Exodus Wallet has grown into one of the most popular non-custodial crypto wallets on the market. Designed for accessibility and self-sovereignty, it allows users to store, manage, and exchange digital assets without giving up control of private keys. From retail investors trading Bitcoin to institutional users monitoring treasury allocations, Exodus serves a wide spectrum of the crypto community. This article breaks down the latest statistics, from user adoption to assets held, revenue, and beyond, to give you a full picture of Exodus Wallet’s standing in the crypto ecosystem.

Editor’s Choice

- Exodus reported digital and liquid assets totaling $291.2 million as of June 2025.

- Q2 2025 revenue was $25.8 million, up 16% year-over-year.

- Exodus held 2,058 BTC, 2,729 ETH, and 43,738 SOL by August 2025.

- Bitcoin represented 19% of processed exchange volume in Q2 2025.

- Monthly active users peaked at 2.2 million in May 2025 due to a Passkeys Wallet promotion.

- Net income in Q2 2025 was $37.7 million, swinging from a loss in Q2 2024.

- Customer support response time averaged less than 60 minutes in Q2 2025.

Recent Developments

- Exodus Wallet experienced a surge in activity in May 2025, with MAUs spiking to 2.2 million, driven by Passkeys Wallet promotions.

- Passkeys Wallets accounted for ~675,000 of May’s MAUs, but usage dropped to ~11,000 by August.

- The company launched monthly treasury and user metrics updates, enhancing transparency and investor confidence.

- Exodus increased its corporate holdings of Ethereum, Bitcoin, and Solana throughout Q2 2025.

- The idea of offering Bitcoin dividends to shareholders is under consideration.

- Revenue grew 16% YoY, while operating expenses also rose significantly, pointing to reinvestment in platform growth.

- Q2 2025 saw a 37% decline in processed exchange volume compared to Q1 2025.

- Exodus is increasingly focusing on integration with third-party providers to improve swap performance and liquidity access.

- The company filed updated SEC reports outlining detailed treasury data, token holdings, and business projections.

