The cryptocurrency exchange Kraken has undergone significant workforce shifts in recent years, driven by market volatility, regulatory changes, and strategic repositioning. From major layoffs to a bolstered remote-first model, the company’s staffing numbers reflect both contraction and intent to scale. These changes matter not only for Kraken’s bottom line but also for the broader crypto-finance labor ecosystem, where hiring and retention trends ripple across fintech, regulatory tech, and digital asset markets. Read on to explore how many people work at Kraken, how that number has changed, and what it means for the business and industry.

How Many People Work At Kraken?

- Kraken announced a workforce reduction of about 400 employees at the end of 2024.

- As of a 2024 internal statement, Kraken had 2,300+ employees globally.

- Kraken describes itself as remote-first, distributed across over 70 countries, with employees speaking more than 50 languages.

- An internal engagement survey indicated that ≈ 81% of Kraken employees (“Krakenites”) reported being engaged in their work.

- About 35% of employees at Kraken choose to receive part of their compensation in crypto assets.

- In Q1 2025, Kraken reported revenue of $472 million, a 19% year-over-year rise, even as it reduced its workforce.

- Kraken’s acquisition of NinjaTrader for $1.5 billion, announced in early 2025, signals workforce strategy shifts ahead of a planned IPO.

Recent Developments

- In late October 2024, Kraken cut around 400 roles under the new co-CEO leadership of Arjun Sethi and Dave Ripley.

- Kraken publicly stated it “continuously evaluates our workforce to ensure it aligns with our strategic priorities” in its 2024 layoff announcement.

- Regulatory clearance improved, the U.S. Securities and Exchange Commission dismissed a civil suit against Kraken in March 2025, and although not directly a staffing change, this regulatory relief supports hiring and retention strategies.

- Kraken’s Q2 2025 results showed revenue of $412 million, up 18% year-over-year, and total exchange volume of $186.8 billion, up 19% year-over-year, signaling business strength amid workforce changes.

- Kraken moved to operate without a physical HQ, emphasizing remote operations and citing regulatory strategy.

- In November 2022, Kraken cut about 1,100 jobs, approximately 30%, in a previous wave of layoffs following broader crypto market stress.

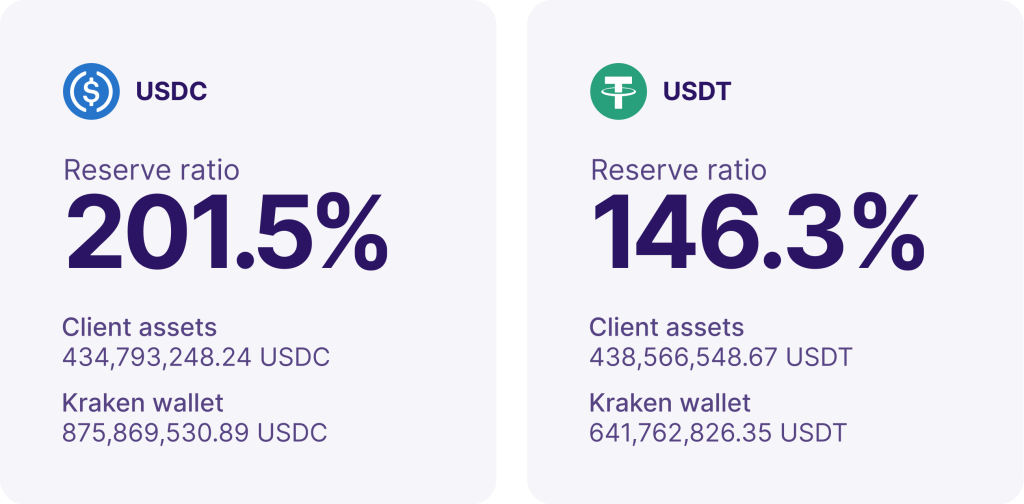

Kraken Stablecoin Reserve Ratios and Holdings

- Kraken’s USDC reserve ratio stands at 201.5%, meaning the exchange holds more than double the client assets in reserves.

- Client assets in USDC total 434.79 million USDC, reflecting strong user trust in this regulated stablecoin.

- Kraken’s wallet balance for USDC reaches 875.87 million USDC, demonstrating robust liquidity coverage.

- USDT reserve ratio is reported at 146.3%, indicating a healthy surplus above client liabilities.

- Client assets in USDT amount to 438.57 million USDT, nearly matching USDC in total holdings.

- Kraken wallet reserves for USDT stand at 641.76 million USDT, ensuring stable collateral support.

- The data shows Kraken maintains overcollateralized reserves for both major stablecoins, reinforcing transparency and solvency confidence across its platform.

Kraken’s Current Team (Key People)

- Arjun Sethi – Co-CEO. He joined Kraken’s board earlier and stepped into the co-CEO role in October 2024, signalling the firm’s pivot toward expansion and regulated markets strategy.

