Mobile banking is transforming how we manage our finances, becoming an essential part of daily life. In the past decade, the way people interact with their banks has shifted drastically, from long queues at brick-and-mortar branches to the convenience of managing accounts right from their smartphones. As mobile banking continues to evolve, it not only offers convenience and speed but also opens up new financial opportunities for millions across the globe. In this article, we explore the key statistics that show how mobile banking is shaping the future of finance, from its adoption to the challenges it still faces.

Editor’s Choice

- 4.2 billion people worldwide use mobile banking, representing about 66% of the global population.

- 76% of adults in the United States use mobile banking apps as their primary banking method.

- 67% of Millennials and 63% of Gen Z in the US report using mobile banking apps most often.

- Mobile banking penetration in Europe stands at 76%, with Nordic markets exceeding 87% adoption.

- China counts around 860 million mobile banking users, remaining the single largest national market.

- Asia-Pacific generates about $740 billion in annual mobile banking revenue.

- Europe’s mobile banking revenue is approximately $445 billion, driven mainly by the UK, Germany, and France.

- Global mobile banking revenue reached about $1.92 trillion, growing roughly 28% year over year.

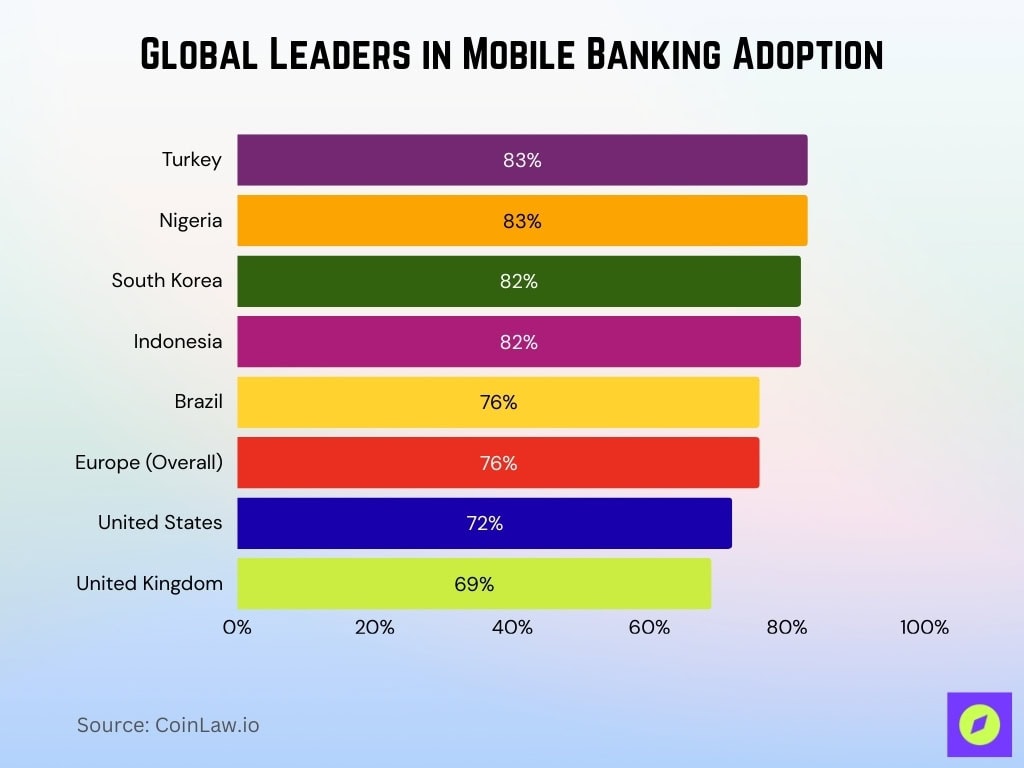

Global Leaders in Mobile Banking Adoption

- 83% of adults in Turkey use mobile banking, placing the country among the top global adopters.

- 83% of adults in Nigeria also rely on mobile banking, matching Turkey’s leading adoption rate.

