Imagine this: You’re a business owner in New York trying to send funds to a partner in Singapore. Time is money, but the transfer takes days, and fees eat into your profits. Now, picture the same transaction happening in seconds, with fees so low they’re almost negligible. That’s the world XRP is building, a sharp contrast to SWIFT, the legacy system that has powered global banking for decades.

As financial ecosystems evolve, the battle between XRP, a blockchain-based payment protocol, and SWIFT, the traditional interbank messaging system, has intensified. From transaction speeds to compliance capabilities, the numbers tell a compelling story of innovation versus legacy.

Editor’s Choice

- XRP network capacity reaches 1,500+ TPS, while traditional cross-border rails like SWIFT still operate around 5–7 TPS on average, underscoring a major speed advantage for XRP-based flows.

- Global high-value payment infrastructures collectively move over $21 trillion in payments per day, with SWIFT-related rails responsible for roughly 20% of this flow.

- Ripple-linked payment partners now span 55+ countries, with especially strong presence across North America, Europe, Asia-Pacific, Latin America, and Africa.

- In the Asia-Pacific region, Ripple-powered corridors generate about 56% of global on-demand liquidity volume, driven by remittance-heavy markets like Japan and the Philippines.

- XRP trades around $2.00 in early 2026, with institutional products such as spot ETFs attracting about $1 billion in net inflows and supporting growing cross-border utility demand

Recent Developments

- Ripple’s Liquidity Hub continues to roll out enterprise routing upgrades, supporting over 6 major crypto assets and smart order pricing across multiple venues.

- Swift has expanded SDKs and tooling to streamline plug-and-play integrations for third-party fintechs and bank platforms.

- XRP Ledger now underpins carbon-neutral operations, with Ripple’s $100 million climate pledge helping it achieve full decarbonization status.

- Swift’s CBDC sandbox has involved more than 30–38 institutions and processed over 750 test transactions across tokenized and FX use cases.

- Ripple’s sustainability roadmap targets carbon neutrality before 2030, with interim milestones already surpassing 90% of required offsets.

- Swift’s experiments with tokenised assets and CBDCs span 200+ potential connected networks and markets via a single interoperability layer.

- XRP Ledger enhancements emphasize real-time messaging and programmability while keeping settlement times near 3–5 seconds and fees around $0.0002.

- Swift has conducted interoperability tests with public-chain ecosystems, including Ethereum-compatible environments via cross-chain protocols.

- Ripple has begun publishing more detailed periodic disclosures on volumes, liquidity, and sustainability metrics to bolster institutional transparency.

- New Swift payment pilots aim to deliver low-value cross-border payments to end beneficiaries in under 10 minutes in a large share of corridors.

