As we navigate an increasingly complex financial landscape, the need for robust financial planning has never been more crucial. Today, financial planning is not just a service; it’s a lifeline for individuals, families, and businesses seeking stability in uncertain times. From saving for retirement to managing unforeseen expenses, the financial planning industry is at the forefront of economic resilience.

This article dives into essential statistics and insights that define the industry, exploring growth trends, technological advancements, and shifts in market demands. Let’s take a closer look at what’s shaping the financial planning world this year.

Editor’s Choice

- The global robo-advisory market is set to grow from $14.25 billion in 2025 to about $18.7 billion in 2026.

- Between one-quarter and one-third of U.S. adults report working with a financial advisor.

- Roughly 77% of global investors say they would choose an advisor or platform based on sustainable investing offerings.

- ESG and sustainability rules now require sustainability-related disclosure in 79% of OECD Factbook jurisdictions.

- SEC climate disclosure rules in 2026 apply to large accelerated and accelerated filers plus foreign private issuers on U.S. exchanges.

Recent Developments

- New U.S. fiduciary and exam priorities keep fiduciary duty and compliance programs at the center of 2026 SEC oversight.

- The UK’s Sustainability Disclosure Requirements affect about 6,000 investment firms, tightening ESG reporting expectations.

- Amended Regulation S-P now mandates written incident response programs and customer breach notifications for financial firms.

- In 2026, SEC exams will test firms’ identity theft prevention programs under Regulation S-ID and related red-flags controls.

- Around 96% of financial firms allocate more than 5% of their total budget to IT and cybersecurity to meet compliance expectations.

- 42% of financial executives cite keeping up with evolving regulatory requirements as their biggest compliance roadblock.

- A new U.S. executive order directs DOL to reassess ERISA rules and potentially classify proxy advisors as investment-advice fiduciaries.

Financial Planning Software Market Growth Trends

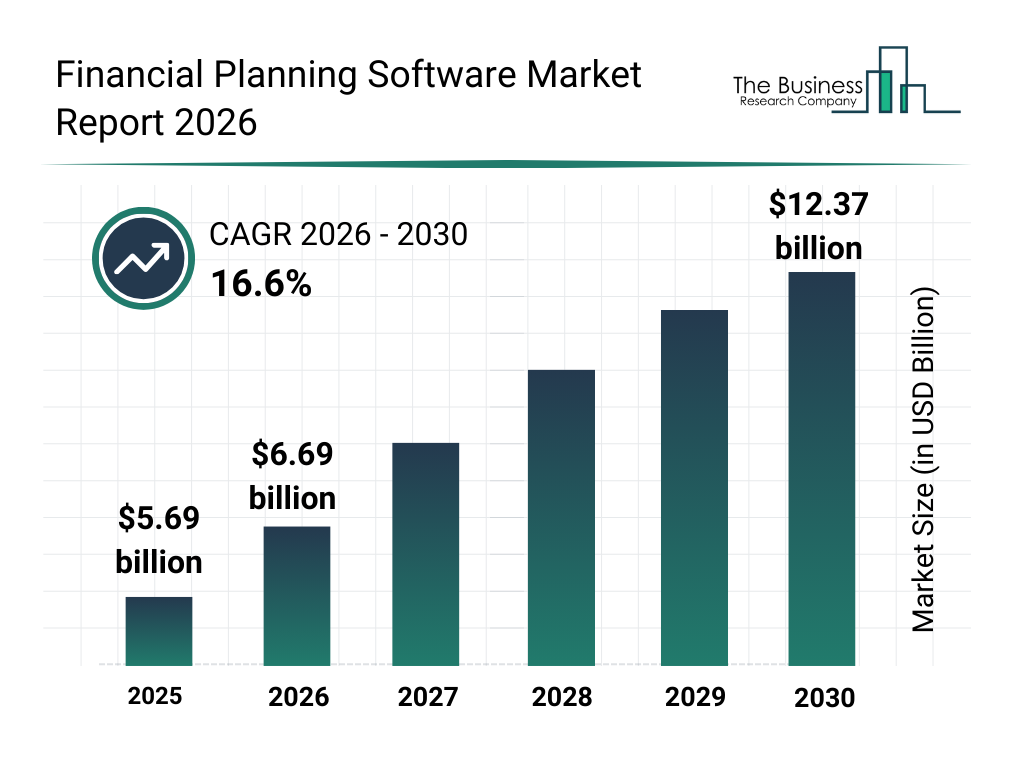

- The market reached $5.69 billion in 2025, showing strong demand for digital financial planning tools.

