Blockchain is transforming how insurers process claims. Its immutable ledger and automated workflows bring transparency, speed, and accuracy. Industries use blockchain to slash claims processing from weeks to hours and reduce fraud. In health insurance, blockchain systems are set to handle nearly one-third of claims. Keep reading to explore how these shifts matter, from fraud prevention to reinsurance efficiency.

Editor’s Choice

- The global blockchain in insurance market grew from $1.86 billion in 2024 to an expected $2.96 billion in 2025.

- Some forecasts peg the 2025 value closer to $3.11 billion.

- Market expansion projected to hit $59.90 billion by 2032 at a 54% CAGR.

- Another estimate suggests 2025 growth to $3.08 billion, with a 58.7% CAGR.

- Some sources show $0.93 billion in 2025 but forecast $5.26 billion by 2030.

- Estimates also list $214.9 million in 2025, growing to $2.21 billion by 2033 (33.8% CAGR).

- About 58% of insurers plan to increase blockchain investment in 2025, especially for claims automation and fraud prevention.

Recent Developments

- Nearly 6 out of 10 insurers (58%) plan to boost blockchain spending in 2025.

- Claims settlement times have fallen from weeks to hours thanks to blockchain-based data sharing.

- Smart contracts are increasingly used in parametric insurance, automating payouts when weather thresholds are met.

- Approximately 30% of healthcare providers could adopt blockchain-enabled systems for claims processing, depending on regulatory environments and infrastructure readiness.

- Blockchain in healthcare finance saw $2.1 billion in investments in 2023, up 60% from the previous year.

- Health blockchain could reduce fraudulent claims by up to 75%, saving over $25 billion annually.

- Blockchain investment helps insurers reduce duplicate coverage and improve data integrity.

- Overall, 77% of insurers expect blockchain to be core to policy issuing and claim settlement.

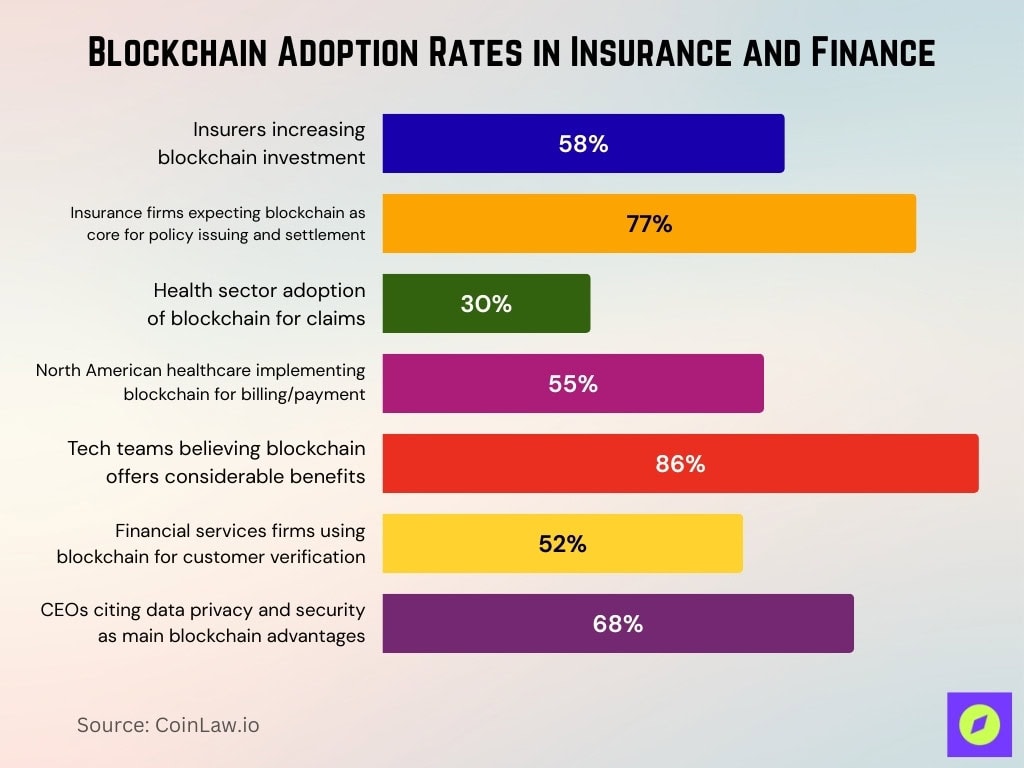

Blockchain Adoption Rates in Insurance Claims

- 58% of insurers plan to increase blockchain investment in 2025.

