GrabPay, the digital wallet arm of Grab Holdings, has become a central figure in Southeast Asia’s evolving payment landscape. As the region shifts rapidly toward a cashless economy, GrabPay is leading innovations across ride-hailing, food delivery, and fintech. For example, merchants in Malaysia have increasingly adopted GrabPay as their preferred digital payment channel, while Grab’s partnership with Alipay+ has enabled cross-border payment convenience for travelers. This article explores the latest statistics on GrabPay, covering user growth, transaction volumes, market share, and more.

Editor’s Choice

- GrabPay’s total payment volume (TPV) surged 38% year-over-year, reaching approximately $5.8 billion in Q2 2025.

- In Malaysia, GrabPay holds a digital wallet market share of 38.3%, leading its competitors.

- Grab’s fintech revenue reached $92 million in Q2 2025, reflecting a 42% year-over-year increase.

- Merchant adoption of GrabPay rose 25% YoY in Q2 2025, indicating stronger business trust.

- Singapore’s mobile wallet penetration exceeds 90%, with GrabPay ranking among the top three wallets.

- Cross-service Grab users spend 4x more than single-service users, boosting wallet loyalty and economic impact.

Recent Developments

- Grab reported $567 million in revenue in Q2 2025, with a 16% YoY increase.

- The company’s Q2 2025 adjusted EBITDA turned positive at $35 million, up from a $30 million loss in Q2 2024.

- Grab’s fintech segment revenue rose 42% YoY in Q2 2025, totaling $92 million.

- Loan disbursements from Grab’s ecosystem grew 51% YoY to $420 million in Q2 2025.

- The GrabFin platform has seen wider adoption among gig workers and MSMEs, supporting inclusive finance.

- Grab launched its third-party partner apps platform in October 2025, enhancing GrabPay utility.

- In July 2025, Grab Philippines integrated cryptocurrency top-ups into GrabPay via PDAX and Triple-A.

- Partnerships with Alipay+ in September 2025 extended GrabPay support to global wallet users in Southeast Asia.

- Q3 2025 saw total on-demand transactions increase by 27% YoY, reflecting a growing user base and transaction frequency.

- Grab’s cross-border payment capability expanded through real-time QR integrations across ASEAN countries.

