As the cryptocurrency market matures, asset managers like CoinShares are playing an increasingly pivotal role in bridging traditional finance with digital assets. CoinShares has emerged as a key player driving institutional adoption, regulatory breakthroughs, and innovative crypto-backed products. From its Nasdaq listing plan to expanding its ETF portfolio, the company’s evolution reflects broader shifts in the digital finance ecosystem. This article breaks down CoinShares’ latest financials, product performance, global market reach, and strategic milestones, providing a clear view into one of the most closely watched firms in crypto asset management.

Editor’s Choice

- CoinShares’ total revenue, gains, and other income in Q1 2025 stood at $40.0 million, down from $47.5 million YoY.

- The company’s adjusted EBITDA margin reached 76% in H1 2025, compared to 68% in full-year 2024.

- CoinShares became the first EU asset manager to receive MiCA licensing in July 2025, allowing full cross-border crypto servicing in the EU.

- The firm’s Nasdaq listing via a $1.2 billion business combination is expected to close by December 2025.

- CoinShares Physical Bitcoin ETP (BITC) saw $202 million in net inflows in Q1 2025 after a fee cut to 0.25%.

- 82% of high-net-worth investors prefer advisors offering crypto, according to a 2025 CoinShares study.

- In Q2 2025, CoinShares reported a net profit of $32.4 million, recovering from a dip in Q1.

Recent Developments

- CoinShares signed a business combination agreement to go public on Nasdaq at a $1.2 billion valuation in September 2025.

- The company plans to delist from Nasdaq Stockholm by December 17, 2025, pending approvals.

- In Q1 2025, CoinShares acquired Valkyrie’s ETF business, adding approximately $530 million in AUM.

- It became the first EU asset manager with full MiCA authorization, allowing frictionless operations across EU states.

- The firm launched a PIPE offering of 5 million shares at $10 each, raising $50 million to support expansion.

- CoinShares reported $126.8 million in FY2024 revenues, up from $76.3 million in 2023.

- New institutional-grade staking products and ETH yield tools were rolled out to attract U.S. investors.

- Treasury operations turned profitable in Q2 2025, reversing earlier losses.

- Its U.S. strategy includes targeting RIAs, asset allocators, and digital brokerages.

- CoinShares maintains compliance with Jersey, French, and incoming U.S. regulatory standards.

