Razorpay stands at an intriguing cross-section of fintech growth and workforce dynamics. As the company continues to expand across payment gateways, banking services, and international markets, the size and composition of its team offer a revealing lens into its strategy. For instance, Razorpay’s rise enables Indian SMEs to scale across geographies, while its payroll platform supports thousands of businesses in optimizing their workforce. Let’s dive into detailed statistics to understand exactly how many people work at Razorpay, and why it matters.

How Many People Work At Razorpay?

- ≈ 4,000 employees at Razorpay as of July–September 2025.

- Employee count up by ~26% year-on-year (YoY) in the recent reported period.

- Employee benefits expenses formed around 25% of total expenses (~₹611 crore) in FY24, showing that workforce cost is a significant line item.

- According to RazorpayX-derived data, full-time employee average salary rose 6.69% over nine months.

- Razorpay announced plans in late 2024 to hire 650 professionals over 10 months across technology and business verticals, as part of its post-reverse-flip expansion strategy.

Recent Developments

- In May 2025, Razorpay completed a reverse flip of its parent entity from the U.S. to India.

- The company launched a pilot with NPCI and OpenAI to enable AI-driven payments through ChatGPT (“Agentic Payments”).

- These moves may drive hiring in AI, product engineering, and international market expansion.

- Razorpay’s employee headcount increased to ~4,000 in September 2025.

- New health insurance policy enhancements in 2024 signal HR evolution and focus on wellbeing.

- Razorpay’s recent announcements reflect a shift from pure payments to full-stack financial services, impacting workforce size and skills.

- Global hiring may accelerate, though overseas numbers remain comparatively low.

- Industry-wide contraction in fintech hiring may influence Razorpay’s workforce strategy.

Mobile Payment Technologies Global Market Overview

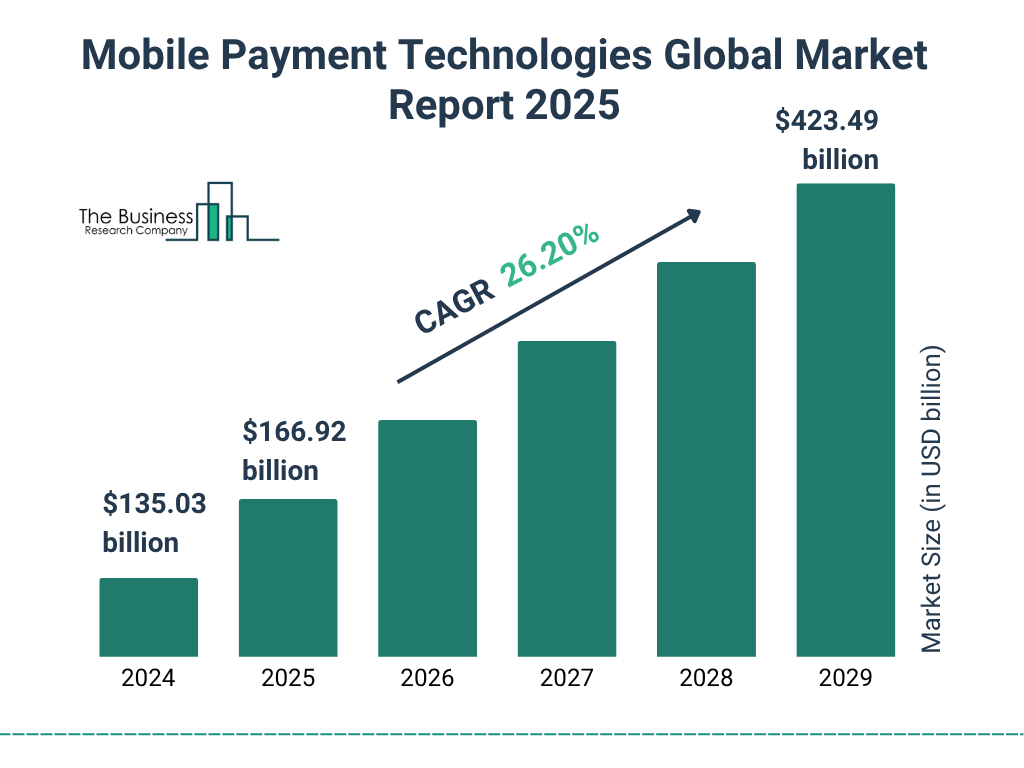

- The global mobile payment technologies market is projected to grow rapidly between 2024 and 2029.

