The cryptocurrency landscape is undergoing one of its most significant regulatory shifts yet. Imagine a world where borrowing digital assets is as regulated as taking out a mortgage, and staking your crypto earns returns under clear, standardized rules. This reality is being shaped by the Markets in Crypto-Assets Regulation (MiCA), the European Union’s groundbreaking framework designed to bring clarity and security to crypto lending and staking.

For years, the crypto lending and staking industry operated in a gray area, with platforms offering sky-high yields and institutional investors hesitating due to unclear rules. However, with MiCA in full effect, new statistics are emerging that reveal a transformed landscape. How are lending volumes changing? Are staking rewards still competitive? This article dives into the latest statistics on crypto lending and staking under MiCA, offering insights into its impact on market growth, institutional involvement, and user participation.

Editor’s Choice

- The total value locked (TVL) in crypto lending platforms within the EU surged by 28%, reaching approximately $53.09 billion in Q2 2025.

- Crypto staking participation on MiCA-compliant platforms grew by 39%, as investor confidence in regulatory clarity increased.

- Lending interest rates for stablecoins stabilized at an average of 5.2%, reflecting reduced yield volatility under MiCA’s oversight.

- DeFi lending protocols saw an 18% decline in European users, as stricter KYC rules deterred anonymity-seeking investors.

- Institutional investors now account for 48% of crypto lending activity in the EU, up sharply from 2024.

- EU-based exchanges reported a 28% increase in staking deposits, with total EU staking hitting $90 billion by mid-2025.

- Non-EU crypto lending platforms saw a 14% drop in European users, as many shifted to MiCA-compliant services.

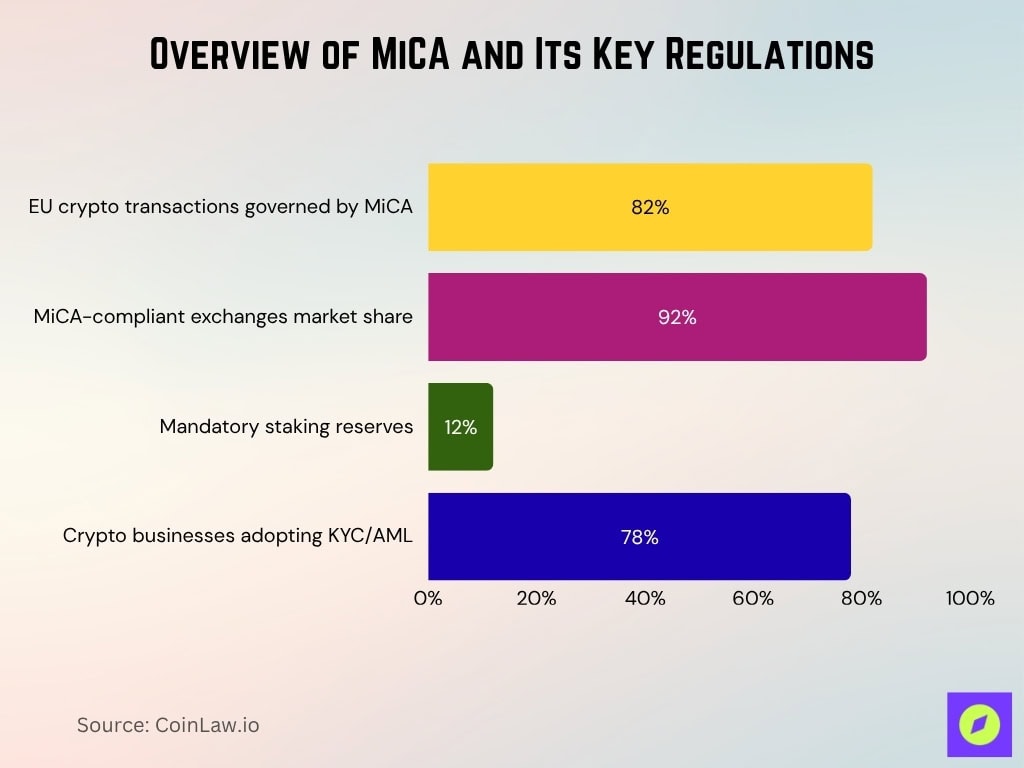

Overview of MiCA and Its Key Regulations

- MiCA now governs roughly 82% of crypto transactions in the EU, including lending, staking, stablecoins, and exchanges.