Transaction Speed Comparison Between XRP and SWIFT

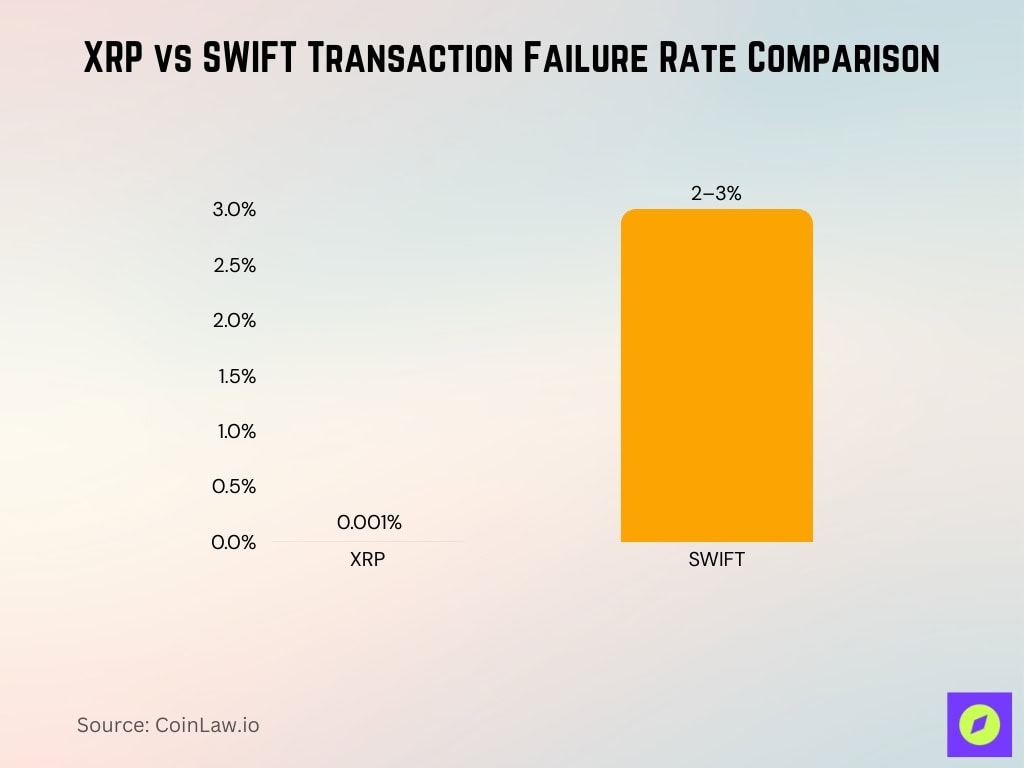

- XRP’s transaction failure rate remains below 0.001%, versus SWIFT error or repair rates estimated around 2–3% for international wires.

- XRP executes transactions within 3–5 seconds globally, with average settlement consistently under 5 seconds.

- Traditional SWIFT transfers typically take 1–5 business days, translating to roughly 24–120 hours end-to-end.

- RippleNet confirmations align with XRPL’s average 3.5-second ledger close time, delivering near-instant payment finality.

- SWIFT cross-border payments still commonly require around 2 business days to fully settle for many retail banks.

- Over 90% of XRP payments reach finality in under 10 seconds, even during elevated network activity.

- Lab tests show large-value XRP transfers (e.g., €10 million) can clear in under 6 seconds, while comparable SWIFT transfers can exceed 24 hours.

- Real-time payment solutions leveraging XRP have expanded to 20+ countries, especially in Asia-Pacific and remittance corridors.

- SWIFT corridors exhibit a latency drift of around 4% YoY, reflecting growing complexity in compliance and intermediary checks.

- In peak 2025–early 2026 periods, XRP on-chain activity rose over 50%, with daily transactions nearing 1 million, supporting high-frequency cross-border throughput.

Overview of XRP and SWIFT as Payment Systems

- XRP Ledger validates payments in 3–5 seconds using a consensus protocol that finalizes blocks every few seconds.

- SWIFT now connects over 11,000 institutions across more than 200 countries and territories.

- RippleNet counts 300+ institutional partners globally, spanning banks, fintechs, and remittance providers.

- XRP interoperates with 40+ fiat currencies and, via cross-chain links like Wormhole, 35+ additional blockchain networks.

- XRP Ledger has processed over 4 billion transactions cumulatively, supporting roughly $95 billion in on‑demand liquidity volume.

- SWIFT-related high-value payment rails help move an estimated $5+ trillion in cross-border payments per day.

- Each XRP transaction consumes about 0.0005 kWh, over 99.99% less energy than Bitcoin’s ~700 kWh per transaction.

- SWIFT’s ISO 20022 migration and gpi enhancements now support richer data and faster tracking across 80+ live markets.

- XRP infrastructure runs 24/7/365 with a target uptime above 98%, while many SWIFT-connected banks still batch settlements in regional business hours.

- RippleNet users report around $550 million in annual cost savings from reduced FX spreads, fees, and trapped liquidity.