Grab Key Highlights

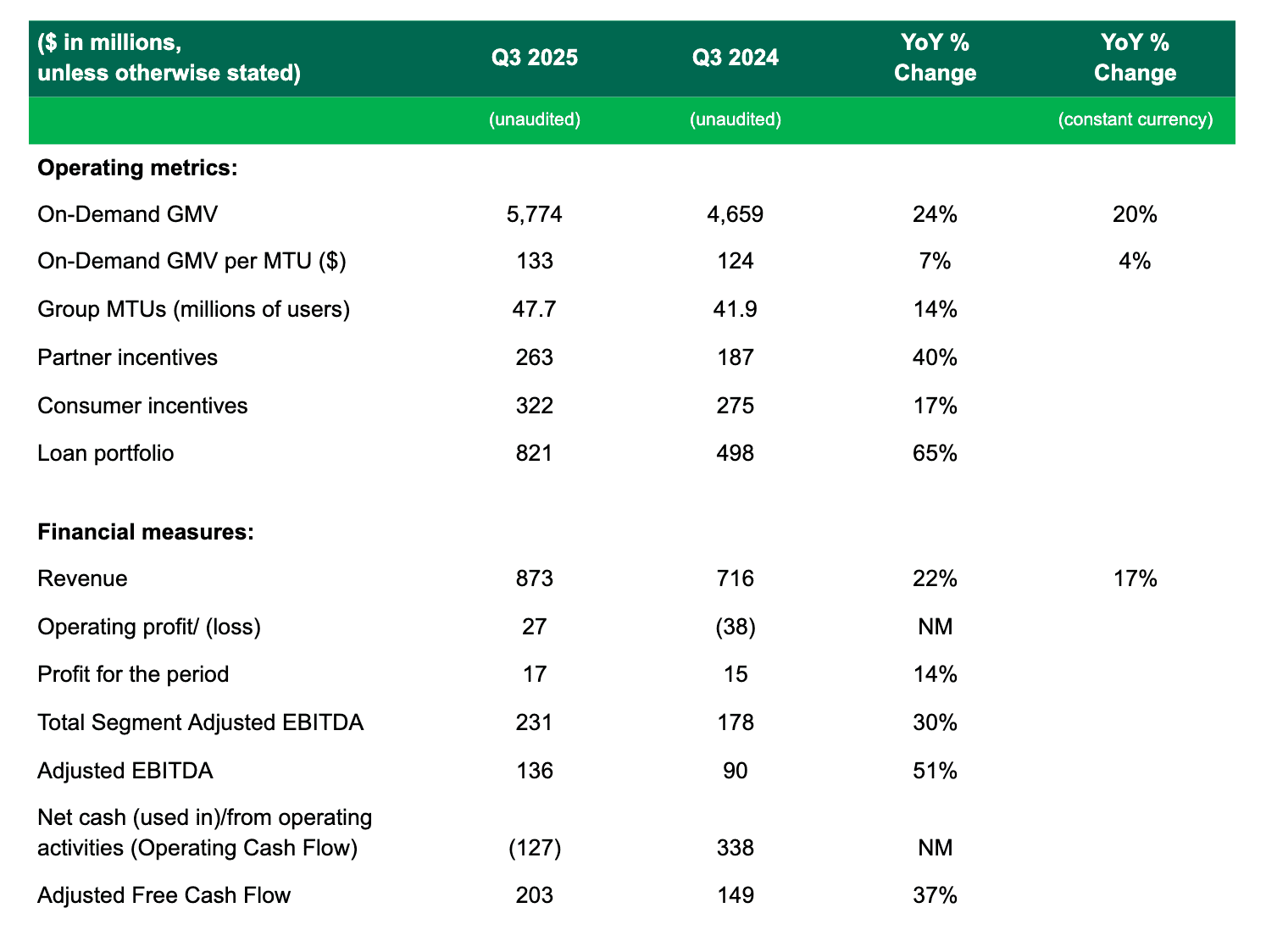

- On-Demand GMV climbed to $5,774 million, rising from $4,659 million and marking a 24% YoY increase.

- On-Demand GMV per MTU moved up to $133, compared to $124, reflecting 7% YoY growth.

- Group MTUs reached 47.7 million, up from 41.9 million, resulting in 14% YoY expansion.

- Partner incentives advanced to $263 million, increasing from $187 million and delivering a 40% YoY jump.

- Consumer incentives grew to $322 million, compared to $275 million, indicating 17% YoY growth.

- The loan portfolio rose to $821 million, up from $498 million, producing a 65% YoY surge.

- Revenue improved to $873 million, up from $716 million, achieving 22% YoY growth.

- Operating profit reached $27 million, reversing the prior $38 million loss.

- Profit for the period closed at $17 million, compared to $15 million, resulting in a 14% YoY uplift.

- Total Segment Adjusted EBITDA increased to $231 million, rising from $178 million for a 30% YoY gain.

- Adjusted EBITDA strengthened to $136 million, up from $90 million, marking a 51% YoY rise.

- Operating cash flow showed $127 million used, compared to $338 million generated previously, indicating a shift in cash movement.

- Adjusted Free Cash Flow improved to $203 million, up from $149 million, representing a 37% YoY increase.

GrabPay User Growth

- GrabPay’s fintech segment experienced a 38% increase in payment volume YoY in Q2 2025.

- Grab’s financial services customer base continues expanding, driven by lending, insurance, and investment features.

- Merchant integration and QR adoption are increasing user conversion in offline spaces.

- In Q3 2025, the average monthly transaction per active user rose by 12%, indicating greater wallet stickiness.

- GrabPay’s rise in the Philippines is tied to digital SME onboarding programs like Grab Asenso.

