The workforce size of Worldpay, Inc. offers a clear indicator of its scale and strategic direction in the payments industry. With one scenario seeing a rapid shift to remote/hybrid work across global merchant processing functions, and another in which expansion into digital wallet and e-commerce services demands new staffing layers, employee numbers tell a story of both growth and change. In the next sections, we will explore key statistics and trends.

How Many People Work At Worldpay?

- The employee count for Worldpay is between 5,000 and 10,000+ across global operations.

- The company operates in 174 countries and across 135 currencies.

- In 2024, the global transaction value processed via digital wallets was reported at $13.9 trillion in the context of Worldpay’s Global Payments Report.

- Worldpay’s share of the global merchant services market in 2024 is estimated at 10%, up from 9.8% in 2023.

- The acquisition deal announced in 2025 by Global Payments Inc. for Worldpay valued it at around $24.3 billion, influencing possible workforce restructuring.

- In the United States and Canada, Worldpay commands approximately 12% of transaction value in its segment.

Recent Developments

- The merger between Global Payments and Worldpay targets $600 million in annual cost synergies.

- Digital payments at physical retail rose from 3% in 2014 to 38% in 2024, according to Worldpay’s 2025 report.

- Mobile devices now account for 57% of global e-commerce payments, tripling since 2014, with expected growth to 64% by 2030.

- The risk and compliance divisions have integrated advanced fraud analytics technology, boosting fraud prevention efficiency by 22% in 2025.

- In the UK, 85.7% of women received bonus pay compared with 84.6% of men.

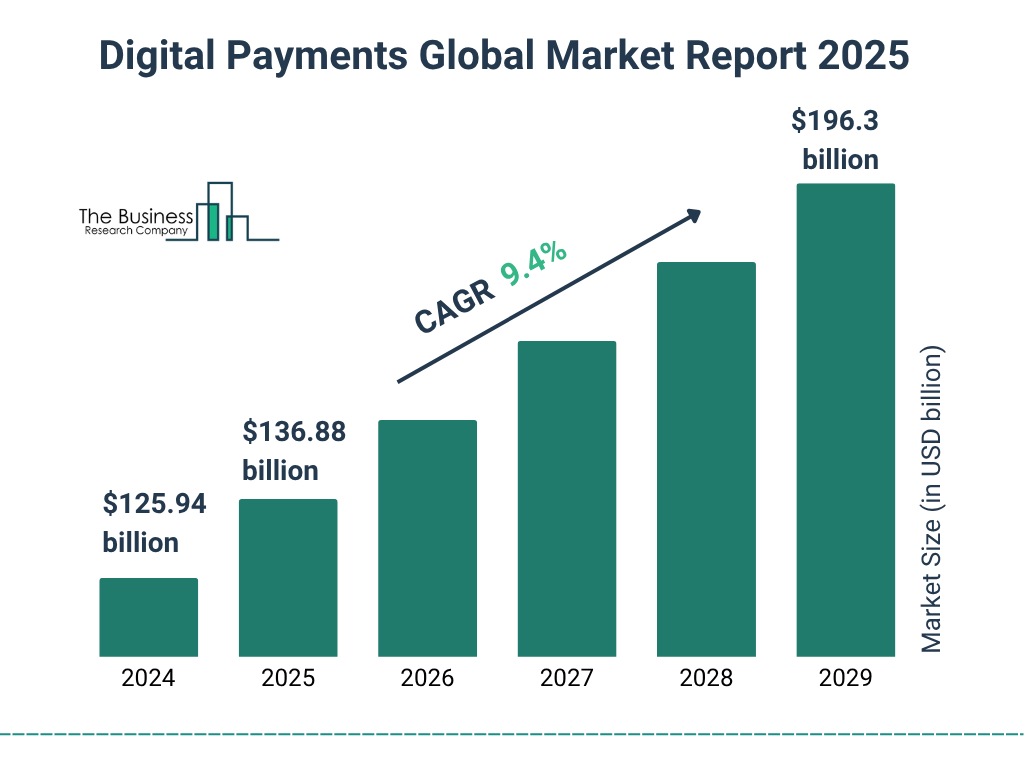

Global Digital Payments Market Outlook

- The digital payments market is projected to grow from $125.94 billion in 2024 to $196.3 billion by 2029.

- This represents an absolute increase of about $70.36 billion over five years.

- The market is expanding at a Compound Annual Growth Rate (CAGR) of 9.4%.

- The 2025 market size is expected to reach $136.88 billion, marking strong early growth.

