Bybit continues to redefine crypto accessibility today. It ranks among the top five crypto exchanges by derivatives trading volume, trailing Binance and OKX, depending on the timeframe and metrics used. Two key applications stand out: first, its AI‑powered TradeGPT, which has empowered more than 5 million users to make smarter trades; second, its MiCA-licensed Bybit Card, offering 20 % cashback and enabling seamless crypto‑to‑fiat spending across Europe. Explore how Bybit’s scale, innovation, and trust shape the broader crypto ecosystem.

Editor’s Choice

- Surpassed 70 million registered users as of May 9, 2025.

- Bybit suffered an estimated $1.4–1.5 billion loss during the Lazarus Group hack in February 2025, but replenished client funds quickly to restore balances.

- Bybit’s centralized exchange market share was estimated at 7.6% in H1 2025, reflecting a slight decrease from approximately 8.5% in 2024, based on derivatives volume data.

- Held 7.2 % market share in Europe in Q1 2025, despite an 18.1 % drop in Q2.

- TradeGPT reached 5 million users, signaling strong traction for AI trading tools.

- MiCA license secured, enabling operations across 29 EEA countries.

- Rapid liquidity recovery post‑attack, $13 million/day BTC market depth within 30 days.

Bybit Overview

- Recognized globally as the world’s second-largest crypto exchange by trading volume.

- Founded in 2018 and headquartered in Dubai.

- In 2024, Bybit tripled its user base to over 60 million users.

- As of mid‑2025, it hosts 70 million users globally.

- Bybit offers a full spectrum: spot trading, derivatives, staking, TradFi instruments, crypto‑linked cards, and AI tools.

- Proudly operates with a 1:1 reserve model, ensuring client funds remain protected.

Bybit Perpetual Trading Volumes

- Bybit’s trading volumes ranged between $4 billion and $13 billion daily through late March 2025.

- On March 22, volumes spiked to about $13 billion, driven largely by BTC and ETH activity.

- The lowest trading levels were seen around March 24–25, with volumes near $4–5 billion.

- Trading picked up again in early April, with April 6 showing a strong rise to nearly $20 billion.

- On April 9, 2025, the day of Trump’s tariff pause announcement, volumes peaked at a massive $35.5 billion, marking the highest level in this period.

- After April 9, activity cooled but remained elevated, fluctuating between $10 billion and $18 billion daily through mid-April.

- The trend highlights how macro events and policy shifts can trigger sharp surges in Bybit’s perpetual contract trading.

User Growth and Demographics

- Grew from 60 million users in 2024 to 70 million by May 2025.

- In 2024, the user base tripled, signaling aggressive international adoption.

- 5 million users have engaged with the TradeGPT AI assistant, demonstrating strong user‑tech interaction.

- 1.5 million Bybit Cards issued globally within two years highlight real‑world crypto utility.

- Q1 2025, 7.2 % European market share with MiCA‑backed operations across 29 countries.

- Q2 2025, European shares slipped by 18.1 %, reflecting rising competition.

Trading Volume and Market Share

- In H1 2025, Bybit’s centralized exchange market share declined 0.9 percentage points, settling at 7.6 %.

- Q2 2025 saw Bybit’s volume drop 18.1 % QoQ, part of a broader decline among most exchanges.

