Cloud mining, promising passive crypto income without hardware, has attracted millions of users. Unfortunately, it’s also become a fertile ground for scams. Two real-world examples: one investor lost $30,000 to a fake “automated mining” site, and another platform reportedly claimed 36.73 million visits in just a few months (likely to lure victims). In this article, we dig into the scale, tactics, and year-on-year trends of cloud mining scams, and help you spot and avoid them.

Editor’s Choice

- In 2024, crypto scams and frauds sent $10.7 billion to fraudulent addresses (per TRM).

- U.S. victims lost $9.3 billion to crypto fraud in 2024 (FBI numbers).

- Investment scams in the U.S. caused $5.8 billion in losses in 2024.

- In 2024, platforms disguised as cloud-mining scams defrauded investors of over $500 million.

- BitFuFu reported $271 million in cloud mining revenue in 2024, but scrutiny remains over legitimacy.

- In 2025, the global crypto mining market is estimated at $14.81 billion, with cloud mining a small but visible slice.

- Ponzi and pyramid schemes drew approximately $4.3 billion in victim funds in 2024, down 37% from 2023.

Recent Developments

- Cloud mining scams such as Tophash and GlobaleCrypto continued operations in 2025, copying legitimate platforms to deceive users.

- Platforms increasingly advertise guaranteed returns (e.g., “10% monthly”) despite volatile crypto economics.

- Some providers now emphasize “green contracts” or renewable energy to gain credibility, even when they offer no proof.

- Aggressive influencer marketing and referral programs (multi-level style) have grown in 2025.

- Declining ASIC hardware costs (used models falling under $2,000) are sometimes touted to lure skeptics into believing feasibility.

- Some platforms now claim real-time performance dashboards or “live mining feeds,” but few provide verifiable transparency.

- Reports show some scam sites operating through messaging apps and private groups, shifting away from open web exposure.

- The notion of “cloud mining” is increasingly used in laundering crypto or hiding illicit flows.

Prevalence and Growth of Cloud Mining Scams

- In 2024, fraud and scam flows to crypto addresses totaled $10.7 billion.

- Investment scams alone caused $5.8 billion in U.S. losses in 2024.

- Crypto scam complaints in the U.S. in 2024 reached nearly 150,000.

- As of 2025, the global crypto mining market is valued at $14.81 billion, hinting at the scope in which scams may hide.

- Some estimates identify $500 million+ in 2024 losses from cloud-mining–style scams alone.

- Ponzi and pyramid schemes (many disguised as cloud mining) drew some $4.3 billion in 2024, down 37% from 2023.

- Scam addresses reportedly pulled in $12 billion in 2024 (all types, including cloud mining).

- Platforms masquerading as cloud miners continue to proliferate weekly in fraud databases.

Total Losses from Cloud Mining Scams

- In 2024, cloud-mining–style scams defrauded investors of over $500 million.

- Among overall crypto fraud losses of $10.7 billion in 2024, a portion is attributable to investment and mining scams.

- In the U.S., crypto fraud losses totaled $9.3 billion in 2024, with investment complaints being the largest share (≈ $5.8 billion).

- On average, platforms claiming cloud mining often promise 5–10% monthly returns, but actual payouts rarely occur.

- Cases documented show individual losses spanning tens to hundreds of thousands of dollars (e.g. $30k in a recent scam).

- Many victims never recover funds. U.S. recovery firms served 10,000–12,000 victims in 2024, but overall success is limited.

- In fraud typologies, Ponzi and pyramid flows in 2024 accounted for $4.3 billion of funds from victims.

- Recovery efforts seldom recoup full amounts, and many platforms vanish or obfuscate in offshore jurisdictions.

Most Common Cloud Mining Scam Tactics

- Many cloud mining scams are structured as Ponzi or pyramid schemes, promising returns from new deposits, not actual mining yields.

- Some scams advertise “guaranteed monthly returns” of 5–10%, irrespective of crypto market fluctuations.

- Scammers often create fake teams and fabricated identity claims (e.g., “mining farm owners,” “mining experts”).

- Referral and network marketing schemes (multi-level commissions) are common to encourage viral recruitment of new victims.

- Use of deepfakes and AI-generated content to simulate endorsements or legitimacy is rising.

- Scams shift heavily toward social media, messaging apps, and private groups to deliver pitches and pressure victims.

- Some frauds launch multiple cloned sites or mirror domains to confuse or re-deploy when caught.

- Operators may run “baiting transactions”, small payouts early to build trust, then demand larger deposits.

Unrealistic Returns and Ponzi Structures

- Ponzi & pyramid schemes in 2024 collected $4.3 billion from victims, down 37% from 2023.

- In 2024, total fraud flows (all types) hit $10.7 billion.

