Imagine you’re a farmer in Iowa, preparing for the year’s harvest season. Everything from corn to soybeans is growing well until an unexpected storm hits, leaving devastating losses in its wake. Traditional insurance policies could take months to assess the damages and settle claims, often with a significant shortfall from the expected payout. Now, consider an insurance model where payouts are triggered automatically based on preset conditions, like a specific level of rainfall or wind speed. This is the promise of parametric insurance, a solution increasingly favored in industries vulnerable to unpredictable natural events. In 2025, parametric insurance is rapidly gaining traction worldwide, promising faster, more transparent, and effective coverage.

With parametric insurance, policies rely on data-driven parameters rather than lengthy claims assessments, creating efficient, scalable risk solutions. In this article, we’ll dive into the statistics that define this emerging industry, exploring key trends, market drivers, and recent advancements shaping parametric insurance in 2025.

Key Takeaways

- 1The global parametric insurance market reached $19.2 billion in 2025 and is projected to grow to $40.6 billion by 2033.

- 2North America leads with a 36% market share and estimated revenue of $6.9 billion in 2025.

- 3The natural catastrophe insurance segment held 57% of total market share in 2025.

- 4The agriculture sector represented 28% of the market, reinforcing its strong demand for climate-risk coverage.

- 5The construction industry made up nearly 33% of the market and posted the fastest growth at 10.8% CAGR.

Parametric Insurance Market Size

- Global parametric insurance premiums reached $15.1 billion in 2025, growing at an annual rate of 19.8% across emerging and developed markets.

- The Asia-Pacific market is expanding at 19.2% in 2025, led by Japan, Australia, and Indonesia, facing increased climate volatility.

- In Europe, Germany and the UK collectively account for 31% of the regional market, driven by resilience-focused investments.

- The North American market recorded a 27% rise in policies sold in 2025, with demand surging after record-breaking climate events.

- Parametric flood insurance grew by 42% YoY in 2025, especially in coastal and river-prone areas across Asia and the US.

- The Latin American market surpassed $5.3 billion in 2025, with Brazil and Mexico maintaining dominance in parametric adoption.

- In agriculture, parametric insurance covered $7.4 billion worth of crops in 2025, reflecting the sector’s continued shift toward risk-based tools.

Parametric Insurance Market Snapshot

- Market Size: USD 16.6B (2024) → USD 62.7B (2037)

- Growth Rate: 11.7% CAGR (2025–2037)

- Top Segment: Natural Catastrophe Insurance – 56.7% share

- Leading Region: North America – 36.1% share

- Key Players: AXA SA, Nephila Capital, Swiss Re, Allianz Group, etc.

Parametric Insurance Market Trends

- Climate adaptation policies fueled demand in 2025, with 73% of new parametric policies focused on climate-related risks like drought, flood, and storms.

- Blockchain adoption rose further, with 48% of parametric insurers now using blockchain for secure and automated payouts.

- Multi-trigger policies saw 28% growth in 2025, driven by uptake in agriculture, energy, and infrastructure sectors.

- IoT-based insurance models continue rising, with IoT-driven parametric policies up 33% annually, thanks to real-time risk monitoring.

- The financial sector’s demand grew, with parametric hedging for commodities and currencies rising 22% as firms seek macro risk protection.

- Insurtech investment in parametric insurance reached $1.6 billion in 2025, up 23% YoY, strengthening digital distribution and analytics.

- Cross-border parametric policies now make up 17% of global offerings, supporting multinational corporations with multi-region exposure.

Parametric Insurance Market Share

As the parametric insurance market grows, certain sectors and regions are leading the way. Here’s a breakdown of the current market share distribution and key players.

- Agriculture and energy sectors hold the largest shares in parametric insurance, accounting for 40% and 25% of the market, respectively, due to their high exposure to environmental risks.

- The global reinsurance market supports over 65% of parametric policies, reflecting the significant role of reinsurers in spreading risk.

