Canaan Inc. (NASDAQ: CAN) designs and markets high-performance computing systems and ASIC chips, notably for bitcoin mining and edge computing. Its trajectory matters not just in the crypto hardware arena, but also in AI accelerators and global expansion efforts. For example, the company’s growing product revenue reflects adoption beyond pure mining. And in another industry scenario, firms evaluating ASIC chip partners in the AI/edge market may view Canaan as a case study in pivoting from legacy mining to broader high-performance computing. Below you’ll find key stats, then a deeper dive into the company’s profile, earnings, and analyst outlook.

Editor’s Choice

- Canaan’s total revenue in Q2 2025 reached $100.2 million, up ~39.5% year-over-year.

- In the same quarter, Canaan achieved a gross profit of $9.3 million, compared with a gross loss of $19.1 million in Q2 2024.

- Mining revenue in Q2 2025 hit $28.1 million, a more than 200% increase year-over-year.

- Product revenue in Q2 2025 was $71.9 million, up from $61.8 million in Q2 2024.

- Analysts’ consensus 12-month price target for CAN stock averages around $3.61, implying ~90% upside from current levels.

- Net income remains negative; for the trailing-twelve-months, net income stands at approximately –$265.97 million.

- The company’s EPS (diluted) for Q2 2025 was about –$0.03 per ADS.

Recent Developments

- In September 2025, Canaan reported a deployed hashrate of 9.30 EH/s, an operating hashrate of 7.84 EH/s, mined 92 bitcoin, and closed with 1,582 BTC and 2,830 ETH.

- In early October 2025, a landmark U.S. order for 50,000+ Avalon A15 Pro miners was announced.

- The $30 million share-repurchase program signals management confidence.

- Strategic exit from Kazakhstan mining operations (~0.59 EH/s removed).

- Expansion of ~1 EH/s of new computing power in U.S. facilities by August 2025.

- Canaan announced the discontinuation of its AI semiconductor business in June 2025.

- Analysts raised price targets to $4.00, citing improved outlook after strategic wins.

- Regaining Nasdaq minimum-bid compliance in October 2025 removed delisting risk.

Canaan Inc. Stock Performance Snapshot

- Canaan Inc. (NASDAQ: CAN) traded at $1.415 as of 2:13 PM EDT on October 13, 2025.

- The stock surged 29.82% in a single day, gaining $0.325 from its previous close.

- Market capitalization stood at $663.64 million, reflecting strong investor momentum.

- Trading volume reached 69.33 million shares, indicating heightened market activity.

- The stock chart shows a steady upward trend throughout the day, peaking near $1.42 in afternoon trading.

Company Overview

- Canaan Inc. was founded in 2013 and is headquartered in Hangzhou, China, with global operations.

- The company focuses on ASIC high-performance computing chip design, research & development, and sales of mining machines and edge computing systems.

- Canaan also engages in leasing of mining equipment and integrated solutions combining ICs and hardware modules.

- The firm serves both the cryptocurrency mining market (notably bitcoin) and emerging segments such as AI/edge computing.

- In Q2 2025, the product sales revenue jumped to $71.9 million was driven by increased computing power sold and a higher average selling price.

- Mining revenue’s rise in Q2 2025 ($28.1 million) reflects both increased energized computing power and a favorable bitcoin price environment.

- Inventory write-downs declined to $1.0 million in Q2 2025 versus $17.3 million in Q2 2024, helping the cost structure.

- As of June 30, 2025, the company held cryptocurrency assets (primarily bitcoin) valued at $61.8 million and cryptocurrency receivables of $107.6 million.

- The company’s target market includes global customers, with expansion in North America among its strategic initiatives.

Analyst Ratings and Price Targets

- The consensus rating for CAN is “Moderate Buy”.

- The average 12-month price target is $3.61, with a range from $1.75 to $8.00.

- The consensus price target via 8 analysts is around $3.81, with highs up to $8.00 and lows at $1.50.

