Imagine a world where wallets are relics of the past, and coins and cash are replaced by seamless digital transactions. This vision of a cashless society is no longer just a futuristic idea; it’s becoming a reality. With innovations driving adoption rates globally, this shift is reshaping economies, consumer behavior, and technological landscapes. The question isn’t whether we are ready for a cashless society but how we are adapting to its rapid evolution.

Editor’s Choice

- 85% of global point-of-sale transactions are now digital, underscoring the accelerating cashless tipping point.

- In the US, 43% of consumers report using mobile wallets daily, reflecting continued upward adoption.

- China leads with 91% of urban transactions conducted via digital platforms such as WeChat Pay and Alipay.

- In Europe, Sweden’s ambition to go entirely cashless by 2025 gains credence as 82% of transactions are now cashless.

- Contactless payments now account for 75% of in-person transactions globally, up from previous years.

- India saw 76% of point-of-sale sales volume via UPI-funded wallets, boosted by strong government backing.

- Retailers globally now report a 50% reduction in cash-handling costs thanks to greater use of card and mobile payments.

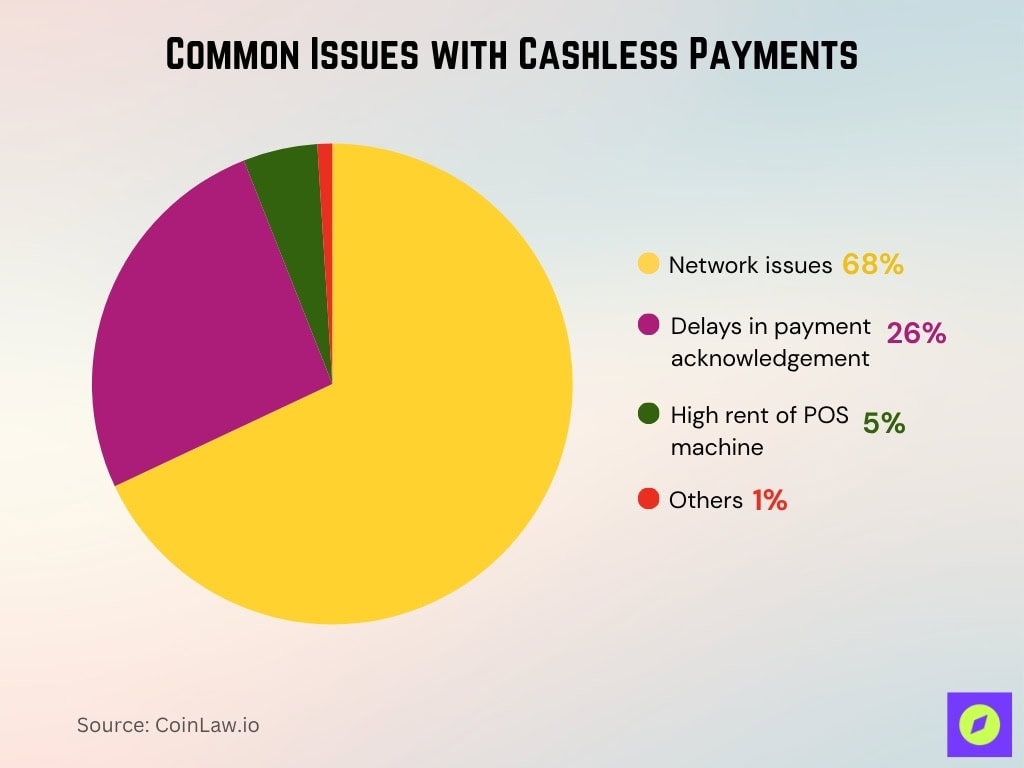

Common Issues with Cashless Payments

- Network issues are the most common problem, affecting 68% of users. Connectivity interruptions often disrupt transactions and create frustration at checkout points.

- Delays in payment acknowledgment impact 26% of users, where transactions take longer to reflect, causing confusion or double charges.

