American Express, commonly known as Amex, has carved out a reputation as one of the most recognized and respected financial service brands in the world. The company, founded in 1850, has a long history of innovation, from pioneering traveler’s checks to offering one of the most elite credit cards available today. Amex’s growth has been driven by its ability to remain agile in a highly competitive and ever-changing market. In this piece, we will dive into the key statistics that define American Express in 2025, shedding light on its market share, customer base, and competitive standing.

Editor’s Choice

- $1.8 trillion in global Card Member spending forecast for 2026, driven by continued strong premium and small-business demand.

- 9–10% expected revenue growth in 2026, in line with the company’s raised guidance range.

- $15.20–$15.50 projected earnings per share for the full year, reflecting resilient affluent cardholder spending.

- About 36% of total network spend comes from Millennial and Gen Z customers, underscoring Amex’s premium youth focus.

- Quarterly revenue reached a record $18.4 billion in late 2025, setting a high baseline heading into 2026.

- Card Member spending grew 7–8% year-over-year in recent quarters, supporting continued transaction volume growth into 2026.

Recent Developments

- Delta’s co-branded American Express portfolio generated $8.2 billion in partner revenue for Delta in 2025, with long-term expectations to reach $10 billion annually.

- Delta’s loyalty–Amex agreement contributed about $2 billion to Delta’s Q3 2025 revenue, up 12% year-over-year.

- American Express has committed at least $10 million in grants for climate and low‑carbon projects through 2025 as part of its climate action funding goal.

- The company has operated with 100% renewable electricity globally since 2018 and targets net‑zero emissions by 2035.

- Amex’s climate philanthropy recently provided $2.25 million in grants to American Forests, National Park Foundation, and Earthwatch Institute.

- Amex Ventures has invested in more than 100 startups spanning fintech, commerce, AI, and enterprise capabilities.

American Express Statistics by Credit Cards and Cardholders

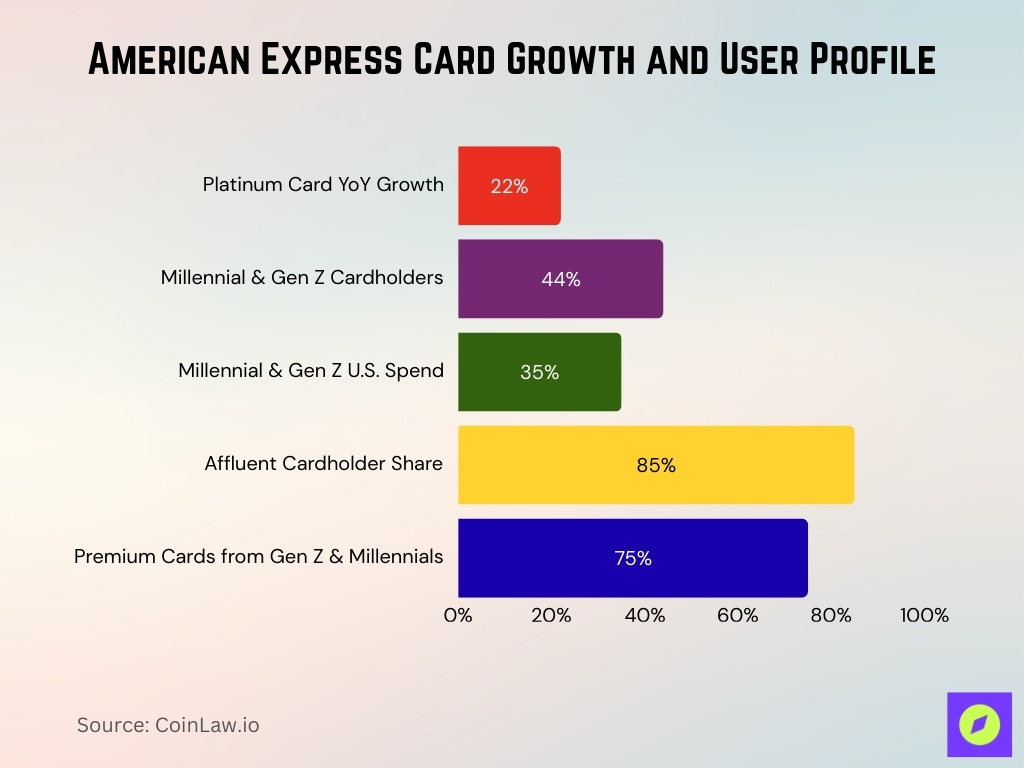

- The Amex Platinum Card® recorded about 22% year-over-year growth in new sign-ups, driven by enhanced travel and lifestyle benefits.