- North America maintains a 38% share of the parametric insurance market, with demand largely from sectors like real estate, energy, and agriculture.

- In Europe, parametric insurance solutions for natural disasters have grown, with Germany holding a 15% share of the European market.

- Public sector participation is notable, as governments and NGOs account for 12% of parametric policy purchases aimed at disaster relief and climate adaptation.

- Insurtech companies are emerging as key players, capturing 20% of the parametric insurance market with innovative digital distribution and claims processing models.

- In Asia-Pacific, Japan and China represent 70% of the regional market, as they pioneer new parametric solutions to protect against typhoons and other natural events.

Parametric Insurance Market Drivers

Several factors drive the parametric insurance market, from climate change to technological advancements. These drivers are pushing the industry forward and expanding its applications.

- The increasing frequency of natural disasters has led to a 30% rise in demand for parametric policies across vulnerable regions.

- Climate change legislation worldwide encourages businesses to adopt parametric insurance, leading to a 15% annual growth in climate-related parametric policies.

- Data accuracy improvements through satellite and IoT technology are enhancing policy reliability, with 60% of insurers now integrating advanced data sources to define triggers.

- Customer demand for faster claim payouts remains strong, with 88% of policyholders citing immediate payouts as a primary reason for choosing parametric over traditional insurance.

- Rising insurance premiums in traditional markets make parametric insurance more attractive, with average savings of 20% on premium costs driving adoption.

- Increased government support and partnerships, particularly in climate-vulnerable countries, contribute to a 25% growth in public-private parametric insurance collaborations.

- Expansion of digital platforms enables easier access and customization, with online sales accounting for 60% of all parametric insurance purchases.

The Power of Technology in Parametric Insurance

- Satellite data usage in parametric insurance grew by 38% in 2025, enabling faster, more accurate event validation for floods, droughts, and hurricanes.

- AI adoption surged, with 53% of parametric insurers using AI-driven models for real-time trigger calibration and dynamic pricing.

- Blockchain-based policies now make up 44% of new parametric offerings, improving data integrity and speeding up claims resolution.

- Geolocation and GPS tech are used by 72% of insurers in 2025 to track event precision and optimize risk zones.

- Automated claims systems processed over 85% of parametric claims within 24–48 hours, drastically outperforming traditional models.

- Big Data analytics improved risk modeling accuracy by 17% in 2025, refining parametric thresholds and reducing false triggers.

- Mobile-first access is rising, with 37% of customers managing parametric policies via dedicated mobile apps for real-time monitoring.

