The global cryptocurrency market continues to evolve at a rapid pace, and the performance of the exchange Binance offers key insights into this dynamic ecosystem. From burgeoning user growth to soaring trading volumes, Binance’s metrics reflect its influence across retail and institutional segments alike. For instance, major traders now routinely execute tens of billions of dollars in daily activity on Binance, while smaller developers list new tokens to tap into its global reach.

In institutional use cases, hedge funds rely on Binance’s deep liquidity, and payment providers integrate its infrastructure for crypto-settled transfers. Let’s explore the full article for an in-depth breakdown of Binance’s performance and how it shapes the broader crypto exchange landscape.

Editor’s Choice

- 280+ million registered users served globally by Binance as of June 2025.

- 41.1% share of global spot trading volume in June 2025, reinforcing its dominant position.

- $2.55 trillion futures trading volume achieved in July 2025, the highest six-month mark.

- 500 + cryptocurrencies and 1,500 + trading pairs available on the platform.

- Maintained a ≈ 38%–40% market share among centralized crypto exchanges in Q2–Q3 2025.

- Lifetime trading volume surpassed $125 trillion with a user base nearing 280 million by mid-2025.

- Daily median trading volume is estimated at $16.3 billion for the 2025 mid-period.

Recent Developments

- In June 2025, the platform captured 41.1% of global spot volume, marking a record share in recent months.

- Futures volume surged in July 2025 to $2.55 trillion, a six-month high linked to Bitcoin volatility.

- Market-share data show Binance at 39.8% in July 2025 among centralized exchanges, ahead of second-place competitors.

- Regulatory and compliance efforts intensified in early 2025 as Binance expanded licensing efforts in multiple jurisdictions.

- New product launches in H1 2025 boosted engagement among advanced traders.

Binance Alpha Network Distribution

- BSC dominates the Binance Alpha ecosystem with a 46.15% share, making it the leading blockchain for deployment and activity.

- Solana follows with 28.21%, reflecting its growing developer and transaction footprint within the ecosystem.

- SUI maintains a 12.82% share, highlighting its steady traction among newer blockchain participants.

- Ethereum (ETH) also holds 12.82%, underscoring its continued relevance despite higher network costs.

- Other networks collectively account for 12.82%, showing modest diversification beyond the top chains.

Binance Global User Base

- Registered users: over 280 million globally as of mid-2025.

- Daily new registrations exceed 150,000 during peak periods of 2025.

- Monthly active users (MAUs) reportedly crossed 100 million during peak trading months in 2025, up ~11% year-over-year.

- Emerging-market onboarding: by April 2025, Binance had onboarded over 30 million new users from Latin America and Africa.

- Weekly active traders: ~75% of the user base reportedly trades weekly in 2025.

- Smart-Chain transactions: average daily transactions on the BNB Chain are processing ~8.865 million per day, up 146% year-over-year.

- Regional expansion: the user growth in Asia and Africa now constitutes a majority of new registrations.

Market Share and Trading Volume

- In June 2025, Binance held 41.1% of all global spot trading volume.

- For the first half of 2025, Binance captured ~37.34% of the global Bitcoin spot market.

- In Q1 2025, derivatives (futures) volume was estimated at over $2.6 trillion, representing ~67% of Binance’s total volume.

- Spot trading volume in Q1 2025 stood at approximately $2.2 trillion, representing ~100% year-over-year growth.

- Median daily trading volume in 2025 was estimated at $16.29 billion, placing Binance far ahead of its nearest competitor.

- Volume dropped from 2021 highs of $9.5 trillion to $3.4 trillion in 2023, reflecting market contraction.

- Market share among top 10 centralized exchanges: Binance ~38% in Q2 2025, with total volume for the top 10 at ~$3.8 trillion.

- The decline in overall exchange volume in Q2 2025 was ~21.6% quarter-on-quarter for Binance, signaling cyclical softness.

- July 2025 volume surged +61.4% month-over-month to ~$698.3 billion for Binance spot alone.

Crypto Sector Performance Highlights

- DeFi leads the market with a 44.6% YTD gain, signaling renewed investor confidence in decentralized finance protocols.

- RWAs (Real World Assets) surged 38.7%, driven by tokenization and institutional adoption trends.

- Stablecoins maintained strength at 38.6%, showing stability demand amid volatile markets.

- Layer 1 networks posted 24.6% gains, reflecting ongoing competition among main blockchains.

- Bitcoin (BTC) rose 19.8%, maintaining its position as a steady benchmark performer.

- Exchanges saw moderate gains of 14.1%, buoyed by higher trading activity.

- Memecoins fell 7.4%, showing reduced speculative demand.

- Layer 2 solutions dropped 26.9%, suggesting cooling momentum after strong 2024 growth.

