In 2016, Bank of America introduced Erica, one of the first AI-powered banking chatbots. Initially met with curiosity, Erica has since helped over 50 million users manage transactions, track spending, and get instant answers. This small innovation kicked off a broader revolution in digital banking.

Fast forward to 2025, and chatbot adoption in banking is no longer an experiment; it’s a foundational pillar. Banks across the globe are now relying on chatbots to handle everything from onboarding to fraud alerts. But how deep does the adoption go? And what trends are shaping this AI-driven shift?

Key Takeaways

- 173% of global banks now deploy at least one chatbot in customer-facing operations in 2025.

- 288% of US-based Tier 1 banks have integrated AI chatbots across mobile and desktop platforms by 2025.

- 3$7.3 billion in operational cost savings are projected globally for banks using chatbots in 2025.

- 4Chatbots handle an estimated 3.1 billion banking interactions per month in 2025, marking a 28% YoY increase.

- 5Customer satisfaction scores for chatbot interactions in banking reached 84% in 2025.

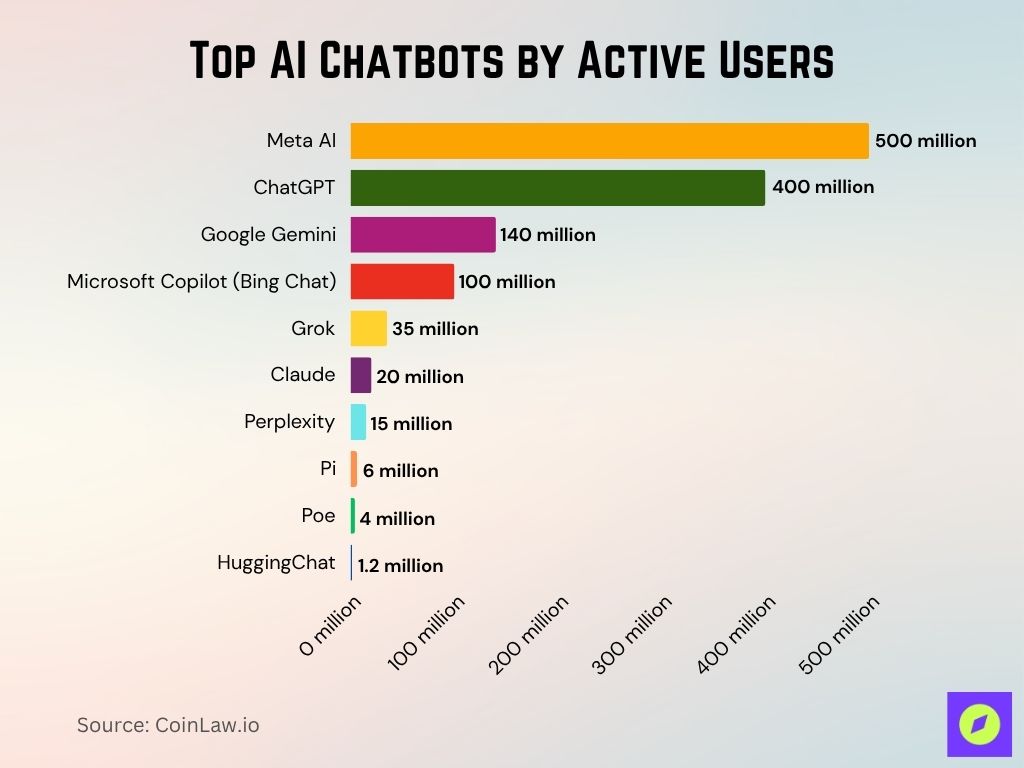

Top AI Chatbots by Active Users

- Meta AI leads the AI chatbot landscape with 500 million active users, making it the most widely used chatbot globally.

- ChatGPT ranks second with 400 million active users, maintaining strong adoption across business and consumer sectors.

- Google Gemini has gathered 140 million active users, reflecting Google’s continued influence in the AI race.

- Microsoft Copilot (Bing Chat) holds 100 million active users, driven by its integration with Microsoft 365.