- In 2024, the market size stood at $135.03 billion, highlighting strong adoption across digital transactions.

- By 2025, the market is expected to reach $166.92 billion, showing robust year-over-year growth.

- The report forecasts continued expansion, reaching $423.49 billion by 2029.

- This represents a compound annual growth rate (CAGR) of 26.20%, emphasizing sustained demand for contactless and mobile payment systems.

- The sharp rise reflects increasing smartphone penetration, fintech innovation, and consumer preference for cashless transactions.

- The data suggests that mobile payments will become a core driver of digital commerce globally by the end of the decade.

Razorpay’s Current Team (Key People)

- Harshil Mathur – Co-Founder & Chief Executive Officer. As CEO, Harshil steers Razorpay’s strategic vision, oversees key business lines, and guides the company through its growth phase.

- Shashank Kumar – Co-Founder & Managing Director. Shashank focuses on business architecture, partnerships, and managing the company’s scaling across markets.

- Rahul Kothari – Chief Operating Officer. Rahul’s domain is operations, execution, and ensuring Razorpay’s internal systems support fast growth.

- Arif Khan – Chief Innovation Officer. Arif owns the innovation agenda, helping Razorpay craft new product features and explore next-gen fintech solutions.

- Arpit Chugh – Chief Financial Officer. Arpit oversees financial strategy, investor relations, and cost discipline for Razorpay’s expansion.

- Murali Brahmadesam – Chief Technology Officer & Head of Engineering. Murali leads the engineering teams, drives the tech stack, and ensures scalability of the platform.

- Khilan Haria – Chief Product Officer. Recently elevated to CPO, Khilan heads product strategy, defining which services Razorpay launches and how they evolve globally.

- Chitbhanu Nagri – Senior Vice President, People Operations. Chitbhanu oversees HR, talent acquisition, and the people agenda, critical in a scaling fintech.

- Aparv Sethi – Senior Vice President, Marketing. Aparv drives brand, go-to-market strategy, and ensures Razorpay’s positioning keeps pace with its growth.

- Ayush Bansal – Vice President & General Manager, RazorpayX. Ayush leads the RazorpayX business unit, which focuses on payroll, banking, and new offerings for enterprises.

Global vs India Employee Distribution

- In Southeast Asia specifically, Razorpay has ~50-60 employees currently, with plans to double by 2025-26.

- The vast majority of operations remain India-centric, given headquarters in Bengaluru and an Indian fintech focus.

- As of May 2024, 2,204 employees reported, likely India-based.

- International footprint remains comparatively small but growing, with the Singapore node in an early stage.

- The global headcount figure (≈4,000) likely incorporates India plus overseas offices and remote hires.

- Given the ~50-60 figure in SEA, overseas employees may represent under 2% of total headcount presently.

- As the company expands into Southeast Asia and possibly other regions, the non-India share is expected to increase.

