The growing demand for crypto asset security has elevated cold wallets from niche tech to essential tools. Whether protecting long-term holdings or ensuring compliance for institutions, these offline storage devices now play a pivotal role. In industries like finance and gaming, cold wallets offer unmatched protection against cyber threats and platform collapses. This article explores the state of cold wallet adoption today, featuring key stats, technology trends, and market insights.

Editor’s Choice

- The global cold storage wallet market (all cold wallets) was valued at about $1,634.5 million in 2024, and is projected to grow at a CAGR of ~9.8% through 2031.

- Hardware wallets account for the largest segment of cold wallets globally, due to stronger security and greater institutional uptake.

- North America held ≈ 40% of the global cold storage wallet revenue in 2024.

- The Asia‑Pacific cold wallet market grew strongly in 2024, with ~23% share of global revenue, and higher growth rates forecasted there.

- The hardware wallet market was estimated at approximately $474.7 million in 2024, with forecasts suggesting it could grow to ~$2.43 billion by 2033, reflecting strong institutional and retail demand.

- Cold wallet adoption among retail investors increased significantly in 2025, with some surveys showing up to 30–34% YoY growth, driven by rising awareness of cybersecurity threats.

- Cold wallet ownership among retail investors rose 34% year-over-year in 2025, reflecting rising security awareness.

Recent Developments

- Investment and interest in cold wallets increased sharply in 2025, driven by concerns over exchange hacks and regulatory pressure.

- Several new hardware wallet devices introduced features like biometric unlocking, Bluetooth/NFC support, and advanced secure chip components.

- Regulatory bodies in key markets, e.g., the US and, EU, have increased scrutiny of crypto custody, boosting demand for cold storage solutions.

- Institutional adoption of cold wallets has risen sharply, with several reports suggesting growth rates of 40–50% year-over-year in 2025, especially among custodial and compliance-focused firms.

- North America has passed new standards and best practice guidelines for custody, some require multi‑signature custody for certain institutional funds.

- Growth in cold wallet providers offering insured or audited storage products, hardware + vaults, for high net worth and institutional clients.

- A shift toward more user‑friendly cold wallets, improved UI, mobile‑app integration, and more accessible seed‑phrase or backup recovery.

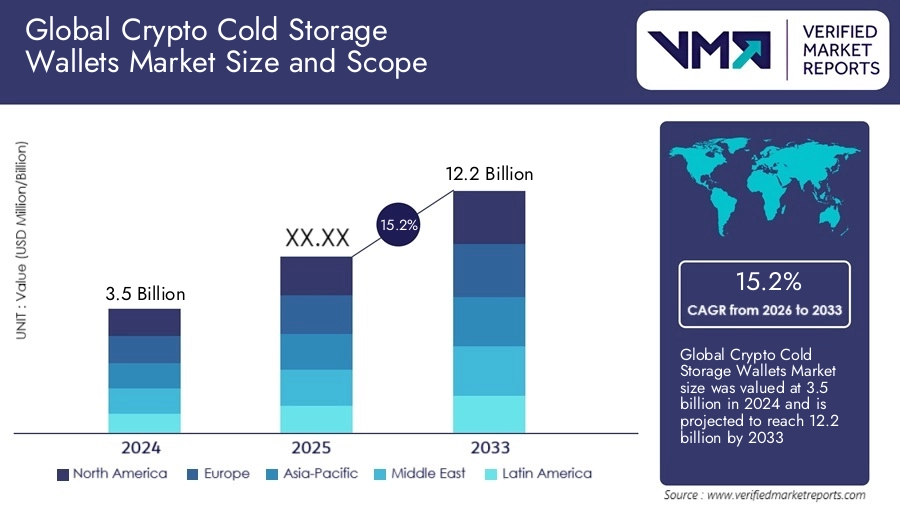

Global Crypto Cold Storage Wallet Market Highlights

- The market was valued at $3.5 billion in 2024.

- It is projected to reach $12.2 billion by 2033.

