The crypto-mining company Marathon Digital Holdings continues to draw attention as it balances rapid scale-up with profitability pressures. For example, the firm’s operations impact renewable energy siting and large-scale computing, and its bitcoin-treasury strategy influences institutional asset allocations. Below you’ll find a data-rich review of its key metrics and recent developments, dive in to explore the full picture.

Editor’s Choice

- Revenue rose 30% year-over-year (YoY) to about $213.9 million in Q1 2025.

- Net loss for Q1 2025, $533.4 million.

- Energized hash rate jumped 95% YoY to 54.3 EH/s in Q1 2025.

- Q2 2025 net income reached $808.2 million.

- Energy cost per Bitcoin in Q2 2025 reported at $33,735.

- Global mining difficulty and hashrate increases remain headwinds, July 2025 saw production down 1% M/M.

Recent Developments

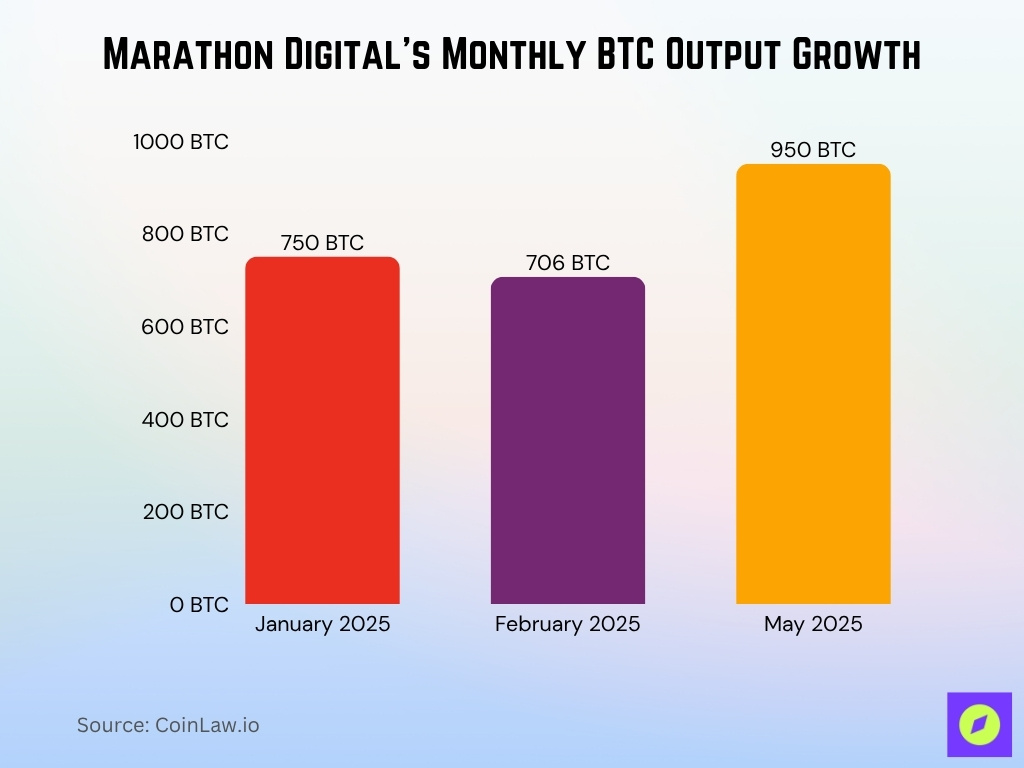

- For May 2025, 950 BTC mined, 35% M/M increase, blocks won 282, up 38% M/M.

- April 2025, energized hash rate grew to 57.3 EH/s, 705 BTC produced.

- The company reduced cost per petahash by ~25% YoY, from ~$38.1 to ~$28.5 in Q1.

- Marathon’s treasury strategy, opted not to sell any BTC in February and June updates.

- Ongoing shift toward vertical integration, acquiring power assets and data centres to reduce costs.

