The global landscape of digital infrastructure is rapidly evolving, and the Canadian company Bitfarms Ltd. (NASDAQ/TSX: BITF) finds itself at the intersection of Bitcoin mining and high-performance computing (HPC) infrastructure. Its operations now span energy, data centers, and cryptocurrency production, which means one industry scenario shows how mining economics drive power-asset deployment, and another shows how AI/HPC demand transforms legacy infrastructure. Explore the full article to delve into detailed performance statistics, leadership breakdown, and key financial metrics.

Editor’s Choice

- 87% year-over-year (YoY) revenue growth in Q2 2025 ($78 million) for Bitfarms.

- Gross mining margin of 45% in Q2 2025, down from 51% in Q2 2024.

- Adjusted EBITDA of $14 million (≈18% of revenue) in Q2 2025.

- Net loss of $29 million, or $0.05 per share, in Q2 2025.

- Operational hashrate growth in March 2025, 19.5 EH/s (21% M/M), and the average was 16.4 EH/s (22% M/M).

- Energised capacity of ~461 MW as of March 2025.

- Long-term debt facility of up to $300 million announced in April 2025 for U.S. HPC campus conversion.

Recent Developments

- In April 2025, Bitfarms signed a private debt facility of up to $300 million with Macquarie Group to fund its U.S. HPC/AI campus at Panther Creek.

- Bitfarms entered a partnership with T5 Data Centers to develop the HPC/AI facility at its Panther Creek campus.

- The company scheduled its Q3 2025 earnings release on November 13, 2025, signalling heightened investor focus.

- Hash-rate and operating efficiency advances in February 2025, the company achieved 16.1 EH/s operating and 13.4 EH/s average, up 6% and 20% M/M, respectively.

- Bitcoin production in March 2025 reached 280 BTC earned, up 31% M/M.

- The company increased its U.S.-based energy pipeline to approximately 1.4 GW (~80% U.S.).

- Liquidity update as of May 13, 2025: total liquidity is approximately $150 million.

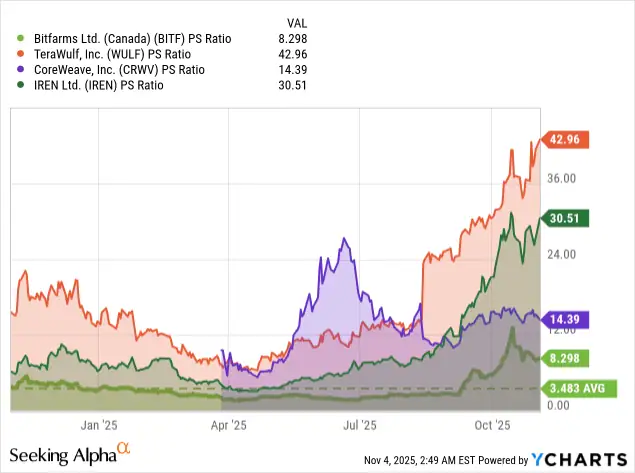

PS Ratio Insights for Bitcoin Mining & HPC Firms

- TeraWulf Inc. (WULF) leads the peer group with a PS ratio of 42.96, reflecting premium investor expectations tied to its AI/HPC infrastructure pivot and aggressive expansion.

- IREN Ltd. (IREN) holds the second-highest valuation at a PS ratio of 30.51, indicating strong market sentiment around its energy-backed mining model.

- CoreWeave, Inc. (CRWW) reports a PS ratio of 14.39, driven by its hybrid positioning in AI compute and data center services.

- Bitfarms Ltd. (BITF) shows a PS ratio of 8.298, suggesting moderate valuation despite robust YoY growth in revenue and infrastructure deployment.

- The industry average PS ratio is 3.483, meaning all four companies trade well above the sector norm, signaling elevated expectations across the board.

- TeraWulf’s PS ratio is more than 12x the industry average, underscoring a strong growth narrative but also potentially higher valuation risk.

Company Overview

- Bitfarms was founded and is headquartered in Toronto, Ontario, with operations extending into the United States and Latin America.

- The business model is vertically integrated; the company develops, owns, and operates data centres and energy infrastructure for Bitcoin mining and shifting toward HPC/AI applications.