- Benchmark maintained a “Buy” rating with a price target of $2.00 as of June 20, 2025, based on 2025 revenue estimates of $533.5 million.

- Some analyst forecasts show the average target as low as $2.53 (range $1.52 to $4.20) for the coming year.

- The average target is $3.57 (+88.9% upside) based on 7 analysts.

- Some models forecast much higher targets (e.g., $16.79 in 2025), though these are speculative.

- As of June 21, 2025, Canaan was reported as cut to “Sell” by one research house, highlighting volatility in sentiment.

- Benchmark’s Mark Palmer lowered the target for CAN from $3 to $2.

- The wide spread of targets ($1.50 up to $8.00) underscores uncertainty in future earnings and market positioning.

Net Income and Earnings Per Share (EPS)

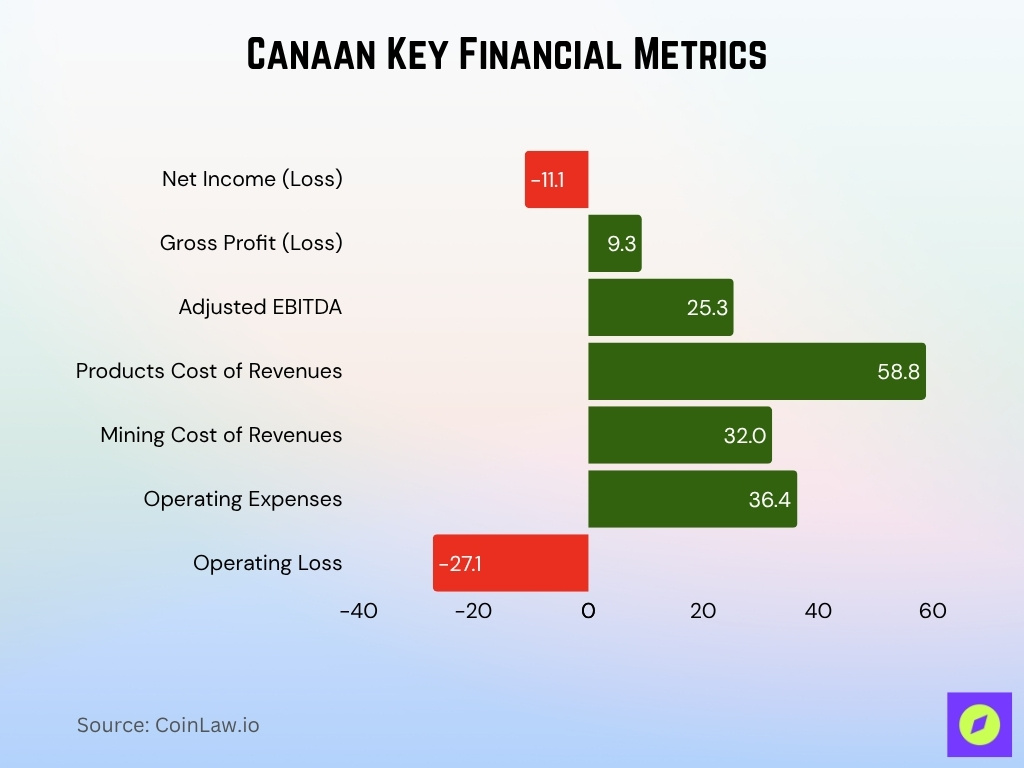

- In Q2 2025, Canaan reported a net loss of $11.1 million, compared with a net loss of $41.9 million in Q2 2024.

- Gross profit in Q2 2025 improved to $9.3 million, up from a gross loss in the same period last year.

- Despite the losses, adjusted EBITDA in Q2 2025 was positive at $25.3 million, showing operational leverage improvement.

- Products cost of products and revenues in Q2 2025 was $58.8 million, down from $79.7 million in Q2 2024, helping margin expansion.