- Across Indonesia and Vietnam, new user registrations for GrabPay rose 31% YoY in H1 2025.

- Digital banking features tied to GrabPay wallets increased wallet funding activity among consumers.

- Gen Z and millennial adoption continues to rise, with integrated features in GrabFood and GrabMart aiding growth.

- Reward programs and partner deals through GrabPay are leading to higher re-engagement rates among inactive users.

Monthly Active Users

- Q2 2025 saw a YoY 18% growth in driver supply, which supports transaction volume growth.

- Increased usage of lending and insurance products indicates deeper platform engagement per user.

- Food and grocery orders via Grab increased significantly, contributing to MTU engagement for GrabPay.

- Daily active usage of GrabPay in urban centers (Kuala Lumpur, Jakarta) shows consistent growth, though official DAU figures are limited.

- MTUs who use two or more services (e.g., mobility + payments) are 4x more valuable in terms of spend.

- Digital onboarding programs targeting MSMEs in the Philippines and Malaysia have helped expand MTUs from rural areas.

- GrabPay’s use in promotional campaigns results in a 17% higher activation rate among dormant users.

- In-app banking deposits, launched in Singapore and Malaysia, are drawing existing MTUs into more wallet activity.

- Cross-service integration (rides + wallet + food) strengthens retention and MTU conversion month over month.

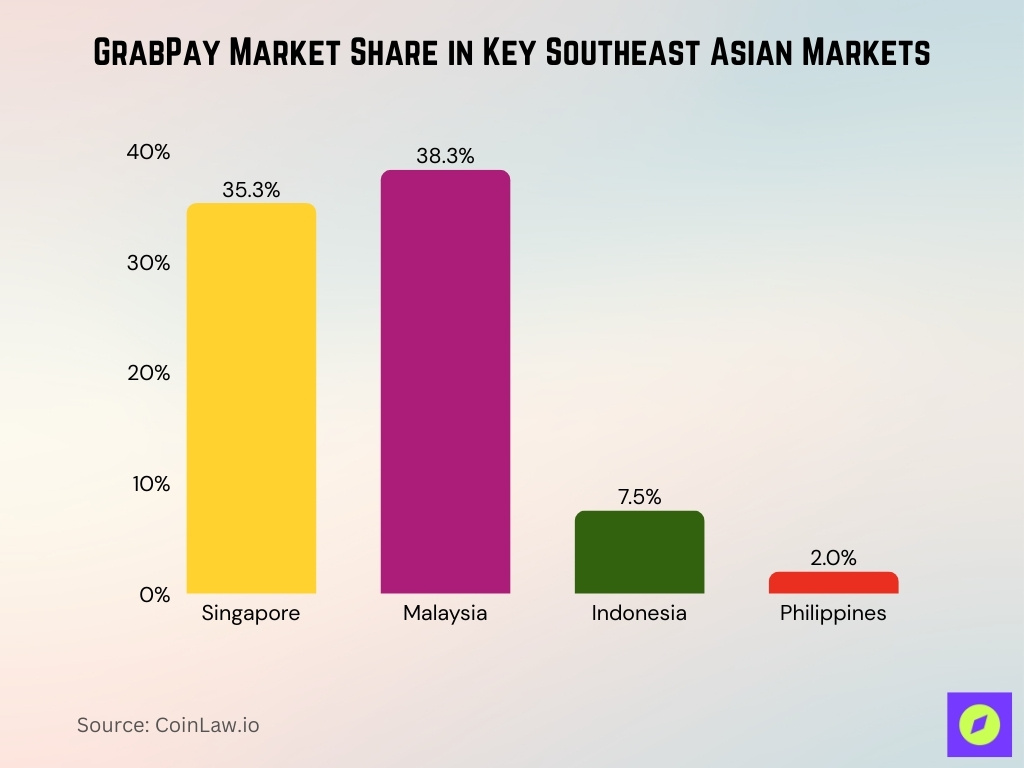

Market Share of GrabPay

- GrabPay holds a 35.3% market share of the digital wallet market in Singapore.