- The market will grow at a strong CAGR of 15.2% (2026–2033).

- Growth is driven by rising demand across North America, Europe, Asia-Pacific, the Middle East, and Latin America.

- Cold wallets are becoming essential as crypto adoption expands in both institutional and retail markets.

Cold Wallet Adoption Rates

- Among retail investors, cold wallet ownership rose by 34% YoY in 2025.

- Institutional wallet usage surged by 51% in 2025.

- Despite growth, hot wallets still dominate primary storage choices; ~78%‑80% of crypto users use hot wallets as their main storage method in 2025.

- Cold wallets represent approximately 22‑30% of the total wallet type revenue share in 2025, depending on definitions.

- The hardware wallet segment is expanding rapidly; market forecasts for 2024‑2025 show ~23‑25% growth rates.

- In the U.S., cold storage usage is higher among experienced cryptocurrency holders and among those with portfolios above certain thresholds.

- Awareness of cold wallets’ security benefits correlates with adoption. Surveys show rising concern over hacks pushes more users to adopt cold storage.

Growth Trends in Cold Wallet Usage

- The cold storage market is forecast to grow from $1,634.5 million in 2024 to higher levels by 2031, reflecting continuous demand.

- Hardware wallets specifically are expected to grow at a CAGR of ~23.5‑25.9% from 2025 to 2033.

- Asia Pacific is one of the fastest‑growing regions for cold wallet usage, with growth rates forecasted at ~11‑13% CAGR in several APAC markets.

- Europe also shows robust growth, with several key markets, the U.K., Germany, and France, forecasted to increase usage at ~7‑9% CAGR from 2024‑2031.

- North America, while already large, continues to have strong incremental growth due to institutional and regulatory drivers.

- Device innovations, USB‑C, NFC, and mobile‑friendly cold wallets, are widening the user base, especially among less technical users.

- Hybrid models, e.g., offline software wallets combined with hardware signatures, are gaining traction.

