Sending money across borders shouldn’t feel like a luxury, but for many, it still does. In 2025, the cost of transferring even modest amounts remains alarmingly high, especially in countries that rely heavily on remittances. From migrant workers supporting families to entrepreneurs paying suppliers, excessive fees continue to erode global financial equity. This article breaks down where cross-border fees are the steepest, why they’re so high, and what’s being done to change that.

Key Takeaways

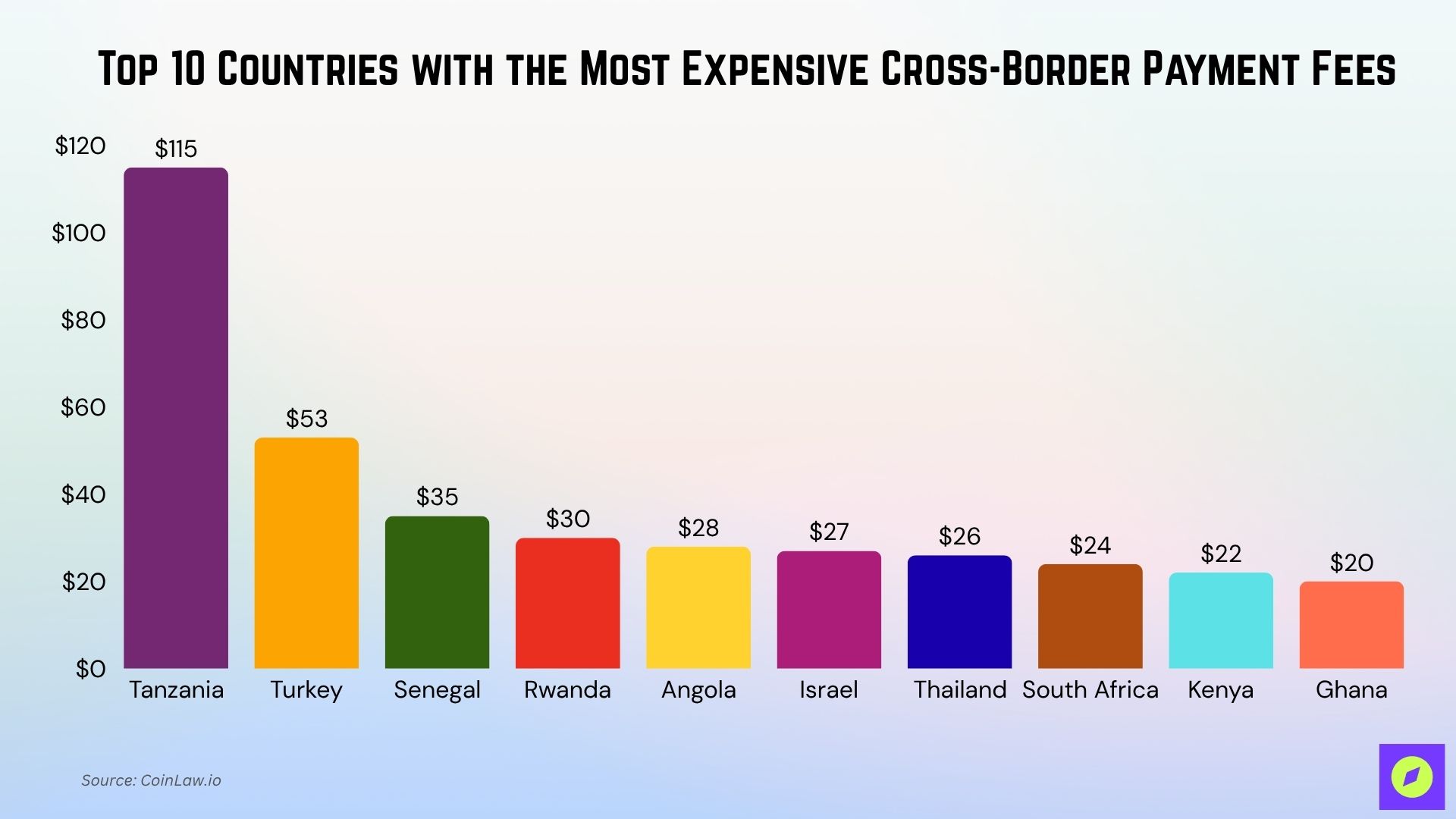

- 1Tanzania leads globally with an average $115 fee to send $200, a staggering 57.5% cut from the principal.

