Imagine a world where financial systems run without banks, borders, or bureaucracy, just code. This isn’t a distant vision. It’s the DeFi ecosystem today, which has evolved from experimental protocols to a robust alternative financial infrastructure. Millions of users now rely on DeFi platforms for lending, trading, saving, and yield generation. But how big is it really? Let’s explore the numbers that define this fast-moving market.

Editor’s Choice

- The total DeFi TVL across all chains sits around $130–140 billion in early 2026, up from a post‑FTX low near $50 billion but still below peak bull‑market levels.

- The top 100 DeFi tokens collectively maintain roughly $90–100 billion in market capitalization as liquidity rotates from smaller long-tail assets.

- Ethereum still dominates DeFi infrastructure, commanding about 68% of all DeFi TVL and remaining the primary hub for institutional activity.

- Solana has emerged as a clear secondary hub with about $9.2 billion in DeFi TVL, rivaling the combined major Ethereum L2s.

- Major Ethereum L2s together hold around $9.05 billion in DeFi TVL and over $40.5 billion in total secured assets (TVS).

- On-chain DeFi lending captured roughly two-thirds of the record $73.6 billion crypto-collateralized lending market by late 2025, setting the base for further growth into 2026.

Recent Developments

- EigenLayer’s restaking TVL is about $18.5 billion, giving it roughly 68% of the $26 billion restaking market.

- zkSync Era hosts about $52.4 million in DeFi TVL and $22.4 million in weekly DEX volume, plus nearly $985 million in weekly perps volume.

- On zkSync Era, the stablecoin market cap is around $61.1 million, with USDC representing nearly 90% of the supply.

- EigenLayer has generated around $107.5 million in cumulative fees, with annualized protocol fees near $75.4 million.

- Linea has processed over 283 million transactions and created more than 7 million wallets, leading zk‑rollups by TVL.

- Swiss‑regulated DeFi ETFs and ETPs target yields of about 15% on SOL, 10% on USD, and 7% on CHF within compliant wrappers.

