Crypto scams have inflicted billions in losses, while recovery efforts strive to reclaim stolen assets. This rising trend touches everyday investors and financial institutions alike, like how exchanges work with blockchain forensics, and law enforcement cracks down on fraud rings. These concerted efforts shape both preventive and recovery strategies. Read on to see how recovery is faring, statistically and strategically.

Editor’s Choice

- Over $3.1 billion lost to crypto scams and hacks in H1 2025 alone.

- Chainalysis projects that 2025 will end with more than $4.3 billion in stolen value if the trend continues.

- In Q1 2025, over $1.63 billion was lost to hacks.

- Recent efforts resulted in freezing $300 million+ in scam-linked crypto assets.

- Some recovery firms report 94–98% success rates in 2024, though these figures are self-reported and may not reflect independent verification or industry-wide norms.

- Estimates from enforcement agencies and recovery providers suggest recovery rates can average up to 70%, depending on scam type and response speed, though independent validation is limited.

- In stark contrast, some large-scale hacks recover as little as 0.4% of stolen funds.

Recent Developments

- Interpol’s “Serengeti 2.0” crackdown in Africa recovered nearly $97.4 million from cybercrime, including crypto scams.

- T3 FCU initiative (TRON, Tether, TRM Labs, Binance) froze $250 million globally, plus additional tens of millions via allied operations.

- The DOJ’s RICO crypto fraud case highlighted a 0.4% recovery rate in one $1.5 billion-plus theft.

- Recovered crypto may trigger unexpected taxable income, depending on prior theft deductions.

- Professional Crypto Recovery uses forensic methods to unlock wallets, showing that demand for these technical services is rising.

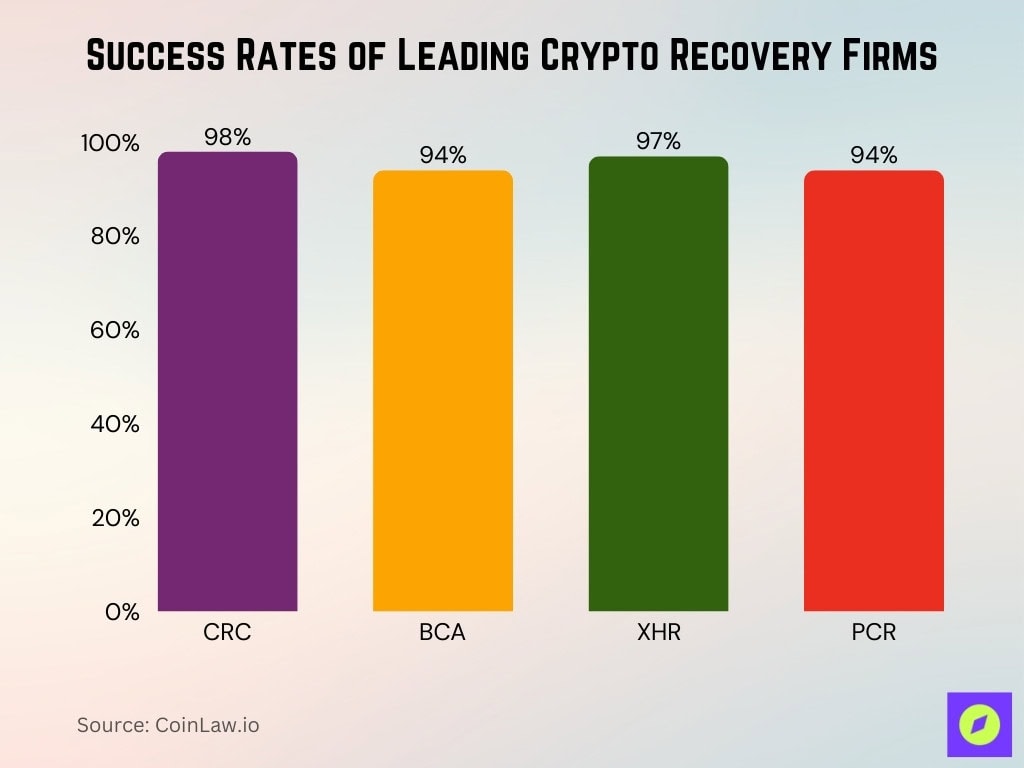

Success Rates of Leading Crypto Recovery Firms

- CRC achieved a 98% success rate, recovering $640 million across 10,000+ cases in 2024.