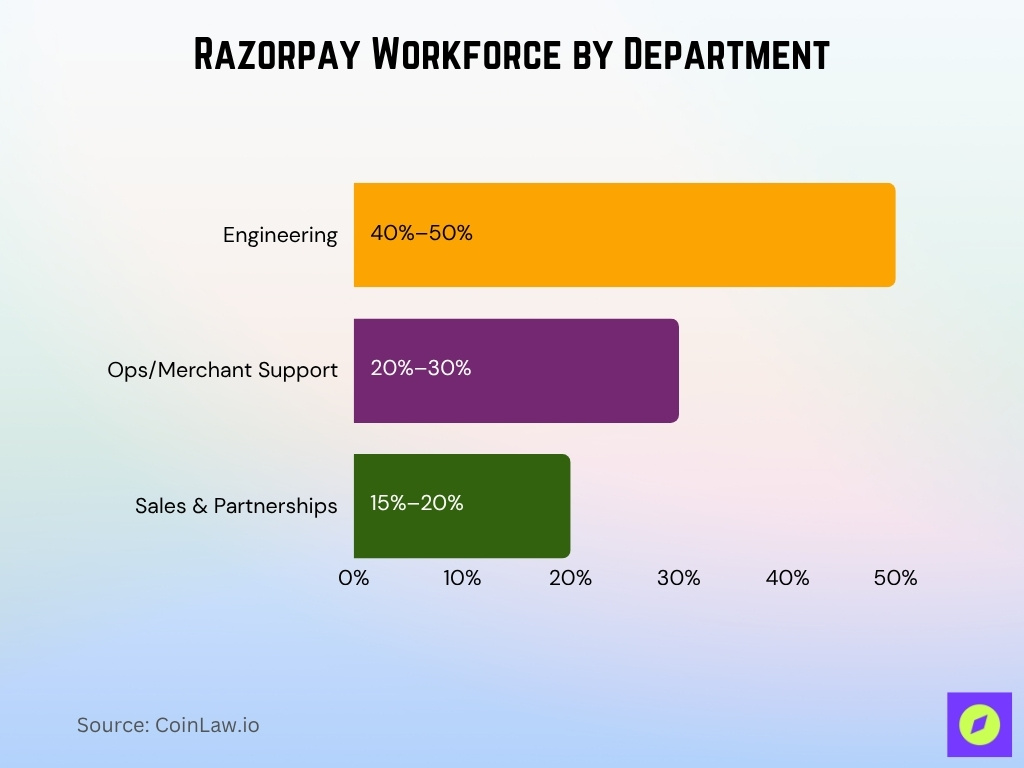

Employee Headcount by Department

- India-centric payment‐gateway companies typically allocate large shares of staff to engineering (40-50%), operations/merchant support (20-30%), and sales & partnerships (15-20%).

- While Razorpay does not publicly publish full department-level staffing, several indicators give signals.

- For FY24, the employee benefits expense of ₹611 crore out of total expenses suggests major headcount across product, engineering, sales, and support.

- The RazorpayX Payroll platform indicated a 17% growth in AI-driven roles (engineering/data science) in 2024.

- Outsourcing trends show growth: in one analysis, contract/outsourced hiring for tech, sales, and operations rose ~14%, 10.7%, and 6.7% respectively.

- Razorpay’s non-payment products (neobanking, payroll, lending) likely increased headcount in product and compliance teams in recent years.

- With the global footprint small (~50-60 employees in SEA) but growing, overseas hiring will skew towards business development and operations rather than large engineering hubs.

Razorpay Workforce Gender Breakdown

- While Razorpay doesn’t publish a full gender split, broader tech-industry data in India shows an unadjusted gender pay gap of about 28-30% in 2023.

- A payroll-insights release from RazorpayX found that over a nine-month period, the average salary increase for female full-time employees was 9.13%, compared with 8.87% for males.