Decentralized Finance Market Growth Highlights

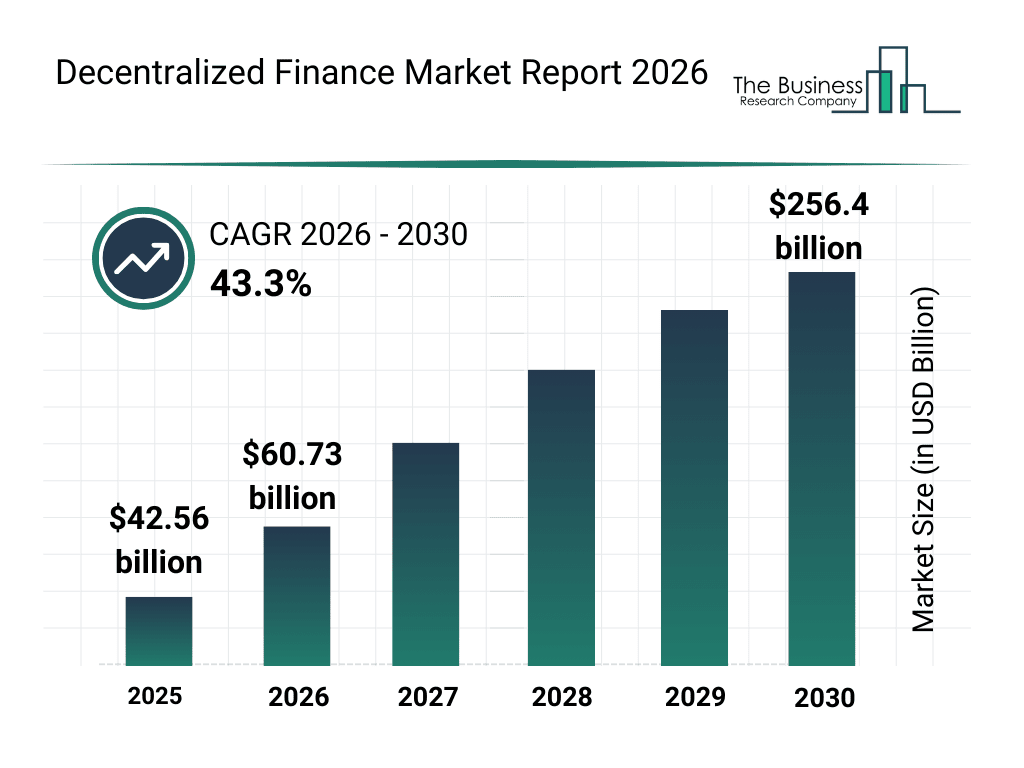

- The global DeFi market is projected to grow to $60.73 billion in 2026, marking a strong year-over-year expansion.

- By 2027, the DeFi market is estimated to surpass $87 billion, driven by expanding use cases across lending, staking, and decentralized exchanges.

- The market is forecast to exceed $125 billion in 2028, supported by rising on-chain activity and Layer-2 scalability improvements.

- In 2029, the DeFi market value is expected to approach $180 billion, as institutional participation and regulatory clarity improve.

- The market is projected to reach $256.4 billion by 2030, representing a more than 6× increase compared to 2025 levels.

- The DeFi industry is expected to grow at a 43.3% CAGR between 2026 and 2030, positioning it among the fastest-growing segments in financial services.

- Sustained growth is fueled by smart contract adoption, tokenized assets, and the shift toward decentralized financial infrastructure.

Decentralized Finance Market Share by Region

- North America accounts for about 36–43% of the DeFi market, retaining the largest regional share by revenue and TVL.

- Europe holds roughly 25–30% of global DeFi activity, supported by MiCA-aligned regulatory frameworks and RWA tokenization hubs.

- Asia Pacific captures an estimated 20–25% share and is projected to grow fastest on the back of mobile-first and inclusion-driven adoption.

- Latin America is estimated to account for around 5–8% of the DeFi market revenue, with crypto usage growing over 60% year-over-year in several countries.

- The Middle East & Africa together contribute roughly 3–5% of DeFi activity, with high potential tied to underbanked populations and remittance use cases.

Decentralized Finance Market by Application

- Savings & yield farming account for about 36.5% of DeFi application revenue, remaining the single largest end-use segment.

- Payments, remittances & cross-border treasury are growing fastest, projected at around 34.7% CAGR over the forecast period as stablecoin rails scale.

- The overall DeFi market size is about $238.5 billion in 2026, projected to reach $770.6 billion by 2031 on a 26.4% CAGR.

- DeFi lending and CDP stablecoins together captured roughly 69% of total crypto borrowing market share by Q4 2024, up from about one‑third in 2020–2021.

- Standalone DeFi lending apps reached about $19.1 billion in open borrows across 20 platforms and 12 chains by the end of 2024.

- The broader DeFi market is estimated to grow from roughly $46.6 billion in 2024 to about $78.5 billion by 2029, implying a >10% CAGR.

