leading markets like China in 2025.

Top Payment Gateway Providers

- PayPal has 436 million active accounts globally, processing over 6 billion transactions quarterly.

- Stripe processed roughly $1.4 trillion in total payment volume in 2024, powering millions of businesses.

- Square (Block Inc.) processed approximately $210 billion in gross payment volume in 2025.

- Adyen processed $1.08 trillion in volume in 2025, with net revenue at €1.82 billion.

- Amazon Pay is accepted by merchants in 87 countries worldwide as of 2025.

- Authorize.Net commands 1.5% market share in eCommerce payment gateways, processing hundreds of millions of transactions.

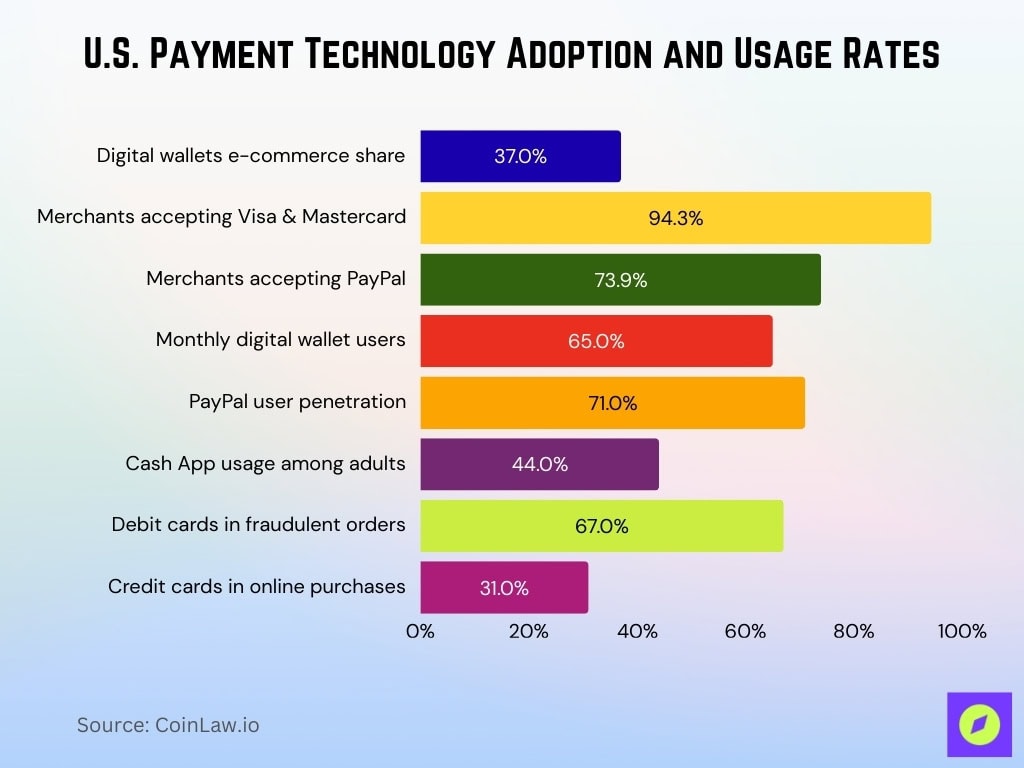

Payment Technology Usage in the United States

- Digital wallets account for 37% of e-commerce transactions.

- 94.3% of online merchants accept Visa and Mastercard.

- 73.9% of online merchants accept PayPal.

- 65% of American adults use digital wallets monthly.

- PayPal penetration reaches 71% among U.S. adults.

- 44% of American adults use Cash App.

- Debit cards are cited as the most-used for 67% of fraudulent orders.

- Credit cards are used for 31% of online purchases.

Transaction Volume and Usage Statistics

- Global payments revenues forecast at $3.0 trillion in 2025, growing 7% annually.

- Visa, Mastercard, and UnionPay process 97% of worldwide credit card transactions.

- Mobile payments and digital wallets drive 52.5% of online transaction values.

- Global average online transaction value reaches $150 across industries.

- Global eCommerce sales hit $6.86 trillion in 2025, up 8.37% year-over-year.

- Apple Pay boasts 624 million users worldwide.

- The global Buy Now, Pay Later (BNPL) market is projected to reach over $565 billion by 2026, growing at a CAGR of ~26%, driven by millennial adoption and e-commerce expansion.

- Digital wallets comprise 63% of retail e-commerce revenue.

Regional Insights

- Asia-Pacific payment gateway market reaches $13.01 billion, growing at 21.89% CAGR.

- North America’s payments industry generated an estimated $1.2 trillion in annual payments revenue in 2025, reflecting the region’s dominant role in global digital payments.

