In 1998, Mary Simmons walked into her neighborhood bank branch in Kansas to deposit her first paycheck. Back then, brick-and-mortar branches were more than service hubs; they were symbols of community trust. Fast forward to 2025, and Mary’s once-bustling branch is now a vacant storefront. This isn’t an isolated story; it’s the reflection of a larger financial transformation. With rapid digitization reshaping how we interact with money, physical bank branches are closing at an unprecedented pace, forcing both customers and institutions to rethink their relationship with banking.

Editor’s Choice

- In 2025, over 8,000 bank branches worldwide are projected to shut down.

- The United States alone is projected to account for 900 to 1,400 branch closures in 2025, the highest national figure globally.

- Digital banking usage has surged to 89% of US adults in 2025.

- Rural areas in the US faced a disproportionate burden, with 1 in 4 branches closed in low-population zip codes.

- Bank of America leads in closures, reducing its physical footprint by 18% over the last 12 months.

- Consumer trust in mobile-only banks hit an all-time high of 71%, reflecting growing digital dependency.

- Real estate savings from closures contributed an estimated $3.5 billion in cost reductions for global banks in 2025.

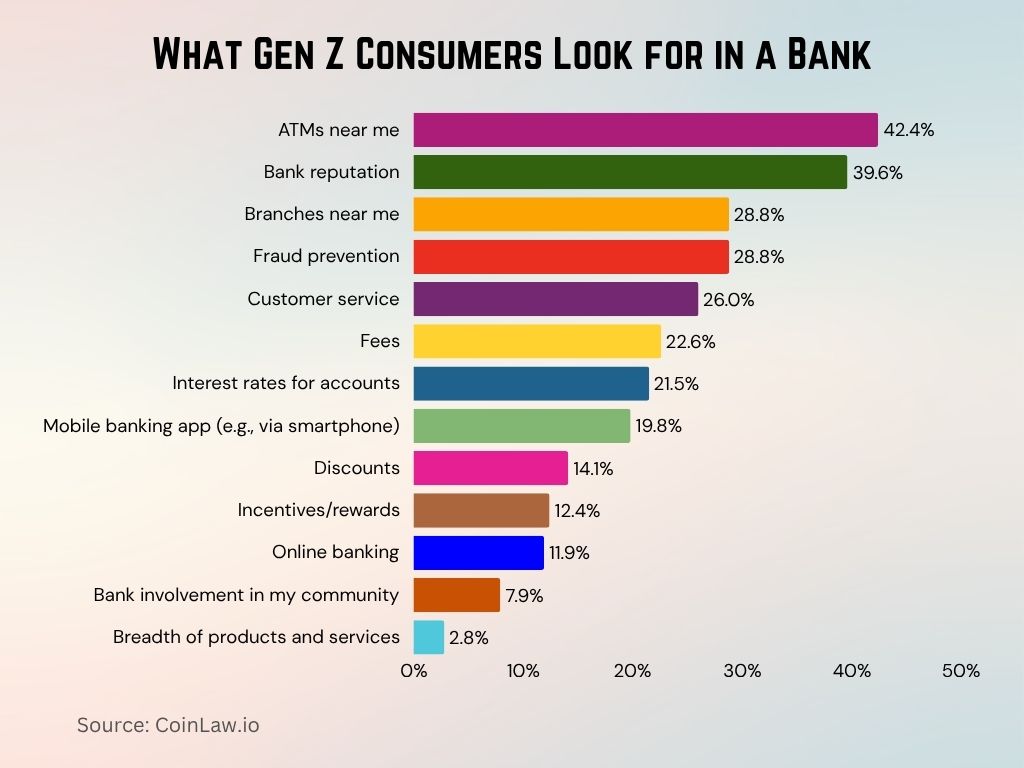

What Gen Z Consumers Look for in a Bank

- ATMs near me top the list, with 42.4% of Gen Z consumers citing this as a key consideration when choosing a new bank.

- Bank reputation matters significantly, influencing 39.6% of respondents, showing the importance of trust and brand image.

- Proximity still counts: 28.8% value branches near them, and an equal 28.8% prioritize fraud prevention.

