The financial services industry is in the midst of a transformation, driven by technology, shifting customer expectations, and global economic conditions. The sector continues to evolve, fueled by digitalization, the growing adoption of AI, and increasing regulations aimed at enhancing security. From the rise of fintech to the adoption of contactless payments, these changes are reshaping the landscape, offering both opportunities and challenges. Understanding the key statistics that define this industry is crucial for businesses and stakeholders navigating these rapid changes.

Editor’s Choice

- The global digital payments market transaction value is forecast to reach $26.89 trillion in 2026.

- The global financial services application market will reach $181.5 billion in 2026, growing at a 13.2% CAGR to 2032.

- The global fintech market is projected to be worth $460.76 billion in 2026, on track to reach $1.76 trillion by 2034.

- Global real-time payments revenues are estimated at about $49.2 billion in 2026, with forecasts pointing to $628.4 billion by 2035 at 42.9% CAGR.

- High-risk third‑country AML list now includes jurisdictions like Bolivia and the British Virgin Islands as of January 29, 2026.

Recent Developments

- 98% of global GDP from countries in CBDC development or pilots.

- Federal Reserve holds fed funds rate at 3.5%-3.75%.

- Green finance sees $40 billion allocation by CAF for growth.

- FIS closes $13.5 billion fintech restructuring deal.

- API attacks on financial services up 65% year-over-year.

- Digital identity document users exceed 6.5 billion globally.

- Finance sector chatter on dark web at 16.5% of total.

- ESG demand rises, with 86% of asset owners increasing allocations.

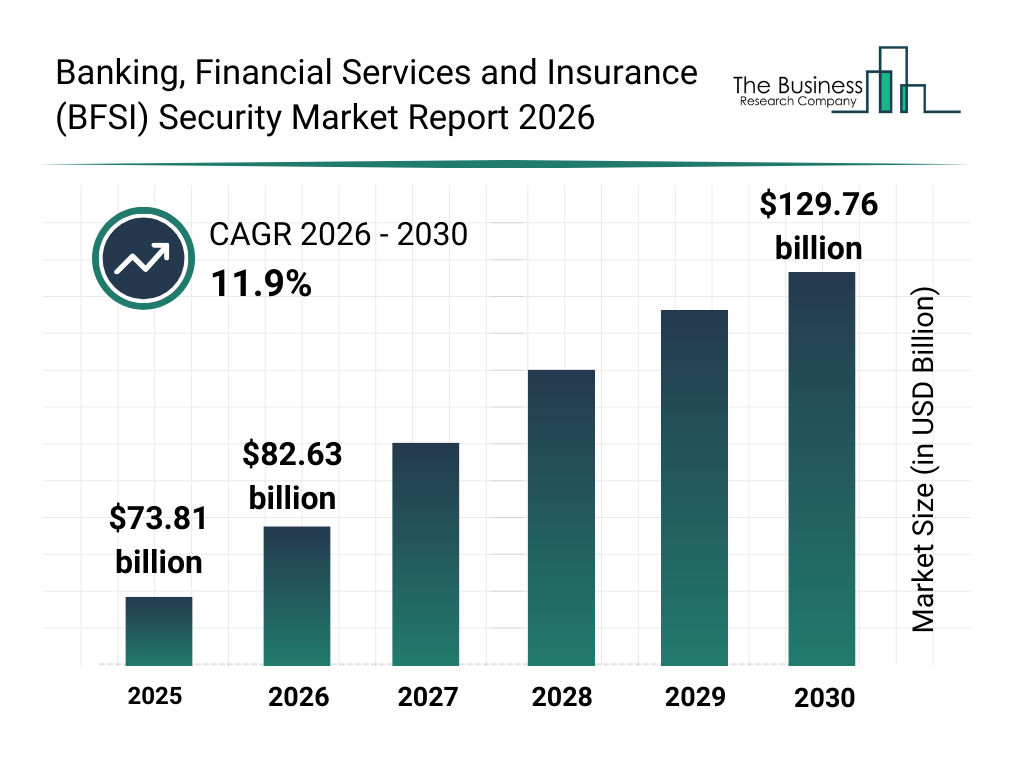

BFSI Security Market Growth Highlights

- The global BFSI security market was valued at $73.81 billion in 2025, reflecting rising cybersecurity demand across banking and insurance institutions.

