Imagine a small business owner eagerly processing a customer’s online order, only for the transaction to fail due to a card decline. For the customer, it’s an inconvenience. For the merchant, it’s a lost sale, and perhaps, a lost customer. Card declines are an invisible challenge affecting millions of transactions daily across the world.

While frustrating, understanding why cards are declined and how often this happens can help businesses and consumers navigate these situations effectively. The issue has only grown in scale as e-commerce thrives and payment systems evolve. This article will delve deep into card decline statistics, causes, and solutions, helping you stay informed and proactive.

Editor’s Choice

- Industry estimates suggest that 10–15% of online card transactions may fail due to various reasons, with variation by region and sector.

- In the US, declined card transactions in 2025 represent $300 billion in annual lost revenue.

- 47% of card declines in 2025 are caused by insufficient funds, the leading global reason.

- E-commerce transactions typically face higher decline rates, ranging from 10–15%, due to increased fraud detection and card-not-present risks.

- Up to 40% of customers in 2025 abandon purchases after a card decline event.

- Banks and card issuers are responsible for 27% of all declines in 2025, mostly for security or fraud prevention.

- 60-70% of card declines are recoverable through follow-up or retries on average in 2025.

Credit Card Balance Statistics

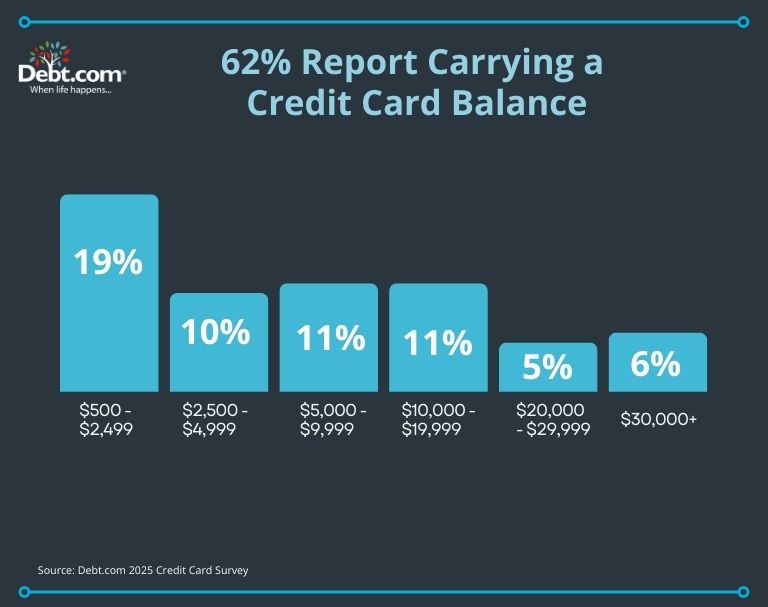

- 62% of Americans report carrying a credit card balance, showing that most consumers revolve debt instead of paying in full each month. This highlights ongoing financial strain despite wage growth in 2025.

- The largest group, 19%, carries a balance between $500 and $2,499, indicating that small to moderate revolving debt remains the most common. Many of these users likely make only minimum payments each month.

- 10% owe between $2,500 and $4,999, suggesting that a notable portion of cardholders accumulate mid-level balances, possibly tied to living expenses or unexpected costs.

- Another 11% carry $5,000 to $9,999 in debt, reflecting the growing dependence on credit cards as inflation and daily costs continue to rise.

- 11% hold $10,000 to $19,999 in balances, showing that a sizable share of users struggle with larger, long-term revolving debt that may take years to pay off.

- 5% have balances of $20,000 to $29,999, which likely stem from multiple cards or extended credit use during financial emergencies.

- The highest tier, 6%, owes $30,000 or more, representing households with persistent or severe credit card dependency often tied to compounding interest and debt cycles.

Key Card Decline Statistics

- 10-15% of card transactions fail at the POS or online checkout globally in 2025.

- Approximately 5–7% of card transactions in the U.S. face declines annually, according to several payment processors.

- For e-commerce, the average decline rate in 2025 is 10–15%, while physical retail stores see only 3-5%.

- Subscription-based businesses face 18-20% decline rates in 2025 due to expired or invalid card information.

- Fraud prevention systems trigger 15-20% of declines in 2025, including false positives.

- In 2025, 70% of cardholders have experienced at least one declined payment.

- Recoverable declines make up 60-70% of the total in 2025, offering businesses reversal opportunities.

Common Causes of Credit Card Declines

- 47% of failed transactions globally in 2025 are caused by insufficient funds.