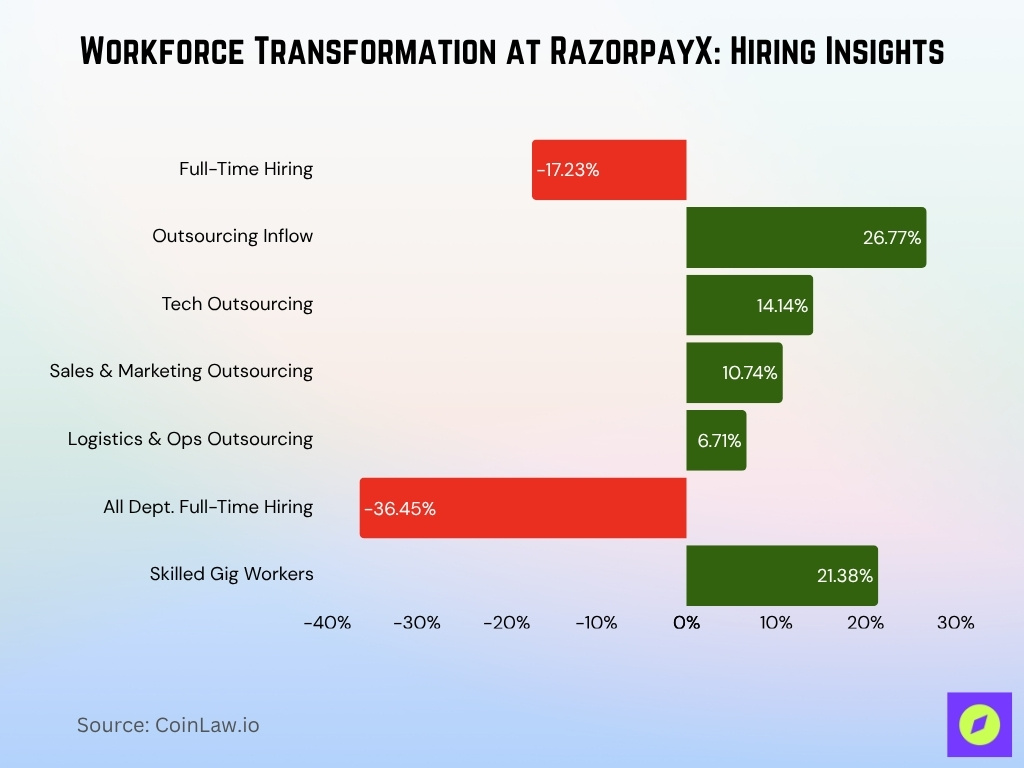

- During that same period, full-time hiring dropped by 17.23%, which may impact gender representation if the declines aren’t uniform across genders.

- In tech-driven companies like Razorpay, women remain underrepresented in senior roles, consistent with industry data.

- Startups using RazorpayX Payroll recorded a salary boost of 11.06% in finance departments and 8.90% in HR for full-time workers, reflecting department-specific gender trends.

- Although no public data gives Razorpay’s exact gender ratio, benchmark firms target ~30% women in the workforce by 2030 in similar sectors.

- Given industry norms, it’s plausible that women make up 20-30% of Razorpay’s workforce, with lower representation at senior levels.

- The salary growth advantage for women (9.13% vs 8.87%) suggests incremental progress toward pay equity in Razorpay’s ecosystem.

RazorpayX Payroll Workforce Analytics

- In that period, total salary payout grew 8.22%, and average full-time salary grew 6.69%.

- Among departments, full-time hiring in sales & marketing grew by 23.24%, and in finance by 21.45%, even as total hiring declined.

- Demand for outsourcing firms increased by 26.77% during that period, indicating a shift in employment models.

- Outsourcing growth by department: technology +14.14%, sales/marketing +10.74%, logistics/operations +6.71%.

- For gig workers earning over INR 150K/month, RazorpayX recorded a headcount growth of 21.38%, though full-time hiring shrank by ~36.45% in a six-month period.

- Average salary for full-time employees in finance and HR rose significantly: 11.06% (finance) and 8.90% (HR).

- Entry-level average salary dipped by 13.36% in that same six-month window despite overall salary growth, suggesting stratified trends.

- RazorpayX’s payroll data thus signals that Razorpay and peer firms are shifting toward outsourced and gig roles while focusing full-time hiring more strategically.