- In Malaysia, GrabPay leads with a 38.3% share of the e-wallet market.

- GrabPay has a 2.0% market share in the Philippines, behind GCash and Maya.

- GrabPay’s market share in Indonesia is around 7.5%, trailing GoPay.

- Merchant partners using GrabPay increased by 25% year-over-year across Southeast Asia in 2025.

- GrabPay is among the top three e-wallets in both Singapore and Malaysia as of 2025.

- GrabPay’s lending business saw loan disbursements grow 51% year-over-year to $420 million in Q2 2025.

- Over 17 million users use GrabPay in Malaysia, projected to exceed 28 million in 2025.

GrabPay Geographic Breakdown

- Grab Holdings operates in 8 countries across Southeast Asia, including Singapore, Malaysia, Indonesia, Thailand, Vietnam, the Philippines, Myanmar, and Cambodia.

- In Singapore, the mobile wallet market share of GrabPay was approximately 35.3%.

- In Malaysia, GrabPay’s share is estimated at about 38.3%, ahead of key competitors.

- In the Philippines in 2024, retail payments by volume that were digital reached 57.4%; by value, the digital share was 59%.

- In Q2 2025, Grab’s digital-bank deposit base (in Singapore & Malaysia) reached $1,543 million.

- A region-wide forecast estimated mobile wallet users in the Asia Pacific to reach 2.6 billion by 2025.

- Indonesia, Vietnam, and the Philippines are cited as underserved markets where GrabPay transaction volume grew strongly in Q2 2025 (38% YoY).

- Strategic reports emphasize strong localization across markets, underlining geographic diversification.

Transaction Volumes

- In Q2 2025, for Grab’s fintech/digital‑payments segment, the total payment volume (TPV) for GrabPay grew by 38% year‑on‑year, reaching $5.8 billion.

- The same Q2 2025 figure marks a 29% increase from Q2 2024 in payment volume for GrabPay.

- For the overall Grab On‑Demand business in Q2 2025, GMV (gross merchandise value) grew 21% YoY to $5.4 billion.

- In Q3 2025, On‑Demand GMV grew 24% YoY (20% constant currency) to $5.8 billion.

- The total number of On‑Demand transactions in Q3 2025 increased by 27% YoY.

- In Q2 2025, customer deposits through digital banking features grew from $730 million to $1,543 million.

- In the Philippines, real‑time payment transactions grew 24% YoY in 2023, reaching 777 million transactions.

- A forecast projected mobile‑wallet transaction volumes in Southeast Asia rising from 101 million in 2020 to 1.1 billion by 2025 in Singapore alone.

- The Philippine digital‑payments market is projected to reach $107.4 billion in 2025.