- It is expected to grow to $6.69 billion in 2026, indicating steady year-over-year expansion.

- The industry is projected to hit $12.37 billion by 2030, more than doubling within five years.

- The market is forecast to grow at a 16.6% CAGR from 2026 to 2030, signaling rapid long-term growth.

- Rising use of automation and digital advice tools continues to push market expansion.

- Financial firms increasingly adopt software to improve planning accuracy and client service.

Revenue Breakdown and Key Financial Statistics

- Estate planning maintains momentum with an annual growth rate of 6.5%, driven by expanding intergenerational wealth.

- Top-performing fee-only financial planners can earn up to $400,000 annually, with a national median of $160,000-$230,000.

- Digital financial planning tools generate revenue for 75% of firms, boosting digital-first models.

- Robo-advisors earned an estimated $6.2 billion in revenue, with AI platforms gaining trust.

- Small business advisory represents 20% of industry revenue as SMBs seek strategies.

- Tax planning services account for increased revenue for 30% of planners due to reforms.

- Independent financial advisors control 38% of the global market share.

Financial Plan Preferences by Wealth Level

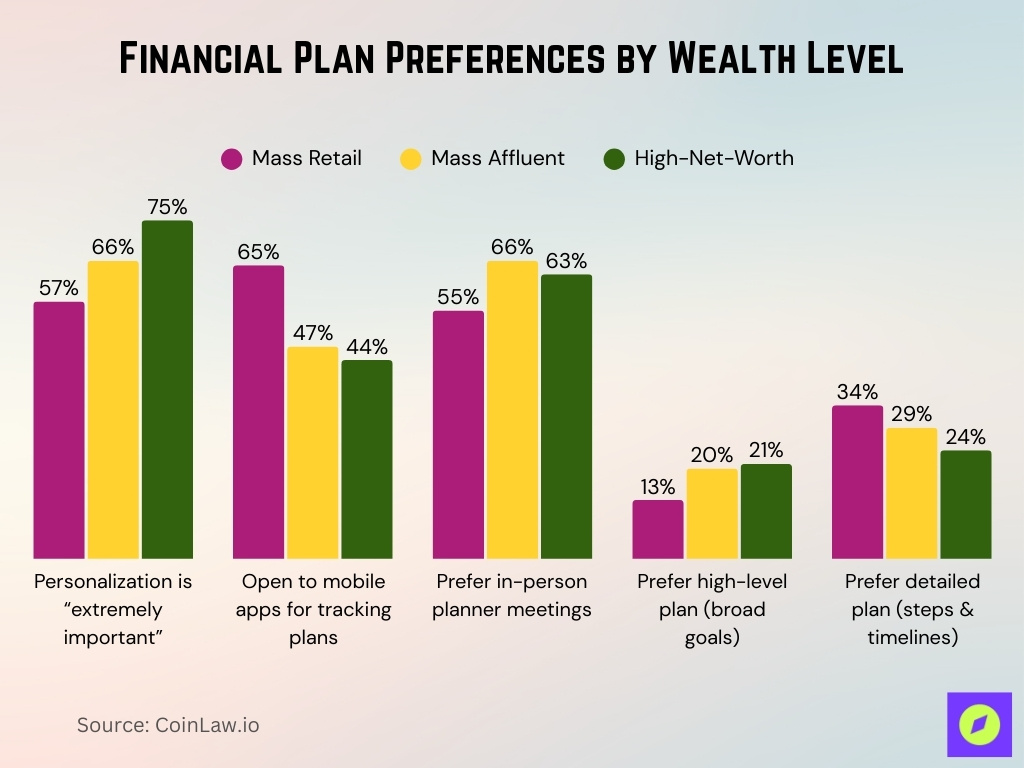

- 75% of high-net-worth individuals say financial plan personalization is extremely important, the highest among all groups.

