The U.S. Securities and Exchange Commission (SEC) has missed its final deadline to decide on the Canary Litecoin ETF, citing operational disruptions due to the ongoing U.S. government shutdown.

Key Takeaways

- The SEC failed to issue a decision on the Canary Litecoin ETF by the October 2 deadline.

- A shift in SEC procedure means old deadlines may no longer be binding.

- The government shutdown has slowed ETF reviews, affecting over 90 crypto ETF filings.

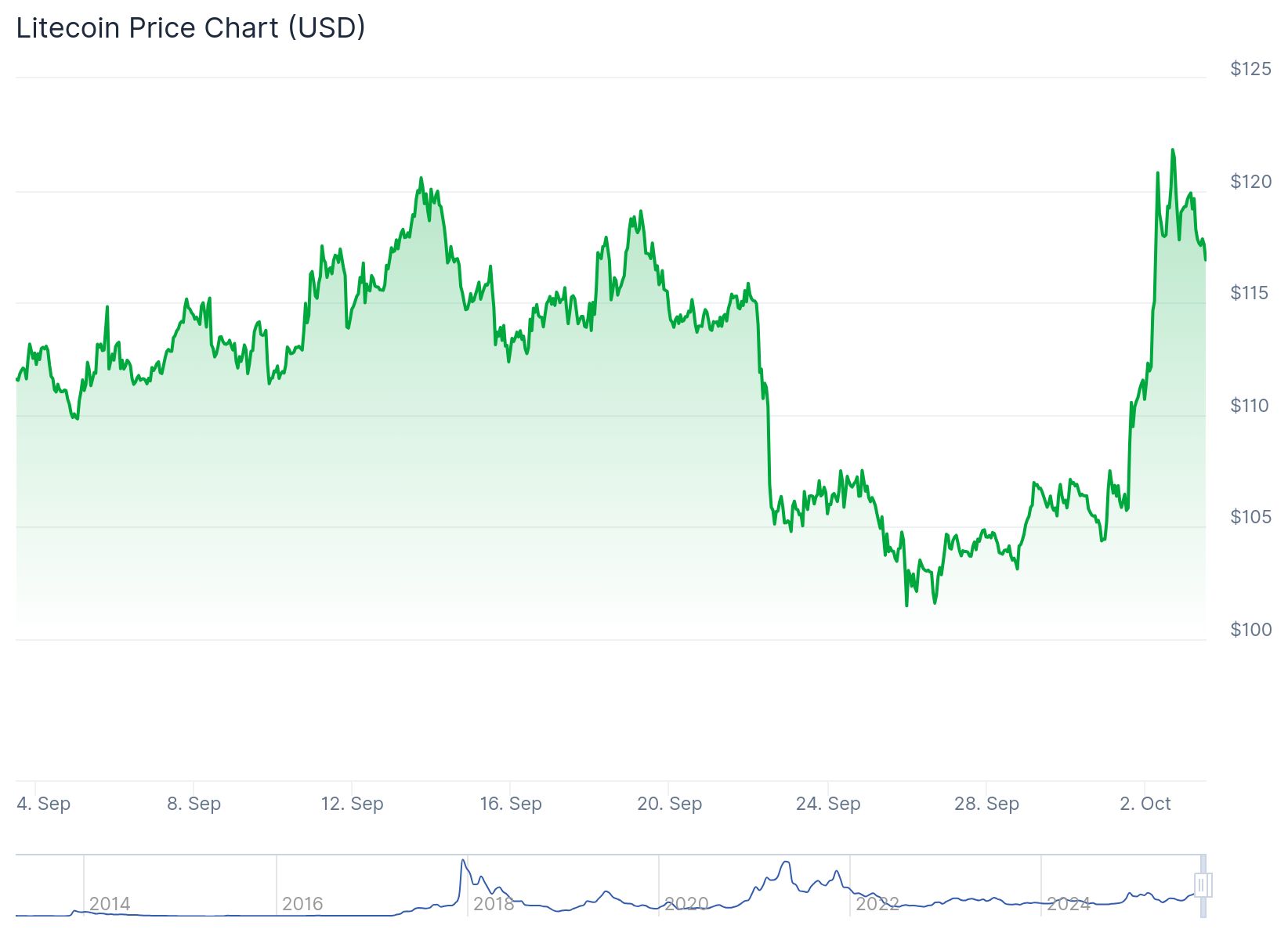

- Litecoin (LTC) surged 15 percent over the week, despite regulatory uncertainty.