- Market size increased to $82.63 billion in 2026, driven by regulatory compliance, cloud adoption, and digital banking expansion.

- The market is projected to reach $93.2 billion in 2027, indicating steady investments in fraud prevention and data protection solutions.

- In 2028, the BFSI security market is expected to grow to $104.5 billion, supported by AI-driven threat detection and zero-trust security models.

- Market value is forecast to hit $116.8 billion in 2029, as financial institutions scale enterprise-wide security infrastructure.

- By 2030, the BFSI security market is projected to reach $129.76 billion, highlighting long-term growth across banking, financial services, and insurance sectors.

- The market is expected to grow at a compound annual growth rate (CAGR) of 11.9% from 2026 to 2030, underscoring sustained demand for advanced cybersecurity solutions.

Impact of AI and Automation on Financial Services

- 90% of financial institutions use AI for fraud investigations and detection.

- AI chatbots boost productivity by 70% and cut costs by 50% in banking.

- Vanguard Digital Advisor robo-advisors manage over $311 billion in AUM.

- 75% of banks use AI agents for customer service processes.

- AI scales reduce operational costs by up to 20% in finance.

- Finance automation eliminates manual back-office workflows at scale.

- 64% of banks deploy AI agents for fraud detection.

- 61% of banks use AI for loan processing automation.

- 88% of companies use AI in at least one banking function.

- AI market in finance is projected to exceed $22.6 billion.

Cybersecurity and Data Breach Statistics

- Finance comprises 16.5% of dark web chatter, ranking 2nd out of 14 industries.

- Data breaches in finance surged to 2668 incidents in the latest Q1 period.

- Nearly 1000 data breach events were reported across sectors, including finance, in Q4 2025.

- 23% of phishing attacks targeted financial institutions.

- The average ransomware recovery cost for finance hit $2.58 million.

- Synthetic identity fraud causes $30-35 billion annual US losses.

- Global cybersecurity spending reaches $240 billion, up 12.5%.

- MFA adoption in finance and banking is at 60%.

- Financial institutions face €3 billion+ in top GDPR fines for 2025.

- Ransomware in 44% of all data breaches.