- High rent of POS machines troubles 5% of merchants, making cashless acceptance more costly for small businesses.

- Other issues, such as system glitches or user errors, make up the remaining 1% of complaints.

- Overall, the data highlights that technical and connectivity problems remain the biggest barriers to seamless digital transactions.

Global Adoption Rates and Trends

- 3.2 billion people globally are expected to use mobile payment apps by 2025, reflecting continued strong growth.

- The Asia‑Pacific region leads adoption with 85% of adults in urban areas using cashless methods.

- Europe now sees 75% of transactions conducted cashlessly in 2025.

- In the US 56% of small businesses now accept mobile payments, showing a marked increase.

- Africa’s mobile money usage continues to boom with 50 million M‑Pesa transactions daily in 2025.

- Latin America experiences a 35% year‑on‑year rise in cashless payments fueled by fintech and QR adoption.

- The total global transaction value for digital payments is projected to reach over $12–13 trillion in 2025.

- Cryptocurrencies account for less than 1% of global payment volume, with their use concentrated in niche markets and cross-border remittances.

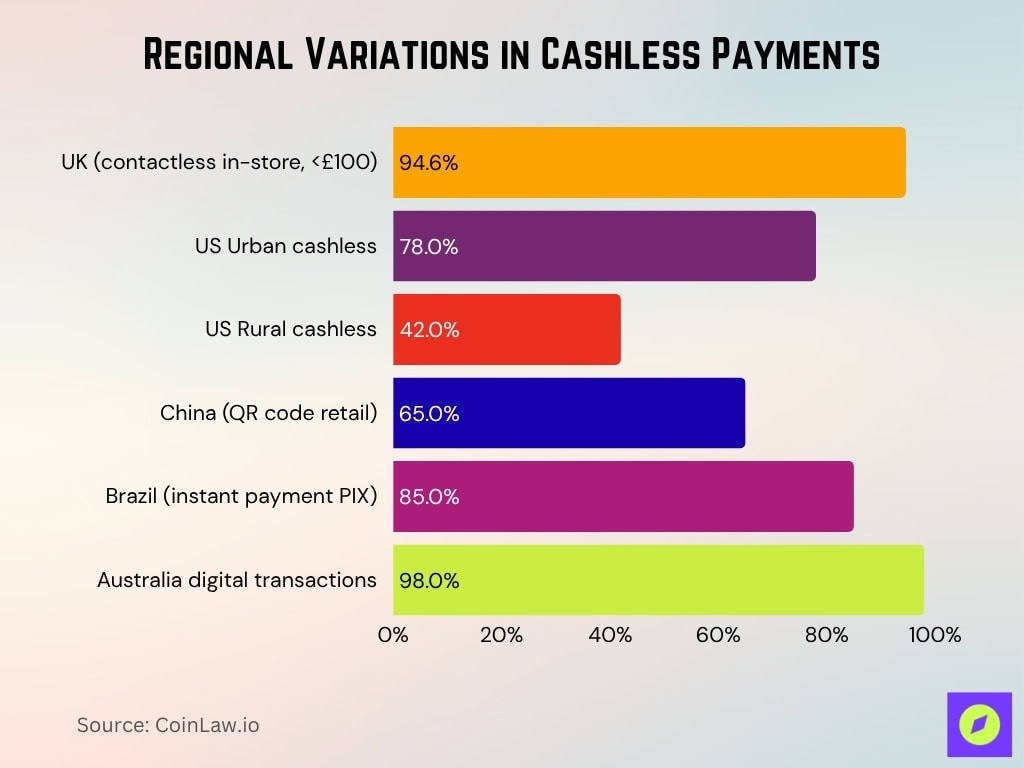

Regional Variations in Cashless Payments

- The UK now sees 94.6% of in‑store card payments under £100 made by contactless in 2024 and rising further in 2025.

- In the US, urban areas achieved 78% cashless transactions while rural areas lag at 42% in 2025.