- Based on the CAGR, estimated future market sizes are approximately $149.7 billion (2026), $163.5 billion (2027), and $179.3 billion (2028).

- The steady growth trend highlights the increasing adoption of e-wallets, contactless payments, and cross-border fintech platforms worldwide.

- By 2029, the digital payments sector will be approaching the $200 billion mark, reinforcing its role as a core driver of global fintech innovation.

Worldpay’s Current Team (Key People)

- Charles Drucker – Chief Executive Officer: Charles oversees Worldpay’s global strategy and operations, bringing decades of payments-industry leadership to guide the company through its next phase of growth.

- Matt Downs – EVP & Group President, Global Platforms: Matt leads the Platforms business, focusing on software-led payments and scalable architecture, with more than 25 years of experience in payments and technology.

- Philip McHugh – EVP & Group President, Global SMB: Philip heads Worldpay’s Small- & Medium-Business division globally, applying over 30 years of fintech and banking leadership to accelerate growth in this core segment.

- Board of Directors — Including Collin Roche, Aaron Cohen, KJ McConnell, Charles Drucker (also CEO), and Stephanie Ferris: The board provides oversight and strategic direction, drawing on deep payment-tech and financial background across its members.

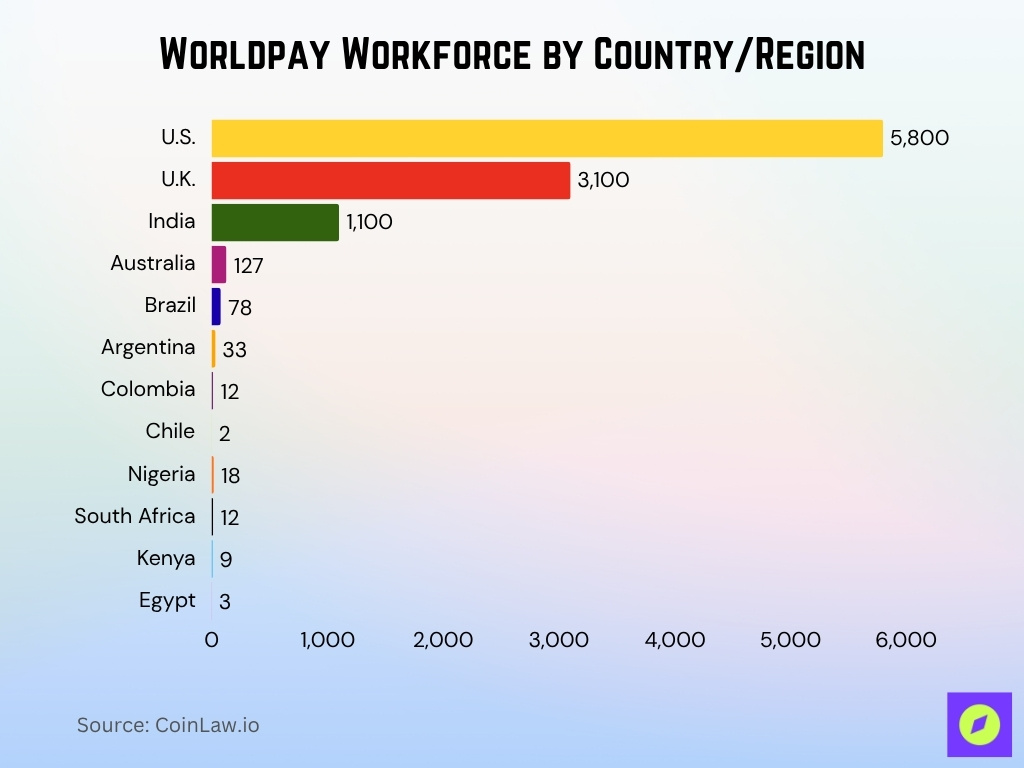

Global Workforce Distribution

- Worldpay lists operations in 174 countries, suggesting its workforce is globally distributed.

- The company supports transactions across 135 currencies, again signalling global staffing needs.

- LeadIQ data notes team members located across six continents (North America, Europe, Asia, plus Latin America, the Middle East & Africa).

- The U.S. and Canada region reportedly contributes roughly 12% of transaction value, which likely corresponds to a proportional share of staffing focused on that geography.

- Europe (including the U.K.) accounts for approximately 30% of Worldpay’s global transactions, staffing there likely reflects that scale.

- Asia-Pacific region recorded about 8% transaction-volume growth in 2024, implying workforce expansion in that geography.