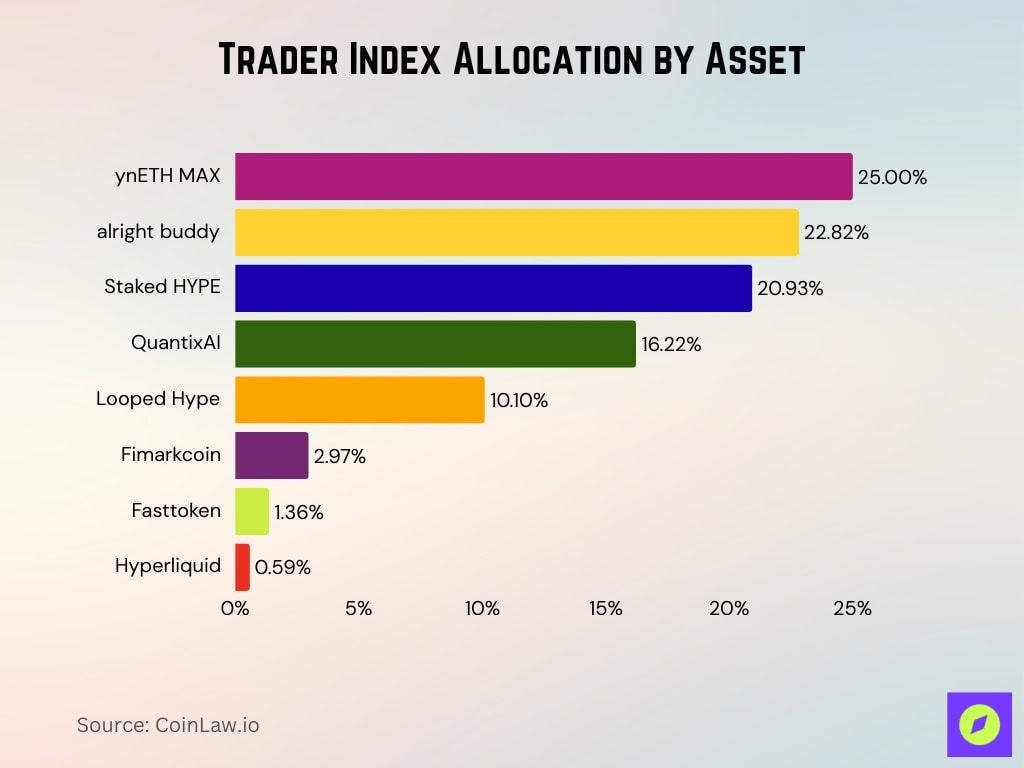

Trader’s Current Index Allocation Breakdown

- ynETH MAX holds the largest allocation at 25%, reflecting strong confidence in Ethereum-based assets.

- alright buddy follows with 22.82%, indicating a major strategic position in this asset.

- Staked HYPE accounts for 20.93%, showing a solid commitment to staking-driven returns.

- QuantixAI makes up 16.22%, highlighting belief in AI-driven trading solutions.

- Looped Hype represents 10.1%, rounding out the mid-range portfolio picks.

- Fimarkcoin is allocated 2.97%, suggesting minor exposure to niche plays.

- Fasttoken holds just 1.36%, a smaller but possibly experimental bet.

- Hyperliquid has the smallest allocation at 0.59%, indicating minimal exposure.

Security and Compliance Metrics

- XRP Ledger reports uptime above 98% for institutional clients, with no major protocol-level hacks disclosed to date.

- Recent industry reviews cite 5+ notable SWIFT-related cyber incidents over the last year, none resulting in systemic data-loss events.

- RippleNet deployments achieve about 87% integration of AML/KYC and sanctions screening among licensed financial institutions using its rails.

- SWIFT’s Customer Security Programme now records compliance attestations from roughly 97% of participating institutions globally.

- Ripple-powered payment flows connect regulated entities in 50+ Travel Rule-active jurisdictions as global oversight surpasses 80–90 implementing countries.

- FATF’s Travel Rule framework has been adopted or is in progress in 99 of 117 surveyed jurisdictions, tightening expectations on cross-border crypto compliance.

- XRP Ledger operations rely on 190 active validators with 35 on the default UNL, enforcing cryptographic finality for every transaction.

- SWIFT’s ISO 20022-aligned compliance stack and CSP controls now underpin screening and monitoring in 120+ countries.

- Independent risk analyses show XRP-based systems can reduce fraud exposure by roughly 30–35% compared with legacy payment rails.

- Real-time compliance and monitoring tools now cover SWIFT traffic in more than 140 countries, enhancing anomaly detection for high-value transfers.

Use in Cross-Border Transactions

- Ripple’s On-Demand Liquidity and payment stack have processed over $95 billion in cumulative cross-border volume, with monthly ODL flows above $15 billion.

- Around 93% of XRP-based cross-border payments settle in under 10 seconds, supporting near-instant retail and B2B remittances.

- Traditional SWIFT cross-border payments still average roughly 1–3 business days end-to-end for many corridors.

