The payments-processing firm Adyen N.V. (Adyen) has emerged as a major player in the fintech landscape, renowned for powering transactions for leading global brands. Across retail, e-commerce, and point-of-sale settings, its workforce underpins powerful platform growth and scalability. For instance, in the retail industry, one application is Adyen’s seamless unified checkout, enabling multi-channel merchants to integrate online and in-store payments.

In the e-commerce world, Adyen supports global expansion by handling multi-currency, multi-region payments and reducing friction for merchants. The following article dives into the latest headcount data, trends, and strategic implications for Adyen’s workforce.

How Many People Work At Adyen?

- Adyen reported 5,100 employees as of September 2025, a year-on-year increase of 755 people (17.4%) compared with 2024.

- For the first half of 2025, Adyen added 114 full-time employees, bringing its indicated headcount to about 5,100 by September.

- Adyen described that its EBITDA margin landed at 53% in H2 2024, notably while headcount growth accelerated again in 2025.

- The company declared it will aim for accelerated growth in 2025, supported by a larger workforce and strategic hiring across key global markets.

- Headcount growth continues to track business expansion, reflecting employee productivity and automation-assisted scaling.

Recent Developments

- Adyen’s net revenue grew by 22% year-on-year in H2 2024.

- In 2024, Adyen processed a payment volume of approximately €1.29 trillion, up 33% from 2023.

- Net revenue for the full year 2024 reached about €1.996 billion, a 23% increase year-over-year.

- As of mid-2025, Adyen employed around 5,100 people, expanding mostly in engineering, sales, and support.

- Adyen’s Q1 2025 net revenue was reported at €534.7 million, up 22% year-over-year.

- The firm’s EBITDA margin for H2 2024 stood at 53%, growing by 35% year-on-year in EBITDA.

- In April 2025, despite potential macroeconomic challenges, Adyen maintained strong hiring momentum.

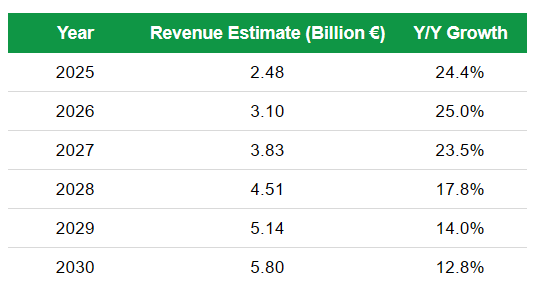

Adyen Revenue Growth Forecast

- Adyen’s revenue is projected to rise from €2.48 billion in 2025 to €5.80 billion by 2030, marking a 134% increase over the six-year period.

- The company is expected to maintain double-digit annual growth throughout the forecast horizon, showcasing continued expansion in global payment processing.

- Peak growth is anticipated in 2026, with a 25.0% year-over-year (Y/Y) increase, reflecting accelerating adoption of Adyen’s unified commerce platform.

- Growth moderates slightly to 23.5% in 2027 and 17.8% in 2028, indicating a gradual stabilization as the company matures.

- By 2029, Adyen’s revenue is projected at €5.14 billion, growing at 14.0% Y/Y, signaling sustained, though slower, expansion.

- The 2030 forecast shows €5.80 billion in revenue with 12.8% Y/Y growth, suggesting a shift from hypergrowth to steady scaling.

- Across 2025–2030, Adyen’s compound annual growth rate (CAGR) is estimated at around 17%, underscoring robust long-term performance in fintech revenue generation.

- These trends highlight Adyen’s resilience amid a maturing digital payments market and its strong positioning among leading global payment processors.

Adyen’s Current Team (Key People)

- Pieter van der Does – Co-Founder & Co-Chief Executive Officer. Pieter co-founded Adyen and now steers the company’s strategic direction and global operations.

- Ingo Uytdehaage – Co-Chief Executive Officer. Ingo oversees the business’s financial and operational functions, bringing deep expertise in finance and scale.

- Alexander Matthey – Chief Technology Officer (CTO). Alexander leads the company’s technology strategy, ensuring its payments platform remains robust and scalable.

- Roelant Prins – Chief Commercial Officer (CCO). Roelant drives the commercial agenda, including global partnerships and merchant-growth initiatives.

