Life insurance is meant to provide peace of mind, but a single oversight can turn a promised payout into a devastating loss. From denied claims due to technicalities to multimillion-dollar policies lapsing without warning, families across the globe have suffered financial and emotional ruin because of avoidable mistakes. Below, we dissect real-world examples of life insurance gone wrong and reveal how you can steer clear of the costliest errors.

Key Takeaways

- $2 million was lost when a widow’s policy lapsed shortly before her husband’s death.

- A $250,000 payout was denied in Louisiana over a failure to disclose hypertension.

- Faking death to claim ₹50 lakh (approx. $60,000) in India led to arrests and criminal charges.

- Denials often stem from contestability periods, misrepresentations, or technical lapses.

- Each case discussed is drawn from publicly reported legal disputes or media coverage involving real policyholders.

How to Avoid Losing Your Life Insurance Payout

A well-structured life insurance policy can provide decades of security, but only if it’s managed proactively. These strategies help ensure your policy pays out when your loved ones need it most.

- Set Auto-Payments for Premiums: Prevent lapses by automating payments, especially if illness or emergencies occur.

- Fully Disclose Health and History on Application: Even controlled conditions must be listed to avoid claims being voided later.

- Review Your Policy Every 1–2 Years: Life changes like marriage, children, or new medical issues should trigger a review of your coverage and beneficiaries.

- Understand What’s Actually Covered: Read the fine print and verify whether benefits like disability or accidental death are included.

- Keep Beneficiaries Updated and Documented: Outdated or vague beneficiary designations can delay or reroute funds during the claims process.