- Mining cost of revenues in Q2 2025 rose to $32.0 million (from $11.0 million in Q2 2024), reflecting increased deployment.

- Operating expenses in Q2 2025 were $36.4 million, compared to $27.5 million in Q2 2024.

- The operating loss shrank to $27.1 million in Q2 2025, from $46.6 million in Q2 2024.

- Basic and diluted net loss per American depositary share (ADS) in Q2 2025 was $0.03, improved from $0.15 in Q2 2024.

- The trailing-twelve-month net income stands around –$265.97 million, indicating ongoing negative profitability.

- EPS (diluted) for the fiscal year shows continued negative values.

Operational Updates (Mining, AI, Expansion)

- In Q1 2025, Canaan reported product computing power sold of 5.5 million TH/s, representing a 62.6% year-over-year increase.

- For April 2025, Canaan mined 87 bitcoins, deployed a hashrate of ~8.15 EH/s, and operated at a hashrate of ~6.20 EH/s.

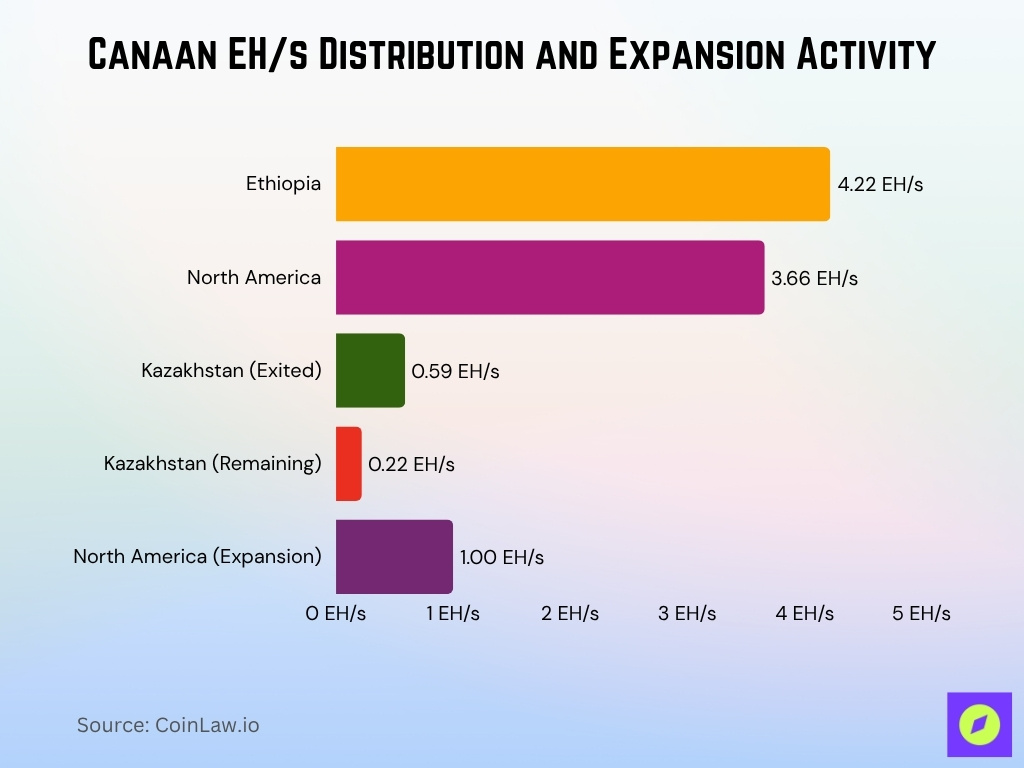

- In June 2025, the operating hashrate was 6.57 EH/s, with ~0.59 EH/s taken offline in Kazakhstan due to a strategic exit.

- July 2025 mining output rose to 89 bitcoins for the month.

- The average all-in power cost was around $0.044–0.045/kWh in April–June 2025.

- The company is phasing out operations in Kazakhstan (remaining ~0.22 EH/s to uninstall by July 2025).