- In Asia-Pacific, about 45% of major remittance providers now use blockchain or digital-asset rails alongside or instead of SWIFT.

- Bank pilots with XRP (such as Santander-style trials) cut settlement times from roughly 24–48 hours to under 5 seconds for test transfers.

- SWIFT continues to dominate high-value transfers above $1 million, with wire transfers handling nearly 80% of B2B cross-border value.

- Ripple-linked payment solutions are estimated to save users over $1.5 billion in aggregate remittance and FX fees versus legacy rails.

- XRP-powered corridors across 55+ countries now handle more than $15 billion in cross-border flows each month.

- XRP usage cuts pre-funded capital requirements by over 60% for institutions that replace nostro accounts with ODL-based flows.

- SWIFT’s new retail cross-border scheme targets 75% of payments reaching beneficiary banks within 10 minutes for low‑value transfers.

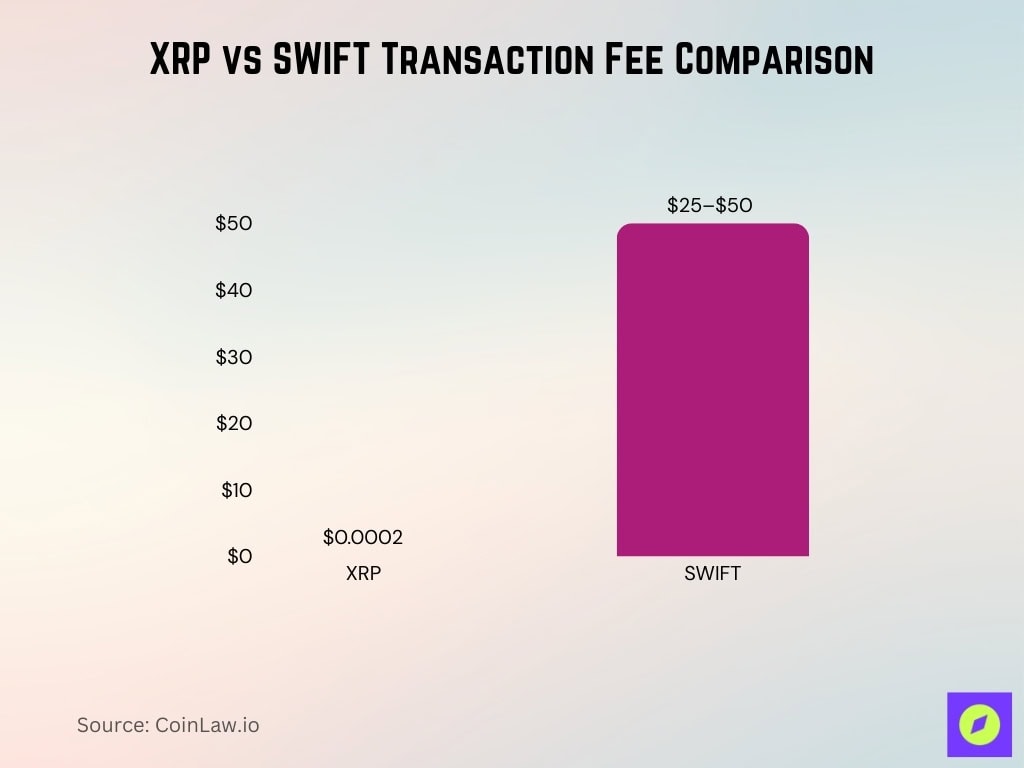

Cost Efficiency: XRP Fees vs SWIFT Transfer Charges

- XRP’s median on-ledger fee stays around $0.0002 per transaction, even during high-volume periods.

- Typical SWIFT-based bank wires still cost about $25–$50 per transfer, before FX markups and agent fees.

- RippleNet remittance corridors often price total costs near 0.3% of the transfer amount, including FX and network fees.

- SWIFT corridors to low-income destinations can average around 7% in total remittance cost, well above global targets.

- RippleNet enterprises collectively report roughly $550 million in annual savings versus legacy cross-border rails.

- Financial institutions using XRP rails have reduced end-to-end operational costs by about 45% compared with SWIFT-based setups.

- XRP infrastructure can run with roughly 90% less payment operations overhead than traditional correspondent banking networks.

