Tokyo-based Metaplanet has officially become the fifth-largest corporate holder of Bitcoin after a massive $632 million purchase, raising its total reserves to more than 25,500 BTC.

Key Takeaways

- Metaplanet acquired 5,419 BTC for approximately $632 million, pushing its total holdings to 25,555 BTC.

- The company now holds nearly $3 billion worth of Bitcoin, with an average cost basis of $106,065 per coin.

- The move vaults Metaplanet above Bullish in global BTC treasury rankings, putting it fifth worldwide.

- Backed by a $1.4 billion capital raise, Metaplanet plans to reach 30,000 BTC by 2025 and 210,000 BTC by 2027.

What Happened?

Metaplanet made headlines after acquiring 5,419 additional BTC in a single transaction, further cementing its reputation as Asia’s top corporate Bitcoin holder. This recent purchase brings the company’s total BTC holdings to 25,555 coins, valued at nearly $3 billion. The acquisition was made at an average price of $116,724 per BTC, and marks a significant leap in the company’s aggressive Bitcoin treasury strategy.

Metaplanet has acquired 5419 BTC for ~$632.53 million at ~$116,724 per bitcoin and has achieved BTC Yield of 395.1% YTD 2025. As of 9/22/2025, we hold 25,555 $BTC acquired for ~$2.71 billion at ~$106,065 per bitcoin. $MTPLF pic.twitter.com/CBhZi2X9lE

— Simon Gerovich (@gerovich) September 22, 2025

Metaplanet Accelerates Bitcoin Treasury Strategy

The September 22 purchase was disclosed officially by the company and is part of a long-term expansion plan. Metaplanet spent approximately 93.65 billion yen (around $627 million) for the latest tranche, translating to an average purchase price of 17.28 million yen (about $115,900) per BTC. Despite the hefty cost, the company sees this move as just the beginning.

Dylan LeClair, Metaplanet’s Head of Bitcoin Strategy, called the buy “just the first tranche”, signaling that more acquisitions are on the way. The company recently raised $1.4 billion via an international share offering and has already deployed about half of that to accumulate BTC.

This bold expansion has helped the firm surpass Bullish in Bitcoin holdings, putting it behind only MicroStrategy, Marathon Digital, Tesla, and Block in the rankings.

Fast-Growing Holdings and Long-Term Vision

- At the end of June, Metaplanet held 13,350 BTC

- By late September, that number jumped to 25,555 BTC

- The company’s BTC “yield” rose 10.3% quarter-to-date and an eye-catching 395.1% year-to-date for 2025

- The average BTC acquisition cost across all purchases stands at $106,065

Metaplanet has shared ambitious future targets. It aims to own 30,000 BTC by the end of 2025, then scale up to 100,000 BTC by 2026, and ultimately 210,000 BTC by 2027. That final target would represent 1% of Bitcoin’s fixed supply, placing Metaplanet among the most influential BTC holders globally.

Market Reactions and Stock Performance

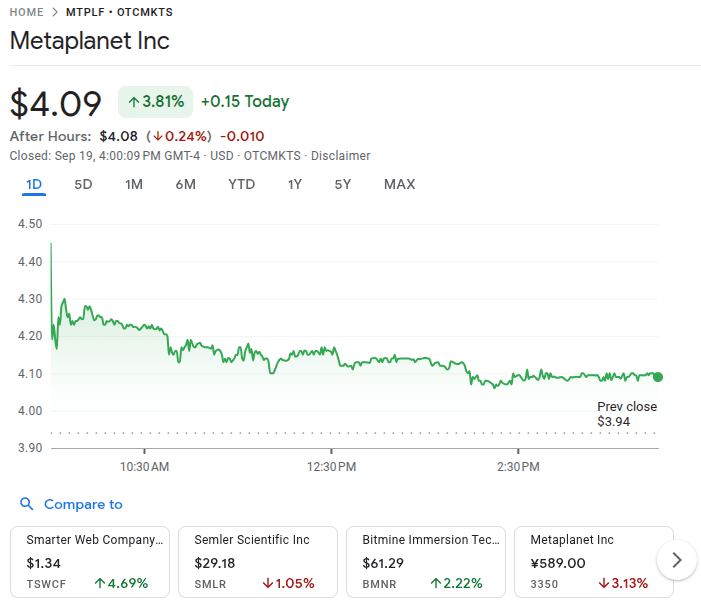

Following the announcement, Metaplanet’s Tokyo-listed shares dipped by about 3%, closing at 589 yen, and have fallen 73% from their all-time high. Its U.S.-listed stock, MTPLF, showed stronger performance, rising 3.81% to $4.09, bringing its year-to-date gain to 83%.

Meanwhile, other Bitcoin-focused firms such as Capital B also made significant purchases. Capital B acquired 551 BTC for $64.29 million, raising its total reserves to 2,800 BTC. However, like Metaplanet, its stock has also faced recent pressure.

Market volatility continued as Bitcoin dipped to $111,700 before rebounding slightly to around $114,685. Trading activity increased, with open interest in Bitcoin futures reflecting cautious optimism among investors.

CoinLaw’s Takeaway

I find Metaplanet’s strategy fascinating. It’s rare to see a company so boldly commit to Bitcoin on this scale, especially outside the U.S. Their long-term vision, backed by real capital, gives them credibility in a market often filled with hype. The fact that they’re aiming for 210,000 BTC shows they’re thinking far beyond price swings. In my experience, moves like this can reshape how public companies approach treasury management. This isn’t just a bet on Bitcoin. It’s a blueprint for how corporations could anchor themselves in the future of digital finance.