- 2Turkey and Senegal follow, with costs of $53 and $35, respectively.

- 37 out of the top 10 most expensive countries are located in Africa.

- 4Digital wallets and crypto-based alternatives remain underutilized in high-fee corridors.

Why Are Cross-Border Payment Fees Still So High?

Despite decades of progress in financial technology, sending money across borders remains surprisingly expensive, especially for those who can least afford it. These high fees are driven by a mix of outdated systems, limited competition, and fragmented global infrastructure.

- Limited Market Competition: A small number of dominant providers keep prices high in underserved regions.

- Too Many Intermediaries: Payments often pass through multiple banks and agents, each adding a fee.

- Currency Conversion Costs: Foreign exchange markups inflate the final amount deducted from the transfer.

- Regulatory Compliance Costs: AML and KYC requirements increase overhead, especially in low-tech environments.

- Lack of Digital Access: Poor mobile connectivity and infrastructure gaps hinder the adoption of low-cost digital alternatives.

Top 10 Countries with the Most Expensive Cross-Border Payment Fees

Despite years of policy pledges and digital innovation, cross-border payment fees are still unreasonably high in many parts of the world. While the global average remittance cost is 6.2%, several countries exceed this, with some corridors reporting costs over 20–25%, particularly in parts of Sub-Saharan Africa and the Middle East.

Here’s a breakdown of the countries with the most expensive average fees:

| Rank | Country | Avg. Fee ($) | Fee % of $200 |

| 1 | Tanzania | $115 | 57.5% |

| 2 | Turkey | $53 | 26.5% |

| 3 | Senegal | $35 | 17.5% |

| 4 | Rwanda | $30 | 15% |

| 5 | Angola | $28 | 14% |

| 6 | Israel | $27 | 13.5% |

| 7 | Thailand | $26 | 13% |

| 8 | South Africa | $24 | 12% |

| 9 | Kenya | $22 | 11% |

| 10 | Ghana | $20 | 10% |

1. Tanzania, East Africa

Tanzania is a diverse country known for its wildlife reserves, Mount Kilimanjaro, and vibrant agricultural economy. It is also one of the top remittance destinations in East Africa, with many families depending on funds sent from relatives abroad.

- Avg. Fee: $115

- Why These Fees Are So High: Limited competition and reliance on manual payout methods contribute to higher remittance costs in Tanzania, although some digital providers are beginning to enter the market. High foreign exchange markups and a lack of digital interoperability drive costs even higher in rural areas.

2. Turkey, Middle East/Eastern Europe

Turkey serves as a cultural and economic bridge between Europe and Asia, with a growing diaspora sending money home from Germany, the Netherlands, and the Gulf. Its strategic location makes it a major hub for regional trade and migration.

- Avg. Fee: $53

- Why These Fees Are So High: Cross-border payments to and from Turkey often involve multiple correspondent banks, each adding fees. Currency volatility and tight capital controls increase foreign exchange costs, while regulatory hurdles limit lower-cost fintech solutions.

3. Senegal, West Africa

Senegal is a coastal West African nation with a strong culture of migration, particularly to France, Spain, and Italy. Remittances represent a significant portion of the country’s GDP and household income.

- Avg. Fee: $35

- Why These Fees Are So High: Traditional money transfer operators dominate the corridor, limiting pricing competition. High agent commission structures and limited digital adoption in rural areas inflate the overall cost of sending money home.

4. Rwanda, East Africa

Known for its rapid economic recovery and digital innovation drive, Rwanda has positioned itself as a rising tech hub in East Africa. However, remittance inflows remain modest and heavily cash-based.

- Avg. Fee: $30

- Why These Fees Are So High: The country’s remittance ecosystem is still dependent on legacy systems, with a lack of digital rails for international transfers. Low transaction volumes also mean higher fixed costs per transfer for service providers.

5. Angola, Central Africa

Angola is a resource-rich nation with vast oil reserves and a growing expatriate workforce scattered across Europe and Latin America. Cross-border payments are essential for family support and trade.

