Overdraft fees remain one of the most contentious charges consumers face when managing checking accounts. These fees directly affect millions of Americans who inadvertently or unavoidably draw their balance below zero, and they also influence how banks design account policies and manage risk.

For example, a U.S. household may rely on a short-term overdraft to cover an urgent expense, incurring a fee that shapes their budgeting decisions. Similarly, a regional credit union may adjust its overdraft protection program to curb customer losses and regulatory scrutiny. In this article, we dive into the latest data and trends on overdraft fees in the U.S. economy.

Editor’s Choice

- The average U.S. bank overdraft fee is $26.77 in 2025 (down 1% from $27.08 in 2024), while major banks still charge up to $35 per overdraft.

- Consumers paid an estimated $12.1 billion in combined overdraft and NSF fees in 2024.

- The average overdraft fee at very large financial institutions was reported at $32.50 in recent federal data.

- Among the roughly 33 million U.S. households that overdrew their accounts pre-pandemic, the reduction in fees since has saved an estimated $185 per household annually.

- Research shows that the primary predictor of frequent overdraft usage is credit constraint, not simply income or race.

Recent Developments

- The Consumer Financial Protection Bureau issued a final rule in December 2024 requiring banks with over $10 billion in assets to choose either: charge a capped fee of $5, charge a fee covering costs/losses only, or treat overdraft as a loan and disclose APR.

- Data show that overdraft/NSF revenue for reporting banks dropped by roughly 24% in 2023 compared to 2022, and more than half since 2019.

- In early 2025, the research community revised prior estimates to show consumers paid $12.1 billion in overdraft/NSF fees in 2024, up from previous lower estimates.

- Some large banks announced expanded accounts with no overdraft fee or lower buffer thresholds in response to regulatory and consumer pressure.

- The new data suggest that credit unions contribute a larger share of overdraft/NSF revenue than previously assumed, up to 45% of total in recent estimates.

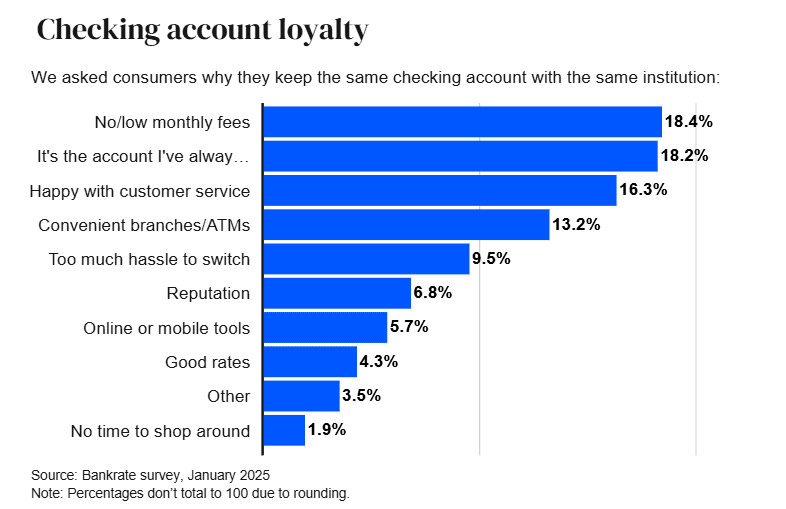

Checking Account Loyalty Insights

- No or low monthly fees are the top reason consumers stay loyal, cited by 18.4% of respondents.

- Long-standing account history is nearly tied, with 18.2% keeping their account simply because it’s the one they’ve always used.

- Customer service satisfaction influences 16.3% of consumers to stay.

- Convenient branches or ATMs keep 13.2% of users from switching.

- 9.5% say switching banks is too much hassle, making inertia a strong loyalty factor.

- Reputation matters for 6.8% of consumers choosing to remain with their bank.

- Online or mobile tools retain 5.7% of customers, showing rising digital expectations.