- Dave Ripley – Co-CEO. He took the helm as CEO before the co-CEO arrangement and remains central to operations, strategy, and scaling Kraken’s offerings.

- Jesse Powell – Co-founder & Chairman of the Board. While no longer CEO, his role remains crucial in governance and long-term vision.

- Carrie Dolan – Chief Financial Officer (CFO). She oversees Kraken’s financial operations, capital structure, and preparation for eventual IPO and regulated-market adaptation.

- Mayur Gupta – Chief Growth & Marketing Officer. His team is responsible for driving Kraken’s brand, user acquisition, and global positioning in a competitive crypto landscape.

- Pranesh Anthapur – Chief People Officer. He leads talent strategy, global remote-first hiring and retention efforts, critical in a distributed workforce spanning 70+ countries.

- Marco Santori – Former Chief Legal Officer. While he stepped down in early 2025, his legacy remains in shaping Kraken’s regulatory and legal posture across jurisdictions.

Recent Workforce Changes

- Kraken cut ~400 roles in October 2024.

- The layoffs were driven by an IPO-preparation strategy under new leadership.

- Kraken reorganized teams and flattened layers, improving organizational agility.

- Recent acquisitions, including NinjaTrader, signal a shift to hiring in traditional finance skills.

- The workforce distribution now spans 70+ countries globally.

- A remote-first policy was reinforced, reducing reliance on fixed office locations.

- Employee engagement rates remained steady or improved at ~81% despite layoffs.

- A prior layoff in 2022 cut about 30% of staff, establishing operational resilience.

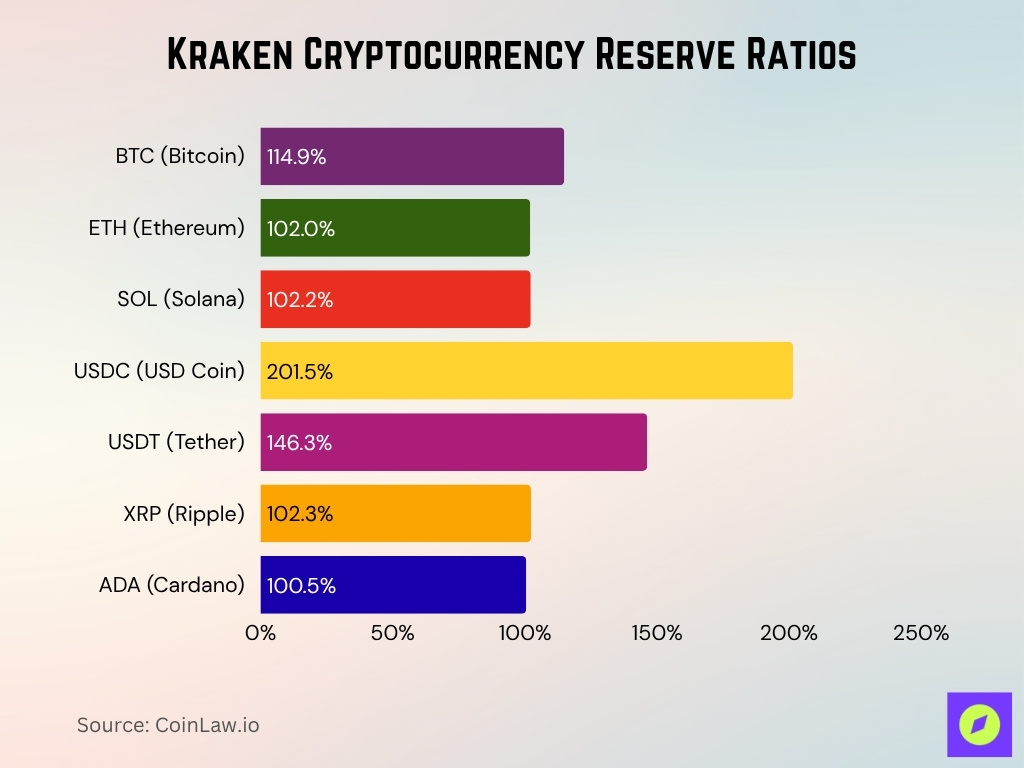

Kraken Cryptocurrency Reserve Ratios

- Bitcoin (BTC) shows a strong reserve ratio of 114.9%, confirming that Kraken holds significantly more BTC than customer deposits.

- Ethereum (ETH) maintains a 102% reserve ratio, indicating a slight surplus over client assets and full collateralization.

- Solana (SOL) records a 102.2% reserve ratio, reflecting Kraken’s consistent over-coverage of user holdings.

- USD Coin (USDC) leads with an exceptional 201.5% reserve ratio, proving more than double coverage and highlighting Kraken’s liquidity strength in stablecoins.