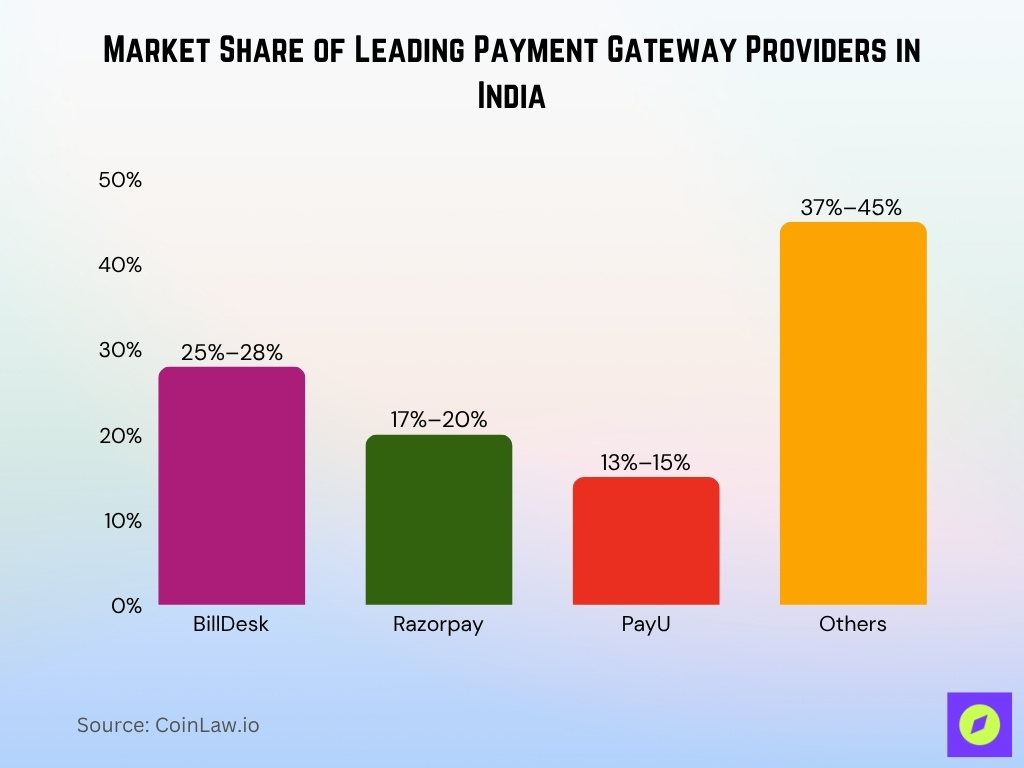

Market Share of Payment Gateway Providers in India

- BillDesk remains the market leader with an estimated market share of 25–28% among payment gateway providers in India for 2025.

- Razorpay holds a significant position, capturing approximately 17–20% of the market as of 2025.

- PayU accounts for an estimated 13–15% share, solidifying its role in the competitive landscape.

- Other providers, such as CCAvenue, Paytm, Cashfree, and smaller regional firms, collectively comprise 37–45% of the market.

- The dominance of these three companies illustrates the concentration of market share in the Indian payment gateway sector.

Salary Distribution Among Employees

- Female full-time employees saw an average salary bump of 9.13%, higher than their male counterparts (8.87%).

- Across the startup ecosystem, total salary disbursements rose 8.22% in the same period.

- In department-specific terms, finance full-time employees got a salary increase of 11.06%, and HR got 8.90%.

- The average salary for individual contract/gig workers increased only 0.22%, despite growth in outsourcing uptake.

- Entry-level salaries for full-time roles dipped by 13.36%, even while senior roles (CXOs) saw a 10.29% salary increase.

- For the Indian tech-fin sector, the gender pay gap remains ~28-30%, which indirectly reflects salary distribution skew.

- Salary distribution at Razorpay likely mirrors these trends: strong growth for mid- and senior-level full-time employees, weaker growth for junior or gig roles.

Employee Retention and Turnover Rates

- While Razorpay hasn’t publicly shared its internal turnover rate, sector benchmarks indicate a typical voluntary turnover rate in 2025 of around 20%.

- The cost of turnover can reach 1.5-2× the annual salary of the employee.

- The turnover formula, (Number of departures ÷ Average number of employees) × 100.

- Given the hiring slowdown and higher outsourcing share, full-time employee churn may be higher than typical.