- BCA has assisted over 12,000 victims with a 94% success rate in formally reported cases.

- XHR reported a 97% success rate, with $715 million recovered in 2024.

- PCR led the field with 94% success, recovering $420 million across 6,000 cases in 2024.

- Top recovery firms report 90%+ success rates; however, these figures are self-reported and may reflect selective case disclosures rather than broad recovery performance across all cases.

Crypto Scam Recovery Statistics Overview

- Investors lost $3.1 billion to scams and hacks in H1 2025, with estimates pointing to $4.3 billion+ stolen by year-end.

- Q1 2025 alone saw $1.63 billion lost to hacks.

- Industry recovery firms report success between 94% and 98% in 2024.

- Yet, in certain hacks, only 0.4% of the stolen value has been regained.

- The wider average recovery across sectors is around 70%.

Global Crypto Scam Losses and Recovery Rates

- 2025 losses could be 17% higher than 2022 totals, based on current growth in illicit crypto activities.

- Chainalysis estimates $2.2 billion was stolen in 2024 as well.

- The global recovery average is roughly 70%, bolstered by cooperation between industries and authorities.

- However, some hacks yield recoveries as low as 0.4%.

- Large-scale seizures and freezes, especially by initiatives like T3 FCU, aim to boost overall recovery totals.

Top 4 Types of Cryptocurrency Scams

- Ponzi Scheme – Promises quick, big profits but relies on new investors’ funds to pay returns, leading to collapse when new investments decline.

- Phishing Scam – Tricks victims into revealing sensitive information by posing as trustworthy exchanges, wallets, or users.

- Cloud Mining Scam – Lures investors with false promises of huge profits through fraudulent mining operations, often disappearing with the investors’ money.

- Romance Scam – Uses fake online profiles to build trust and convince victims to send money or cryptocurrency, usually with little chance of recovery.

Average Percentage of Funds Recovered

- Industry‑wide, recovery efforts return around 70% of stolen crypto assets on average.

- Some recovery firms claim 94–98% success, yet independent firms note such high rates may be overstated.

- In large-scale hacks, actual recovery can be as low as 0.4%, particularly in complex, high-value thefts.

- Law enforcement seizures accounted for $2.4 billion recovered in 2024, up 17% year‑over‑year.

- Recovery rates differ by case size, small wallet thefts see 60–80% recovery, and spectral large hacks hover at <1%.

- Agencies highlight that quicker reporting of thefts often correlates with higher recovery percentages.

- In cases of government‑led recoveries, victims may reclaim crypto or cash, though each affects success rates differently.

Regional Differences in Recovery Success

- In North America and Europe, recovery success hovers near 70–75%, thanks to mature infrastructure and enforcement.

- In Africa, Interpol’s Operation Serengeti 2.0 recovered $97.4 million, showing strong cross‑border cooperation potential.

- Recovery figures in Asia vary sharply; some well‑regulated hubs deliver strong rates, others lag due to less transparency.

- Latin America and Southeast Asia see lower recovery rates, often below 50%, because of fragmented legal recourse.

- By contrast, Australia and Canada, with robust regulatory frameworks, mirror or exceed North American averages.

- Legal obstacles and anonymity lead to especially low recovery in regions with weak KYC/AML enforcement.

- Collaborative frameworks, including shared blockchain analysis, boost recovery success where they exist.