- With digital wallet adoption rising globally, a higher share of the workforce may now be dedicated to online/mobile payments in markets beyond the U.S.

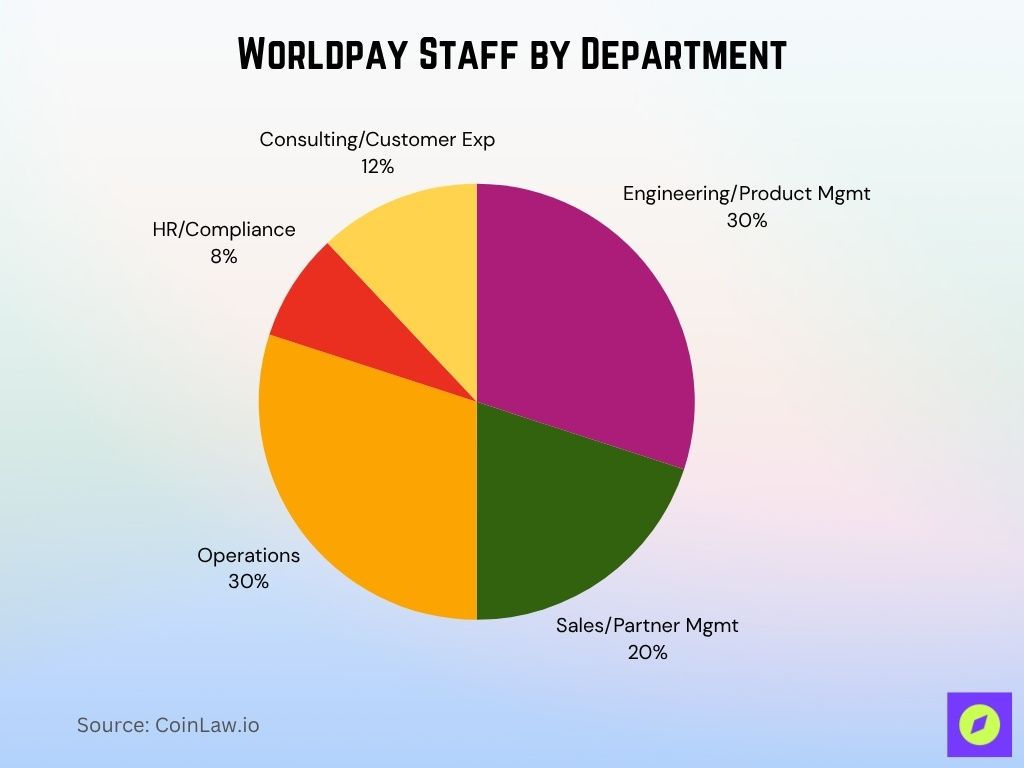

Roles and Departments at Worldpay

- Worldpay employs approximately 30% of its workforce in Engineering and Product Management as of mid-2025.

- Sales and Partner Management teams represent about 20% of the global headcount, driven by embedded-finance growth.

- Operations employees constitute around 30% of the total staff, supporting merchant services globally across 6 continents.

- Chief People & Culture Officer and Chief Compliance Officer roles highlight HR and compliance teams, which account for roughly 8% of employees.

- Consulting and customer experience teams support merchant solutions, accounting for about 12% of total employees.

- Digital Payments and e-commerce expansions have driven a 15% increase in Engineering staff in 2025 alone.

- Product teams work closely with regional operations, reflecting a global distributed workforce model.

- Sales & partner teams focus on platform partnerships, contributing to a doubling of partnership deals in 2024-2025.

Recent Workforce Changes and Trends

- The planned $600 million cost synergies in the Global Payments merger may reduce the workforce via consolidation.

- About one-third of cost savings come from eliminating duplicate administrative roles, risking staff cuts.

- Workforce focus is shifting with digital wallets and e-commerce, increasing roles in merchant platforms by 40% since 2023.

- Remote and hybrid work models are used by over 50% of international employees as of 2025.

- Outsourcing in Asia and Latin America accounts for roughly 20% of support and back-office functions.

- Recruitment prioritizes technical roles in data analytics and cloud, with a 30% increase in hiring for these areas in 2025.

- Employee mobility across departments rose by 18% year-over-year, enabling role flexibility across sectors.

- Back-office offshoring increased by 22% between 2023 and 2025, reflecting cost management strategies.

Diversity and Inclusion Statistics

- Worldpay’s culture rating for diverse employees is 81/100, ranking in the top 10% for companies with 5,000 and 10,000+ employees.