- Customer service is essential for 26.0% of Gen Z banking consumers, reflecting their demand for support and responsiveness.

- Fees impact decision-making for 22.6%, highlighting sensitivity to cost transparency.

- Competitive interest rates on savings and loans attract 21.5% of respondents.

- A smooth mobile banking experience is important to 19.8%, showing the need for robust digital tools.

- Discounts (14.1%) and incentives/rewards (12.4%) are appealing, though secondary to functional features.

- Only 11.9% emphasize online banking, indicating mobile may be more crucial than web.

- Community involvement by banks influences just 7.9%, showing limited concern for local engagement.

- The breadth of products and services matters least, with only 2.8% considering it a deciding factor.

Global Trends in Bank Branch Closures

- The Asia-Pacific region saw the fastest decline, with a 16% reduction in bank branches between January and May 2025.

- In Europe, Germany and France reported a combined 1,100 branch closures, driven largely by cost-efficiency mandates.

- Latin America experienced mixed trends, with urban consolidation offset by new branch openings in underbanked rural zones.

- China’s tier-1 cities are shifting to fully digital service models, leading to the closure of over 600 traditional branches this year alone.

- The UK banking sector closed over 450 branches in the first quarter of 2025, continuing a five-year downward trend.

- Remote banking services, including AI chatbots and virtual banking agents, now handle up to 65% of routine transactions globally.

- Southeast Asian banks, especially in Thailand and Malaysia, have piloted branchless micro-banking kiosks as substitutes.

- Cross-border digital account management has surged, decreasing the necessity for maintaining physical branches for international customers.

- In Sub-Saharan Africa, the closure rate remains minimal at 2%, as banks still rely heavily on face-to-face customer interaction.

Bank Branch Closures in the United States

- As of Q2 2025, the total number of active US bank branches has dropped below 65,000.

- California, Texas, and New York top the list of states with the most closures this year.

- JPMorgan Chase has shut down 375 locations since January 2024, with an accelerated closure plan underway for 2025.

- Community banks (those with less than $10B in assets) accounted for 29% of closures, primarily in low-income districts.

- Digital-only banks now serve over 40 million US customers, marking a dramatic shift in consumer preferences.

- The Federal Reserve’s 2025 Banking Access Report highlights a growing “banking desert” issue in midwestern states.

- ATMs and drive-thru banking options are replacing branch-based services, now facilitating 52% of all deposits.

- The FDIC noted a 15% decrease in physical branch service-related complaints, correlating with fewer in-person interactions.

- Branch closures in urban minority neighborhoods have drawn increasing scrutiny from advocacy groups and policymakers.

- Some banks are experimenting with mobile branch vans in remote areas to retain customer engagement post-closure.

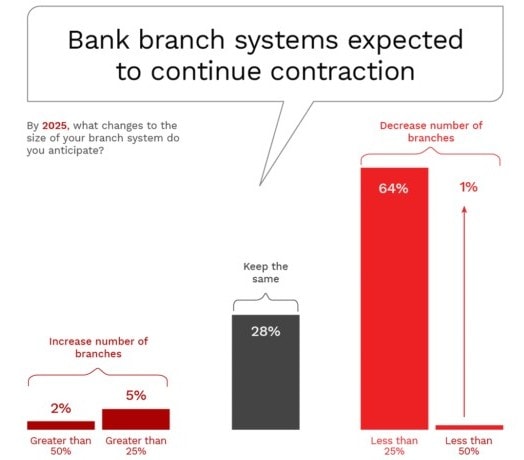

Bank Branch Contraction Forecast by 2025

- 64% of banks expect to decrease their branch networks by less than 25%, indicating a major shift toward downsizing.

- Only 1% anticipate a reduction of more than 25%, suggesting deeper cuts are rare.

- 28% of institutions plan to maintain the same number of branches, showing some stability in branch presence.

- Just 5% foresee an increase in branches by more than 25%, while a minimal 2% expect a growth of over 50%, pointing to limited physical expansion.