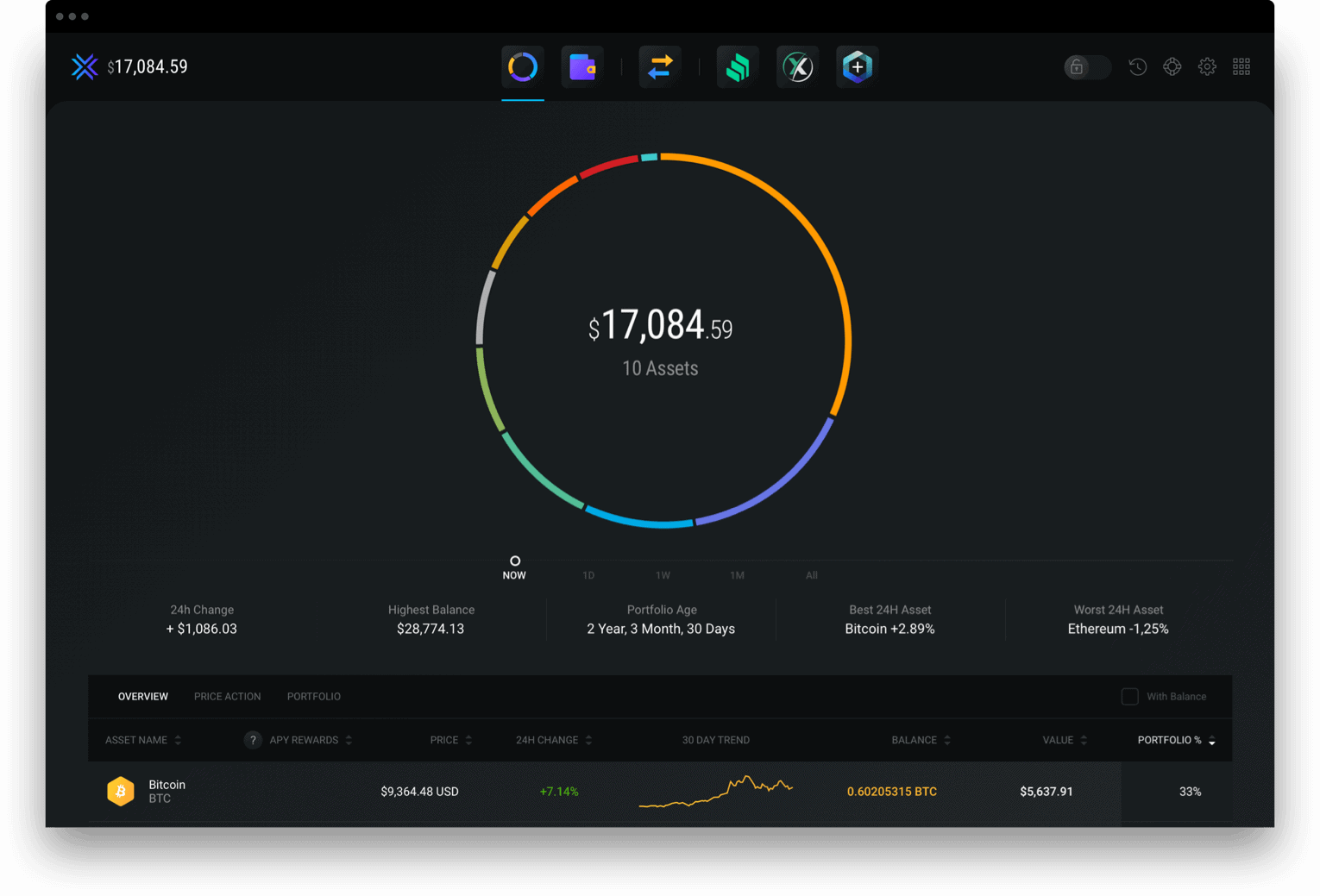

Exodus Wallet Portfolio Snapshot

- Total crypto portfolio value stands at $17,084.59 across 10 digital assets.

- The portfolio saw a 24-hour gain of $1,086.03, signaling strong short-term performance.

- The all-time highest recorded balance was $28,774.13, indicating previous higher valuation levels.

- The wallet has been active for 2 years, 3 months, and 30 days, showing long-term user engagement.

- Bitcoin was the best-performing asset over the past 24 hours with a +2.89% gain.

- Ethereum recorded the worst 24-hour performance, dipping by -1.25%.

- Bitcoin (BTC) makes up 33% of the total portfolio, valued at $5,637.91.

- Current BTC balance is 0.60205315 BTC, with a market price of $9,364.48 per BTC.

- Bitcoin price surged by +7.14% in the last 24 hours, contributing significantly to the portfolio gain.

Exodus Wallet User Growth and Active Users

- Q2 2025 ended with 1.7 million Quarterly Funded Users (QFUs), up 13% YoY.

- Monthly Active Users (MAUs) at the end of Q2 were 1.5 million, unchanged from Q2 2024.

- Exodus saw a temporary MAU spike to 2.2 million in May 2025 due to Passkeys Wallet.

- Of those, ~675,000 users were Passkeys Wallet users, driven by a promotion.

- Passkeys Wallet MAUs dropped significantly by August, down to ~11,000.

- Exodus Wallet has consistently ranked among the top 10 crypto wallets by global downloads.

- The company regularly reports user activity in monthly metrics updates.

- Despite a dip in swap volumes, user engagement remained relatively stable through Q2.

- User retention is driven by ease of use and support for multiple assets.

Number of Supported Cryptocurrencies and Blockchains

- Exodus supports over 100 cryptocurrencies, including BTC, ETH, SOL, ADA, and DOT.

- More than 40 blockchain networks are compatible with Exodus Wallet.

- Users can store and manage both native coins and ERC-20 tokens.