Total Value Locked (TVL) in DeFi Platforms

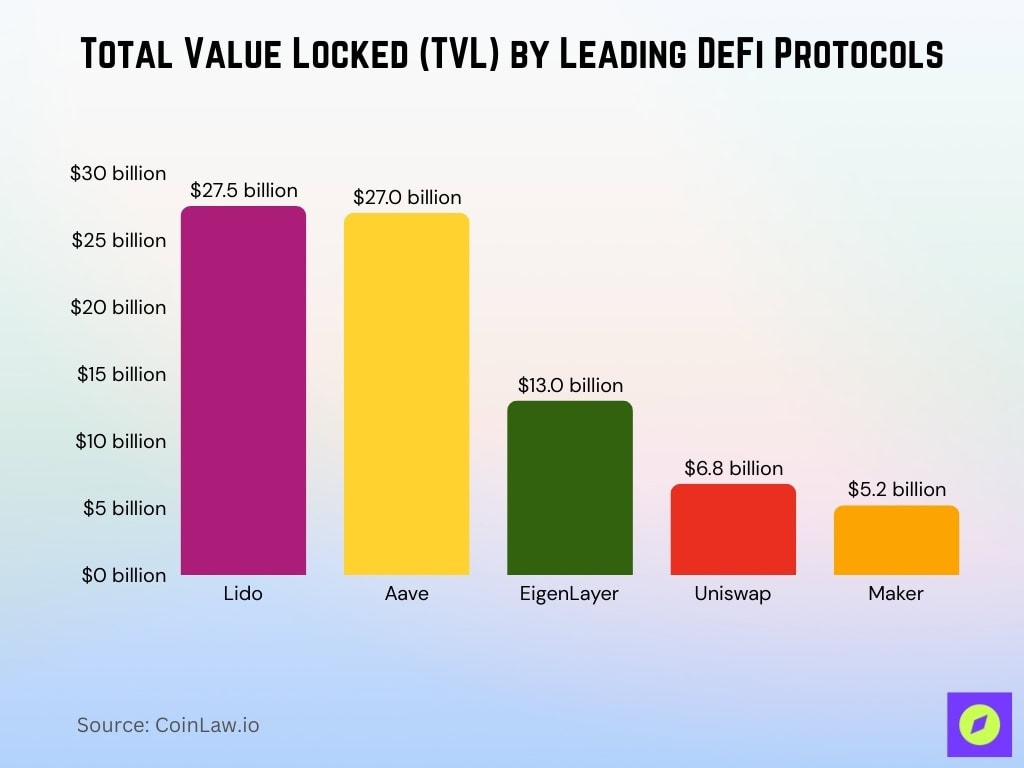

- Leading blue‑chip protocols include Lido with about $27.5 billion, Aave with $27 billion, EigenLayer with $13 billion, Uniswap with $6.8 billion, and Maker with $5.2 billion in TVL.

- Ethereum maintains around 68% of total DeFi TVL, with roughly $70 billion locked across its protocols.

- Bitcoin DeFi TVL stands near $7.0 billion, more than 23% below its October 2025 peak of $9.1 billion.

- BNB Chain currently holds about $6.8 billion in DeFi TVL, down over 25% from its prior peak of $9.1 billion.

- Base’s DeFi TVL is around $4.7 billion, reflecting a drawdown of over 12% from its October 2025 high.

Lending and Borrowing in DeFi

- Lending protocols now command about 21.3% of all DeFi TVL, up from 16.6% at the start of 2024.

- Aave controls roughly 50–62% of DeFi lending, with TVL ranging from about $3.6 billion on its main deployment to nearly $55 billion across versions and chains.

- Compound manages around $2.0 billion in TVL, representing roughly 5.3% of the DeFi lending market.

- Total on-chain real-world asset lending has climbed to roughly $17.5–20 billion in tokenized value, making RWAs DeFi’s fifth‑largest category.

- Tokenized RWA value overall jumped from about $6 billion in 2022 to more than $30 billion by late 2025, nearly a 5× increase.

- Prediction markets linked to speculative borrowing and hedging have reached over $550 million in TVL, led by Polymarket.

- Stablecoin supply, a core driver of DeFi credit and leverage, grew 49% in 2025 to roughly $300 billion outstanding.

Decentralized Exchange (DEX) Volume and User Base

- Weekly DEX trading volume has climbed to about $86 billion, up roughly 12% over the prior week as on-chain trading accelerates.

- Uniswap now processes around $10 billion in weekly volume, with daily trading near $2.02 billion across its deployments.

- PancakeSwap handles roughly $5.54 billion in weekly volume and about $1.12 billion in 24‑hour trading, leading BNB Chain DEXs.

- Meteora tops current DEX rankings with $10.85 billion in 7‑day volume and $2.15 billion in daily trades.

- Raydium records about $2.72 billion in weekly volume, while Aerodrome posts around $2.96 billion, both exceeding $450 million in 24‑hour activity.

- StarkNet‑based perp DEXs collectively surpassed $10 billion in weekly trading volume for the first time, led by edgeX, Paradex, and Extended.

- DEXs account for more than 21% of total crypto trading volume and are forecast to approach 50% market share over the next cycle.

- TokenPocket’s integrated DEX Transit reports over 5 million active addresses and 1 million monthly active addresses, with a 668% surge in transaction volume during 2025.

