Insurance fraud remains one of the most damaging financial crimes globally, draining billions from industries and consumers alike. From corporate healthcare scandals to nationwide scams, fraud schemes expose deep weaknesses in insurance systems and regulators. The impact stretches far beyond finances, premiums rise, trust erodes, and in extreme cases, fraud escalates into violence. These top cases provide a clear look at the scale and diversity of insurance fraud worldwide.

Key Takeaways

- $14.6 billion in false healthcare claims uncovered in the U.S. “Operation Gold Rush” (2025).

- $3 billion corporate settlement by GlaxoSmithKline set historic records for healthcare fraud penalties.

- $2 billion cross-border scheme by Greg Lindberg reshaped insurance regulation.

- ₩1.15 trillion ($795 million) in fraudulent claims detected in South Korea (2024), a record national total.

- Fraud is both systemic and diverse, ranging from inflated medical bills to staged accidents and even violent crimes.

How Massive Fraud Cases Impact Policyholders and Premiums

Insurance fraud directly affects honest consumers, raising the cost of coverage and reducing trust in the system. Large cases show how the burden of fraud is spread across millions of policyholders.

- Higher Premiums: Insurers offset fraud-related losses by charging customers more.

- Reduced Trust: Public confidence in insurers declines when major fraud cases dominate headlines.

- Hidden Costs: Fraud increases operational expenses, making legitimate claims harder to process.