- Tether (USDT) follows with a 146.3% reserve ratio, ensuring a robust margin of reserves above client assets.

- XRP (Ripple) shows a stable 102.3% reserve ratio, consistent with Kraken’s full-reserve transparency model.

- Cardano (ADA) holds a 100.5% reserve ratio, maintaining parity and safeguarding customer balances.

- Overall, Kraken’s 100%+ reserve coverage across all major assets underscores its commitment to solvency, transparency, and user trust in 2025.

Percentage Growth or Reduction in Staff

- ~30% workforce reduction in November 2022, ~1,100 of ~3,700, during the crypto market downturn.

- Internal engagement surveys suggest Kraken retained ~81% engagement post-cut, compared to ~31% benchmark for the general industry.

- Growth in revenues, 18-19% year-over-year in 2025, despite headcount reductions, suggests improved productivity per employee.

- The remote-first policy implies that geographic boundaries no longer limit growth; hence, the “staff reduction” figure may understate redeployment or retraining rather than pure shrinkage.

Impact of Layoffs on Workforce Size

- November 2022 cuts accounted for around 30%, approximately 1,100 positions eliminated.

- Q2 2025 revenue grew by +18% year-over-year despite a smaller team.

- Strategic hires continued amidst cuts, impacting net job count but reallocating talent.

- Employee engagement remained high at ~81% post-layoff, per internal survey.

- Layoffs aligned with a shift to traditional finance markets, requiring new staffing profiles.

- Workforce reduction was part of IPO streamlining typical in fintech and crypto sectors.

- Roles shifted from operations to product and infrastructure, altering workforce focus.

Workplace Culture and Employee Satisfaction

- An internal survey found ~81% employee engagement, compared with only ~31% in a broad Gartner survey, indicating strong internal morale.

- Approximately 94% of employees said they understood how their work tied into the company’s mission.

- On Glassdoor, about 80% of reviews indicated a positive outlook for the business, suggesting optimism among staff.

- On Comparably, around 83% positive reviews based on 127 employee reviews in 2025, signaling good culture metrics.

- The company emphasizes its culture document with values such as “we assume ignorance before we assume malice” and “we disagree using logic, reason, and better ideas.”

- Review feedback notes high flexibility, “incredible flexibility of work,” though some comments raise concerns about top-management culture variation.

- The remote-first model is integral to culture, employees report freedom of schedule, fewer geographic constraints, and global peer collaboration.

- Culture remains a key retention tool amid the layoffs, as strong engagement may stabilize turnover during transitions.

Global Distribution of Kraken Employees

- Kraken employees are distributed across 70+ countries as a remote-first company.

- About 94% of employees recognize how their work impacts company success.

- 82% of employees would recommend Kraken on Glassdoor globally.

- The company offers a competitive salary regardless of location, with crypto payment options.

- Kraken emphasizes an asynchronous, globally remote work culture in its talent strategy.

- Global remote model supports flexibility and broad talent recruitment across regions.

- Employee engagement in the global survey reflects strong alignment with the company’s mission at 94%.

Remote Work and Flexible Schedules

- Kraken is officially remote-first with employees in 70+ countries globally.

- Asynchronous collaboration supports a workforce spread across more than 70 countries.

- Employee reviews highlight incredible work flexibility and an inclusive remote environment.

- Flexible schedules reduce relocation need and time-zone constraints for global talent.

- Remote-first status enables recruiting across multiple regions and time zones.

- Employee engagement remains strong at ~81%, supporting remote culture alignment.