- 82% of adults in South Korea use mobile banking services, reflecting strong digital finance uptake.

- 82% of adults in Indonesia use mobile banking, tying South Korea among the highest adopters.

- Brazil records 76% mobile banking penetration, underscoring widespread app-based banking usage.

- The United Kingdom has about 69% mobile banking usage among its population.

- Around 72% of adults in the United States use mobile banking apps, showing continued growth.

- Europe overall records 76% mobile banking usage, with top markets exceeding 87% penetration.

Global Mobile Banking Usage Statistics

- 66% of the global population now has access to mobile banking, with India, Nigeria, and Bangladesh among the fastest-growing markets.

- North America’s mobile banking penetration stands at 61%, up from 58% in 2023.

- Mobile payments account for roughly 49% of all digital banking transactions worldwide.

- Latin America’s mobile banking revenue reached about $172 billion, growing around 29% annually.

- Africa added roughly $58 billion in digital banking revenue, with adoption up by about 43%.

- Europe records about 76% mobile banking usage, with leading countries surpassing 87% penetration.

- Asia-Pacific generates around $740 billion in mobile banking revenue, the highest of any region.

- Global mobile banking revenue reached approximately $1.92 trillion, rising about 28% year over year.

Mobile Banking Adoption by Demographics

- In the US, about 67% of millennials primarily use mobile banking apps, compared with roughly 38% of baby boomers.

- Around 63–64% of Gen Z adults in the US say they use mobile banking apps most often, confirming them as a strongly mobile-first cohort.

- Baby boomer mobile app preference has risen to about 35–38%, up from the low teens a decade ago.

- Roughly 92% of millennials use some form of mobile banking regularly, with 95% engaging in digital banking at least weekly.

- About 89% of Gen Z and 84% of millennials report using finance-related or mobile banking apps to manage money.

- Approximately 60% of US adults now prefer mobile banking overall, up from 37% in 2019.

- Women in Asia show about 55% mobile banking usage, compared with 45% of women in Africa.

- Around 60% of urban residents worldwide use mobile banking, with China and India’s metro areas among the fastest adopters.

- Roughly 40% of US mobile banking users are aged 25–34, making older millennials the largest single user segment.