- 66% of mass affluent and 57% of mass retail clients also place strong importance on personalized planning.

- 65% of mass retail clients are open to using mobile apps to track and manage financial plans, more than wealthier groups.

- Only 47% of mass affluent and 44% of high-net-worth clients show the same level of interest in mobile tools.

- 66% of mass affluent clients prefer in-person meetings with a financial planner, the highest share overall.

- This preference remains strong among 63% of high-net-worth and 55% of mass retail clients.

- Just 13% of mass retail clients prefer a high-level plan focused on broad goals.

- Preference for high-level plans rises to 20% among mass affluent and 21% among high-net-worth individuals.

- 34% of mass retail clients want a detailed plan with clear steps and timelines, the highest among the groups.

- Demand for detailed plans declines to 29% for mass affluent and 24% for high-net-worth clients.

Role of ESG and Sustainable Investing

- ESG-focused assets surpass $60.2 trillion globally, representing over 38% of all assets under management.

- 78% of U.S. financial planners now offer ESG investment options, up from 75% last year.

- 90% of clients under 40 prefer sustainable investments aligned with their values.

- Climate risk assessments are integrated into 52% of portfolio strategies amid environmental concerns.

- 49% of global investors believe ESG practices enhance long-term returns.

- 68% of large investment firms pledged net-zero emissions by 2050.

- Financial planners report 29% increase in sustainable investing inquiries since 2022.

- Social impact bonds featured in portfolios by 42% of firms.

- 60% of financial advisors evaluate corporate ESG scores before recommendations.

Impact of Financial Credentials on Careers

- CFP® professionals earn 30% more than non-certified peers.

- 77% of financial planners hold at least one professional designation.

- 66% of CFP® holders receive promotion within three years.

- 65% of firms require CFP® for senior advisory roles.

- CFA or CIMA credential holders achieve 35% higher client acquisition.

- Entry-level advisors gain an 18-25% salary boost post-certification.

- 90% of high-net-worth clients prefer certified advisors.

- 55% of firms offer tuition reimbursement for development.

- Half of firms report increased client inquiries on advisor certifications.