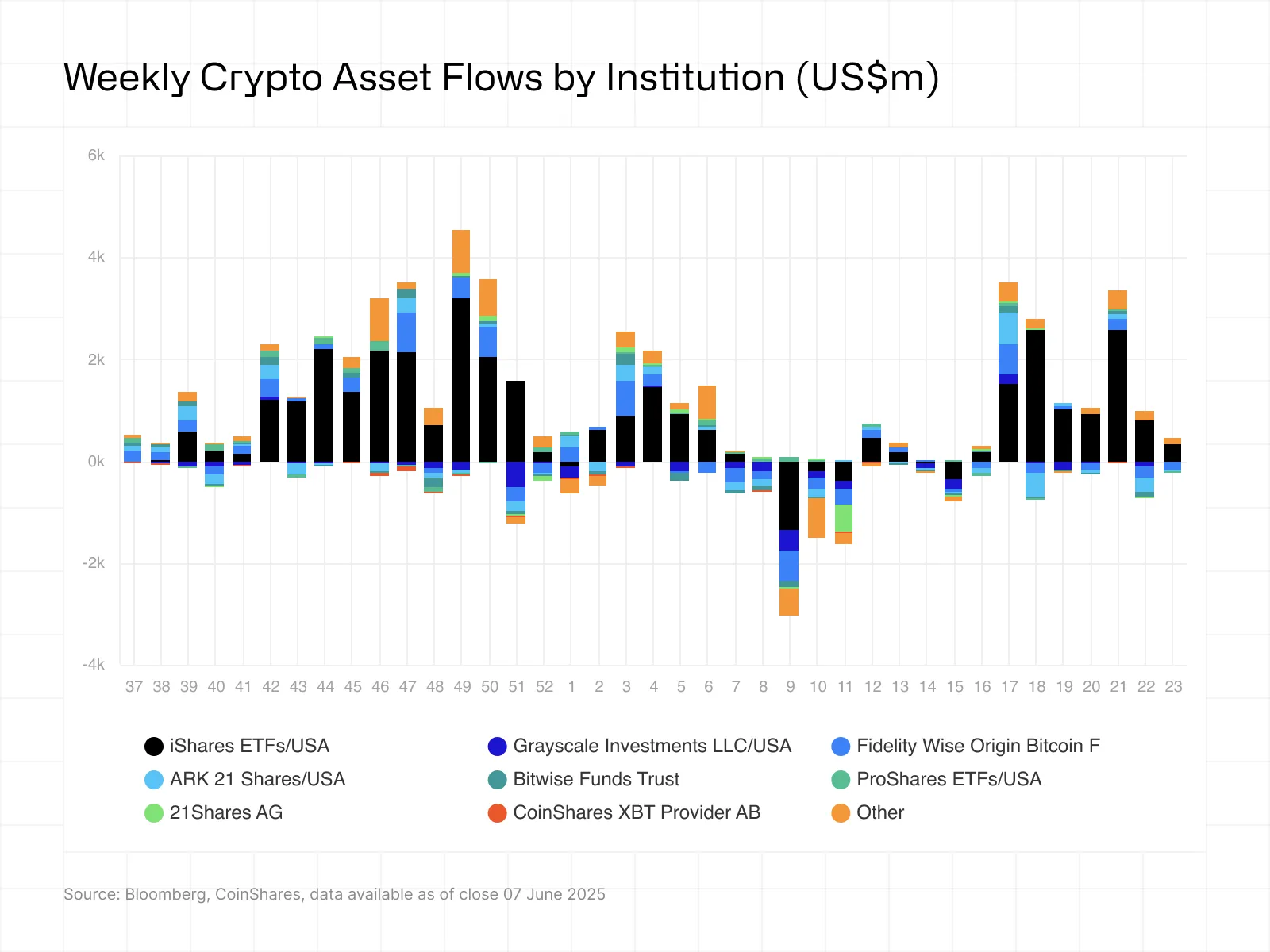

Weekly Crypto Asset Flows by Institution

- iShares ETFs (USA) dominated flows, frequently recording multi-billion inflows, peaking near $4–5 billion in some weeks.

- Grayscale Investments showed consistent activity with both inflows and outflows, highlighting its role as a major institutional player.

- Fidelity Wise Origin Bitcoin ETF and ARK 21 Shares saw steady contributions, often in the hundreds of millions per week.

- Bitwise Funds Trust and ProShares ETFs (USA) provided moderate flows, supporting diversification across institutional products.

- 21Shares AG and CoinShares XBT Provider AB contributed notable European exposure, with weekly volumes often crossing $500 million.

- Other providers added smaller but frequent flows, underscoring the breadth of the ETF market.

- Overall market activity ranged from +6 billion inflows to -4 billion outflows week to week, reflecting high volatility in institutional crypto demand.

Company Overview

- Headquartered in Jersey, CoinShares operates under the Jersey Financial Services Commission license.

- The firm also holds registration with France’s AMF and plans to register with the SEC, FINRA, and NFA in the U.S.

- Its business includes asset management, capital markets, indices, principal investments, and treasury operations.

- In 2025, CoinShares holds over $6.1 billion in assets under management (AUM).

- It employs a hybrid structure combining regulated ETPs, custom indices, and digital market strategies.

- The firm runs CoinShares Capital Markets, one of Europe’s most active crypto trading desks.

- CoinShares is led by Jean-Marie Mognetti (CEO) and Daniel Masters (Chairman).

- Product distribution is active across Europe, the UK, and North America.

- The business now includes U.S. ETF capabilities through the Valkyrie acquisition.

- CoinShares emphasizes transparency, compliance, and institutional alignment in all its operations.

Assets Under Management (AUM)

- As of Q2 2025, CoinShares reports over $6.1 billion in AUM, up from $4.5 billion in Q2 2024.

- The AUM represents a 35% YoY growth, despite volatility in crypto markets.

- Bitcoin-based products account for approximately 65% of total AUM.

- Ethereum-linked products represent about 17% of total assets, slightly down from 2024.

- Alternative crypto ETPs (Solana, Polkadot, Cardano) collectively contribute around $480 million.

- AUM from staking-enabled ETPs grew 58% YoY in Q2 2025.