- MiCA-compliant exchanges account for 92% of total crypto trading volume inside the EU.

- Staking providers must retain at least 12% of staked assets as reserves to reduce liquidity risks.

- Over 78% of crypto businesses in the EU have adopted new KYC/AML protocols to align with MiCA standards.

- 53 crypto firms had secured MiCA licenses by mid-2025, signaling a major push toward regulatory compliance.

- EU-based lending platforms hold an estimated $210 billion in user deposits, a 17% rise from 2024, reflecting growing investor confidence.

- Fines for MiCA non-compliance exceeded €145 million in Q1 2025, highlighting firm regulatory enforcement.

Growth Trends in Crypto Lending and Staking Before MiCA

- Between 2020 and 2025, crypto lending volume surged by 320%, driven by high yields and minimal oversight.

- DeFi lending platforms held over $95 billion in TVL before facing liquidity shocks.

- Staking rewards in 2023 averaged 8.2%, though yields in 2025 average closer to 4.6% on major PoS networks.

- Over 45% of crypto lending in 2023 involved stablecoins, with USDT, USDC, and DAI dominating the market.

- Retail investors made up 64% of staking participation before MiCA, while institutional involvement remained limited.

- Approximately 11% of crypto lending users lost funds due to platform failures, underscoring risks in unregulated markets.

Key Statistical Changes in Crypto Lending Post-MiCA

- Crypto lending platforms in the EU now hold $275 billion, a 22% rise from 2024, signaling stronger institutional adoption.

- Stablecoin lending rates in the EU averaged 5.9% in Q1 2025, down from ~8.9% pre-MiCA, showing smoother volatility.

- Collateralized lending now comprises 95% of the market as unsecured crypto loans dropped by 75% under tougher risk rules.

- Borrowing demand for BTC and ETH rose 38%, with many shifting to regulated EU platforms over offshore options.

- Liquidation rates on lending platforms fell 24% as MiCA’s stricter rules improved risk controls.

- DeFi lending in Europe contracted by 20% as protocols struggled to comply with EU regulatory standards.

- Non-compliant crypto lenders lost 33% of their European user base as users migrated to MiCA-approved platforms.

- Institutional participation in crypto lending jumped to 52% in Q1 2025 from ~26% in 2024.

- Retail lending deposits only grew by 3% in 2025 as regulatory barriers made large player lending more attractive.

- Regulated platforms now process 87% of crypto loans in the EU, up from just ~55% before MiCA.

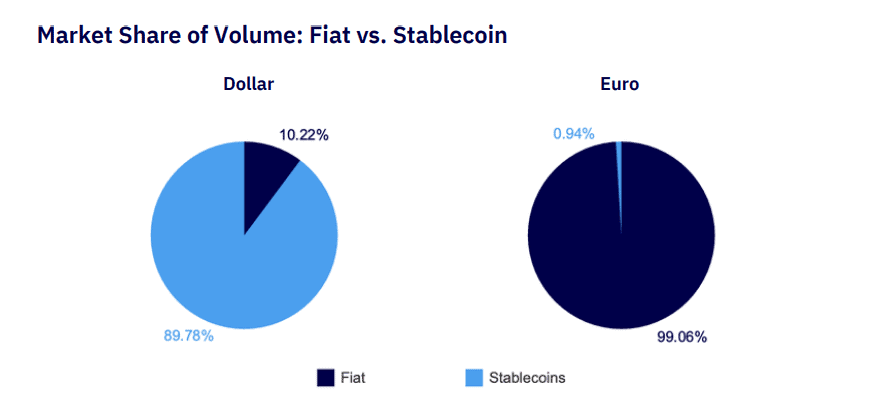

Market Share of Fiat vs Stablecoins

- In USD markets, stablecoins dominate with 89.78% of total trading volume.

- Only 10.22% of USD volume is settled in traditional fiat.

- In the Euro market, fiat commands 99.06% of trading volume.

- Stablecoins represent just 0.94% of euro-denominated volume, showing minimal adoption.

- The data highlights a sharp contrast between the USD and Euro markets, with stablecoins thriving in USD but almost absent in Euro transactions.