- In China, 65% of retail transactions now use QR code payments, solidifying the model’s dominance.

- Latin America accelerates fintech adoption, with Brazil leading at 85% usage of instant payment systems like PIX.

- Australia is phasing out paper checks entirely by the end of 2025 as 98% of transactions shift to digital methods.

Payment Methods in a Cashless Economy

- Peer‑to‑peer platforms like Venmo and PayPal grew 30% year‑on‑year by 2025, especially among younger users.

- Contactless cards are preferred by 72% of global cardholders for in‑person transactions in 2025.

- QR code payments now represent 37% of retail transactions in Asia and Africa in 2025.

- BNPL services in the US grew by 35%, reaching 70 million active users in 2025.

- Cryptocurrencies are accepted by 15,000 global retailers in 2025 as blockchain payments gain ground.

- Biometric payments now account for 10% of digital transactions in 2025, doubling prior levels.

- Bank apps facilitate 58% of digital payment volume in 2025, strengthening their role in the ecosystem.

- Super‑apps like WeChat and Grab support seamless payment systems for 1.4 billion users globally in 2025.

Cash vs Cashless Usage by Income Level

- Lower-income groups rely heavily on cash, with 63% of people earning under $20K still preferring physical money for transactions.

- As income rises, cash use steadily declines from 60% in the $20K–$30K bracket to just 43% in the $50K–$60K range.

- Middle-income earners ($40K–$70K) show a near balance, averaging around 50% cashless adoption, signaling growing trust in digital payments.

- The cashless preference overtakes cash starting from the $40K–$50K group, where 53% of payments are now digital.

- High-income consumers ($90K–$100K) are overwhelmingly digital, with 83% of their transactions being cashless—the highest among all groups.

- Even those earning over $100K show a strong 69% cashless usage, indicating digital payments dominate in affluent demographics.

- Overall, the data show a clear inverse relationship between income and cash usage: as income increases, cash dependence drops sharply.

Technological Innovations Driving Adoption

- AI‑driven fraud detection systems reduced digital payment fraud by 45% in 2025, boosting trust in cashless systems.

- Blockchain technology usage increased by 30%, powering more secure and transparent financial transactions.

- IoT devices enabled $3 billion in payment volumes via connected appliances and vehicles in 2025.

- 5G networks compressed transaction times by 35%, especially in developing markets.

- Open banking integrations are now supported by 80% of major FinTech providers.

- The DeFi ecosystem holds $129 billion in value locked across protocols in 2025.

- VR/AR environments processed $500 million in in‑app purchases via embedded payments.

- Payment APIs adoption grew by 40% across e‑commerce platforms in 2025.

- AI chatbots handled $2 billion in transactions via conversational commerce in 2025.