- The U.S. segment accounts for about $900 million in AUM, primarily via the Valkyrie integration.

- CoinShares Physical, its flagship ETP suite, has seen $1.9 billion in net inflows since 2023.

- Institutional clients account for nearly 72% of AUM, led by wealth platforms and RIAs.

- Passive investment strategies now dominate product allocation, with over 85% of AUM in passive structures.

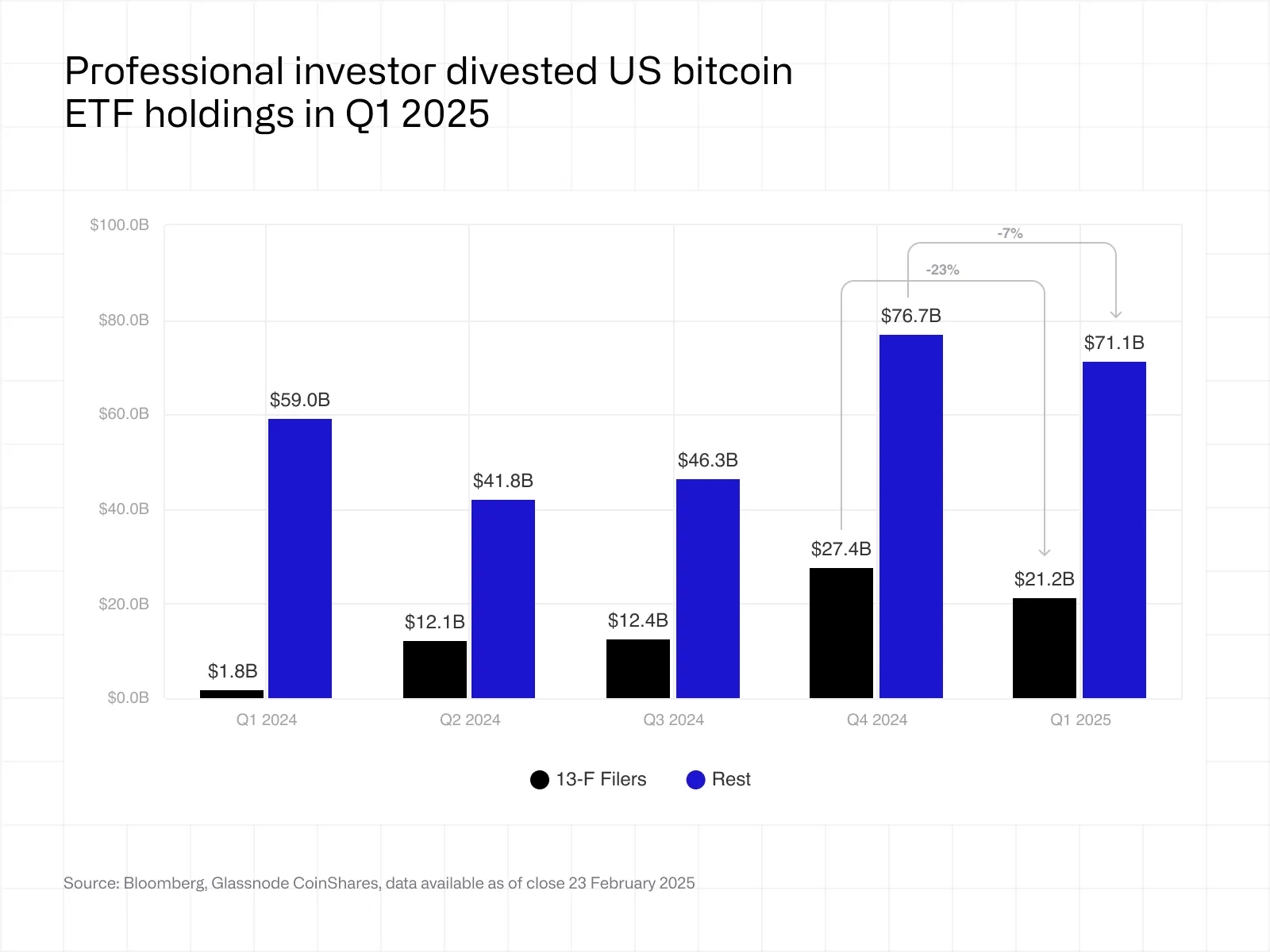

Professional Investor Divestment from US Bitcoin ETFs

- Total US Bitcoin ETF holdings dropped from $104.1 billion in Q4 2024 to $92.3 billion in Q1 2025, a decline of $11.8 billion.