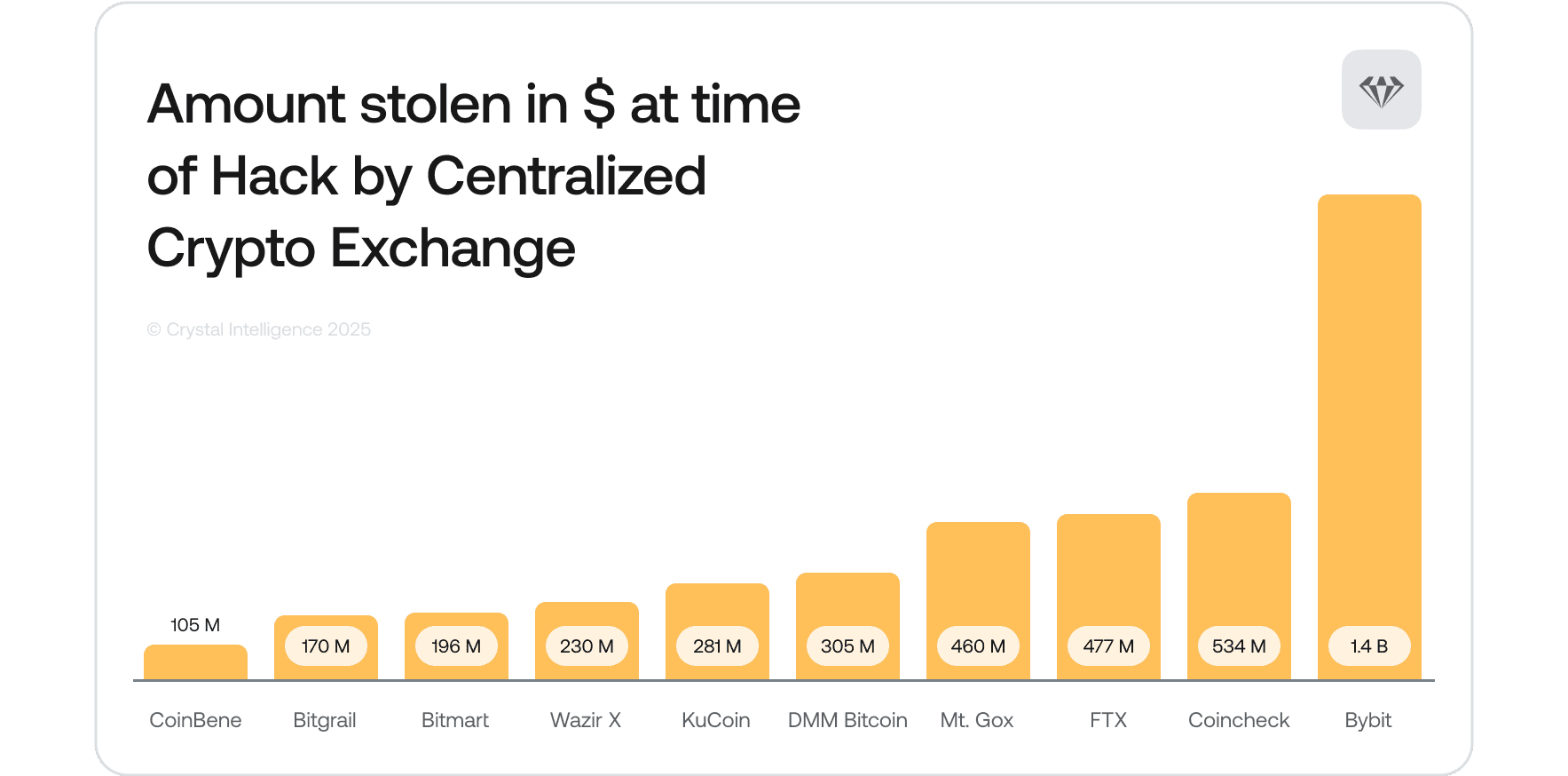

Amount Stolen in Hacks by Centralized Crypto Exchanges

- CoinBene lost $105 million in one of the major exchange hacks.

- Bitgrail suffered losses of about $170 million.

- Bitmart reported a theft of $196 million.

- Wazir X was hacked for around $230 million.

- KuCoin faced losses totaling $281 million.

- DMM Bitcoin saw a hack amounting to $305 million.

- Mt. Gox, one of the most infamous cases, lost $460 million.

- FTX was hacked for approximately $477 million.

- Coincheck recorded one of the largest single hacks at $534 million.

- Bybit tops the list with a staggering $1.4 billion stolen.

