Block, Jack Dorsey’s Bitcoin-focused fintech company, delivered strong third-quarter Bitcoin revenue but missed key earnings expectations, sending its stock downward.

Key Takeaways

- Block reported $6.11 billion in Q3 2025 revenue, missing analyst estimates of $6.34 billion.

- Bitcoin revenue accounted for $1.97 billion, nearly one-third of total revenue, but was down from $2.4 billion in the same quarter last year.

- Net income rose 64% to $461.5 million, but adjusted operating income and EBITDA fell short of forecasts.

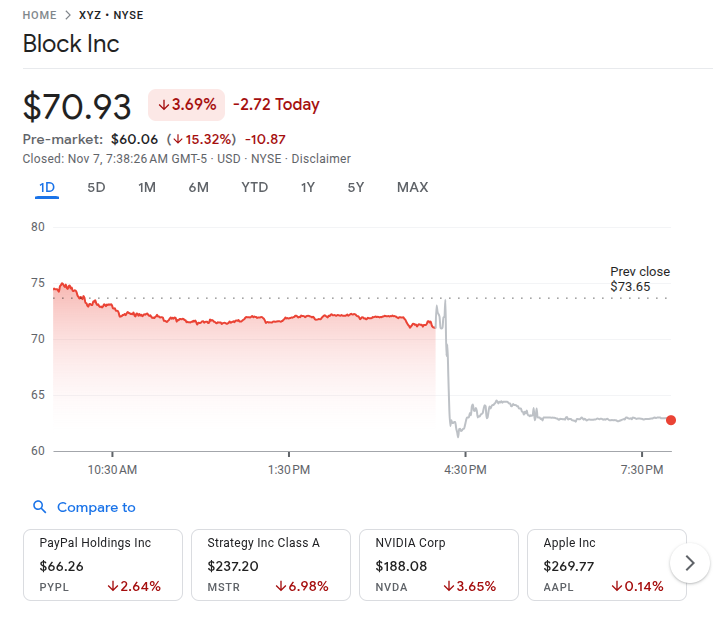

- Shares dropped nearly 10% in after-hours trading following the earnings release.

What Happened?

Jack Dorsey’s fintech firm Block, Inc. reported mixed financial results for the third quarter of 2025. While Bitcoin continues to play a significant role in the company’s revenue, Block fell short of several analyst expectations, leading to a notable drop in its stock price.

Despite an 18% year-over-year increase in gross profit and a major role played by Bitcoin-related income, the company missed consensus targets on operating income and EBITDA, creating investor concerns about future performance.

Block $XYZ Q3 2025 Shareholder Letter: “We had another strong quarter…Square GPV growth accelerated to 12%. Cash App gross profit growth accelerated to 24%, and in September we hit 58 million Cash App monthly actives. Proto generated its first revenue, seeding what we believe… pic.twitter.com/FFUbBzb7cI

— Jevgenijs Kazanins (@jevgenijs) November 6, 2025

Block’s Bitcoin Bet Pays Partially

Block, known for its deep Bitcoin integration, reported $6.11 billion in Q3 revenue, including $1.97 billion from Bitcoin. While that Bitcoin total was down from $2.4 billion in Q3 2024, it still represented the firm’s second-largest revenue stream, just behind subscriptions and services.

- Bitcoin costs declined to $1.89 billion, down from $2.36 billion a year earlier.

- Block’s Bitcoin holdings stood at 8,780 BTC as of September 30, up from 8,485 BTC at the beginning of the year.

- The company recorded a $59 million negative remeasurement on its BTC holdings for the quarter, totaling $178 million in year-to-date losses on valuation.

Despite the year-over-year revenue dip, Bitcoin remains a central part of Block’s growth narrative. In October, Block launched new Bitcoin payment tools and a merchant wallet aimed at helping businesses accept and manage Bitcoin transactions directly.

Financial Performance: Some Hits, Some Misses

Block reported:

- Net income of $461.5 million, up 64% year-over-year.

- Gross profit of $2.66 billion, up 18% YoY, led by Cash App (24% growth) and Square (9% growth).

- Adjusted diluted EPS of $0.54, lower than analyst expectations of $0.63.

- Adjusted operating income of $409 million, versus the $473 million consensus.

- EBITDA at $833 million, missing the $840 million forecast.

Looking ahead, Block expects a Q4 gross profit of $2.75 billion, implying 19% growth compared to last year.

Stock Reaction and Regulatory Backdrop

Block’s stock closed at $70.94, down 3.7%, and dropped further in after-hours trading to $64.10, reflecting a nearly 10% decline. The market’s reaction underscores how closely investors are watching the company’s ability to balance innovation with financial discipline.

Earlier this year, Block paid $40 million to settle with the New York Department of Financial Services, following allegations of compliance failures linked to its Bitcoin operations. This regulatory fine came amid increased scrutiny of crypto-integrated financial platforms.

CoinLaw’s Takeaway

In my experience watching Jack Dorsey and his ventures, he’s never afraid to double down on bold ideas. Bitcoin is central to his vision, and Block’s Q3 numbers reflect both the promise and the risks of that strategy. Nearly one-third of Block’s revenue came from Bitcoin, and that’s no small feat. But the misses on earnings and operating income show that even strong Bitcoin bets can’t make up for broader performance gaps.

I found it especially telling that despite the excitement around new merchant tools and wallets, investors remain cautious when expectations aren’t fully met. Still, the continued growth of Cash App and Bitcoin initiatives makes Block one of the most interesting fintech companies to watch going into 2026.