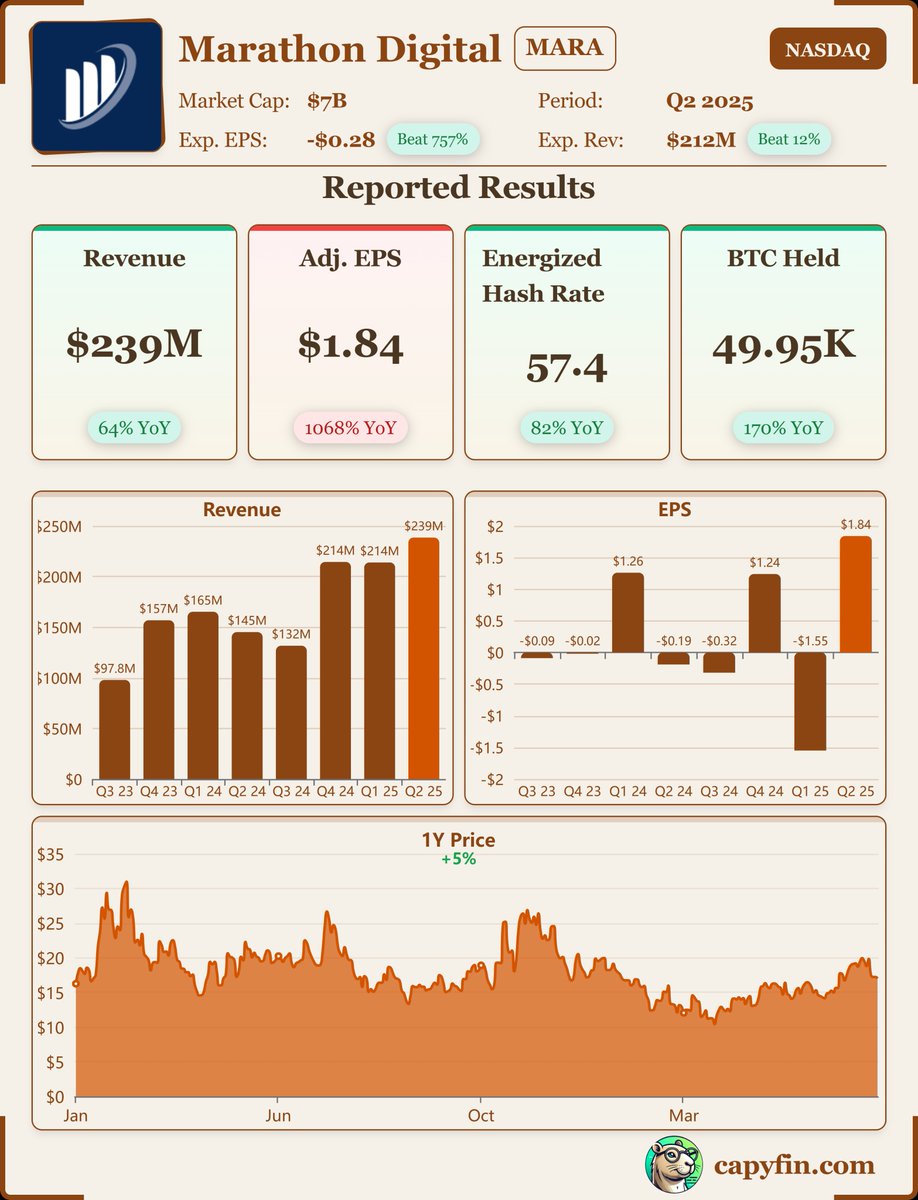

Marathon Digital Highlights

- Revenue surged to $239 million, marking a 64% year-over-year (YoY) increase and surpassing the expected $212 million estimate.

- Adjusted EPS jumped to $1.84, an impressive 1,068% YoY rise, significantly beating the projected -$0.28 per share.

- Energized hash rate reached 57.4 EH/s, up 82% YoY, reflecting Marathon’s aggressive expansion in mining capacity.

- Bitcoin holdings grew to 49.95K BTC, representing a 170% YoY increase, strengthening the firm’s position as one of the largest corporate Bitcoin holders.

- Market capitalization hit $7 billion, highlighting strong investor confidence amid improved financial performance.

- Revenue trend shows steady growth, climbing from $97.8 million in Q3 2023 to $239 million in Q2 2025, with the last two quarters setting record highs.

- EPS performance flipped from losses to profitability, improving from -$1.55 in Q3 2024 to $1.84 in Q2 2025, signaling a major financial turnaround.

- Share price rose 5% year-over-year, supported by consistent quarterly gains in both revenue and earnings.