Increase in Career Satisfaction by Certification

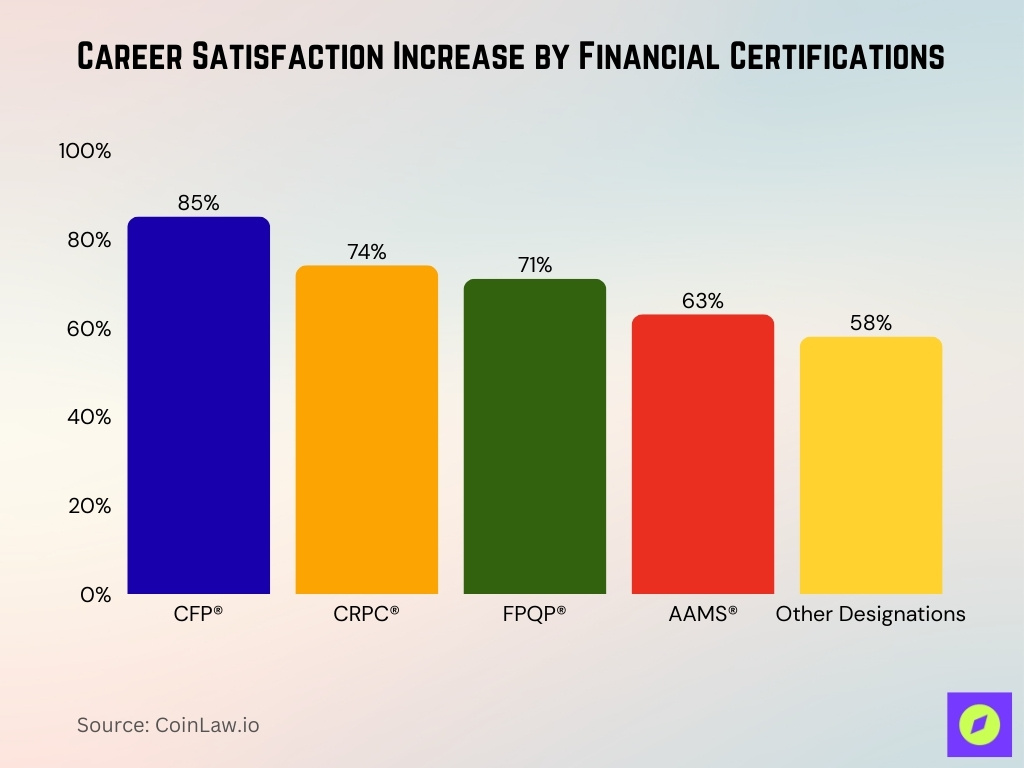

- CFP® holders report the highest career satisfaction boost at 85%.

- CRPC® professionals see a 74% improvement in career satisfaction.

- AAMS® designation holders experience a 63% increase in job fulfillment.

- FPQP® certified individuals report a 71% rise in satisfaction levels.

- Other specialized designations contribute to a 58% boost in career satisfaction.

Impact of AI and Robo-Advisors on the Industry

- Robo-advisors now manage 20% of all financial advisory assets in the U.S.

- Global robo-advisory market projected to reach $3.5 trillion AUM.

- Automated planning tools cut advisor workload by 35%, enhancing client support.

- Predictive analytics is used by 55% of financial firms for market shifts.

- AI chatbots manage 57% of routine client interactions, cutting costs.

- 74% of investors under 35 prefer digital or hybrid advisory models.

- AI compliance tools are active in 47% of firms, reducing regulatory risks.

- Robo-advisors are expanding at 28% annual growth rate.

Demographics and Workforce Insights

- Women represent 40% of financial planners in the U.S., advancing gender diversity.

- The average age of financial advisors is 57, heightening succession planning needs.

- Millennials comprise 31% of the client base, demanding tech-driven solutions.

- 64% of firms launched diversity initiatives for underrepresented talent.

- Average starting salary for new planners reaches $70,000; top earners exceed $130,000.

- CFP® professionals see 25% projected job growth through 2030.

- 76% of financial planners hold at least one professional certification.

- 25% of clients qualify as high-net-worth individuals, focusing on estate services.

- 68% of firms support remote and hybrid work arrangements.