- Europe’s digital payments see non-cash transactions surpassing 600 billion by 2028.

- Latin America’s digital payments represent 60% of consumer spending.

- Africa’s e-payments revenues grow to nearly $40 billion by 2025.

- Middle East mobile commerce hits 70% of online transaction value by 2025.

- India’s UPI records 16.58 billion transactions in October 2025.

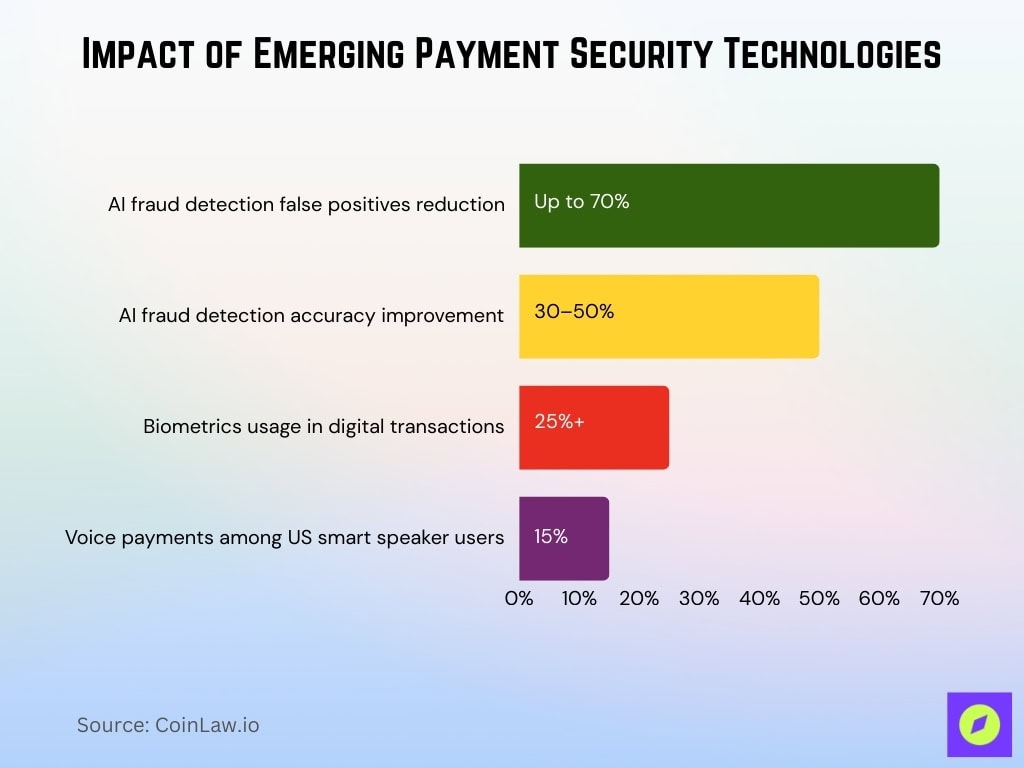

Technological Advancements and Innovations

- AI-based fraud detection systems can reduce false positives by up to 70% and improve fraud detection rates by 30–50%, depending on the system and dataset.

- Biometrics authenticates over 2 billion payment transactions globally.

- Real-time payments RTP network processed 98 million transactions worth $80 billion in Q4 2024.

- Mobile payment transactions reach $20.4 trillion.

- Biometrics such as fingerprint and facial recognition are used in over 25% of digital financial transactions, with voice authentication adoption growing in call centers and mobile banking.

- 15% of US smart speaker users make voice payments.

Security and Fraud Prevention Trends

- Card-not-present (CNP) fraud losses are projected at $28.1 billion globally.

- EMV 3-D Secure enables frictionless flow for real-time risk-based authentication.

- MFA significantly reduces account takeover and unauthorized transaction fraud.

- 42% of issuers saved over $5 million using AI fraud prevention.

- Tokenization is used in one-third of global transactions per Mastercard.

- GDPR fines total €5.88 billion by January 2025 under enhanced regulations.

- 60% of executives use AI anomaly detection for fraud prevention.

Impact of Regulatory Changes

- PSD3 political agreement targets 25% further fraud reduction via Verification of Payee.

- RBI mandates 2FA for all digital payments effective April 2026, securing 12,549 crore transactions in H1 2025.

- APRA CPS 234 requires self-assessments by August 2025 to combat 60% third-party breaches.

- MAS AML enforcement issued S$960,000 penalties to payment firms in 2025.

- Brazil’s PIX handled 42 billion transactions worth R$17.2 trillion.

- GDPR evolves with PSD3, strengthening SCA and fraud prevention mandates.

