Ethereum ETFs are seeing strong institutional demand with $4 billion in August inflows, but ETH price action remains shaky below resistance.

Key Takeaways

- Ethereum ETFs pulled in $4 billion in August, outpacing Bitcoin ETFs, which faced $622.5 million in outflows.

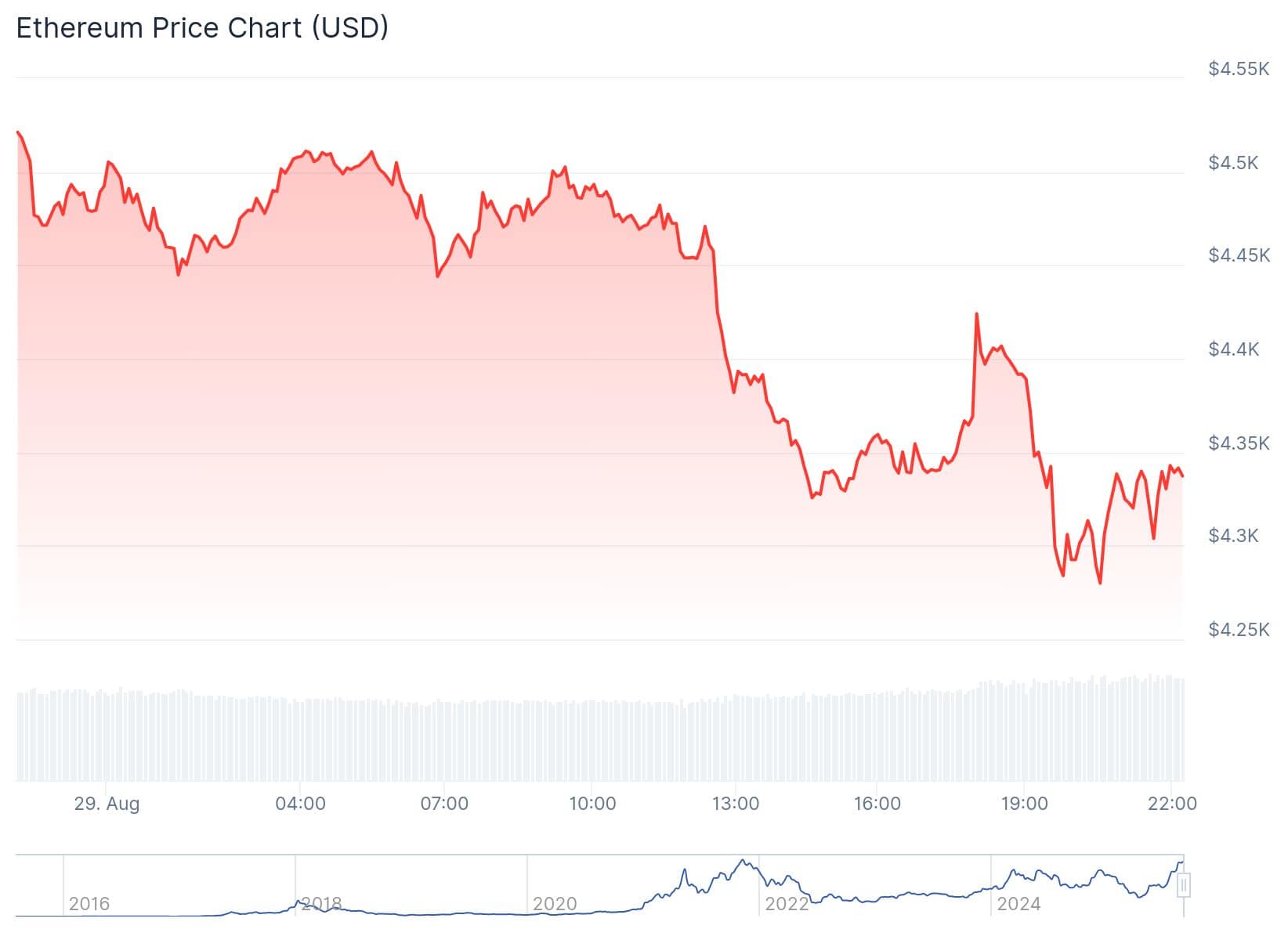

- ETH price fell 6.1% to $4,323, showing signs of bearish momentum despite consistent ETF demand.