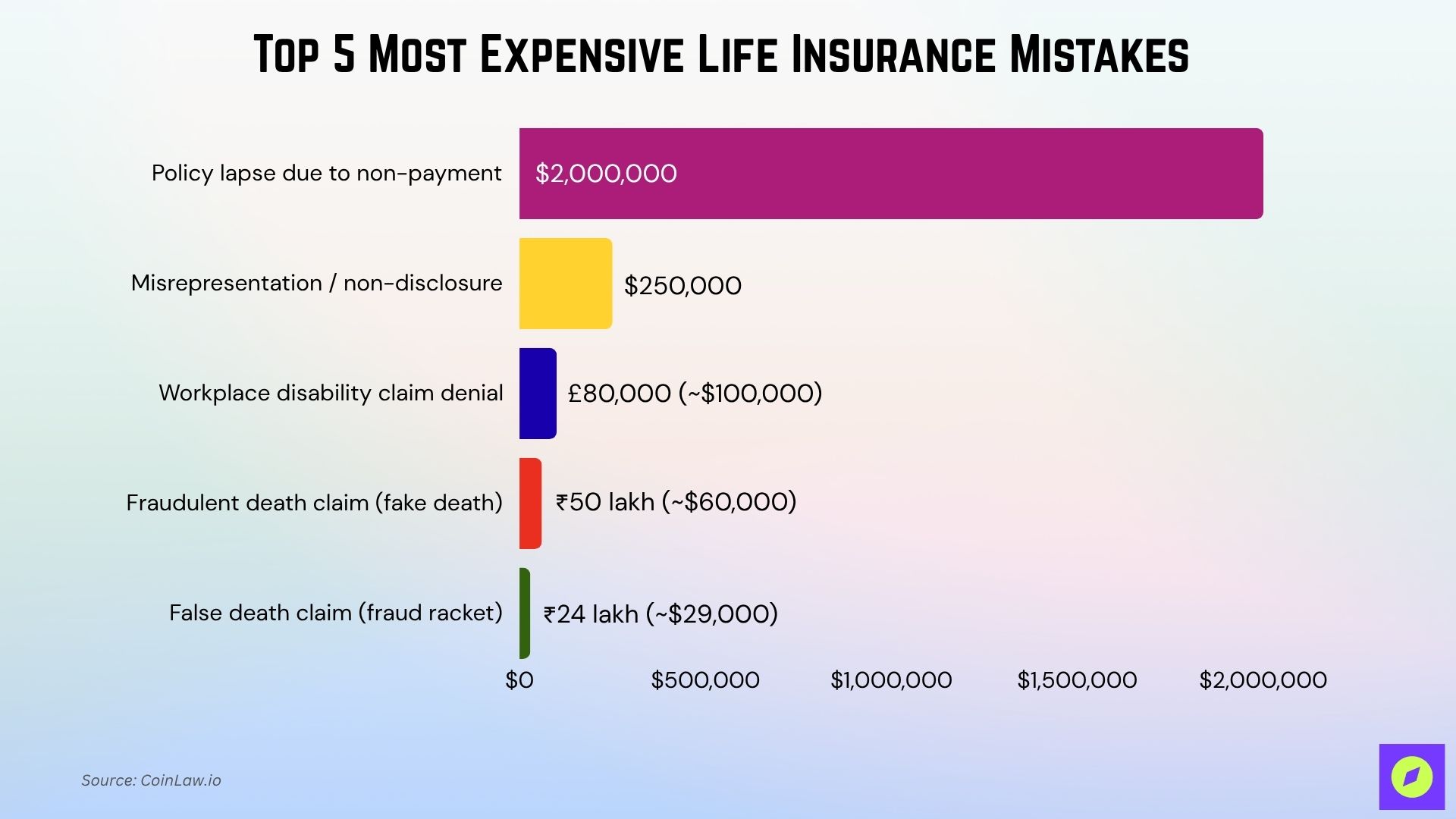

Top 5 Most Expensive Life Insurance Mistakes

Even a single misstep with life insurance can erase years of planning and premium payments, leaving families without the protection they expected. These five real-world cases show how small oversights can lead to devastating financial losses, and how you can avoid them.

| Mistake | Amount (Approx.) | Case / Impact |

| Policy lapse due to non-payment | $2,000,000 | The widow almost lost the entire payout after the insurer claimed the policy lapsed despite years of premiums. |

| Misrepresentation/non-disclosure | $250,000 | The family denied full benefits after the insured failed to disclose blood pressure medication. |

| Workplace disability claim denial | £80,000 (~$100,000) | A UK woman was misled by policy documents, denied a payout when she became too ill to work. |

| Fraudulent death claim (fake death) | ₹50 lakh (~$60,000) | Man faked his death; insurer caught the fraud before paying. |

| False death claim (fraud racket) | ₹24 lakh (~$29,000) | Fraudsters filed a fake death claim; the insurer uncovered the scam. |

1. Policy Lapse Due to Non-Payment

- Amount: $2,000,000

- Impact: A physician’s life insurance policy was declared lapsed (due to missed premiums) just before his death. The widow had paid ~$350,000 over the life of the policy.

- What Happened / Case: The insurer refused to pay, claiming the policy had lapsed. The widow sued, and the case revealed that the company wrongfully withheld the payout.

- Why It Was Expensive: The family nearly lost the entire $2 million death benefit, despite paying hundreds of thousands in premiums.

2. Misrepresentation / Non-Disclosure in Application

- Amount: $250,000

- Impact: A Louisiana man’s $250,000 life insurance claim was denied after his death because he failed to disclose he was taking blood pressure medication.

- What Happened / Case: Although the policy had passed the two-year contestability period, the insurer claimed the applicant’s omission was fraudulent and material, which, under many state laws, still allows denial of payout if intent to mislead can be demonstrated.

- Why It Was Expensive: His family lost the full $250,000 payout, leaving them without the expected financial support.

3. Denial of Workplace Critical Illness / Disability Claim

- Amount: £80,000

- Impact: UK woman Violet Baker expected a payout from her workplace policy when she became too ill to work. Marketing materials suggested that disability would be covered, but her insurer denied her claim.

- What Happened / Case: The documents implied “total permanent disability” was part of her policy, but it was excluded in the fine print.

- Why It Was Expensive: She was left without the £80,000 benefit she was counting on, leading to financial hardship.