- Gaming tokens plunged 43.6%, indicating lower user engagement and investment.

- AI-related tokens experienced the steepest decline at -55.4%, reflecting market correction after prior hype cycles.

Listed Cryptocurrencies and Trading Pairs

- Coin data show that currently there are 434 coins and 1,595 trading pairs listed.

- Historical listing count: at one point ~380 coins and 1,226 pairs.

- The listing pipeline remains active with regular “New Cryptocurrency Listing” updates.

- Projects continue seeking a Binance listing because of volume and brand exposure.

- Regional listing differences exist, as Binance.US supports fewer listings given regulatory constraints.

- Listing criteria focus on community traction, security, and compliance.

- The broad listing base supports diverse trading strategies and enhances user choice.

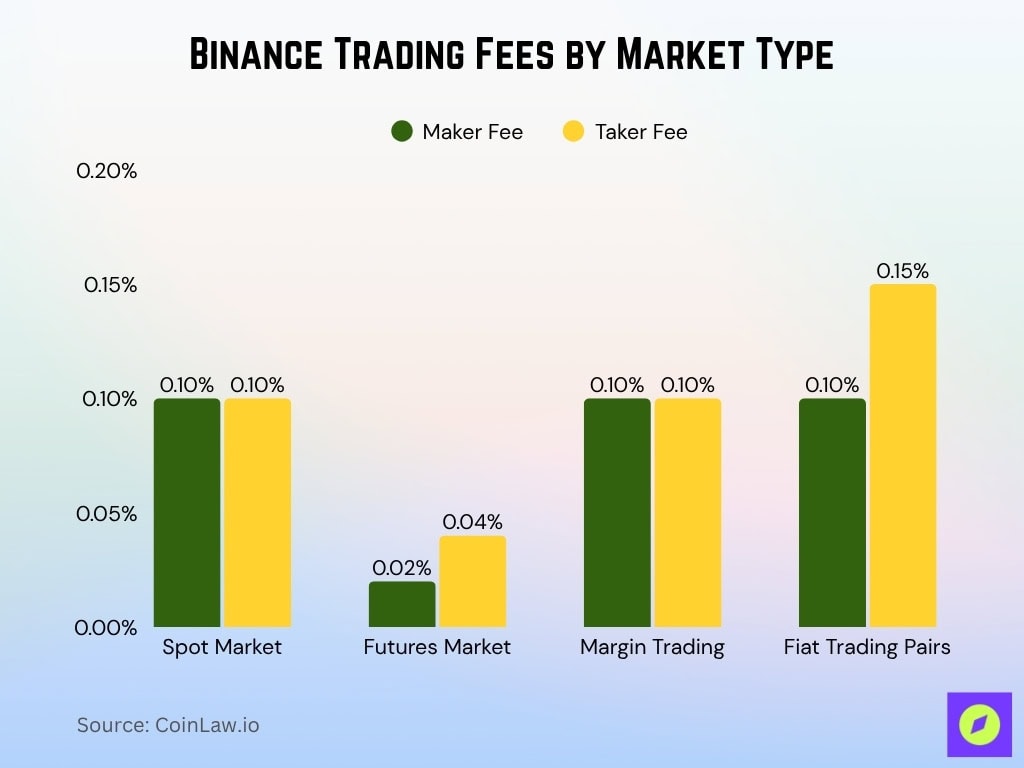

Fee Structure

- The base spot trading fee is 0.10% for both maker and taker at the standard level.

- Futures trading fees for a typical user: 0.0200% maker and 0.0400% taker.

- Paying fees in BNB gives a discount up to 25%, lowering spot cost to ~0.075%.

- Deposit fees are generally zero for crypto assets; withdrawal fees vary by network.

- The fee schedule is tiered by 30-day volume and BNB holdings.

- A fiat market-maker program introduced rebates as low as -0.010%.

- Compared to competitors like Coinbase, Binance’s fees remain among the lowest globally.

- The structure rewards volume and native-token usage, benefiting retail and institutional users alike.

Main Trading Products (Spot, Futures, Margin)

- On the spot market, the standard maker/taker fee starts at 0.10%/0.10% for users under the first VIP tier.

- For the futures market, fees for regular users begin at 0.02% maker and 0.04% taker.

- Margin trading is supported, with similar fee parity around 0.10% for both maker and taker.

- The futures fee schedule spans VIP levels 0–9 with volume thresholds.

- For fiat-trading pairs, fees start at 0.10% maker and 0.15% taker but can be reduced significantly at higher tiers.

- Payment of fees using the native token BNB grants up to a 25% discount, reducing spot fees to approximately 0.075%.

- Futures contracts are available in both USDT-margined and COIN-margined versions.