- Ponzi schemes remain a persistent fraud type, e.g., CBEX (≈ $800 million) collapsed in 2025.

- Roughly 45% of the decline in fraud flows in 2024 came from fewer large Ponzi schemes.

- More than $24 billion has been lost to major crypto Ponzi schemes since 2014.

- In early 2025, charges were brought in the $1.9 billion HyperFund scheme.

- Many cloud mining scams adopt Ponzi logic, paying old users via new investments rather than mining yields.

- Promoters heavily emphasize “compound returns” to lock funds in and delay withdrawals.

Geographic and Demographic Victim Statistics

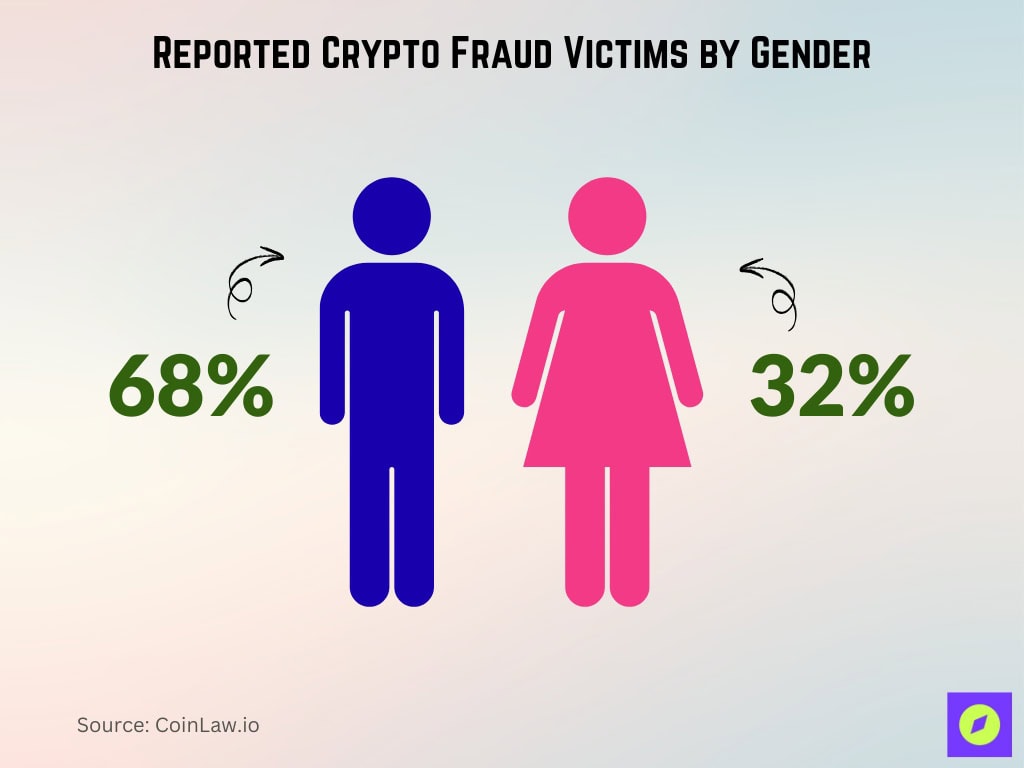

- Men made up 68% of reported crypto fraud victims in 2024, women 32%.

- In 2024, U.S. citizens filed nearly 150,000 crypto scam complaints.

- Americans over 60 lost $2.8 billion in crypto scams in 2024, more than any other age group.

- Victims aged 25 to 40 accounted for 61% of all cryptocurrency fraud cases in 2024 (up from 54% in 2023).

- Baby Boomers (55+) suffered an average loss of $14,600 per scam in 2024.

- Gen Z (18–24) were 2.5× more likely to be targeted by social media crypto scams in 2024.

- Losses to SIM-swapping attacks targeting crypto wallets hit $320 million in 2024.

- U.S. crypto ATM fraud in 2024 resulted in $29 million in losses.

Aggressive Marketing and Referral Schemes

- Many schemes offer multi-tier referral commissions (e.g., 5–10% on deposits of referred users).

- Some marketing claims use FOMO (fear of missing out) with “limited slots” or time-bound offers.

- Paid influencers and social media ads promote false returns.

- Use of ambassador programs and MLM marketing materials is common.

- Some campaigns promise “guaranteed ROI in 30 days” to push reckless deposits.

- Some push “VIP tiers” that require large minimum deposits with promised higher yields.

- Scams use Telegram, Discord, WhatsApp groups, and private chat channels to pressure users.

- As of mid-2025, Meta reported banning 6.8 million WhatsApp accounts linked to fraudulent crypto operations.

Social Media and Messaging App Promotion

- In 2024 and 2025, many cloud mining scams leveraged Telegram channels and private WhatsApp groups to pressure victims with limited-time offers.