- Grok, developed by xAI, has reached 35 million active users, showing rapid growth despite being newer to the field.

- Claude, from Anthropic, has attracted 20 million active users, valued for its focus on safety and alignment.

- Perplexity serves 15 million active users, gaining popularity for its AI-powered search capabilities.

- Pi, the personal AI assistant from Inflection AI, engages with 6 million active users.

- Poe, a platform aggregating multiple AI models, sees 4 million active users.

- HuggingChat, an open-source alternative, maintains 1.2 million active users, appealing to the developer and research community.

Global Banking Chatbot Adoption Rates

- The global chatbot market for banking is valued at $2.1 billion in 2025, growing at a CAGR of 24% since 2020.

- In 2025, 6 out of 10 new core banking platforms come with built-in chatbot capabilities.

- By 2025, 71% of financial institutions globally have implemented chatbots for internal employee support as well.

- Asian-Pacific banks show an adoption rate of 79% in 2025, outpacing North America.

- The average bank chatbot in 2025 handles 40,000+ customer interactions monthly.

- 46% of mid-sized banks worldwide have adopted at least one AI chatbot in 2025, up from 30% in 2022.

- Latin America sees a rapid uptick, with chatbot penetration reaching 62% of banks in 2025.

- 15% of banks globally now develop proprietary chatbot technology in-house as of 2025, reducing dependency on third-party vendors.

- In 2025, banking chatbots are used in 23 languages globally to cater to regional customer bases.

- Chatbots now serve over 1.8 billion global banking customers directly or indirectly in 2025.

Regional Trends in Chatbot Usage in Banking

- 92% of North American banks use AI-powered chatbots in customer service as of 2025.

- In Europe, the UK leads adoption with 85% of banks using chatbots, followed by Germany at 78% in 2025.

- Middle East and Africa banking chatbot usage stands at 59% in 2025.

- In 2025, India becomes the largest chatbot user base in banking by volume, handling over 250 million chatbot interactions per month.

- Southeast Asia experiences explosive growth, with chatbot adoption in banking rising to 73% in 2025.

- Australian banks maintain high satisfaction levels, with 88% of chatbot users rating their experiences as helpful in 2025.

- South American adoption hits 68% in 2025, driven by mobile banking expansion in Brazil and Colombia.

- Canadian banks report 63% of all digital service inquiries now routed through chatbots in 2025.

- In the Nordic region, 81% of banks utilize chatbots as first-line support in 2025, particularly in Sweden and Finland.

- African fintech-led banks are pushing innovation, with 34% offering multilingual chatbot support in 2025.

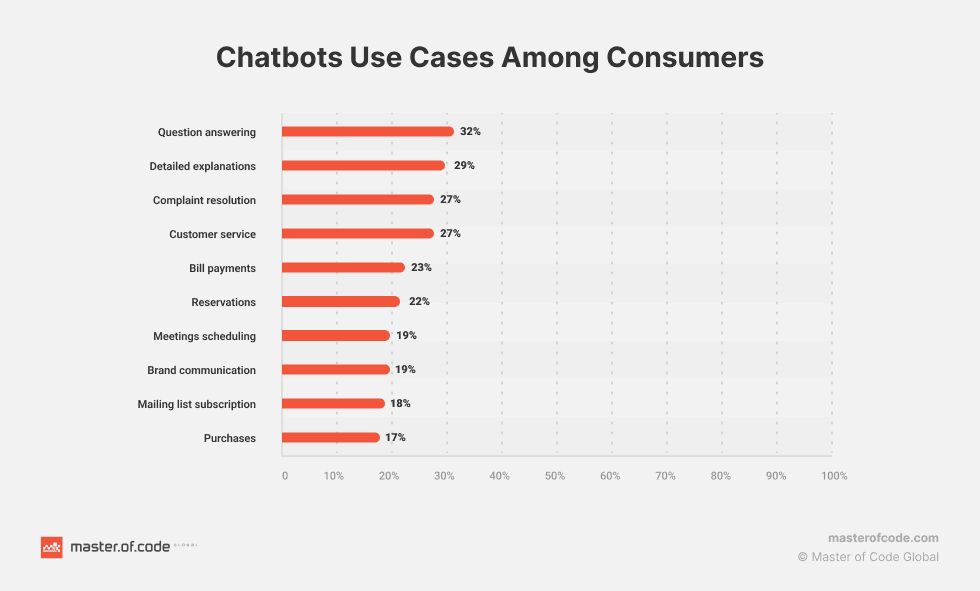

Top Chatbot Use Cases Among Consumers

- 32% of consumers use chatbots for question answering, making it the most popular use case.