- As of March 2025, Bitfarms reported operating hashrate at 19.5 EH/s, average 16.4 EH/s, with energized capacity ~461 MW.

- In Q2 2025, revenue breakdown indicated ~$71 million from mining and ~$7 million from hosting/electricity services.

- Energy portfolio is increasingly U.S.-centric; about 80% of the 1.4 GW pipeline is U.S.-based.

- The company is actively disposing of or impairing certain non-core assets to refocus on the U.S./Canada.

- The Panther Creek campus (~180 acres under purchase-and-sale agreement) is expected to host multiple phases of HPC/AI conversion.

- Investor relations site reports 410 MW energized capacity and 17.7 EHuM as baseline metrics for growth.

Leadership and Management

- Bitfarms’ board includes 9 members as of November 2025.

- CEO Ben Gagnon was officially appointed in October 2024, succeeding Nicolas Bonta.

- Jonathan Mir became CFO in October 2025, bringing over 25 years’ experience in finance.

- The company added ex-AWS exec Wayne Duso to its board in August 2025.

- Bitfarms reported a 22% YoY increase in operational hashrate by March 2025.

- 100% of board members are independent except for executive directors.

- The leadership team oversaw a 14% reduction in the non-performing asset base during 2025.

- Current governance disclosures include a published diversity matrix and a listed whistle-blower hotline.

- By Q3 2025, capital expenditures will shift to focus 70% on U.S. HPC/data-centre expansion.

- The company’s 2025 strategy document outlined regulatory clarity as a top-3 leadership priority.

Bitfarms (BITF) Intraday Stock Performance

- Bitfarms Ltd. (BITF) traded at $1.3050 as of 3:50 PM EDT, showing strong upward momentum for the day.

- The stock gained +$0.1750, marking a sharp +15.49% increase compared to the previous close.

- Day’s low hovered near $1.13, while the intraday high approached $1.35, indicating increased volatility and investor activity.

- After a morning surge peaking around 10 AM, the price stabilized in the $1.28–$1.31 range during the afternoon session.

- This price action reflects renewed investor confidence, potentially tied to recent updates in infrastructure, EPS improvements, or market sentiment around AI/HPC exposure.

Profitability Metrics

- In Q2 2025, Bitfarms achieved total revenue of $78 million, an increase of 87% year-over-year.

- The company’s gross mining margin in Q2 2025 was 45%, down from 51% in Q2 2024.

- Adjusted EBITDA for Q2 2025 was $14 million, representing 18% of revenue.

- In Q1 2025, the gross mining margin was 43%, down from 63% in Q1 2024.

- Q1 2025 adjusted EBITDA margin was 23%, compared with 46% in Q1 2024.

- The cash general and administrative (G&A) expenses in Q2 2025 were $18 million, up from $11 million in Q2 2024.

- For Q2 2025, Bitfarms produced 718 BTC with an average direct cost of production per BTC of $48,200.

- Bitfarms reported liquidity of approximately $230 million as of August 2025.

Operating Margins

- In Q1 2025, the operating margin was -48%, worsening slightly from -47% in the same quarter of 2024.

- In Q4 2024, the operating margin was -29%.

- Q2 2025 operating loss was $40 million, including a non-cash impairment charge of $15 million and depreciation of $37 million.

- The depreciation and amortization in Q4 2024 increased by 64% year-over-year.

- Adjusted EBITDA margin in Q4 2024 was 25%, down from 35% in Q4 2023.

- The total cash cost per BTC in Q2 2025 was $77,100 compared to $72,300 in Q1 2025.

- Bitfarms reported average revenue per BTC in Q2 2025 of $98,000.

- Efficiency (watts per TH) in Q2 2025 was 19 w/TH, unchanged from Q1 2025.