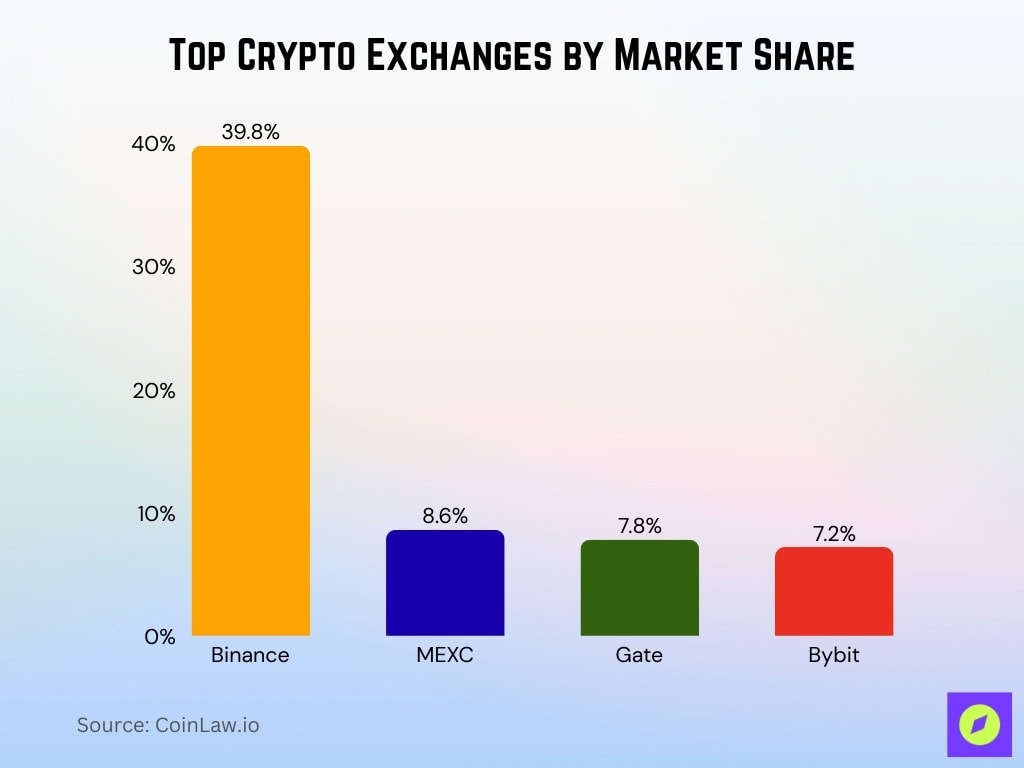

- Top exchanges in July 2025, Binance at 39.8 %, MEXC at 8.6 %, Gate at 7.8 %, and Bybit at 7.2 %.

Most Traded Cryptocurrencies

- BTC/USDT leads with ~18.84 % of volume.

- ETH/USDT follows at ~14.91 %.

- SOL/USDT captures ~7.65 %.

- Additional top pairs include CAMP/USDT (4.05 %), XRP/USDT (3.84 %), and USDC/USDT (3.71 %).

- Others like SOMI, WLFI, MNT, and INJ each hold a 1.7–3.8 % range.

Derivatives Trading Statistics

- Daily crypto derivatives trading across platforms averaged $24.6 billion in 2025, up 16% from 2024.

- Bybit’s share of daily derivatives volume sits at $6.0 billion, trailing Binance’s $15.5 billion and ahead of OKX at $4.5 billion.

- Perpetual contracts account for a dominant 78% of total crypto derivatives volume.

- Open interest in Bitcoin futures rose from $12 billion in 2024 to $16.3 billion in 2025.

- Ethereum futures open interest climbed by 29%, reflecting growing institutional and DeFi activity.

- Solana and Cardano options volume surged, up 35% and 28%, respectively.

- Leveraged tokens made up 18% of retail trading volume, indicating continued interest in high-leverage instruments.

- Short-term speculation dominates; 81% of derivatives positions close within 24 hours.

Leverage and Margin Trading Stats

- Bybit offers leverage up to 100× on select derivatives.

- Margin trading spans multiple instruments, including spot, futures, and options, with standard stablecoin collateral models.

- VIP users enjoy steadily lower fees, reflecting higher leverage use, e.g., Supreme VIP enjoys 0.0300% maker and 0.0450% taker spot fees, and zero maker fee on derivatives.

- Pro users and market makers often face 0.02–0.03% taker fees, emphasizing advanced leverage and liquidity provision.

- Leverage drives liquidity, but also increases regulatory scrutiny, particularly for 100× offerings.

- Automated tools manage risk through automated liquidation, safeguarding solvency under extreme conditions.

ETH-USDT Tick Trades on Bybit

- Around 14:15, flagged illicit transfers triggered market activity, with some trades exceeding $0.2M in size.

- At 14:25, when ZachXBT confirmed the hack, heavy sell pressure emerged, with red trades plunging close to -$0.4M.

- Following the Bybit announcement at 15:45, volatility surged, with both buy and sell orders swinging between -$0.3M and +$0.3M.

- Despite spikes, most trades clustered near $0.0M order size, showing steady small-scale retail activity alongside large whale movements.

- The chart highlights how security breaches and news events can instantly reshape liquidity and order flow in ETH-USDT markets.

Bybit Fees and Transaction Costs

- VIP 0 users pay 0.1000% taker and maker fees on spot, with derivatives at 0.0550% taker / 0.0200% maker, and options at 0.0300% / 0.0200%.

- Bybit scales fees down, VIP 5-tier spot fees drop to 0.0500% / 0.0400%, while derivatives settle at 0.0320% / 0.0100%.

- Supreme VIP perks include 0.0450% spot taker, zero maker on derivatives, and just 0.0150% maker on options.

- Non-VIP tiers, maker and taker fees around 0.10% each for spot, while Pro-level users may see taker fees as low as 0.02–0.03%.

- Fee tiers are recalculated daily, based on asset balance or prior 30-day trading volume.

- Fiat-to-crypto spot pairs carry a different fee schedule; high-volume users enjoy deeper discounts.

- No deposit fees, withdrawal fees vary, e.g., BTC withdrawal costs 0.0005 BTC with a 0.001 BTC minimum.

Order Types and Limits

- Bybit supports inverse and linear perpetuals, inverse futures, and European-style linear options.

- Flexible order types include market, limit, and conditional orders, as well as grid trading and copy trading setups.