Company Overview

- The company mined an average of 25.9 BTC per day in Q2 2025, lowering energy cost per bitcoin to $33,735, among the lowest in the sector.

- Marathon held 49.95K BTC, continuing its HODL strategy and confirming its position as one of the largest public Bitcoin holders.

- Bitcoin holdings grew 197% year-over-year to 44,893 BTC by the end of 2024, reflecting Marathon’s expanded treasury operations and hybrid acquisition approach.

- In May 2025, production hit 950 BTC, a 35% increase from April, with a record 282 blocks won, underscoring operational efficiency from MARA Pool.

- The firm added $950 million in new capital to expand Bitcoin purchases and digital infrastructure, reinforcing strategic energy-optimization goals.

- Marathon’s energized hashrate surged 82% YoY to 57.4 EH/s, highlighting growth through efficient scaling of mining infrastructure.

Annual Financial Highlights

- For Q1 2025, $213.9 million revenue, up ~30% from ~$165.2 million in Q1 2024.

- Annualised trends, revenue growth rate accelerates into Q2 (64% YoY).

- Macrotrends data shows historical revenue growth from ~$131.6 million in Q3 2024.

- Despite revenue gains, Q1 2025 net loss of $533.4 million due to asset-valuation impairments.

- Q2 2025 net income of $808.2 million marks a sharp reversal.

- Cash plus bitcoin holdings around $4.1 billion as of end Q1.

- Increase in bitcoin holdings drives asset base expansion and may impact reserve accounting.

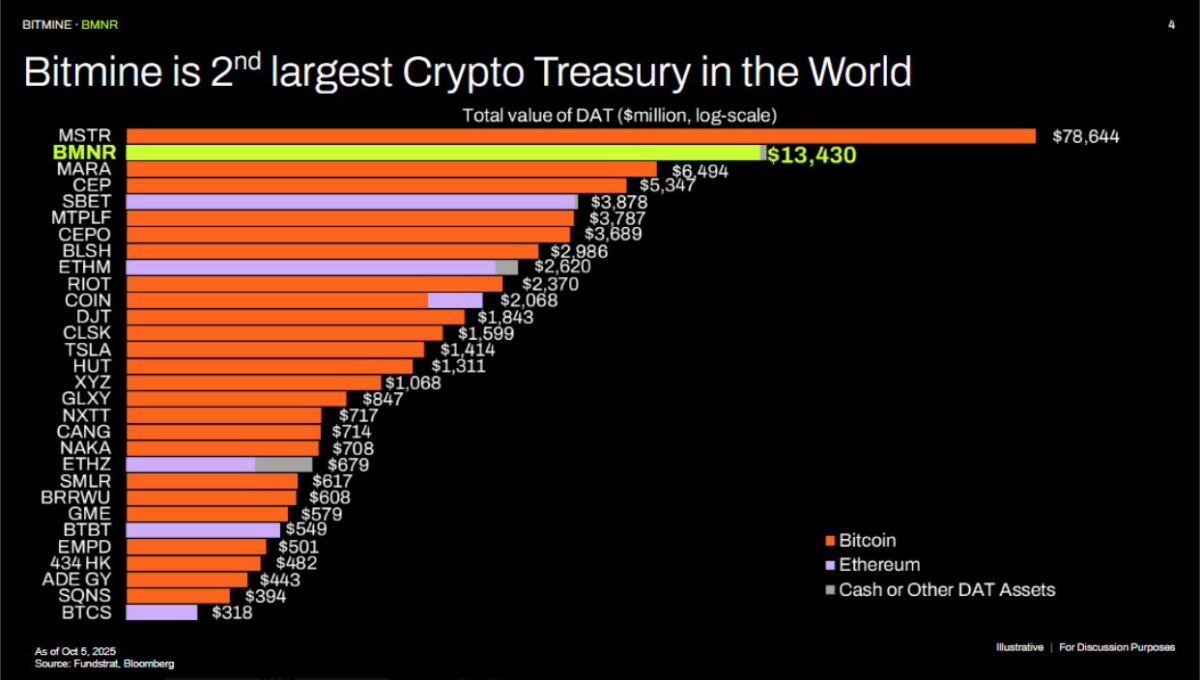

Largest Crypto Treasuries by Public Companies

- MicroStrategy (MSTR) holds the largest crypto treasury in the world with $78.64 billion, entirely in Bitcoin.