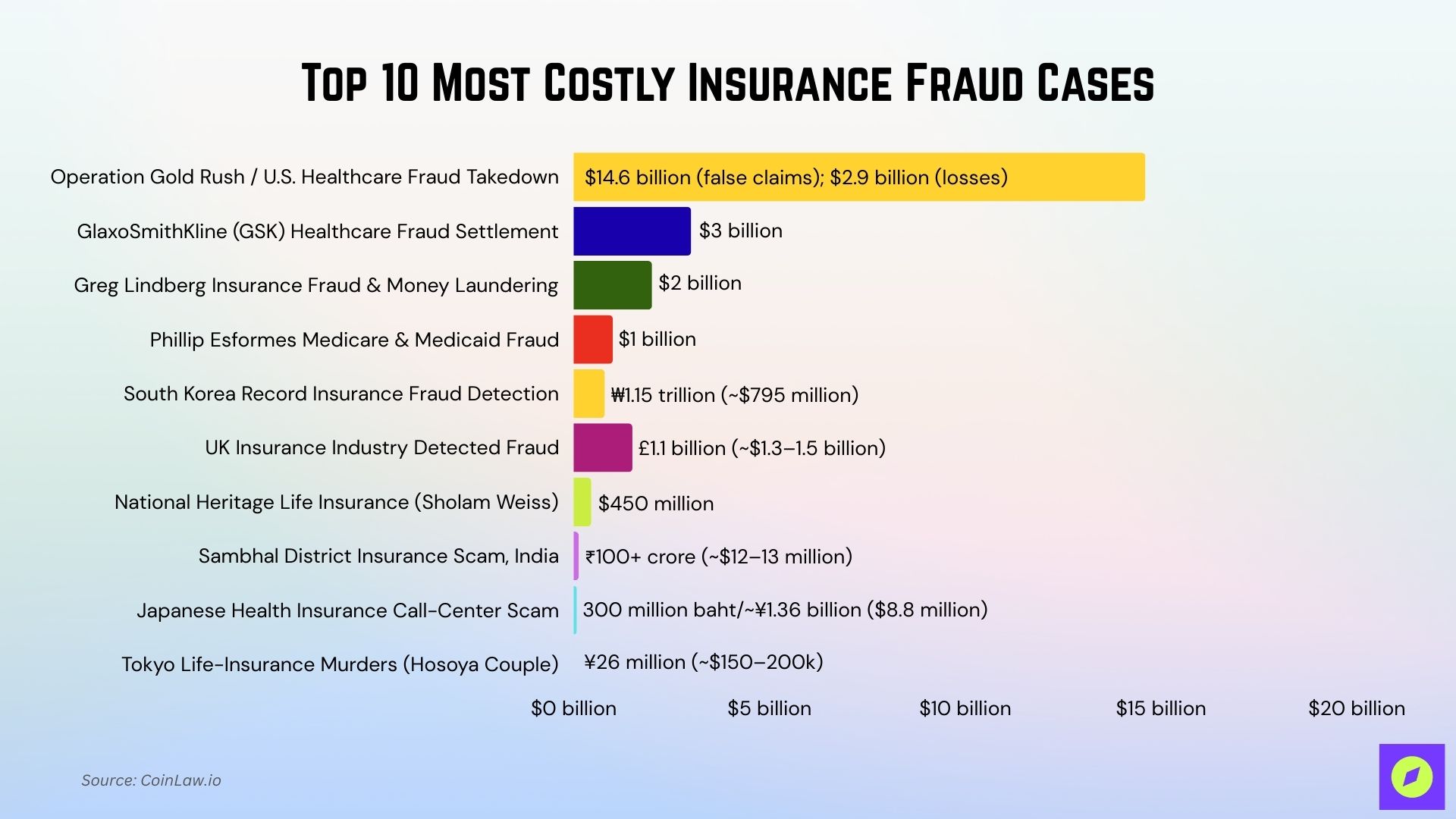

Top 10 Most Costly Insurance Fraud Cases

These landmark cases reveal how insurance fraud can range from billion-dollar corporate schemes to smaller but equally destructive crimes. They highlight the financial, social, and regulatory consequences that continue to shape the global insurance industry.

| Case | Year | Amount | Key Highlight |

| Operation Gold Rush / U.S. Healthcare Fraud Takedown | 2025 | $14.6 billion (false claims); $2.9 billion (losses) | Largest U.S. healthcare fraud action ever |

| GlaxoSmithKline (GSK) Healthcare Fraud Settlement | 2012 | $3.0 billion | The biggest U.S. healthcare fraud settlement at the time |

| Greg Lindberg Insurance Fraud & Money Laundering | 2024 | $2.0 billion | Multi-country scheme reshaping regulation |

| Phillip Esformes Medicare & Medicaid Fraud | 2019 | $1.0 billion alleged | Largest individual U.S. healthcare fraud |

| South Korea Records Insurance Fraud Detection | 2024 | ₩1.15 trillion (~$795 million) | National record for detected insurance fraud |

| UK Insurance Industry Detected Fraud | 2023 | £1.1 billion (~$1.3–1.5 billion) | Over 84,000 fraudulent claims uncovered |

| National Heritage Life Insurance (Sholam Weiss) | 1990s | $450 million | The largest insurer collapsed from fraud in the U.S. |

| Sambhal District Insurance Scam, India | 2025 | ₹100+ crore (~$12–13 million) | Fraud plus murders to claim life payouts |

| Japanese Health Insurance Call-Center Scam | 2025 | 300 million baht/~¥1.36 billion | Targeted 200,000 retirees in Thailand |

| Tokyo Life-Insurance Murders (Hosoya Couple) | Ongoing | ¥26 million (~$150–200k) | Insurance fraud escalated to homicides |

1. Operation Gold Rush / U.S. Healthcare Fraud Takedown (2025)

This case illustrates how large-scale fraud can infiltrate trusted healthcare systems and exploit complex billing structures. It highlights the need for continuous monitoring and innovation in fraud detection.

- Amount: ~$14.6 billion in false claims; ~$2.9 billion in actual losses

- What Happened: Over 320 individuals, including doctors and medical business owners, were charged for schemes involving fake medical supply companies and shell firms submitting fraudulent claims to Medicare and other programs.

- Why Significant: Considered the largest healthcare fraud enforcement action in U.S. history, both in scope and dollar amount.