Market Capitalization of Leading DeFi Tokens

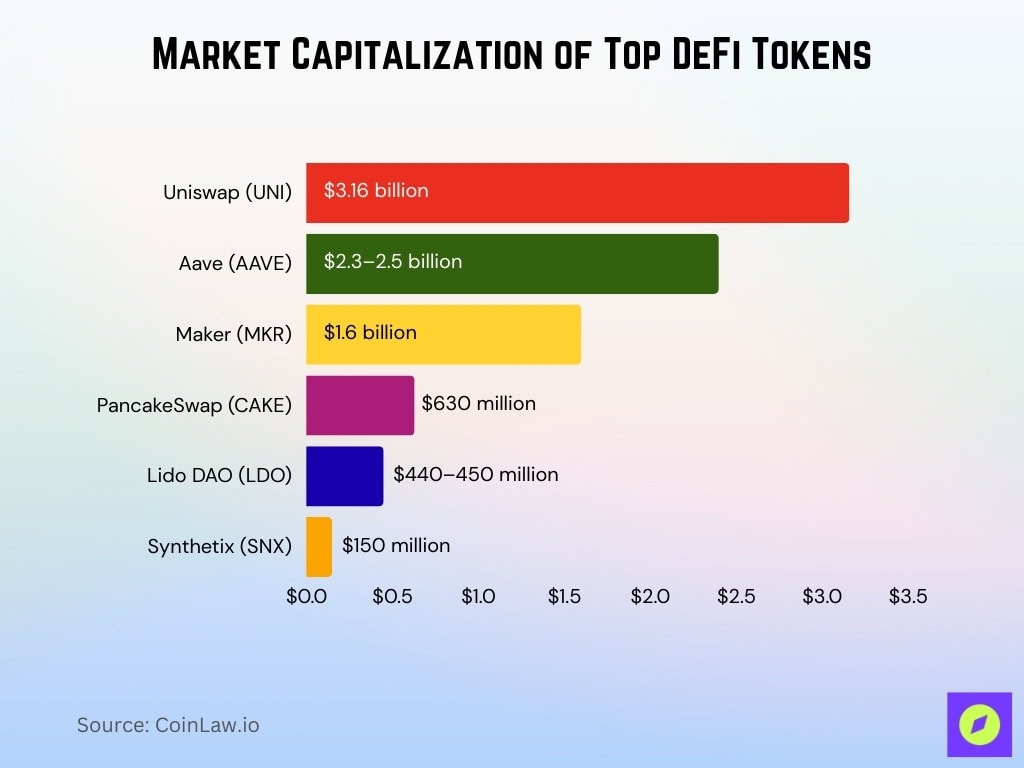

- The DeFi token market cap currently sits around $90–100 billion, reflecting a modest pullback from mid‑2025 levels.

- Uniswap (UNI) now has a market cap of about $3.16 billion, with a price near $4.99 per token.

- Aave (AAVE) trades with an estimated market cap of roughly $2.3–2.5 billion, supported by multichain lending demand.

- Maker (MKR) has a TVL slightly above $5 billion and a token market cap near $1.6 billion, reflecting renewed interest in DAI.

- Lido DAO (LDO) holds a market cap of roughly $440–450 million, alongside a leading liquid‑staking TVL above $30 billion.

- Synthetix (SNX) maintains a market cap of about $150 million, with a circulating supply of about 343 million tokens.

- PancakeSwap (CAKE) records a market cap of roughly $630 million, remaining the dominant DEX token on BNB Chain.

Top Decentralized Finance Investors (All-Time Investment Amounts)

- Capital Management has invested about $1.0 billion into DeFi and Web3 ventures, topping dedicated DeFi investor rankings.

- Far Peak Acquisition has committed roughly $550 million to at least one major DeFi-related company and associated infrastructure.

- GEM Digital has deployed about $531.7 million across 12 DeFi and blockchain companies, including a $50 million commitment to SEALCOIN AG.

- Andreessen Horowitz (a16z) has invested an estimated $4.5–5.0 billion across crypto, Web3, and DeFi startups, remaining the largest sector-focused VC.