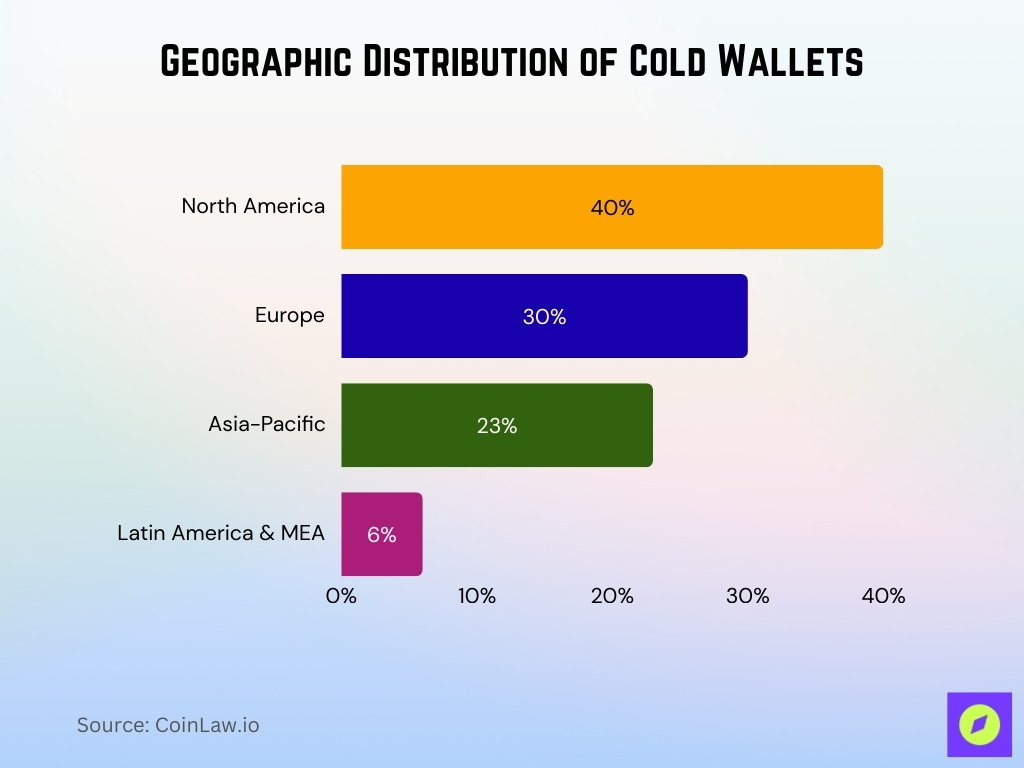

Geographic Distribution of Cold Wallets

- North America accounted for more than 40% of global cold storage wallet revenue.

- Europe held about 30% of the revenue share.

- Asia‑Pacific represented ~23% of revenue, with countries like China, India, and South Korea showing the fastest growth.

- Latin America and the Middle East & Africa had smaller shares, each under ~6%, but forecasted to grow at comparable CAGRs.

- The U.S. alone had cold storage market revenue of approximately $515.85 million.

- In Asia, India’s market size was around $45.11 million.

- Regions with greater regulatory clarity, North America and Europe, show higher adoption, while regions with less infrastructure lag.

Market Share by Cold Wallet Type

- Hardware wallets lead market revenue share in 2024 among cold wallet types.

- Paper wallets hold a significantly smaller share due to concerns over physical loss and damage.

- “Others”, metal, vault, etc., have modest and growing shares, especially in institutional or high‑net‑worth segments.

- Within hardware wallets, the USB‑connected kind is a large part, ≈ 44.7% share in 2025 for “connection type”.

- By end user, the commercial/institutional segment accounts for a large share of hardware wallet revenue, e.g., ~68.9% in 2025.

- By region, North America is the largest market, then Europe, and then APAC, for the hardware wallet market share.

- Forecasts show that as new hardware wallet types, metal‑backed, air‑gapped, become more affordable, their share will grow.

Leading Cold Wallet Brands and Providers

- The top players in the global cold storage wallet market include Ledger, Trezor, SafePal, Ellipal, KeepKey, Tangem, Cypherock, GridPlus, and BitGo.

- Ledger’s newer models, e.g., Flex, combine Secure Element chips, multiple connectivity options, and wide coin/token/NFT support.

- Tangem’s smartcard‑style wallets are gaining traction for physical durability, EAL6+ secure chip certification, and NFC-based operation.

- Cypherock X1 is notable for “no‑seed phrase vulnerability” designs, using Shamir’s Secret Sharing for backup, making it safer against single‑point failures.

- Among budget cold wallets, models under $200‑250 still compete well based on essential security features, PIN, basic biometric, and durable seed‑backup accessories.

- Many brands are integrating “air‑gap” hardware or discrete backup devices to complement seed phrases.

- Some offerings are reducing dependence on wireless connectivity or battery power to lower attack surfaces.