- Elliptic’s 2025 report highlights that pig-butchering scams often begin via social media or dating apps before transitioning to fake investment platforms.

- Platforms sometimes use deepfake videos, AI-generated voices, and cloned influencer accounts in ads to create false credibility.

- Fake cloud mining ads appeared in Facebook and Instagram feeds, often promising “guaranteed 6% monthly returns.”

- Some fraudsters send direct messages via LinkedIn, Discord, or Telegram bots with personalized pitches.

- Messaging-app pressure tactics include persistent follow-ups, countdown timers, and “private room” offers.

- In 2025, AI-driven crypto scams surged by 456% year-over-year, partly via impersonation in chat apps.

- Social platforms and app stores have struggled to fully block such promotion, partly because scam pages shift domains frequently.

Industries Most Targeted by Phishing Attacks

- The global average of phishing attacks per reported user was 1.4.

- Media production was the most targeted industry, facing an average of 2.91 phishing attacks per user.

- The government sector experienced 2.08 phishing attacks per user, placing it among the highest-risk groups.

- Manufacturing & construction reported 1.65 attacks per user, showing notable exposure.

- Financial services were hit with 1.41 phishing attacks per user, slightly above the global average.

- The oil and energy sector had the lowest among listed industries, at 1.28 phishing attacks per user.

Regulatory Warnings and Enforcement Actions

- In 2024, funds sent to fraud (including cloud mining scams) reached $10.7 billion, a 40% decrease from 2023.

- The U.S. DOJ and agencies seized $2.4 billion in crypto assets in 2024, a 17% rise over 2023.

- The Karnataka (India) Enforcement Directorate filed charges involving 285 BTC (approx. ₹150 crore) in a crypto scam case involving impersonation.

- Globally, Operation First Light 2024 resulted in 3,950 arrests and $257 million seized across 61 countries, targeting online scams, including investment fraud.

- States like Illinois passed laws in 2025 to better protect consumers from crypto scams, including the regulation of crypto kiosks.

- The U.S. SEC has shifted its enforcement strategy in 2025, reviewing how crypto assets are categorized amid leadership changes.

- The GENIUS Act was passed in July 2025, setting new standards for stablecoin backing and oversight, part of broader regulatory tightening.

- State regulators are pushing for stricter crypto market laws, signaling growing pressure from below.

Notable Cloud Mining Scam Cases

- The Heartland Tri-State Bank collapse in 2023 was tied to a pig-butchering scheme; the ex-CEO was found to have embezzled $47 million for a purported crypto investment.

- The FBI’s 2025 “largest ever seizure” case cited over $5.8 billion in losses from crypto investment fraud in 2024.

- A 2025 DOJ complaint targets $225 million in crypto tied to pig-butchering and linked to 400+ victims.

- Many scam operations impersonate real industry figures or registrants, leading to high-profile confusion or reputational damage.

- Some cloud mining fraud sites reused domain names and rebranded under new names once exposed.

- Fictitious law firms have posed as recovery agents post-scam, defrauding already-victimized individuals.

- In multiple cases, victims lost six-figure sums, often after reinvesting initial “returns.”

- Scammers sometimes traffic individuals abroad into “fraud factories” to execute mass deception.

