The global cryptocurrency landscape continues to evolve rapidly, and staffing levels at major exchanges reflect both growth opportunities and market pressure. In the case of Huobi Global (also branded as “Huobi” or “HTX”), workforce metrics offer insight into the company’s strategic direction and operational health.

For example, a rise in employee count can drive expanded global support and product development; conversely, reductions may signal cost-cutting in response to regulatory headwinds. In this article, we’ll dig into recent employment data, workforce trends, and what they reveal about Huobi’s current state, and invite you to explore the full article for a comprehensive view.

How Many People Work At Huobi?

- Huobi’s global workforce was approximately 1,200–1,600 employees.

- Planned workforce reduction of ~20% announced in January 2023.

- Regional layoffs claimed “over 300 employees” in late 2022.

- Mid-2025 user metrics, new registered users increased 92% month-on-month, and assets surpassed $6.4 billion.

- Earlier report, Huobi cut around 20% of staff in early 2023 due to the bear market.

Recent Developments

- In 2023, Huobi announced a plan to reduce its workforce by about 20%, citing the “bear market” as a driver.

- Bloomberg and Reuters reported the layoff plan with Huobi stating it would maintain “a very lean team.”

- In mid-2025, Huobi’s mid‐year results showed strong user growth and asset accumulation (new users up 92%, assets up 14% to > $6.4 billion).

- As of 2024, Huobi reported over 49 million cumulative registered users, and the exchange recorded about $2.4 trillion in transaction volume that year.

- Global regulators increasingly scrutinize crypto firms, while not strictly employment data, compliance burdens may influence staffing decisions.