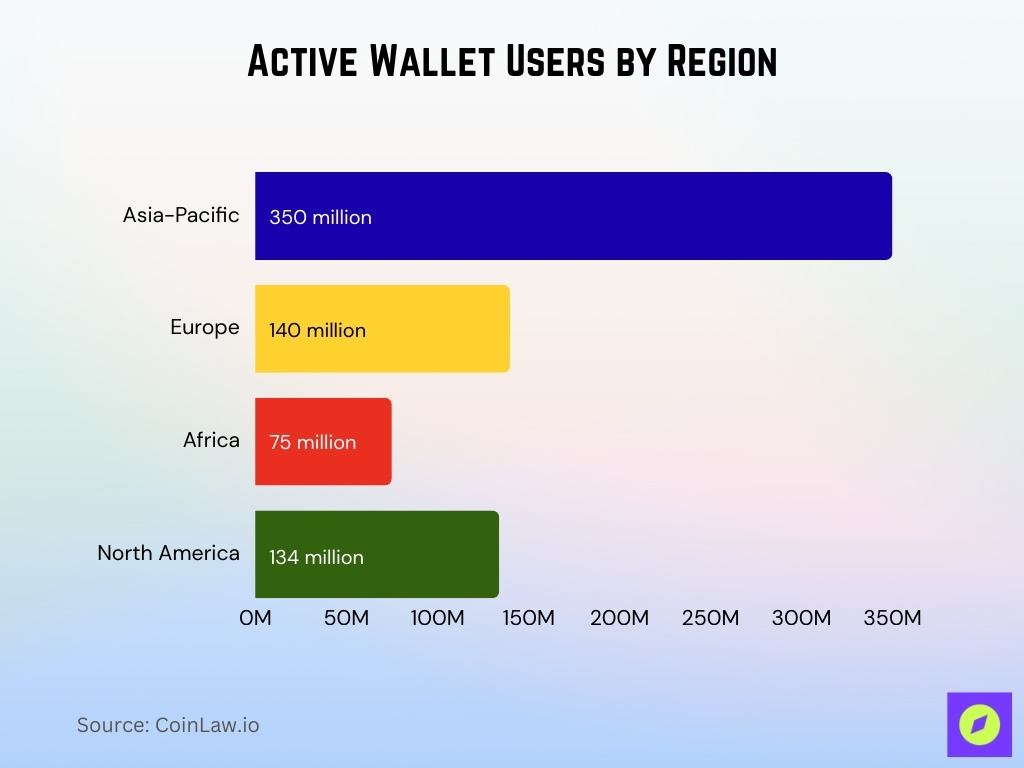

User Demographic Statistics (Retail, Institutional, Regional)

- Regional distribution, crypto wallet users, Asia‑Pacific has ~43% of all active crypto wallet users in 2025, ~350 million out of ~820 million.

- Europe has ~140 million active wallet users in 2025, up ~12% YoY.

- Africa reached ~75 million wallet users in 2025, roughly double from two years prior.

- North America has ~134 million wallet users, ~16% of the global user base.

- Retail users represent ~82% of all crypto wallet holders in 2025, and institutions are remaining ~18% by count, though institutions hold disproportionately more value.

- Institutional wallet ownership grew by ~51% year‑over‑year in 2025.

- Demographics show younger users, ages 25‑34, dominate crypto ownership globally; in many countries, this age group holds the largest share of active wallets.

Cold Wallets vs Hot Wallets Statistics

- In 2025, hot wallets remain the dominant method of crypto storage, used by ~69% of all crypto holders, while cold wallets account for ~30% of primary usage among security-conscious users and institutions.

- Globally, ~78% of all crypto wallet users use hot wallets as their primary wallet, with ~22% using cold wallets.

- The overall hardware wallet market was valued at $474.7 million in 2024, projected to reach $2.4351 billion by 2033, with a CAGR of ~18.93%.

- Cold wallet market size was ~$3.5 billion in 2024, projected to reach ~$10‑12+ billion by ~2032/2033 with CAGR ~15.2%.

- Hardware wallet adoption is growing faster among institutional users, higher % growth year‑over‑year, than among typical retail users.

Cold Wallets in Financial Services, Gaming, and E‑commerce

- In 2024, the global hardware wallet market was ~$474.7 million, with forecasts projecting growth to ~$2,435.1 million by 2033.

- Commercial/institutional users are expected to drive a large portion of hardware wallet demand. In 2025, the commercial segment is projected to hold ~ 68.88% of the hardware wallet market by end user.

- E‑commerce merchants increasingly accept or integrate payment options that rely on crypto wallets, though direct cold wallet involvement is less frequent in daily payments, cold storage is growing for settlement and custody services in payment infrastructure.

- Financial institutions are also building cold storage infrastructure for corporate treasury holdings of crypto, especially following regulation and accounting guidance requiring auditable custody.

- In 2025, more fintechs and payment processors will offer custodial services that include cold storage, insurance, and audit, embedding cold wallet reliance in financial services.