- Staking is available for 11 different tokens, including Cosmos, Cardano, and Polygon.

- The wallet supports stablecoins like USDC and Tether across Ethereum and Tron.

- NFT functionality is available for selected blockchains like Solana and Ethereum.

- Exodus actively adds new assets through software updates.

- Many DeFi tokens are also supported via Ethereum and Binance Smart Chain.

- The asset list is customizable within the wallet, enabling users to hide unused tokens.

- No third-party custodians are involved; assets remain in the user’s control.

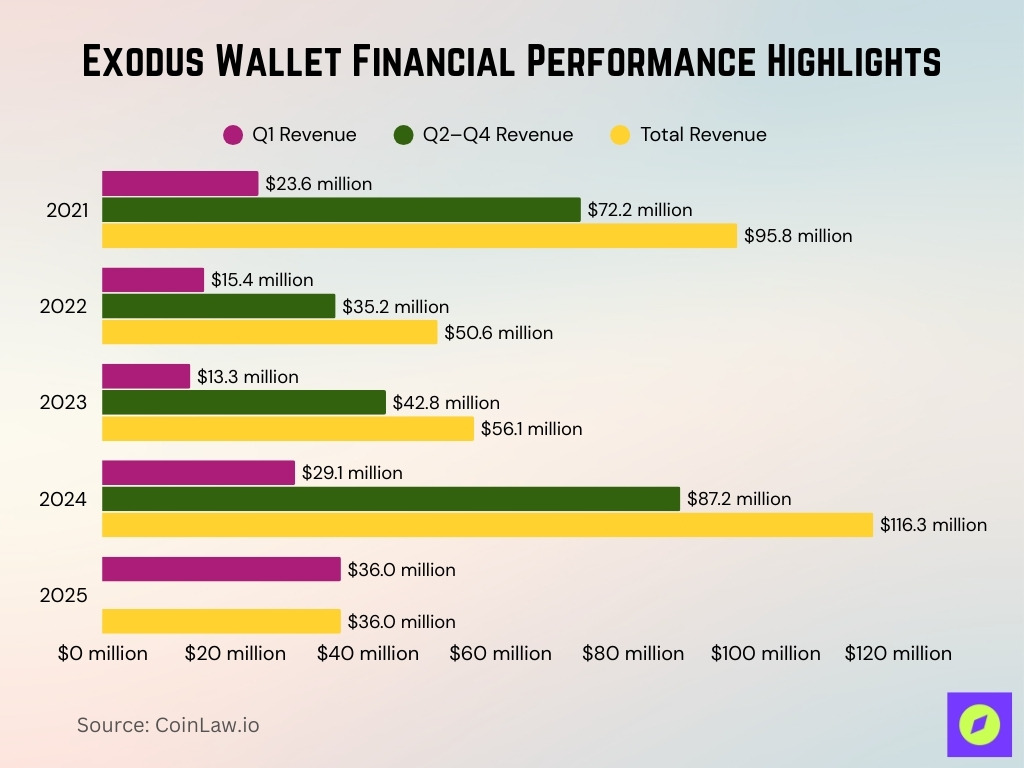

Exodus Wallet Financial Performance Highlights

- Revenue in 2021 totaled $95.8 million, with $23.6 million in Q1 and $72.2 million across Q2–Q4.

- Revenue in 2022 dropped to $50.6 million, with $15.4 million in Q1 and $35.2 million from Q2–Q4.

- In 2023, revenue recovered slightly to $56.1 million, including $13.3 million in Q1 and $42.8 million in Q2–Q4.

- 2024 marked the peak, with total revenue hitting $116.3 million, led by $87.2 million in Q2–Q4 and $29.1 million in Q1.

- For 2025 (Q1 only), Exodus already posted $36.0 million, signaling strong early growth.

- The company runs a scalable operating model with relatively fixed costs, making it durable in bear markets and profitable in bull markets.

