Imagine a world where purchasing a cup of coffee with Bitcoin or Ethereum is as ordinary as swiping a credit card. This is no longer a fantasy but a growing reality. The cryptocurrency payments industry has seen an incredible transformation over recent years. The evolution from fringe technology to mainstream payment methods is no longer just a topic for tech enthusiasts; businesses, governments, and everyday consumers are embracing this shift. Let’s explore the latest numbers and trends that outline the progress of crypto payments in the current landscape.

Editor’s Choice

- 39% of U.S. merchants accept cryptocurrency payments, with 88% citing customer demand as the primary reason.

- Approximately 2,300 U.S. businesses accept Bitcoin, excluding Bitcoin ATMs.

- A survey of 619 U.S. payment decision-makers shows 79% adopting digital currency to attract new customers.

- More than 29.9 million different crypto tokens have been created, with Bitcoin, Ethereum, and XRP leading in market value.

- 53% of cryptocurrency owners are men, while women comprise 47%.

- Global payments revenue reached $3.12 trillion, fueled by digital wallets and mobile transactions.

Recent Developments

- Crypto payment adoption grew by 82% from 2024 to 2026, driven by stablecoins and merchant integrations.

- Gucci accepts 12 cryptocurrencies across U.S. stores, targeting Gen Z and Web3 shoppers.

- In 2026, OKX expanded stablecoin services for tokenized assets and regulatory compliance.

- Visa’s VTAP supports stablecoin pilots for cross-border payments with PayPal integrations.