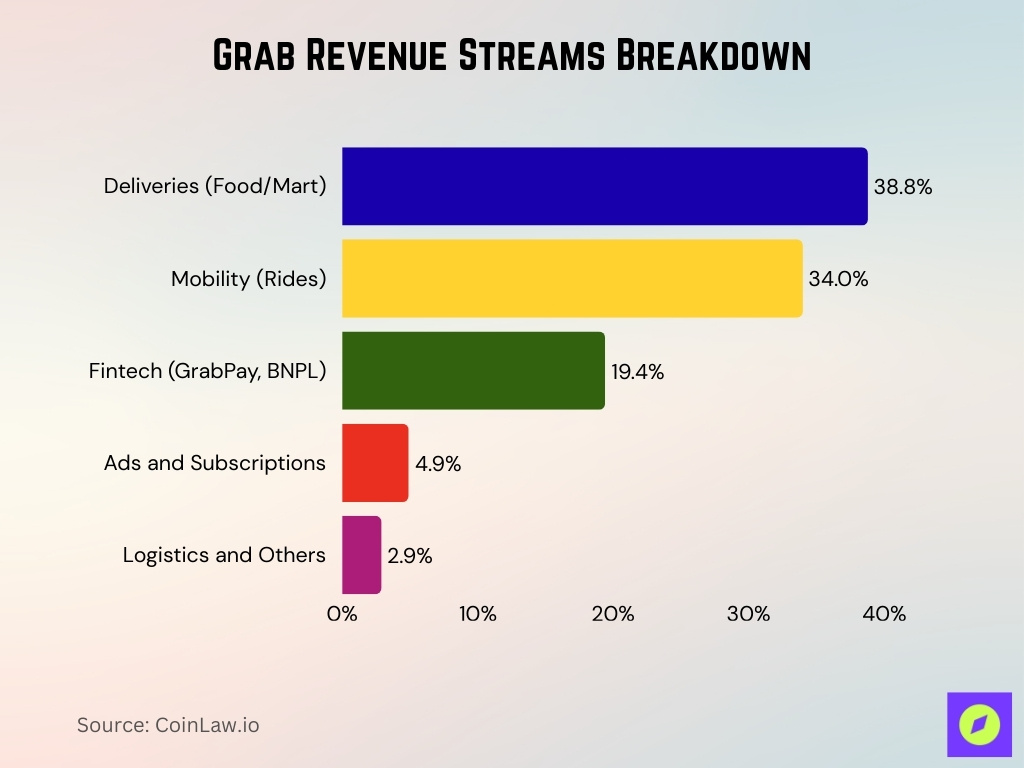

Grab Revenue Streams Breakdown

- Deliveries from Food and Mart services contributed the largest share at 38.8% of total revenue.

- Mobility services such as ride-hailing generated 34.0%, making it the second-largest revenue driver.

- Fintech offerings, including GrabPay and BNPL, accounted for 19.4%, showing strong traction in digital financial services.

- Ads and subscription products added 4.9% to overall revenue.

- Logistics and other service categories represented 2.9%, forming the smallest share of the revenue mix

Merchant Adoption Rates

- In Q2 2025, Grab reported a 25% year‑on‑year increase in merchant partners accepting GrabPay.

- In Q3 2025, the number of quarterly active advertisers on Grab’s self‑serve platform increased 15% YoY to 228,000, while average spend by those advertisers rose 41% YoY.

- In Q2 2025, the number of quarterly active advertisers increased 31% YoY to 220,000, and average spend increased 42% YoY.

- Strategic studies highlight Grab’s success from deep integration with merchants and localized services.

- In the Philippines 2024 initiative, Grab launched the “Grab Asenso” program targeting MSMEs and emphasized merchant digitalization.

- In Malaysia and Singapore, projections in 2021 suggested GrabPay’s merchant network would continue to grow due to strong adoption.

- Merchant adoption contributes to transaction volume growth, shown by Q2 2025 On‑Demand incentives reaching 10.1% of GMV.

- In Q3 2025, merchant earnings on the delivery segment increased 12% YoY.

GrabPay Usage by Generation

- Southeast Asia trend analyses suggest younger users (18‑34) drive mobile wallet growth.

- Mobile wallet penetration in Malaysia & Singapore in 2020 was 83% and 71% respectively, led by younger demographics.

- A forecast from 2021 showed significant smartphone and mobile‑wallet adoption among millennials and Gen Z.

- Grab’s super-app model offers high-frequency services, attracting younger tech-savvy cohorts.

- In Q3 2025, on‑demand transactions grew 27% YoY, indicating increased frequency among younger users.

- Reward features and digital wallet credits create recurring behavior in younger segments.

- In the Philippines, digital‑wallet accounts grew 52.8% from 2022 to 2023, largely driven by Gen Z and millennials.

GrabPay Demographics

- In Q2 2025, driver supply rose 18% YoY, contributing to user diversity.

- Digital-bank deposit growth in Q2 2025 shows expansion into new user profiles, with deposits hitting $1,543 million.

- MSMEs in the Philippines (99.59% of establishments) were key targets in merchant expansion, widening demographics.

- Mobile‑wallet penetration in Malaysia was 83% of adults, implying near-universal adoption.

- Asia‑Pacific’s wallet user base is expected to hit 2.6 billion by 2025, showing wide demographic inclusion.