Parametric Insurance Market by End Use

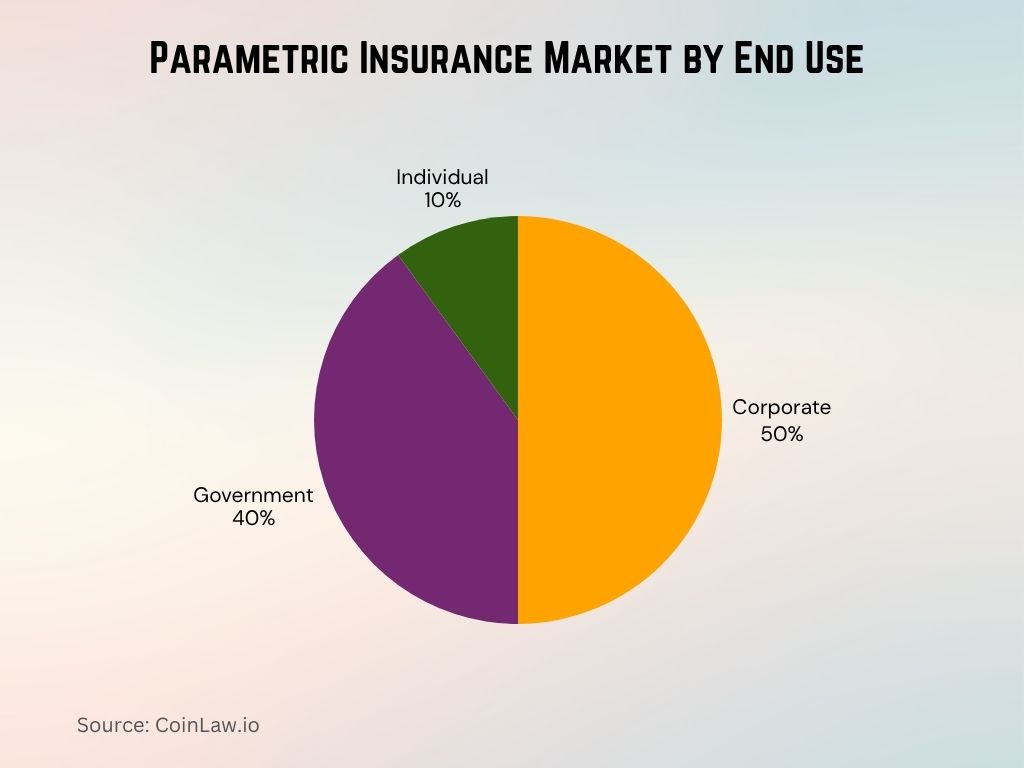

- The corporate segment dominates with a 50% revenue share.

- Government use is the second largest, at 40%.

- Individual end users account for the remaining 10%.

The data reflects growing interest from businesses and the public sector in parametric insurance solutions.

Parametric Insurance Segmentation

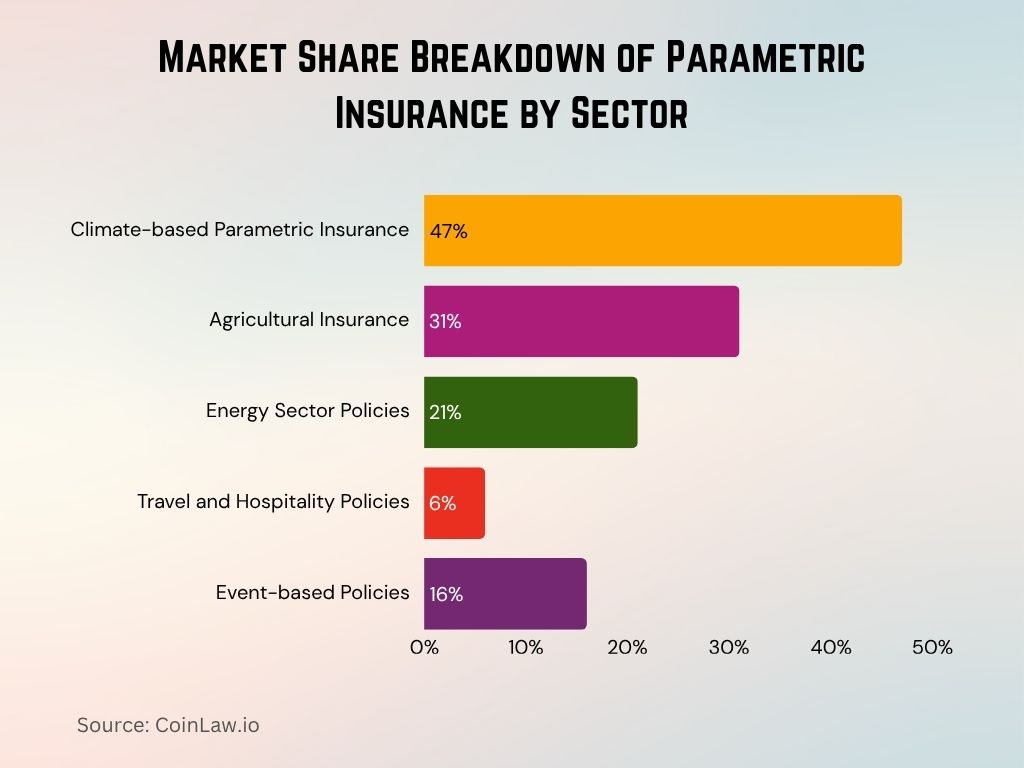

- Climate-based parametric insurance dominates with a 47% market share in 2025, driven by demand for coverage against storms, droughts, and floods.

