Travel insurance isn’t just about lost bags or minor delays; it’s a financial safeguard against catastrophes that can spiral into seven-figure disasters. Recent industry cases reveal that claims have surged not only in size but in variety, from helicopter evacuations in remote zones to freak wildlife incidents in Southeast Asia.

For both digital nomads and occasional travelers, the cost of being unprepared is rising fast. Here’s a deep dive into the world’s most expensive, and sometimes bizarre, travel insurance claims.

Key Takeaways

- Single travel insurance claims can exceed $3 million, primarily due to ICU stays and international evacuation costs.

- Medical emergencies account for over 40% of all travel claims, with the US, Japan, and Switzerland ranking among the priciest destinations.

- Non-medical mishaps like traffic gridlocks, animal attacks, and luxury trip cancellations are increasingly contributing to high claims.

- Underinsured travelers face denial or partial reimbursement, especially if high-risk activities or pre-existing conditions are undeclared.

- Global insurers are tightening coverage policies as claim sizes escalate due to aging travelers, adventure tourism, and medical inflation.

Common Reasons Claims Get Denied or Reduced

Even legitimate travel mishaps can result in denied or reduced payouts if the traveler fails to meet policy conditions. Insurers are increasingly strict with documentation, disclosure, and coverage limitations, often leaving policyholders exposed when they least expect it.

- Undeclared Pre-Existing Conditions: Many claims are rejected because travelers failed to disclose chronic illnesses like diabetes, asthma, or heart issues. Even unrelated complications may be excluded if the condition was omitted from the initial policy.

- Excluded Activities Without Add-Ons: Activities like scuba diving, skiing, and mountain trekking often require special coverage. Injuries during these high-risk activities can void claims if they weren’t included in the policy beforehand.

- Alcohol or Substance Involvement: Claims linked to intoxication, such as falls, accidents, or injuries, are frequently denied. Even minimal alcohol consumption can void coverage depending on local laws and medical reports.

- Delayed Medical Notification or Reporting: Insurers typically require immediate contact when a serious incident occurs abroad. Delays in notifying the provider or receiving unauthorized treatment may result in non-payment.

- Insufficient Policy Limits: Many travelers choose cheaper plans with low medical caps or no evacuation coverage. When claims exceed these thresholds, insurers pay only up to the limit, leaving the traveler to cover the rest.

- Negligence or Lack of Precaution: If a claim stems from careless behavior, like unattended valuables or ignoring travel advisories, it may be partially or fully denied. Policies usually contain clauses requiring reasonable precautions from the insured.