- 77% of insurance firms expect blockchain to become core for policy issuing and settlement within two years.

- Health sector adoption is estimated at 30% of providers handling claims with blockchain by 2025.

- North American healthcare orgs, 55% implementing blockchain for billing/payment.

- Deloitte finds 86% of tech teams believe blockchain offers considerable benefits.

- 52% of financial services firms see blockchain as useful for customer verification.

- 68% of CEOs cite data privacy and security as the main blockchain advantages to speed adoption.

Blockchain in Reinsurance

- Integration is trending, with data privacy tech use at 49%, and reinsurance roles at 32%.

- Blockchain enables streamlined, transparent reinsurance contracts and risk sharing across distributed ledgers. While detailed stat numbers are rare, growing integration interest is clear.

Smart Contracts in Insurance Claims

- AXA Insurance processes 94% of travel insurance claims within 48 hours using smart contracts.

- Smart contracts are a growing component of parametric insurance, representing a majority of technology applications in 2024, with some sources estimating up to 55.6%, though adoption varies by region and insurer type.

- The smart contracts market for parametric insurance is projected to grow from $9.5 billion in 2024 to $25.6 billion by 2034, at a 10.4% CAGR.

- Smart contracts cut claims administration costs, improve payment speed, and curb fraudulent claims.

- Self‑executing code enforces policy terms automatically, removing intermediaries and reducing delays.

- Smart contract use in complex vendor workflows, such as ISDAs in finance, informs insurance models too.

- Lemonade’s parametric drought insurance in Kenya automatically paid 7,000 farmers without manual claims.

- Nexus Mutual pools over $190 million, with $18 million paid in claims, using automated smart contract logic.