- 13-F filers’ holdings fell from $27.4 billion to $21.2 billion, a sharp 23% decrease.

- The rest of the investors declined more moderately, from $76.7 billion to $71.1 billion, a 7% drop.

- Compared to Q1 2024, when total holdings were just $60.8 billion, overall exposure was still significantly higher despite recent divestment.

- The peak came in Q4 2024 with $104.1 billion, underscoring that Q1 2025 marked the first significant pullback after strong late-2024 growth.

Market Share and Global Ranking

- CoinShares ranks among the top 3 digital asset managers in Europe by AUM.

- It is the largest non-U.S. crypto ETP provider as of 2025.

- Globally, CoinShares is now 6th in total crypto ETP AUM, trailing only Grayscale, BlackRock, Fidelity, 21Shares, and VanEck.

- Within EU-regulated crypto products, CoinShares holds a 32% market share.

- It is the only European asset manager with MiCA authorization as of Q3 2025.

- CoinShares leads the UK market in Bitcoin ETP trading volume, holding over 45% share.

- In 2025, the company expanded distribution to 15 EU countries post-MiCA approval.

- The firm is targeting North American institutional adoption via the Nasdaq listing.

- Its Valkyrie acquisition added ETF exposure to U.S. distribution and boosted market ranking.

- CoinShares has increased brand recognition and inflows in Latin America and Southeast Asia via digital broker partnerships.

Product Portfolio Growth

- CoinShares’ ETP count reached 36 products in 2025, up from 24 in early 2023.

- It introduced 3 new staking-enabled ETPs for Ethereum, Solana, and Polkadot.

- The firm reduced fees across major products, including BITC, to enhance competitiveness.

- A new Multi-Asset Crypto Basket ETP was launched in March 2025.

- Valkyrie Bitcoin ETF (BRRR) added to CoinShares’ U.S. product suite.

- Index-based strategies were enhanced with the BLOCK and META indices.

- CoinShares expanded structured note offerings for wealth clients in France and Germany.

- Digital advisory integrations were established with multiple EU fintech platforms.

- Its active trading strategies (via capital markets) expanded into market-neutral funds.

- Cross-listed ETPs now cover the UK, Germany, Sweden, France, and Switzerland, providing broader access.