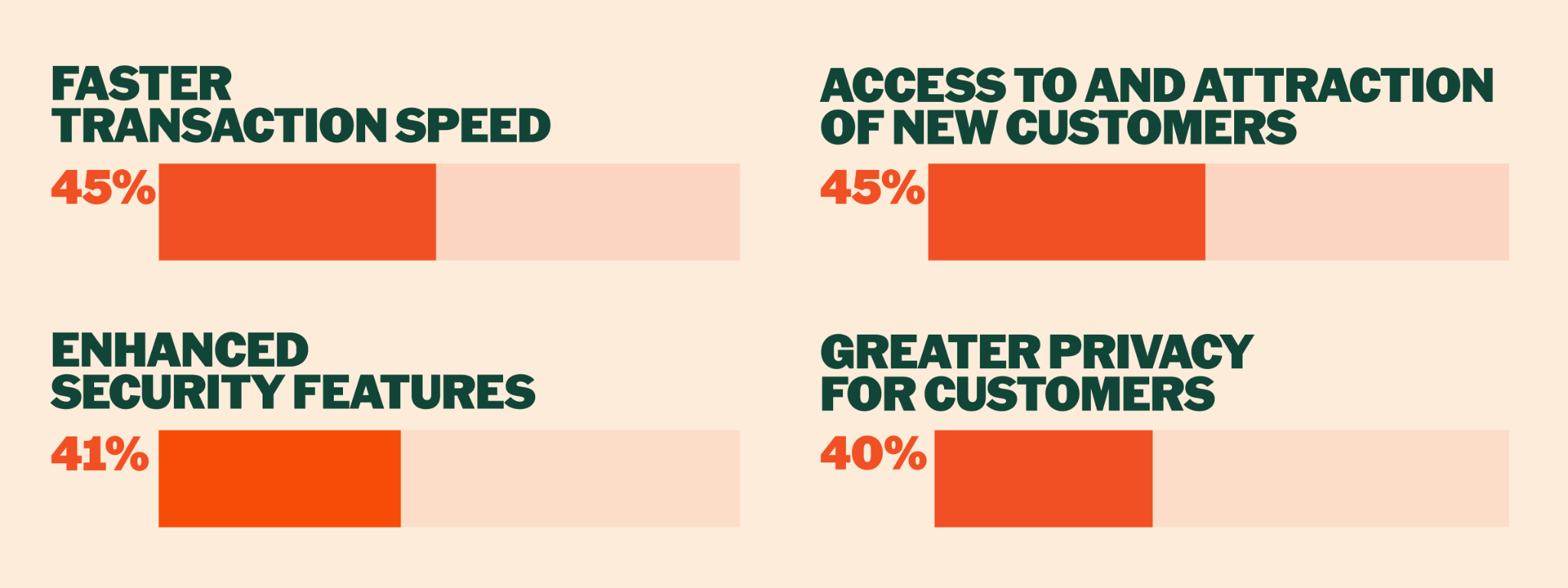

Merchants Cite Key Advantages of Accepting Crypto

- 45% of merchants say crypto offers faster transaction speed, helping them process payments more quickly.

- Another 45% report that crypto helps them attract new customers and reach wider audiences.

- About 41% believe crypto provides enhanced security features, reducing fraud risks.

- Around 40% say crypto delivers greater privacy for customers, which builds trust.

Crypto Payment Gateways Market Trends

- Crypto credit cards with cashback are supported by 72% of top providers.

- Stablecoin transactions represent 82% of crypto payments, led by USDT, USDC, and FDUSD.

- Web3 wallets are embedded in 92% of crypto gateways.

- Biometric security is used by 61% of providers.

- Cross-chain compatibility is offered by 48% of platforms.

- Zero-confirmation payments are adopted by 42% of crypto-friendly businesses.

- Direct NFT transactions are enabled by 18% of payment gateways.