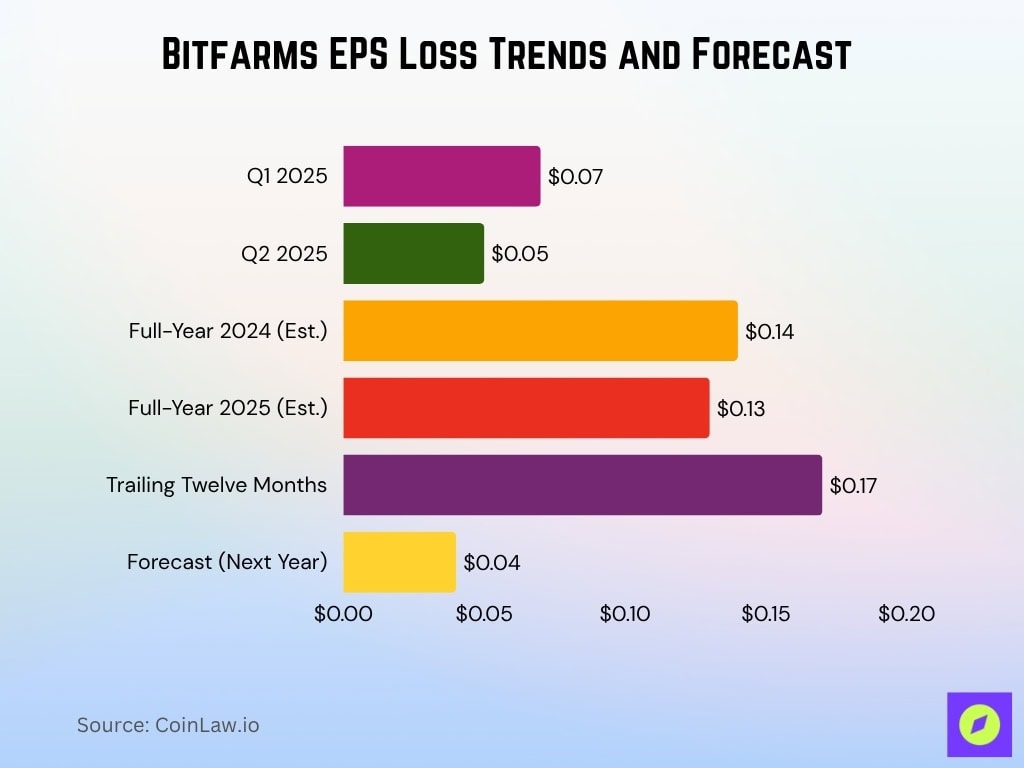

Earnings Per Share (EPS)

- Reported EPS for Q2 2025 was a loss of $0.05 per basic and diluted share.

- For Q1 2025, the basic and diluted net loss per share was $0.07.

- Trailing EPS is -$0.17 (ttm) and forecast growth in EPS loss reduction to -$0.04 per share for next year.

- The consensus loss per share for 2025 is forecast at $0.13, improved from $0.14 in 2024.

- Share-count dilution appears limited as no new shares were issued via the ATM program during the first eight months of 2025.

- The improvement in EPS outlook aligns with revenue growth projections of ~66.5% Y/Y for 2025.

- The company holds significant unencumbered Bitcoin (1,402 BTC), which may offer optionality to improve EPS if sold or monetised.

Net Income Statistics

- The net loss in Q2 2025 was $29 million, or $0.05 per share, compared with a net loss of $27 million in Q2 2024.

- For the full year 2024, Bitfarms reported a net loss of about $54.06 million.

- The estimated net income for 2025 is a loss of approximately $46.53 million.

- The profit margin (ttm) for Bitfarms is around -35.09% as of mid-2025.

- Operating margin (ttm) stands at -34.58%.

- In January 2025, Bitfarms earned 201 BTC and ended the month with an operating capacity of 386 MW.

- The number of BTC earned in Q1 2025 was 693, compared to 718 in Q2 2025.

- The company sold 1,052 BTC in Q2 2025 at an average price of $95,500 per BTC, generating $100 million in proceeds.

Assets and Liabilities

- As of Q2 2025, Bitfarms reported total liquidity of approximately $230 million.

- The company held 1,402 BTC as of August 2025.

- Operating capacity in March 2025 (end of Q1) was 461 MW, and operating EH/s was 19.5.

- Q2 2025 operating capacity had fallen to 410 MW from 461 MW in Q1.

- The company’s total debt to equity ratio is approximately 7.8%, well below the industry benchmark.