Impact of Digital Banking on Physical Branches

- Digital banking penetration in 2025 reached 92% among US Gen Z and Millennials, reducing the need for in-branch visits.

- Banks report that 86% of loan applications are now submitted online, with automated approval rates hitting 62%.

- Mobile check deposits rose by 24% YoY, accounting for nearly three-quarters of all deposit transactions in 2025.

- Cost-per-transaction for digital banking is now $0.04 compared to $4.00 for branch-based equivalents.

- The average foot traffic at branches has declined by over 55% since 2019, according to the ABA.

- Customer service interactions via live chat and AI now outnumber in-branch inquiries by a factor of 3 to 1.

- Banks investing in fintech partnerships to enhance mobile platforms have shown 32% higher customer satisfaction scores.

- Hybrid banking models, combining virtual and appointment-only branch services, are emerging as transitional solutions.

- Cybersecurity investment in digital platforms increased by 37% in 2025 to support the scaling back of branch security budgets.

- Older adults (65+) have increased digital banking adoption by 19%, though they remain the most branch-reliant group demographically.

Bank Branch Closure Statistics by Region

- The Midwest US recorded the highest regional closure rate in 2025, with 19% of branches shuttered since January.

- The South followed closely, with 850 closures, heavily impacting small-town and suburban banking services.

- Northeast metro areas saw moderate closures, but with higher consolidation into digital-first “smart branches.”

- In the West, particularly in California, branch closures have become routine, with some counties seeing a 35% reduction.

- Alaska and Hawaii reported the fewest closures by volume, but each closure there carries a heavier impact due to geographic isolation.

- The FDIC’s regional analysis shows that more than 60% of closures occurred in areas where banks previously operated more than five branches within a 10-mile radius.

- Florida’s coastal cities, driven by retiree populations, have seen closures slow down, with banks maintaining selective physical presence.

- Appalachian regions face emerging “banking deserts,” where residents must travel 20+ miles for in-person banking.

- Urban Midwest cities such as Cleveland and Detroit have converted legacy bank buildings into community fintech hubs.

- Southwest border towns report banking access pressures amid both closures and increasing population inflows.