- 12% of declines in 2025 are due to expired cards that have not been updated.

- 8% of declines result from incorrect card information, such as typos in numbers, CVVs, or expiration dates in 2025.

- 20% of declines happened due to fraud protection triggers, often as false positives, in 2025.

- 8% of declines in 2025 occur when card limits are reached through daily or transaction maximums.

- 5% of declines in 2025 are due to merchant account restrictions, including unsupported cards or regions.

- Cross-border payments have a higher failure rate of 15-25% in 2025, primarily because of fraud protection or currency issues.

- Bank-issued declines remain a notable share in 2025 for non-specific reasons, frustrating customers and businesses.

Top Payment Decline Reasons

- 47% of declines worldwide in 2025 are due to insufficient funds.

- 10-12% of transactions fail in 2025 because customers haven’t updated their expired cards.

- 20-25% of transactions are flagged as fraud in 2025, even if legitimate, causing false declines.

- Cross-border transactions see 15-25% higher decline rates in 2025, mainly from fraud and currency concerns.

- Daily spending limits result in 8% of declines in 2025 when thresholds are exceeded.

- Card Not Present transactions experience 3x higher failure rates than in-store payments in 2025.

- 8-10% of payments fail in 2025 due to user errors like wrong card numbers, CVVs, or expiration dates.

- Technical errors account for 5% of all payment declines in 2025, emphasizing reliable processing.

- Card blocks cause declines in 2025 when banks flag unusual activity or overdue payments.

Reasons for Declined Payment: Debit and Credit

- Insufficient funds remain the most common cause of debit card declines in 2025.

- Transactions exceeding daily card limits caused 8-10% of debit card failures in 2025.

- Expired debit card accounts account for 12% of declined payments for recurring transactions in 2025.

- Technical issues contribute to 5-7% of debit payment declines in 2025.

- Blocked accounts due to overdrafts or suspicious activity prompt notable debit declines in 2025.

- Fraud detection flags cause 15-20% of credit card declines in 2025, mainly as false positives.

- Exceeding credit limits is responsible for 6-8% of credit card declines in 2025.

- Expired cards lead to 10-12% of credit declines, particularly with subscriptions in 2025.

- Billing address mismatch results in a significant share of credit declines in 2025.

- International purchases face up to 20% higher failure rates for credit cards in 2025.

Credit Card Max-Out Rates by Generation

- Gen Z leads with 15.3% of individuals maxing out their credit cards, reflecting early financial stress as younger adults face rising living costs and limited credit experience. This group often relies heavily on cards to manage expenses and build credit history.

- Millennials follow at 12.1%, showing that many continue to carry significant revolving balances from previous years. High housing costs and family-related spending contribute to their credit utilization challenges.

- Gen X reports 9.6% with maxed-out cards, indicating more stable credit management but still notable financial strain amid mortgage payments and inflation pressures. This generation balances debt repayment with long-term financial obligations.

- Baby Boomers show the lowest rate at 4.8%, suggesting stronger financial discipline and higher income stability. Many in this group rely less on credit cards and more on savings or fixed income sources for spending.

Declined Payments: Merchant, Card Issuer, and Processor

- 5% of total declines in 2025 are caused by technical gateway errors or system downtime.

- Incorrect payment settings by merchants lead to a significant share of declines in 2025.

- Unsupported card types or payment methods result in notable declines in 2025.

- Fraud detection systems flagged 20-25% of transactions as suspicious, causing declines in 2025.

- Exceeding credit limits triggers automatic payment rejections, impacting 6-8% of declines in 2025.

- Account freezes for overdue payments or unauthorized usage remain a key cause of declines in 2025.

- Authorization failures at processors account for a substantial share of declines in 2025.

- Network outages cause 5% of temporary payment declines in 2025.

- Cross-border restrictions result in a 15-25% higher failure rate for international payments in 2025.

Impact of Payment Declines on Businesses and Consumers

- Businesses lose an estimated $300 billion annually in the US due to failed transactions in 2025.

- Up to 40% of customers abandon purchases entirely after a decline in 2025.

- Payment retries, customer support, and chargeback management increase operational costs by a significant margin in 2025.

- Frequent declines damage brand trust and reputation, affecting over half of online merchants in 2025.

- Subscription businesses can lose up to 20% of revenue due to failed renewals in 2025.

Recovery Rate and Time by Payment Decline Reason

- 60-70% of insufficient funds declines are recoverable within 24-48 hours through reminders or retries in 2025.