Number of Victims Successfully Recovered Funds

- In 2024, U.S. consumers submitted nearly 150,000 crypto scam complaints, though not all led to recovery.

- Leading recovery firms reported serving over 10,000–12,000 victims each in 2024.

- Investment scams caused over $5.8 billion in U.S. losses in 2024, directly affecting tens of thousands.

- Fraud claims doubled in 2024 compared to previous years, reflecting growing victim numbers.

- An estimated 65,000 people were impacted by a major crypto fraud case in Zambia, though official victim confirmation and restitution progress remain limited.

- Nearly 88,000 victims were targeted in Interpol’s recent Africa-focused operation.

- U.S. older people faced a heightened risk, many falling prey to sophisticated scams.

Typical Timeframes for Fund Recovery

- Recovery timelines range from several weeks to multiple months, depending on the complexity of the case.

- For straightforward wallet compromises, successful recovery can occur within 1–3 months.

- Complex hacks involving cross-border laundering often take 6–12+ months.

- Government-led actions under the Crime Victims’ Rights Act may unfold over 1–2 years, due to legal processes.

- Fake recovery services sometimes promise “instant” results; these are typically scams themselves.

- Faster reporting correlates with more efficient retrieval; delays reduce chances and extend timelines.

- Publicized recovery operations, like with Interpol, can conclude in under 3 months for coordinated cases.

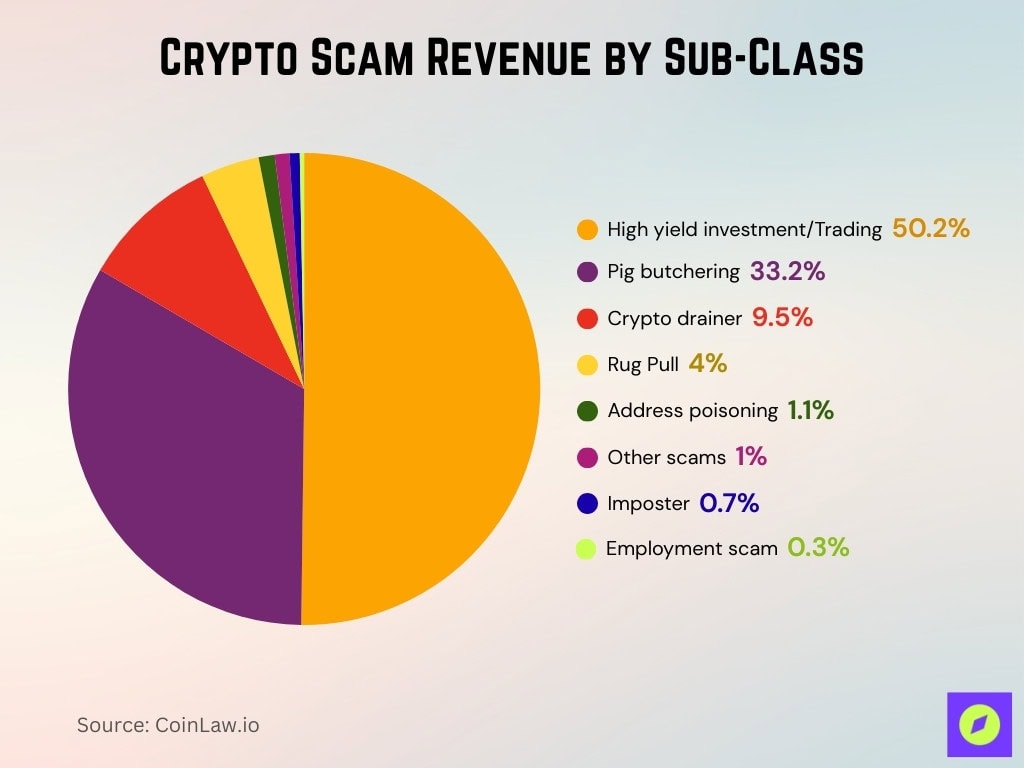

Crypto Scam Revenue by Sub-Class

- High-yield investment/Trading scams dominate, generating 50.2% of total crypto scam revenue.

- Pig butchering scams account for 33.2%, making them the second-largest source of fraudulent gains.