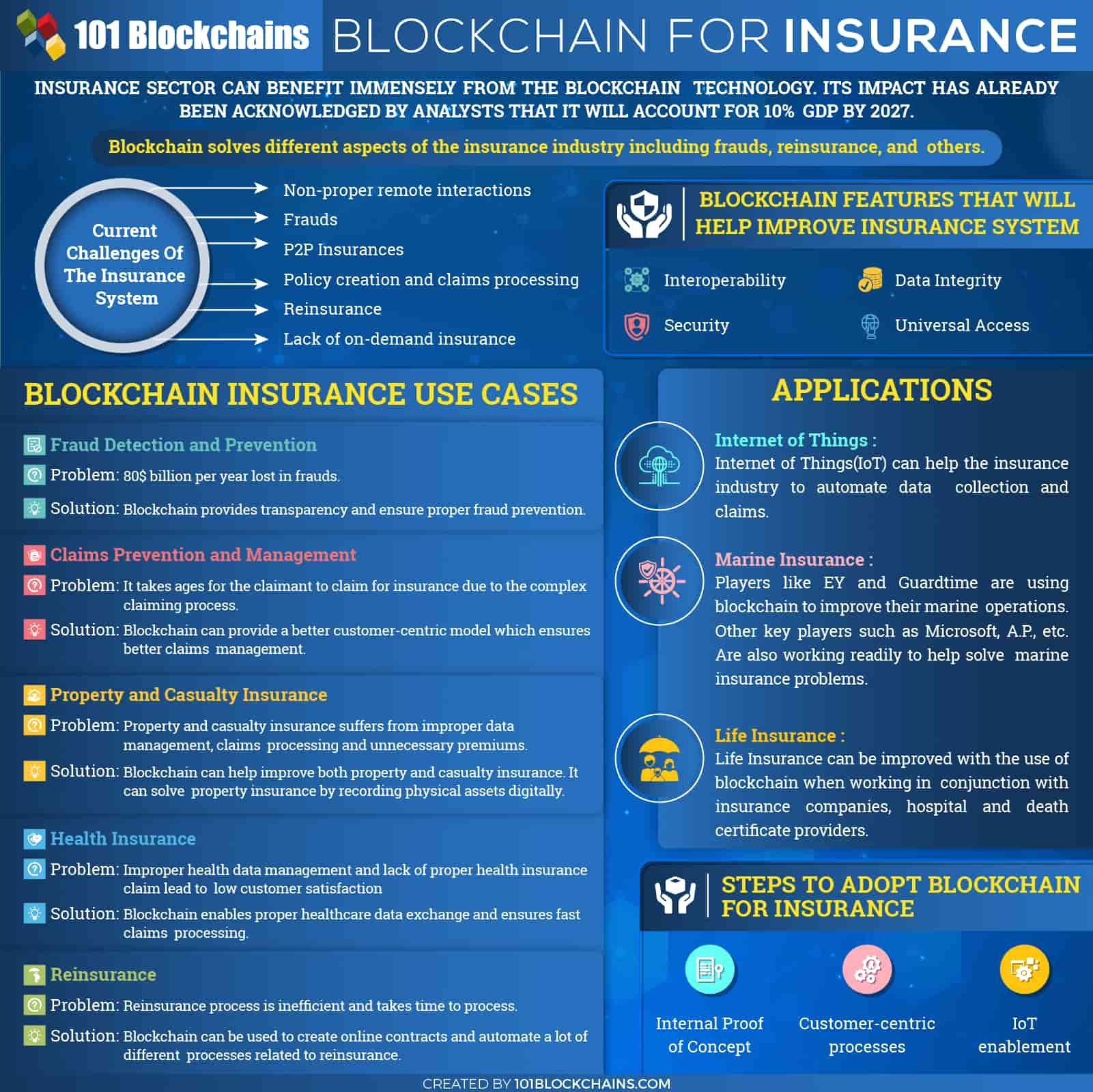

Blockchain in Insurance: Key Insights

- The insurance industry loses $80 billion per year to fraud, making fraud detection and prevention a top blockchain use case.

- Complex claim processes slow down settlements, but blockchain enables a customer-centric model that improves claims management.

- Property and casualty insurance suffers from improper data management and unnecessary premiums, which blockchain can reduce through digital asset recording.

- In health insurance, poor data management reduces customer satisfaction. Blockchain ensures secure healthcare data exchange and faster claims processing.

- Reinsurance remains time-consuming and inefficient, but smart contracts can automate processes and improve efficiency.

- IoT integration with blockchain allows insurers to automate data collection and claims, reducing delays.

- Marine insurance leaders like EY and Guardtime already use blockchain, with support from companies such as Microsoft.

- Life insurance benefits when blockchain connects insurers with hospitals and certificate providers, ensuring trust and efficiency.

- Key blockchain features driving adoption include interoperability, security, data integrity, and universal access.

- Steps for adoption include internal proof of concept, customer-centric processes, and IoT enablement.

Blockchain in Peer-to-Peer Insurance Models

- Some analysts forecast that the decentralized (P2P) insurance market could grow from $1.65 billion in 2024 to as much as $110 billion by 2035, though estimates vary significantly depending on market conditions and technology maturity.

- Peer-to-peer (P2P) insurance reduces overhead, refunds excess premiums to members, and builds community trust.

- Blockchain enables participants to form their own risk pools, adjudicate at claim time, and redistribute leftover premiums.

- Decentralized platforms like Ensuro automate premium collection, claims, and dispute resolution via smart contracts.

- P2P models offer greater transparency, as every transaction and payout is visible to all pool members.

- P2P insurance decreases reliance on central insurers, aligning member incentives, especially in low-claim periods.

- Conservatively, the P2P insurance market may reach $500 million to $1 billion by 2025, with growth toward $5–10 billion by 2033.

- Blockchain bridges trust gaps by automating group-based decision-making and payouts.

Blockchain Adoption in Health Insurance Claims

- Estimates place the compound annual growth rate (CAGR) for blockchain in healthcare at 63.3% between 2024 and 2030, based on select industry analyses, though such high rates should be interpreted cautiously.

- Implementations yielded a 25% drop in fraudulent claims at Allianz in 2023.

- Industry-wide tools blocked 65% of application fraud through blockchain systems.

- Participating insurers reported an 80% decrease in duplicate claims.

- Blockchain enables secure, transparent billing that aligns with HIPAA and reduces handling errors.

- Smart contracts with multi-signature approval models ensure every entity in a claim (patient, provider, insurer) actively participates, boosting accountability.