- Only 4.3% stay because their bank offers good rates, suggesting low rate sensitivity in checking accounts.

- 3.5% fall under other reasons, a small but notable cluster.

- Just 1.9% say they have no time to shop around, the lowest influence among the listed reasons.

How Overdraft Fees Work

- An overdraft fee is charged when a bank covers a transaction that exceeds the available account balance, rather than returning it unpaid.

- 94% of bank accounts charge overdraft fees on transactions that exceed balances.

- About 83% of the largest banks allow overdraft coverage on ATM and debit card transactions.

- Consumers paid an estimated $12.1 billion in overdraft and NSF fees in 2024.

- Overdraft fees can stack, with customers sometimes paying overdraft on multiple transactions in one day.

- Roughly 86% of banks operate at least one formal overdraft program or linked protection account.

- Some banks apply a buffer of up to $50 negative balance before charging fees; others charge immediately.

- Approximately 67% of large banks charge overdraft fees in the range of $35 to $38 per occurrence.

Overdraft Fee Trends Over Time

- Annual reported overdraft/NSF fee revenue at large banks dropped from ~$11.96 billion in 2019 to ~$5.83 billion in 2023.

- That represents a decline of about 51% from 2019 to 2023.

- The average overdraft fee across major institutions was $35 (median) or about $32.50 (weighted average) in recent data.

- The reported number of adults paying overdraft fees held at 11% of bank-account-holders in 2024, which is similar to 2022 and 2023.

- The share of fees originating from credit unions rose as banks scaled back programs.

- Some banks reduced fee amounts (e.g., from ~$35 to ~$10) or eliminated NSF fees entirely, contributing to the trend.

- The pace of change slowed in 2024–25, suggesting structural shifts may have largely played out in prior years.

- The minimum checking account balance required to avoid other bank fees has simultaneously increased, underscoring that fee risk has shifted rather than vanished.

