Michael Saylor is once again signaling that Strategy may be preparing to buy more Bitcoin, just as BTC tests the critical $90,000 resistance zone.

Key Takeaways

- Michael Saylor posted another cryptic “Green Dots” message, often a precursor to major Bitcoin purchases by Strategy (formerly MicroStrategy).

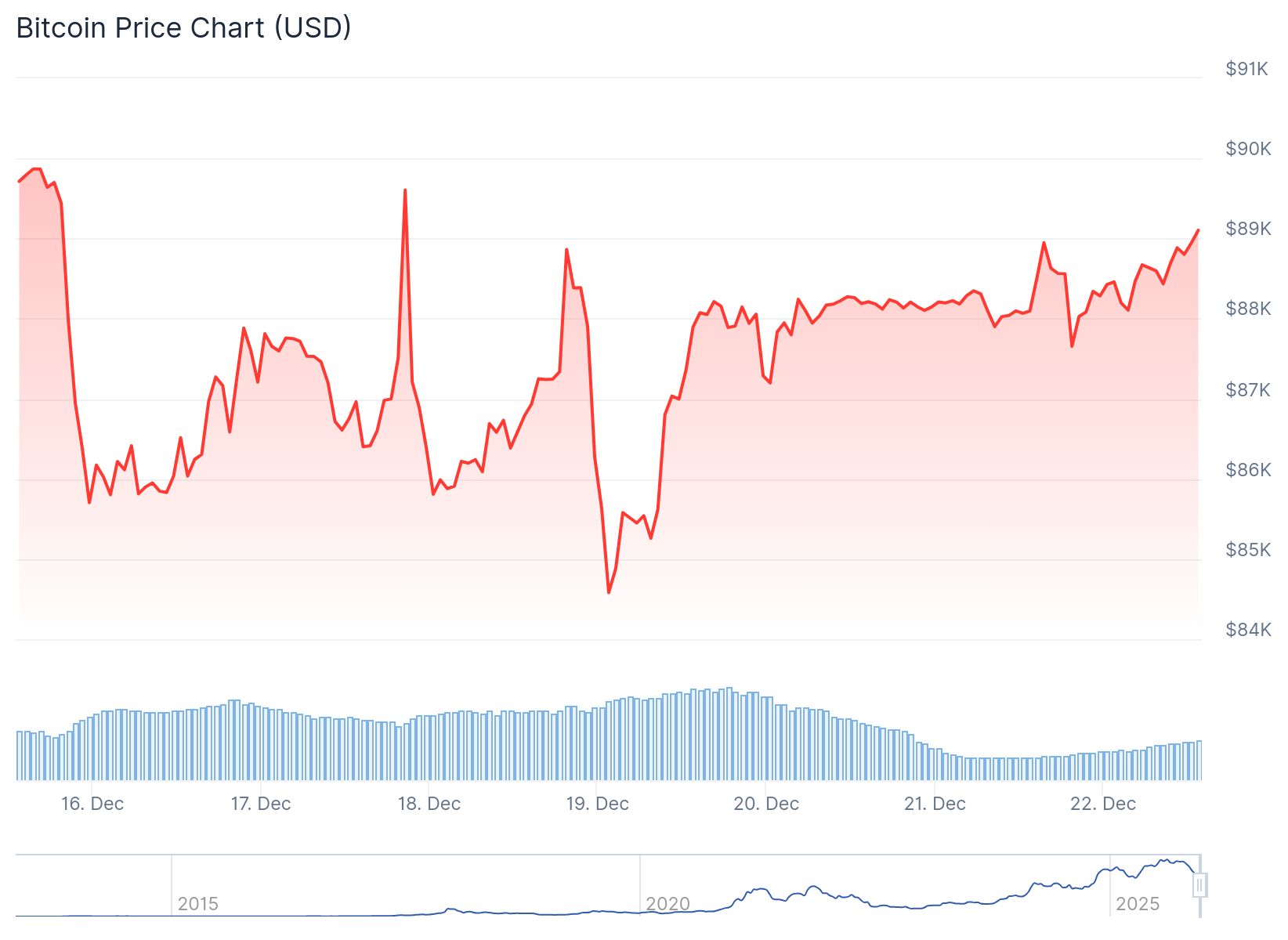

- Bitcoin is hovering around the $90,000 mark, a significant resistance zone filled with liquidity clusters and sell orders.

