Access to credit shapes how both businesses and individuals plan, grow, and adapt. In the U.S., business and personal loans drive investments, from a startup expanding operations to a family consolidating debt. These loans influence job creation in small firms and ease financial strain on households. Explore down below for the full breakdown of statistics.

Editor’s Choice

- 24.6 million Americans hold personal loans as of Q1 2025, a 4.7% increase year over year.

- National personal loan debt stands at $253 billion, up 3.3% from Q1 2024.

- The average personal loan per borrower is $11,631 in Q1 2025, slightly down from $11,829 in Q1 2024.

- Delinquency rate (60+ days) for personal loans dropped to 3.49%, down from 3.75% a year earlier.

- The average personal loan interest rate is around 12.6% as of mid‑August 2025.

- Small business loan originations rose modestly through January 2025, though quality remains mixed.

- Outstanding small business loans grew by 1.0% year over year, led by mid‑sized banks.

- 88% of small businesses applying to CDFIs in 2023 gained at least some financing.

Recent Developments

- A Fed survey in Q1 2025 found credit demand fell sharply, especially among small businesses seeking commercial loans.

- Household lending standards held steady even as demand for credit, like credit cards and mortgages, declined.

- The private credit market now exceeds $2 trillion globally, signaling rapid growth outside traditional banks.

- SBA 7(a) loans hit 70,242 approvals in FY 2024, aggregating $31.1 billion in funding.

- Despite tightening standards, small business originations improved in early 2025, reflecting mixed lender sentiment.

- Mortgage delinquency rates are near multi-decade lows, while HELOC originations are rising, fueled by senior home equity gains.

- SoFi saw a 66% year‑over‑year jump in personal‑loan originations in Q2 2025, totaling $7 billion.

- U.S. credit card balances remain elevated, reflecting broader household financial strain.

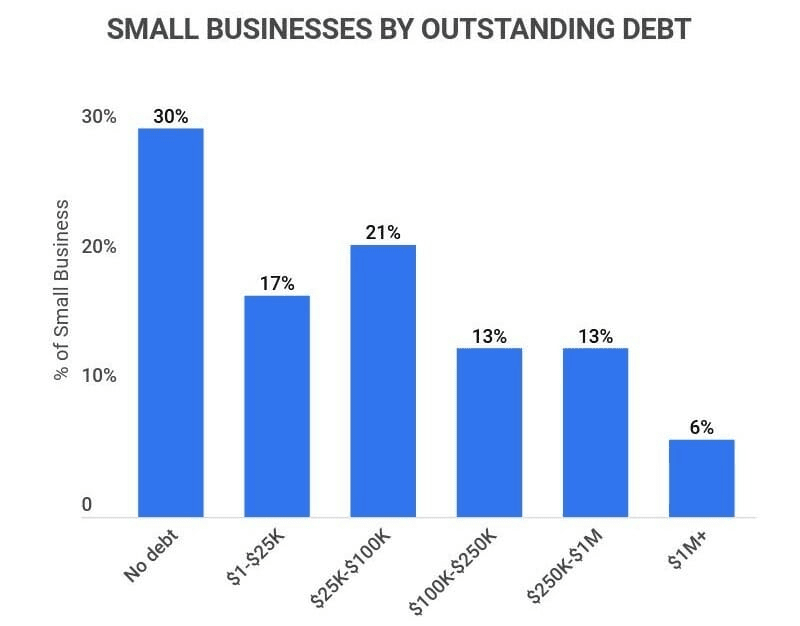

Small Businesses by Outstanding Debt

- 30% of small businesses operate with no outstanding debt.

- 17% carry debt between $1 and $25K.

- 21% have outstanding debt ranging from $25K to $100K.

- 13% owe between $100K and $250K.

- Another 13% have debt in the $250K to $1M range.

- Only 6% of small businesses carry over $1M in debt.

Business Loan Statistics Overview

- Small business loan originations edged up through January 2025, signaling a cautious recovery.

- Outstanding small business loans rose 1.0% year over year, largely from mid‑sized bank activity.

- 43% of applicants pursued a business line of credit, 36% sought a business loan, and 20% went for SBA products.

- 73% approved for equipment loans, 54% for real estate, 46% for lines of credit.

- 7% of applicants applied to credit unions for business loans annually, and 51% were fully approved.