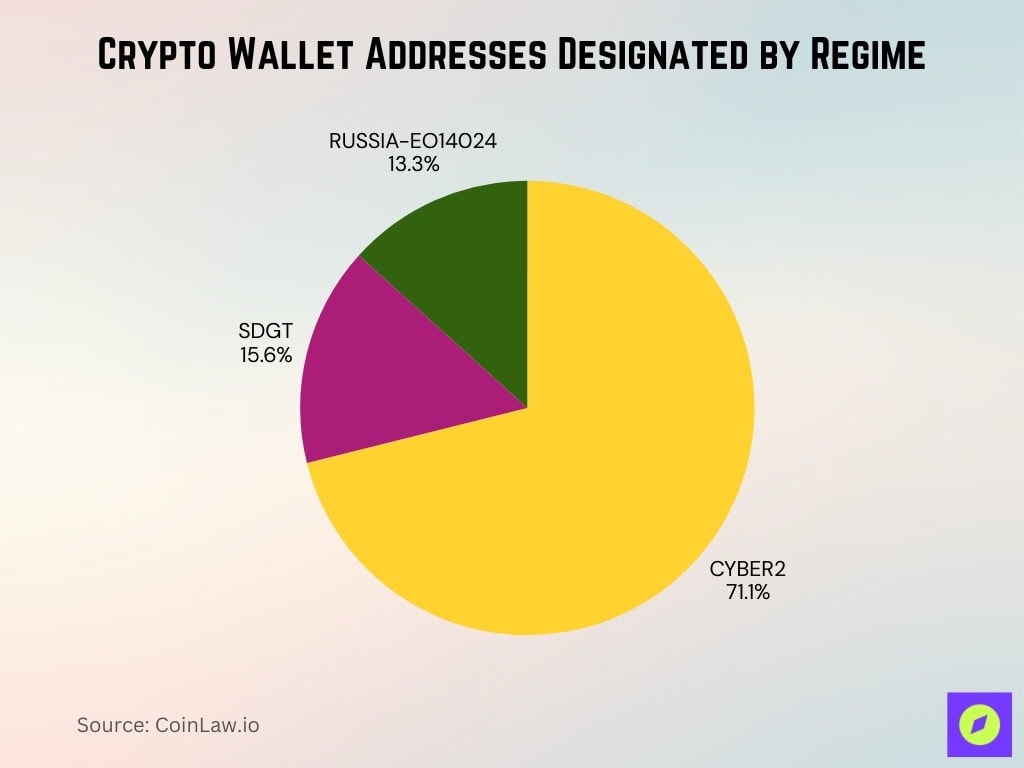

Crypto Wallet Addresses Designated by Regime

- The majority of designated wallets fell under CYBER2, accounting for 71.1% of all cases.

- SDGT (Specially Designated Global Terrorists) made up 15.6% of designated wallet addresses.

- RUSSIA-EO14024, tied to Russia-related sanctions, represented 13.3% of cases.

Law Enforcement and Asset Recovery Statistics

- Law enforcement agencies seized approximately $2.4 billion in crypto-related illicit assets in 2024.

- Interpol’s operations in Africa and Europe recovered $97.4 million in crypto in recent cross-border actions.

- A DOJ RICO case recovered only 0.4% of over $1.5 billion in purportedly stolen crypto.

- Global operations like First Light confiscated $257 million in fraud assets in 2024.

- U.S. recovery firms tracked 10,000–12,000 victims in 2024, but full recovery often fails.

- Some countries lack extradition frameworks or crypto tracing capacity, hampering recovery across borders.

- Victim claims under the U.S. Crime Victims’ Rights Act may allow partial restitution in some cases.

- The ratio of recovered to lost funds remains extremely low, often under 5% of total victim losses.

Year-on-Year Cloud Mining Scam Trends

- Fraud flows in crypto fell from ~$16.8 billion in 2022 to $10.7 billion in 2024.

- Scam addresses reportedly pulled in $12 billion in 2024 (all types, including cloud-mining–style frauds).

- Ponzi/pyramid scheme funds dropped 37% year-over-year in 2024.

- The share of illicit transactions in on-chain volume dipped to 0.14% in 2024, the lowest point in 4 years.

- Pig-butchering scams contributed ~33.2% of crypto fraud types in 2024, with ~40% growth from the prior year.

- In recent years, fraud has shifted from classic exit scams to relationship-based, long-term cons.

- The rise of AI-generated content and deepfakes has accelerated scam sophistication in 2025.

- Cloud mining scams continue to exploit volatility in mining profitability and public interest.

Methods of Prevention and Safe Alternatives

- Always demand proof of operation, audits, and on-chain verifiable data from any cloud mining provider.

- Avoid promises of guaranteed returns or “risk-free” profits; these are strong red flags.

- Use reputable crypto platforms and cold storage wallets rather than keeping funds in unverified hands.

- Verify team identities via LinkedIn, regulatory registries, professional references, and third-party audits.

- Prefer projects with transparent costs (electricity, hash rate, maintenance) rather than vague metrics.

- Use blockchain analytics tools to trace wallet histories and flag suspicious behavior.

- Be skeptical of high-yield referral programs and multi-level commission models.

- Regularly check for regulatory alerts from agencies like the SEC, FinCEN, DFPI, or your country’s financial regulator.

- Report suspicious services early and avoid re-investing gains unless proven credible over a long duration.

- Diversify exposures, don’t bet heavily on cloud mining as your only crypto income stream.

Frequently Asked Questions (FAQs)

The global crypto mining market is estimated at $14.81 billion in 2025.

About 0.14 % of total on-chain transaction volume in 2024 was associated with illicit activity.

Investors lost approximately $3.1 billion to scams and hacks in the first half of 2025.

U.S. miners hold about 34 % of the global Bitcoin hash rate in 2025.

Conclusion

Cloud mining scams remain a potent threat, blending innovative deception with age-old fraud techniques. Victims worldwide are still losing hundreds of millions despite stronger law enforcement efforts and evolving regulations. But you can tilt the odds in your favor, stay informed, demand proof, and treat offers promising “risk-free profits” with deep suspicion. Use this article as a foundation to explore deeper sections, including detailed tips, risk signals, and case studies that may help you avoid falling into their traps.