- User acquisition is driven by paid ads, word-of-mouth, YouTube, social media, and partner integrations.

- As of March 31, 2025, Exodus reported $238 million in assets and held no outstanding debt.

Transaction Volume and Swap Statistics

- Q2 2025 processed swap volume was $1.38 billion, down from $2.2 billion in Q1 2025.

- Exchange provider volumes varied month-to-month: $486 million in May, $446 million in June, $632 million in July, and $572 million in August.

- Swap revenue accounted for 70-80% of total revenue historically, though the exact Q2 ratio is not disclosed.

- Bitcoin accounted for 19% of Q2 swap volume, the highest of all assets.

- Tether on Tron and Ethereum networks made up 30% combined of processed volume.

- Ethereum contributed 10% of the total volume, followed by Solana and USDC at 6% each.

- Exodus partners with XO Swap for additional liquidity aggregation and swap execution.

- Swap slippage and gas fees vary depending on network congestion and asset.

- Users can preview all transaction details, including fees, before finalizing a swap.

- Exodus does not take custody of funds during swaps; they are routed through decentralized or partner-based exchanges.

Assets and Funds Held by Exodus

- As of June 30, 2025, Exodus reported digital and liquid assets totaling $291.2 million.

- Holdings included 2,058 BTC (~$220.5 million), 2,729 ETH (~$6.8 million), and $58.1 million in stablecoins and cash equivalents.

- BTC holdings increased month over month: 2,038 BTC in May, 2,087 in July, 2,116 in August.

- ETH holdings rose slightly each month as well, reaching 2,756 ETH by August.

- Solana holdings saw rapid growth: 29,109 SOL in May to 43,738 SOL in August.

- Exodus holds no debt as of the latest financial reports.

- A majority of its assets are held in volatile digital currencies rather than stable instruments.

- Monthly treasury updates disclose real-time changes in asset allocations.

- These holdings are part of Exodus’s corporate treasury and not user assets.