- 29% rely on chatbots for detailed explanations, highlighting their value in providing context or clarity.

- 27% use chatbots for complaint resolution, showing their role in customer satisfaction.

- Another 27% turn to chatbots for customer service needs, supporting routine queries.

- 23% use chatbots to handle bill payments, emphasizing their utility in financial tasks.

- 22% make reservations via chatbots, showcasing their convenience in booking-related tasks.

- 19% of users schedule meetings through chatbots, streamlining productivity workflows.

- Another 19% use them for brand communication, such as announcements or promotions.

- 18% subscribe to mailing lists via chatbot interfaces.

- 17% complete purchases through chatbots, showing growing e-commerce integration.

Impact of Chatbots on Customer Service Efficiency

- In 2025, chatbots resolve 87% of banking inquiries in under 60 seconds without human escalation.

- 61% of banks report a reduction in average call center wait times due to chatbot deflection in 2025.

- The average cost of a chatbot-handled interaction is $0.11 in 2025, compared to $6 for live agent support.

- Customer service productivity improved by 32% across banks utilizing AI chatbots in 2025.

- In 2025, banks using chatbots reduced their average case resolution time by 38%.

- 74% of chatbot interactions now lead to first-contact resolution in 2025.

- Banks saw a 41% drop in ticket backlog rates after chatbot integration by 2025.

- Internal chatbot use for IT and HR queries led to 50% faster response times in 2025.

- 92% of banks implementing chatbots reported improved Net Promoter Scores (NPS) in 2025.

- Voice-enabled banking chatbots handled 21% of all customer service traffic in 2025, a growing trend in accessibility.

Key Industries Within Banking Using Chatbots

- 98% of retail banks are actively using chatbots in customer service or onboarding processes in 2025.

- Investment banks leverage chatbots for client portfolio updates and alerts in 63% of operations in 2025.

- 78% of credit unions in the US now use chatbots for member service and fraud alerts in 2025.

- Private banks have adopted secure chatbots for wealth management inquiries in 55% of institutions by 2025.

- 66% of banks offering mortgage services employ chatbots for pre-qualification and FAQs in 2025.

- Commercial banks use AI chatbots in 72% of their business accounts onboarding flows in 2025.

- 48% of banks involved in cross-border services integrate multilingual chatbots in 2025.

- Fintech-led challenger banks have a 100% adoption rate of chatbot support by 2025, often as the sole customer service channel.

- Islamic banking institutions saw chatbot adoption rise to 46% globally in 2025, focusing on Sharia-compliant guidance.

- 52% of cooperative banks now rely on chatbot platforms for daily customer interaction in 2025.

Chatbot Technology Adoption by Business Size

- Micro businesses have the lowest current usage of chatbots at 8%, but 66% plan to adopt them in the future.

- Small businesses show 16% chatbot adoption, with another 55% intending to implement them soon.

- Medium-sized businesses lead adoption rates at 19%, though 47% are still planning to integrate chatbot solutions.

- Big businesses have a slightly lower current usage at 14%, but also the highest share not planning to adopt chatbots at 52%.

AI and NLP Advancements Driving Chatbot Integration

- 95% of banking chatbots now use advanced NLP frameworks like transformer-based models in 2025.

- Sentiment analysis is active in 69% of bank chatbot platforms to personalize customer responses in 2025.

- Real-time learning systems were implemented in 58% of chatbot engines to adapt from live conversations in 2025.

- 82% of banks enhanced chatbot language support in 2025, adding local dialects and slang interpretation.