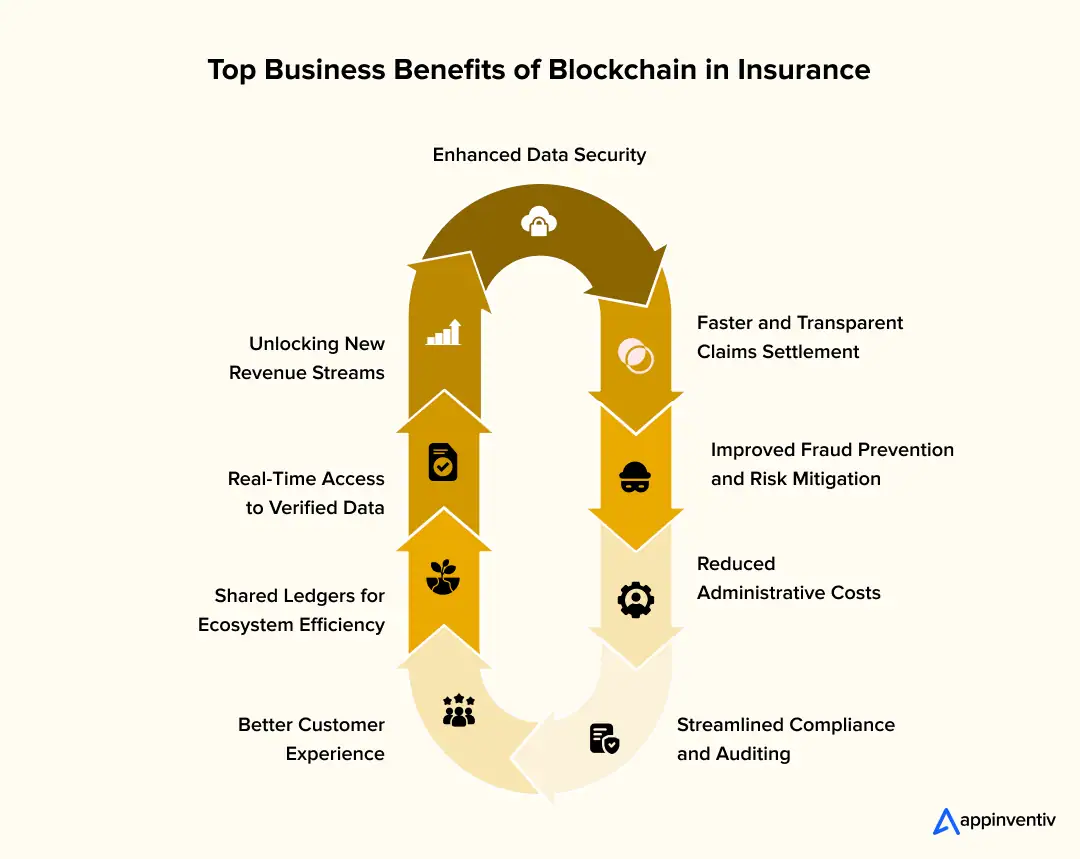

Business Benefits of Blockchain in Insurance

- Enhanced Data Security – Blockchain ensures tamper-proof records, safeguarding sensitive insurance data and reducing breaches.

- Unlocking New Revenue Streams – Opens doors to innovative insurance products and new business models.

- Real-Time Access to Verified Data – Provides insurers with instant and accurate data, improving decision-making.

- Shared Ledgers for Ecosystem Efficiency – Streamlines operations by enabling transparent collaboration across insurers, reinsurers, and regulators.

- Better Customer Experience – Faster processing and transparent policies lead to higher client trust and satisfaction.

- Faster and Transparent Claims Settlement – Automates claim verification, reducing delays and ensuring quick payouts.

- Improved Fraud Prevention and Risk Mitigation – Detects anomalies early, cutting down billions lost in fraudulent claims.

- Reduced Administrative Costs – Automation lowers paperwork and cuts back-office expenses significantly.

- Streamlined Compliance and Auditing – Immutable blockchain records simplify regulatory reporting and auditing processes.

Regional Trends in Blockchain Insurance Adoption

- North America held 33.9% of the global blockchain insurance market share in 2024.

- For parametric smart contracts, North America captured $3.3 billion, or 35.6%, of the market in 2024.

- The U.S. smart contract-related parametric insurance market was valued at $2.7 billion in 2024, with an 8.9% CAGR forecasted.

- Blockchain-friendly states like Vermont, Arizona, and Delaware have passed laws recognizing ledger records and smart contracts in business.

- Emerging models like P2P insurance gain traction in tech-driven regions with strong DeFi ecosystems (e.g., U.S., Canada).

- Europe is seeing growing parametric product uptake, especially in travel and natural disaster payouts.

Blockchain‑Driven Cost Reductions

- Smart contracts in parametric insurance cut administrative delays and intervening layers, lowering claim costs.

- Nexus Mutual’s automated pools eliminated manual processing, directing over $18 million in claims with minimal staff overhead.

- AXA’s smart contract adoption in travel claims slashed processing time to under 48 hours for 94% of claims.