- KYC levels define limits. Level 0 users face a 2 BTC withdrawal cap, Level 1 allows up to 50 BTC, and Level 2 reaches 100 BTC.

- The exchange supports over 100 derivatives contracts and more than 180 trading pairs across spot and derivatives markets.

- P2P trading spans 70 fiat options and 80+ payment methods, with no platform fees.

- Visa/Mastercard crypto purchases allowed, minimum purchase $10, capped at $10,000, fees vary by region.

- Advanced users can access API, mobile, and web order execution, with full support for automated strategies and bots.

Bybit Private Wealth Management AUM Breakdown

- The USDT Strategy dominates with 69% of total assets under management, showing strong investor preference for stable returns.

- The BTC Strategy accounts for 26%, reflecting substantial confidence in Bitcoin as a long-term growth asset.

- The Option-Linked Strategy makes up just 5%, indicating cautious but selective adoption of derivative-based yield products.

- Overall, the data highlights how Bybit clients prioritize stability through stablecoins, while still maintaining diversified exposure to BTC and options.

Website Traffic and Engagement

- In July 2025, Bybit saw 22.95 million visits, up 13.8% from June, with 12.6 pages per visit and sessions averaging 14 minutes 26 seconds.

- Bounce rate hovered around 35%, consistent with active, engaged traffic.

- In August 2025, SimilarWeb estimated 19.8 million visits, 8:34 average duration, and 14.7 pages per visit.

- Traffic sources skew heavily to Direct (~89%), followed by organic search (~11%).

- Top traffic origins, Russia (~24%), Germany (~6%), Ukraine (~5.6%), South Korea (~4.3%), and the US (~3.7%).

Geographic Distribution of Users

- The majority of web traffic originates from Russia (23.9%), with notable followings in Germany (6%), Ukraine (5.6%), South Korea (4.3%), and the U.S. (3.7%).

- Audience skews 67.6% male, aged predominantly 25–34 years.

- Search behavior reflects cross-interest in Investing, Finance, and Tech news.

- Frequent site transitions include moves from Bybit to Google and TradingView, indicating active market research behavior.

- Top alternative platforms in audience browsing include CoinGecko, CoinMarketCap, and Bitget.

Bybit Copy Trading Statistics

- Classic Copy Trading has recorded over 32 million successful trades and garnered more than 800,000 followers as of mid‑2025.

- Followers of classic traders have realized total Profit & Loss (PnL) exceeding $530 million.

- The leaderboard showcases top-performing Master Traders.

- Featured traders like Warchart (KR) delivered a 7‑day ROI of 118.63%, while danell_d (AT) achieved 60.11%.

- Copy Trading Pro allows investors to buy into managed strategies created by Pro Masters.

- Across all models, users can mirror trades via real‑time feeds, structured strategy shares, or even TradFi instruments on MT5.

- The platform supports high leverage and robust infrastructure, making it one of the leading choices for derivatives and active traders.

Market Depth and Liquidity Metrics

- Bybit’s recovery to $13 million per day in BTC market depth within 30 days post‑hack speaks to its backend resilience.

- The Proof of Reserves audits also reinforce liquidity transparency, particularly during crises.

Bybit Security and Incident Statistics

- On February 21, 2025, Bybit fell victim to the largest crypto exchange hack ever, losing approximately $1.4–1.5 billion in Ethereum.

- The breach stemmed from a compromised Safe{Wallet} cold wallet transfer, resulting in a flood of withdrawal requests.

- Through emergency borrowing from peers, Bybit replenished reserves within 72 hours, restoring client assets to $14 billion.

- Bybit’s market share dropped from 12% to 8% following the incident.

- Bybit has collaborated with forensic experts and offered a 10% bounty for recovered funds, up to $140 million.

- The FBI and blockchain analysts linked the attack to North Korea’s Lazarus Group.

Proof of Reserves and Asset Holdings

- A Hacken‑verified audit on February 26, 2025, confirmed that Bybit’s reserve ratio exceeded 100%.

- A follow‑up audit on August 14, 2025, reaffirmed that reserves stayed above 100%.

- Bybit maintains a real-time PoR portal, enabling users to independently verify the backing of their assets.

- These audits highlight Bybit’s systematic approach to transparency and asset accountability.

Recent Developments

- The 2025 World Series of Trading (WSOT) attracted over 350,000 participants, more than quadruple 2024’s turnout, with 1,400 squads.

- Compliance with the EU’s MiCA regulations and the launch of Bybit.eu have expanded Bybit’s legitimacy within the EEA.

Conclusion

Bybit’s story weaves resilience, transparency, and growth. From 32 million successful copy trades, audited reserves above 100%, to a swift $1.4 billion recovery, the platform has navigated adversity with data-backed resolve. Its expanding global presence, from MiCA compliance to record-breaking WSOT engagement, cements its influence. Investors and casual users alike can rely on this robust foundation. Stay curious, the trends, risks, and innovations floor the crypto stage yet to unfold.