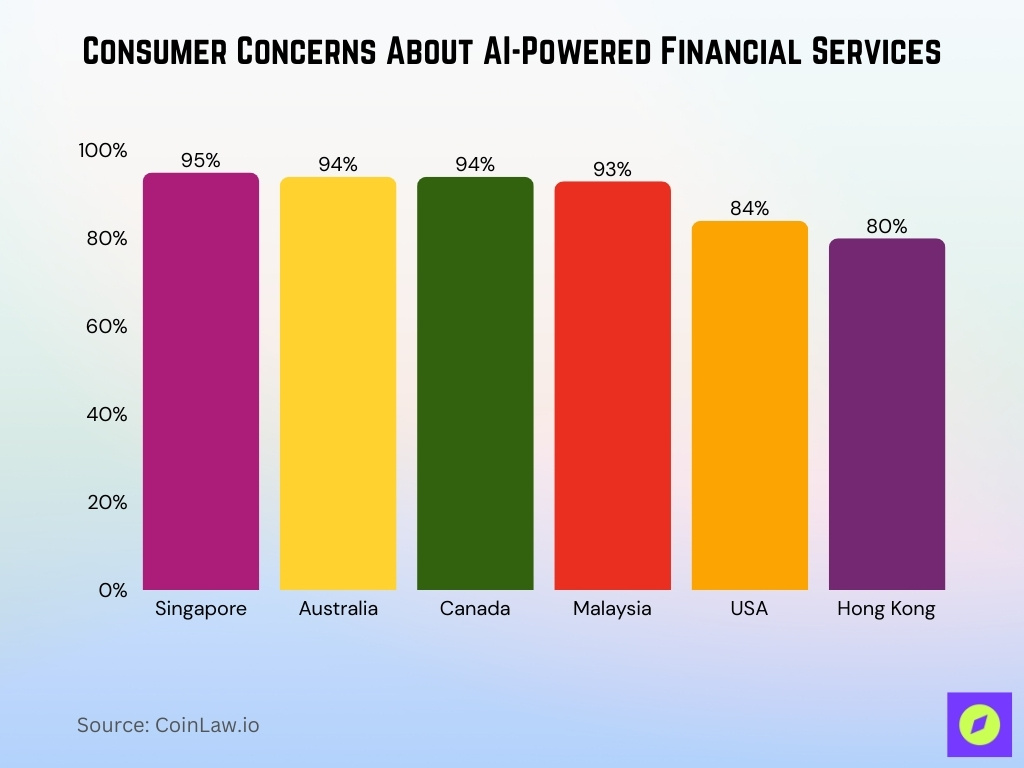

Consumer Concerns About AI-Powered Financial Services

- Singapore records the highest level of concern, with 95% of consumers expressing worries about AI-powered financial services.

- In Australia, 94% of consumers report concerns, highlighting strong apprehension around AI use in financial decision-making.

- Canada also shows high concern levels, with 94% of consumers cautious about AI-driven financial services.

- Malaysia follows closely, where 93% of consumers express concerns related to AI adoption in finance.

- In the United States, 84% of consumers report concerns, indicating comparatively lower but still widespread AI trust issues.

- Hong Kong shows the lowest concern level among surveyed regions, yet 80% of consumers still report worries about AI-powered financial products.

Financial Services Industry Regulations

- Basel III and ECB requirements keep overall CET1 capital requirements and guidance at 11.2% for 2026.

- Basel III mandates a minimum CET1 of 4.5% plus a 2.5% capital conservation buffer.

- Global AML and financial crime compliance spending by banks and fintechs is estimated at $206 billion per year.

- Finance, insurance, and consulting have incurred over €89 million in GDPR fines across 306 cases.

- Insufficient legal basis for data processing has generated about €3.01 billion in cumulative GDPR fines.

- Non-compliance with general data processing principles accounts for roughly €2.52 billion in GDPR fines.

- Insufficient information security controls have led to about €933.8 million in GDPR penalties.

- Climate-related disclosure under the BCBS framework is expected to be required by 2026 for internationally active banks in member jurisdictions.

Insurance Sector Overview

- Global health insurance costs rise 10.3%.

- 36% of Gen Z adults have life insurance.

- Property & casualty premium growth at 3.4%.

- Cyber insurance premiums hit $23 billion.

- The reinsurance market is valued at $530 billion, growing 5.4% CAGR.

- Insurers enter 2026 as the hard market ends amid AI pressures.

- 14.0% health cost increase expected in the Asia Pacific.

- Global reinsurance to surpass $850 billion by 2033.

- 9.6% US healthcare cost projection.