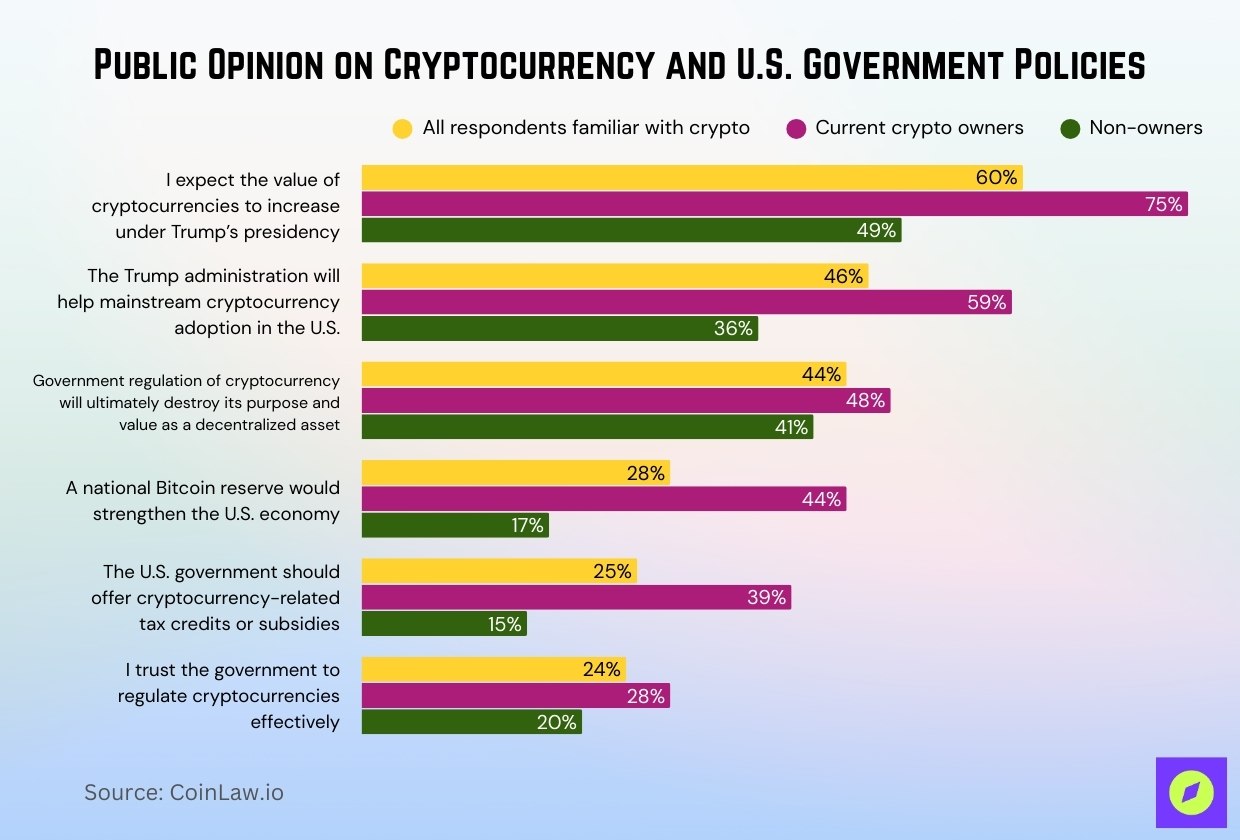

Public Opinion on Cryptocurrency and U.S. Government Policies

- 60% of respondents familiar with crypto expect the value of cryptocurrencies to rise under Trump’s presidency, including 75% of crypto owners vs 49% of non-owners.

- 46% believe the Trump administration will help mainstream crypto adoption in the U.S., with stronger support among crypto owners (59%) than non-owners (36%).

- 44% think government regulation will ultimately destroy crypto’s purpose as a decentralized asset (48% of owners vs 41% of non-owners).

- 28% support the idea of a national Bitcoin reserve, strengthening the U.S. economy, rising to 44% among owners but only 17% among non-owners.

- 25% think the government should provide crypto-related tax credits or subsidies, including 39% of owners vs 15% of non-owners.