- In Q4 2024, Bitfarms reported property, plant, and equipment impairment and assets held for sale of $2,270 versus $12,252 in the prior year.

- As of Q4 2024, assets for the year ended December 31 were $192.881 million in revenues versus $146.366 million in 2023.

- Bitfarms announced in April 2025 a private debt facility of up to $300 million with Macquarie Group.

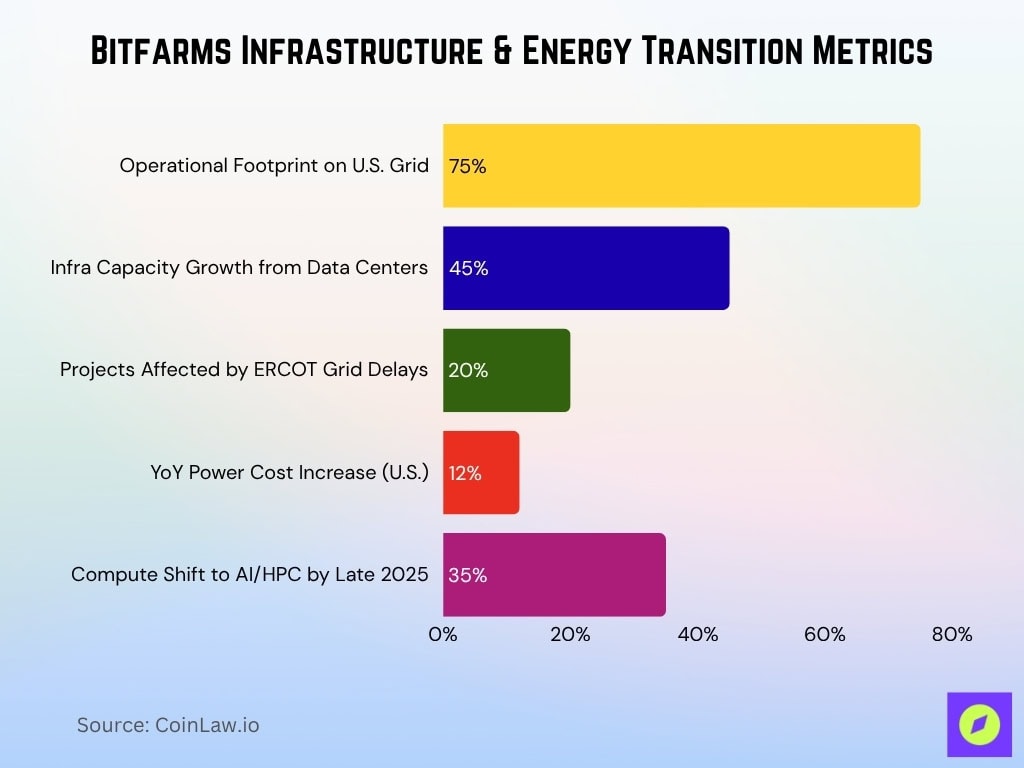

Technical Infrastructure

- U.S. energy grid access supports over 75% of the current operational footprint.

- Data-centre build-outs account for 45% growth in infrastructure capacity projected for 2025.

- Grid interconnection delays, particularly in ERCOT regions (Texas), have affected approximately 20% of Bitfarms’ planned energy expansion projects, due to backlogs in approval processes and infrastructure strain.

- Power cost escalation has averaged an increase of 12% YoY in key U.S. locations.

- Pivot to AI/HPC infrastructure represents a shift of 35% of total compute capacity by late 2025.

- Bitfarms’ energized mining capacity reached 461 MW as of March 2025.

- The average operating hashrate was 19.5 EH/s in March 2025.

- The reported average hashrate rate was 16.4 EH/s for the same period.

- Over 60% of mining operations are now located in U.S. jurisdictions.

- The company plans to deploy next-gen mining rigs compatible with AI/HPC workloads.

Equity and Shareholder Structure

- Bitfarms’ 2025 revenues are estimated at $321.1 million, with expected growth of ~66.5% Y/Y.

- As of October 2025, the company’s enterprise value is about $2.2 billion, reflecting investor pricing ahead of AI/data-centre monetisation.

- The company issued zero shares through the ATM program from January 24 to August 8, 2025.