- The gender diversity score for women places Worldpay in the top 20% of peer companies on Comparably.

- Glassdoor’s Equality, Diversity, and Inclusion rating for Worldpay is 3.8 out of 5 stars from 426 reviews.

- Women constitute 38% of senior leadership positions globally at Worldpay.

- More than 200 Culture Champions globally support Worldpay’s inclusion and engagement programs.

- Over 70% of employees report looking forward to coworker interaction, with 67% women and 60% diverse employees.

Company Locations and Offices

- Worldpay operates in 174 countries, supporting transactions in 135 currencies.

- North America has multiple offices with about 5,800 employees in the U.S. alone.

- Europe, led by the U.K. with 3,100 employees, also has offices in Romania, the Netherlands, France, and Germany.

- Asia-Pacific includes around 1,100 employees in India, plus offices in Singapore, China, Japan, the UAE, the Philippines, Indonesia, and Malaysia.

- Oceania’s workforce is roughly 127 employees in Australia, along with New Zealand and regional hubs.

- Latin America offices include Brazil (78 employees), Argentina (33), Colombia (12), and Chile (2).

- Africa and the Middle East have smaller teams with 18 in Nigeria, 12 in South Africa, 9 in Kenya, and 3 in Egypt.

Financial Performance and Revenue

- According to the 2025 Global Payments Report, digital payment methods (via Worldpay’s network) reached $13.9 trillion in total value in 2024.

- Worldpay’s proprietary “Revenue Boost” product claims that its clients benefited from an additional $200 million in incremental revenue in 2024.

- The planned acquisition by Global Payments Inc. of Worldpay targets cost synergies of $600 million annually, which will influence future margin performance.

- While transaction-value growth remains high, several sources note that processor fee revenue growth is slowing in the broader market to around 5% per year from prior ~7%.

- Profitability metrics for Worldpay alone are not widely publicised, but its ownership structure and pending M&A deal suggest margin improvement is a strategic priority.

Notable Partnerships and Clients

- Worldpay partnered with BVNK in May 2025 to enable global stablecoin payouts in 180+ markets.

- In June 2025, Worldpay teamed with Santander UK to serve business and corporate customers with e-commerce and POS services.

- Worldpay collaborated with POS-tech firm Yabie in May 2025 to support UK small businesses via the Worldpay 360 platform.

- The company was recognized as “Best in Breed” for API onboarding and developer experience in 2025.

- Partnerships emphasize fintech integrations and alternative payment methods like stablecoins, boosting cross-border reach by 30% since 2024.

- Embedded payments and platform partnerships account for over 40% of transaction flow volume in 2025.

- Global partnerships support seamless transaction flow across 6 continents.