- Bitmine (BMNR) ranks 2nd globally, holding $13.43 billion in Bitcoin.

- Marathon Digital (MARA) is the 3rd largest, with $6.49 billion in Bitcoin holdings.

- CEP follows closely with $5.35 billion in Bitcoin, making it the 4th largest holder.

- SBET, MTPLF, and CEPO each hold between $3.6B–$3.9B, all primarily in Bitcoin.

- Ethereum holders include ETHM ($2.62B), ETHZ ($679M), EMP ($501M), and BTCS ($318M), highlighting growing ETH adoption among public firms.

- Coinbase (COIN) holds a diversified crypto portfolio worth $2.07 billion, spanning Bitcoin and Ethereum.

- Tesla (TSLA) retains $1.41 billion in Bitcoin, maintaining its legacy position in the corporate crypto space.

- Riot Platforms (RIOT) and Cleanspark (CLSK) own $2.37 billion and $1.6 billion in Bitcoin, respectively.

- GameStop (GME) appears on the list with $579 million, focused entirely on Bitcoin holdings.

- The top 10 firms together account for over $124 billion in crypto assets, showing corporate treasury diversification is accelerating beyond just Bitcoin.

Net Income Trends

- Q1 2025, –$533.4 million net loss.

- Q1 2024, net income of roughly $337.2 million.

- Q2 2025, net income flipped positive to $808.2 million.

- The swing largely reflects bitcoin price volatility and impairment accounting, not purely operational profit.

- Analysts note profitability remains volatile and tied to bitcoin markets.

- Investor caution remains as EBITDA, depreciation and asset write-downs could fluctuate.

- The trend underscores both upside and downside risks, scale matters, but timing matters too.

Hashrate Statistics

- Q1 2025 energized hashrate, 54.3 EH/s, up 95% YoY.

- February 2025, 53.2 EH/s maintained.

- Fleet efficiency improved, cost per petahash day-rate cut ~25% from prior year.

- Share of miner rewards, ~5.1% in Jan 2025 from ~5.9% in Dec 2024.

- Blocks won, 207 in July 2025 (down 2% M/M) despite higher hashrate.

Bitcoin Production Statistics

- May 2025, mined 950 BTC, up 35% M/M.

- February 2025, produced 706 BTC, down 6% M/M.

- January 2025, produced 750 BTC, down 13% M/M.

- Q1 2025 average per day in January, ~24.2 BTC.

- Holdings, 46,374 BTC as of Feb 28 2025.

- Holdings, 48,237 BTC as of April 30 2025.

Operational Efficiency Metrics

- In Q2 2025, Marathon achieved fleet efficiency of 18.3 J/TH, improving ~26% YoY.

- Cost per petahash dropped ~24% YoY to about $28.7 USD/PH in Q2 2025.

- Despite improvement, Marathon’s efficiency lags top-tier miners who are below 15 J/TH.

- Enhanced uptime at sites, e.g., a wind-farm data centre achieving ~99% uptime in September 2025.

- The shift toward owned/operated sites rose significantly, helping lower fixed cost burdens.

- Streamlined container/miner deployment at Texas wind-farm contributed to improved productivity.

- The company emphasises that “we don’t just hold Bitcoin, we put it to work”, reflecting operational leverage of mined assets.

Energy Cost Per Bitcoin

- Marathon’s energy cost per bitcoin was $33,735 in Q2 2025, less than half the sector median.

- The global average cost to mine one bitcoin in mid‑2025 stood at approximately $101,000 per coin

- Marathon achieved a cost per petahash of $28.7 in Q2, reflecting a 22% reduction year-over-year.

- Owned and contracted renewable energy sources now supply 68% of Marathon’s total power, directly lowering input costs.

- Vertical integration and on-site power generation offset market volatility, with fleet-wide energy cost at $0.04/kWh.

- Scaling production with improved hardware efficiency, Marathon enjoys 18.3 J/TH fleet efficiency, ranking in the industry’s top quartile.

- Cost per bitcoin could rise by up to 77% if energy prices spike or market competition intensifies.

- A recent review notes that immersion‑cooled mining deployments can improve energy efficiency by around 15‑20% compared to standard air‑cooled systems, depending on the site specifics.

- Hasrate expansion projects in Texas and Ohio expected to decrease cost per bitcoin by a further 6–12% over next six months.

