Monero, one of the leading privacy-focused cryptocurrencies, is in turmoil as Qubic claims to have seized control of over 51 percent of its network hashrate, raising serious concerns about its stability and future.

Key Takeaways

- 1Qubic, led by IOTA co-founder Sergey Ivancheglo, claims majority control over Monero’s hashrate.

- 2The takeover has triggered blockchain disruptions, including 60 orphaned blocks and a six-block chain reorganization.

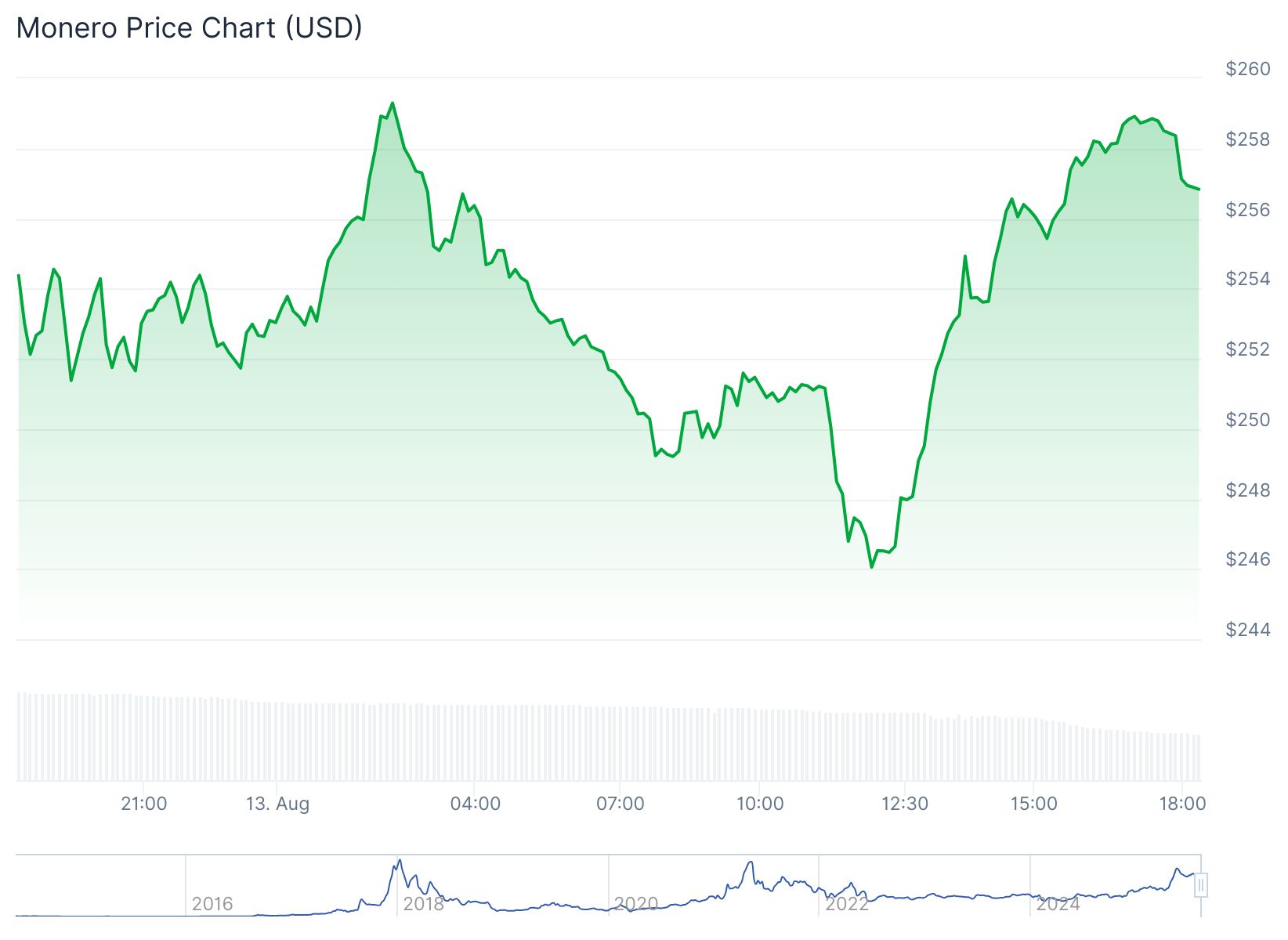

- 3Monero’s price has fallen over 25 percent in a week, hitting its lowest level since May.