What Happened?

Canary Capital’s bid to launch a spot Litecoin ETF is in limbo after the SEC remained silent past its expected decision date. The delay stems from a combination of procedural changes at the SEC and the ongoing federal government shutdown that has forced the agency to operate with minimal staff.

SEC Shifts Rules as Shutdown Freezes Activity

The final decision on the Canary Litecoin ETF was originally due on October 2 under the 19b-4 rule. However, Canary withdrew its 19b-4 filing on September 25 at the SEC’s request, which coincided with the agency’s push toward using new Generic Listing Standards. This move changes the regulatory process, making traditional deadlines effectively irrelevant.

According to Bloomberg ETF analyst James Seyffart, the SEC now wants all issuers to file under the new framework, stating, “Which means this deadline date might not matter at all.” The shift has created confusion across the industry, with dozens of crypto ETF applications in flux.

Lot of questions from clients and people on here because the @CanaryFunds Litecoin filing was technically due today under 19b-4. But as multiple people have reported (including @EleanorTerrett) it looks like SEC wants everyone to file under the new Generic listing standards for… https://t.co/HdmW7IfQjg

— James Seyffart (@JSeyff) October 2, 2025

At the same time, the government shutdown has severely limited the SEC’s capacity to function. Although the EDGAR system remains online, the agency publicly stated it will not review or approve new applications during the shutdown. This includes all crypto ETFs.

FOX Business reporter Eleanor Terrett emphasized that the SEC is operating with a skeleton crew and cannot respond to most media inquiries. “It’s unclear what remaining staff are working or what their priorities are at the moment,” she said in a post on X.

As I understand it, the shutdown could affect the $LTC ETF approval because the @SECGov still needs to sign off on the S-1 and the agency is operating on a skeleton crew.

— Eleanor Terrett (@EleanorTerrett) October 2, 2025

It’s unclear what remaining staff is working/what their priorities are at the moment. Since the generic… https://t.co/uD1uO9udtO

Growing Concerns Over Altcoin ETFs

The Litecoin ETF was expected to be the first altcoin ETF approved under the Securities Exchange Act of 1933. Its delay has cast doubt on the fate of other pending ETF proposals for tokens like Solana (SOL), XRP, Dogecoin (DOGE), Cardano (ADA), and Hedera (HBAR). Over 90 digital asset products are currently awaiting approval.

Bloomberg analyst Eric Balchunas recently said the new listing standards could make approval timelines faster under Rule 6c-11, potentially streamlining the process. Still, that promise is on hold until the government resumes full operations.

Nate Geraci, co-founder of the ETF Institute, warned, “ETF Cryptober might be on hold for a bit.” He added that prolonged delays would slow the momentum altcoin ETFs had built heading into October.

Market Reacts to Uncertainty

Despite regulatory limbo, Litecoin’s price jumped 15 percent in a week, currently trading around $116.89. The LTC derivatives market also saw increased activity, with total open interest rising 25 percent over the past week to $962.89 million.

However, short-term sentiment appears mixed. CoinGlass data shows LTC futures open interest fell 0.80 percent on Binance in the last 4 hours but rose modestly on OKX and Bybit.

Meanwhile, the broader crypto market also showed strength. The total crypto market cap climbed to $4.16 trillion. Bitcoin crossed $120,000 and Ethereum recovered to $4,500.

CoinLaw’s Takeaway

I’ve been tracking ETF developments in crypto for years, and this moment is both exciting and frustrating. The SEC’s move toward generic standards could be a game changer by speeding up approvals. But right now, the government shutdown feels like pulling the emergency brake on what could have been a breakthrough month for altcoin ETFs. In my experience, regulatory clarity often moves at a snail’s pace, but when the floodgates open, things move fast. So while this delay is a letdown, I still think we’re on the verge of something big. Litecoin and others may just need to wait a little longer.