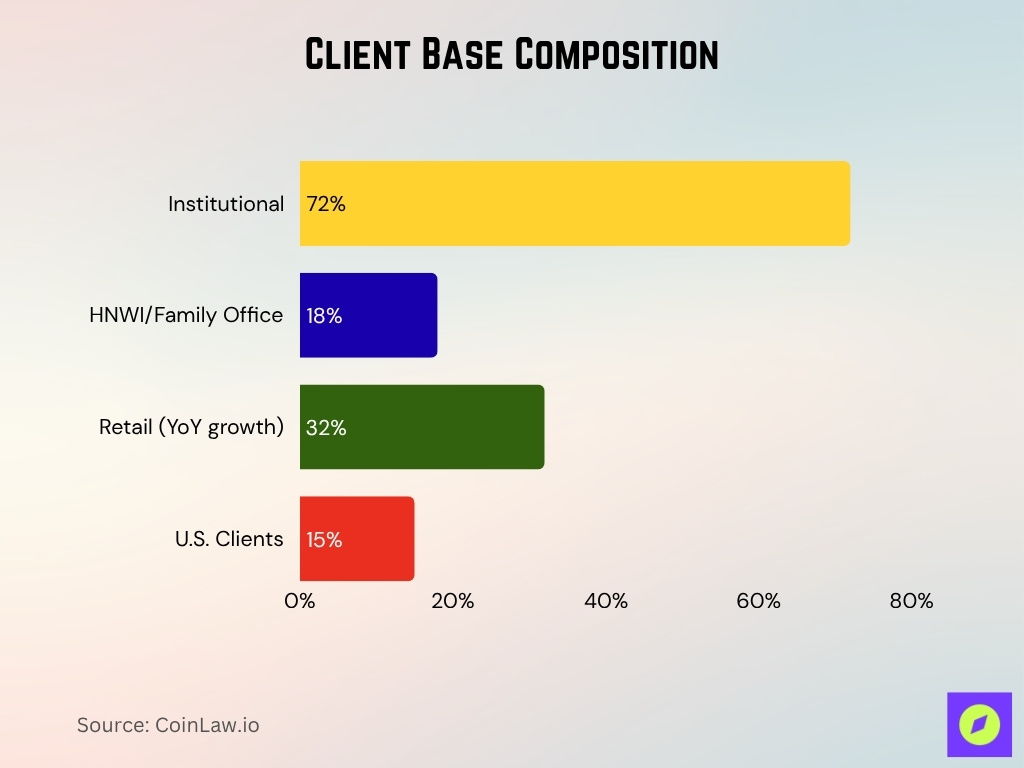

Client Base Composition

- Institutional investors make up 72% of CoinShares’ AUM, led by private banks, RIAs, and wealth platforms.

- High-net-worth individuals and family offices account for about 18% of AUM.

- Retail flows via digital brokers have grown 32% year-over-year, particularly in Germany and the UK.

- U.S. clients account for 15% of total AUM, up from 8% pre-Valkyrie acquisition.

- CoinShares reports onboarding over 340 institutional accounts as of mid-2025.

- The average institutional ticket size in 2025 was $2.1 million per mandate.

- CoinShares’ new staking and yield ETPs are popular among yield-seeking retirement portfolios.

- Advisors remain a strong distribution channel, supported by CoinShares’ education content and research.

- European fintechs embedding CoinShares’ indices reach over 1.8 million end-users.

- Institutional capital is concentrated in BTC and ETH products, while retail favors diversified exposure.

Financial Performance

- In Q1 2025, CoinShares reported $40.0 million in total revenue, gains, and other income, down from $47.5 million in Q1 2024.

- Its EBITDA in Q1 2025 was $29.8 million, compared to ~$35.3 million in Q1 2024.

- Net profit in Q1 2025 stood at $23.8 million, sharply down from $41.5 million in the same quarter of 2024.

- In Q2 2025, CoinShares reported an adjusted EBITDA of $26.3 million, versus $25.5 million in Q2 2024.

- Also in Q2 2025, net profit rose to $32.4 million.

- The firm claims ~76 % adjusted EBITDA margin in H1 2025, compared to ~68 % for full‑year 2024.

- Over fiscal year 2024, CoinShares posted £126.8 million in revenue, gains, and other income, up from £76.3 million in 2023.

- Its adjusted EBITDA in 2024 was ~£109.8 million, more than double its 2023 figure.

- In Q4 2024, EBITDA for the quarter was ~£33.6 million.

Revenue Breakdown

- In Q1 2025, asset management revenue was $29.6 million, up from $24.5 million in Q1 2024.

- In that same quarter, capital markets income fell from $14.1 million to $11.9 million.

- Also in Q1 2025, the principal investments segment recorded a $1.5 million loss.

- In Q1 2025, the treasury recorded a $3.0 million unrealized loss.

- The CoinShares Physical platform reportedly grew ~5.4× in revenue from 2023 through Q2 2025.

- In Q2 2025, asset management fees accounted for the majority of revenue.

- In Q2 2025, the treasury gain was $7.8 million.

- Recurring fee income from asset management is becoming a more stable base versus volatile gains or trading income.