- Hidden FX spreads and intermediary bank charges on SWIFT routes can add an extra 3–5% to the effective transfer cost.

- High SWIFT fee structures remain a barrier in 30+ emerging markets, highlighted by multilateral financial bodies.

- Ripple’s On-Demand Liquidity solution cuts pre-funding and nostro requirements by approximately 65% for institutional corridors.

Market Share in Institutional Payments

- Ripple reports over $95 billion in cumulative institutional payment volume, with on-chain and ODL flows growing more than 50% YoY.

- Analysts estimate XRP-linked rails could realistically capture 2–3% of SWIFT’s payment volume in the near term, versus SWIFT still commanding 75–80% of institutional flows.

- In Latin America, blockchain and XRP-style payment rails are involved in roughly 25% of cross-border corporate transactions.

- SWIFT-enabled institutions help move roughly $5 trillion in cross-border value per day, exceeding $120 trillion annually in institutional payments.

- Ripple’s average institutional payment size sits in the low- to mid-$200,000s, reflecting a shift from small remittances to larger B2B flows.

- Ripple onboarded 30+ new major institutional partners over the last year, keeping its total financial institution count above 300.

- XRP’s institutional client retention metrics remain above 90%, supported by multi-year contracts and embedded payment integrations.

- Average all-in costs for institutional payments on RippleNet are near $0.001–$0.01 per transaction, compared with about $30+ via traditional SWIFT-based wires.

- RippleNet usage among Fortune 500 firms has climbed from 32 to 47 companies over roughly a year, signalling rising blue-chip adoption.

- Spot XRP ETFs and related institutional products now hold around $1.4–1.5 billion in assets, reinforcing XRP’s role in institutional payment strategies.

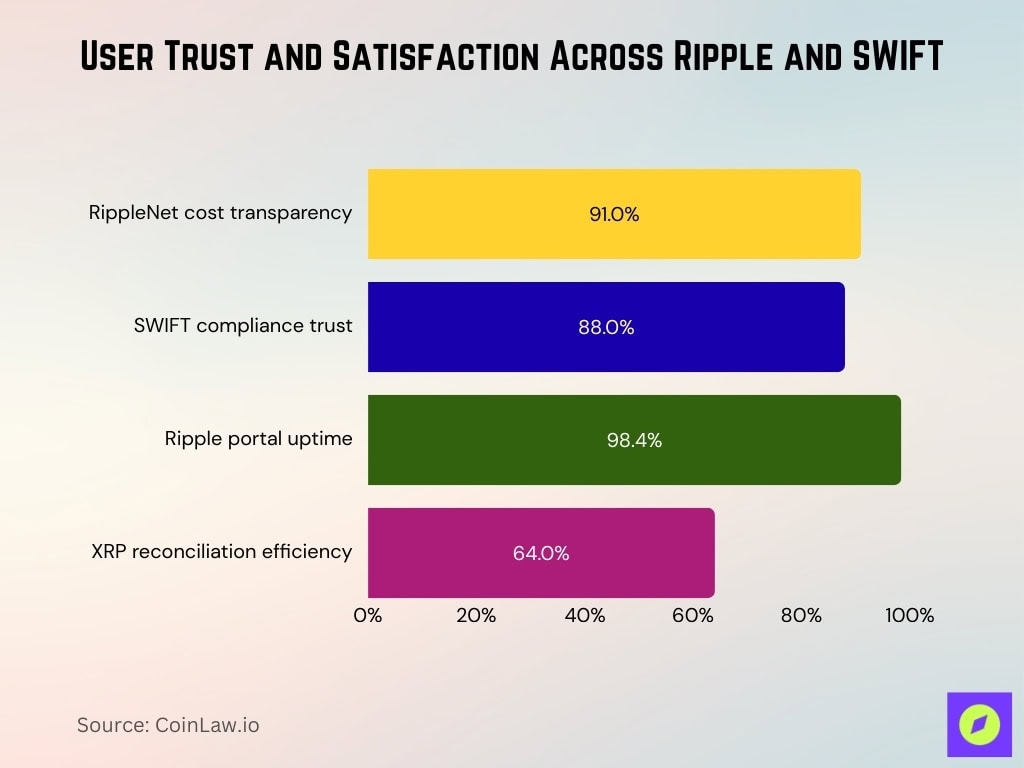

User Trust and Satisfaction Metrics

- 91% of RippleNet clients cite “cost transparency” and “real-time visibility” as primary advantages.