2. GlaxoSmithKline (GSK) Healthcare Fraud Settlement (2012)

Beyond the financial penalty, this case showed how regulatory scrutiny can reshape corporate behavior. It remains a reminder that accountability applies even to industry leaders.

- Amount: $3.0 billion

- What Happened: GSK illegally promoted prescription drugs for unapproved uses, failed to report safety data, and defrauded Medicaid.

- Why Significant: At the time, it was the largest healthcare fraud settlement in U.S. history.

3. Greg Lindberg Insurance Fraud & Money Laundering Scheme (2024)

The Lindberg case reflects the growing risks of globalized financial operations in the insurance sector. It highlights the vulnerability of regulators when dealing with multi-jurisdictional fraud.

- Amount: ~$2.0 billion

- What Happened: Greg Lindberg, an insurance magnate with companies in North Carolina, Bermuda, Malta, etc., pleaded guilty to conspiracy and money laundering in connection with a scheme to defraud insurance regulators and policyholders

- Why Significant: Because of its scale ($2B), cross-border components, and its impact on regulatory oversight in the insurance sector, both for regulators and for how insurance companies are allowed to finance operations and deal with policyholder funds.

4. Phillip Esformes / Medicare & Medicaid Fraud Case (2019)

The Esformes case underscores how individual actors can manipulate loopholes in public healthcare programs for years before being caught. It emphasizes the importance of oversight in eldercare and medical services.

- Amount: ~$1 billion alleged; $44.2 million restitution + forfeitures

- What Happened: Esformes ran a massive fraud network across nursing homes, billing for medically unnecessary services and paying kickbacks for patient referrals.

- Why Significant: Labeled as one of the biggest individual healthcare fraud prosecutions in U.S. history.

5. South Korea Record Insurance Fraud Detection (2024)

This case reflects how fraud can become systemic when detection systems lag behind the sheer volume of false claims. It highlights the pressure regulators face in balancing enforcement with the protection of genuine policyholders.

- Amount: ~ ₩1.15 trillion (~US$795 million) in fraudulent insurance claim payments detected in 2024.

- What Happened: Insurance scammers in South Korea submitted a very large volume of wrongful/false insurance filings, fabricated medical records, staged/false accidents, inflated claims, etc. The Financial Supervisory Service reported that fraud reached record levels, with the number of suspects nearly 109,000.

- Why Significant: This is one of the highest annual totals for insurance fraud for a single country in recent years. It shows not a single spectacular case but systemic, widespread claims fraud that impacts insurers and policyholders broadly. Also, the relatively few recoveries mean large amounts of the damage may remain unrecovered.

6. UK Insurance Industry: £1.1 Billion in Detected Claims, 2023

This case underscores how fraud is not limited to massive scandals but is also embedded in everyday claims. It highlights the continuous challenge insurers face in balancing customer trust with fraud prevention.

- Amount: ~£1.1 billion (~$1.3–1.5 billion) in fraudulent/bogus insurance claims detected in the UK in one year (2023) by the Association of British Insurers.

- What Happened: Over 84,000 fraudulent claims in 2023 were detected (various types: exaggerated loss, motor fraud, fake property claims). Estimated cost: ~£1.1 billion.

- Why Significant: This is a high annual aggregate, showing the scale of everyday insurance fraud in a developed market; the volume and value indicate that fraud is a constant pressure on insurers and affects premiums for everyone.

7. National Heritage Life Insurance Company – Sholam Weiss Case (1990s)

This collapse revealed how financial misconduct in the insurance sector can destabilize entire institutions. It continues to serve as a cautionary tale about weak governance and oversight.

- Amount: ~$450 million

- What Happened: Weiss and associates siphoned company assets through mortgage and stock fraud schemes, leading to the insurer’s collapse.

- Why Significant: Known as the largest U.S. insurance company failure caused by criminal fraud.