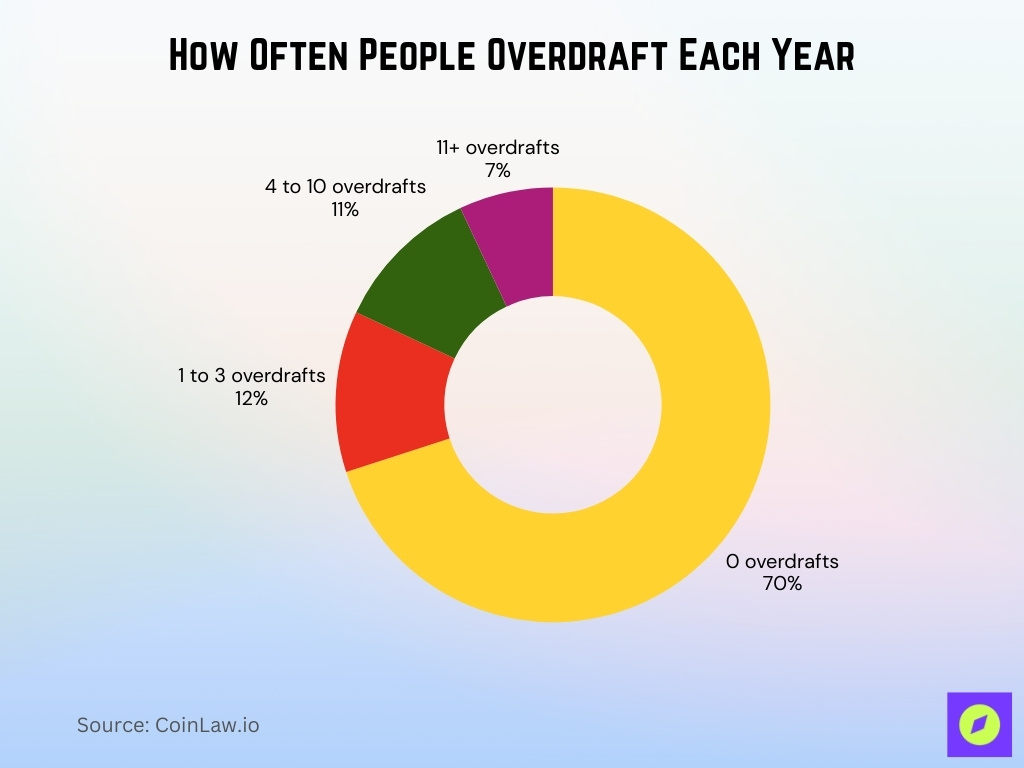

How Often People Overdraft Each Year

- 70% of bank accounts had zero overdraft incidents in the past year.

- 12% of account holders incurred 1 to 3 overdrafts annually.

- 11% experienced 4 to 10 overdrafts per year, signaling moderate risk.

- 7% of accounts had 11 or more overdrafts, indicating frequent overdraft behavior and likely financial strain.

Average Overdraft Fee Amounts

- The weighted average overdraft fee at very large financial institutions was reported at $32.50 in recent data.

- In that survey, 94% of account types still charged an overdraft fee.

- Other sources suggest that fee amounts still widely range from $30–$35 in many institutions.

- A minority of banks reduced their standard fee to $10 or eliminated it, significantly lower than the typical $34–$37 range.

- The average household savings from reduced overdraft/NSF revenue equated to about $185 per household in 2023.

Overdraft Fees by Bank Type

- Large banks still account for the majority of overdraft fee revenue; an estimated $5.2 billion of the $12.1 billion total fees came from large banks/credit unions.

- “Credit unions generated up to $5.4 billion in overdraft/NSF fee revenue in 2024, accounting for about 40–45% of the total U.S. market.

- Institutions offering digital-only or fintech-style checking services tend to charge no overdraft fee or a significantly reduced fee ($0–$10).

- Many large banks have adopted newer policies: some impose a minimum overdraw threshold ($50) before charging a fee; some limit how many daily fees can be charged.

