The insurance industry has long been a bedrock of financial security, offering peace of mind to millions worldwide. But behind its perceived stability lies a dynamic, ever-evolving market. This year was a milestone year for the sector, with significant shifts driven by technology, changing consumer behavior, and regulatory transformations. As we look ahead, understanding key statistics can give us a better sense of where the industry is headed.

Editor’s Choice

- The global insurance market is projected to reach $8.88 trillion in total premiums in 2026, up about 6.6% from 2025, supported by life, health, and non-life segments.

- North America is expected to generate roughly 42% of global premiums in 2026, maintaining its lead on the back of strong life, property, and commercial lines.

- The global cyber insurance market is forecast to see premiums rise by around 15–20% in 2026 as ransomware severity and regulatory pressures increase.

- The cyber insurance market is on track to approach $22.5 billion by 2026, reflecting steady double-digit expansion in corporate cyber risk transfer.

- The global insurtech market is expected to reach about $23.5 billion by 2026 as carriers scale AI underwriting, digital claims, and embedded insurance.

- Global primary insurance premiums are forecast to grow by around 2.0% in 2025 and 2.3% in 2026 in real terms, with non‑life moderating as competition intensifies.

Recent Developments

- California’s SB 261 mandates climate risk disclosure for companies with >$500 million annual revenues by January 1.

- 85% of U.S. insurers now report on climate risks and short-term management strategies.

- 38 states passed AI legislation effective January 1, targeting insurance pricing bias.

- SEC requires public companies, including insurers, to disclose material cyber incidents within 4 business days.

- UK PRA schedules Dynamic General Insurance Stress Test for May, focusing on climate scenarios.

- European insurers maintain strong Solvency II ratios at the top-end or above targets entering 2026.

- Insurance AI spending projected to grow by more than 25%.

- U.S. P&C premiums expected to grow roughly 3% amid regulatory pressures.

- Over 25 states adopted the NAIC AI bulletin by mid-2025 for pricing scrutiny.

- State insurance regulations increased by more than 13% midway through 2025.

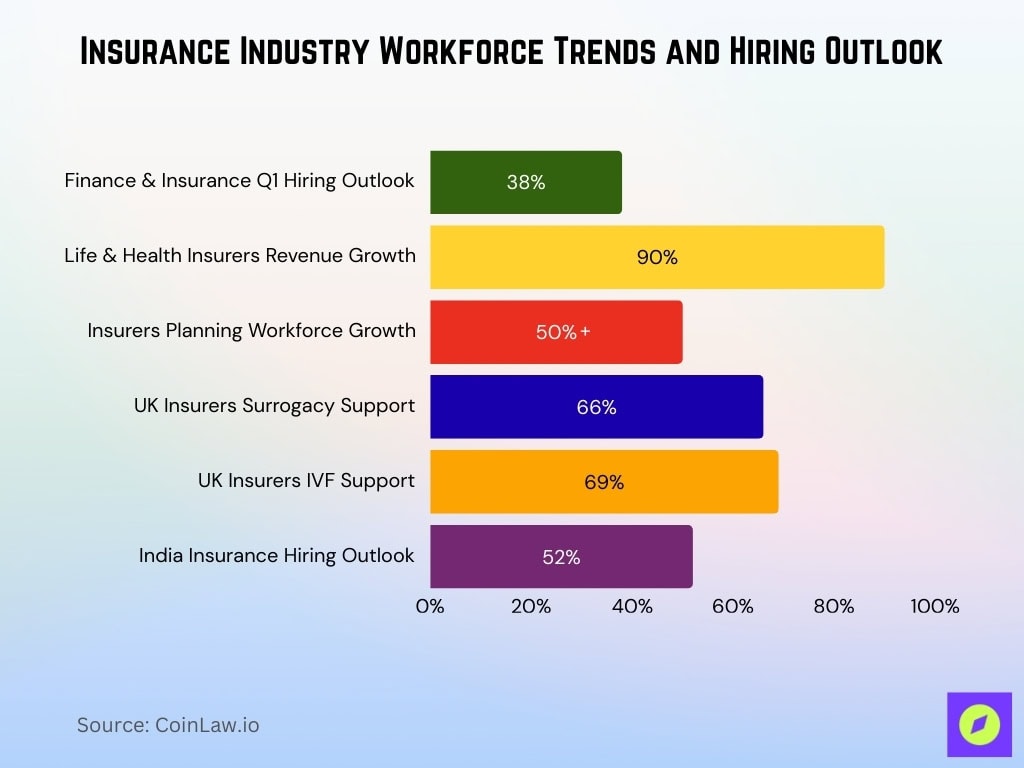

Workforce Statistics in the Insurance Industry

- The global insurance industry anticipates resilient employment with unemployment rates lower than the national average.