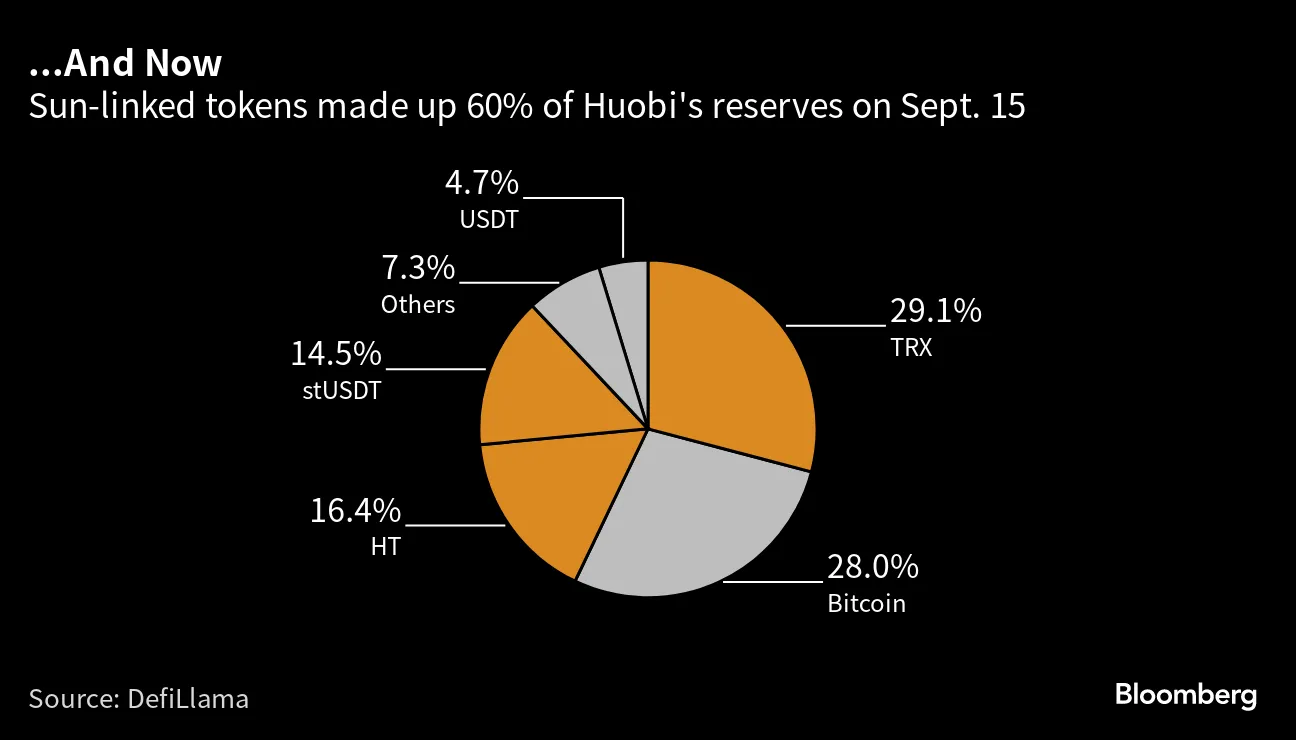

Huobi Reserve Composition Breakdown

- TRX made up 29.1% of Huobi’s reserves, representing the largest individual token share.

- Bitcoin accounted for 28.0%, nearly equal to TRX, highlighting its central role in reserve backing.

- HT held a 16.4% share, reinforcing the platform’s reliance on its native exchange token.

- stUSDT contributed 14.5%, marking it as a significant part of Sun-linked token exposure.

- Others made up 7.3%, suggesting some level of diversification outside major assets.

- USDT represented just 4.7%, showing a relatively small portion allocated to the leading stablecoin.

Huobi’s Current Team (Key People)

- Leon Li – Founder and Chairman. He founded the firm around 2013, holds a master’s degree in automation engineering from Tsinghua University, and emphasises system security and stability.

- Du Jun – Co-Founder and Chief Executive Officer (HTX). Listed among the main executives on CB Insights as the current CEO.

- Jiawei Zhu – Chief Operating Officer (COO). Identified in public listings as one of the senior leadership figures for HTX.

- Xianfeng Cheng – Chief Technology Officer (CTO). Listed as a key part of the senior technical team, responsible for platform architecture and infrastructure.

- Charlie Tsai – Chief Strategy Officer (CSO). Named in available team lists as contributing to strategic outreach and business expansion.

- Peng Hu – Vice President. Included in the management listings with responsibility for operational functions within HTX.

- Wang Yang – Vice President and Advisory Board member. Listed as a senior adviser with an academic and business background, supporting global strategy.

- Ted Chen – Advisory Board member (CEO of About Capital Management). His role is non-executive but plays into governance and oversight for global expansion.

- Justin Sun – Global Adviser. Although not listed as a core executive in current teams, he is publicly referenced as an advisor and investor with strategic influence.