- Major institutions like Goldman Sachs and Jane Street are heavily investing in Ethereum, adding credibility to ETH’s long-term role.

- Traders are watching key levels at $4,401 for bullish breakout and $4,174 for bearish breakdown.

What Happened?

Ethereum spot ETFs in the United States are on track to close August with over $4 billion in net inflows, according to data from The Block and SoSoValue. This performance significantly outshines Bitcoin ETFs, which are heading toward monthly net outflows of more than $600 million. Despite the strong capital inflows, Ethereum’s price is under pressure, recently falling below crucial technical levels.

Ethereum ETFs Continue to Attract Institutional Inflows

Ethereum ETFs have seen positive net inflows for five straight trading days, racking up $4 billion in August alone, with $309 million added on Wednesday. These ETFs have gathered $9.5 billion in the past two months, while Bitcoin ETFs accumulated only $5.4 billion over the same period.

- In July, Ethereum ETFs brought in a record $5.4 billion, narrowly trailing Bitcoin ETFs at $6 billion.

- Since their launch in July 2024, Ethereum ETFs have totaled $13.7 billion in lifetime inflows, compared to Bitcoin ETFs’ $54.6 billion, which had a six-month head start.

Major financial players are backing Ethereum heavily. Goldman Sachs, Jane Street, Millennium Management, and DE Shaw are among the top institutional holders of Ethereum ETFs. Even corporate treasuries are piling in. Companies like BitMine Immersion and SharpLink Gaming now hold 3.3 million ETH, valued around $15 billion.

Bitwise CIO Matt Hougan described the buying pressure as a “relentless bid for ETH,” underscoring how Ethereum is solidifying its position as a core asset in institutional portfolios.

ETF Flows in August

— Matt Hougan (@Matt_Hougan) August 28, 2025

BTC: -$800 million

ETH: +4.0 billion

There is a relentless bid for ETH atm.

(h/t @FarsideUK)

Bitcoin ETFs Lag Behind While Ethereum Dominates

Bitcoin ETFs have faced $800 million in outflows this month, losing inflow dominance to Ethereum ETFs over most of August. Ethereum led in daily inflows for seven consecutive days until August 28, when Bitcoin ETFs briefly regained the top spot, with $178.9 million in daily inflows compared to $39.1 million for Ethereum.

Although Bitcoin still leads in daily trading volume, Ethereum is catching up fast. On Thursday, Ethereum ETFs recorded $2 billion in volume compared to $2.5 billion for Bitcoin.

Ethereum Technicals Signal Caution Despite Bullish Fundamentals

Despite the strong demand, Ethereum’s technical chart shows signs of weakening bullish momentum. ETH is currently trading at $4,323, down 6.1% in the past 24 hours.

- ETH was rejected above $4,567, slipping below its ascending trendline.

- It sits below the 50-day EMA at $4,514, but remains above the 200-day EMA at $4,174.

- Indicators like RSI at 35 (near oversold) and a turning MACD suggest growing bearish pressure.

- In the past day, $88 million in ETH positions were liquidated, including $63 million in longs.

Key levels traders are watching:

- Bullish breakout above $4,401 could drive ETH to $4,567 and $4,809.

- Bearish breakdown below $4,174 could lead to declines toward $4,007 and $3,885.

Analysts advise caution: long positions above $4,401 with stops below $4,174, and short positions below $4,174 with stops above $4,401.

CoinLaw’s Takeaway

In my experience, when institutional money starts pouring into an asset like this, it usually means they’re preparing for the long haul. Ethereum is clearly gaining Wall Street’s trust, and that’s not something to brush off. However, I also noticed that price action doesn’t lie. Despite the flood of capital, ETH is struggling to stay above key levels. To me, this feels like a short-term shakeout in a long-term bullish setup. I’d be watching those $4,401 and $4,174 lines closely.