- Allianz reported potential annual savings of $87 million from fraud reduction through the integration of blockchain solutions, though whether these figures represent realized or projected savings should be clarified.

- Blockchain systems cut duplicate insurance claims by 80%, reducing payout waste.

- Shared ledger transparency reduces manual checks and reconciliation costs across insurer networks.

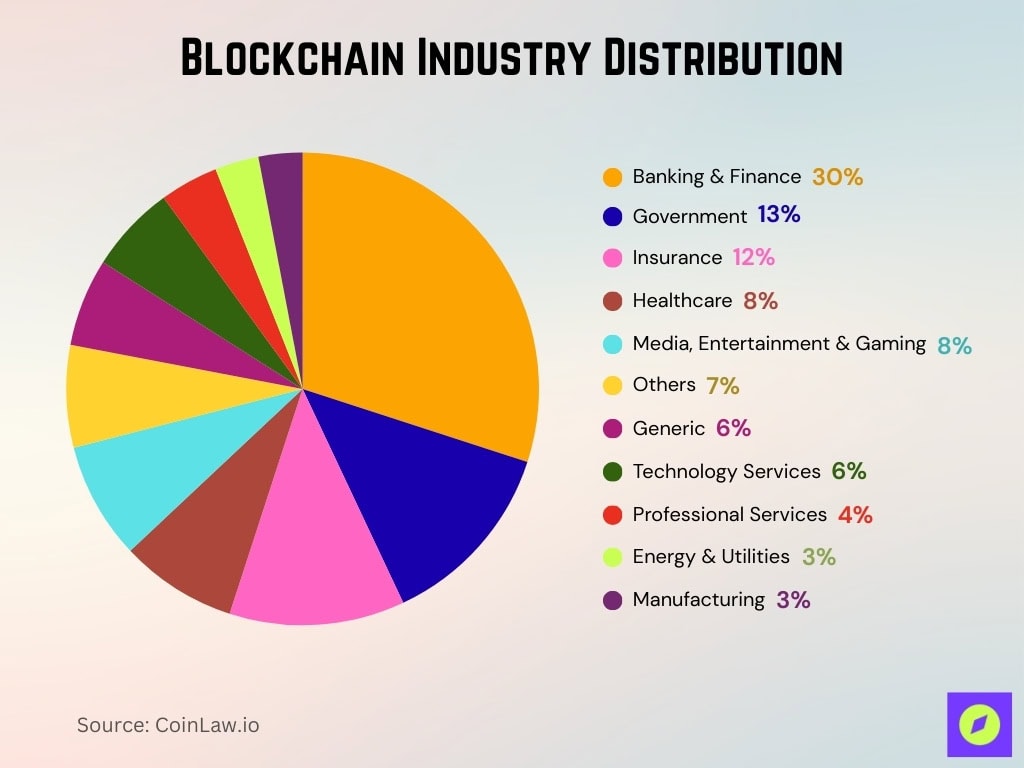

Blockchain Industry Distribution

- Banking & Finance leads with 30%, showing the strongest adoption of blockchain across all industries.

- Government holds 13%, using blockchain for transparency, digital IDs, and secure recordkeeping.

- Insurance accounts for 12%, leveraging blockchain for fraud detection, claims automation, and policy management.

- Healthcare has 8%, applying blockchain to secure patient data and streamline billing processes.

- Media, Entertainment & Gaming also stands at 8%, adopting blockchain for digital rights management and NFTs.

- Others make up 7%, reflecting diverse experimental use cases across smaller sectors.

- Generic blockchain services represent 6%, covering cross-industry tools and frameworks.

- Technology Services also holds 6%, focusing on infrastructure and enterprise integration.

- Professional Services contribute 4%, applying blockchain for auditing, consulting, and compliance.

- Energy & Utilities capture 3%, adopting blockchain for smart grids and energy trading.

- Manufacturing rounds out with 3%, using blockchain for supply chain tracking and product authenticity.

Fraud Prevention and Detection Statistics

- Allianz reduced fraudulent claims by 25% using blockchain systems.

- Blockchain platforms prevented 65% of application fraud industry-wide.

- Duplicate claim incidents fell by 80% among insurers using distributed ledger systems.

- Smart contracts ensure immutability and transparency, making tampered claims easier to detect.

- Multi-signature smart‑contract frameworks increase accountability by logging every stakeholder action.

- Parametric insurance minimizes subjective claims, reducing fraud opportunities.

Impact on Claims Processing Times

- AXA processes 94% of claims within 48 hours via smart contracts.