- Contextual memory capabilities allow 76% of banking chatbots to manage multi-turn conversations effectively in 2025.

- 70% of chatbots are now integrated with customer CRM tools for deeper personalization in 2025.

- Voicebot integration rose by 43% among banks offering omnichannel support in 2025.

- AI chatbots now support document uploads and real-time scanning in 62% of digital banking platforms in 2025.

- 88% of chatbots in 2025 can now escalate to a human agent with full conversation context retained.

- Predictive AI features help 54% of banking chatbots suggest next steps or related services in real time in 2025.

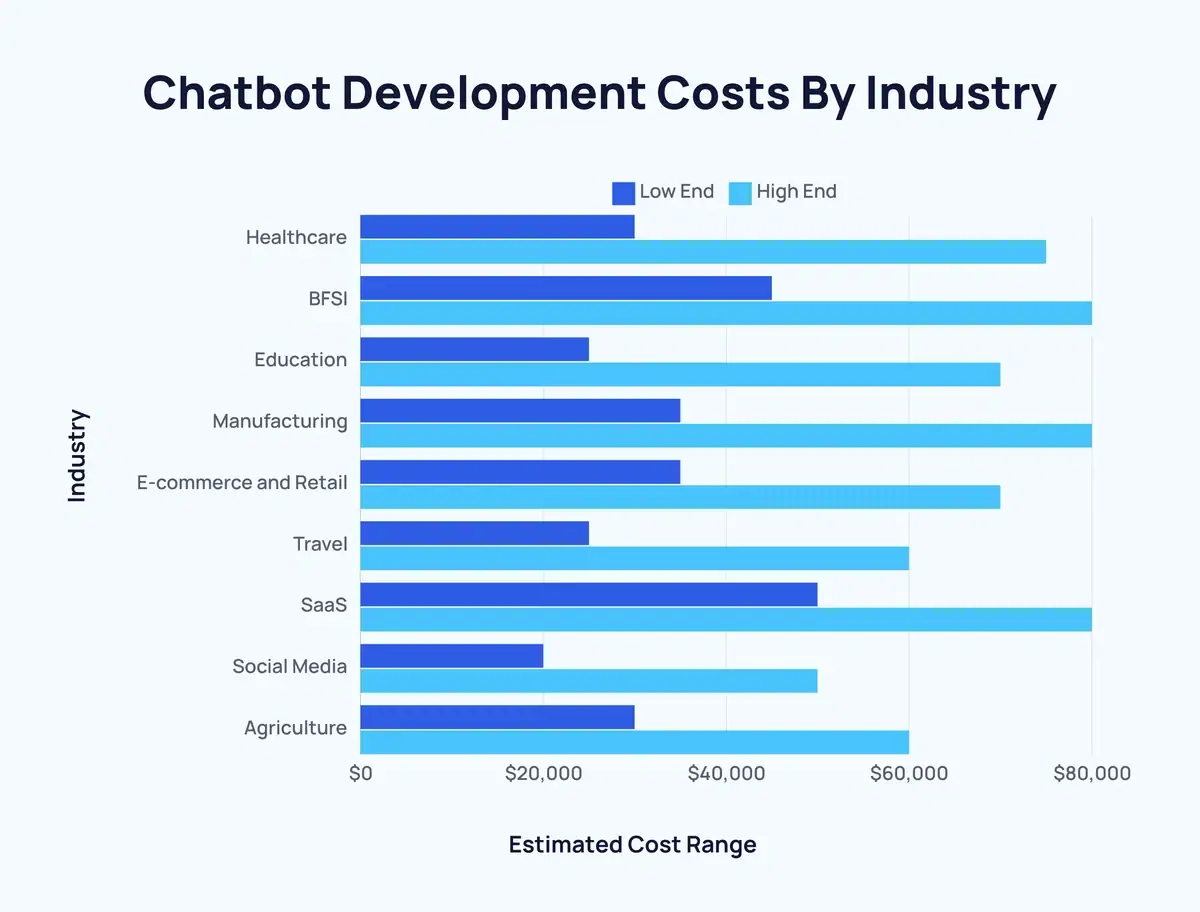

Chatbot Development Costs by Industry

- Healthcare chatbot development costs range from $30,000 to $75,000, reflecting complex integration and compliance needs.