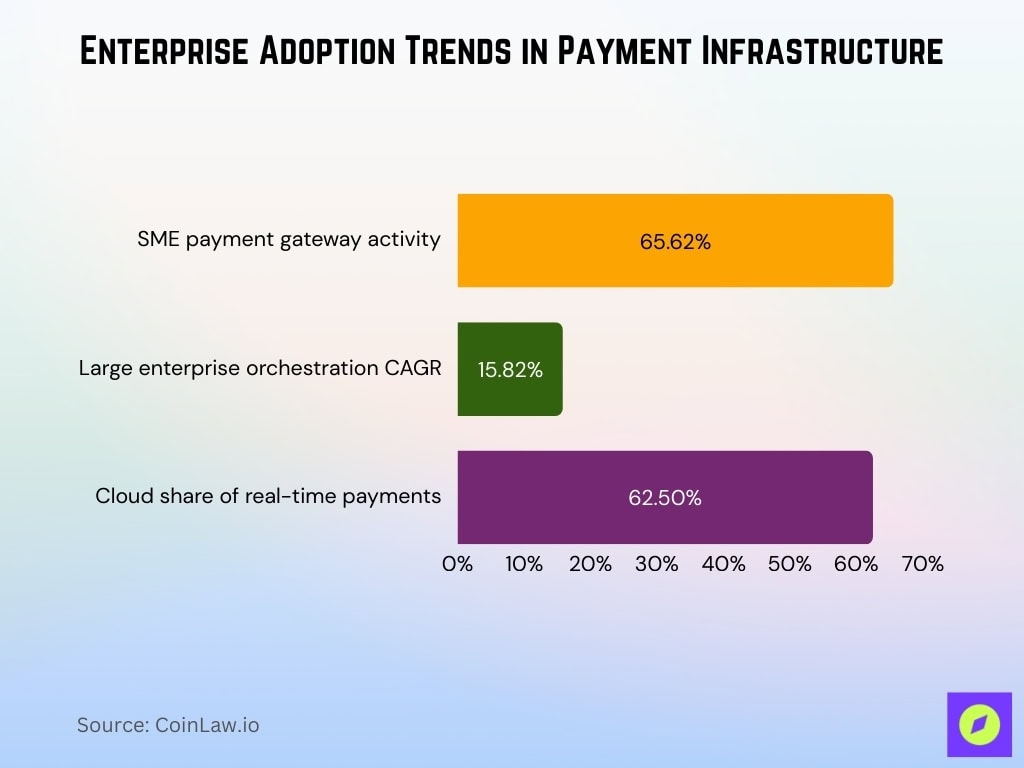

Enterprise Size Insights

- SMEs accounted for 65.62% of the 2025 payment gateway market activity.

- Large enterprises drive 15.82% CAGR growth through orchestration services.

- Cloud deployment holds 62.5% of the real-time payments market share.

- Fintech startups raised $31.6 billion across 2,558 deals in 2025.

- B2B blockchain transactions surpass $4.5 trillion globally.

- Recurly processes $15 billion annual payment volume at enterprise scale.

- Large enterprises generate $420,000 average annual Stripe contract value.

- SMBs adopting unified commerce boost conversion rates significantly.

End-use Insights

- Retail and e-commerce hold 31.52% of the payment gateway market share.

- Travel and hospitality grow fastest at 14.68% CAGR.

- Subscription billing market reaches $16.9 billion.

- Healthcare digital payments are valued at $9.12 billion.

- Education payments platform grows to $5.71 billion at 14.6% CAGR.

- Food and beverage dollar sales increase 2.0%-4.0%.

- Healthcare digital payments are projected to $49 billion by 2030.