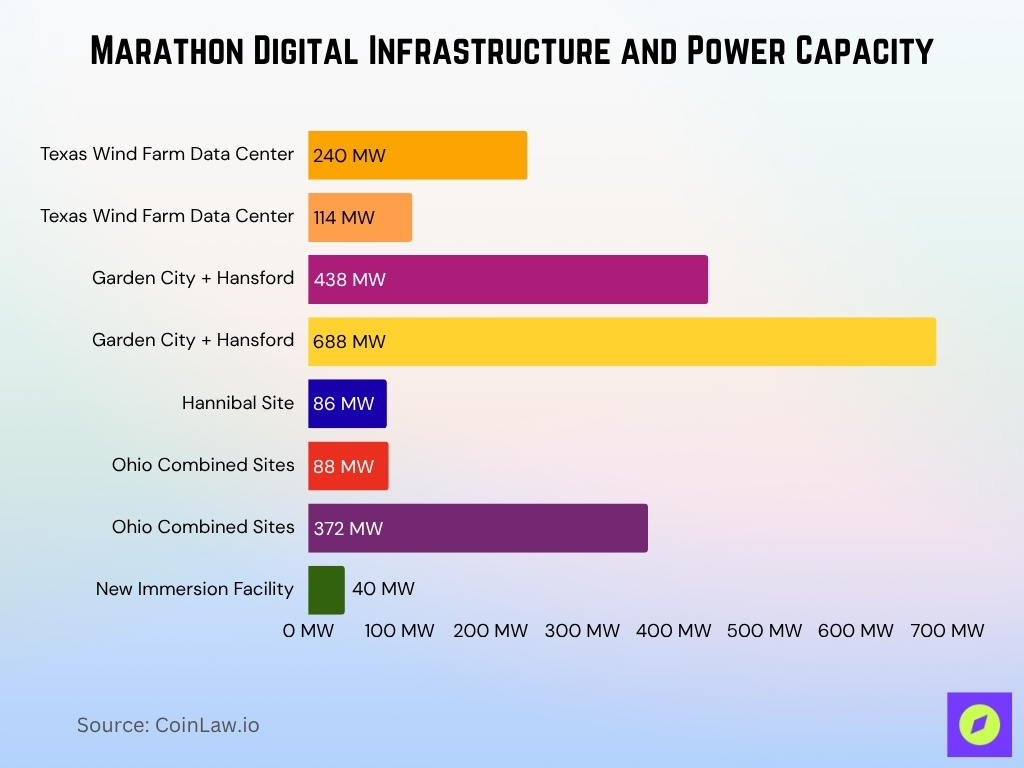

Infrastructure Investments

- The Texas wind-farm data centre features 240 MW facility capacity and 114 MW nominal wind capacity, set to reach full operational status by Q4 2025.

- Garden City and Hansford, Texas sites provide a combined 438 MW renewable computing capacity, with expansion prospects to 688 MW.

- The Hannibal, Ohio site operates at 86 MW capacity, with an additional 14 MW to be energised by year-end, ensuring 100% control at the location.

- Across Ohio, Marathon manages 88 MW at Findlay, Hopedale, and Hannibal, aiming for up to 372 MW interconnection-approved capacity.

- MARA invested $67 million to acquire two Ohio data centers and launched a new 40 MW facility for immersion mining.

- Companywide, fleet efficiency reached 18.3 J/TH, reflecting a 26% year-over-year improvement with S21 Pro miners deployment.

- Power costs remain among the lowest in the sector at $0.04/kWh for owned power, supporting both mining and AI-infrastructure models.

Block Production Trends

- As of September 30 2025, the company won 218 blocks, up ~5% from August.

- In August 2025, the company won 208 blocks (vs 207 in July), showing rising block share.

- BTC produced in September 2025, 736 BTC, up ~4% M/M from 705 BTC.

- Average daily bitcoin production in September, ~24.5 BTC/day (vs 22.7 BTC/day in August).

- Energized hashrate at 60.4 EH/s in September 2025, supporting block-winning potential.

- Block-winning share (MARAPool) rose to ~5.2% in September 2025 (vs 4.9% in August).

- The upward trend in block production improves revenue potential but remains exposed to network difficulty.

Bitcoin Holdings and Asset Management

- The company uses ~31% of its total holdings (≈15,550 BTC) in loans, active management or as collateral.