- Millennials and Gen Z now account for 44% of Amex’s global cardholder base and 35% of U.S. consumer spending on Amex cards.

- Around 85% of Amex cardholders are classified as affluent or high-net-worth customers.

- About 75% of new premium card accounts (Platinum and Gold) now come from Millennials and Gen Z.

- American Express has about 127.6 million basic cards in force globally, up from 122.4 million a year earlier.

- In 2025, Amex had 67 million active cardholders in the U.S. and 118 million cards in circulation worldwide.

- The average Amex cardholder makes 52 transactions per month versus an industry average of 41 for other issuers.

Market Share and Competitive Position

- American Express accounts for about 9% of global purchase volume by card network, ranking behind Visa and Mastercard but ahead of Discover in overall spending share.

- In the U.S., Amex generates about $548 billion in purchase volume, making it the second-largest issuer by purchase volume after Chase.

- Amex is accepted at about 99% of U.S. merchants that take credit cards, reaching near‑parity with Visa and Mastercard.

- Globally, Amex Cards are accepted at an estimated 160 million merchant locations, nearly 5x the footprint the network had in 2017.

- Amex continues to dominate premium cards, with affluent and high‑net‑worth customers representing roughly 85% of its cardholder base.

- Millennials and Gen Z now make up about 44% of Amex’s global cardholder base, strengthening its position in younger premium segments.

- Corporate and travel‑related spending contributes about $8.6 billion in annual revenue, reinforcing Amex’s leadership in corporate T&E solutions.

- Digital payments revenue reached about $5.1 billion, reflecting Amex’s growing share in contactless and mobile payment transactions.

Financial Position and Efficiency

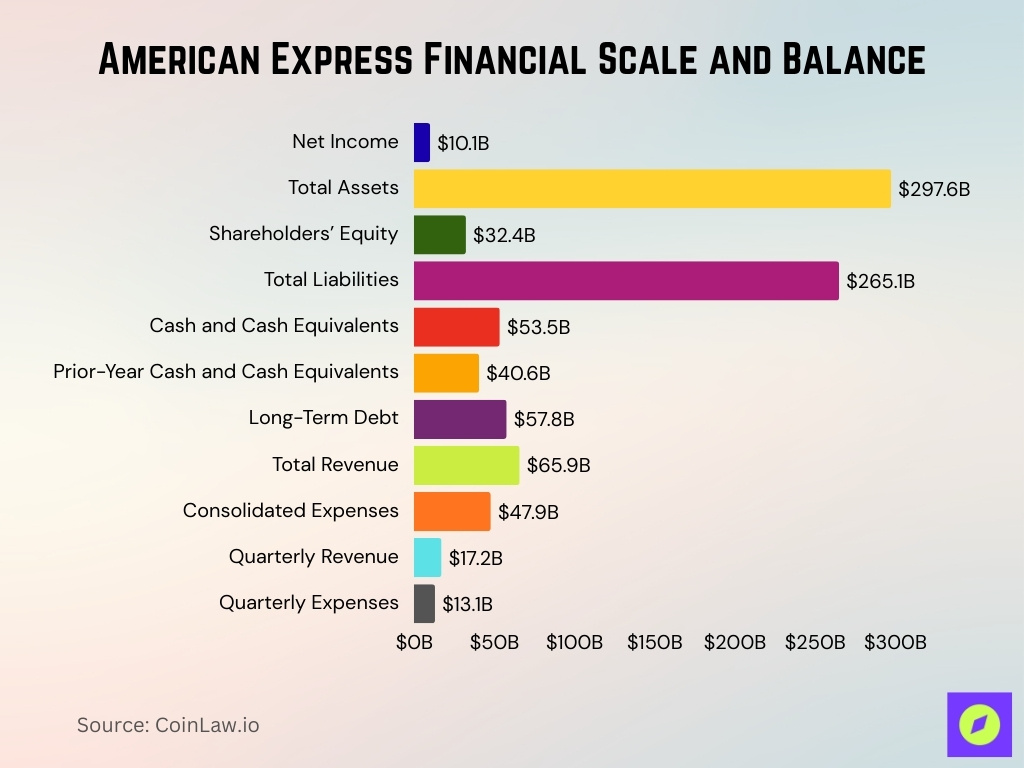

- Net income reached about $10.1 billion, up 21% year-over-year, with EPS of $14.01.