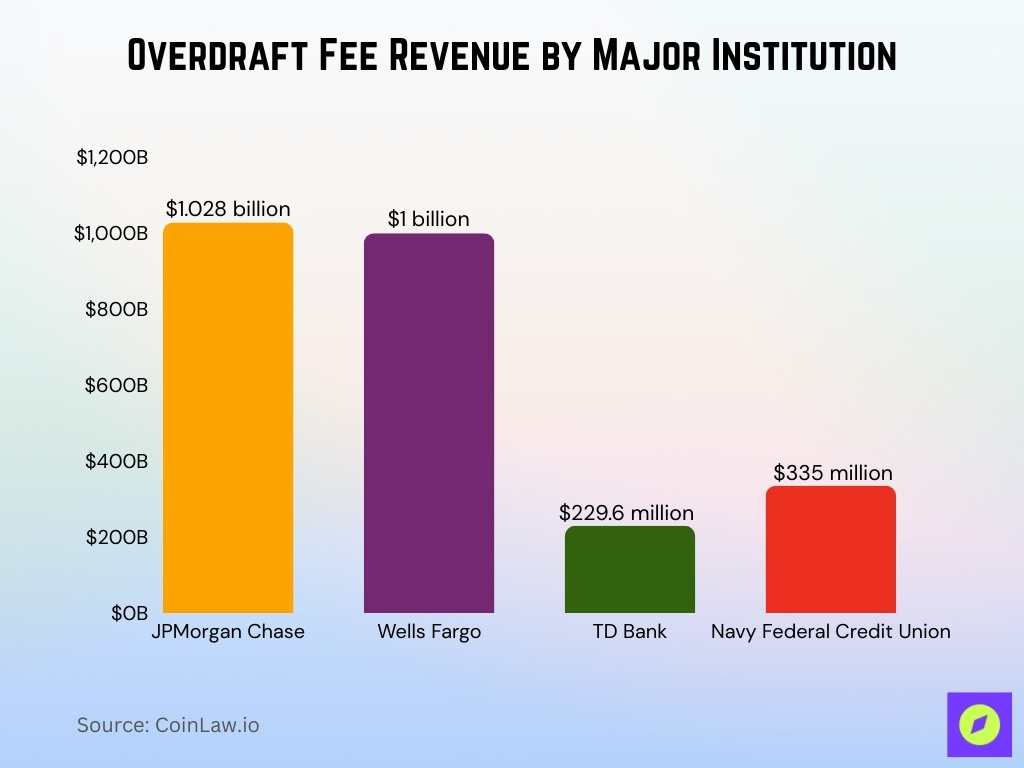

Overdraft Fees by Institution (Major Banks Comparison)

- JPMorgan Chase Bank recorded approximately $1.028 billion in overdraft fee revenue.

- Wells Fargo Bank also collected around $1.0 billion in overdraft fees.

- TD Bank collected roughly $229.6 million.

- Navy Federal Credit Union collected approximately $335 million in overdraft fees.

- Among the top 10 banks, only a handful now persist with high overdraft fee revenue.

- Despite reforms, major institutions still collect hundreds of millions in overdraft fees annually.

- The distribution shows a high concentration of revenue among a few institutions.

- Some banks have phased out NSF fees, shifting focus to overdraft fees and thereby changing comparative revenue lines.

Total Revenue from Overdraft Fees

- Combined overdraft + NSF fee revenue declined to $5.83 billion in 2023, down ~51% from 2019.

- Consumers paid $12.1 billion in overdraft and NSF fees in 2024.

- For 2023, the updated estimate for all banks and credit unions is about $11.8 billion.

- Among large financial institutions, the combined overdraft fee revenue was $5.2 billion in 2024.

- The drop in revenue suggests policy change rather than consumer behavior is driving results.

- Revenue figures reflect collected fees, not full consumer costs.

- Regulatory reforms could reduce revenue further by $5 billion annually in savings.

Overdraft vs. NSF Fees

- The average NSF fee was $17.72 in 2024, down 11% from the previous year.

- In contrast, average overdraft fees at large institutions remain in the $30–$35 range.

- NSF fees apply when a bank declines a transaction, whereas overdraft fees apply when a bank covers it.

- Around 36% of accounts surveyed reported no NSF fee in 2024.

- Regulatory reforms place greater scrutiny on overdraft fees than NSF fees.

- Historically, overdraft fee revenue peaked at ~$12 billion annually for major banks.

- NSF fees are declining faster than overdraft fees as banks eliminate them altogether.

- Consumers may face multiple overdraft or NSF fees for the same shortfall event.