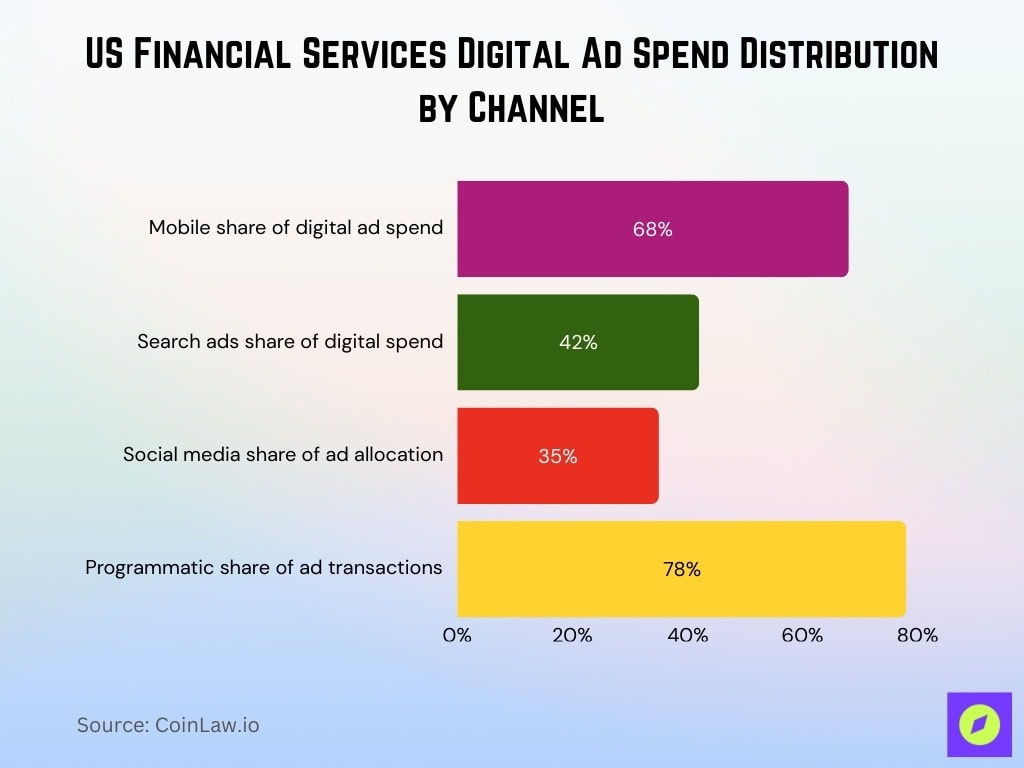

US Financial Services Digital Ad Spending Trends

- Mobile advertising captures 68% of the total digital ad budget.

- Search ads account for 42% of financial services digital spend.

- Video advertising grows 18%, hitting $9.8 billion.

- Social media platforms drive 35% of total digital ad allocation.

- Programmatic buying represents 78% of digital ad transactions.

- Digital ad spending reaches $41.2 billion, up 11.5% year-over-year.

- Retargeting campaigns boost ROI by 150% average.

- CTV advertising surges 25% to $2.1 billion.

Banking and Investment Statistics

- Global banking ROE forecasted at 13.0%.

- Global banking NII projected to grow over 7%.

- Global investment banking fees reach $137.6 billion, up 11%.

- US mortgage origination volume projected at $2.27 trillion.

- Global financial intermediation revenue totals $6.8 trillion.

- Banking revenues after risk cost hit a record $5.5 trillion.

- Banking net income reaches a highest-ever $1.2 trillion.

- Apac ex-Japan investment banking fees grow 19% to $24.9 billion.

- Private equity AUM expected to hit $11.12 trillion.

- Alternative assets AUM forecasted at $23.21 trillion.

Fintech Innovations and Growth

- The global BNPL payment market reaches $509.2 billion.

- Standard Chartered processes $8 billion annually in blockchain trade finance.

- Santander handles over $20 billion in blockchain cross-border transfers.

- Global fintech investment rises 21% to $53 billion across 5,918 deals.

- Illicit crypto volume reaches an all-time high of $158 billion.

- Neobanks offer FDIC insurance up to $250,000 per account.

- 96.3 million US BNPL users projected.

- Digital finance becomes a foundational infrastructure layer.