- Crypto VC deal data indicates that about $22 billion was invested into crypto startups in 2025, with DeFi infrastructure and applications capturing a substantial share.

- Top crypto VCs such as a16z, Paradigm, Pantera, Galaxy Digital, and Sequoia together account for roughly 40% of the highest-valuation crypto and DeFi rounds.

- Leading Web3 funds typically write DeFi checks in the $250,000–$100 million range per deal, depending on round stage and protocol traction.

Stablecoin Integration and Circulation in DeFi

- USDT dominates with roughly $186–187 billion in market cap and about 60–61% share of the stablecoin sector.

- USDC holds around $76.6 billion in market value, with supply up about 2.3% in a single week and strong DeFi demand.

- DAI/USDS sits near $4.7 billion in capitalization after a weekly increase of about 3.9%, remaining a core DeFi collateral asset.

- Ethena’s USDe supply is about $6.3 billion, with roughly 3.48 billion staked as sUSDe, implying a staking ratio above 55%.

- USDe has climbed back to the third‑largest stablecoin slot with a market cap near $6.47 billion after adding about $162 million in a week.

- Tokenized RWA‑linked stable assets such as USDY and USdai together exceed $1.4 billion in market cap, with USDY alone up more than 12% on the week.

- Emerging stablecoins like USDS, USD1, USDO, and FDUSD each hold between $500–6,200 million in capitalization, contributing to a long tail of DeFi‑integrated dollar tokens.

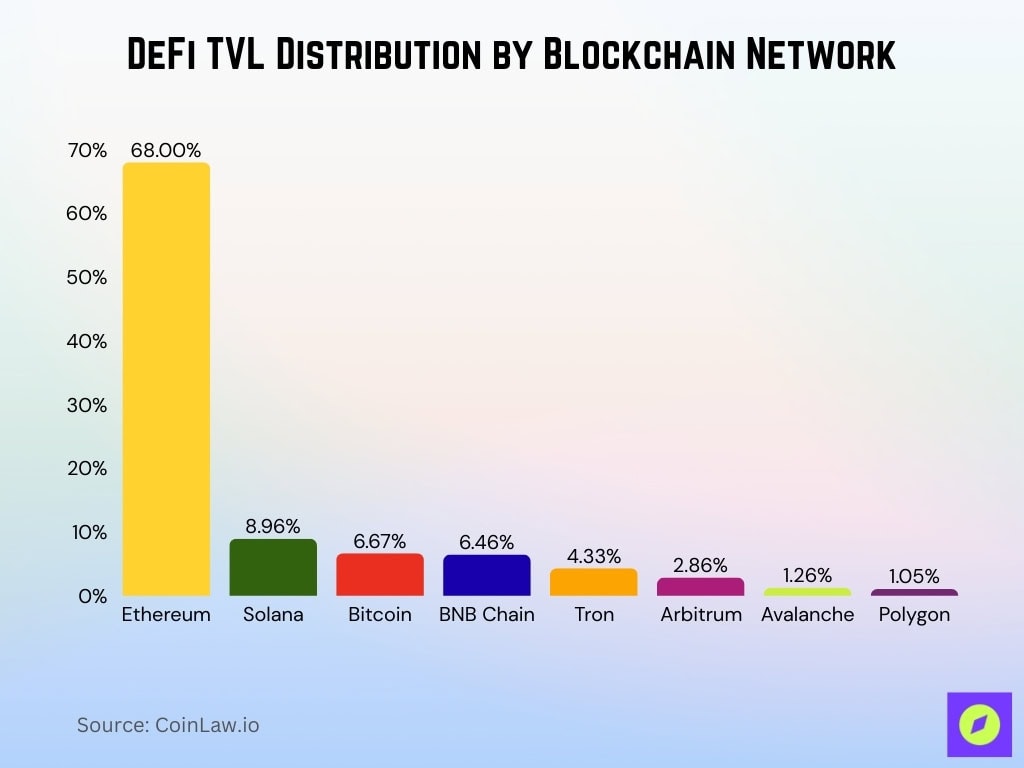

DeFi Protocol Usage by Blockchain (Ethereum, BNB Chain, etc.)