- Marathon treats bitcoin as a productive asset rather than a passive treasury reserve.

- Digital assets (current portion) on the balance sheet ~$2.259 billion as of June 30 2025.

- Digital assets net of current portion ~$3.686 billion as of June 30 2025.

Strategic Partnerships & Global Expansion

- Marathon claims presence across four continents, ~96% of its compute locations in the U.S., ~4% abroad.

- It announced an investment agreement to acquire a 64% stake in Exaion, enhancing low-carbon energy access.

- Strategic collaborations include Pado AI Orchestration, TAE Power Solutions, and Two Prime.

- Marathon targets 50% international revenue by 2028 as part of its global expansion strategy.

- Nameplate power capacity, ~1.738 GW across owned and hosted sites. Owned share moved toward ~70%.

- Partnerships with renewable and alternative power providers support Marathon’s cost-profile goals.

- International growth carries regulatory, energy-supply and geopolitical risk which Marathon acknowledges.

Debt and Equity Structure

- As of June 30 2025, total assets stood at $7.721 billion and total liabilities at ~$2.293 billion.

- Total debt (long-term) ~$2.47 billion.

- Debt to equity ratio around 0.55, indicating moderate leverage.

- Debt-to-assets (debt ratio) ~34.3%.

- Interest coverage ratio reported at ~23.55.

- Long-term debt to capitalization ~37.2%.

- Working capital is negative (~ –$204.6 million), current ratio ~0.54.

- The note offering in mid-2025 signals further capital raising possibly dilutive to equity.

Liquidity and Solvency Metrics

- Current ratio around 0.54, signalling limited near-term liquidity.

- Quick ratio also ~0.39, indicating fewer liquid assets relative to short-term obligations.

- Cash and equivalents ~$109.5 million as of June 30 2025.

- While no single peer‑reviewed model publishes a 4.4% bankruptcy probability for the sector, industry commentary suggests a moderate solvency risk for large miners given negative free cash flow and bitcoin‑price exposure.

- Solvency score estimated at 30/100, suggesting moderate financial strength.

- Negative free cash flow noted, which may strain liquidity if not offset by asset sales or bitcoin holdings.

- Digital assets (~$5 billion combined current and long-term) offer liquidity potential.

- Liquidity is supported by bitcoin holdings, but those carry price risk and are not purely cash.

Valuation Metrics (P/E, P/B, EV/EBITDA)

- As of October 2025, Marathon’s trailing P/E ratio is approximately 9.69×, based on share price of $20.73 and EPS of $2.14.

- Historical five-year average P/E is ~19.03×, making the current P/E roughly 49% below its historical average.

- The company’s EV/EBITDA was reported at ~7.16× (TTM data ending June 2025).

- Other sources list EV/EBITDA around 8.82× and P/B (price-to-book) ~1.48×.

- The enterprise value of Marathon was quoted around $9.79 billion, with market cap ~$7.68 billion.

- Analysts suggest the stock may be undervalued relative to peers given the low multiples.

- The relatively low multiples reflect both the cyclical nature of bitcoin mining and the volatility of earnings.

- Metrics like EV/EBITDA must be interpreted carefully, given hardware churn and crypto-asset price swings.

Analyst Ratings & Price Targets

- 12 analysts rate MARA as a “Moderate Buy”, with an average 12-month price target of $23.90.

- Another consensus reports an average price target of $23.65 (20.85% upside) based on 11 analysts.

- Additional consensus data, average target ~$24.73 with 15 ratings as of FY12 2025.

- Brokerage recommendation average (ABR) is ~2.00, indicating a “Buy” consensus.

- Some firms are more bullish, e.g., Cantor Fitzgerald set a target of $39, others more conservative.

- Analysts highlight both growth potential (AI/data-centre pivot) and risks (bitcoin price, regulation, energy cost).

- The range of targets and ratings underscores mixed sentiment, bullish on scale and diversification, but wary of volatility.

Shareholder Returns & Stock Performance

- MARA’s stock price as of late October 2025 stands around $20.73.

- Over the last 12 months the number of shares outstanding increased ~60%.

- Institutional ownership is about ~61% of shares outstanding.

- Price-to-book ratio ~1.48× suggests the market values the company at roughly 1.5 times book value.

- Free cash flow remains negative in recent periods, which may impact future returns.