- Canaan is expanding its North American footprint, deploying ≈1 EH/s of new computing power in U.S. facilities.

- The company completed tape-out of its next-generation Avalon A16 series mining machine in April 2025.

- It is balancing geographic deployment (U.S. and international) to manage regional risk and policy exposures.

Bitcoin and Cryptocurrency Holdings

- As of March 31, 2025, Canaan held 1,468.1 BTC on its balance sheet.

- As of April 30, 2025, holdings were 1,424 BTC.

- At the end of June 2025, holdings rose to 1,484 BTC, a record high.

- By July 31, 2025, Canaan reported holdings of 1,511 BTC.

- A newly adopted Cryptocurrency Holding Policy in July 2025 formalized long-term retention of mined bitcoins.

- The company added 177 BTC during Q1 2025.

- Cryptocurrency assets were valued at $40.0 million as of March 31, 2025.

- The bitcoin-holding strategy signals Canaan’s shift from purely equipment sales toward asset accumulation.

- Other digital assets may be temporarily held but typically converted to fiat.

Canaan Inc. Historical Put/Call Ratio Trends

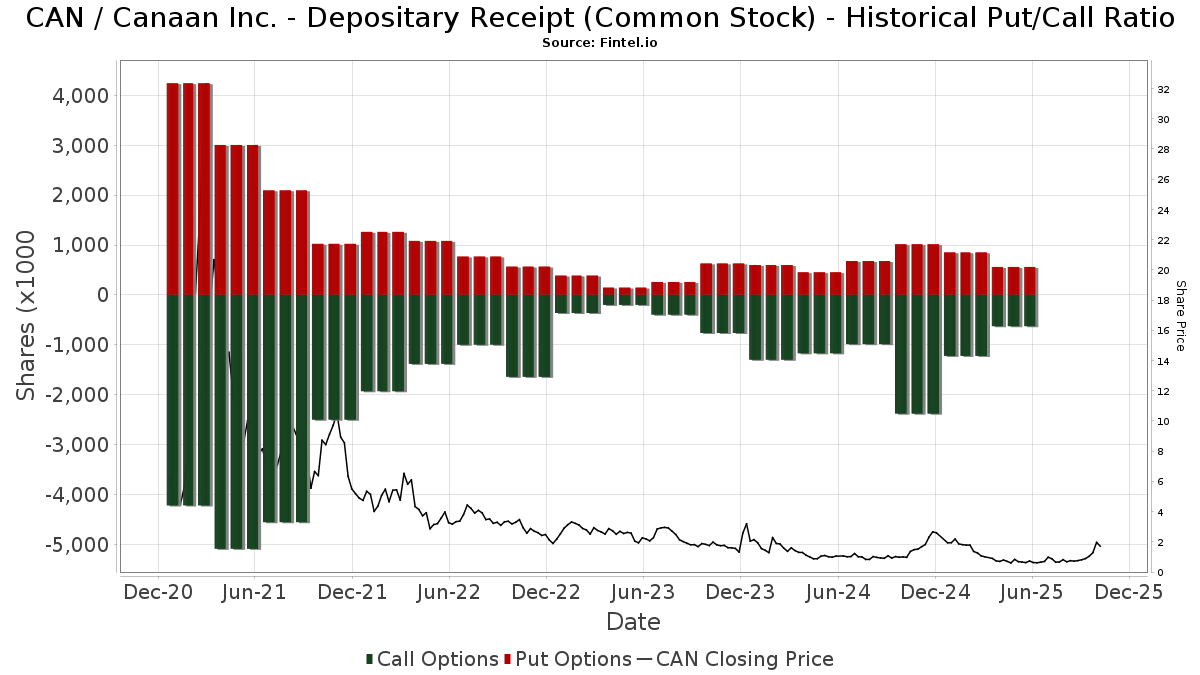

- Call option volume peaked around 4,000,000 contracts in early 2021, coinciding with Canaan’s share price surge above $30.