- Ethereum commands about 68% of all DeFi TVL, with more than $90–100 billion locked across protocols.

- Solana is the second‑largest DeFi chain with roughly 8.96% of global TVL.

- Bitcoin ranks third in DeFi with around 6.67% of cumulative TVL.

- BNB Chain holds about 6.46% of DeFi TVL, keeping a solid position among top ecosystems.

- Tron accounts for roughly 4.33% of global DeFi TVL, driven largely by stablecoin and yield activity.

- Arbitrum contributes about 2.86% of DeFi TVL, leading Ethereum Layer‑2 networks.

- Avalanche captures approximately 1.26% of DeFi TVL, supported by gaming and subnet‑based dApps.

- Polygon hosts around 1.05% of DeFi TVL, remaining a key low‑fee EVM chain.

- OP Mainnet (Optimism) sits within the top 10 DeFi chains by TVL share, closing out the leaderboard of major networks.

Security Incidents and Exploits in DeFi

- Total crypto theft reached about $3.4 billion in 2025, with DeFi-related attacks driving a substantial share of losses.

- DeFi security breaches alone exceeded roughly $3.1 billion in 2025, marking about a 40% year-over-year increase.

- Q1 2025 saw a record $1.64 billion lost across 39 hacking incidents, the worst quarter on record for crypto exploits.

- Cross-chain bridge exploits have historically accounted for around 50%+ of DeFi hack value, with more than $3 billion lost on bridges since 2021.

- Access-control flaws were responsible for about 59% of total DeFi losses in 2025, with smart contract bugs adding another $263 million.

- Immunefi has paid out over $112 million in bug bounties to date and advertises more than $180 million in available rewards, claiming to have protected over $25 billion in user funds.

Regulatory Impact on DeFi Markets

- EU MiCA enforcement led to about 120 actions against non‑compliant DeFi and stablecoin issuers by August 2025, while over 75% of EU CASPs registered or transitioned under the new regime.

- MiCA-driven rules contributed to a 12.3% decline in EU DeFi lending activity in Q1 2025 and an 8.5% drop in average DeFi lending yields to around 4.8%.

- EU stablecoin supply grew to roughly €450 billion in 2025, a 37% year‑over‑year increase, while non‑compliant stablecoins like USDT lost about 28% of their European market share.

- Around 5% of DeFi protocols in Europe still support algorithmic stablecoins after MiCA effectively banned the category.

- Over $8.7 billion in stablecoins migrated out of the European DeFi market in 2025 toward more flexible offshore jurisdictions.

- Eight EU member states were piloting dedicated DeFi regulatory sandboxes by Q3 2025, with additional sandbox programs under discussion globally.

- US tax guidance confirmed that non‑custodial DEXs and self‑custody wallets generally are not treated as brokers and do not need to issue Form 1099‑DA, following legislation signed in April 2025.

Institutional Investment in DeFi

- Institutional DeFi and RWA TVL is around $17 billion, with tokenized treasuries and equities now surpassing DEXs as collateral.

- Yield‑bearing stablecoins in institutional treasury strategies grew from $9.5 billion to over $20 billion, offering average yields near 5%.

- Tokenized RWAs were valued at about $297.71 billion in 2024 and are projected to reach $9.43 trillion by 2030.

- On-chain tokenized RWA value rose from roughly $6 billion in 2022 to more than $30 billion by late 2025, a nearly 5× increase.

- Surveys show about 11% of institutions already hold tokenized assets, with another 61% expecting to invest within a few years.

Frequently Asked Questions (FAQs)

The DeFi market is projected to reach about $770.56 billion by 2031.

The decentralized finance technology market is expected to grow at about 26.20% CAGR from 2026 to 2034.

Ethereum hosts more than 63% of the total DeFi TVL.

Conclusion

Decentralized Finance today is no longer a niche; it’s a borderless, programmable, and increasingly regulated sector in locked value and touching nearly every continent. With broader institutional participation, tighter security, and growing regulatory clarity, the DeFi ecosystem is evolving into a parallel financial infrastructure. From wallets in Lagos to hedge funds in New York, DeFi is quietly becoming the rails of tomorrow’s open economy.