- GrabPay services now include gig workers and SMEs, especially as loans disbursed to them rose 51% YoY.

Preferred Payment Methods

- In the Philippines, wallets like GrabPay are among the most popular e-commerce payment methods.

- Digital payments represented 59% by value in the Philippines in 2024, with QR and e-wallets preferred.

- GrabPay leads mobile-wallet usage in Singapore and Malaysia with ~35–38% market share.

- Integration into food delivery, transport, and e-commerce makes GrabPay more desirable than cash.

- In Q3 2025, driver earnings increased 4% YoY while fares declined 7%, nudging users toward wallet-based discounts.

- App-based payment methods are set to become dominant in Southeast Asia by 2025.

- Grab’s frequent promos and rebates through GrabPay further boost its preferred payment status.

Adoption in Southeast Asia

- Asia Pacific is projected to have 2.6 billion mobile-wallet users by 2025, up from 1.8 billion in 2020.

- Younger Southeast Asian consumers prefer super‑apps like GrabPay for convenience.

- Smartphone penetration exceeds 70% in most SEA countries, making mobile wallets accessible.

- Consumers value daily integration; wallet usage spikes with ride, food, and bill pay integration.

- In Malaysia, convenience explains 73.1% of wallet adoption behavior.

- GrabPay ranks in the top three wallets in Malaysia as of 2025.

- GrabPay is growing in cross-border acceptance via regional travel integrations.

- E-wallet registrations in the Philippines are expected to exceed 80 million by 2025.

- Incentives and loyalty programs through merchants are increasing wallet adoption.

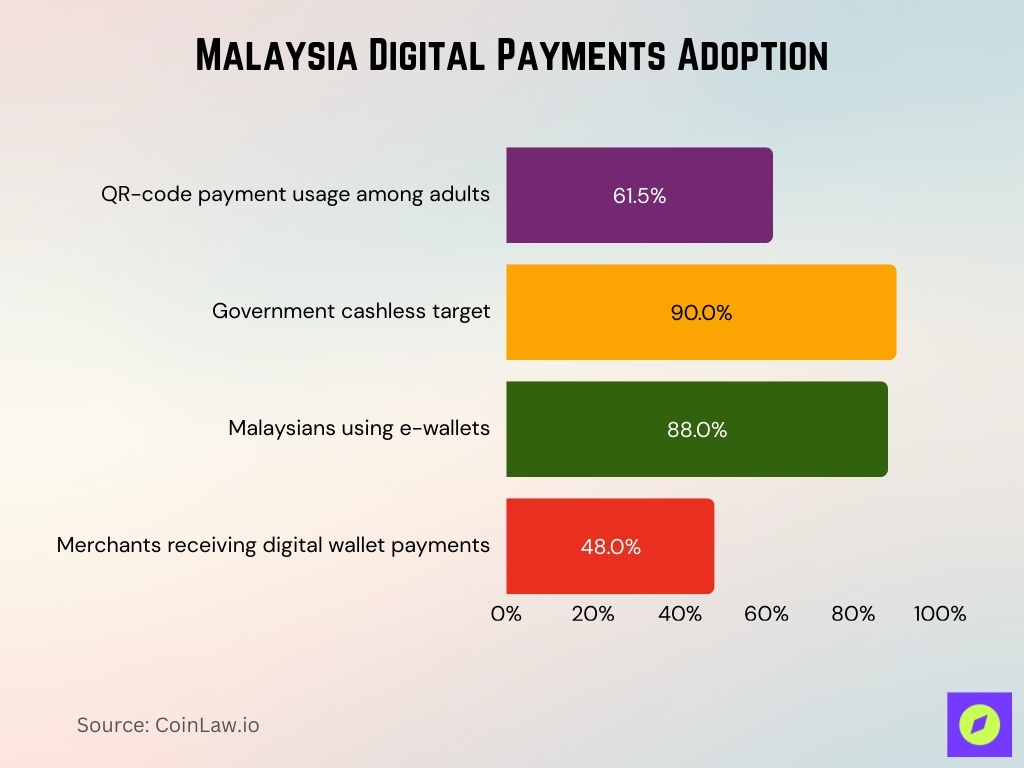

Cashless Adoption in Malaysia

- Malaysia ranks second globally in QR-code payment use at 61.5% of adults.