- 50-60% of expired card declines are recoverable, usually within 3-5 days after customer updates in 2025.

- 40-50% of fraud detection declines are recovered, typically in around 24 hours after re-verification in 2025.

- 70-80% of technical issue declines are recovered, often immediately within 24 hours after resolution in 2025.

- 30-40% of cross-border failures are recoverable, taking 48-72 hours with alternative payment methods in 2025.

- 50-60% of daily spending limit declines are retried and resolved within 1-2 days as limits refresh in 2025.

Strategies to Reduce Credit Card Declines

- Automatic payment retries can recover up to 70% of failed payments by scheduling retries at optimal times in 2025.

- Card update automation improves subscription renewals and reduces declines by an estimated 50% for expired cards in 2025.

- Offering alternative payment methods like digital wallets or BNPL can decrease decline rates by 10-20% in 2025.

- Clear decline messaging helps resolve payment issues 30% faster for customers in 2025.

- Optimized fraud detection reduces false declines by 10-15% while maintaining security in 2025.

- Customer notifications for payment failures prompt quick resolution in over 60% of cases in 2025.

- Local payment solutions minimize cross-border failures by 20% with regional options in 2025.

- Monitoring payment gateways prevents technical errors and reduces declines by 5-7% in 2025.

- Data-driven insights boost transaction approval rates by up to 12% using analytics in 2025.

Using Data Insights to Decrease Declined Payment Rates

- Customer segmentation enables tailored recovery efforts, increasing reclaimed payments by 20% in 2025.

- Optimizing retry logic with payment data improves recovery rates by 20-30% in 2025.

- Benchmarking against industry averages closes decline gaps and boosts performance by 10-12% in 2025.

- Adjusting fraud detection filters can cut false declines by 10-15% without reducing security in 2025.

- Subscription management tools proactively reduce churn by tracking at-risk recurring payments, recovering 18-20% in 2025.

- Customer behavior analytics support proactive notifications, resolving 60% of card expirations before failure in 2025.

- Predictive AI models forecast declines and enable alternative payments, lowering overall failure rates by 12% in 2025.

Payment Declines Cost E-commerce Businesses Billions

- Studies show that up to 40% of consumers may abandon a purchase following a failed payment.

- Businesses with recurring payments can lose up to 20% of revenue from declined card renewals in 2025.

- Subscription businesses often see elevated churn rates due to failed renewals, with some studies linking it to up to 20% of customer drop-off.

- Automated retry systems recover 50-70% of failed transactions, but many businesses underutilize these solutions in 2025.

- Resolving declined payments adds up to 5-7% of operating expenses for e-commerce merchants in 2025.

Technological Solutions to Reduce Card Declines

- AI and machine learning improve approval rates by up to 15% by forecasting decline risks and optimizing retries in 2025.

- Payment orchestration platforms boost successful payments by 8-12% by routing through top gateways in 2025.

- Tokenization streamlines card transactions and reduces error-related declines by 10% in 2025.

- Account updater services recover 50-60% of failed subscription payments by automatically updating expired cards in 2025.

- Real-time fraud detection by AI reduces false declines by 10-15% and secures approvals in 2025.

- Local payment gateways minimize cross-border failures by 20% using regional solutions in 2025.

- Advanced billing tools recover 20-30% of at-risk transactions by scheduling retries and customer notifications in 2025.

- Multi-currency payment support raises approval rates for international payments by 12% in 2025.

Recent Developments

- AI-driven payment systems by Stripe and Square are increasing approval rates by up to 15% in 2025.

- EMV 3DS 2.0 adoption is reducing online fraud and decline rates by 10-15% for global e-commerce in 2025.

- Subscription payment tools help businesses recover 50-60% of declined renewals efficiently in 2025.

- Digital wallet adoption, such as Apple Pay and Google Pay, has reduced card declines by 20% in e-commerce in 2025.

- Global Payments Innovation initiatives are improving cross-border payment approvals by 12% in 2025.

Frequently Asked Questions (FAQs)

47% of card declines worldwide in 2025 result from insufficient funds.

E-commerce platforms report a decline rate of 10–15% in 2025.

Up to 40% of customers abandon their purchase after experiencing a card decline in 2025.

Conclusion

Card declines remain a significant challenge for businesses worldwide, with billions in revenue lost annually. However, strategic solutions, technology integration, and data-driven insights offer opportunities to recover failed payments and prevent future declines. By understanding the root causes and adopting proactive measures, businesses can reduce decline rates, improve customer experience, and protect their bottom line.