- The agriculture segment makes up 31% of policies, fueled by farmers adapting to volatile climate conditions.

- The energy sector holds 21% of the parametric market, covering risks from grid failures, weather disruptions, and price shocks.

- Travel and hospitality account for 6% of policies in 2025, covering event cancellations and weather-related travel disruptions.

- Event-triggered policies, such as earthquake and wildfire coverage, represent 16% of the global parametric insurance market.

- Healthcare parametric insurance is gaining traction, with over $1.4 billion in coverage value in 2025 for risks like epidemics and service disruption.

- The marine and aviation sectors expanded adoption, now representing a combined 5% share, targeting weather and logistical risk events.

Competitive Landscape and Key Companies

- Swiss Re remains a leader with $1.8 billion invested in parametric solutions targeting climate risks across agriculture, energy, and public sectors.

- AXA Climate continues to lead in agri-coverage, with 37% of its parametric policies focused on crop and livestock protection in 2025.

- Munich Re expanded its offerings, recording a 24% increase in parametric policies related to natural disaster insurance in 2025.

- Global Parametrics manages over $240 million in parametric coverage for disaster recovery in vulnerable nations through NGO and government partnerships.

- Jumpstart Insurance serves high-risk US zones, with automated earthquake payouts now active in 12+ states using updated seismic triggers.

- Nephila Capital scaled rapidly, managing $620 million in parametric policies for weather-related and catastrophe-linked risks in 2025.

- Lloyd’s of London launched new partnerships delivering custom parametric solutions in emerging markets, with a focus on flood and cyclone risk.