- Malaysia’s government targets 90% cashless transactions by 2025.

- Over 88% of Malaysians reportedly used e-wallets.

- 48% of merchants received payments from digital wallets.

- GrabPay’s presence in Malaysia includes 17 million users, expected to exceed 28 million by 2025.

- Average monthly expenditures via e-wallets rose to RM388 in 2024.

- Malaysia’s total digital payment market value is projected to hit $91.99 billion in 2025.

Economic Impact of GrabPay

- Grab’s fintech revenue reached $92 million in Q2 2025, a 42% YoY increase.

- TPV through GrabPay hit $5.8 billion, growing 38% YoY.

- Loan disbursements grew 51% YoY to $420 million, aiding SMEs and drivers.

- Cross-service Grab users spend 4x more, enhancing platform monetization.

- GrabPay reduces cash dependency, improving transaction formalization.

- GrabFin enables gig workers and micro-entrepreneurs to access lending and insurance.

- Full-year 2024 revenue rose 19% YoY, showing strong economic contribution.

- Wallet adoption contributes to tax compliance, merchant success, and reduced cash-handling costs.

- Growth in wallet usage supports Southeast Asia’s broader economic transformation by 2030.

GrabPay Partnerships and Integrations

- Grab integrated with Alipay+ in September 2025, enabling ride booking in over 800 cities across eight countries.

- In October 2025, Grab launched third-party partner apps within its super-app, reaching 46 million monthly users.

- GrabPay transaction volume grew 29% year-on-year to $5.8 billion in Q2 2025.

- GrabPay crypto top-ups launched in July 2025 via partnerships with PDAX and Triple-A, supporting Bitcoin, Ether, USDC, and USDT.

- GrabPay payment acceptance expanded into retail, travel, food delivery, and in-store sectors with a 25% increase in merchant partners.

- Partner integrations drive wallet stickiness, with GrabPay users earning and redeeming GrabCoins across services.

- Ecosystem monetization now includes financial services, rewards, and merchant advertising, boosting revenue growth by 36% year-on-year in Q1 2025.

Government Initiatives and GrabPay

- Southeast Asian governments have increased digital wallet use by implementing supportive policies, boosting GrabPay’s market potential.

- Malaysia’s 61.5% QR code adoption is driven by proactive government cashless initiatives.

- Financial inclusion programs enable over 60% of MSMEs and unbanked populations to access digital payment services.

- Governments provide incentives like rebates and tax discounts for wallet payments, increasing e-wallet transaction volume by 30% regionally.

- National payment frameworks expand GrabPay’s reach into underserved rural and semi-urban areas.

- Merchant digitization programs increase small-business partners by 40%, supporting GrabPay’s acquisition strategy.

- ASEAN cross-border interoperable payment systems are projected to increase digital transactions by 45% by 2026.

Frequently Asked Questions (FAQs)

Loans disbursed grew 51% year‑on‑year to US $420 million.

About 2.6 billion mobile‑wallet users in the Asia Pacific by 2025.

Approximately 61.5% of Malaysian adults use QR‑code payments.

21% year‑on‑year growth in On‑Demand GMV, reaching $5.4 billion.

Conclusion

In sum, the evidence shows that GrabPay is not just growing; it is scaling across users, merchants, and geographies. From strong wallet adoption in markets like Malaysia and the Philippines to deep partnerships and infrastructure integration, GrabPay’s value lies in being part of a broader ecosystem. Whether through consumer wallets, merchant acceptance, or fintech services, the numbers point to meaningful penetration and impact. For U.S.-based observers with interests in digital payments and Southeast Asia, the GrabPay story offers a clear window into how super-apps can drive regional financial change.