Key Statistical Changes in Crypto Staking Post-MiCA

- Staking participation on MiCA-compliant platforms increased by 45% in 2025 as investors flocked to regulated and secure protocols.

- Staking yields across PoS networks stabilized at 4.8% on average, down from ~7.4% in 2024 under regulatory smoothing.

- Ethereum staking deposits in the EU jumped by 35%, reaching $115 billion in staked ETH as institutions scaled in.

- EU-based staking providers now process 80% of all staking transactions, up from 75% post-MiCA.

- Non-EU staking platforms lost 25% of their European users, as compliance became a top priority for participants.

- Institutional staking participation surged to 50% in 2025, rising from 31% in 2024 amid stronger legal protections.

- Retail staking deposits fell by 9.5%, as some individual investors shifted to riskier offshore yield options.

- Validator node count in the EU grew by 22% due to MiCA’s mandates for enhanced security and decentralization.

- Regulatory-compliant staking providers now control 85% of staking pools, curbing the dominance of unregulated players.

- MiCA’s mandatory 10% staking reserve rule remains in force to ensure platforms can honor withdrawal demands.

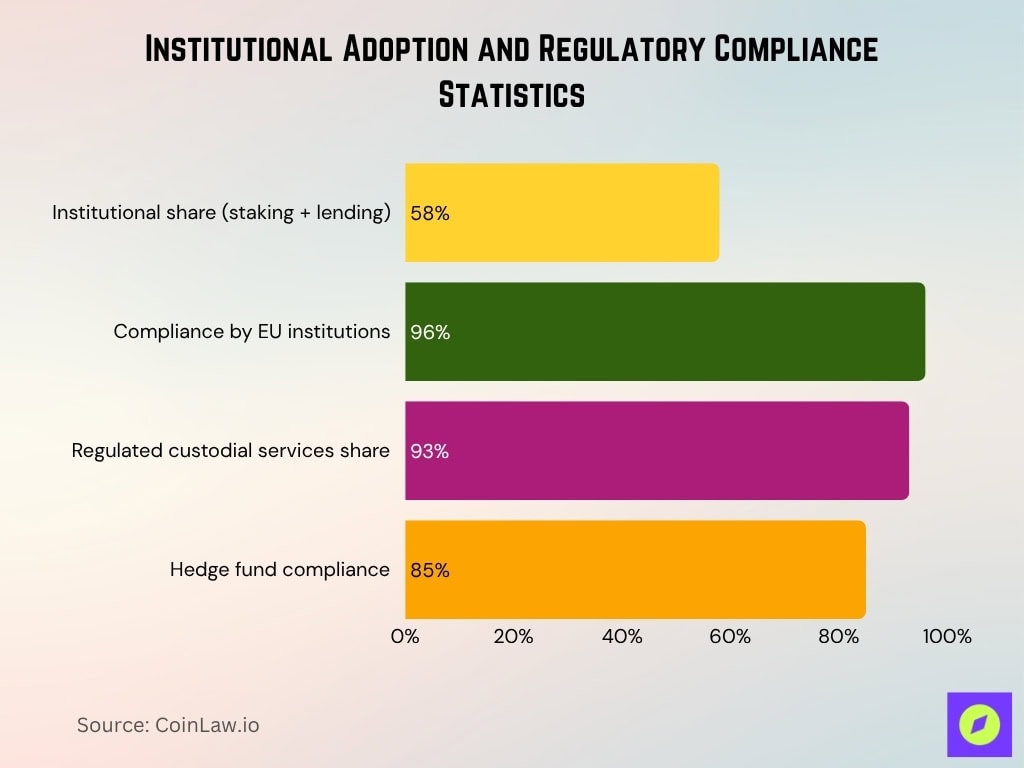

Institutional Adoption and Regulatory Compliance Statistics

- Institutional investors now represent 58% of crypto staking and lending activity in the EU.

- 96% of European financial institutions comply with MiCA’s crypto rules, enabling them to legally offer digital asset services.

- Regulated custodial services now manage 93% of institutional crypto assets, reducing reliance on offshore platforms.

- Over 85% of crypto hedge funds in the EU now comply with MiCA.

- EU banks now hold over $110 billion in digital asset reserves.