- Return on equity stands near 34%, well above typical large-bank and card-issuer averages.

- Total assets are about $297.6 billion, with shareholders’ equity around $32.4 billion and total liabilities $265.1 billion.

- Cash and cash equivalents total roughly $53.5 billion, up from $40.6 billion at the end of the prior year.

- Long-term debt is approximately $57.8 billion, versus total shareholders’ equity of $32.4 billion, implying a debt-to-equity ratio of around 1.8.

- Consolidated expenses were $47.9 billion on $65.9 billion in revenues, yielding an expense-to-revenue ratio near 73%.

- In a recent quarter, expenses of $13.1 billion on revenues of $17.2 billion imply a quarterly efficiency ratio near 76%.

AMEX Financial Growth Overview

- Full-year revenue reached about $65.9 billion with net income of $10.1 billion, delivering a net margin of 15–16%.

- Total revenues grew 9–10% year-over-year, supported by record Card Member spending and higher net interest income.

- Earnings per share climbed to $14.01, with guidance raised to $15.20–$15.50 for the following year, implying mid‑teens EPS growth.

- Quarterly revenue peaked at about $18.43 billion, up 11% year-over-year, while net income for the quarter rose 16% to $2.9 billion.

- Net interest income increased around 12%, driven by growth in revolving loan balances and improved lending margins.

- Discount revenue exceeded $9 billion, posting about 5% year-over-year growth as spending on goods and services expanded.

Average Customer Spending

- American Express cardholders spend an average of $24,059 per year per card member globally, well above typical industry levels.

- Total billed business reached about $416.3 billion in a recent quarter, reflecting strong spend among premium and everyday cardholders.

- Amex cardmember spending grew roughly 7% year-over-year, supported by resilient travel, dining, and lifestyle categories.

- Premium card fees, fueled by high-spending Platinum and Centurion users, surged 20% year-over-year to about $2.48 billion in a single quarter.

- Travel-related benefits usage increased alongside elevated T&E spend, contributing to record quarterly revenues of $17.9 billion, up 9% year-over-year.

- Average spend per Amex Business Card remains significantly above consumer averages, with many business users charging in the five- to six-figure annual range.