- Finance and insurance sectors report 38% Net Employment Outlook for Q1 hiring demand.

- 90% of life & health insurers expect revenue growth, over 50% plan workforce increases.

- Indian insurance market job openings increase by 5.71 per month amid rapid growth.

- 66% of UK insurers offer surrogacy support, 69% provide IVF under D&I initiatives.

- U.S. insurance average salary reaches $58,198 annually as of January.

- Asia Pacific insurance hiring is strongest in India at 52% Net Employment Outlook.

Consumer Behavior and Insurance Product Trends

- 81% of insurance buyers research online, 68.5% complete purchases digitally.

- 47% of auto insurance consumers buy policies through digital channels.

- 44.3% of new life insurance policies were sold to Millennials.

- Usage-based insurance is projected to reach $122 billion by 2034.

- Global telematics insurance reaches 278.41 million active premiums.

- 27% of total loss claims in auto insurance.

- Pet insurance market predicted to hit $10 billion globally.

- 26% of customers carry auto deductibles above $1,000.

- 41.9% of professionals see the need for eco-friendly insurance products.

Life Insurance Industry

- Global life insurance premiums projected to grow 6.5%.

- Market size estimated at $3.71 trillion.

- The term life insurance market is valued at $1.1 trillion.

- Online life insurance revenue is at $1,150 billion.

- Asia-Pacific life and non-life market is worth $2.11 trillion.

- Global premiums are expected to reach $4.8 trillion by 2035.

- North America dominates with 35% market share.

Women in Insurance

- 1 in 20 senior vice presidents in insurance are women of color.

- Women hold 59% of U.S. insurance workforce positions.

- Women comprise 31% of agency principals and owners in independent insurance agencies.

- Female CEOs are associated with lower insurer insolvency propensity and higher z-scores.

- Women make up 66% of entry-level insurance positions.

- Less than 7% of insurance CEOs are women.

- Women constitute 16% of chief financial officers in insurance.

- Less than 11% of insurance chairpersons are women.

- Companies with higher female board participation show 3% improved returns.

- Women are responsible for up to $1.7 trillion in insurance purchases by 2030.

Life Insurance Claims and Age-Based Trends

- Global life insurance claims payouts total $1.72 trillion.

- Average policyholder claim age reaches 62.8 years.

- Millennials represent 31.4% of life insurance policyholders.

- Older people aged 60+ account for 61.7% of all claims.

- Accidental death claims increase by 4.6% among under 45s.

- Critical illness riders grow by 10.3% in new policies.

- 78.5% of U.S. life claims processed digitally.

- Claims processing time reduced by an average 30% via AI tools.

- Death claims from chronic diseases comprise 68% of payouts.

Car/Auto Insurance Statistics

- U.S. auto insurance market reaches $301.2 billion in premiums.

- Telematics adoption grows by 21.4% among drivers under 35.

- EV insurance premiums are 16-22% higher than gas vehicles.

- Accident claims increase by 3.5% due to urban traffic.

- Natural disaster claims surge 9.3% from weather events.

- Liability claims comprise 61.5% of total payouts.

- Average annual premium hits $1,865 nationwide.

- 27% of claims involve total vehicle loss.

- Collision coverage claims average $5,200 per incident.