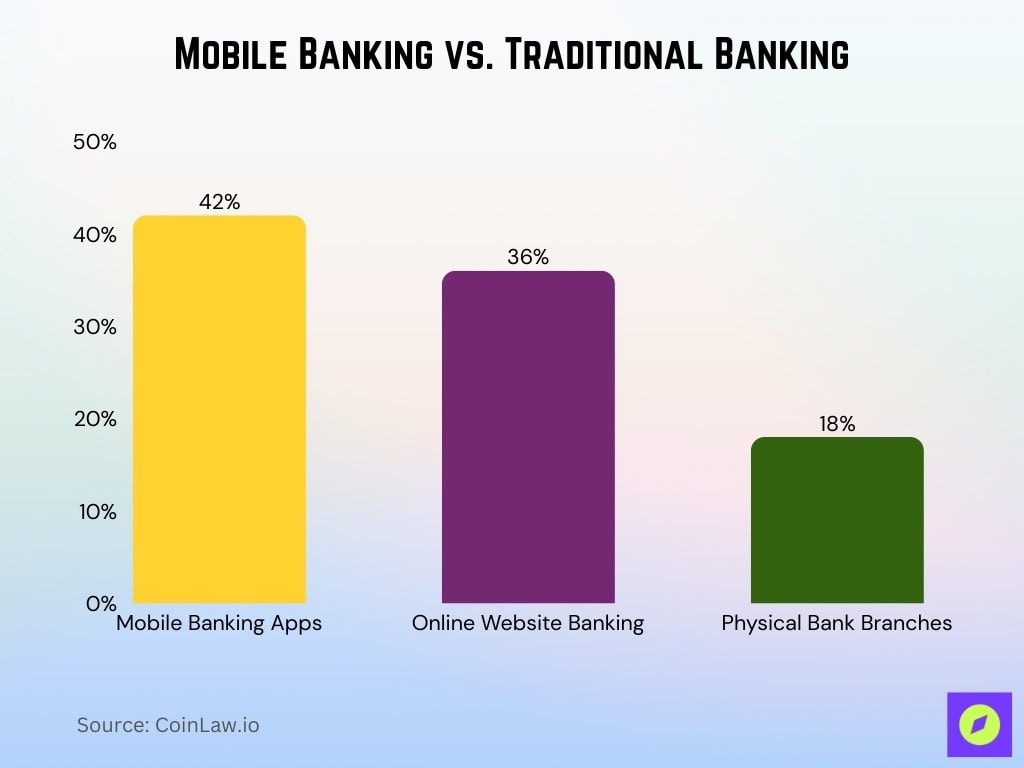

Mobile Banking vs. Traditional Banking

- Roughly 42% of consumers prefer mobile apps, versus 36% who favor website banking and 18% who still prefer branches.

- Mobile banking app preference rose to around 55%, making it the top banking method in the US for the sixth straight year.

- Banks using digital tools have cut operating costs by 20–40%, helping mobile-focused and online models undercut traditional branch-heavy banks on fees.

- Traditional banks have reduced monthly fees by about 18% since 2022 as neobanks and mobile-first platforms pressure pricing.

- Only about 18% of consumers still favor visiting a branch in person as their primary banking method.

- Around 91% of consumers say access to mobile or online banking is a priority for payments, budgeting, and investment services.

- Global digital banking platform revenue is projected to reach about $13.4 billion by 2026, reflecting rapid migration from branch-based systems.

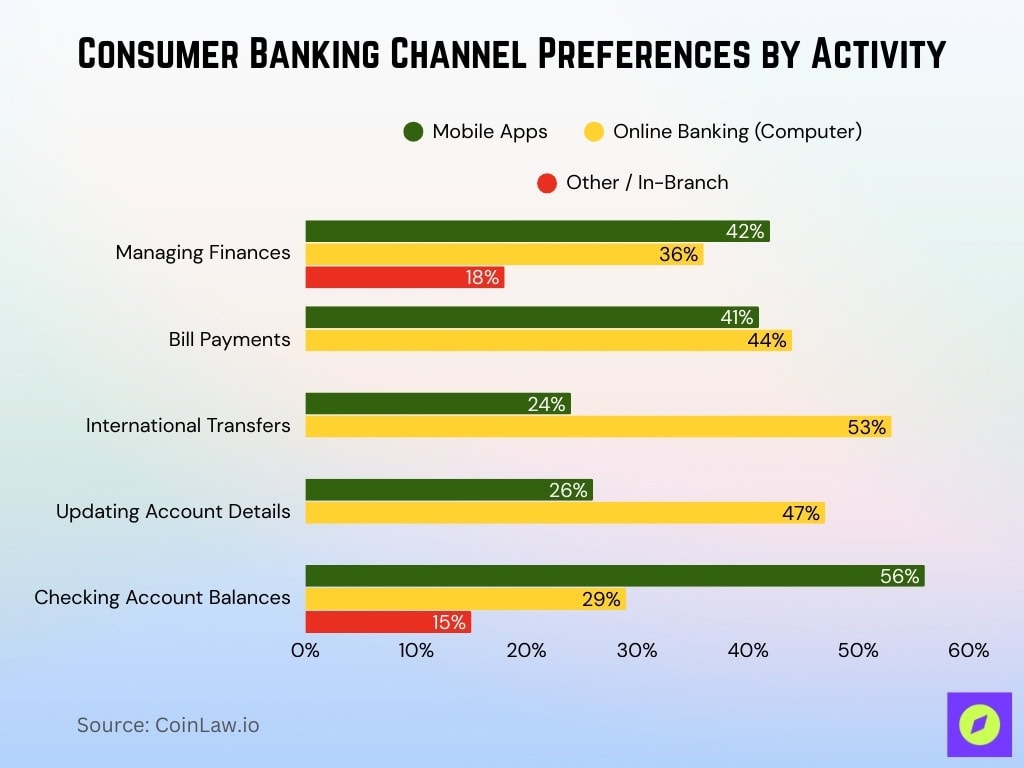

How Users Prefer to Bank: Online, Mobile Apps, or Traditional?