- 6% applied through CDFIs, with 88% securing at least partial financing.

- In FY 2024, 70,242 SBA 7(a) loans were approved, totaling $31.1 billion.

- Banks continue to tighten credit standards, although delinquency rates have recently edged lower.

Personal Loan Statistics Overview

- 24.6 million Americans hold personal loans as of Q1 2025, up 4.7% from Q1 2024.

- Total personal loan debt is $253 billion, up 3.3% year‑over‑year.

- Personal loans account for just 1.4% of total consumer debt and 5.1% of non‑housing debt.

- The average personal loan size is $11,631, slightly lower than a year earlier.

- Delinquency (60+ days) stands at 3.49%, down from 3.75% a year ago.

- Bankrate data shows average APRs at 12.58% for typical borrowers as of August 2025.

- Broader averages reached as high as 26.51%, with ranges from 5.99% to 295%.

- Just 25% of borrowers are deemed “financially healthy”, 47% are financially vulnerable.

Total Loan Market Size and Growth

- Consumer credit expanded at a 2.3% annualized rate in Q2 2025; nonrevolving loans grew 2.9%, revolving at 0.7%.

- Consumer mortgage balances rose by $131 billion, totaling $12.94 trillion in Q2 2025.

- Personal loan debt reached a record $253 billion in Q1 2025.

- Business-originated loans grew modestly early in 2025.

- The private credit market now exceeds $2 trillion.

- SoFi’s digital lending powered +66% growth in personal loan originations in Q2 2025.

- Household debt overall remains elevated.

- Tightening business credit demand contrasts with steady consumer borrowing patterns.

Number of Borrowers

- 24.6 million Americans held personal loans in Q1 2025, up from 23.5 million a year earlier.

- An estimated 29.3 million personal loans exist.

- The share of firms borrowing regularly fell to its lowest since May 2022.

- The number of active borrowers rose as outstanding balances increased.

- Over 70,000 SBA 7(a) loans were approved in FY 2024.

- SBA microloans average about $13,500.

- Small business owners borrowed, on average, $23,000 from friends and family.

Average Loan Amounts

- The average personal loan per borrower dropped to $11,631 in Q1 2025.

- For FICO 720+, average personal loans are around $19,911.

- The average small business loan amount is about $437,482.

- Bank loans average $448,439; SBA 7(a) loans average $437,481.

- Microloans average $13,500, max at $50,000.

- SBA business loans averaged roughly $480,000.

- Equipment financing covers 80–100%, and invoice financing covers 70–90%.

Interest Rate Comparison

- Average personal loan rates are around 12.58%.

- The lowest personal loan rate is 6.49%.

- Broader average APR reached 20.78%, with highs up to 30.20%.

- Business bank loan rates fall between 6.6% and 11.5%.

- SBA 7(a) loans have variable rates of 10.5–14.0%, fixed rates of 12.5–15.5%.

- Online term loans can reach APRs up to 99%.

- Business loan rates often sit above personal loan averages.

Approval and Rejection Rates

- Only 39% of business loan applications get fully approved, 30% are partially approved.

- 40% of small business owners don’t apply, citing loan difficulty.

- 70,242 SBA 7(a) loans were approved in FY 2024.

- Approval rates are more favorable for microloans.

- Banks continue to tighten standards.

- Approval rates fell across all bank sizes in Q4 2024.

Delinquency and Default Rates

- Personal loan delinquency dropped to 3.49%.

- That’s higher than home mortgages (1.36%), auto loans (1.56%), and credit cards (2.43%).

- Small business delinquency has edged down but remains elevated.

- Tighter credit conditions reflect elevated risk in loan performance.

Typical Loan Uses and Purposes

- Personal loans finance debt consolidation, home renovation, weddings, dental work, and taxes.

- SBA microloans fund working capital, supplies, equipment, and marketing.

- SBA 504 and 7(a) loans support real estate purchases, equipment, and expansion.

- Online business loans serve cash flow gaps, emergency needs.

- Equipment financing funds machinery or technology.

- Invoice financing bridges payment delays.

- Friends and family loans average $23,000 for startups.

Distribution of Small Employer Business Industries

- 20% of small employer businesses operate in professional services and real estate.

- 18% are involved in non-manufacturing goods production and associated products.