- The stock has exhibited high volatility, moving in correlation with bitcoin price swings.

- For shareholders, key return drivers will be bitcoin price, hashrate growth, cost control, and AI/data-centre success.

Risks and Market Challenges

- Bitcoin mining energy cost inflation raised average power expense per BTC to $35,508 in Q1 2025, with total operational cost per BTC reaching $54,002.

- Among publicly listed miners the average cost to produce one bitcoin reached about $82,000 in Q4 2024, signifying substantial upward cost pressure.

- The global mining hardware market reached $23.7 billion in 2024, driving capital-intensive replacement risk for large public miners.

- U.S. mining operations accounted for 0.6% to 2.3% of national electricity consumption in 2025, exposing companies to grid and price volatility.

- Hardware efficiency for next-gen miners, like Antminer S20, improved to 15 J/TH in 2025, yet risk remains for obsolescence if market shifts.

- The Bitcoin network’s annual CO₂‑equivalent emissions are in the range of 30‑100 Mt CO₂ per year, depending on methodology.

- Share issuance and convertible note dilution remain active risk factors, with several public firms including Marathon raising $950 million in new capital for expansion.

- Mining profitability varies by cycle, with home-miner ROI at 8–18 months depending on hardware and energy market conditions.

- Bitcoin price volatility exposes holdings to rapid value swings, as annual network consumption ranges from 173 to 211.58 TWh in 2025, impacting enterprise liquidity.

AI and Data Center Expansion

- Marathon operates 16 data centers across four continents, with 70% now owned and operated, supporting both Bitcoin mining and scalable AI/HPC compute.

- The company acquired a control stake in Exaion (EDF’s AI/data center subsidiary) for $168 million to boost high-performance compute offerings in Europe.

- Four Tier 3 and Tier 4 data centers are dedicated for AI and HPC workloads with scalable modular systems for rapid expansion.

- Revenue diversification targets a 50/50 split between U.S. and international operations within five years, with AI as a major driver.

- Over $5 billion in treasury reserves is earmarked for digital infrastructure, AI, and data center expansion.

- The company aims to tap into the AI inference-as-a-service market, projected to reach $160 billion by 2028.

- Data center heat reuse in Finland now supports 80,000 homes, affirming Marathon’s energy optimization and sustainability focus.

- Modular load management, enabled through TAE Power Solutions, underpins seamless transition between mining and AI workloads.

- Recent capital raises of $3 billion support aggressive infrastructure and AI/data center growth, with execution risk noted as high.

Environmental & Sustainability Initiatives

- As of Q2 2025, 68% of power used for Marathon’s U.S. operations comes from renewable sources, with additional wind and solar partnerships planned.

- The acquisition of a 114 MW wind farm in Texas powers a major data center and supports overflow grid management and grid efficiency.

- Sustained energy costs for Bitcoin mining average $33,735 per bitcoin mined, reflecting reliance on low-cost renewables.

- The company’s immersion cooling upgrade delivers 16% higher energy efficiency, supporting sustainability goals.

- Participation in grid-balancing programs in Texas enables flexible load management and access to surplus renewable power at off-peak rates.

- Regulatory attention on carbon emissions encourages further uptake of carbon-neutral mining initiatives and offset programs.

- Marathon sets an industry benchmark with fleet-wide power costs at $0.04/kWh from owned and contracted sources.

- Disclosure of Scope 1 and Scope 2 carbon emissions is ongoing, with companywide sustainability reporting expected to expand by year-end.

Frequently Asked Questions (FAQs)

$212 million is the expected revenue, representing a 64% year-over-year increase.

49,940 BTC (including collateral or loaned holdings).

57.3 EH/s, an increase of about 5.5% month-over-month.

$33,735 per bitcoin mined.

Conclusion

This three-part statistical deep dive into Marathon Digital Holdings provides a comprehensive look at how the company is performing across multiple dimensions, from production metrics and cost efficiency to valuation, strategy and risk. Investors should watch closely the company’s execution on AI/data-centre expansion, energy-cost control, and bitcoin-price exposure.

While the numbers reflect both opportunity and risk, the evolving nature of both crypto-mining and digital infrastructure means that future outcomes remain uncertain. As always, conduct your own assessment of timing, strategy, and broader market context. For a more detailed breakdown of each section, review the full article above.