- Around 42% of consumers prefer mobile apps to manage finances, 36% favor online banking websites, and 18% still choose in-branch banking.

- For bill payments, about 41% of users rely on mobile apps, while 44% prefer online banking on a computer.

- For international transfers, roughly 24% prefer smartphone apps, compared with 53% who use laptops or desktop online banking.

- For updating account details, about 26% of users choose mobile apps, while 47% use online banking via computer.

- Most people check balances via digital channels, with 56% using mobile and 29% using desktop, leaving 15% to other methods, including branches.

- Around 77–78% of consumers say their go-to banking method is either a mobile app or an online website, underscoring digital dominance over branches.

- Only about 8–9% of consumers now prefer visiting a physical branch as their primary banking channel, with ATMs and phone calls even less favored.

Digital and Mobile Banking Trends

- Contactless and mobile payments now account for about 30% of global point-of-sale transaction value, up from 18% in 2020.

- Global digital wallet transaction value is projected to exceed $16 trillion by 2028, with several Asian markets already above 90% wallet penetration at checkout.

- Around 64.2% of mobile banking users now rely on biometric authentication, such as fingerprint or facial recognition, for logins.

- Roughly 39% of US adults use only mobile banking, avoiding physical branches altogether.

- Tap-to-pay now represents over 70% of all card transactions in some markets, reflecting mainstream adoption of contactless technology.

- Apple Pay has about 65.6 million active users in the US, compared with roughly 35 million for Google Wallet.

- Apple accounts for about 49% of US mobile wallet users and roughly 54% of in-store mobile wallet taps.

- Biometric verification now secures around 70% of wearable contactless transactions worldwide.

Role of Neobanks and Digital-Only Banks

- Neobanks now capture about 21% of all new bank accounts opened in the US, reflecting rapid mobile-first adoption.

- In parts of Europe, around 46% of adults aged 18–35 use a neobank as their primary bank.

- The global neobanking market is estimated at roughly $230.6 billion in 2025 and projected to reach about $4.40 trillion by 2034.

- The market is expected to grow at a CAGR of about 40.3% from 2025 to 2034.

- Global neobank market forecasts show values up to $12.42 trillion by 2030 under broader digital-banking definitions.

- Chime serves about 22 million customers, with roughly 11 million using it as their primary account.

- Chime’s users complete an average of 58+ transactions per month, supporting strong engagement metrics.

- Indian neobanks have recorded year-over-year user growth of roughly 70%+, supported by UPI rails and inclusion schemes.