- 4The incident highlights vulnerabilities in smaller proof-of-work cryptocurrencies.

What Happened?

Qubic announced that after a month-long operation, it had achieved 51 percent control of Monero’s mining power. The claim coincided with a six-block chain reorganization that discarded 60 previously accepted blocks, a move interpreted by some as proof of a successful 51 percent attack.

However, the Monero developer community is not entirely convinced. Luke Parker from SeraiDEX argued that the chain reorganization could simply reflect a lucky hash streak rather than conclusive evidence of an attack.

Qubic just reached 51% share of Monero. This is a huge feat. They will be the first to manipulate a cryptocurrency with a 51% attack. They intend to orphan all blocks from every other miner, making themselves the only mining entity of Monero. The only way to mine Monero will be… pic.twitter.com/rIihj5CtPo

,Caffeinated User | ꓘ & ױ (@CaffeinatedUser) August 11, 2025

Qubic’s Strategy: Economics Over Exploits

Qubic’s approach diverges from traditional blockchain attacks. It uses a “useful proof-of-work” model that redirects mining to Monero and converts the rewards into USDT. These funds are then used to buy and burn QUBIC tokens, creating an internal incentive loop. This strategy boosted mining profitability to nearly three times higher than traditional Monero mining at its peak.

According to Qubic, the operation was not meant as a malicious assault but rather an economic experiment testing game theory within blockchain consensus. Ivancheglo, Qubic’s founder, admitted that the goal was to centralize Monero’s hashrate, rejecting blocks from other pools after reaching majority control.

Qubic has reached over 51% of Monero’s hashrate, effectively giving it control of the network.

,Qubic (@_Qubic_) August 12, 2025

Qubic chose not to launch the takeover yet, proving a powerful theory by action.

But this story isn’t over yet. What’s next for Qubic and the future of PoW chains?

Article below⏬ pic.twitter.com/JqQNqpy95j

Monero Network Disruption and Community Response

Despite Qubic’s framing of the incident as an experiment, the effects on Monero have been significant:

- 60 orphaned blocks have appeared within the last 720 blocks, indicating clear network instability.

- A six-block-deep chain reorganization replaced previous confirmations.

- Monero’s community launched distributed denial-of-service (DDoS) attacks against Qubic’s mining pool, temporarily reducing its hashrate by two-thirds.

- The XMR token price has plunged over 25 percent for the week, reaching $252 and breaking critical support levels.

- Technical analysis shows Monero in oversold territory, with key indicators suggesting strong downward pressure.

Security experts have weighed in. Ledger’s CTO, Charles Guillemet, estimates that sustaining this dominance could cost around $75 million per day, warning that while the operation may be profitable in the short term, it could rapidly erode trust in the network.

Monero appears to be in the midst of a successful 51% attack.

,Charles Guillemet (@P3b7_) August 12, 2025

The privacy-focused blockchain, launched in 2014 and long targeted by governments and 3-letters agencies, is already banned from most major centralized exchanges.

The Qubic mining pool has been amassing hashrate for…

Why This Matters: Proof-of-Work at Risk?

Qubic’s success in gaining majority control challenges Monero’s core defense mechanism: the RandomX algorithm, which favors CPU mining to ensure decentralization. The situation has exposed vulnerabilities in mid-tier proof-of-work coins, which unlike Bitcoin, lack the hashrate strength to deter 51 percent attacks.

Historical parallels with Ethereum Classic and Bitcoin Gold show that similar attacks can lead to millions in damages and prolonged trust issues.

BitMEX research suggests that Qubic’s strategy could escalate into full selfish mining, monopolizing block rewards and compromising Monero’s censorship resistance. Although Qubic claims it stopped short of full consensus takeover to avoid harming Monero’s market value, the community remains on high alert.

CoinLaw’s Takeaway

Honestly, this situation feels like a wake-up call. Monero was designed to be decentralized and private, but what we’re seeing now is how powerful economic incentives can override even the most robust consensus designs. I don’t think Qubic’s move was just an experiment. Whether or not you call it an attack, the result is the same: trust in Monero has been shaken, and its price is reflecting that. We need to rethink how smaller proof-of-work networks protect themselves against these kinds of takeovers.