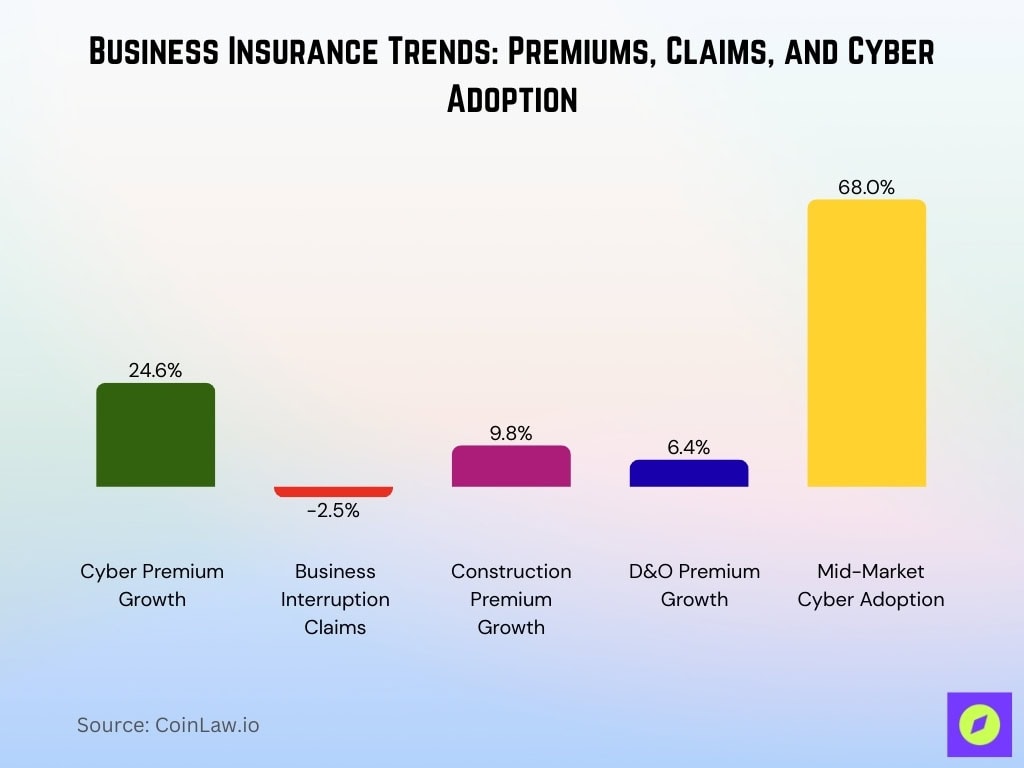

Business Insurance Statistics

- Commercial property premiums surpass $79 billion.

- Cyber insurance premiums grow 24.6% amid ransomware surge.

- Liability claims total $248.7 billion.

- Workers’ compensation premiums steady at $45.5 billion.

- Business interruption claims decline 2.5%.

- Construction insurance premiums rise 9.8%.

- D&O insurance premiums increase 6.4%.

- Mid-market cyber adoption reaches 68% of businesses.

- Construction claims average $285,000 per incident.

Impact of Technology and AI on Insurance

- More than 82% of insurers apply AI/ML in claims and risk evaluation.

- Insurance AI spend is expected to grow by over 25%, shifting from pilots to scaled deployment.

- AI-driven automation can shorten processing time by 50–70% and cut operational costs by up to 30%.

- Advanced fraud analytics could save P&C insurers up to $160 billion by 2032.

- Around 74.8% of Q3 2025 InsurTech funding went to AI-centered companies.

- European InsurTech funding fell 40% year over year to $520 million in 2025.

- Global blockchain in the insurance market is projected at $4.74 billion.

- North America holds 34.2% share of the blockchain in the insurance market.

- The global embedded insurance market is projected to reach roughly $210.9 billion in gross written premiums by 2025 and could exceed $700 billion by 2030, approaching about 15% of global GWP by 2033.

Top U.S. Insurance Companies by Annual Ad Spending

- GEICO’s 2025 ad spend is modeled at about $1.89 billion, implying around $2.41 billion to return to pre-cut ratios.

- Progressive spent roughly $3.5 billion on advertising in 2024 and is expected to maintain similar elevated levels into 2025–2026.

- State Farm’s latest disclosed annual advertising spend is $1.11 billion, up 11.9% from $992 million.

- Allstate’s advertising outlay climbed to about $1.87 billion in 2024, a 187.6% jump from $651 million.

- Progressive’s quarterly 2025 ad spend hit $1.3 billion in Q1, $1.2 billion in Q2, and $1.3 billion in Q3, totaling about $3.8 billion for the first nine months.