- Crypto drainers contributed 9.5% of scam revenue, targeting wallets and draining funds.

- Rug pulls represented 4.0%, where projects vanish after attracting investor money.

- Address poisoning attacks made up 1.1%, tricking users into sending funds to fraudulent addresses.

- Other scams collectively added 1.0% to the total revenue.

- Imposter scams accounted for 0.7%, using fake identities to deceive victims.

- Employment scams contributed 0.3%, luring victims with fake job offers.

Success Rates by Type of Crypto Scam

- Phishing scams yield lower recovery, often <50%, due to rapid fund movement to mixers.

- Ponzi and HYIP scams have similarly low rates, often below 40–50%.

- Pig-butchering romance scams comprised over 33% of fraud value in 2024, with poor recovery due to emotional manipulation.

- DeFi protocol exploits account for high-dollar losses, but vary; some get 60–70% back via protocol rollbacks or frozen assets.

- SIM-swapping attacks caused $320 million in losses in 2024, with moderate recovery (around 50%) via swift action.

- Crypto ATM frauds led to $29 million in U.S. losses, with very low recovery rates due to anonymity.

- Exit scams/Ponzi ICOs often end with zero recovery, due to jurisdictional and anonymity issues.

Law Enforcement Involvement in Recoveries

- Law enforcement seized $2.4 billion in crypto assets in 2024, a 17% increase over 2023.

- Interpol’s recent operation recovered $97.4 million across Africa and Europe.

- The DOJ’s RICO case recovered just 0.4% of over $1.5 billion in stolen crypto.

- Authorities recovered and froze parts of a Bybit hack via Lazarus-related tracing, though figures are partial.

- Victims may reclaim assets through criminal forfeiture processes under the Crime Victims’ Rights Act.

- Government-led efforts often complement private recovery firms, improving overall success.

- In cross-border cases, coordinated investigations accelerate recovery and prosecution.

Recovery Statistics by Scam Method (Phishing, Ponzi, etc.)

- Pig butcher and HYIP schemes accounted for 50.2% and 33.2%, respectively, of overall crypto fraud value in 2024, with pig butchering growing by 40% year-over-year.

- SIM-swapping attacks caused about $320 million in losses in 2024.

- Crypto ATM fraud in the U.S. resulted in $29 million in losses.

- DeFi protocol exploits remain financially dangerous, and forensic rollbacks or frozen funds sometimes enable 60–70% recovery.

- Phishing scams typically result in poor recovery rates, often <50%, particularly without rapid intervention.

- Exit scams and ICO Ponzi schemes often leave victims with 0% recovery, limited by jurisdictional barriers.

- DeFi scams leveraging obfuscated smart contracts evade detection, analysis frameworks detect these with only ~12% accuracy versus 80% for unobfuscated contracts, complicating recovery.

- ERC-20 scam detection frameworks using transfer-graph models have demonstrated accuracy rates of up to 88.7%, but effectiveness may drop in adversarial conditions or with heavily obfuscated contracts.

Impact of Quick Reporting on Recovery Odds

- The FBI initiative Operation Level Up notified 6,475 victims of crypto investment fraud by July 2025, 77% were unaware they were being scammed, and estimated victim savings hit $400.9 million.

- Early reporting enables law enforcement to trace transactions before funds are laundered, significantly improving outcomes.

- Crypto recovery firms emphasize that reporting within 24–72 hours dramatically increases recovery success.

- Delayed reporting often leads to funds being moved through mixers, reducing traceability and recovery odds.

- Timely reporting can trigger collaborations among exchanges, forensic firms, and regulators under coordinated frameworks like T3 FCU.

- Government guidance underscores that reporting to IC3 or relevant agencies is the essential first step in any recovery process.

- Victims who report quickly may also benefit from law enforcement interventions such as freezing assets or forfeiture procedures.

Legal Actions and Court‑Ordered Recoveries

- Victims may seek restitution through the Crime Victims’ Rights Act, especially in government-led crypto recoveries.

- In the largest U.S. crypto seizure, the DOJ aims to return over $9 billion in Bitcoin from the 2016 Bitfinex hack to rightful owners.