- Parametric smart contracts automate immediate payouts once conditions are met, bypassing manual reviews.

- Smart contract automation cuts claims workflows from weeks or months to hours.

- Nexus Mutual’s protocol enables near-instant processing for covered DeFi events.

- Smart contracts reduce intermediaries, speeding up each step in the claims chain.

Efficiency Improvements in Claims Management

- The global claims management market reached $4.60 billion in 2023 and is forecast to hit $13.95 billion by 2032 (CAGR of 13.3%).

- U.S. insurance claims processing software grew at a 4.3% CAGR, reaching approximately $12.7 billion in 2024.

- Automation cut claims processing time by 50%, enabling settlements within hours instead of days.

- AI-driven systems in 2025 reduced administrative costs by 33% in major U.S. insurers.

- Predictive analytics improved risk scoring 10–12× over traditional actuarial methods.

- AI-powered claims processing cut error rates by 43% via automated validation.

- New systems, cloud-native, AI-powered, low/no-code, are replacing legacy COBOL systems, boosting agility and resilience.

- Agentic AI now autonomously manages workflows like intake triage, speeding operations, and reducing backlog.

Automated Claims Settlement Rates

- Smart contracts automate nearly instant payouts in parametric scenarios post-event, bypassing manual review.

- AXA used smart contracts to process 94% of travel claims within 48 hours.

- McKinsey reports blockchain integration reduces operating costs by ~30% through automation and fraud reduction.

- Blockchain delivers a 41% reduction in claim time via smart contract automation, according to market data.

- Lemonade’s parametric drought insurance auto-paid 7,000 farmers in Kenya, no adjusters involved.

- Nexus Mutual has automated claim adjudication, processing $18 million in payouts with minimal human input.

Data Security and Privacy Statistics

- Blockchain systems prevent 65% of application fraud and reduce duplicate claims by 80%.

- It is reported that 25% reduction in fraudulent claims and $87 million in annual fraud savings.

- Zero-knowledge proof (ZKP) protocols can significantly improve privacy in blockchain transactions and have been reported to reduce verification gas costs by up to 80% in certain use cases, especially on Ethereum Layer 2 solutions.

- Key industry benefits: 33% fraud loss reduction, 40% better auditability, 42% claim time cut.

- Roughly 48% of blockchain adoption is driven by fraud prevention needs, 44% by digital identity uses.

- In health insurance, 49% of providers are exploring blockchain for secure, compliant data sharing under HIPAA/GDPR.

- Blockchain’s immutable ledger and multi-signature workflows ensure accountability and traceability in claims processing.

Regulatory Compliance and Blockchain

- About 32% of reinsurance players now use shared ledgers for multi-party transparency and auditability.

- North America led with 41% market share in 2025’s blockchain insurance landscape, fueled by smart contract regulation-friendly jurisdictions.

- States like Vermont, Arizona, and Delaware now legally recognize blockchain records and smart contracts in business operations.

- Blockchain promotes regulatory audit ease, 40% improvement in auditability, per market insights.

- As regulations evolve, insurers are partnering with insurtechs and consortia (e.g., B3i, RiskBlock) to pilot compliant blockchain platforms.

Investment in Blockchain Insurance Solutions

- The global blockchain in insurance market, which was valued at $160.5 million in 2024, is projected to reach $214.9 million in 2025 and grow to $2.21 billion by 2033 (CAGR 33.8%).

- Forecasts estimate the market will expand to $2.96 billion in 2025 en route to $59.90 billion by 2032 (CAGR 53.7%).

- Some models estimate $3.11 billion in 2025, driven by fraud prevention, automation, and parametric product growth.

- Key investment drivers, fraud prevention (48%), claims automation (41%), smart contract adoption (36%), and regulatory auditability (40%).

- Blockchain‑insurtech partnerships rose 31%, with 29% enabling auto‑payouts, and 43% launching new products across global markets.

- Insurers continue ramping up blockchain spending, 58% plan to increase investment in 2025, targeting claims automation and fraud prevention.

- Digitization plans echo, 63% of insurers aim to fully digitize operations by 2025, with blockchain part of that drive.

Conclusion

Blockchain is reshaping insurance claims with precision. It’s helping insurers settle claims in hours, slash fraud by up to 80%, cut costs by tens of millions, and strengthen data integrity and compliance. Smart contracts, automation, and regulatory support are fueling fast-growing investments, and projections reach into the billions. As insurers digitize, blockchain transitions from pilot to foundational. The data shows what’s already possible, and where the industry is headed next.