Global Offices and Employee Distribution

- Huobi Global has between 1,200–1,600 employees worldwide

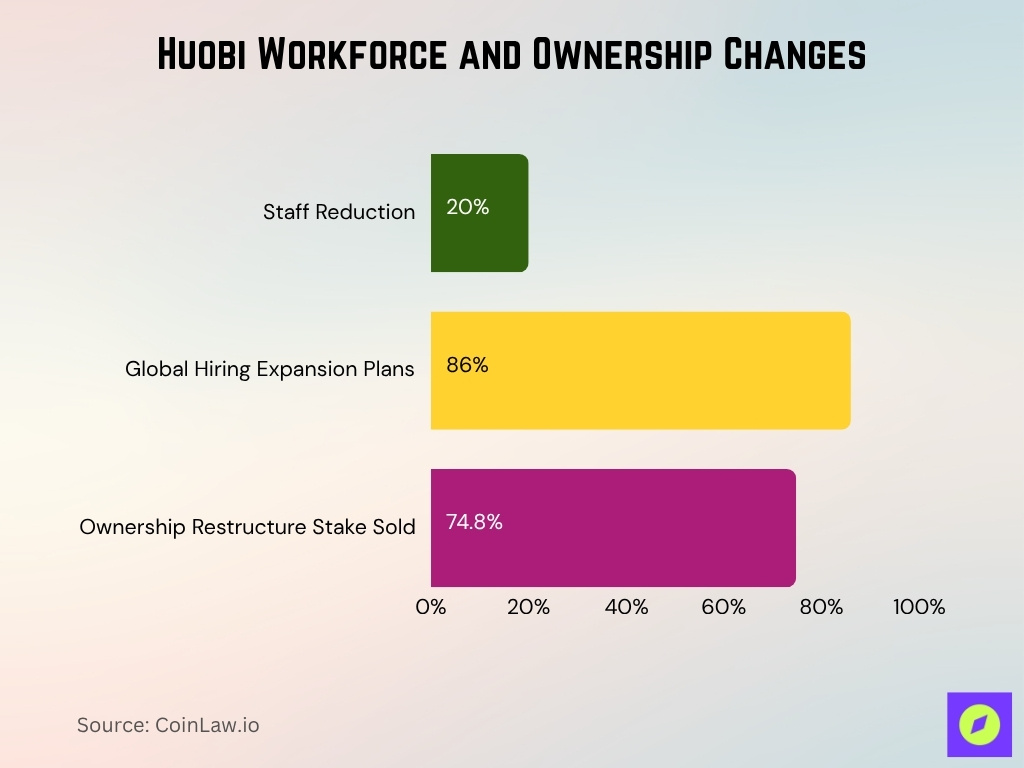

- The company planned a 20% workforce reduction due to a bear market in early 2023

- More than 70% of Huobi’s business originates outside mainland China as of 2021

- Huobi has offices in at least four major locations: Hong Kong, Beijing, Seoul, and Singapore

- The company serves customers in over 140 countries across five continents

- Huobi relocated about 200 employees from Seychelles to the Caribbean to adjust its global footprint

Impact of Market Conditions on Employment

- Market contraction and regulatory pressure contributed to Huobi’s decision to reduce staff size by about 20%.

- With 86% of companies planning to expand international hiring over the next two years, 2025 global hiring trends provide relevant context for Huobi’s staffing approach.

- The company completed a major ownership restructure involving a 74.8% stake sale.

- Huobi cited the bear market as the reason for its 20% workforce reduction in early 2023.

- The exchange experienced average daily net outflows of approximately $94.2 million in one week.

- Huobi planned to maintain a “very lean team” going forward to optimize structure and efficiency.

- Trading volume fluctuation at Huobi saw daily amounts near $370 million during turbulent market conditions.

Compliance and Security Teams

- Industry evaluations gave Huobi a low compliance rating of 50 out of 100, indicating under-resourcing in governance.

- Huobi expanded its compliance staffing in 2024-25 to meet EU MiCA and other licensing requirements.

- Security teams support reserve proofs across 8 assets in 2024, indicating a significant operational burden.

- The exchange intercepted 15 fraudulent withdrawal requests and recovered over $100,000 in losses in H1 2025.

- Huobi’s platform reserves exceeded $1.82 billion as of mid-2025, requiring robust compliance and security oversight.