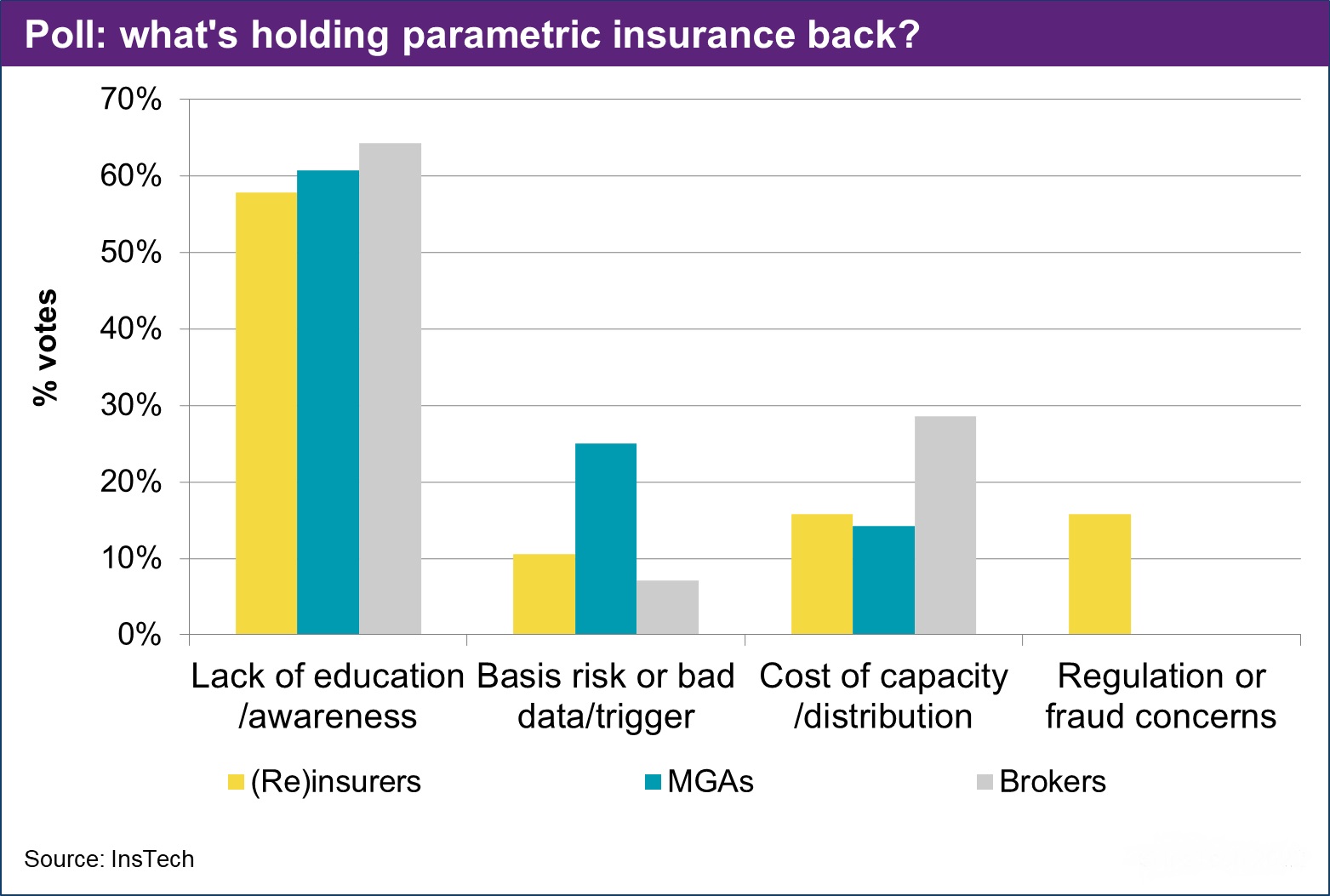

Barriers to Parametric Insurance Adoption – Poll Insights

The biggest challenge is a lack of education/awareness, cited by:

- 65% of Brokers

- 61% of MGAs

- 58% of (Re)insurers

Basis risk or bad data/trigger concerns were noted by:

- 26% of MGAs

- 10% of (Re)insurers

Cost of capacity/distribution is a barrier for:

- 28% of Brokers

- 17% of (Re)insurers

- Regulation or fraud concerns were highlighted by 15% of (Re)insurers

Recent Developments in the Industry

- The parametric insurance market reached $17.6 billion in 2025 and is projected to exceed $39.3 billion by 2032 as digital risk tools gain traction.

- AI-driven innovations and real-time data streams enhanced product precision, increasing adoption among global corporates and reinsurers.

- The African Risk Capacity (ARC) scaled its reach, with coverage extending to 41 member states in 2025, targeting full AU integration by 2034.

- In the Caribbean, CCRIF expanded coverage to include fisheries and public health, boosting disaster resilience across 24 member countries.

- Blockchain integration surged in 2025, powering smart contract-based parametric claims that deliver automated payouts in under 48 hours.

Conclusion

Parametric insurance is reshaping the insurance landscape, offering rapid, data-driven solutions that address the growing need for protection against climate and catastrophic risks. The industry’s expansion highlights a broader shift towards innovative, tech-driven insurance models that provide faster payouts, greater transparency, and cost-effective alternatives to traditional insurance. With advancements in AI, blockchain, and IoT, the scope of parametric insurance is widening, and its applications are expected to grow in both high-risk and emerging markets.

As climate volatility continues to impact global economies and daily lives, parametric insurance represents a proactive, flexible option that can adapt to various sectors’ unique challenges. From agriculture to travel, and energy to finance, this insurance model’s potential is vast and transformative. The next decade is likely to see parametric insurance become a cornerstone in climate resilience and economic stability, providing peace of mind to businesses and individuals alike.