Macro-Investor Sentiment Trends

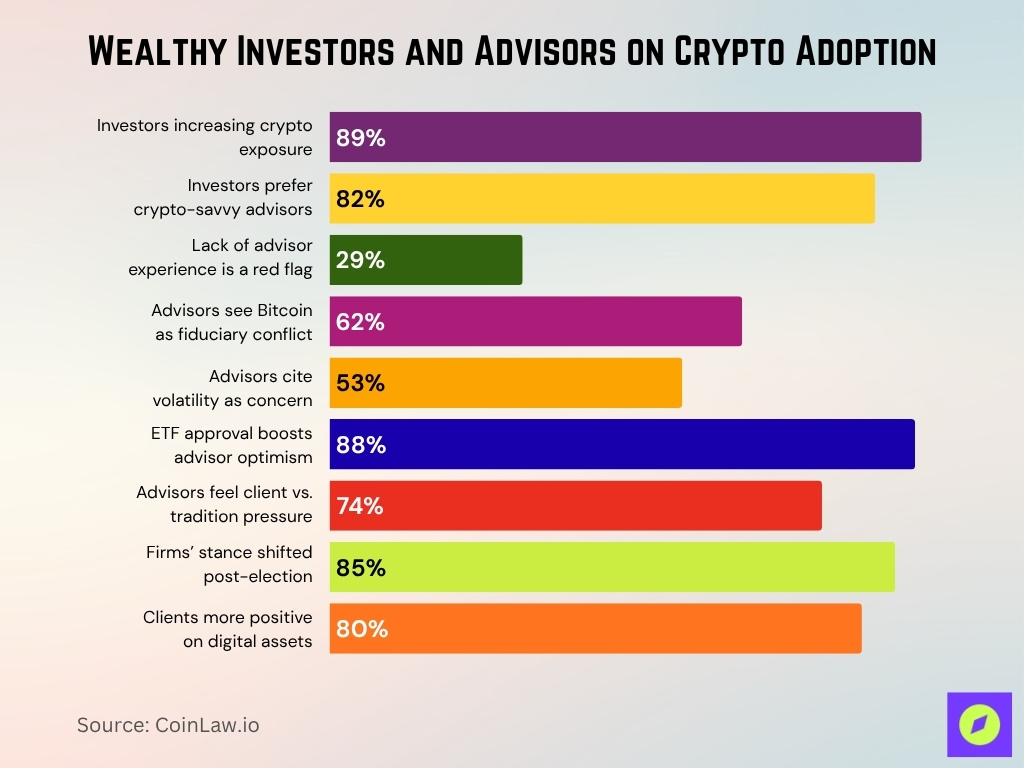

- A 2025 CoinShares survey of 500 wealthy investors finds 89% plan to increase crypto exposure.

- 82% prefer advisors who offer crypto guidance, but 29% say lack of advisor experience is a red flag.

- Among financial advisors surveyed, 62% believe recommending speculative assets like Bitcoin conflicts with fiduciary duty, and 53% cite volatility as a top concern.

- 88% say SEC approval of Bitcoin or Ethereum ETFs has made them more optimistic about digital assets.

- 74% of advisors feel pressure between traditional goals and client demands to adopt crypto.

- 85% of advisors say their firm’s attitude toward digital assets changed after the election, and 80% see clients as more positive.

- In analyses of fund flows, year-to-date in 2025, ~$33 billion flowed into Bitcoin products and ~$12 billion into Ethereum products.

- Bitcoin’s volatility has declined (circa ~27% in 2025) compared to prior eras (e.g., 130% in 2018), improving investor confidence.

- Tokenization and regulatory clarity are fueling demand for crypto infrastructure and institutional products.

EBITDA and Profit Margins

- CoinShares achieved an adjusted EBITDA margin of 76% in H1 2025, up from 68% for the full year 2024.

- The company’s EBITDA in Q2 2025 was $26.3 million, representing a quarterly increase.

- For fiscal 2024, CoinShares delivered £109.8 million in adjusted EBITDA, more than double the 2023 figure.

- EBITDA margins have been consistently above 65% since early 2023, reflecting operational efficiency.

- Net profit margin in Q2 2025 was 81%, supported by reduced treasury losses.

- CoinShares’ capital markets business, despite fluctuations, maintains operating profit margins near 70%.

- Treasury volatility impacts EBITDA seasonally, but recurring revenues offer strong baseline support.

- The firm uses cost controls and automation in trading to maintain lean operations.

- Increased passive product flows have reduced reliance on performance-linked revenue.

- Long-term targets aim to keep EBITDA margins above 70% across all business units.

Index and ETP Performance

- CoinShares Physical Bitcoin (BITC) ETP posted $202 million in net inflows in Q1 2025 after its fee was lowered to 0.25%.

- Ethereum ETPs posted $74 million in inflows YTD 2025, despite a 15% price drop in ETH.

- CoinShares’ Solana and Polkadot ETPs collectively grew by 28% YoY in 2025.

- Total ETP assets rose 22% year-over-year, driven by strong institutional demand.

- The CoinShares Blockchain Global Equity Index (BLOCK) returned +16.7% YTD, outperforming the Nasdaq.