Payment Technology Usage in the United States

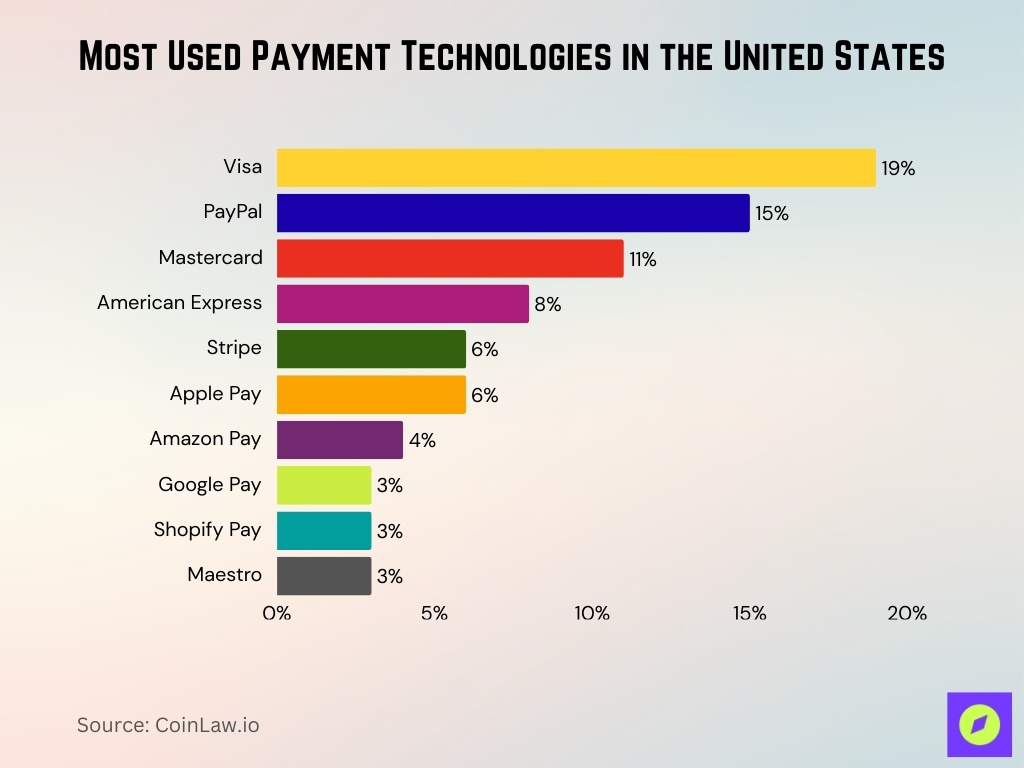

- Visa powers about 19% of global payment technology usage across websites, making it the leading network.

- PayPal ranks second with a roughly 15% share of payment technologies implemented on websites worldwide.

- Mastercard accounts for about 11% of website payment technology usage.

- American Express is used in around 8% of website payment technology stacks.

- Stripe and Apple Pay each hold about 6% share of website payment technology usage.

- Amazon Pay represents roughly 4% of websites using payment technologies.

- Google Pay, Shopify Pay, and Maestro each capture about 3% of website payment technology usage.

Financial Performance and Revenue Breakdown

- Total revenues net of interest expense reached about $65.9 billion, up 9% year-over-year, with net income around $10.0 billion and a profit margin near 16%.

- Global Consumer Services Group generated about $31.43 billion or 47.45% of total revenue, remaining Amex’s largest business line.

- Global Commercial Services contributed roughly $15.86 billion, representing 23.94% of total revenue and growing about 7.3% year-over-year.

- International Card Services delivered around $11.46 billion, accounting for 17.3% of revenue, supported by growth in key non-U.S. markets.

- Global Merchant and Network Services produced about $7.48 billion, or 11.3% of revenue, reflecting continued expansion in merchant acceptance.

- In a recent quarter, total revenues reached about $17.2 billion, up 9% year-over-year, driven by higher cardmember spending and net interest income.

- Discount revenue, net interest income, and net card fees together represented roughly 89% of total revenue, underscoring Amex’s fee- and spend-driven model.

- Net card fees alone increased by about 12% year-over-year, contributing meaningfully to overall top-line growth.

Profitability and Management Effectiveness

- Earnings per share reached $14.01, up 25% year-over-year from $11.21, with full-year net income of $10.1 billion.

- Net profit margin stood at about 16%, improving from roughly 15% in the prior year as revenues rose 9–10%.

- Operating income was approximately $12.9 billion, implying an operating margin near 17.4% on revenues of about $74.2 billion.

- Return on equity is estimated at around 33–34%, reflecting highly efficient use of shareholder capital.

- Gross margin reached roughly 81.9%, underscoring the high-fee, asset-light nature of Amex’s business model.

- EBIT margin was about 17.4%, supported by disciplined expense growth alongside rising cardmember spending.

- The quarterly dividend was increased 17% to $0.82 per share, signaling confidence in sustained earnings power.

- Amex shares delivered roughly 20–25% total return over the latest year, outpacing many broader financial sector benchmarks.