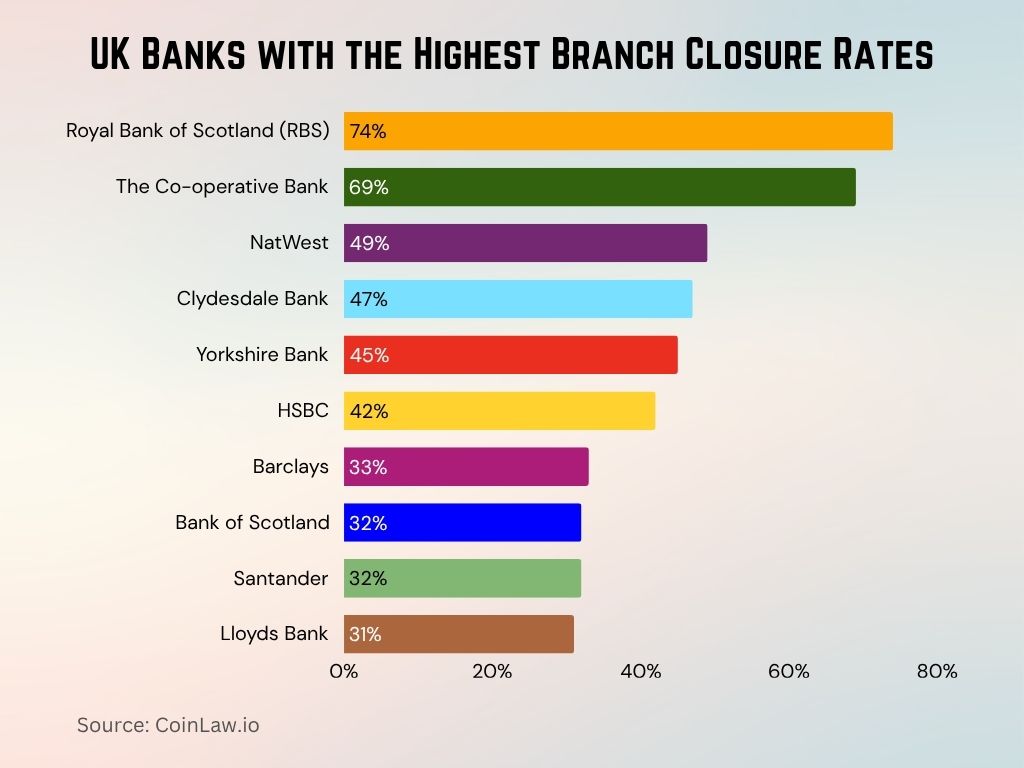

UK Banks with the Highest Branch Closure Rates

- Royal Bank of Scotland (RBS) leads with 74% of its branches closed, making it the top bank for closures in the UK.

- The Co-operative Bank follows closely, shutting down 69% of its branch network.

- NatWest has closed 49% of its branches, reflecting a major scale-back in physical presence.

- Clydesdale Bank and Yorkshire Bank reported closures of 47% and 45%, respectively.

- HSBC has reduced its branches by 42%, also contributing significantly to the UK’s banking contraction.

- Barclays has closed 33% of its branches, although complete data was not disclosed.

- Both Bank of Scotland and Santander each reported 32% branch closures.

- Lloyds Bank rounds out the list with 31% of its branches shut down.

Urban vs. Rural Branch Closures

- Rural America has borne the brunt, with 1 in 3 rural bank branches closing or consolidating in the past 18 months.

- In contrast, urban centers have transitioned more toward hybrid models rather than outright closures.

- Urban branches in downtown financial districts are being repurposed into digital consultation pods.

- The average rural county now has just 1.2 bank branches.

- Mobile banking units, outfitted vans serving multiple towns, have tripled in deployment across the rural Midwest and South.

- Rural customers rely on ATM access 60% more than their urban counterparts, yet the number of standalone ATMs has also declined.

- Bank closures in rural Black and Latino communities have accelerated financial inclusion concerns, prompting federal attention.

- School-based financial literacy programs are emerging as a response to closure-induced financial knowledge gaps.

- Rural credit unions are seeing modest growth as trust in local, member-driven institutions remains strong.

- In some cases, post offices are being retrofitted with basic banking services under pilot programs backed by the USPS.

Major Banks Leading in Branch Closures

- Bank of America tops the list with over 540 branch closures since early 2024, citing digital migration strategies.

- Wells Fargo reduced its network by 14% in the past year, often merging two or more locations into a single hub.

- Chase Bank has focused on “smart branches,” closing older physical branches while opening tech-forward spaces in strategic markets.

- Citibank has largely exited several regional markets, including parts of the Midwest and Southeast, closing over 180 branches.

- U.S. Bank has eliminated branches in over 15 states, shifting its footprint to mobile and digital-first solutions.

- PNC and Truist collectively closed more than 300 branches, focusing investments on app-based services and online lending platforms.

- Regional banks, such as Huntington and Fifth Third, reduced physical branches by 12% on average.

- Credit unions, while smaller in scale, closed nearly 400 locations, especially in overlapping service areas.

- Bank consolidations and mergers have fueled closures; for instance, the Citizens-HSBC branch alignment resulted in 120 branch eliminations.

- Retail partnerships with companies like Walmart and CVS are replacing some brick-and-mortar presence with in-store kiosks.

Mobile Customer Service Matters Most to Younger Generations

- 64% of Millennials (ages 26–40) say it’s critical or important to have a tap-to-call option for customer service in mobile banking apps.

- 59% of Gen Z (ages 21–25) also value this feature highly, reflecting their strong preference for mobile-first convenience.

- 51% of Gen X (ages 41–55) find this capability important, showing notable interest across middle-aged users.

- Only 28% of Baby Boomers (ages 56–75) consider this feature critical or important, indicating a significant generational gap.

- Among Seniors (ages 76+), just 21% view tap-to-call support as important, showing low adoption of mobile-first service expectations.

Consumer Behavior Shifts Driving Closures

- Digital-first behavior dominates, with 2025 seeing 78% of Americans preferring mobile apps for day-to-day banking.