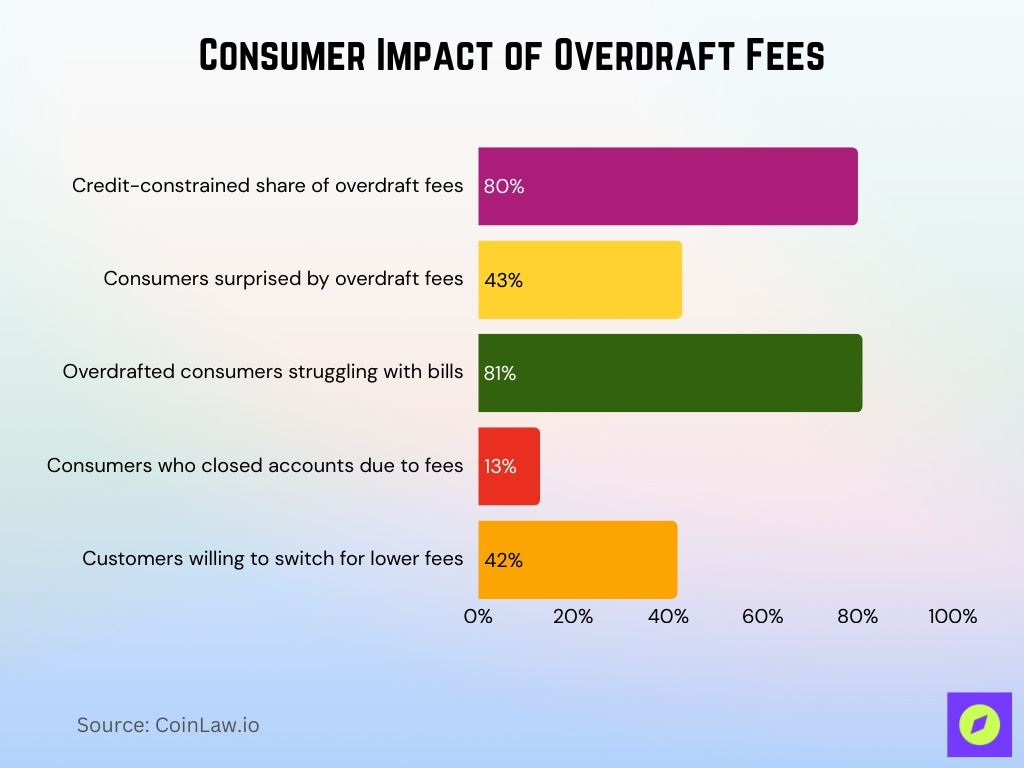

Overdraft Fee Impact on Consumers

- Frequent overdrafters are 4 times more likely to have credit access issues.

- The average household could save $225 annually under the new overdraft fee rule.

- About 80% of overdraft fees are paid by credit-constrained individuals.

- 43% of consumers were surprised when they incurred an overdraft fee.

- Around 81% of those charged overdraft fees struggled with bill payments.

- Frequent overdraft users often rely on higher-cost credit channels like payday loans.

- Approximately 13% of consumers with overdraft fees closed their bank accounts.

- 42% of customers say they would switch banks for lower overdraft fees.

- Some consumers avoid traditional banking entirely to prevent recurring overdraft fees.

Effects of Overdraft Fees on Financial Health

- Frequent overdraft users have an average credit score 10 to 20 points lower than non-overdrafters.

- Just 9% of households generate almost 75% of all overdraft fee revenue.

- Households paying overdraft fees tend to hold checking balances under $500.

- Overdraft fees reduce available funds, costing affected households an average of $380 annually.

- Banks’ high-to-low posting order causes consumers to incur up to 3 times more overdraft fees.

- Overdraft fees can discourage financial inclusion, with fees pushing some consumers away from banking.

- About 10% of U.S. households report paying overdraft fees annually.

- Approximately 1.76 million U.S. households overdrafted more than 10 times in a year, indicating chronic strain.

Overdraft Protection Options

- 75% of banks link checking to savings or credit lines for overdraft protection.

- Fintech platforms have reduced overdrafts by up to 19% using real-time alerts.

- Around 60% of banks now offer a buffer or grace policy, commonly $50 negative balance.

- About 25% of banks allow one free courtesy overdraft per billing cycle.

- Consumers opting into overdraft protection programs incur fees up to 30% more frequently.

- Negative-balance alerts lead 51-61% of users to transfer money from savings to avoid fees.

- Financial wellness programs have reduced overdraft risk by over 15% in participating consumers.

- Roughly 70% of consumers find overdraft protection valuable despite fees.

Banks That Have Eliminated Overdraft Fees

- At least 12 major banks now offer checking accounts with no overdraft fees in 2025.

- Over 60% of fintech-style banks and credit unions waive overdraft fees or reduce them substantially.

- Citibank and Capital One had a ~100% drop in overdraft fee revenue in 2024 compared to previous years.

- JPMorgan Chase collected $1.028 billion and Wells Fargo took $1.0 billion in overdraft fees in 2024, followed by TD Bank ($229.6 million) and Navy Federal Credit Union ($335 million).