Popular Choices in Investment Portfolio Allocation

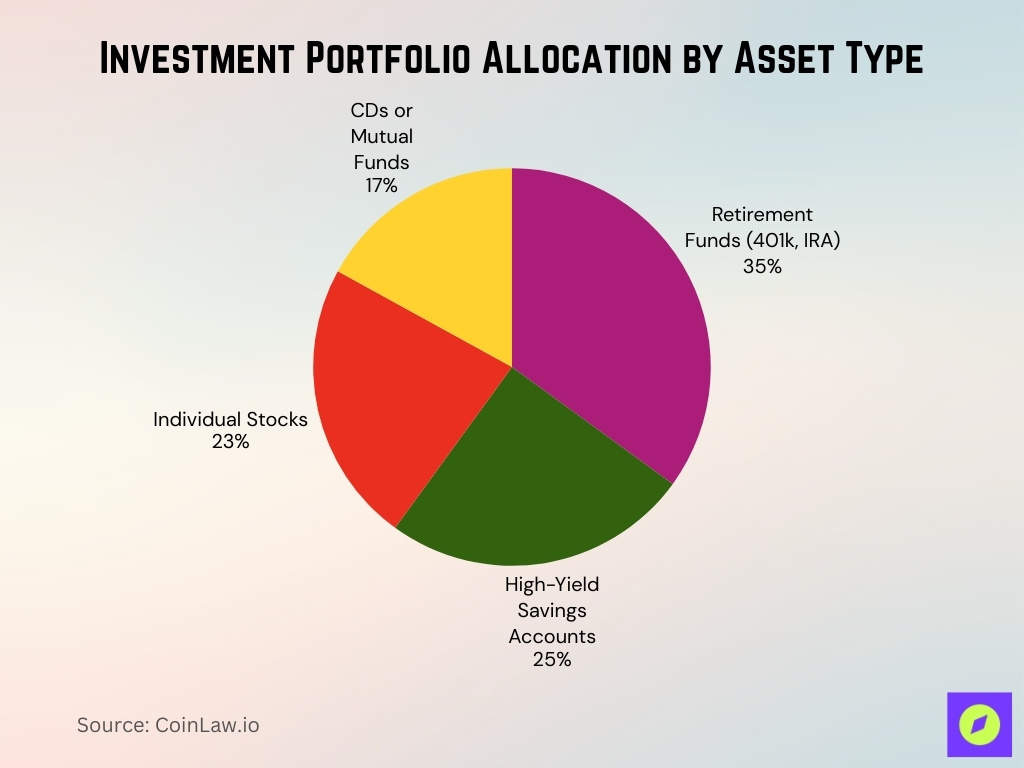

- Retirement funds (401k, IRA) comprise 35% of allocations.

- High-yield savings accounts account for 25% of portfolios.

- Individual stocks represent 23% of investment allocations.

- CDs or mutual funds hold 17% of the portfolio share.

Factors That Help People Feel More Prepared for Retirement

- Projections of estimated income and expenses valued by 90% of individuals.

- Learning retirement income sources is seen as helpful by 89% of respondents.

- Understanding CPP/QPP strategies assists 87% in feeling prepared.

- Consultations with financial advisors are beneficial for 87% of people.

- Professional management of retirement investments is preferred by 86% of respondents.

Career Satisfaction in the Financial Planning Industry

- 85% of U.S. financial planners report high job satisfaction from client impact.

- 71% of advisors benefit from hybrid or remote work arrangements.

- 95% of advisors feel fulfilled helping clients achieve financial security.

- 48% cite compensation as a key factor, salaries averaging $90,000-$130,000.

- 28-33% of advisors report burnout signs from client and regulatory stress.

- 78% feel confident in job stability despite economic uncertainties.

- 65% of firms promote internally for clear career advancement.

- Women report 82% satisfaction rate, seeking more mentorship opportunities.

- 50% engage in wellness programs, reducing burnout and boosting retention.

Challenges Facing Financial Planners

- 55% cite regulatory compliance as the top challenge from evolving rules.

- 42% concerned about client retention among younger digital investors.

- 47% identify cybersecurity as the primary operational risk.

- Compliance costs rose 22-32% since 2020 due to cybersecurity and ESG.

- 35% lost clients to robo-advisors and DIY investment tools.

- 36% struggle adapting to AI and digital CRM platforms.

- 52% manage client expectations amid market volatility.

- 48% dedicate time to financial literacy for younger investors.

- 30% of Baby Boomer clients disengage from regular reviews.

Frequently Asked Questions (FAQs)

67% prioritize retirement planning in client conversations.

Wealth management accounts for 29% of revenue.

69% of CFP® professionals recommend tax optimization.

The average salary is $74,164 to $96,681 annually.

Conclusion

The financial planning industry today is a vibrant landscape shaped by technology, shifting client values, and regulatory changes. Advisors are adapting to new demands for sustainable investing, robo-advisory solutions, and hybrid models that balance human and digital interaction. Credentialing continues to play a crucial role in building client trust, while job satisfaction remains high, supported by flexibility and career growth opportunities.

However, challenges such as regulatory compliance, data security, and market volatility require ongoing attention. As the industry evolves, financial planners are well-positioned to guide clients through financial uncertainty, leveraging a blend of technology and personalized expertise to create a stable financial future.