Gemini is pushing into the prediction markets space with a CFTC application, even as government delays and falling stock prices pose significant challenges.

Key Takeaways

- Gemini has applied to the CFTC to operate a regulated derivatives exchange offering prediction market contracts on real-world events.

- Approval delays due to the U.S. government shutdown may hinder Gemini’s launch timeline and give rivals a competitive edge.

- Platforms like Kalshi and Polymarket are seeing record-breaking trading volumes, with Kalshi reaching $4.4 billion in monthly volume.

- Gemini’s stock has plummeted 56 percent since its September IPO, adding pressure as the company aims to diversify and expand.

What Happened?

Gemini, the crypto exchange led by Cameron and Tyler Winklevoss, has filed with the U.S. Commodity Futures Trading Commission (CFTC) to launch a derivatives exchange aimed at hosting regulated prediction market contracts. However, the ongoing U.S. government shutdown has slowed down the approval process, putting Gemini at risk of falling behind competitors like Kalshi and Polymarket, both of which are breaking new ground with record trading volumes.

Gemini, the crypto exchange founded by billionaires Tyler and Cameron Winklevoss, is preparing to offer prediction market contracts, according to sources https://t.co/xMZhziKaDK

— Bloomberg (@business) November 4, 2025

Gemini’s Move Into Prediction Markets

Prediction markets allow traders to bet on outcomes of future events like elections, sports, or economic reports. While decentralized platforms such as Augur and Polymarket have been in the space for years, Gemini’s strategy is to bring these markets into the fully regulated financial system.

- Gemini filed its CFTC application in May to operate as a designated contract market, a status required to offer derivatives trading legally in the U.S.

- The company outlined its plan to launch event contracts in IPO filings submitted ahead of its September 2025 public debut, which raised $433 million at a $4.4 billion valuation.

According to Bloomberg, Gemini executives aim to roll out these event contracts as soon as approval is granted. The contracts would allow users to speculate on outcomes across economic data, politics, financial markets and sports.

Mounting Challenges from Competitors

Despite Gemini’s ambitions, other platforms are surging ahead in the prediction markets race:

- Kalshi, a CFTC-approved exchange, has seen explosive growth, hitting $4.4 billion in monthly volume in October and $1.2 billion weekly as of early November.

- Polymarket, previously offshore, has re-entered the U.S. and is now crossing the $1 billion mark in weekly volume.

- Major players like Robinhood, Coinbase, DraftKings, MetaMask, and Intercontinental Exchange have either integrated prediction market features or announced substantial investments. ICE notably poured $2 billion into Polymarket at a $9 billion valuation.

While some firms have partnered with licensed platforms to bypass lengthy regulatory wait times, Gemini is pursuing its own license – a strategy that offers long-term autonomy but requires patience.

Regulatory Uncertainty Remains

Although the CFTC has shown increasing openness toward prediction markets, especially after its previous cautious stance, legal ambiguity still surrounds the space:

- State gaming regulators have challenged the CFTC’s jurisdiction, leading to legal battles that could reshape how these markets are regulated.

- Kalshi continues expanding amid this uncertain backdrop, operating in 140 countries and raising $300 million in recent funding.

This evolving environment presents both risk and opportunity for Gemini as it seeks to innovate without running afoul of regulators.

Gemini’s Stock Under Pressure

Gemini’s public market performance has not inspired confidence among investors:

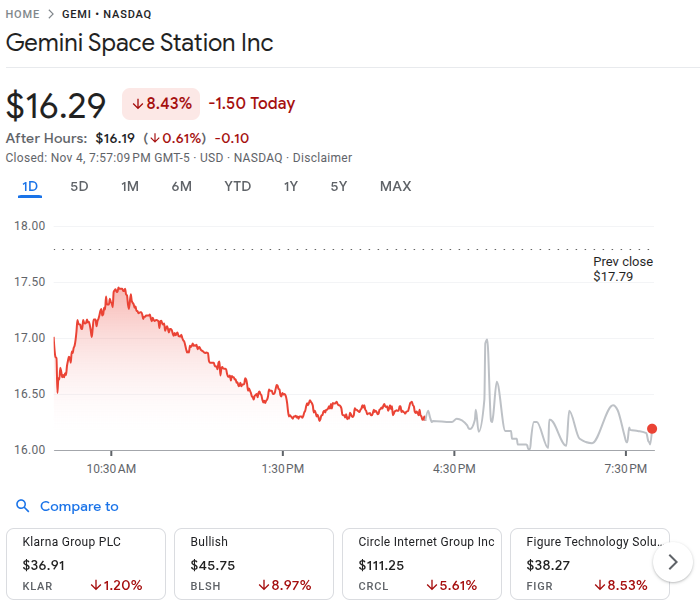

- The company’s stock has dropped 56 percent since its IPO, falling from $37 to $16.29 as of November 4, 2025.

- Investors are awaiting the company’s first earnings report, scheduled for November 10, which could be a critical moment for assessing the viability of its expansion plans.

Despite the market dip, Gemini is betting that becoming a regulated prediction market provider can help diversify its offerings and attract both retail and institutional users seeking a compliant platform.

CoinLaw’s Takeaway

In my experience covering fintech and crypto, regulatory positioning can make or break a new product launch. Gemini is clearly taking the high road by filing with the CFTC rather than skirting around U.S. laws like some of its competitors. That strategy has merit, especially with institutions watching closely. But the timing is rough. Between the government shutdown and fierce competition from fast-moving rivals like Kalshi and Polymarket, Gemini risks being late to a very hot party. I found it bold that they’re sticking with their regulated-first approach. If they can weather the wait, it might just pay off long term. But for now, they’ll need to manage investor expectations and hope the CFTC clears the path soon.