- The BFSI sector (Banking, Financial Services, and Insurance) sees some of the highest costs, from $45,000 to $80,000, due to security and regulation requirements.

- Education chatbots are relatively affordable, with development costs between $25,000 and $70,000.

- Manufacturing chatbots cost around $35,000 to $80,000, driven by the need for automation and system integration.

- E-commerce and Retail chatbots typically cost $35,000 to $70,000, helping improve customer interaction and sales.

- Travel industry chatbots fall between $25,000 and $60,000, supporting booking and customer service functions.

- SaaS chatbot development is among the most expensive, with costs ranging from $50,000 to $80,000.

- Social Media chatbots are more budget-friendly at $20,000 to $50,000, focusing on engagement and messaging.

- Agriculture sector chatbots cost about $30,000 to $60,000, supporting smart farming and user assistance.

Cost Reduction and Operational Benefits for Banks

- In 2025, banks saved an estimated $7.3 billion globally due to chatbot-related efficiencies.

- Chatbots have helped reduce inbound call volumes by 42% in 2025, cutting down staffing needs.

- On average, chatbot integration lowered customer service operating costs by 29% per bank in 2025.

- Employee time savings from internal chatbot use resulted in productivity gains worth $1.2 billion across US banks in 2025.

- 38% of banks redirected savings from chatbot deployment into digital transformation initiatives in 2025.

- Operational overhead in customer support dropped by 24% on average after chatbot adoption in 2025.

- In 2025, banks using chatbots reported a 21% reduction in time-to-resolution metrics across service channels.

- Chatbots enabled 48% of surveyed banks to scale support without increasing staff during high-demand events in 2025.

- Banking executives ranked chatbots as the #1 driver of cost optimization in digital service channels for 2025.

- 56% of new digital-only banks cited chatbot systems as their most cost-effective support solution in 2025.

Common Challenges in Chatbot Implementation

- In 2025, 63% of banks reported difficulty in integrating chatbots with legacy core systems.

- 34% of chatbot implementations exceeded budget by at least 15% due to unforeseen customization needs in 2025.

- 48% of banks experienced a need to retrain or replace chatbot AI models due to evolving customer expectations in 2025.

- 59% of mid-sized banks reported challenges with maintaining conversational consistency across platforms in 2025.

- 41% of chatbot systems faced issues with detecting customer intent accurately for non-standard queries in 2025.

- The average time to full deployment increased to 7.2 months in 2025.

- Only 36% of banks reported having adequate in-house expertise to maintain and train chatbot AI in 2025.

- Language and dialect nuances posed implementation challenges for 28% of global chatbot deployments in 2025.

- 52% of banks had to upgrade their infrastructure to support advanced chatbot features like voice and video in 2025.

- Vendor lock-in was identified as a risk factor by 44% of banks using third-party chatbot providers in 2025.

Preferred Chatbot Platforms by Age Group

- Desktop websites are the most preferred chatbot platform overall, used by 83.81% of respondents. Notably, 100% of Generation X users favor this platform, compared to 87.04% of Millennials and 55.56% of Gen Z.

- Messenger apps are favored by 73.33% overall, with 83.33% of Gen Z leading the preference, followed by 75.68% of Millennials. Only 46.15% of Gen X users prefer this platform.

- Mobile apps are used by 57.14% in total, but they are particularly popular among Gen Z (77.78%), while Millennials trail at 51.35% and Gen X is slightly higher at 61.54%.

- Voice assistant devices appeal to 40.95% overall. Usage increases with age, 53.85% of Gen X prefer them, followed by 40.54% of Millennials, and only 33.33% of Gen Z.

- Mobile websites are the least preferred across all age groups, with just 20% overall usage. Gen X (30.77%) is most open to using them, compared to 18.92% of Millennials and 16.67% of Gen Z.