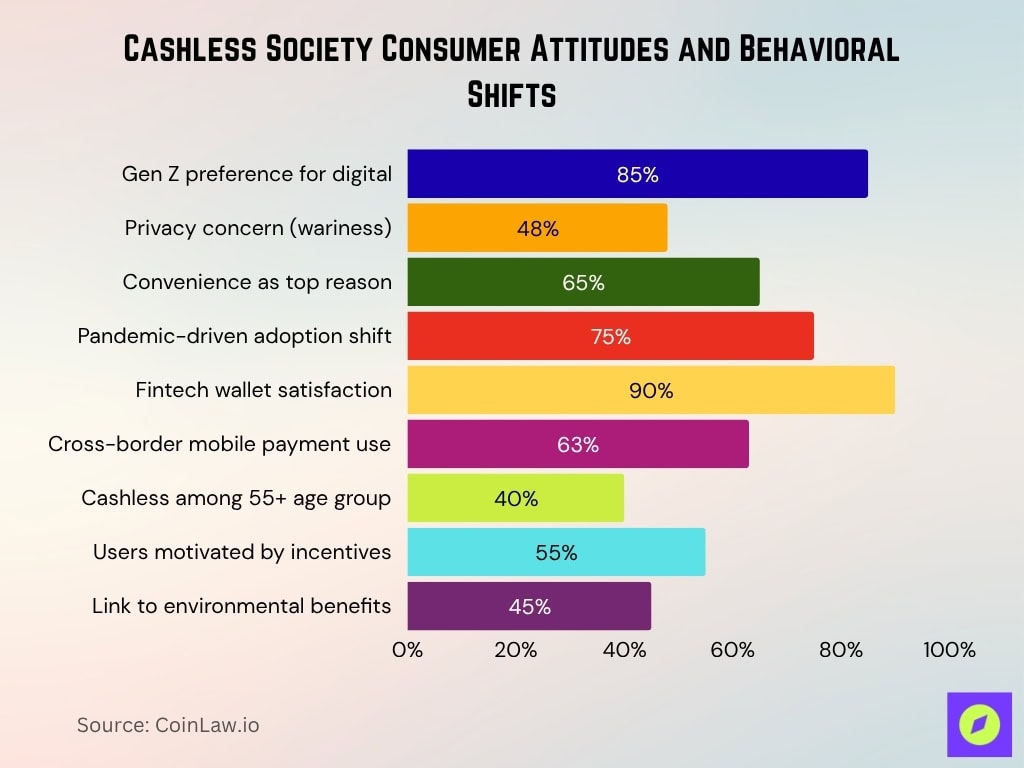

Consumer Attitudes and Behavioral Shifts

- 85% of Gen Z consumers now prefer digital payments over cash, reflecting growing tech affinity.

- Privacy concerns persist, with 48% of consumers expressing wariness over data breaches in cashless systems.

- 65% of consumers cite convenience as the top reason for embracing cashless payments.

- The pandemic prompted 75% of consumers to shift toward digital payment methods during lockdowns.

- Trust in fintech soared, with 90% of users expressing satisfaction with digital wallets in 2025.

- Cross‑border payments are used by 63% of frequent travelers using mobile apps to avoid currency worries.

- Among older generations (55+), 40% now regularly use cashless methods in 2025.

- Incentives like cashback and rewards drive adoption for 55% of users selecting platforms with loyalty perks.

- 45% of consumers link cashless payments with reduced carbon footprints and environmental benefits.

Recent Developments

- Governments are accelerating digital adoption with 49 nations piloting CBDCs in 2025.

- Apple Pay and Google Pay now support cross‑border payments in over 30 countries to streamline international purchases.

- Visa launched Visa+, enabling seamless peer‑to‑peer transfers across multiple apps by early 2025.

- The EU enacted rules requiring interoperable payment systems across all member states by the end of 2025.

- Decentralized identity systems will now secure 20 million blockchain‑based payment users globally in 2025.

- Amazon rolled out palm‑reading payment tech, enabling instant contactless payments at over 500 stores.

- Japan’s push for the 2025 World Expo includes incentives aiming for 80% cashless adoption nationwide.

- In Africa, interoperability pacts cover 25 countries, enabling seamless cross‑border mobile money transfers.

- Real‑time systems like FedNow expanded nationwide access in the US, allowing instant settlement for 300 million accounts.

- Fintechs raised $90 billion globally in 2025, fueling growth across digital payments ecosystems.

Frequently Asked Questions (FAQs)

84% of payments in the U.S. are made digitally as of 2025.

Around 4.8 billion users are projected to adopt mobile wallets by 2025.

The global revenue of the digital payments industry is projected at $121.53 billion in 2025, whereas transaction volume exceeds $12 trillion.

The real-time payments market is projected to grow at a CAGR of 35.4% from 2025 to 2032.

Conclusion

The world is at the cusp of a cashless revolution. With technological advancements, shifting consumer behaviors, and supportive governmental policies, digital payments are becoming the norm. While challenges like privacy and infrastructure gaps remain, the benefits of a cashless economy, from efficiency and inclusivity to security and environmental sustainability, are undeniable. The journey toward a truly cashless society will be defined by innovation, collaboration, and adaptability.