- Studies show that companies with solid onboarding and engagement reduce turnover; for tech firms, that may mean targeting retention below 15-18%.

- The move toward gig and outsourced workers could increase turnover on the full-time side, as contract roles typically have higher exit rates.

- Retention strategies at Razorpay likely need to adapt: increased focus on employee engagement, growth opportunities, and career pathing.

Outsourcing vs Full-Time Hiring Statistics

- In the nine-month window tracked by RazorpayX, full-time hiring declined by 17.23%.

- Over the same period, inflow to outsourcing firms for hiring purposes grew 26.77%.

- Outsourced hiring by department, technology +14.14%, sales & marketing +10.74%, logistics & operations +6.71%.

- For the past six months, full-time hiring across all departments dropped by 36.45%.

- Meanwhile, demand for skilled gig workers (INR >150K/month) rose 21.38%.

- The trend signals that outsourcing now outpaces full-time hiring in the fastest-growth roles.

Industry Recognition and Workplace Awards

- Razorpay has been listed by LinkedIn as #6 on the Top 10 Indian Startup List.

- The company was the only Indian brand on the Forbes Cloud 100 list in 2021.

- Industry coverage describes Razorpay as having “cracked the code of cultural integration of employees.”

- Its revamped benefits and insurance policy were described as “raising the bar for employee well-being.”

- Razorpay emphasizes recognition for engineers, designers, and marketers and highlights a growth-oriented culture.

- Employee count grew by ~26% year-on-year, drawing attention as a scaling workplace.

- Inclusion of siblings and same-gender partners in health benefits was described as industry-first.

- By publicly articulating HR innovations, Razorpay positions itself among startups that treat workplace quality as part of its brand.

Comparison with Competitors’ Employee Count

- Razorpay has ≈ 3,933 employees and grew its headcount by ~26% last year.

- Razorpay has approximately 4,000 employees as of September 2025 across six continents.

- Paytm is listed as having 21,498 employees.

- The significant difference in headcount reflects Razorpay’s niche focus versus Paytm’s broader consumer financial-services footprint.

- Based on Razorpay’s estimated revenue of $740 million in FY24 and a headcount of ~4,000, the revenue per employee approximates $185,000, reflecting lean operations compared to fintech peers.

- Comparisons must consider how each company defines “employee,” which may differ across firms.

- The gap also highlights that Razorpay remains significantly smaller than some large fintech peers, though its growth rate is stronger.

- Razorpay sits in the “growth-stage” fintech category rather than an enterprise-scale employer.

Future Hiring Plans and Projections

- Razorpay’s careers page continues to list open roles in engineering, design, product, and marketing, signaling ongoing hiring momentum.

- Given its estimated ~4,000 current employees, even a modest scale-up (10-20%) would add several hundred roles in 2025.

- As Razorpay expands geographically and into new product lines, hiring is likely skewed towards engineering, compliance, and partnerships.

- Salary and outsourcing trends suggest Razorpay may prioritize higher-skilled full-time hires over large volumes of junior recruits.

- Outsourcing growth signals that demand may also come from contract roles and flexible staffing models.

- The company’s reverse-flip from the US to India in May 2025 may free up structural flexibility for hiring in India.

- Razorpay may aim for workforce growth of 15-20% annually in core roles for the next 2-3 years.

- This implies opportunities in AI/data science, compliance, and international operations.

Frequently Asked Questions (FAQs)

46% of customers.

April–December 2023.

~4,000 employees.

Conclusion

Razorpay has grown with a forward-leaning strategy in hiring, benefits, and international expansion. Its internal policies around diversity and inclusion, along with industry recognition, position it as a noteworthy employer in the Indian fintech ecosystem. Yet the company remains significantly below some larger peers, which brings both agility and unique talent-attraction challenges.

As Razorpay pushes into new products (neobanking, AI-powered payments) and geographies, its workforce composition and hiring approach will be key metrics to watch. For professionals considering a career there, and for observers tracking fintech workforce trends, the evolving data offers a clear window into how Razorpay is scaling not just its business, but its people.