KindlyMD’s $5 Billion Bitcoin-Focused Stock Offering Triggers Market Selloff.

Key Takeaways:

- KindlyMD filed for a $5 billion at-the-market (ATM) equity offering with the SEC

- Proceeds will support its Bitcoin Treasury Strategy, acquisitions, and other corporate purposes

- Shares dropped over 23 percent following investor concerns over dilution

- The company recently merged with Nakamoto and now holds over 5,765 Bitcoin

What Happened?

KindlyMD shares plunged following the announcement of a massive $5 billion stock offering aimed at expanding its Bitcoin holdings and general corporate growth. The move comes shortly after the company merged with Nakamoto Holdings and launched its Bitcoin Treasury Strategy.

Stock Sale and Strategic Pivot

On August 27, KindlyMD Inc., a healthcare company recently merged with Nakamoto Holdings, filed a Form S-3 automatic shelf registration with the U.S. Securities and Exchange Commission. This filing sets up an at-the-market equity offering program of up to $5 billion.

According to the company, the proceeds will be used for:

- General corporate purposes

- Funding acquisitions

- Investing in current and future projects

- Supporting its Bitcoin Treasury Strategy

CEO David Bailey said, “We intend to deploy the ATM Program thoughtfully and methodically, using it as a flexible tool to strengthen our balance sheet, seize market opportunities, and deliver accretive value for shareholders.”

Bitcoin is becoming the world’s reserve asset right in front of your eyes. You can either embrace it or ignore it but you can’t stop it. Accelerate.

— David Bailey🇵🇷 $1.0mm/btc is the floor (@DavidFBailey) August 27, 2025

The sale of shares will be handled through several agents including TD Securities, Cantor, and B. Riley Securities. Timing and volume will depend on various factors, including prevailing market conditions.

Market Reaction and Share Performance

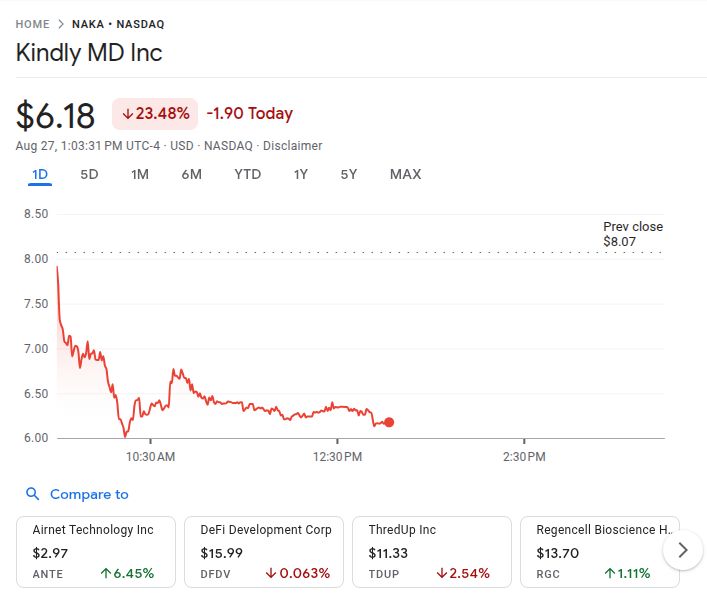

Despite management’s strategic vision, the announcement spooked investors. Shares of KindlyMD (trading under ticker NAKA) have fallen 23.52 percent in the last 24 hours, now trading at $6.17.

The offering, if fully executed, would significantly increase the number of shares in circulation, raising alarms among analysts and investors already cautious due to Bitcoin’s recent price dip of over 10 percent.

Bitcoin Holdings and Corporate Treasury Shift

KindlyMD is now firmly positioning itself among the most aggressive corporate Bitcoin holders. Since the merger, the company has already:

- Raised $500 million through private placements

- Issued a $200 million convertible debenture backed by more than $400 million worth of Bitcoin

- Purchased approximately 5,765 BTC valued at over $635 million as of August 19

Bailey called Bitcoin the world’s “reserve asset,” signaling that the firm sees BTC as central to its long-term strategy.

If the full $5 billion offering is completed, KindlyMD would rank among the top institutional Bitcoin holders globally, in the company of MicroStrategy and other major players.

Growing Trend Among Corporations

KindlyMD’s move reflects a growing trend where companies diversify treasuries using Bitcoin to hedge against inflation and fiat currency instability. Currently, 174 publicly listed companies reportedly hold over 988,000 BTC combined.

Japanese firm Metaplanet also announced plans to raise $1.2 billion for Bitcoin purchases, citing inflation risks and a weakening yen.

Still, experts caution that such aggressive strategies carry risks. If the underlying stock weakens, further share issuances can dilute shareholder value without necessarily enhancing returns.

CoinLaw’s Takeaway

I’ve been tracking corporate crypto strategies for years, and this move by KindlyMD is one of the most bold yet risky shifts I’ve seen. Jumping into Bitcoin at this scale, right after a merger, and doing so with a $5 billion stock sale is a lot for the market to digest. In my experience, this kind of aggressive treasury play can work wonders if Bitcoin climbs, but it can seriously backfire if prices keep sliding. I get the appeal of Bitcoin as a reserve asset, but using shareholder capital at this scale? That’s not something every investor will cheer for.