- MSTR stock has fallen 43% in 2025, raising concerns about Strategy’s financial resilience and classification by index providers.

- Strategy now holds 671,268 BTC, representing 3.2% of total Bitcoin supply, but a further BTC price drop could trigger asset sales.

What Happened?

Michael Saylor, executive chairman of Strategy Inc., posted a short message on X saying “Green Dots ₿eget Orange Dots.” While seemingly cryptic, this phrase is widely recognized by crypto watchers as a signal that the company may be preparing to buy more Bitcoin. The post coincided with BTC trading just under $90,000 and reflects a pattern Saylor has followed before announcing purchases.

Green Dots ₿eget Orange Dots. pic.twitter.com/aLdvPe4YuG

— Michael Saylor (@saylor) December 21, 2025

His message comes at a tense moment for both Strategy and Bitcoin, with the company’s stock under pressure and liquidity signals suggesting BTC may soon face a strong directional move.

Saylor’s Signal and Its Market Impact

Saylor’s symbolic post, which included a graph showing past Bitcoin purchases by Strategy, fits a well-known playbook. He often teases major moves during the weekend, with official filings usually appearing the following Monday. This pattern has created anticipation among both retail and institutional investors.

Despite the excitement, Strategy is under pressure:

- MSTR stock has dropped 43% in 2025, partly tracking Bitcoin’s 30% decline since October.

- MSCI has announced it plans to remove Strategy from its global indices, citing concerns the company functions more like an investment vehicle than an operating business.

- Market analysts warn that the financial implications of MSCI’s decision could further hurt investor confidence.

Still, Saylor’s unwavering focus on Bitcoin persists. He is betting on a BTC rebound to support the company’s position.

Liquidity Clusters and Market Risks

As Bitcoin trades near $90,000, multiple liquidity clusters have formed, reflecting zones where large sell and buy orders are concentrated. These areas can act as short-term resistance or support, shaping the next big move.

Crypto analyst Ted Pillows noted:

$BTC has 3 decent liquidity clusters right now.

— Ted (@TedPillows) December 21, 2025

On the upside, there’s a huge liquidity cluster at the $90,000 level.

On the downside, there are liquidity clusters at the $86,000 and $84,000 levels.

I think MMs will sweep all these 3 liquidity clusters next week. pic.twitter.com/Hl7dRLgWR4

According to on-chain data:

- Upside liquidity is concentrated at $90,000.

- Downside liquidity ranges from $86,000 to $84,000.

A strong buyer near these levels could trigger significant price movement.

Tom Lee’s Fundstrat also warned of the potential for BTC to revisit $60,000, despite maintaining a positive long-term outlook.

Strategy’s Financial Tightrope

Strategy now holds 671,268 BTC, or 3.2% of the total Bitcoin supply. These holdings have primarily been funded through share issuances, raising concerns over shareholder dilution and sustainability.

One key metric to watch is the mNAV ratio, currently around 0.93. If Bitcoin were to fall 15% to 20% further, the ratio could drop below 1, potentially triggering Bitcoin sales by Strategy. According to Strategy President Phong Le, the firm would only sell BTC if capital access dries up and the mNAV drops below this critical threshold.

Such a scenario could put Strategy’s long-standing “never sell” position to the test.

CoinLaw’s Takeaway

In my experience watching Saylor’s strategy unfold over the years, his conviction in Bitcoin is unmatched. But this time feels different. While his “green dots” message usually excites markets, the underlying risk is higher now. Strategy’s financial metrics are tightening, MSTR stock is sliding, and regulatory reclassification looms. If BTC doesn’t hold above key levels, Saylor may be forced into decisions that go against his Bitcoin-maximalist stance. Personally, I admire his boldness, but I can’t ignore that his bet is getting riskier with every drop in price. Let’s see if he doubles down or if the pressure forces a pivot.