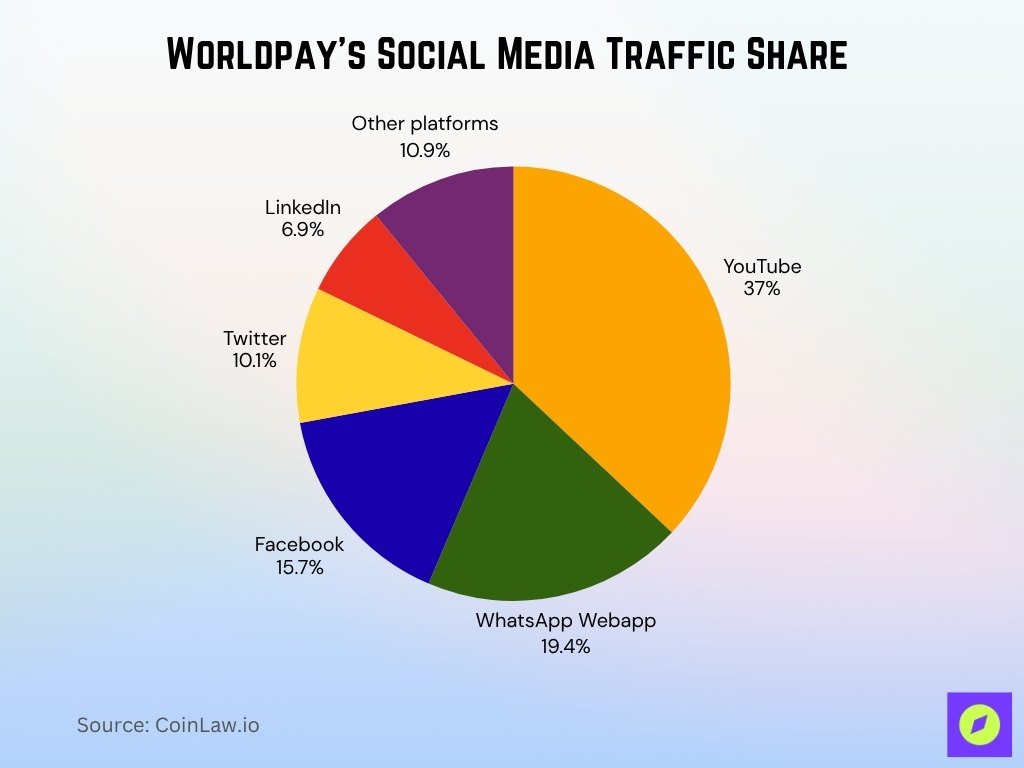

Worldpay’s Social Media Traffic Share

- YouTube drives the highest share of traffic at 37.0%, showing Worldpay’s strong video presence and engagement through tutorials, case studies, and brand campaigns.

- WhatsApp Webapp follows with 19.4%, indicating Worldpay’s reliance on instant communication channels for merchant and partner interactions.

- Facebook contributes 15.7%, remaining a consistent platform for community engagement and company updates.

- Twitter (X) accounts for 10.1%, used primarily for quick news, product alerts, and support communication.

- LinkedIn represents 6.9%, emphasizing Worldpay’s corporate communications and B2B networking strength.

- Other platforms make up 10.9%, reflecting minor engagement through niche or emerging social media channels.

Worldpay’s Position in the Payments Market

- Worldpay operates in 174 countries and supports transaction processing in 135 currencies.

- It is considered among the largest non-bank merchant acquirers globally, with transaction volumes in the trillions.

- According to a market snapshot, the payment-processing vendor revenue pool for 2025 is ~$64 billion, a segment where Worldpay competes.

- In the UK specifically, Worldpay is reported as the largest end-to-end full-stack processor, processing about 40-50% of card transactions by volume in conjunction with Barclaycard.

- The firm’s strategic intent is to position itself as a global omnichannel payments platform, online, mobile, and in-store.

- Given scale and geographic reach, Worldpay holds a strong competitive stance, yet pressure from fintechs and platform players is rising.

Comparison with Peer Companies

- Compared to peer processors like PayPal Holdings, Inc. and FIS, Worldpay’s mind-share in payment-processing software was estimated at about 3.4% in February 2025, down from 6.1% the year prior.

- In the UK market, Worldpay and Barclaycard together handle ~36% of merchants serviced among major providers.

- The acquisition by Global Payments indicates consolidation; the combined entity aims to process ~94 billion transactions worth ~$3.7 trillion annually across 174 countries.

- While Worldpay’s revenue growth is modest (~5-6%), some competitor fintechs report higher percentage growth but from smaller bases.

- In technology stack and geographic reach, Worldpay compares favorably, but newer entrants may outpace it in niche or embedded segments.

Impact of Mergers & Acquisitions on Staffing

- Global Payments’ acquisition valued Worldpay at $24.3 billion.

- The deal targets $600 million in annual cost synergies, primarily from reducing duplicate roles and systems.

- One-third of synergies are expected from eliminating overlapping administrative and corporate staff.

- No public disclosure of precise headcount cuts, but M&A restructuring typically affects up to 15% of combined workforces in payments industry benchmarks.

- The UK CMA cleared the deal in October 2025 after a regulatory review began in July.

Implications for Business Operations & Culture

- Worldpay operates in 174 countries, requiring strong infrastructure and compliance frameworks.

- Digital payments now represent 66% of global e-commerce spend, according to the 2025 Global Payments Report.

- Staffing has shifted to include more engineers, data scientists, and product managers, reducing traditional processing roles.

- The company’s API recognition signals a shift toward an innovative and developer-friendly culture.

- Operations are transitioning from legacy POS to platform-centric and embedded commerce models.

Frequently Asked Questions (FAQs)

More than ≈ 66% of the global workforce.

Employees are located across 6 continents.

Somewhere between 5,000 and 10,000+ employees.

Conclusion

In assessing how many people work at Worldpay, the headcount, revenue growth, global reach, partnerships, market position, and a massive upcoming acquisition all shape the workforce and strategic posture of the company. For U.S. businesses evaluating Worldpay as a partner, or for employees exploring the company, the next phase will involve integration, innovation, and a shift in workforce priorities. As the payments landscape accelerates, Worldpay is positioning itself not just to process transactions, but to orchestrate commerce worldwide.