- Ethan Tandowsky – Chief Financial Officer (CFO). Ethan handles financial strategy, reporting, and supports growth through disciplined fiscal management.

- Mariëtte Swart – Chief Risk & Compliance Officer (CRCO). Mariëtte manages regulatory, compliance, and risk frameworks across Adyen’s global operations.

- Brooke Nayden – Chief Human Resources Officer (CHRO). Brooke leads the global HR, talent acquisition, and culture functions for the 5,100-strong workforce.

- Warren Hayashi – President, Asia-Pacific. Warren heads regional business operations in Asia-Pacific, driving local market growth and execution.

- Alexa von Bismarck – President, EMEA. Alexa leads the Europe, Middle East, and Africa region, overseeing strategy and growth in those markets.

Employees by Department

- The largest department remains Engineering, with approximately 1,500 employees, representing about one-third of the total workforce.

- Sales and Support follow closely, with around 1,000 employees, highlighting the company’s customer-centric model.

- The combined Marketing and Product functions employ roughly 600 staff.

- Finance and Administration accounts for approximately 400 employees.

- The Operations team numbers about 250 employees.

- Business Management functions include roughly 230 employees.

- The Information Technology (IT) segment employs around 190 professionals.

- Departments focused on Risk, Safety & Compliance number about 150 employees.

- The Human Resources function includes approximately 140 employees.

- Remaining roles classified under “Other” capture about 640 employees, reflecting smaller specialist teams.

New Hires and Departures

- Adyen added approximately 750 new hires during the first three quarters of 2025, reflecting sustained expansion.

- About 300 employees departed, resulting in a net growth of 450 employees (nearly 10% net growth).

- The hiring focus remains on high-skill technical and commercial roles, particularly in data engineering and sales.

- Historical context shows 4,345 employees in 2024, confirming over 17% headcount growth within one year.

- Hiring has become more balanced geographically, with strong recruitment in the United States, Singapore, and São Paulo.

- The company’s turnover rate remains low at an estimated 6%, reflecting strong employee retention.

- Adyen continues to invest in leadership development and early-career talent programs to strengthen its internal pipeline.

Revenue Per Employee

- Adyen reported €1,996.1 million in net revenue for fiscal year 2024, up 23% year-on-year.

- With 5,100 employees as of September 2025, revenue per employee stands at approximately €391,400 per employee.

- Earlier figures placed revenue per employee near €460,000 when the workforce was smaller, indicating continued efficiency despite scaling.

- Average monthly revenue per FTE was ~€42,000 in H2 2024, maintaining consistency into 2025.

- Adyen generates strong revenue per employee, supported by automation and a streamlined technology platform.

- Compared to peers like Stripe, Adyen’s lean model continues to produce higher per-capita output.

- The firm’s balance between staff growth and revenue expansion suggests sustainable scaling rather than margin dilution.

- Revenue per employee remains among the highest in global fintech companies.