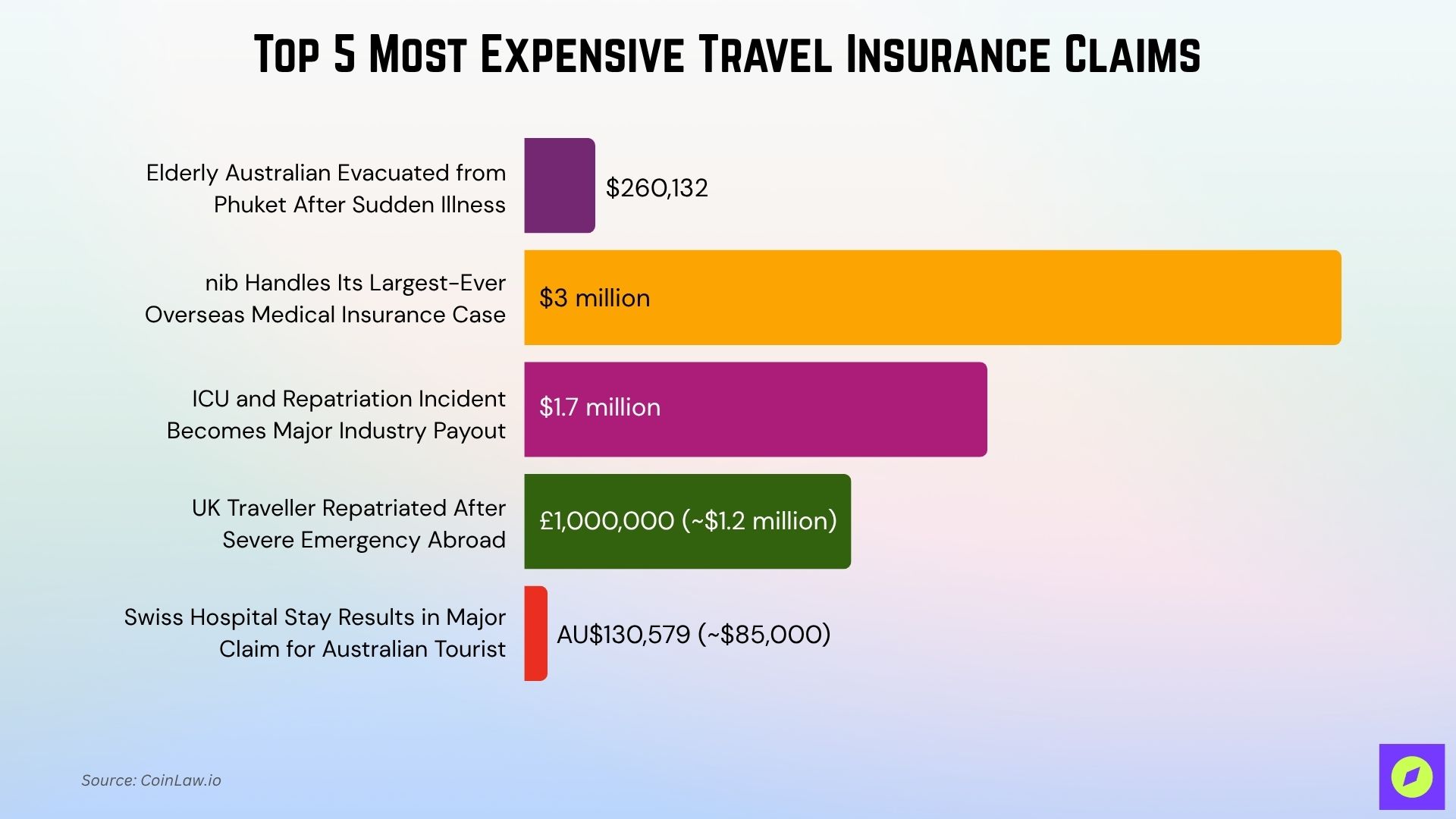

Top 5 Most Expensive Travel Insurance Claims

Extreme medical emergencies, long-distance evacuations, and high-cost destinations continue to produce the most financially devastating insurance cases. These examples serve as cautionary benchmarks for travelers who underestimate the true cost of falling ill abroad.

| Travel Insurance Claim | Amount (Approx.) | Why It Was Expensive |

| Elderly Australian Evacuated from Phuket After Sudden Illness | $260,132 | Air ambulance, critical care, and medical staff for repatriation. |

| NIB Handles Its Largest-Ever Overseas Medical Insurance Case | $3 million | Overseas hospitalization, emergency surgery, and repatriation. |

| ICU and Repatriation Incident Becomes Major Industry Payout | $1.7 million | Prolonged ICU stay in Europe plus medical flight services. |

| UK Traveller Repatriated After Severe Emergency Abroad | >£1,000,000 (~$1.2 million) | Foreign hospital costs + medically equipped repatriation flight. |

| Swiss Hospital Stay Results in Major Claim for Australian Tourist | AU$130,579 (~$85,000) | High-cost European healthcare and extended inpatient care. |

1. Elderly Australian Evacuated from Phuket After Sudden Illness

Medical repatriations from Southeast Asia remain one of the most complex and resource-intensive scenarios for insurers. Age, distance, and onboard care requirements often combine to create significant logistical and financial challenges.

- Amount: $260,132

- What Happened / Case: An Australian woman in her 80s fell seriously ill while in Phuket, Thailand. She required an emergency medical evacuation back to Perth for critical treatment.

- Why It Was Expensive: Air ambulance flights, intensive onboard medical staff, and hospital transfers drive up the cost of repatriation. Without insurance, her family would have been responsible for over a quarter-million dollars.

2. nib Handles Its Largest-Ever Overseas Medical Insurance Case

Severe medical events abroad can quickly escalate into multi-layered emergencies requiring coordination across hospitals, air crews, and specialist providers. Insurers increasingly face these high-stakes scenarios as global travel resumes at full pace.