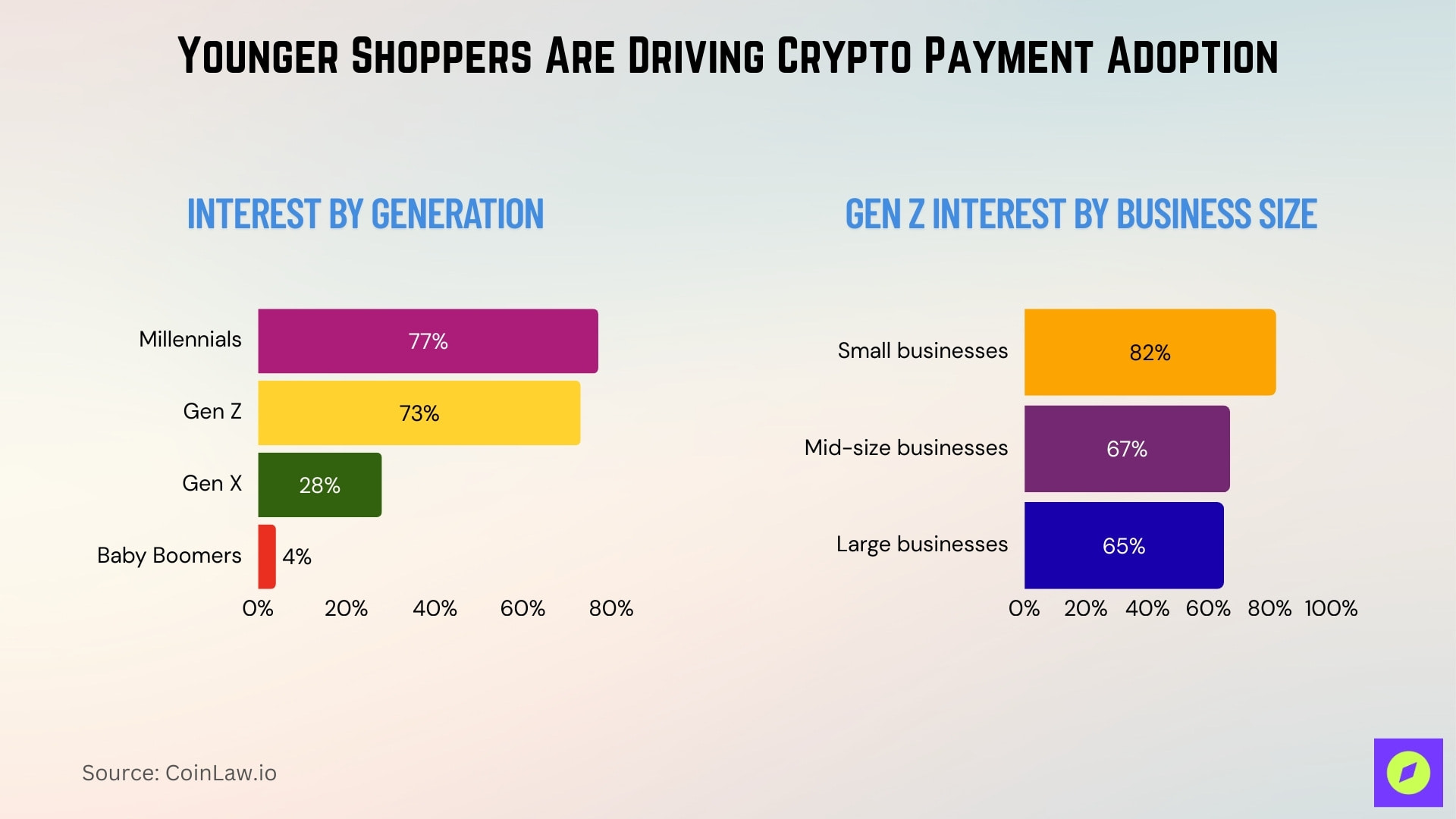

Younger Shoppers Are Driving Crypto Payment Adoption

- Millennials lead adoption, with 77% showing interest in crypto payments.

- Gen Z follows closely, as 73% express a strong interest in using crypto to pay.

- Interest drops among older groups, with Gen X at 28%.

- Baby Boomers show minimal interest, with only 4% considering crypto payments.

- Among Gen Z, small businesses see the strongest demand, with 82% reporting interest.

- Mid-size businesses report 67% Gen Z interest in crypto payments.

- Large businesses still see high demand, with 65% of Gen Z showing interest.

Role of Layer 2 Solutions Like Lightning Network

- Bitcoin’s Lightning Network facilitates 52% of Bitcoin’s payment volume, with instant finality.

- Arbitrum processes 15% of Ethereum-based crypto payments, leading scalable DeFi platforms.

- Optimism powers 11% of Layer 2 Ethereum transactions, reducing costs for retail payments.

- zk-Rollups handle 14% of Ethereum Layer 2 transactions, enhancing speed and privacy.

- StarkNet covers 7% of Ethereum transactions, driven by low-cost DeFi payments.

- Immutable X commands 25% of Layer 2 NFT transaction volume, gas-free for gaming.

- Loopring is used for 8% of Ethereum Layer 2 payments, with high throughput for retail.

- Lightning Network nodes grew 42% year-over-year, strong in North America and Europe.

- Cross-chain Layer 2 solutions account for 20% of total transactions.