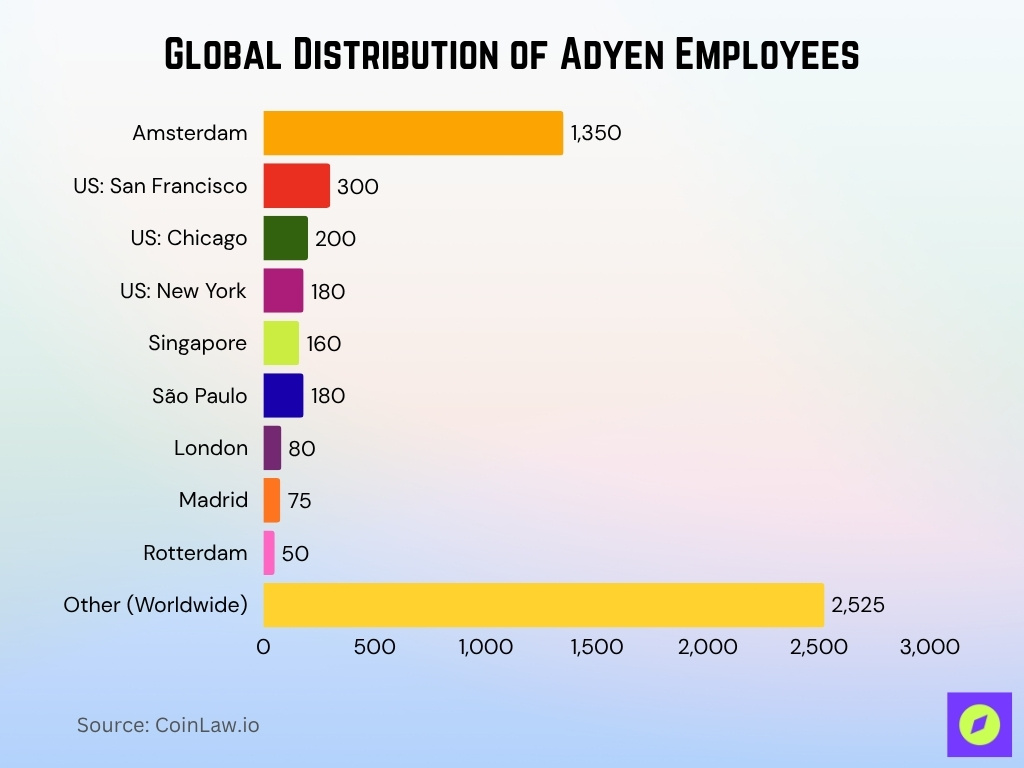

Employees by Location

- The largest single office is in Amsterdam, Netherlands, with about 1,350 employees.

- The U.S. presence is expanding, with San Francisco, CA, hosting around 300 employees.

- In Chicago, IL, approximately 200 employees are based.

- The New York, NY office counts around 180 employees.

- In the Asia-Pacific region, Singapore employs about 160 employees, highlighting regional market importance.

- In Latin America, São Paulo, Brazil, has roughly 180 staff.

- Other European offices include London, UK, with 80 employees, Madrid, Spain, with 75 employees, and Rotterdam, Netherlands, with 50 employees.

- A large residual category labelled “Other” includes ~2,525 employees, representing remote and hybrid workers across smaller global offices.

- The company operates in 28 offices worldwide, representing 115 nationalities.

Profits Per Employee

- Profits per employee for 2024 were approximately €195,000, adjusting for the current 2025 workforce size.

- Adyen’s EBITDA for full-year 2024 was €992.3 million, implying about €195,500 per employee with 5,100 staff.

- The company’s net income for 2024 was €925 million, or roughly €181,000 per employee.

- Profit per employee decreased slightly year-on-year due to expanded hiring and strategic investment in growth markets.

- Employee benefit costs rose by approximately 15%, reflecting new talent acquisition.

- Margin efficiency remains strong, with profit per employee among the top tier of fintech peers.

- The company’s focus on automation and platform scalability continues to offset higher personnel costs.

- A steady ratio of profit per employee indicates disciplined cost management amid workforce expansion.

- Adyen continues to rank as one of the most profitable fintech firms globally on a per-employee basis.

Gender and Diversity Statistics

- Adyen continues to build an inclusive culture through equitable recruitment, education, and employee-led communities.

- The company operates several Employee Resource Groups, including Women @ Adyen, Pridyen, Black @ Adyen, Neurodiversity @ Adyen, and Latine @ Adyen.

- As of 2025, executive leadership includes 40% women and underrepresented groups.

- Company-wide satisfaction scores remain high at 92%, reflecting inclusive engagement practices.

- Employee productivity has increased 15% since 2023 due to workplace flexibility initiatives.

- Adyen participates in European gender-equality frameworks and publishes annual DE&I progress updates.

- Global representation continues to expand, with employees from 115 nationalities.

- Although full gender data is not public, executive-level diversity provides a strong indication of company culture.

- The company’s DE&I strategy is central to its long-term growth and retention model.