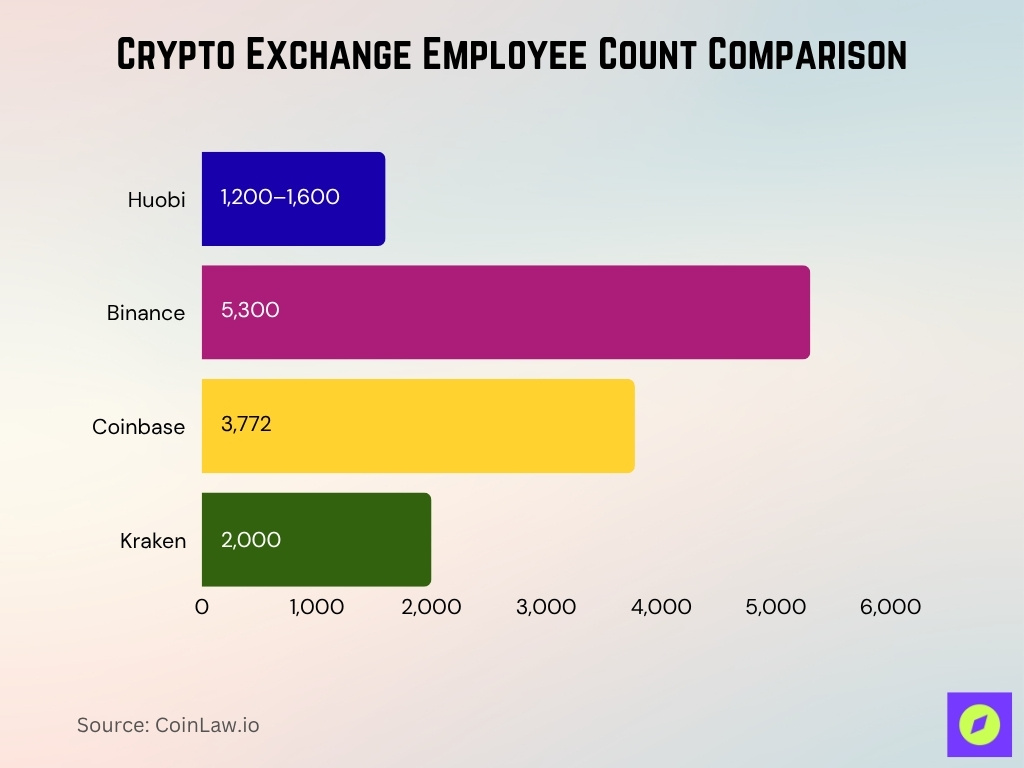

Employee Count Compared to Competitors

- Huobi had about 1,200–1,600+ employees worldwide before layoff announcements in late 2022.

- Binance employs over 5,300 people globally as of Q1 2025.

- Coinbase Global reported approximately 3,772 employees as of December 31, 2024.

- Some competitors like Kraken have around 2,000 employees, situating Huobi on the smaller side of major exchange staffing.

- Compared to Coinbase, Huobi operated with about 29% of the competitor’s workforce size by the end of 2024.

- Binance’s compliance department grew by 34% year-over-year, now employing over 645 compliance staff.

- Huobi’s smaller workforce reflects a leaner operational scale aligned with its more focused market presence.

Highlights from Annual and Financial Reports

- According to Huobi’s 2024/25 report, the platform achieved close to $2.4 trillion in transaction volume in 2024.

- Also in 2024, the user base exceeded 49 million registered users, with net inflows of ~$1 billion and platform user assets of ~$5 billion (an ~80% increase year-on-year).

- The revenue data from earlier years (e.g., 2022) show losses; for example, in the 2022 fiscal year, the gross profit margin dropped to 28.8% from 51.2% the prior year.

- Financial pressures (loss before income tax of HK$44,568 in 2022) may have forced headcount discipline.

Technological and Product Development Teams

- With transaction volumes in the trillions (see above), Huobi’s engineering/product teams are central to platform stability and feature expansion.

- The 2024 report mentions the launch of 218 new assets on the Huobi / HTX platform, of which 171 were first-time on any platform. Product/asset onboarding obviously requires dedicated dev/ops staffing.

- Given the head-count estimates (1,200–1,600 employees) and a broad global user base, product/tech staffing may cover engineering, platform operations, blockchain integrations, DevOps, QA, UI/UX.

- The workforce reduction announcements (~20%) likely impacted development teams as well, shifting priorities from rapid expansion to optimization and maintenance.