- Only 24% trust the government to regulate cryptocurrencies effectively, with slightly higher confidence among owners (28%) compared to non-owners (20%).

Best Practices for Cold Wallet Storage and Backup

- Use multiple backups, seed phrases stored in at least two geographically separate, secure locations.

- Employ metal backups, steel/titanium plates, rather than paper, for seed phrase durability against fire, water, and decay.

- Practice air‑gapped transaction signing, i.e., keeping the device offline when generating signed transactions whenever possible.

- Utilize multi‑signature (multi‑sig) set‑ups for higher value or institutional use, and distribute keys among trusted parties.

- Update firmware from trusted sources only, verify code signatures, and avoid devices with known vulnerabilities.

- Maintain secure element and hardware certification status, e.g,. EAL5+, Common Criteria, especially for institutional / high‑value use.

- Plan for disaster recovery, create a procedure for lost devices or misplaced backups, and consider dividing backups using Shamir’s Secret Sharing.

- Use strong physical security, locked safe, vaults, secure cabinets, and protected environments for storage.

Recovery Rates and Lost Access Incidents

- In 2025, the average transaction volume conducted via cold wallets increased by ~12–14% YoY, reaching an estimated $5,000–$5,300, based on user surveys and provider analytics.

- Data from wallet user surveys show that loss of access, due to lost seed phrase or damaged device, continues to be a key reason for permanent loss.

- Users with backup using a metal plate or multiple seed phrase copies report significantly higher recovery success than those relying solely on paper backups.

- Among retail users, the rate of seed phrase misplacement or improper backup is still substantial; some surveys suggest that up to 20‑30% of users admit to having no reliable backup.

- Some cold wallet devices have introduced “seed‑phrase recovery services” or partial hardware‑based recovery. Adoption is modest but growing.

Trends in Cold Wallet Technology and Innovation

- NFC and Bluetooth‑enabled hardware wallets are growing, for connection type, USB held ≈ 44.67% of the hardware wallet market share in 2025, with NFC segments forecast to grow rapidly.

- Air‑gapped wallets, no direct online connection, are gaining popularity for higher security; devices like Tangem’s smartcard and set‑card wallets are examples.

- Multi‑chain and layer‑2 compatible wallets, wallets that support many blockchains, 5,000+ assets in some cases, are desired by users who hold diversified portfolios.

- UX innovations, more devices attempting to reduce friction, e.g., simpler backup procedures, better companion apps, simpler recovery processes.

- Enhanced certification and audit features for institutional confidence, secure elements, formal audits, standards, SOC‑2, and ISO, increasingly required.

- Alternative backup schemes, using metal, distributed backups, non‑seed phrase backups, e.g., card‑based, are expanding in advanced cold wallet offerings.

Frequently Asked Questions (FAQs)

The hardware wallet market is estimated at $348.4 million in 2025 and is expected to reach $1,527.6 million by 2032, with a CAGR of 23.5% from 2025 to 2032.

In 2025, hot wallets are expected to have about ~69.% of the hardware wallet market share, leaving ~30% for cold wallets.

The average transaction volume through cold wallets in 2025 was $5,000–$5,300, representing an increase of ~14% YoY

The hardware wallet industry is projected to be valued at approximately $680 million in 2025 and is expected to surpass $4,767.2 million by 2035, with a CAGR of 21% over the forecast period.

Conclusion

Cold wallet usage is no longer niche; it’s a growing pillar of crypto security among both individual long-term holders and institutions. The hardware wallet market is expanding rapidly, with a CAGR often in the ~20‑30% range depending on region and segment, as demands for offline safety, multi‑sig features, and robust backup methods rise. Key brands like Tangem, Ledger, and Trezor stand out, and innovation in UX, certification, and backup designs is helping close the gap between extreme security and usability.

For crypto users, the clear choices lie in balancing security, ease of use, and feature set. For institutions, auditability and compliance are increasingly non‑negotiable. As regulatory regimes tighten and user incidents of loss highlight risk, cold wallets will likely grow still more important.