- Its META index, tracking Metaverse assets, is down 9.4% YTD amid sector contraction.

- CoinShares’ diversified crypto ETP (Crypto Basket ETP) saw $31 million in net inflows in Q2 2025.

- The company has lowered expense ratios across its top five ETPs by an average of 35 basis points.

- CoinShares was ranked as one of the top 3 ETP providers in Europe for ETP liquidity in Q2 2025.

- The firm launched its first proof-of-stake (PoS) yield index, tracking ETH and SOL validator returns.

Key Products and Indices

- The CoinShares Physical Bitcoin (BITC) ETP remains the flagship product, with $2.1 billion in AUM.

- The Valkyrie Bitcoin ETF (BRRR), acquired in 2024, contributes ~$530 million in U.S. ETF AUM.

- The Ethereum ETP (ETHE) is CoinShares’ second-largest, with ~$810 million AUM.

- Its new staking-enabled ETPs for Solana and Polkadot have gained ~$130 million combined since launch.

- The CoinShares Crypto Basket ETP offers diversified exposure to the 10 top tokens by market cap.

- CoinShares’ META and BLOCK indices are widely referenced benchmarks in thematic crypto exposure.

- The firm offers physically backed ETPs that hold actual digital assets in cold custody.

- CoinShares’ proprietary indices are designed to track on-chain, market-neutral, and smart contract trends.

- Its capital markets team uses these indices in both structured notes and passive retail wrappers.

- CoinShares has also partnered with fintech platforms to embed its indices into automated portfolios.

Geographic Expansion

- CoinShares expanded its product registration into 15 EU jurisdictions in 2025, following MiCA approval.

- The U.S. client base has doubled since the Valkyrie acquisition and is expected to grow post-Nasdaq listing.

- Distribution partnerships in Latin America have increased ETP penetration in Mexico, Chile, and Brazil.

- The company launched its first bilingual content and ETP disclosures in Spanish and Portuguese.

- Its APAC strategy includes research distribution in Singapore and Hong Kong, with future product ambitions.

- CoinShares is cross-listed across multiple European exchanges, including Xetra, Euronext, and SIX.

- U.S. growth is being supported through new broker-dealer and RIA relationships.

- Nordic markets, once core to CoinShares, now represent less than 10% of new inflows, reflecting diversification.

- France and Germany remain key client geographies, contributing over $1.4 billion combined in AUM.

- Expansion efforts are focused on regulated product access, not just marketing presence.

Regulatory and Governance Metrics

- CoinShares is regulated by the Jersey Financial Services Commission (Jersey) and the Autorité des marchés financiers (AMF) in France.

- In the U.S., it intends to operate under oversight from the SEC, FINRA, and the National Futures Association post-listing.

- The firm claims to be the first EU asset manager approved under MiCA (Markets in Crypto Assets), enabling pan-EU service without needing separate national licenses.

- The pending Nasdaq business combination values the firm at $1.2 billion pre-money, implying that governance and regulatory scrutiny will intensify.

- The transaction is priced at 7.3× EV / CY2024 EBITDA and 10.7× P/E relative to peer multiples of ~20.9× and 25.4×.

- A scheme of arrangement must gain 75 % voting support and Royal Court of Jersey sanction, plus delisting from Nasdaq Stockholm by late 2025.

- Legal counsel roles span jurisdictions: White & Case (U.S./UK/Sweden), Carey Olsen (Jersey/Cayman), etc.

- The firm aims to increase reporting transparency, including audit, disclosures, and compliance aligned with U.S. public company norms.

- CoinShares’ board includes Daniel Masters (Chair) and professionals with deep institutional and trading backgrounds.

- Its governance narrative emphasizes credibility, risk oversight, and alignment with regulated markets as crypto integrates more with mainstream finance.

Nasdaq Listing and U.S. Expansion

- On September 8, 2025, CoinShares and Vine Hill Capital announced a $1.2 billion business combination to list on Nasdaq U.S.

- The listing is intended to drive growth in the U.S. market and broaden the investor base.

- The company will delist from Nasdaq Stockholm around December 17, 2025, subject to shareholder and court approvals.

- As part of the reorganization, existing CoinShares shares will be exchanged for shares in Odysseus Holdings Limited, the new U.S.-listed entity.