- Private wealth funds increased their crypto holdings by 71%, focusing heavily on regulated lending and staking opportunities.

- Corporate treasury investments in crypto lending platforms more than doubled to $42 billion as MiCA gave legal protections.

- Non-compliant institutions faced over €230 million in fines in 2025, underscoring strict enforcement.

- Crypto-related lawsuits in the EU dropped by 32% in 2025, as MiCA delivered clearer legal frameworks.

- Centralized exchanges saw a 27% increase in institutional users as more firms adopted regulated trading and staking services.

Impact on DeFi Lending and Staking Platforms

- DeFi lending volume in the EU fell by 23% in 2025 as stronger KYC rules deterred anonymous lending.

- 78% of European DeFi users migrated to centralized platforms, citing regulatory clarity and better security.

- Uniswap, Aave, and Compound lost 18% of their European user base amid MiCA compliance challenges.

- Regulated DeFi platforms, including MiCA-compliant DEXs, saw 26% growth in EU transaction volume.

- DeFi staking rewards dropped by 35% as compliance uncertainty pushed platforms to lower incentives.

- 83% of new DeFi projects now require KYC verification, shifting away from pure anonymity.

- European DeFi lending now represents 29% of the global market.

- User engagement on non-compliant DeFi lenders declined by 24%, as users favored protected alternatives.

- DeFi liquidity pools in the EU experienced a 20% decline in TVL from withdrawals by cautious investors.

- MiCA-compliant DeFi platforms outperformed non-compliant ones by 32% in Q1 2025, signaling a regulated DeFi future.

MiCA’s Influence on User Participation and Market Dynamics

- Retail crypto lending deposits dropped by 8.2% in 2025 as stricter KYC rules discouraged some casual investors.

- EU-based staking platforms saw a 34% rise in active users as participants switched from offshore to MiCA-compliant services.

- Crypto lending participation by HNWIs rose by 42% in 2025 as regulatory certainty spurred larger capital deployment.

- Total staking rewards paid on MiCA-compliant platforms reached $5.0 billion in Q1 2025, a 15% year-over-year increase.

- Daily crypto lending transaction volumes in the EU grew by 25% in 2025, reflecting stronger confidence in regulated platforms.

- Ethereum staking deposits in MiCA-approved platforms peaked at $120 billion, setting a new record for regulated staking.

- Lending default rates fell by 28% as MiCA’s enhanced collateral and liquidity rules improved repayment reliability.

- More than 65% of new EU crypto investors said MiCA’s consumer protection features motivated their participation.

- Institutional user accounts on EU crypto lending platforms increased by 48%, highlighting a deepening institutional presence.