- GEICO’s ad spending in 2023 was $838.2 million, having previously been cut 35% year over year before the 2024 rebound.

- Allstate’s 2023 advertising spend was approximately $651 million, a reduction of about 31% from the prior year before the 2024 surge.

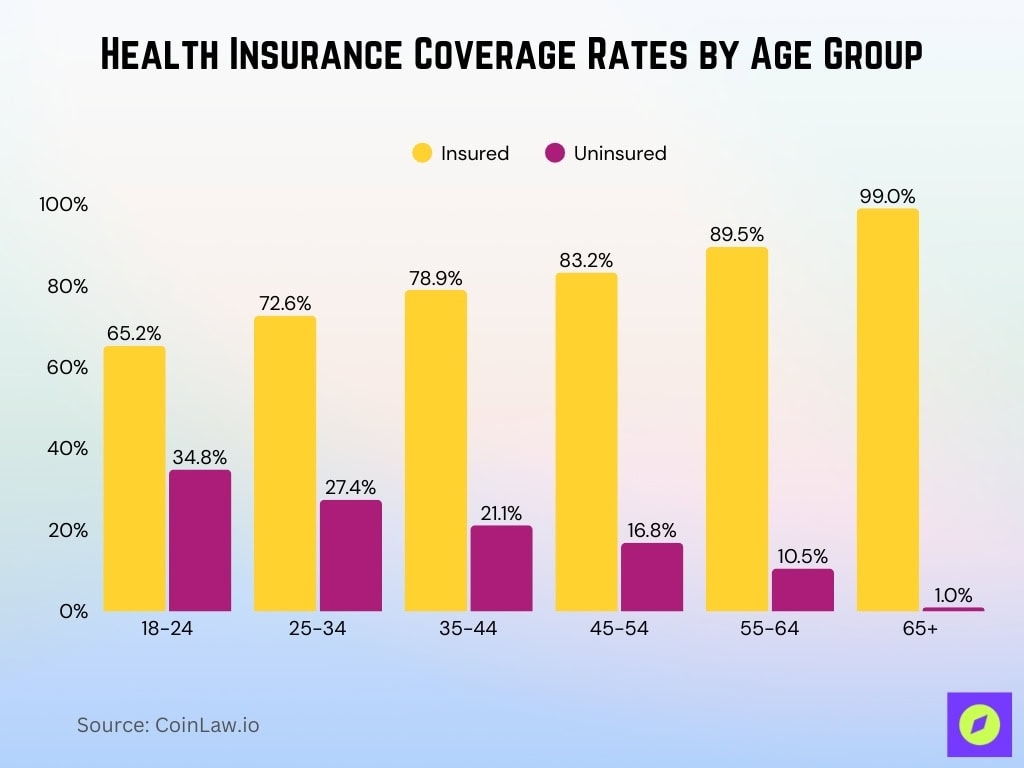

Health Insurance Coverage by Age Group

- Ages 18–24: 65.2% have health insurance, 34.8% are uninsured.

- Ages 25–34: Coverage rises to 72.6%, leaving 27.4% uninsured.

- Ages 35–44: Insurance rate reaches 78.9%, with 21.1% uninsured.

- Ages 45–54: Coverage improves to 83.2%, uninsured rate is 16.8%.

- Ages 55–64: Insurance climbs to 89.5%, and 10.5% remain uninsured.

- Ages 65+: Older people achieve 99.0% coverage (mostly through Medicare), with just 1.0% uninsured.

Frequently Asked Questions (FAQs)

Global non‑life insurance premiums were forecast to grow by ~1.7% in real terms in 2026.

The U.S. remained the largest insurance market with $3.22 trillion in total premiums, representing nearly 55% of global premiums, with China and the UK included.

Pie Insurance surpassed 55,000 policies in force, growing more than 25% year‑over‑year.

Conclusion

The insurance industry demonstrates resilience and adaptability in the face of global challenges. With significant strides in digital transformation, climate risk adaptation, and consumer-centric product offerings, the sector continues to evolve. As we move forward, technology, sustainability, and regulatory frameworks will be key drivers shaping the industry’s future.