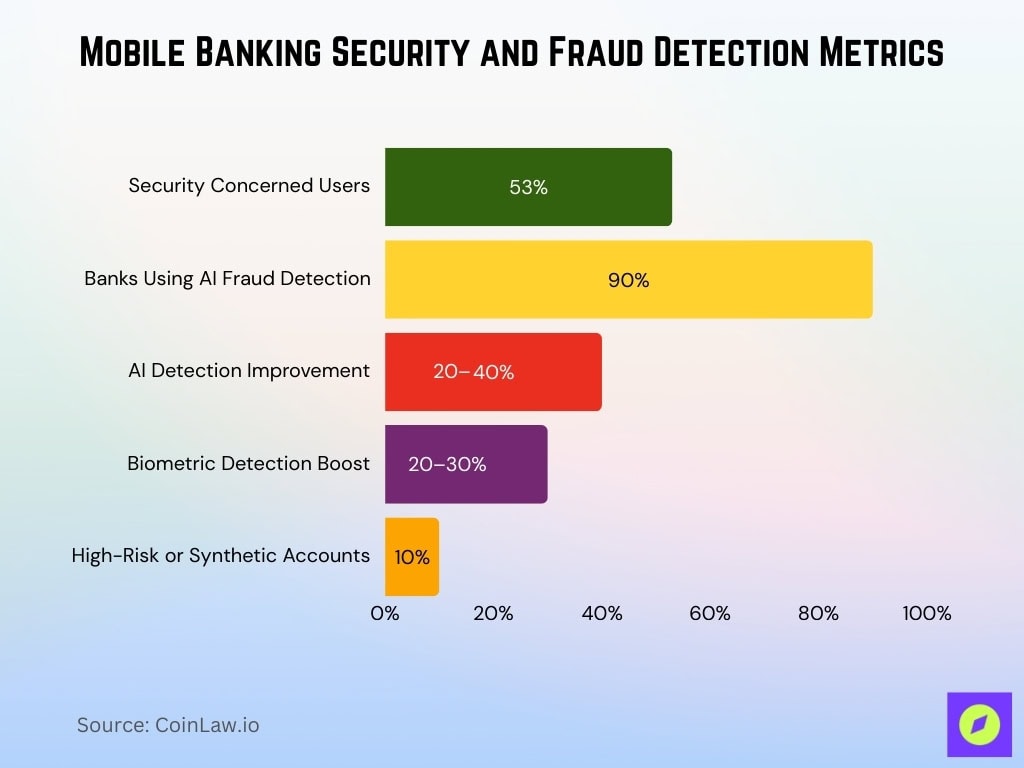

Security Challenges and Fraud Detection in Mobile Banking

- Around 53% of US and global banking customers still cite security as a key concern when using mobile apps, despite rising adoption.

- Roughly 1 in 20 digital-banking verification attempts is now fake, underscoring the growth of deepfake- and AI-driven fraud.

- About 90% of financial institutions use AI-driven fraud detection, reporting up to 20–40% better detection of complex schemes.

- Biometric authentication can boost fraud detection effectiveness by around 20–30% compared with passwords and one-time codes alone.

- Synthetic identity fraud could drive losses up to $23 billion by 2030 without stronger biometric and AI defenses.

- Industry estimates suggest that at least 10% of bank accounts at a typical institution may be synthetic or high-risk.

- Advanced AI and risk platforms are delivering between 300% and 2100% ROI on fraud-prevention investments within the first year.

Recent Developments in Mobile Banking

- Cross-border B2B payment transactions are forecast to reach 18.3 billion by 2030, up from 16.3 billion in 2025.

- In the Asia-Pacific region, non-cash transactions are projected to hit 1.5 trillion by 2028, with digital wallets making up 66% of POS payments by 2027.

- Real-time payments are expected to reach a market size of about $112.32 billion globally by 2028, growing at a CAGR of 40.94% from 2023.

- Instant payments are projected to account for 16% of the global payments mix by 2027 and 22% by 2028, with 70–80% of FIs able to receive them.

- Globally, real-time payments represented 19.1% of all electronic transactions in 2023, with volumes reaching 266.2 billion.

- Asia-Pacific’s mobile and digital wallet payments are projected to reach around $10.109 trillion by 2028.

- The global BNPL market is expected to reach about $1.09 trillion in gross merchandise value by 2029, growing at an 11.4% CAGR from 2024.

- In the US, BNPL spending is projected to hit roughly $124.82 billion by 2027, up from $97.25 billion in 2025.

Frequently Asked Questions (FAQs)

Roughly 77% of consumers prefer managing accounts via mobile apps or computers, leaving about 18–22% favoring branches and other channels.

There are over 216.8 million digital banking users in the U.S. and about 3.6 billion online banking users globally.

Mobile banking penetration has reached about 76% in Europe and 61% in North America.

Roughly 89% of banks worldwide have launched mobile banking apps.

Conclusion

Mobile banking is no longer just a convenience; it’s the future of financial services. With global adoption rates surging, technological innovations like AI and blockchain driving new features, and neobanks disrupting traditional banking models, the landscape of banking has changed forever. As we look ahead, mobile banking is poised to offer more personalized, secure, and accessible financial solutions, with challenges like fraud detection and security concerns remaining critical areas of focus. The trends suggest that the digital-first approach to banking will continue to grow, reshaping how consumers interact with their finances for years to come.