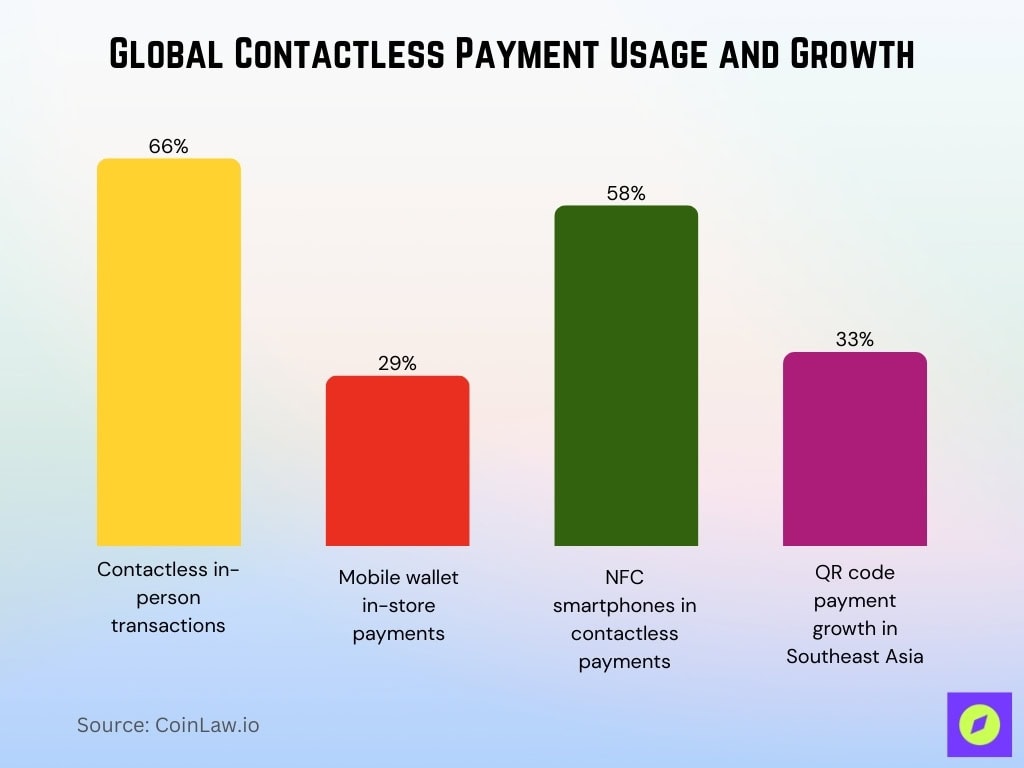

Contactless Payment Method Statistics

- Contactless payments represent 66% of all in-person transactions in North America.

- Europe tap-to-pay transactions increased 21% year-over-year.

- Wearable payments are used by 48 million consumers worldwide.

- Mobile wallets account for 29% of US in-store payments.

- NFC smartphones enable 58% of global contactless transactions.

- WeChat Pay and Alipay processed $39 trillion in China.

- QR code payments grew 33% in Southeast Asia.

Future of Digital Payments

- Digital commerce transactions will exceed $20 trillion globally by 2027.

- Merchants accepting Bitcoin payments rose to 19,900 by early 2026.

- The biometric payments market is expected to reach $66.97 billion by 2029 at a 9.6% CAGR.

- Tokenization unlocks over $135 billion in asset management cost savings.

- Digital payments fraud losses surpass $40 billion by 2027.

- Cross-border e-commerce payments grow to $227.63 billion in 2025.

- Mobile payments will be used by over 60% of worldwide mobile users by 2025.

- Stablecoins record 46 trillion transaction volume in 2025.

Real-time Payment Adoption System

- RTP volumes reached $266.2 billion in 2023, growing 42.2% YoY.

- 80 countries operate RTP systems as of 2023.

- UPI volumes hit 106.36 billion transactions worth ₹143.34 trillion in H1 2025.

- FedNow processed $245 billion in Q2 2025, up 49,000% YoY.

- SEPA SCT Inst mandatory from January 2025, up to €100,000 limit.

- Brazil PIX B2B transactions reach R$1,026 trillion in April 2025.

- ISO 20022 will be mandatory for SWIFT cross-border after November 2025.

- RTP transactions are projected $575.1 billion by 2028 at a 16.7% CAGR.

Recent Developments

- Stripe launches stablecoin accounts in 101 countries and the Open Issuance platform.

- PayPal redesigned checkout to boost conversion by 2-5 points with biometrics.

- Amazon AI models analyze anomalies, reducing fraud via real-time monitoring.

- Adyen AI suite increases approvals over 90% for known shoppers.

- Square Afterpay integration supports BNPL expansion for SMBs.

- Visa Tap to Phone grows 200% YoY, 30% new SMBs.

- Mastercard cuts Scope 1&2 emissions 38%, Scope 3 20% by 2025.

- Adyen Uplift reduces US processing costs up to 5%.

Frequently Asked Questions (FAQs)

UPI processes 20 billion transactions monthly.

Self-hosted gateways grow at 16.46% CAGR through 2031.

North America contributes 28% of global revenue.

Global tokenized transactions hit 574 billion by 2029.

Conclusion

The future of payment gateways is driven by innovation, security, and user experience. As digital transactions continue to grow globally, businesses must stay ahead of these trends to maintain customer trust and drive growth. The increasing adoption of real-time payments, contactless solutions, and AI-powered fraud prevention systems will shape the payment landscape in the coming years. Companies that adapt to new technologies and changing consumer behaviors will be well-positioned to thrive in this ever-evolving market.