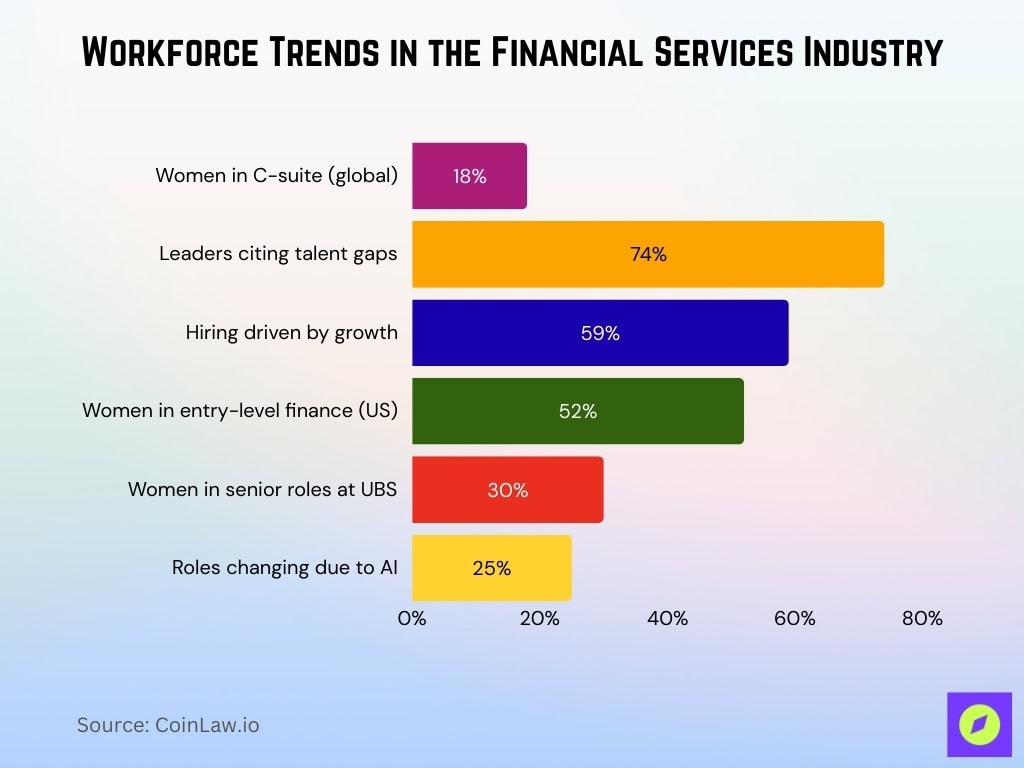

Employment in the Financial Services Industry

- Women hold 18% of C-suite positions globally.

- 74% of leaders expect talent gaps to constrain growth.

- 59% of employers cite growth influencing hiring decisions.

- 52% women at entry-level finance jobs in the US.

- 30% senior management positions at UBS are held by women.

- 25% roles to change due to AI by 2026.

- 963,500 annual job openings are projected in business and financial occupations.

- 4,342 finance jobs listed for 2026.

Marketing Personalization in Financial Services

- 86% of financial institutions prioritize personalization in their digital strategy.

- 92% plan further investments in personalization practices.

- AI personalization boosts customer engagement up to 200%.

- Advanced AI personalization improves customer lifetime value by 25-35%.

- Email marketing yields $44 ROI per dollar spent.

- 50% of consumers prefer email for business communication.

- Predictive analytics firms are 23x more likely to acquire customers.

- 6x more likely to retain customers with predictive analytics.

- 19x more likely to be profitable using predictive analytics.

- Direct-indexing market grows to $730 billion.

Frequently Asked Questions (FAQs)

46% of U.S. consumers have adopted fintech services.

77% of U.S. households engage monthly with mobile banking apps.

Nearly 78% of financial firms reported increased IT and cybersecurity spending in 2026.

An average of 64% of consumers globally have adopted fintech services.

Conclusion

The financial services industry is set to witness continued growth, driven by digital transformation, regulatory changes, and shifting consumer preferences. As AI, automation, and fintech innovations reshape the landscape, the sector will face both opportunities and challenges. With cybersecurity threats increasing and customer demands evolving, financial institutions will need to stay agile and focus on personalization, innovation, and sustainability to remain competitive. Understanding the key statistics and trends will be critical for businesses and stakeholders aiming to thrive in this dynamic environment.

LWLydia Weissnat

Great insights on the impact of AI in financial services! It’s fascinating to see how digital payments are evolving. Excited to see where this leads us!