- The fee floor for high-VIP futures traders can drop as low as 0.0000% maker / 0.0170% taker for VIP 9.

Security Measures and Proof of Reserves

- Binance holds user assets 1:1, with additional reserves verified by Merkle-tree proof.

- In its April 2025 Proof-of-Reserves report, BTC ratio was 105.78%, ETH 104.21%, BNB 107.90%, USDT 101.34%, and USDC 102.66%.

- Binance maintains an emergency fund called the SAFU (Secure Asset Fund for Users).

- Licensed or in-process status across 21+ countries as of 2025 ensures compliance coverage.

- Proof-of-Reserves is updated regularly with cryptographic verification.

- Binance has had no major unresolved hacks since 2019.

- Security credentials reinforce trust among institutional and retail participants.

Regulatory Status and Compliance

- Binance controls ~39.8% of global spot trading volume among centralized exchanges in 2025, maintaining its market leadership despite increased regulation.

- The exchange paid a record $4.3 billion fine in the U.S. settlement over AML and sanctions violations, marking one of the largest crypto penalties to date.

- France launched a judicial probe in January 2025 into alleged money laundering and tax fraud at Binance, covering operations from 2019–2024.

- The ACPR in France identified gaps in AML and CTF controls, citing heightened supervision under the EU’s MiCA framework.

- Binance currently holds regulated registrations or licenses in 15+ jurisdictions, including France, Italy, Lithuania, Bahrain, and Dubai.

- In 2025, 90% of exchanges in North America, including Binance, were confirmed fully KYC compliant, up from 85% in 2024.

- The Binance U.S. entity operates under a distinct compliance structure, monitored by U.S. authorities following the 2023 consent decree.

- Under MiCA readiness reviews in 2025, Binance was flagged for internal control weaknesses but is expected to meet MiCA licensing standards by 2026.

Earn and Staking Products

- Binance supports over 100 PoS coins for staking and earning rewards.

- Locked Savings products reached ~6.1% APR in early 2025.

- Flexible stablecoin savings averaged 3.9% APR.

- Some Dual Investment campaigns offered up to 35% APR yields.

- SOL staking yielded about 11.7% APY after fees.

- Binance charges ~10% commission on staking rewards, lower than competitors.

- Soft-staking launched in June 2025 and allows rewards directly in spot accounts.

- Earn products include lock periods from 15–120 days and flexible liquidity.

- About 38% of retail investors used staking platforms in 2025.

Supported Fiat Currencies and Payment Methods

- Over 70 countries now support direct USD deposits and withdrawals via BPay Global with zero deposit fees and major payment options.

- Binance integrated Apple Pay and Google Pay in April 2025, expanding its EUR and USD contactless fiat gateways.

- The fiat network spans 125+ currencies and 1,000+ payment methods, including mobile money in nine African nations.

- Binance Connect powers fiat on/off-ramps for Web3 wallets like Trust Wallet, SafePal, and Phantom.

- Trust Wallet’s Binance Connect integration enables 300+ cryptocurrencies and 7 fiat on-ramps via banks and P2P.

- Binance supports fiat trading in 30+ currencies through bank transfers, cards, and P2P globally.

- Daily P2P volumes in emerging markets grew 7–10% per month in 2025, showing stronger fiat accessibility.

- The platform processes up to $50 million/day in fiat deposits and $13 million per transaction for institutional-grade users.

- Binance expanded “Sell to Card” and “Withdraw to Card” features across Europe for seamless Euro cashouts.

Mobile and Web Platforms

- The mobile app drives 72% of activity with 100M+ installs and ratings of 4.4★ (iOS) and 4.2★ (Android).

- 75% of users trade weekly via mobile, showing strong engagement across Lite and Pro modes.

- The web platform generates 62.55% of traffic, while mobile contributes 37.45%, reflecting multi-device use.

- Binance Smart Chain processes 8.9 million daily transactions, with web traders dominating spot and futures.

- 2025 UX upgrades improved onboarding by 26%, enhancing login and fiat integration.

- Lite mode usage rose 35% YoY, boosting access in low-bandwidth regions.

- Binance.com logged 70.3 million visits in April 2025, averaging 11m 30s per session, showing deep engagement.

Launchpad and IEO Statistics

- The Binance Launchpad ecosystem hit an $8.05 billion market cap with $524 million in 24-hour trading volume by mid-2025.

- The average Binance IEO ROI in 2024–2025 was 7.7×, led by projects like Axie Infinity, Polygon, and Injective.

- BNB/FDUSD staking stayed the main subscription model for all IEO participation phases.

- In 2025, Binance hosted 20+ IEOs, showing strong growth and tighter project vetting.