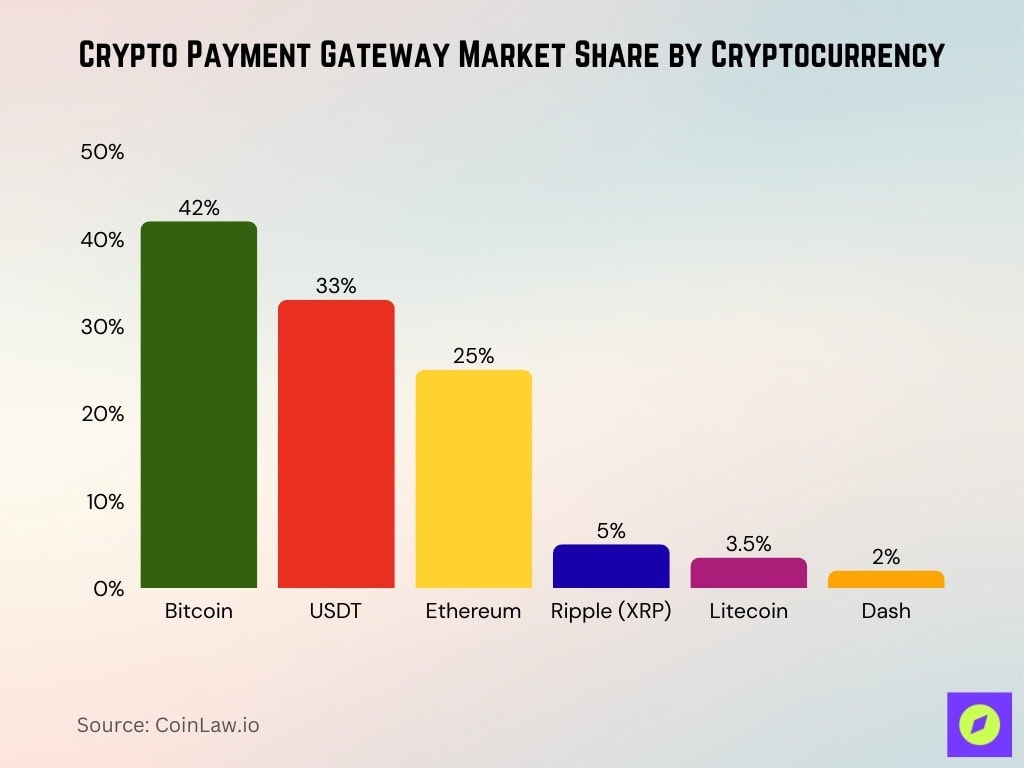

Crypto Payment Gateway Market Share Breakdown

- Bitcoin dominates with a 42% share of crypto transactions in payment gateways.

- Ethereum holds 25% share, driven by DeFi and smart contract payments.

- Litecoin captures 3.5% of the market, valued for speed and low fees.

- Ripple (XRP) represents 5% share, focused on cross-border payments.

- Dash accounts for 2%, chosen for privacy and efficiency.

- USDT leads stablecoins with 33% transaction volume share.

Operating System Insights

- Android accounts for 68% of mobile crypto payments, favored for wallet compatibility.

- iOS users represent 29% of crypto transactions, boosted by secure wallet apps.

- Linux powers 78% of Bitcoin mining operations, valued for blockchain robustness.

- Windows handles 42% of desktop crypto transactions, popular among traders.

- macOS accounts for 16% of crypto desktop transactions, used by professionals.

- Chrome OS sees 6% of mobile crypto wallet downloads, driven by Chromebook growth.

- Wearable OS platforms represent 3% of total crypto payments via smartwatches.

- IoT devices facilitate 1.5% of crypto transactions for micropayments.

- Embedded systems cover 4% of crypto transaction volume in digital regions.

- Blockchain-native OS platforms like Solana Stack gain 2% developer adoption.