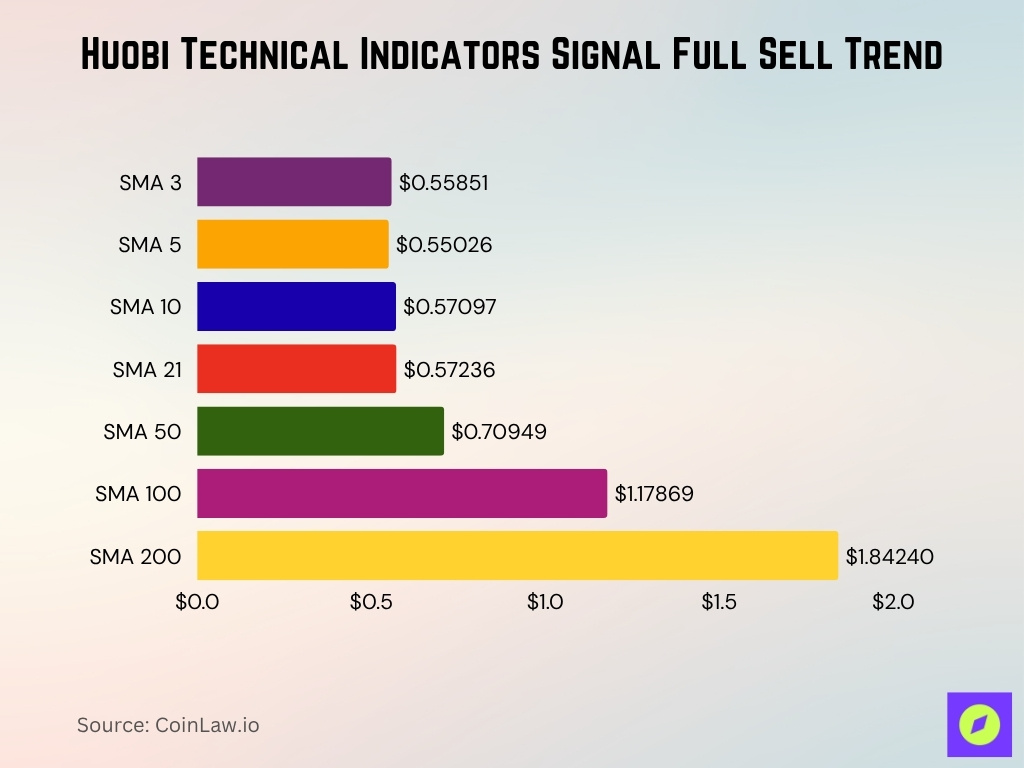

Huobi Technical Indicators Signal Full Sell Trend

- SMA 3 is at $0.558514, triggering a SELL signal due to short-term bearish momentum.

- SMA 5 stands at $0.550257, continuing the SELL trend in ultra-short-term analysis.

- SMA 10 is at $0.570971, maintaining a SELL recommendation for early trend identification.

- SMA 21 shows $0.572360, suggesting a sustained SELL bias over a 3-week view.

- SMA 50 hits $0.709489, reinforcing SELL sentiment over the mid-term horizon.

- SMA 100 has risen to $1.178693, further confirming SELL pressure in the long-term view.

- SMA 200 tops $1.842403, indicating deep SELL territory from a long-range market perspective.

Customer Support and Community Operations

- Serving a reported >49 million registered users in 2024 (per the report) demands substantial global support operations.

- Crypto-exchange customer support often deals with multi-lingual teams (Asia, Europe, Americas), with fewer than 1,200–1,600+ total staff. Huobi’s support and community teams may be relatively modest.

- Reports of investor complaints regarding withdrawal delays and account problems suggest community/support staffing may be under strain.

- As the business shifted from growth to say “lean maintenance”, customer support hiring may have slowed or been outsourced rather than internal hires.

- Future growth in users or markets will require corresponding support staffing increases unless automated/AI-chat mechanisms scale.

- The head-count reductions (~20%) may have proportionally impacted support and community operations as cost-control measures.

Regional Expansion and Hiring Trends

- In late 2022, Huobi outlined a “new strategy for global expansion” focusing on Southeast Asia and the Caribbean, indicating hiring and local presence in those regions.

- The company has been targeting regions such as Turkey, Europe, and the Caribbean as new growth markets, implying local hiring and staffing trends.

- Global hiring trends in 2025 show that 86% of companies plan to expand hiring abroad within two years, which provides context for Huobi’s staffing strategy.

Mergers, Acquisitions, and Staffing Impact

- Huobi’s workforce was around 622 employees in 2020 before later expansions and layoffs.

- The company completed a major ownership restructure in 2020 involving a 74.8% share sale.

- In 2022, Huobi laid off about 30% of its staff, nearly 300 employees, due to market challenges.

- Huobi announced plans to explore M&A opportunities focused on Southeast Asia and the Caribbean regions in 2025.

- Huobi’s M&A strategy supports a lean headcount with emphasis on talent acquisition and regional operational synergies.

Frequently Asked Questions (FAQs)

Huobi Global reportedly serves clients in about 170 countries.

The World Economic Forum lists Huobi Global as having 1,200–1,600+ employees globally.

Huobi Global’s estimated revenue per employee is about $65,000.

Conclusion

In sum, Huobi Global has navigated a challenging staffing environment, while transaction volumes and user growth are strong, head-count growth has not kept pace, likely due to cost pressures, regulatory demands, and global market shifts. Key staffing trends include a shift toward compliance, regional operations, and lean product/engineering teams rather than mass hiring. For readers evaluating exchange staffing benchmarks or hiring strategy in crypto and fintech, Huobi provides a case study in balancing growth ambition with operational discipline.