- Put option activity also spiked during the same period, suggesting high speculative trading interest at the height of the crypto bull market.

- From mid-2022 onward, both call and put volumes declined sharply, indicating a cooling options market for Canaan.

- Between 2023 and 2024, call options averaged around 1,000,000 contracts, with puts slightly lower, showing neutral sentiment.

- In late 2024, a temporary rise in both calls and puts corresponded with a brief stock price rebound to around $10–12.

- By mid-2025, the stock stabilized near $1–2, with low option trading activity, reflecting reduced volatility and market interest.

Major Orders and Partnerships

- In August 2025, Canaan secured a purchase order from Bitfury Group for Avalon® ASIC upgrade kits to enhance up to 10 MW of capacity in North America.

- On October 2, 2025, Canaan reported a purchase order for more than 50,000 Avalon® A15 Pro miners, the company’s largest order in three years.

- A follow-on order from Cipher Mining (July 17, 2025) for Avalon A15 Pro units reinforced repeat customer confidence.

- Canaan terminated a hosting agreement involving ~0.96 EH/s of its own miners in South Texas.

- The company announced a $30 million share-repurchase program in May 2025.

- The Bitfury order emphasized infrastructure reuse and cost-efficiency via upgrade kits.

- These partnerships illustrate Canaan’s expanding role from equipment vendor to strategic infrastructure partner.

- Canaan’s largest U.S. order reflects renewed demand in the U.S. bitcoin mining sector.

Employee Count and Organizational Data

- As of December 31, 2024, Canaan employed 463 employees, up by 18 from the prior year (~4.0% growth).

- Employee count trend shows modest headcount growth in recent years.

- In 2023, Canaan had around 445 employees, indicating a 4%+ growth in 2024.

- Revenue per employee (2024) was approximately $745,918.

- The company structure is oriented toward ASIC design, mining operations, and equipment production.

- Canaan’s leadership team includes Chairman & CEO Nangeng Zhang.

- The employee growth rate indicates cautious scaling consistent with a capital-intensive business.

- Organizational emphasis is shifting from hardware manufacturing toward integrated mining and computing services.

Geographic Presence and Expansion

- Canaan maintains a global mining footprint, as of May 2025, operating mining projects in 9 geographies, including Ethiopia (~4.22 EH/s) and North America (~3.66 EH/s).

- Exit from Kazakhstan, ~0.59 EH/s mining computing power taken offline in June 2025, with remaining ~0.22 EH/s to be uninstalled in July 2025.

- North American expansion, deploying ~1 EH/s of new computing power in U.S. facilities by mid-2025.

- Canaan is strengthening its U.S. product supply chain to mitigate tariff exposure.

- Canaan’s headquarters is in Singapore, serving global markets.

- Global hash-rate deployment implies geographic diversity, balancing regulatory and energy-cost risks.

- African operations underscore the strategy to access lower-cost power.

- The expansion aligns with the company’s ambition to become a high-performance computing provider beyond mining hardware alone.

Recent Strategic Initiatives

- In March 2025, Canaan entered into a Securities Purchase Agreement for up to $200 million in Series A-1 preferred shares financing, closing $100 million.

- Adoption of the Cryptocurrency Holding Policy in July 2025 formalized bitcoin accumulation as a strategic asset.

- Launch of the 10 MW upgrade initiative with Bitfury in August 2025.

- A share-repurchase program of up to $30 million in May 2025 signaled shareholder-value focus.

- Geographic repositioning, exit from Kazakhstan mining operations.

- The largest purchase order (50,000+ A15 Pro) announced in Q4 2025 validated an institutional-scale focus.

- Focus on North American manufacturing and supply-chain localization to mitigate tariff risk.

- Leveraging mining operations, equipment sales, and bitcoin treasury accumulation into a hybrid business model.

Regulatory and Compliance Status

- Canaan’s stock closed above $1.00 for 10 straight trading sessions in October 2025 to regain Nasdaq compliance.