Security and Privacy Considerations in Banking Chatbots

- In 2025, 89% of banks enforced multi-factor authentication within chatbot interactions.

- 76% of chatbot systems in banking now use end-to-end encryption by default in 2025.

- Chatbot platforms flagged 3.4 million potential fraud attempts in 2025.

- 64% of banks implemented real-time threat detection systems integrated with chatbot data streams in 2025.

- 58% of banks use AI-based anomaly detection to monitor chatbot conversation patterns in 2025.

- Privacy compliance frameworks (GDPR, CCPA) were cited as top priorities by 92% of banks deploying chatbots in 2025.

- 39% of banks reported chatbot-related customer data privacy incidents in the past 12 months as of 2025.

- 43% of chatbot tools now allow customers to manage or delete conversation history directly within the app in 2025.

- Internal audits of chatbot logs were conducted quarterly by 68% of large banks in 2025.

- AI ethics reviews were established in 27% of chatbot development teams in banks as of 2025.

Future Outlook for Chatbots in Financial Services

- By 2026, 82% of banks plan to expand chatbot capabilities to investment advisory and insurance queries.

- 73% of financial institutions in 2025 expect to invest further in multilingual NLP to support global growth.

- Predictive banking chatbots capable of financial coaching are expected to be in 44% of apps by the end of 2026.

- 57% of banking execs see AI chatbots as central to their digital personalization strategy in 2025.

- Banks anticipate chatbots will reduce human customer support roles by 25% over the next 3 years from 2025 levels.

- 64% of banks are planning to integrate chatbot services with IoT-enabled smart home devices by 2027.

- In 2025, 49% of banks started pilots for emotionally intelligent AI to handle sensitive interactions like debt recovery.

- The use of generative AI to create contextual chatbot responses is forecasted to grow by 85% by 2026.

- 91% of fintech startups plan to launch with embedded chatbot features as core user interface by 2026.

- Chatbots are expected to contribute to $11 billion in cumulative savings for banks between 2025–2028.

Global AI Chatbot Market Forecast

- The AI chatbot market size is projected to grow from $8.6 billion in 2024 to $31.11 billion by 2029.

- In 2025, the market is expected to reach $11.14 billion, continuing its rapid expansion.

- This growth represents a compound annual growth rate (CAGR) of 29.3%, highlighting strong global demand.

- The market is forecast to see steady increases year-over-year through 2026, 2027, and 2028, before peaking at $31.11 billion in 2029.

The data emphasizes the accelerating adoption of AI chatbots across industries due to efficiency, cost savings, and 24/7 availability.

Recent Developments in Banking Chatbot Technology

- In 2025, major US banks like Chase and Citi adopted LLM-based chatbots for real-time portfolio Q&A services.

- AI-powered biometric authentication via chatbot was launched in 38% of mobile banking apps by mid-2025.

- Embedded video call support through chatbots went live in 22% of global banks in 2025, mainly for loan servicing.

- 61% of new chatbots in 2025 offer cross-platform support, enabling continuity between mobile, web, and voice assistants.

- Integration with generative AI like ChatGPT allowed 46% of banks to deploy more nuanced chatbot scripts in 2025.

- 58% of banks now use proprietary AI models fine-tuned on their own customer interaction data in 2025.

- Gamified chatbot training platforms were implemented in 19% of banks to continuously improve performance in 2025.

- In 2025, 33% of chatbots launched predictive risk alerts for account activity based on behavioral AI analysis.

- Blockchain-based chatbot data logging was introduced in 17% of pilot projects to enhance audit trails in 2025.

- Emotion-aware chatbots using sentiment detection expanded to 26% of financial service providers in 2025.

Conclusion

From customer service to compliance, banking chatbots are reshaping the digital experience. In 2025, banks are no longer just adopting chatbot technology; they’re optimizing, expanding, and innovating on top of it. Whether it’s operational savings, improved customer engagement, or smart security, the benefits are compounding. But challenges around integration, trust, and scalability remain in focus. The next wave of evolution lies in personalization and context, turning chatbots from simple responders into proactive financial companions.