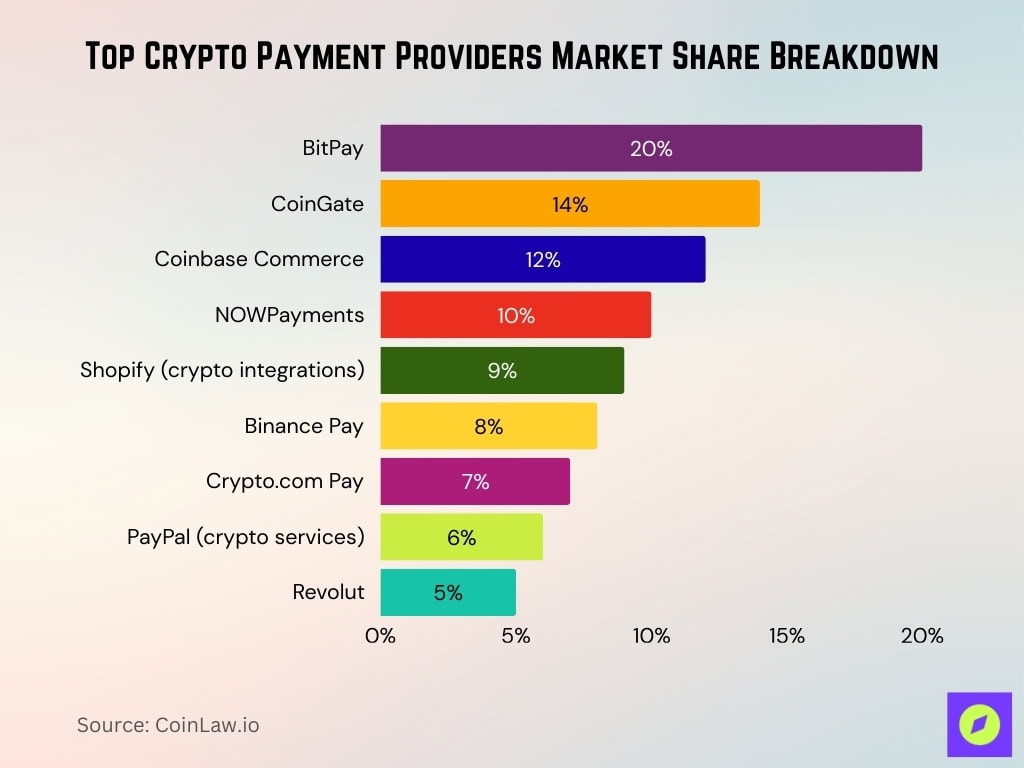

Key Companies & Market Share Insights

- BitPay leads with a 20% market share, dominant in merchant adoption.

- Coinbase Commerce holds 12% share, boosted by institutional integrations.

- Binance Pay ranks third with 8% share, leveraging its global user base.

- NOWPayments commands 10% of the market, popular with SMBs.

- CoinGate secures 14% share, strong in European markets.

- Crypto.com Pay grown to 7% share, with zero-fee attractions.

- PayPal crypto services at 6% share, bridging traditional users.

- Shopify integrates crypto via gateways for 9% of merchants.

- Revolut controls 5% in European crypto payments.

Top 10 Countries by Crypto Ownership Rate

- UAE leads with a 31% crypto ownership rate, the highest globally.

- Singapore ranks second at 24.4%, driven by the fintech ecosystem.

- Türkiye holds 25.6% rate amid economic volatility.

- Vietnam at 21.2%, a major Southeast Asian hub.

- United States shows 15.6% ownership rate.

- Brazil records 12% ownership, Latin America leader.

- Argentina has around 19%, fueled by currency instability.

- Thailand at 17.6%, with rising retail participation.

- Saudi Arabia reports 12.6% ownership rate.

- Philippines at 13.4%, strong adoption growth.

Blockchain Adoption by Industry: Sector-Wise Market Share

- Supply Chain & Logistics at 29.6%, driven by traceability needs.

- The government holds 13% share for identity and public records.

- Healthcare accounts for 8%, securing medical data sharing.

- Media, Entertainment & Gaming 8%, powered by NFTs and rights management.

- Insurance leverages 12% for claims and fraud prevention.

- Manufacturing represents 6%, enhancing supply chain automation.

- Energy & Utilities claim 3%, for trading and grid management.

- Technology Services 6%, in software innovations.

- Professional Services 4%, for smart contracts.

Frequently Asked Questions (FAQs)

39% of U.S. merchants now accept digital assets, up significantly due to customer demand.

Stablecoins account for nearly 60% of all crypto payment activity.

There are over 45,000 crypto ATMs globally.

19% of U.S. small businesses accept cryptocurrency payments.

Conclusion

As crypto payments grow, they represent a significant shift in the global financial landscape, promising new efficiencies and accessibility. While challenges remain, particularly in regulation and environmental impact, innovations in blockchain technology and user demand are propelling forward. The cryptocurrency payments industry is carving out its place, aiming to complement and occasionally even replace traditional financial systems. For consumers and businesses alike, staying informed on trends, regulations, and technological advancements will be crucial as crypto payments continue to evolve.