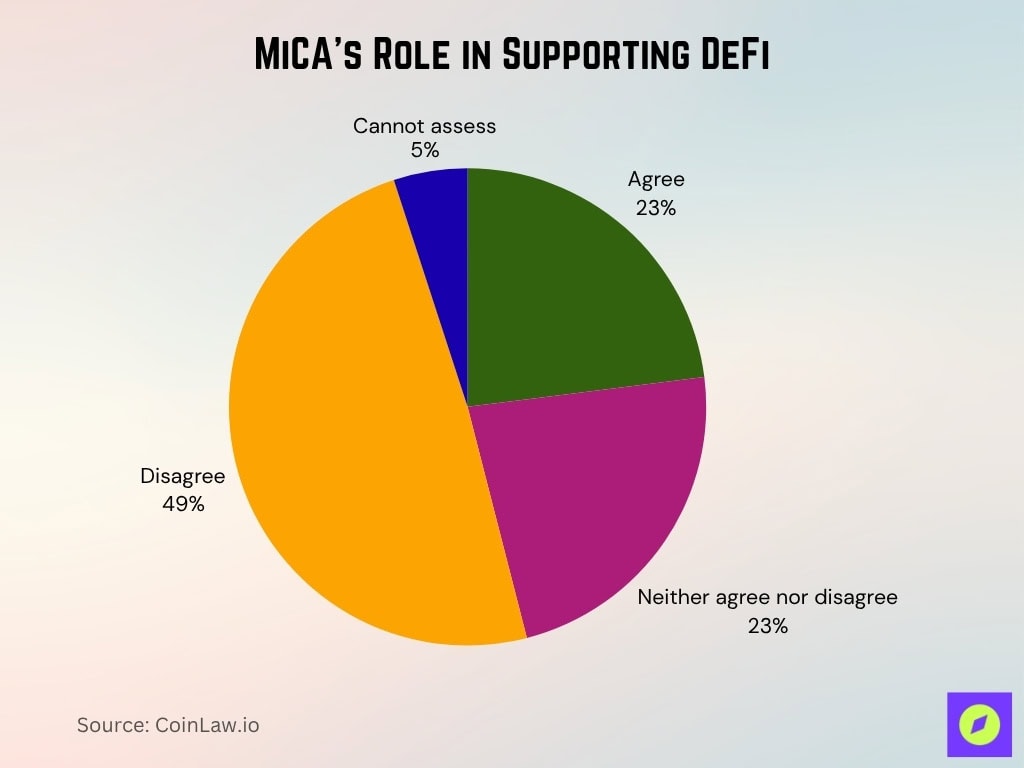

MiCA’s Role in Supporting DeFi

- 49% disagree that MiCA sufficiently facilitates emerging sub-industries like DeFi.

- Only 23% agree that MiCA provides adequate support for DeFi growth.

- Another 23% neither agree nor disagree, showing mixed perceptions in the industry.

- Just 5% cannot assess, indicating most stakeholders have formed a clear opinion.

- Overall, the data highlights skepticism outweighing confidence in MiCA’s role for DeFi.

Comparative Analysis: EU vs. Non-EU Crypto Markets

- Total crypto lending volume in the EU grew by 27%, while non-EU markets saw only a 12% increase.

- EU staking participation rose 39%, whereas non-EU staking growth was 22% as investors sought regulatory clarity.

- Offshore crypto lending platforms lost 14% of European users as many migrated to MiCA-approved services.

- DeFi lending outside the EU expanded by 9%, while EU DeFi lending declined by 18% under stricter regulation.

- Stablecoin lending interest rates averaged 8.1% in non-EU platforms versus 6.5% on MiCA-compliant EU platforms.

- Institutional crypto lending participation was 52% in the EU compared to 34% in non-EU markets.

- Retail investors made up 72% of staking participants in non-EU markets, while in the EU, 44% of staking is driven by institutions.

- EU regulatory enforcement triggered $200 million in fines in Q1 2025, whereas non-EU markets had fewer central crackdowns but higher fraud risk.

- Market liquidity in EU crypto lending platforms rose by 26%, while non-EU liquidity remained volatile due to disparate regulation.

Recent Developments and Updates

- EU regulators revoked the license of a non-compliant staking platform, marking their first such enforcement action under MiCA.

- Germany and France lead institutional staking uptake, with German banks now holding over $25 billion in staked assets.

- New EU blockchain initiatives aim to establish a standardized staking framework to strengthen security and compliance.

- Ethereum staking in the EU under MiCA-approved platforms reached a record 40 million ETH locked.

- Decentralized lending firms began integrating on-chain KYC systems so users remain pseudonymous while meeting MiCA rules.

- Retail participation in EU staking pools rebounded with a 7% increase in Q2 2025 as incentives and protections improved.

- Cross-border staking and lending alliances are in discussions to harmonize regulation between the EU and other jurisdictions.

Frequently Asked Questions (FAQs)

As of early 2025, there are 12 CASPs and 10 EMT issuers licensed under MiCA, with projections of 100 to 130 by year’s end.

EU-based providers handle 75% of staking transactions in 2025, up from 59% before MiCA.

78% of European stablecoins are fully compliant with MiCA reserve and reporting requirements in 2025.

EU DeFi usage fell by 16% in 2025 as many protocols remained outside the MiCA perimeter.

Institutional participation accounts for 44% of EU staking in 2025.

Conclusion

MiCA has revolutionized crypto lending and staking, bringing institutional credibility, security, and legal clarity to the European market. While it has created challenges for DeFi and retail investors, its impact on stability and institutional adoption is undeniable.

Looking ahead, the future of MiCA’s regulatory framework will shape how crypto lending and staking evolve, not just in Europe, but globally. As other regions look to implement similar regulations, the EU’s model may serve as a blueprint for sustainable and compliant crypto growth worldwide.