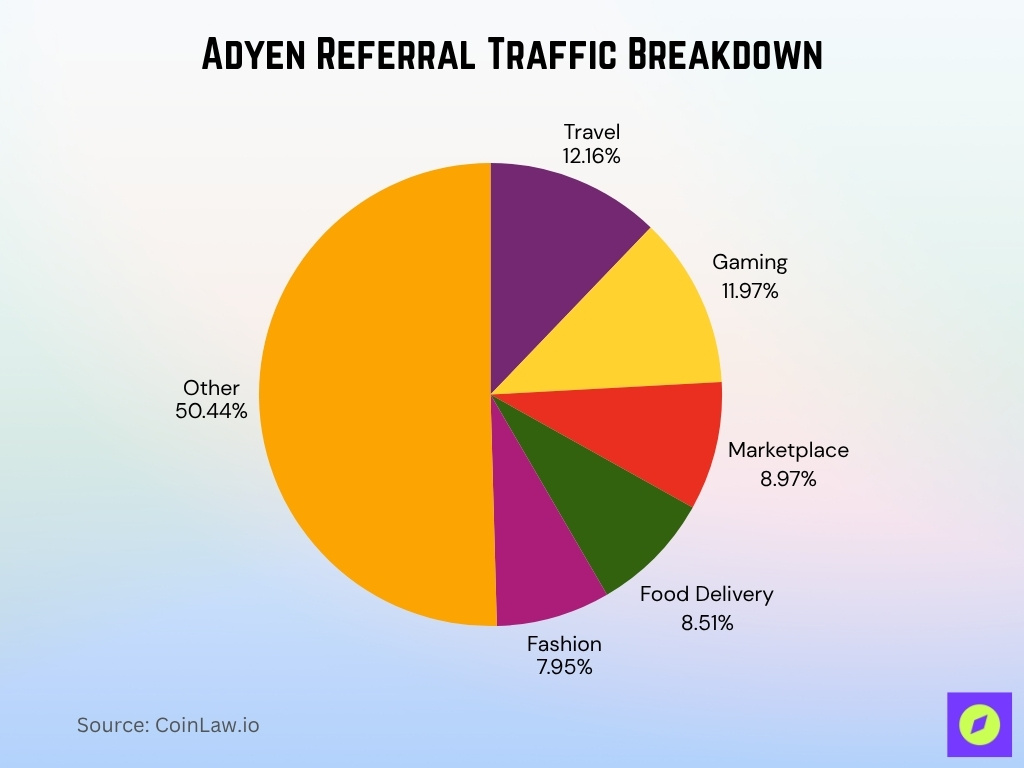

Adyen Referral Traffic Breakdown

- Adyen’s referral traffic is broadly diversified, with over half (50.44%) coming from other industries, showing the platform’s wide application beyond core sectors.

- Travel leads the named categories at 12.16%, underscoring strong adoption by airlines and booking services using Adyen’s global payment network.

- Gaming follows at 11.97%, reflecting the company’s growing influence in online and console-based entertainment payments.

- Marketplace traffic accounts for 8.97%, driven by Adyen’s role in facilitating secure multi-vendor transactions.

- Food Delivery contributes 8.51%, highlighting rapid digital payment adoption across restaurant and delivery platforms.

- Fashion generates 7.95%, illustrating steady demand from retail and e-commerce brands for seamless checkout solutions.

- Collectively, the data reveals Adyen’s strong cross-sector reach, emphasizing its scalability and relevance across travel, entertainment, retail, and service markets.

Competitor Employee Comparisons

- Adyen employed 5,100 people as of September 2025.

- Stripe’s workforce in 2025 is about 8,500 employees.

- Stripe has roughly 65% more employees than Adyen but generates similar transaction volume.

- Adyen processed €1.29 trillion in 2024 (+33% YoY).

- Stripe processed ~$1.4 trillion in 2024 (+38% YoY).

- The lean structure of Adyen’s workforce underscores its focus on efficiency and technology-led automation.

- Adyen’s revenue per employee (~€391k) continues to exceed most fintech peers.

- Compared to legacy payment processors, Adyen operates with significantly lower staff-to-revenue ratios.

- The company’s smaller, efficient workforce enables higher profitability and faster operational execution.

- Adyen’s compact organizational model remains a competitive advantage in fintech scaling.

Frequently Asked Questions (FAQs)

Approximately 5,100 employees.

Over 115 nationalities represented.

Around 28 offices worldwide.

Conclusion

Adyen is reinforcing its efficiency-driven business model. Its gender and diversity progress reflects a forward-thinking culture aligned with global standards. Compared to competitors such as Stripe, Adyen achieves near-equal transaction processing output with a significantly leaner staff base. This combination of disciplined hiring, automation, and inclusive culture positions Adyen to sustain profitability and innovation.