8. Sambhal District Insurance Scam, Uttar Pradesh, India (2025)

This case exposed how fraud can entangle not just financial systems but also public institutions and communities. It highlights the social costs of corruption beyond monetary loss.

- Amount: Over ₹100 crore (~$12–13 million+, depending on exchange rates)

- What Happened: A gang operated in Sambhal district involving fake insurance policies, forged documents, and even murders to claim life insurance money. They used accomplices from the insurance, health sectors, and public health workers. Over 50 arrests have been made.

- Why Significant: Because of the scale (₹100+ crore), the extreme criminal methods (even murders), and cross-district spread. It shows how insurance fraud can be deeply embedded and severely harmful.

9. Japanese “Health Insurance Call-Center” Scam Targeting Retired Japanese in Thailand (2025)

This scam demonstrated how fraudsters prey on vulnerable groups with false promises of security. It underlines the need for stronger consumer education and international cooperation.

- Amount: ~300 million baht (~¥1.36 billion or $8.8 million)

- What Happened: A fraudulent operation impersonated Japanese government/health insurance officials, selling bogus health insurance plans to over 200,000 Japanese retirees in Thailand. Victims paid premiums for policies that were not valid.

- Why Significant: A very large number of victims; foreign retirees targeted; shows cross-border fraud and the vulnerability of older people groups.

10. “Tokyo Life-Insurance Murders” / Hosoya Couple Case, Japan (ongoing)

The case shows how financial motives tied to insurance can drive extreme criminal acts. It stands as a stark warning of the dangers when fraud intersects with personal relationships.

- Amount: ~¥26 million (~$150–200k depending on rate) for life insurance payouts on three family members allegedly murdered.

- What Happened: A Tokyo couple is alleged to have poisoned several relatives to claim life insurance payouts. Three of the deaths (initially thought natural) are now under suspicion. Criminal investigations have tied the murders to fraudulent insurance claims.

- Why Significant: The case combines insurance fraud with violent crime; it shows how fraud can escalate to lethal levels when payouts are large and detection is weak.

Regulatory Crackdowns and the Future of Fraud Detection

Authorities worldwide are strengthening their approach, using technology and cross-border collaboration to stay ahead of fraudsters. The future of fraud detection lies in smarter systems that predict and prevent fraudulent activity before it spreads.

- AI and Analytics: Predictive tools identify patterns of fraud with greater accuracy.

- Global Cooperation: Countries are increasingly sharing data to disrupt international scams.

- Stronger Penalties: High-profile convictions serve as deterrents and signal tougher enforcement.

Global Patterns and Emerging Hotspots in Insurance Fraud

Fraud is no longer confined to one region, with schemes emerging from both advanced economies and developing markets. The scale and creativity of these operations reveal that insurance fraud adapts quickly to economic conditions and regulatory gaps.

- Healthcare Systems at Risk: Countries with expansive healthcare programs face continuous threats from inflated or false claims.

- Cross-Border Scams: Fraud rings exploit international jurisdictions to avoid detection and enforcement.

- Emerging Market Vulnerabilities: Weak regulatory structures in developing nations create fertile ground for organized fraud.

Frequently Asked Questions (FAQs)

$14.6 billion in false claims, with about $2.9 billion in actual losses and 324 defendants charged.

$3.0 billion total to resolve criminal and civil allegations.

₩1.1502 trillion detected, about $790–$795 million USD equivalent.

About $2.0 billion is tied to the scheme that led to a 2024 guilty plea.

Conclusion

Insurance fraud remains a persistent challenge that spans industries, geographies, and scales of operation. From multi-billion-dollar healthcare scandals to localized scams involving violence, the cost of fraud is borne not only by insurers but also by millions of honest policyholders through higher premiums and reduced trust. As detection technology evolves and regulatory cooperation strengthens, the fight against fraud is becoming more proactive, but the stakes continue to rise. The lesson is clear: vigilance, transparency, and accountability are essential to safeguard the integrity of the insurance system worldwide.