- Foot traffic at branches has dropped by 59%.

- Millennials and Gen Z account for over half of all new account openings, 91% of which are conducted digitally.

- Senior adoption of digital tools rose to 61% in 2025, helping reduce the dependency on branch visits.

- Consumers prioritize speed and accessibility, with mobile banking satisfaction now exceeding in-branch satisfaction by 28%.

- Deposits via ATM and app surpass in-person deposits at a 3:1 ratio.

- Paper checks and cash withdrawals are down, reducing the relevance of many traditional teller services.

- Financial planning and advisory services are increasingly offered via virtual consultations, replacing branch-based sessions.

- Users of digital budgeting tools (like Mint and YNAB) grew by 35% YoY, indicating wider acceptance of digital financial management.

- Voice banking and biometrics, used by 44% of mobile banking customers in 2025, enhance convenience and reduce reliance on staff.

Economic and Regulatory Influences

- Rising operational costs and real estate inflation have made branches less viable in low-traffic areas.

- The 2025 Dodd-Frank updates encourage fintech innovation but impose tighter rules on legacy physical infrastructure usage.

- Federal incentives for digital transition include tax credits for banks investing in cybersecurity and remote infrastructure.

- Labor costs for staffing branches have outpaced digital infrastructure costs by nearly 4 to 1.

- The Community Reinvestment Act revisions now assess digital outreach as part of banks’ obligations, reducing the reliance on physical locations.

- Interest rate fluctuations have pressured bank margins, encouraging efficiency through branch consolidation.

- Insurance and security expenses for physical branches remain high, even as crime rates have shifted more toward cyber threats.

- Pandemic-era relief policies prompted some permanent structural shifts in branch operations that remain in effect in 2025.

- Real-time payments and open banking APIs are making the need for in-person banking even more obsolete.

- State-level banking laws in places like New York and Illinois are evolving to require digital alternatives when branches close.

How Consumers React to Bank Branch Closures

- 34% of consumers said they would drive farther to another branch, showing a preference for maintaining in-person banking access.

- 25% reported no impact, suggesting that branch closings do not affect a quarter of customers.

- 19% chose to use more digital banking services, highlighting a shift toward online and mobile alternatives.

- 12% switched their checking account to another bank with a nearby branch, indicating a willingness to change institutions for convenience.

- 11% moved all their business to a different institution with closer physical access, showing that loyalty is affected by branch availability.

Effects on Financial Inclusion and Accessibility

- Low-income communities are the most affected, with over 40% of closures in 2025 occurring in zip codes with median incomes below the national average.

- Elderly populations continue to face barriers, with nearly 1 in 5 seniors lacking access to digital banking tools.

- People with disabilities report increased challenges as physical branches disappear, especially in areas without ADA-compliant digital support.

- Unbanked and underbanked rates rose slightly to 6.3% in 2025, reversing a decade-long decline.

- Indigenous communities in states like Arizona and New Mexico saw closure rates triple compared to 2022.

- Public libraries and community centers are stepping in, offering digital banking tutorials and secure internet access points.

- Racial disparities persist, with Black and Latino neighborhoods facing disproportionate closures and slower fintech adoption.

- The CFPB (Consumer Financial Protection Bureau) launched initiatives in 2025 to monitor equity gaps in banking access post-closures.

- State-run financial inclusion grants are helping establish fintech pop-ups and mobile units in banking deserts.

- Multilingual banking app interfaces gained traction, aiming to serve non-English speakers previously dependent on in-person branch assistance.

Reactions from Communities and Advocacy Groups

- Local protests and town hall forums have emerged in areas hit hardest by closures, especially in mid-sized towns.

- AARP has advocated for more inclusive digital banking solutions for aging populations.

- Rural mayors across the Midwest issued joint statements in 2025 calling for legislative support against unchecked branch closures.

- Consumer advocacy groups such as the National Community Reinvestment Coalition argue that closures without alternatives violate fair access principles.

- Pop-up banking clinics, often coordinated by NGOs, are being piloted to teach digital literacy and offer temporary services.