- CoinShares shareholders are expected to retain ~78% ownership post-transaction, and the SPAC and co-investors will hold ~22%.

- A PIPE (Private Investment in Public Equity) of 5 million new shares at $10 each ($50 million) is also planned to support liquidity and capital.

- The listing metrics target more favorable valuations and liquidity compared to European peers.

- U.S. expansion is aligned with introducing institutional products like staking solutions, yield strategies, and derivatives tailored to U.S. regulatory allowances.

- The firm anticipates that a U.S. listing will increase its premium multiple and visibility in global digital asset capital markets.

Strategic Partnerships and Mergers

- In early 2024, CoinShares completed its acquisition of the Valkyrie ETF business, adding ~$530 million in AUM and U.S. capabilities.

- The Valkyrie acquisition bolstered distribution access and regulatory experience in the U.S. ETF space.

- In June 2024, CoinShares became the sole sponsor of the Valkyrie Bitcoin Fund (BRRR).

- The SPAC tie-up with Vine Hill is itself a major merger or transaction with structural and financial implications.

- CoinShares continues to consider bolt-on acquisitions in U.S. custody, distribution, or niche product firms to accelerate entry.

- Partnerships with advisors, broker platforms, and wealth firms are part of its expansion strategy into the U.S. and EU channels.

- The firm also collaborates with financial advisor audiences via education, surveys, and research to raise its brand and credibility.

- Its approach is to combine organic product growth with selective acquisitions to complement core capabilities.

Quarterly and Annual Results

- In Q2 2025, treasury management recorded $7.8 million in unrealized gains, recovering the previous quarter’s $3.0 million loss.

- The Capital Markets unit in Q2 2025 generated $11.3 million in income and gains, led by ETH staking ($4.3 million), liquidity provision ($1.5 million), delta neutral ($2.2 million), and lending ($2.6 million).

- The firm emphasizes steady growth in recurring fee income, with more stable revenue from asset management.

- Full-year 2024 results showed £126.8 million in revenue or gains and £109.8 million in adjusted EBITDA, up from 2023.

- Q1 2025 net profit was $23.8 million, a decline from $41.5 million in Q1 2024.

- Over the past two years, the firm’s AUM has more than tripled, reflecting strong compound growth.

- The Q2 2025 net profit was $32.4 million, signaling recovery.

- Revenue from capital markets and product innovation has helped buffer volatility in treasury and principal segments.

- The results indicate disciplined expense control and resilient margins even in a volatile market.

Shareholder Structure

- Post-SPAC, original CoinShares shareholders are expected to hold ~78% of the combined entity, with SPAC or co-investors owning ~22%.

- A PIPE offering of 5 million shares at $10 each (~$50 million) supports capital structure and liquidity.

- Pre-transaction, CoinShares trades under the Nasdaq Stockholm ticker CS and OTCQX ticker CNSRF.

- The delisting from Stockholm is expected around December 17, 2025.

- The SPAC structure may bring new investors with shorter-term horizons, prompting governance adjustments.

- Shareholder alignment will be critical, especially with cross-jurisdictional listing transitions.

- Equity dilution risks exist via PIPE or future issuances to support U.S. expansion.

- Long-term shareholders may benefit if the U.S. listing unlocks valuation multiple expansion.

- The structure places emphasis on clear communication, voting rights, and legal compliance across jurisdictions.

Frequently Asked Questions (FAQs)

CoinShares earned $32.4 million in net profit in Q2 2025.

Its AUM rose by 26 % quarter‑over‑quarter in Q2 2025.

Asset management fees reached $30.0 million in Q2 2025.

CoinShares reported $26.3 million in adjusted EBITDA in Q2 2025.

CoinShares manages on the order of ~$10 billion in assets under management ahead of its Nasdaq listing.

Conclusion

CoinShares stands at a pivotal crossroads. Its strategy to move onto Nasdaq, combine governance enhancements, and expand U.S. operations positions it to challenge entrenched incumbents in the digital asset space. At the same time, its financials show resilience, strong margins, growing recurring revenue, and disciplined capital deployment. Yet it must navigate regulatory uncertainty, execute integration plans, and sustain investor confidence. For institutional and retail participants alike, CoinShares’ journey offers a real-time case study of how crypto asset management can evolve into fully regulated, scalable platforms.