- 15% focus on business support and consumer services.

- 13% operate in the retail sector.

- 13% are in health care and education.

- 11% belong to the leisure and hospitality industry.

- 6% are part of the finance and insurance sector.

- Only 4% operate in manufacturing.

Loan Application Requirements

- SBA 7(a) loans require U.S.-based, for-profit, small businesses and proof of lack of alternative credit.

- SBA requires borrowers’ date of birth in the E‑Tran system.

- Borrowers must document 100% beneficial U.S. ownership and legal status.

- Real estate loans require environmental review.

- SBA guarantee fees in 2025 are 2% for under $150k, 3% for $150k–$700k.

- Big banks approve only 14.6% of SMB loan applications.

- 40% of potential business borrowers avoid applying.

- CDFIs and credit unions offer more flexible application standards.

Repayment Terms and Schedules

- SBA microloans carry a 40-month average repayment term, up to 72 months.

- SBA 504 loans run 10 to 20 years.

- SBA 7(a) loans allow 10 years for working capital, 25 years for real estate.

- Bank term loans range from 1 to 10 years.

- Term loans can extend up to 30 years.

- Credit union loans run between 5 and 15 years.

- SBA 7(a) loans are fully amortized with prepayment penalties from 5% to 1%.

- Collateral and personal guarantees are commonly required.

Impact on Credit Scores

- Personal loan usage supports FICO score growth when timely.

- SBA loans require strong credit, and missed payments can damage credit.

- Business loan delinquency affects business and owner credit.

- Efficient repayment builds a favorable credit history.

- High-interest short-term loans can increase the risk of late payments.

- Investments that boost business assets may support credit.

- On-time payments may be reported to business bureaus.

Five Main Factors That Drive Your Credit Score Calculation

- 35% of your credit score is influenced by your payment history, making it the most significant factor.

- 30% is determined by the amounts owed on your credit accounts.

- 15% comes from the length of your credit history, reflecting how long you have managed credit.

- 10% is based on the new credit accounts you open.

- 10% is determined by your credit mix, or the variety of credit types you use.

Sources of Funding

- Bank loans are most common but hard to qualify for.

- SBA-backed loans offer favorable terms with more documentation.

- CDFIs and credit unions serve niche markets.

- Merchant cash advances and online lenders offer speed, high APRs.

- Friends-and-family loans average $23,000 for startups.

- Private credit markets exceed $2 trillion globally.

- Community Advantage loans provide up to $250,000.

- Credit card financing and trade credit are common backup sources.

Market Share and Lending Trends

- 14.6% of SMB loan applications are approved by big banks.

- One-third of the credit market is non-bank.

- Application rates among small businesses have dropped.

- SBA guarantee fees returned in 2025.

- Transparency from CFPB and SBA is reshaping access.

- Private credit is expanding in alternative channels.

- Big bank share is contracting.

- SBA Community Advantage supports inclusive lending.

Loan Eligibility Criteria

- SBA 7(a) eligibility includes U.S.-based, for-profit, small, and creditworthy businesses.

- SBSS credit score minimum rose from 155 to 165 in 2025.

- DSCR of 1.2x or higher is often required.

- Online lenders offer flexible eligibility but high APRs.

- Big banks maintain narrow eligibility.

- Community Advantage targets underserved borrowers.

- Businesses must submit extensive documentation.

- Collateral and personal guarantees are typical.

Loan Performance During Economic Cycles

- SBA loans show varied performance; tighter rules aim to reduce risk.

- Delinquency rates are higher than historic lows.

- Business loan demand fell in Q1 2025, and consumer demand held steady.

- Non-bank lenders gained share in downturns.

- SBA-backed loans offer stable terms.

- Private credit is more volatile.

- SBA 504 loans are sensitive to cash flow and collateral.

- Personal loan delinquency has gradually declined.

Conclusion

Business and personal loans each play distinct roles, but the landscape is shifting under tightening standards, evolving regulations, and competition from alternative lenders. SBA-backed loans offer relatively favorable terms, yet come with more documentation and higher eligibility hurdles today. Personal loans remain widely accessible, though interest rates and delinquency trends warrant cautious borrowing. Whether funding a startup, expansion, or personal need, understanding these trends and tailoring your financing choices carefully is now more critical than ever.