- Religious organizations and food banks are facilitating access to mobile bank vans during peak welfare distribution periods.

- Public-private collaborations are emerging, with some fintech companies offering free digital onboarding in underserved regions.

- Academic institutions have begun studying the socio-economic impact of closures, with several universities publishing case studies in early 2025.

- State attorneys general in four states launched investigations into whether closures discriminate against protected communities.

- Tech-access nonprofits are distributing subsidized smartphones and tablets with preloaded banking apps in low-income areas.

How Customers Prefer to Be Informed About Bank Branch Closures

- 69% of respondents prefer to receive closure and alternative banking info via email, making it the top choice for communication.

- 55% would like a physical letter, showing that traditional mail still holds value for many.

- 22% favor consultations at the local branch, indicating a desire for personal, face-to-face communication.

- 17% prefer a public meeting like a town hall, suggesting some want a more community-based approach.

- 13% choose the telephone as their preferred method for receiving such updates.

- Only 1% selected other methods, showing limited interest in non-traditional formats.

Future Outlook for Bank Branch Networks

- Analysts forecast that physical bank branches in the US will drop below 60,000 by late 2026, a threshold not seen since the 1970s.

- Hybrid banking models combining video banking, kiosks, and limited-service branches are set to become standard practice.

- Biometric and AI-driven interfaces will reduce the need for human tellers even further in the next three years.

- Cloud banking infrastructure investments will reach $12 billion globally by the end of 2025.

- Neobank growth is expected to continue, with account openings projected to surpass 90 million in the US by 2026.

- Blockchain-based identity verification tools may replace traditional in-branch KYC (Know Your Customer) processes by 2027.

- Smart ATMs with remote teller video support are being rolled out in partnership with major telecom providers.

- Banking in the metaverse, still in experimental stages in 2025, shows potential for personalized virtual branch experiences.

- Consumer trust in digital-only institutions is now higher among those under 35 than in traditional banks with branches.

- Despite this, over 50% of Americans still value the availability of a physical branch, especially for complex financial decisions.

Recent Developments

- In April 2025, Bank of America unveiled its first fully autonomous branch, featuring biometric access and AI-led services only.

- Chime and SoFi announced plans to open digital lounges in high-traffic malls to provide fintech education without conducting transactions.

- The FDIC’s updated guidance mandates that all closures include a published digital alternative strategy plan.

- The U.S. Senate Banking Committee held hearings in March 2025 on equitable digital banking expansion post-closure.

- Mastercard and Visa are funding pilot programs aimed at expanding mobile banking in underbanked urban zones.

- Google Pay integrates virtual financial advisors powered by Gemini AI to assist users with tasks traditionally done in branches.

- Amazon and JPMorgan are reportedly collaborating on “branchless financial hubs” with retail tie-ins.

- Mobile wallet adoption in the US surpassed 72% in Q1 2025, signaling a peak shift in transactional behavior.

- USPS Banking Access Act, introduced in early 2025, proposes using post offices to fill gaps left by traditional branch closures.

- Digital banking satisfaction hit a record 82% approval rating, despite ongoing access and inclusion challenges.

Conclusion

The story of bank branch closures in 2025 is not one of simple decline; it’s a story of transformation. While the numbers point to a steady erosion of brick-and-mortar networks, they also highlight the evolving ways Americans manage their finances. Digital-first banking is not just the future; it’s the now. Yet, for millions, access remains unequal. As the banking industry streamlines and digitizes, the challenge ahead is clear: ensuring no one is left behind. Whether through public policy, fintech innovation, or community engagement, the next chapter in banking must be as inclusive as it is efficient.

FRFreddie Raphael

The Branch Closure numbers for 2025 in US seems to be overstated. The number seems to be under 1000. Could you please reveal the source?

Thanks for pointing this out! According to CoinLaw’s updated research and regulator filings, 900 to 1,400 branch closures are projected in the US for 2025. The trend is being driven by rapid digital banking adoption and continued consolidation among major banks. Already, more than 320 closures were announced in the first 13 weeks of 2025, underscoring how quickly this shift is accelerating.