Credit Card Networks by Number of Cardholders

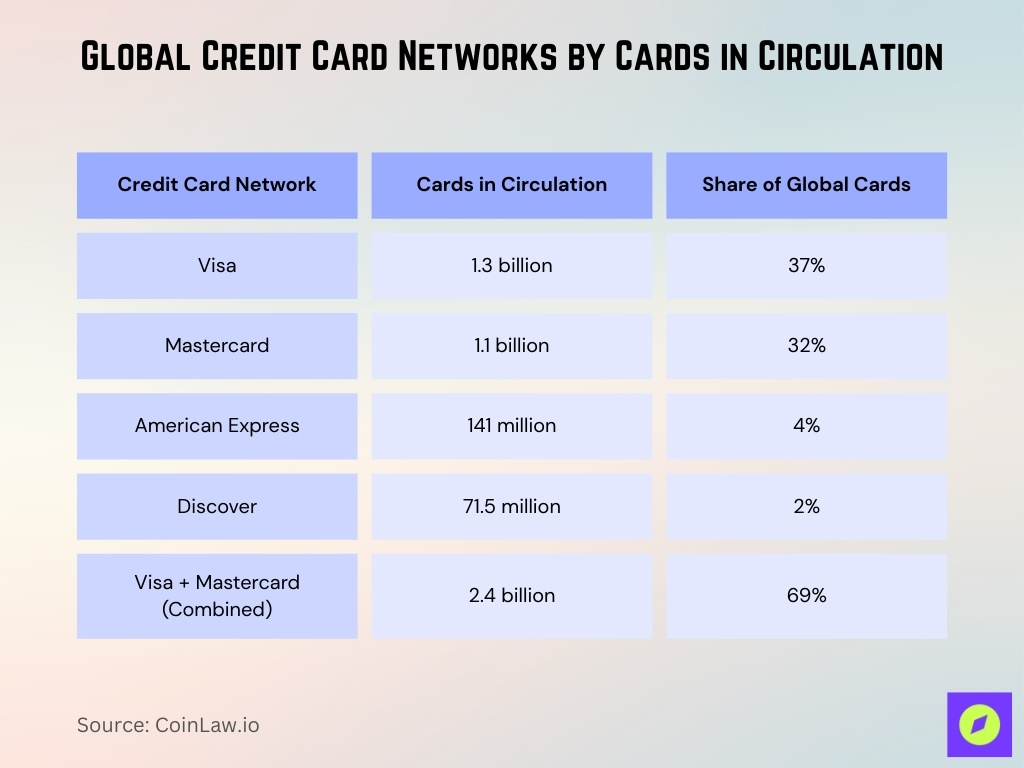

- Visa has about 1.3 billion credit cards in circulation worldwide, representing roughly 37% of all credit cards.

- Mastercard has around 1.1 billion credit cards globally, accounting for about 32% of all credit cards.

- American Express has approximately 141 million cards in use worldwide, equal to about 4% of global credit cards.

- Discover counts roughly 71.5 million cards in circulation, giving it about 2% of global credit cards.

- Combined, Visa and Mastercard represent 2.4 billion, about 69% of all credit cards in circulation globally.

Technological Innovations and Digital Solutions

- American Express invested about $2.6 billion in technology enhancements, emphasizing AI-powered support, real-time payments, and improved mobile experiences.

- Around 87% of Amex transactions are now processed via contactless, digital wallets, or mobile apps, reflecting strong digital-first usage.

- AI-driven fraud models help Amex maintain one of the lowest fraud rates in the industry, identifying roughly $2 billion in potential annual fraud.

- Amex’s gen AI “Travel Counselor Assist” tool achieved an 85% satisfaction rate among travel counselors using it for itinerary and recommendation support.

- Monthly active users of the Amex mobile app and website increased about 8% year-over-year in the U.S., indicating record digital engagement.

- The Amex mobile app and website ranked #1 in the 2025 J.D. Power U.S. Credit Card Mobile App and Online Satisfaction Studies.

- AI and automation initiatives now monitor sentiment on calls from about 12,900 support agents across multiple countries to improve service quality.

Frequently Asked Questions (FAQs)

In Q3 2025, American Express logged $18.4 billion in revenue (up 11 % YoY) and an EPS of $4.14 (up 19 % YoY).

American Express has a 5‑year compound annual growth rate (CAGR) of about 26.11 % for basic earnings per share.

Approximately 85 % of American Express cardholders were categorized as affluent/high‑net‑worth in 2025.

Conclusion

American Express continues to lead the financial services industry through its commitment to innovation, customer satisfaction, and strategic growth. With its robust financial performance, enhanced digital solutions, and focus on sustainability, Amex remains a trusted name among consumers and businesses alike. It is well-positioned to maintain its market leadership while continuing to push the boundaries of what’s possible in financial services.