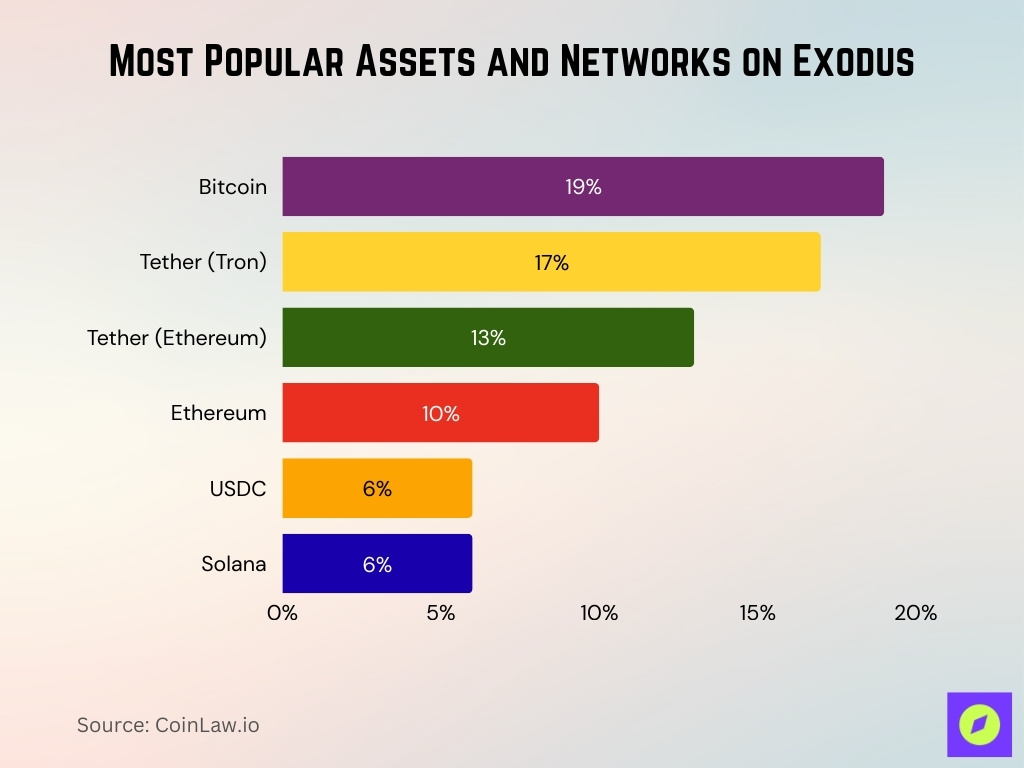

Most Popular Assets and Networks on Exodus

- Top traded assets in Q2 2025: Bitcoin (19%), Tether on Tron (17%), Tether on Ethereum (13%), Ethereum (10%), USDC (6%), Solana (6%).

- Combined Tether usage across networks comprised nearly 30% of volume.

- Ethereum remains one of the top four traded assets, but has lost share to stablecoins.

- USDC and Solana each made up about 6% of total swap volume.

- The rise of stablecoins indicates growing demand for on-chain liquidity and stability.

- Solana’s increasing share aligns with rising holdings in Exodus’s treasury.

- Exodus continues to reflect overall market trends in its most-used assets.

Exodus Wallet Revenue and Financial Statistics

- Revenue in Q2 2025 was $25.8 million, up 16% from Q2 2024.

- Net income reached $37.7 million, a significant improvement over last year’s loss.

- General & administrative expenses were $18.8 million, up from $9.1 million YoY.

- Development and user support expenses grew to $14.7 million in Q2 2025.

- Exchange provider volume for Q2 was $1.38 billion, down from Q1’s $2.2 billion.

- Quarterly funded users increased to 1.7 million.

- Monthly active users held steady at 1.5 million.

- Operating margins improved due to higher Bitcoin holdings and rising asset values.

- Swap service revenue remains the primary income driver for Exodus.

Exodus Wallet Staking Statistics

- Exodus supports staking for Ethereum, Solana, Tezos, Cardano, Aptos, Polygon, Cosmos, Kava, Injective, Axelar, and Osmosis.

- Auto-restaking is available for selected tokens like Cosmos and Kava.

- Staking rewards can be compounded once thresholds are met (e.g., 0.25 ATOM).

- Unstaking periods vary: Cosmos has a 21-day cooldown after unstaking.

- Annual Percentage Yields (APY) vary by asset and network performance.

- Users stake through third-party validators, not directly through the Exodus infrastructure.

- Smart contract and slashing risks are disclosed transparently.

- Exodus does not release centralized Total Value Staked (TVS) numbers.

- Staking calculators are embedded in the wallet interface.

Customer Support Performance

- Average response time in Q2 2025 was under 60 minutes.

- Exodus employs approximately 210 FTEs, including support staff.

- Support channels include email and live chat.

- User reviews note “fast resolution” for most technical issues.

- Complex cases may experience longer wait times.

- Regular reports and documentation reduce the need for user outreach.

- Fee transparency and swap delays are common support topics.

- The company maintains a robust knowledge base and help center.