- Avg. Fee: $28

- Why These Fees Are So High: A weak financial infrastructure and regulatory inefficiencies contribute to inflated remittance costs. The Angolan Kwanza’s instability further increases the cost of currency exchange in cross-border flows.

6. Israel, Middle East

Israel is a high-income nation with a strong financial infrastructure and global ties. It receives remittances primarily from expatriates and foreign workers.

- Avg. Fee: $27

- Why These Fees Are So High: Cross-border payments to and from Israel often face high compliance and documentation costs. Additionally, mainstream banking services dominate the remittance space, limiting access to cheaper digital channels.

7. Thailand, Southeast Asia

Thailand is a key regional player in Southeast Asia, both as a remittance-sending and receiving country. Migrant labor flows to and from Cambodia, Myanmar, and Malaysia make remittances vital.

- Avg. Fee: $26

- Why These Fees Are So High: Most remittances are routed through conventional banks or legacy money transfer operators, which charge premium fees. Language barriers and tech literacy gaps also slow digital remittance adoption among migrant workers.

8. South Africa, Southern Africa

South Africa is the economic powerhouse of Africa and a major remittance-sending country for workers from neighboring nations like Zimbabwe, Mozambique, and Lesotho.

- Avg. Fee: $24

- Why These Fees Are So High: A small number of providers dominate the market, creating little incentive for price reductions. Cross-border payments within Southern Africa are also complicated by fragmented regional banking regulations and FX spreads.

9. Kenya, East Africa

Kenya is a global leader in mobile money innovation, known for pioneering services like M-Pesa. Despite that, international transfers remain costly for many users.

- Avg. Fee: $22

- Why These Fees Are So High: While domestic digital transfers are cheap and fast, international remittance channels often exclude mobile-first options. Dependency on traditional banking corridors and international licensing limitations keeps fees high.

10. Ghana, West Africa

Ghana is one of West Africa’s most stable economies, with a growing tech sector and strong diaspora links, especially in the US and UK.

- Avg. Fee: $20

- Why These Fees Are So High: Despite progress in fintech, most international transfers rely on older, bank-based infrastructure. Low competition in corridors from North America and Europe maintains above-average pricing structures.

How High Fees Hurt Households and Economies

High cross-border payment fees chip away at the money meant to support families, fund education, and grow small businesses. The ripple effect stretches beyond individuals, undermining financial inclusion and slowing economic progress in developing nations.

- Reduced Household Support: When over 50% of a $200 transfer disappears in fees, as seen in Tanzania, families on the receiving end face a severe shortfall in their basic budgets.

- Widening the Financial Inclusion Gap: High fees discourage formal channels, pushing people toward unregulated cash networks. This limits access to savings tools, credit options, and digital identity systems.

- Small Businesses Suffer: SMEs involved in cross-border trade face inflated operating costs when paying overseas suppliers or freelancers, making them less competitive in global markets.

Can Technology Solve the Problem?

Several innovations are reshaping the cross-border payment landscape, introducing faster, more secure, and more transparent methods of transferring money internationally. If these technologies are widely adopted, they could significantly reduce transaction fees and improve financial inclusion on a global scale.

- Mobile Money Platforms: Countries like Kenya and Ghana have built robust mobile ecosystems domestically, but the challenge now is extending that efficiency to international corridors.

- Fintech Remittance Providers: Players like Wise, Revolut, Remitly, and WorldRemit are already slashing fees in popular routes, offering real-time rates, and transparent pricing.

- Blockchain and Stablecoins: Technologies like USDC, RippleNet, and Stellar are creating near-instant settlement rails with minimal costs. Though adoption remains low in high-fee regions, regulatory clarity could open the door.

- CBDCs and Interoperable Payment Networks: Governments are piloting Central Bank Digital Currencies and regional clearing systems to streamline cross-border settlement at near-zero cost.

Conclusion: The Cost of Sending Shouldn’t Be a Burden

As the world becomes more connected, the cost of sending money should be decreasing, not climbing. Yet, the data from 2025 tells a different story for millions living in and sending to high-fee countries. Whether through policy, competition, or technology, the pressure to fix the broken cross-border system is mounting.

For now, transparency, awareness, and digital alternatives offer the best route forward until a fairer, faster, and more affordable global payment network becomes the norm.