- A significant portion of shares is held by institutional investors; total long-term debt is $71 million against assets of $828 million.

- Bitfarms disclosed its board diversity matrix and governance documents on its investor relations site.

- Mining asset sales of over $25 million in miners are being marketed for sale.

- The company’s energy and compute pivot means future shareholder value is increasingly linked to data-centre contracts rather than only crypto mining.

- The shareholders’ structure remains geared toward long-term institutional holdings rather than high-leverage retail speculation.

Stock Performance

- The share price of Bitfarms Ltd. ranged between approximately $0.67 and $6.60 over the past 52 weeks.

- Year-to-date, the stock has shown a rally of around +62.7%, outperforming the broader market.

- On a recent trading day, the shares fell by 9.8%, trading around $4.49 after previously closing at about $4.98.

- The company’s beta is reported in the range of ~4.0 to 4.4, indicating higher volatility relative to the market.

- Trading volume surged to over 110 million shares during one recent decline episode, significantly above the average.

- Analyst sentiment is mixed with an average price target of $6.58.

- Despite the gains this year, some sources note that much of the stock’s upside may already be priced in.

- The stock’s large swings reflect the dual risks of crypto-market exposure and the company’s pivot into HPC/AI infrastructure.

Valuation Metrics

- Bitfarms’ market capitalization is around $2.55 billion, with enterprise value roughly the same magnitude.

- The company’s price-to-sales ratio is approximately 8.3×, significantly higher than peer averages of around 3.2×.

- Debt-to-equity is modest at ~7.8%, implying comparatively low leverage.

- Future-oriented forecasts suggest revenues could reach $504.8 million and earnings $58.8 million by 2028, assuming a 27.1 % annual growth rate.

- The company raised $588 million in convertible notes recently, which may dilute equity or raise risk if not deployed profitably.

- Analysts caution that although the pivot to HPC and AI infrastructure is promising, many expected gains may already be reflected in the current valuation.

Dividend Policy

- Bitfarms has paid no dividends in the last 25 years.

- The company reported a net loss of -$46.53 million in 2025.

- Bitfarms’ 2025 revenues are estimated at $321.1 million, a 66.5% YoY increase.

- Consensus EPS loss for 2025 is -$0.13 per share, improving from -$0.14 in 2024.

- Bitfarms holds a $300 million debt facility supporting infrastructure growth.

- The company shifted capital expenditures, with 70% focused on U.S. HPC/data-centre expansion by 2025.

- EBITDA margin remains negative at about -28.6% for 2025, limiting dividend prospects.

- Analysts predict sustained losses into 2026 with EPS expected around -$0.01 per share.

Mining Capacity and Efficiency

- In March 2025, Bitfarms achieved an average hashrate of 16.4 EH/s and a peak of 19.5 EH/s.

- Monthly production for March was reported at 280 BTC, up 31% month-over-month.

- As of January 2025, the company reported 201 BTC mined in the month, down ~44% year-over-year.

- The cash cost per BTC in Q2 2025 was reported at $77,100, compared to $72,300 in Q1 2025.

- Efficiency (in watts per TH) was about 19 W/TH during Q2 2025, unchanged from Q1.

- The company plans to grow its energized capacity beyond the current ~461 MW and convert mining infrastructure into data centers for AI work.

- One major risk is that Bitcoin price swings or increases in energy cost may impair margin and capacity utilisation.

- The strategic shift toward compute capacity may improve long-term resource utilisation but may reduce bitcoin mining output in the short term.

Frequently Asked Questions (FAQs)

$78 million, up 87% year-over-year.

Earned 718 BTC, with an average direct cost of production $48,200 per BTC.

45%, down from 51% in Q2 2024.

Conclusion

Bitfarms Ltd. presents a complex picture. On the one hand, the company is showing strong growth in revenue and mining capacity, and it is executing a meaningful pivot into the high-growth HPC/AI infrastructure market. On the other hand, it remains unprofitable, highly volatile, and subject to valuation risks given that many of the growth expectations already appear priced in. While strong technical infrastructure and capacity metrics offer promise, the shift from mining to computing brings new execution and market risks that investors should monitor closely.