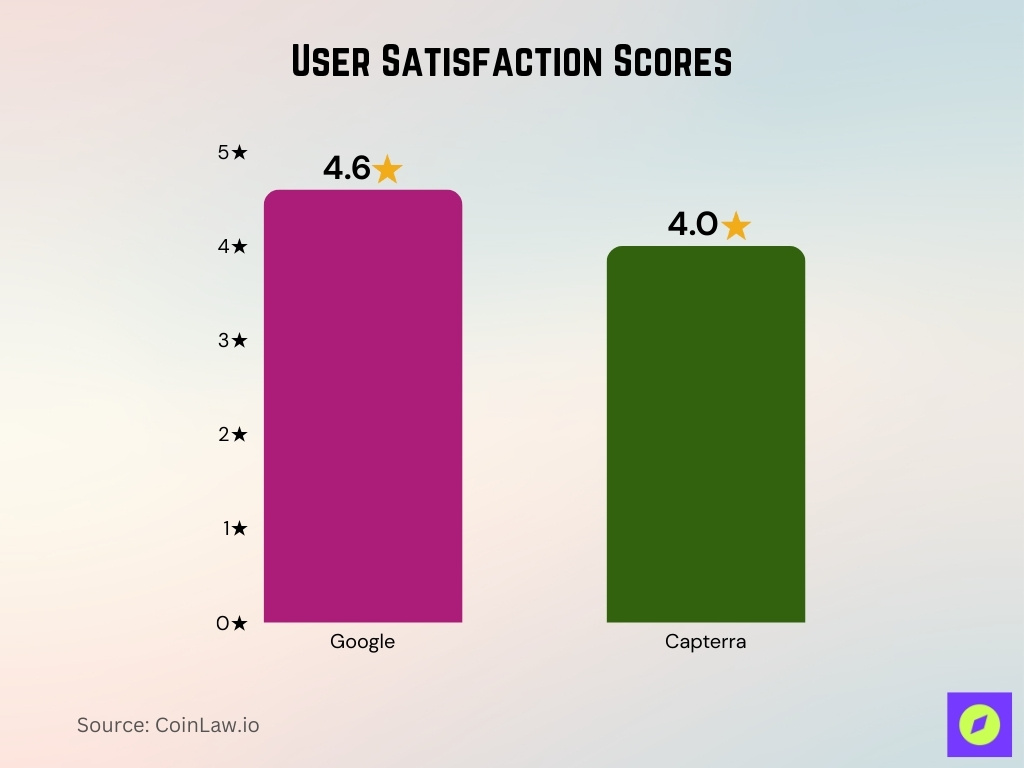

Reviews and User Satisfaction Scores

- Exodus has a 4.6/5 rating on Google as of September 2025.

- It scores 4.0/5 on Capterra based on user reviews.

- Users praise its interface, design, and ease of use.

- Complaints include high gas fees and limited 2FA.

- Ratings for customer service and usability are higher than value-for-money.

- Stablecoin and swap integrations are seen as valuable.

- Advanced users may want more control or developer tools.

- Overall satisfaction remains high across platforms.

Product Updates and New Features

- May 2025 promotion drove MAUs to 2.2 million.

- Passkeys Wallet launched, and later saw a drop in usage to ~11,000 by August.

- Monthly transparency reports include treasury data and volume.

- SOL holdings increased 50%+ over Q2 2025.

- Exchange volumes fluctuated monthly, showing active swap usage.

- Exploration of dividends indicates new shareholder-oriented strategies.

- Ongoing updates enhance UX and asset support.

Frequently Asked Questions (FAQs)

1.6 million MAUs, of which ≈ 11,000 were Passkeys wallets.

Revenue was $25.8 million in Q2 2025 (up ~16% from Q2 2024), and net income was $37.7 million (versus a loss of $9.6 million in Q2 2024).

July volume was $632 million, August volume was $572 million, and ~26% ($149 million) of August’s volume came from XO Swap partners.

Top traded assets were Bitcoin (19%), Tether on Tron network (17%), Tether on Ethereum network (13%), etc., and the two largest (Bitcoin + Tether‑TRX) together made up 36% of total Q2 2025 volume.

Conclusion

Exodus Wallet stands out for its strong financial results, growing corporate treasury, and consistent volume in its swap and exchange services. While MAUs have fluctuated, the core user base remains significant. User satisfaction leans positively, especially for design, ease of use, and multi-asset support, but areas like security features and fee structure show room for improvement. Emerging features like dividend exploration, expanded asset support, and promotion-driven growth suggest that Exodus is aiming not just to retain relevance but to push into new utility territory. As the crypto landscape evolves, Exodus’s balance between user-friendly design and financial strength will likely define its success.