- Average post-launch token performance rose 115% within 72 hours of listing in 2025.

- Binance IEOs saw an 87% success rate for 2024–2025 launches, outperforming rivals.

- AXS, SAND, and GMT tokens together reached $5.1 billion in market cap after Launchpad listings.

- BNB staking for Launchpad access grew 32% YoY, reflecting strong global retail engagement.

NFT Marketplace Statistics

- Total NFT sales across 23 blockchains hit ~$598.8 million in August 2025, up 4.32%.

- BNB Chain accounted for 11.67%, around $69.94 million.

- Global NFT sales in 2025 year-to-date reached $3.62 billion.

- NFT marketplace forecast to reach $247 billion by 2029.

- Binance supports NFTs via listings, creator tools, and wallet integration.

API and Technology Stats

- Binance achieved 99.98% API uptime in H1 2025 with 100% availability across Spot, Margin, and Futures CM systems.

- Only 1 minor outage occurred in Futures UM, lasting 45 minutes and auto-resolved through system monitoring.

- The API infrastructure supports 280 million+ users worldwide for real-time price and depth data.

- Latency dropped from 55.8 ms to 1.8 ms, boosting high-frequency trading reliability.

- Binance APIs power programmatic trading for 300+ assets across Spot, Futures, Margin, and Options.

- REST and WebSocket endpoints maintain microsecond-level precision for order updates.

- The Link Program offers institutional clients FIX API access with low-latency routing.

- 24/7 automated diagnostics ensure zero unplanned downtime beyond the single 2025 incident.

- Algorithmic and quant traders account for 65% of daily trading activity via API infrastructure.

Customer Support and Service Metrics

- Binance provides 24/7 customer support in 100+ countries and 18 languages, ensuring global user accessibility.

- The company employs 5,300+ people worldwide, with a 34% YoY rise in compliance and risk roles totaling 645 specialists in 2025.

- Average chat response time dropped below 90 seconds, marking a 41% improvement from 2024.

- Customer satisfaction reached 92% globally, driven by faster multilingual chatbot-assisted resolutions.

- Institutional clients receive dedicated VIP and OTC support for settlement, custody, and onboarding processes.

- Binance processed 1.4M+ support tickets monthly in 2025, with 79% auto-resolved via guided help tools.

- The support satisfaction index rose 22% YoY, powered by analytics from uptime transparency reports.

- Service quality feedback improved 19%, while user complaints fell 26% compared to 2024.

- Over 10,000 support and compliance staff are projected by 2026, underscoring Binance’s focus on user trust.

- Binance maintained 99.98% support uptime, keeping live chat and account services fully operational.

Major Partnerships and Integrations

- Binance formed 27 global partnerships in 2025 across governments, fintechs, and tech firms, with CoinLedger as its largest partner.

- Collaboration with Worldpay® enabled Apple Pay and Google Pay in 125+ countries, streamlining fiat-to-crypto purchases.

- Partnership with the Kyrgyz Republic advanced the digital som project to integrate blockchain into national systems.

- The Africa Fintech Summit 2025 named Binance a Platinum Sponsor, driving blockchain education and cross-border payments.

- The Link Program provided institutions with low-latency liquidity and API trading across partner networks.

- Binance and Franklin Templeton co-developed digital asset investment products bridging traditional finance and Web3.

- Partnerships expanded Binance operations into the UAE, Singapore, and 20+ regulated markets, strengthening compliance reach.

- University programs sponsored by Binance trained 10,000+ students globally in Web3 and crypto literacy.

- Worldpay integration boosted fiat gateway usage by 43% YoY, with 60% of new users transacting via mobile wallets.

- Binance’s fintech and government alliances helped BSC handle 36% of global retail transaction volume by Q2 2025.

Frequently Asked Questions (FAQs)

Binance reported approximately 280 million users globally in early 2025.

Binance held about 41.1% of global spot trading volume in June 2025.

In July 2025, Binance’s spot volume reached $698.3 billion, up 61.4% compared with June.

Binance captured about 37.34% of the global Bitcoin spot-trading volume in H1 2025 (amounting to over $3.44 trillion).

Conclusion

The performance metrics of Binance reflect a mature and diversified exchange ecosystem that extends well beyond spot trading alone. From its robust Earn and staking offerings, through token launch services and NFT marketplace activity, to educational initiatives, high-availability APIs, global customer support, and extensive partnerships, Binance is positioning itself not just as a trading venue but as a crypto infrastructure hub.

Stakeholders, from retail users seeking passive income to institutions requiring reliability and service quality, will find multiple entry points in its ecosystem. As regulatory clarity improves and global adoption deepens, Binance’s evolving data and ecosystem will continue to shape the next phase of digital-asset markets.