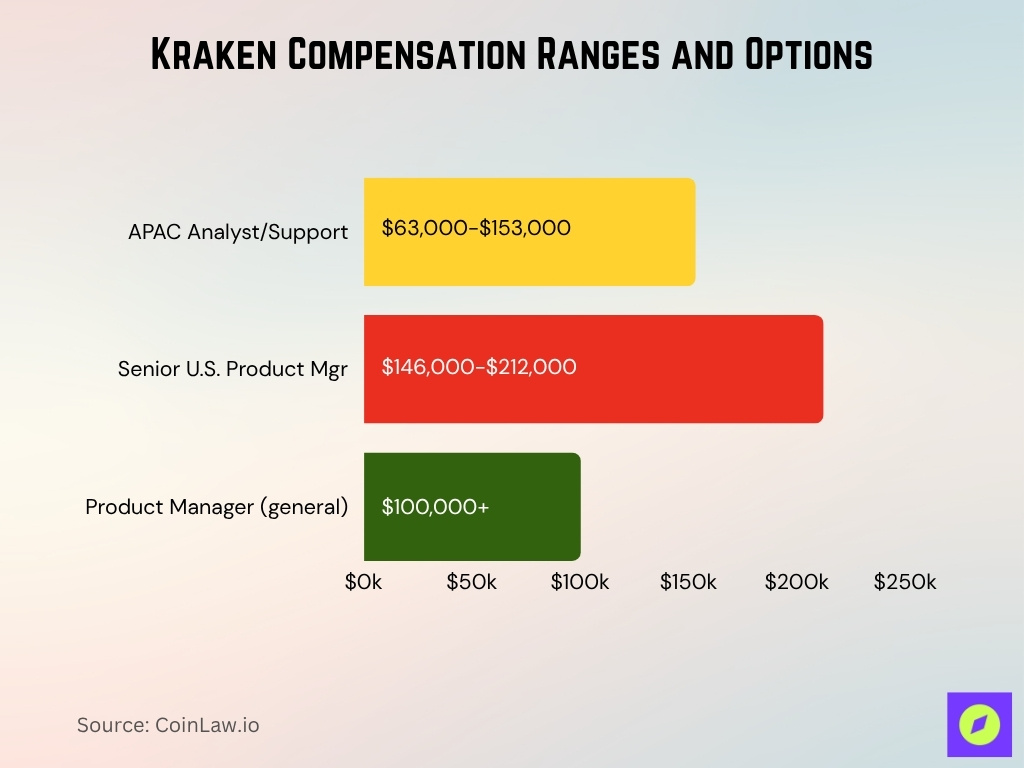

Staff Compensation, Digital Assets, and Shares

- Kraken offers the option to be paid partially in crypto with equity grants for most roles.

- APAC analyst and support roles have salaries ranging from $63,000 to $153,000 as of October 2025.

- Senior U.S. product and engineering roles pay between $146,000 and $212,000 for Staff Product Managers.

- Product manager roles in crypto and payments command salaries of around $100,000+.

- Compensation is location-agnostic, with a competitive salary regardless of location policy.

Diversity and Inclusion Statistics

- The company operates a globally inclusive workforce with employee mobility across regions.

- 95% of employees understand company values emphasizing inclusion and psychological safety.

- The workforce spans 70+ countries, suggesting significant multicultural exposure.

- Employee feedback indicates some diversity concerns at leadership levels.

- Review data notes positive sentiments about the inclusive work environment.

Talent Acquisition and Retention Trends

- The top 10 crypto exchanges, including Kraken, advertise over 1,600 open roles as of October 2025.

- Kraken emphasizes remote-first hiring with a global talent focus, promoting work-from-anywhere.

- Kraken’s HR uses AI to enhance hiring and improve candidate experience in 2025.

- The recruitment process includes CV screening, talent assessment, and practical interviews.

- The global crypto talent pool has grown by 50% since 2020, with another ~30% growth projected by 2027.

- Kraken targets a $15 billion valuation in upcoming IPO, driving talent acquisition in key roles.

IPO and Strategic Workforce Restructuring

- In October 2024, about 400 roles were cut alongside leadership changes.

- Restructuring linked to NinjaTrader acquisition and multi-asset capability build-out.

- Workforce shifted toward traditional finance compliance and crypto-native tech roles.

- Teams were consolidated, and organizational layers were eliminated to boost agility.

Comparison With Competitors’ Workforce

- Binance had approximately 14,818 employees, growing by ~9% year-over-year.

- Coinbase reported about 3,772 full-time employees as of 2024.

- Kraken pursues a broad product set with fewer staff, implying higher leverage per employee.

- October 2025 hiring shows Kraken with ~100+ open roles, less than Coinbase and Binance’s ~300+ each.

- Kraken operates a globally remote, asset-class diverse workforce versus competitors’ larger in-house teams.

Major Hiring Initiatives and Acquisitions

- Kraken acquired NinjaTrader for $1.5 billion in March 2025, impacting hiring and integration.

- The September 2025 acquisition of Breakout expanded Kraken into proprietary trading tech and operations.

- Acquisitions brought entire teams, talent, and infrastructure into Kraken’s workforce strategy.

- Post-acquisition hiring focuses on engineers for futures, product specialists, compliance, and legal staff.

- Over 100 remote jobs were listed globally in October 2025, showing expansion beyond back-filling.

Frequently Asked Questions (FAQs)

Kraken’s distributed workforce spans 70+ countries.

In its initial wave, Kraken cut ~400 jobs in late 2024.

Kraken reported 2,300+ employees globally.

Conclusion

In sum, while the exact headcount at Kraken may fluctuate, the data indicate a workforce in transition, leaner than some rivals yet sharpening its focus on product expansion, regulated markets, and global remote talent. Workforce reductions reflect cost and structure rationalization as Kraken positions itself for an IPO and multi-asset-class growth. At the same time, hiring initiatives, compensation innovations, and global recruiting signal a forward-looking talent strategy.