- The $LIBRA rug‑pull in Argentina affected around 44,000 investors, with over 100 criminal complaints filed.

- Jurisdictional investigations continue, class action suits and investigations are underway, linked to political ties in the $LIBRA incident.

- Liquidators of Cryptopia returned NZ$400 million in crypto, around 85–90% of original holdings, to 10,000 account holders.

- In the WazirX hack, legal processes via the Singapore High Court opened creditor meetings and recovery planning for $235 million in stolen funds.

- Courts often appoint crypto forensic specialists to aid tracking and recovery in high-profile cases, as seen with mirror Ponzi schemes like MTI.

Recoveries Facilitated by Crypto Exchanges

- T3 FCU, involving Binance, TRON, Tether, and TRM Labs, froze over $250 million, assisting in recovery operations.

- Chainalysis helped freeze additional “tens of millions” in scams across 14 countries.

- BigONE exchange pledged to fully cover losses from its $27 million hack, working with SlowMist to trace and recover assets.

- CoinDCX launched India’s largest crypto recovery bounty, offering up to $11 million to recover $44 million stolen.

- Exchanges play vital roles by placing token flags on suspect wallets and partnering with trace analysts.

- Some exchanges issue internal reserve payouts to affected users pending recovery results.

- Policies like cold wallet isolation and KYC improvements support efficient recovery by limiting the movement of stolen assets.

Role of Blockchain Forensics in Case Success

- Blockchain analytics firms traced over $4 billion in fraudulent transactions in 2024.

- Internal estimates from forensics firms suggest that AI-driven tools can preemptively detect up to 85% of suspicious activity, though such figures depend heavily on training data and network access.

- Detection frameworks using transaction graphs achieve ~88.7% accuracy in spotting suspicious ERC‑20 token behavior.

- Obfuscation analysis tools like ObfProbe reveal that scam contracts delay detection and obscure recovery paths.

- Forensics underpin operations like T3 FCU and Project Atlas, enabling targeted freezes.

- Recovery firms rely on sophisticated tracing to pinpoint pooled funds across swap paths and mixers.

- Law enforcement leverages forensics to identify funds eligible for seizure or restitution, improving recovery odds.

Rates of Fraudulent Recovery Service Scams

- The FBI warns of fictitious law firms posing as legitimate recovery services, often targeting distressed, older victims.

- These scammers exploit emotional vulnerability and impersonate government agencies for credibility.

- There’s no reliable public data on recovery from such scams, but experts note zero return combined with further victimization.

- Victims often pay upfront fees with no results, leading to doubled losses.

- Verified firms emphasize transparency, no upfront arrangement, and escrowed fees to distinguish themselves from fraud.

- Reporting suspected recovery scams early is advised to aid law enforcement.

- Educative campaigns suggest verifying firm credentials independently before engaging.

Key Factors Affecting Recovery Success

- Speed of reporting remains the top factor; starting investigations promptly improves tracking outcomes.

- Type of scam influences complexity, e.g., pig butchering vs. DeFi exit‑scams yield different recovery paths.

- Geographic region matters; robust legal systems (e.g., U.S., EU) yield better recovery rates than fragmented jurisdictions.

- Blockchain obfuscation techniques make tracing harder and extend case timelines.

- Blockchain forensics and exchange cooperation enhance outcomes, especially for complex laundering chains.

- Legal frameworks like seizure and restitution laws directly enable recovery mechanisms.

- Recovery service credibility affects success; only legitimate firms with verifiable track records deliver returns.

- Public-private collaboration, as seen in T3 FCU and Interpol operations, can lead to high-value freezes and eventual restitution.

Conclusion

Crypto scam recovery today remains a complex, evolving field, marked by both progress and persistent pain points. Across global landscapes, recovery success hinges on speed, cooperation, forensic capability, and legal pathways. While average recoveries sit near 70%, that figure is buoyed by select effective interventions amid many unresolved losses. As practices mature, from Interpol’s coordinated operations to bounty incentives and crypto exchange freezes, victims stand a stronger chance of recouping assets when institutions act quickly, transparently, and in tandem.