4. Fraudulent Death Claim (Fake Death Case)

- Amount: ₹50 lakh (~$60,000)

- Impact: A man in Bikaner, India, faked his death to claim ₹50 lakh in life insurance. The scheme was uncovered during the investigation.

- What Happened / Case: Fake documents and a fraudulent death certificate were submitted to claim the payout. The insurer flagged it as fraud.

- Why It Was Expensive: If undetected, the company would have paid out ₹50 lakh fraudulently, driving up costs for legitimate policyholders.

5. False Death Claim via Organized Fraud Racket

- Amount: ₹24 lakh (~$29,000)

- Impact: In Bhavnagar, India, fraudsters filed a false claim worth ₹24 lakh, stating the insured had died when he was actually alive and receiving treatment.

- What Happened / Case: Fraudulent nominees tried to collect the benefit, using false death reports. Investigations uncovered the racket.

- Why It Was Expensive: The insurer nearly lost ₹24 lakh to fraud, showing how weak controls can cost companies and affect honest beneficiaries.

What These Mistakes Teach Us About Claim Denials and Policy Traps

Life insurance claims don’t fail because of bad luck; they fail due to overlooked clauses, procedural gaps, and small errors with massive consequences. These real-world cases reveal the common traps hidden in plain sight, especially during times of crisis.

- Contestability Window Is Critical: Claims made within the first 2 years of a policy are often scrutinized heavily, and even minor misstatements can void the benefit.

- Policy Lapse Can Invalidate Everything: Missed payments, especially when paired with illness or disability, are a major cause of sudden and total loss of coverage.

- Misrepresentation is a Leading Cause of Denials: Failing to disclose medications, medical history, or lifestyle habits, even unintentionally, often leads to “material misrepresentation” claims by insurers.

- Marketing Language Isn’t Legally Binding: Many assume riders like disability or critical illness are included, but policies may exclude them unless clearly purchased and documented.

- Beneficiary Mistakes Create Legal Delays: Failing to update beneficiaries or relying on verbal instructions can trigger probate battles or benefit disputes.

Why Insurers Deny Claims and How You Can Fight Back

Insurers have clear incentives to deny payouts where possible, especially when technicalities or incomplete disclosures are involved. Knowing the most common denial reasons gives you a powerful head start when appealing or preventing rejections altogether.

- Claims Denied for Material Misrepresentation: If the insurer believes any part of the application was misleading, even unintentionally, they may withhold the entire payout.

- Policy Not in Force at Time of Death: If the policy lapsed, even by a few days, it gives the company legal ground to deny the claim.

- Failure to Meet Definitions for Riders: Riders like total disability or critical illness often have narrow definitions that policyholders don’t meet without expert documentation.

- Suspected Fraud or Documentation Errors: Inconsistencies in forms, death certificates, or timelines can trigger denial or investigation.

- How to Fight Back: Appeal through the insurer first, then escalate to a regulatory body or hire a life insurance attorney, especially if the claim is within legal rights.

Frequently Asked Questions (FAQs)

Between 10 % and 20 % of life insurance claims face an initial rejection or protracted review.

The published industry average lapse ratio is about 7.0 %.

The rate is 5.4 % (including 4.3 % lapses and 1.0 % surrenders).

Approximately 1 % to 3 % of claims are investigated for fraud or misrepresentation or are denied.

Conclusion

Life insurance is one of the most important financial tools you can invest in, but it only works if it’s managed correctly. As these real-life cases show, even well-intentioned policyholders can lose everything due to a missed payment, incomplete disclosure, or misunderstanding of coverage terms. From a $2 million lapse to denied disability claims and outright fraud, the consequences of these mistakes are not hypothetical; they’re devastating and real.

The good news? Every one of these costly outcomes was preventable. By reviewing your policy regularly, disclosing health history honestly, understanding exclusions, and keeping your beneficiaries updated, you dramatically increase the chances that your loved ones will receive the payout they’re counting on. Don’t wait for a crisis to expose the gaps in your coverage; take action now. A well-managed policy doesn’t just protect wealth; it protects your family’s future when they need it most.