- Bank of America limits fees and transaction types, cutting revenue to less than 0.5% of net income.

- Fee elimination by some banks sets a benchmark that has influenced over 50 banks to reform overdraft policies.

Daily / Extended Overdraft Fees

- About 19% of banks impose a $5 daily overdraft fee starting on the 6th business day.

- Some banks charge an additional $3 per business day beyond day 7 for overdrafts.

- Extended overdraft fees can push total costs over $50 for a single overdraft event.

- Nearly 40% of banks do not clearly disclose daily or continuous overdraft fee structures.

- Daily overdraft fees remain in over 60% of standard checking account agreements.

- Long-term negative balances can trigger cascading fees, sometimes accumulating over $150.

- Banks with daily fees commonly cap charges at about 5 days or around $150-$180 per event.

Overdraft Fees as a Percent of Bank Income

- Overdraft revenue at Bank of America is about 0.5% of its net income.

- Overdraft and NSF fees represent less than 2% of total U.S. banking revenue.

- Fee revenue from overdraft and NSF fees dropped by more than 50% between 2019 and 2023.

- In California, overdraft income as a percent of net income varies from under 1% to over 100% at some credit unions.

- Overdraft fees are a shrinking share of banks’ non-interest income, now less than 5% for many institutions.

- Some smaller banks and credit unions depend heavily on overdraft fee revenue, sometimes above 20% of net income.

Geographic Differences in Overdraft Fees

- Rural households face a 29.5% chance of incurring overdraft/NSF fees, compared to 26.2% for urban households.

- Low-income households are over 15 percentage points more likely to pay overdraft fees than high-income households.

- Rural and low-density areas have a consistently higher overdraft incidence than urban areas.

- Banks in lower-income ZIP codes charge similar fees but impose a higher proportional burden on residents.

Regulatory Changes and Overdraft Policies

- The CFPB finalized a rule in December 2024, expected to save consumers up to $5 billion annually.

- The rule requires large banks to choose between capping overdraft fees at $5, justifying higher fees, or treating overdrafts as credit.

- In 2023, overdraft/NSF fee revenue totaled approximately $5.83 billion for banks with over $1 billion in assets.

- Congress voted in early 2025 to repeal the CFPB overdraft rule, leaving its future uncertain.

- The NCUA began requiring large credit unions to report overdraft/NSF fee revenue separately starting in 2024.

- Several state attorneys general continue pushing for stricter overdraft fee oversight and consumer protections.

Consumer Attitudes Toward Overdraft Fees

- 7 in 10 Americans believe overdraft fees are unfair.

- About 51% of consumers who paid overdraft fees were surprised by them.

- Overdraft risk correlates more with credit constraints than demographic factors.

- 80% of consumers find overdraft protection useful but confusing.

- Frequent overdraft fees often lead to account closures for about 14% of customers.

- Younger adults (ages 18-25) report overdraft incidence rates of over 10% with 10+ overdrafts annually.

- Many consumers remain unaware of daily or extended overdraft fees, with less than 35% fully understanding these charges.

Frequently Asked Questions (FAQs)

The final rule is expected to save about $225 per household that pays overdraft fees.

Roughly 70 % of Americans consider overdraft fees to be unfair.

About 9 % of accounts are estimated to comprise 79 % of overdraft and NSF fees.

Around 70% of consumers reported that they find overdraft protection valuable.

Conclusion

The latest data on overdraft fees in the U.S. reveal a sector in transition. While billions of dollars in fees are still paid by consumers, the burden is shifting, large banks are cutting back, regulators are imposing stricter rules, and fintech alternatives are increasing in prominence. For consumers, the key takeaway is that overdraft fees are not inevitable; choice of institution, account terms, and usage behaviour all matter. For banks and policymakers alike, the changing landscape suggests overdraft fees are no longer the reliable revenue stream they once were.