- 88% of SWIFT users rate its compliance and risk controls as a key reason for continued reliance.

- Ripple reported 98.4% uptime for partner access portals across the first half of the year.

- 64% of XRP-using businesses report average reconciliation times cut roughly in half.

- XRP’s Net Promoter Score climbed to 72, reflecting strong advocacy among enterprise users.

- SWIFT posted a satisfaction score of 61 in surveys of institutional banking clients.

- 3 out of 5 RippleNet clients say XRP Ledger integration lifted customer retention by over 15%.

- User complaints about SWIFT payment delays peaked at over 7,100 global support tickets in a single month.

- Ripple’s onboarding timeline dropped to under 7 days, versus SWIFT’s typical 2–6 weeks window.

Scalability and Network Capacity

- XRP Ledger consistently processes around 1,500 TPS today, with stress tests showing capacity above 65,000 TPS using off-chain scaling and payment channels.

- SWIFT’s network handles roughly 44.8 million payment messages per day, equating to about 5–7 TPS when averaged globally.

- XRP network usage jumped about 38% YoY, driven by DeFi, tokenized assets, and rising institutional payment flows.

- XRPL has recorded daily peaks above 5.1 million transactions while maintaining a near 100% success rate and low fees.

- New routing and optimization features on SWIFT have cut average latency by roughly 10–11%, improving throughput under heavy loads.

- Ripple-led throughput enhancements and parallelization have effectively delivered around 2x transaction capacity without increasing node counts.

- SWIFT’s instant cross-border settlement pilots are targeting up to 10,000 concurrent transactions per second in controlled environments.

- Lab simulations on XRPL infrastructure have demonstrated the ability to support 100,000+ TPS under synthetic, high-load conditions.

Impact of Regulations on XRP and SWIFT

- Ripple now holds full or expanded licenses in 10+ key jurisdictions, including Singapore’s broadened MPI regime under MAS.

- SWIFT’s standards and compliance stack touch over 200 national regulatory frameworks and global rulesets such as ISO 20022 and Basel III.

- Courts and regulators in major markets increasingly treat XRP as a utility-style token for payments, separating it from traditional securities classifications.

- A draft U.S. “Clarity Act” would deem XRP and several large-cap tokens non-securities when packaged in regulated products like ETFs.

- Ripple has paused or limited services in at least 2 restrictive jurisdictions while expanding licensed operations in others, such as Singapore.

- Surveys show roughly 80%+ of financial executives link clearer digital-asset rules with faster enterprise adoption of XRP-powered payment rails.

- SWIFT has updated sanctions and screening controls in response to more than 20 regional regulatory changes during the last year.

- FATF-style Travel Rule and AML expectations now apply in about 99 of 117 tracked jurisdictions, directly shaping XRP compliance implementations.

- XRP-facing compliance dashboards increasingly aggregate real-time KYC/AML data feeds from 20+ national or regional databases.

- At least 6 major regulatory bodies are still assessing how to fit SWIFT-linked digital-asset services into existing rules, slowing down on-chain integration.

Frequently Asked Questions (FAQs)

Ripple’s CEO projects that XRP could capture up to 14% of SWIFT’s total transaction volume within five years.

If XRP captures 14% of SWIFT’s $150 trillion annual volume, that equals roughly $21 trillion per year.

XRP transactions settle in 3–5 seconds, while SWIFT transfers typically take 36–96 hours (1.5–4 days).

XRP’s average per‑transaction cost is about $0.0002, versus SWIFT’s $26–$50 fee per transfer.

Conclusion

As we move deeper, the lines between traditional and decentralized finance are blurring faster than ever. SWIFT remains a global payments giant, backed by decades of trust and infrastructure. But XRP is gaining undeniable traction, especially in areas where speed, cost, and real-time tracking are vital. The statistics reveal a growing pivot: institutions and emerging markets alike are looking to blockchain-driven alternatives that streamline operations without sacrificing compliance or control.

Whether one chooses SWIFT’s security and regulatory rigor or XRP’s agility and scalability, the payments landscape is being redefined, one transaction at a time.