- Nasdaq formally notified Canaan of compliance restoration on October 24, 2025.

- Nasdaq’s $1.00 minimum bid rule applies to over 3,300 listed companies, including Canaan.

- Canaan faced potential delisting after its stock traded below $1.00 for more than 30 consecutive business days earlier in 2025.

- Achieving compliance improved Canaan’s access to U.S. capital markets and investor sentiment.

- Canaan operates under multiple regulatory regimes in the U.S., China, and other international markets.

- The company cites tariff risk and U.S.–China policy uncertainty as major regulatory exposures.

- Adoption of a Cryptocurrency Holding Policy in 2025 aimed to increase reporting transparency.

- Canaan is required to file quarterly and annual disclosures with the SEC as a foreign issuer.

Product Portfolio and Innovation

- Canaan continues to market its Avalon® series mining machines, including the Avalon A15 Pro, secured in a large U.S. order.

- The company’s gas-to-computing pilot in Alberta uses Avalon A15 Pro units with containerized modules to convert flared gas into computing power.

- In June 2025, Canaan discontinued its non-core AI semiconductor business to focus on mining machines and self-mining.

- The Avalon line claims improved energy efficiency. North America miner efficiency reached 19.7 J/TH as of September 2025.

- Canaan reported an average all-in power cost of $0.042 per kWh in September 2025.

- Product innovation emphasizes modularity and deployment flexibility.

- The order for over 50,000 Avalon A15 Pro units signals strong demand.

- Canaan must navigate supply-chain risks, component lead times, and competitive pressure.

- Manufacturing localization may impact cost, innovation speed, and delivery timelines.

Environmental and Sustainability Initiatives

- In October 2025, Canaan launched a pilot gas-to-computing project in Alberta, expected to reduce 12,000–14,000 metric tons of CO₂-equivalent emissions annually.

- The project uses methane-rich gas at well-heads to power Avalon miners directly.

- Global mining operations achieved average all-in power costs of $0.042 / kWh in September 2025.

- North American miner efficiency of 19.7 J/TH implies lower energy consumption.

- Higher-efficiency miners support sustainability by reducing energy per compute unit.

- Deployment in jurisdictions with renewable energy access supports ESG alignment.

- Canaan has not yet released full emissions-scopes disclosures, a potential gap in sustainability reporting.

- Withdrawal from Kazakhstan aligns with sustainability and regulatory risk management.

- As ESG scrutiny increases, Canaan’s efficiency and alternative power projects enhance its positioning.

Risks and Challenges

- Canaan’s Q2 2025 net loss was $11.1 million amid sector volatility and tariff pressures.

- Operating costs increased by 15–25% due to U.S. import tariffs in 2025.

- Bitcoin price swings in 2025 forced Canaan to manage risk across a treasury of over 1,500 BTC.

- Global hash rate reached 700 EH/s by June 2025, intensifying ASIC competition.

- Canaan’s reliance on bitcoin mining grew after discontinuing its AI semiconductor business in Q2 2025.

- Product sales reached $72 million in Q2 2025 with a strong shift toward non-U.S. orders.

- Supply chain bottlenecks continue to threaten delivery targets and increase costs in 2025.

- Tariffs and regulatory barriers are cited as compressing gross margins below historic averages.

- Rising environmental and ESG pressure may restrict capital access and increase compliance costs in 2025.

Frequently Asked Questions (FAQs)

+39.5% year-over-year.

$11.1 million.

6.4 million TH/s.

$9.3 million.

Conclusion

Canaan Inc.’s performance shows strengthened operations, sustainability innovation, and resolved regulatory challenges. It still faces volatility tied to bitcoin prices, global trade issues, and ESG expectations. As cryptocurrency markets evolve, Canaan’s execution on large orders, efficiency gains, and cost control will decide its long-term growth. Readers seeking a comprehensive view of Canaan’s trajectory will find this data-driven analysis timely and actionable.