- Amount: >$3 million

- What Happened / Case: nib Travel confirmed its most expensive individual travel insurance claim ever, involving a complex overseas medical emergency.

- Why It Was Expensive: The case required prolonged overseas hospitalisation, emergency surgery, and eventual medical repatriation, easily pushing costs into the multi-million-dollar range.

3. ICU and Repatriation Incident Becomes Major Industry Payout

When extended ICU care is involved, even short delays in treatment planning or transport can dramatically inflate costs. Such cases often highlight the importance of having high policy limits and robust emergency coordination.

- Amount: ~$1.7 million

- What Happened / Case: Travel insurance industry data highlighted a single seven-figure payout, covering extended ICU care and repatriation from Europe.

- Why It Was Expensive: Emergency hospitalisation in a European city with advanced treatment, combined with long ICU care and medical flight services, dramatically inflated costs.

4. UK Traveller Repatriated After Severe Emergency Abroad

British insurers frequently deal with long-haul medical returns from countries with vastly different healthcare systems. Repatriation logistics often depend on local infrastructure, time zones, and the stability of the patient’s condition.

- Amount: >£1 million (~$1.2 million)

- What Happened / Case: A British traveller suffered a severe medical emergency overseas, requiring urgent care abroad and repatriation back to the UK.

- Why It Was Expensive: Foreign hospital costs, coupled with repatriation on a medically equipped flight, pushed the claim over £1 million.

5. Swiss Hospital Stay Results in Major Claim for Australian Tourist

Western Europe’s advanced healthcare systems are also among the most expensive for out-of-pocket visitors. A few nights of inpatient care in Switzerland can eclipse an entire trip’s budget without adequate insurance.

- Amount: AU$130,579 (~$85,000)

- What Happened / Case: An Australian traveller required hospital care in Switzerland, where treatment costs are among the highest in Europe.

- Why It Was Expensive: Switzerland is one of the world’s most expensive healthcare systems, and extended inpatient care led to a six-figure bill.

What Drives These Massive Claims? A Breakdown of Cost Components

Behind every large payout is a chain of high-cost services, emergency care, air evacuations, specialist treatments, and logistical delays. Understanding these cost drivers helps reveal why even routine incidents can spiral into six- or seven-figure claims.

- ICU and emergency surgeries: One night in an intensive care unit in the US or Switzerland can cost $8,000–$12,000.

Medical evacuations: Air ambulances range from $25,000 to $250,000, depending on distance, aircraft, and medical staffing. - Hospital transfers and post-surgical care: Add up to $30,000–$100,000 in cases where the patient cannot immediately travel.

- Repatriation: Flights with full-time medical supervision or stretchers require extensive planning and insurer approval, sometimes running $50,000+ even on commercial aircraft.

Frequently Asked Questions (FAQs)

Emergency medical claims accounted for 27 % of all benefits paid in one recent insurer dataset.

SCTI paid $672,630 for a 76‑year‑old stroke patient requiring air ambulance and hospital care.

In the UK, insurers processed £511 million in travel claims from 574,000 claims, about £890 per claim on average.

In 2024, the average payout rose from $1,900 to $2,609, a 37 % increase.

Conclusion

Adventure travelers are particularly at risk. For example, a traveler injured in the Italian Alps required helicopter rescue, orthopedic surgery, and six months of physiotherapy, tallying a $420,000 claim. These high-cost scenarios are becoming more common as travel rebounds post-pandemic, and tourists venture into more remote or under-resourced areas.

Travel insurance is no longer just a safety net for misplaced luggage or delayed flights; it’s a financial shield against emergencies that can reach into the millions. As global travel becomes more adventurous and healthcare costs continue to rise, the margin for error shrinks dramatically. The most expensive claims on record reveal just how quickly accidents, illness, or logistical challenges can overwhelm even seasoned travelers.

Whether you’re planning a luxury vacation or a backpacking trip, the right insurance isn’t an afterthought; it’s a necessity. Understanding the true risks, reading the fine print, and choosing adequate coverage can make the difference between a fully covered crisis and lifelong debt.