Imagine this: You’re splitting a dinner bill with friends, shopping online, or even paying for a cup of coffee at a local café. Venmo, a name synonymous with seamless peer-to-peer payments, has revolutionized how people in the U.S. manage their finances. Founded in 2009, Venmo has transformed into much more than just a digital wallet; it’s now a vital part of the social and economic fabric. Today, the company’s impact continues to grow, fueled by cutting-edge innovations and a rapidly expanding user base. This article explores key Venmo statistics, unpacking its milestones, growth, and influence.

Editor’s Choice

- As of early 2025, Venmo is estimated to process over $300 billion annually, according to recent market projections, though exact Q4 data is pending from PayPal.

- Venmo reportedly surpassed 90 million users as of late 2024, with Q1 2025 estimates suggesting continued user growth, though official user counts are not released quarterly.

- Approximately 44%–47% of small U.S. businesses accepted Venmo, with growth concentrated in hospitality and services.

- Venmo’s transaction fee revenue stood at $1.62 billion in 2025.

- Venmo is now accepted at over 2.55 million POS terminals in 2025.

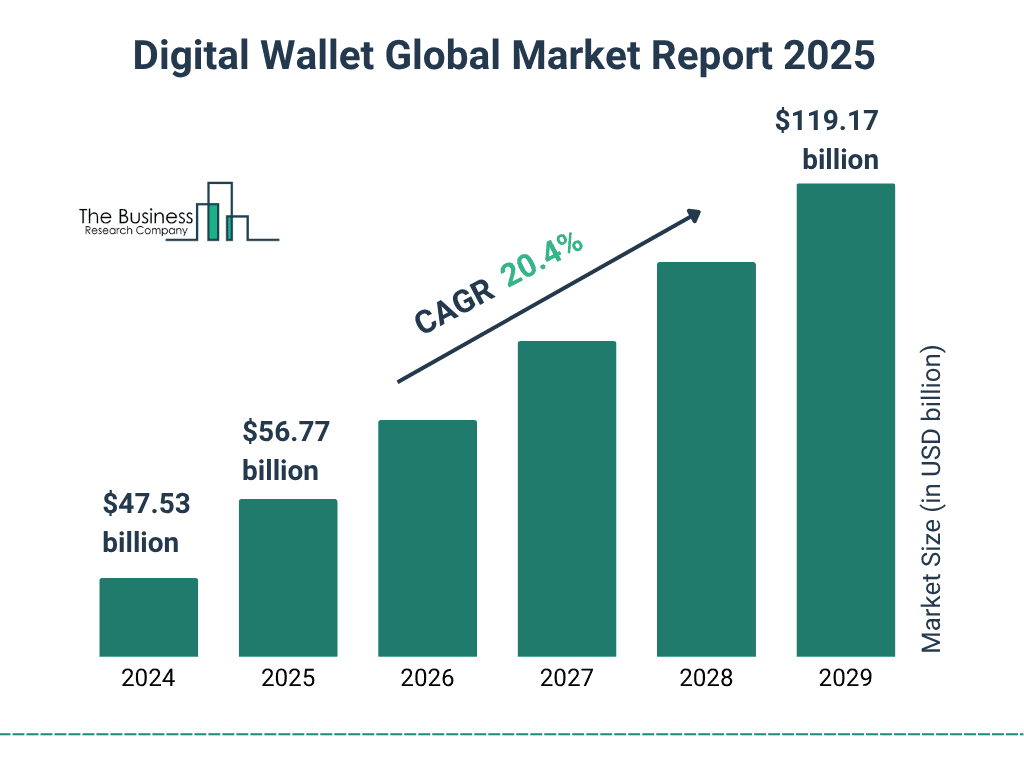

Global Digital Wallet Market Growth

- The global digital wallet market is projected to expand to $119.17 billion by 2029.

- This reflects a compound annual growth rate (CAGR) of 20.4%, signaling strong adoption across both developed and emerging markets.

- In 2025, the market value is expected to reach $56.77 billion, driven by rising mobile payments and e-commerce penetration.

- The steady growth trend highlights increasing consumer trust in contactless and app-based payment systems.

- By 2029, the market will have more than doubled in size, positioning digital wallets as a core element of global financial infrastructure.

POS vs. Online Payments in the U.S.

- Small businesses using Venmo saw a 14% lift in checkout conversion in 2025, especially in the food and beverage.

- 73% of U.S. college campuses support Venmo for student payments and tuition services in 2025.

- The average POS transaction value is $47, while online payments average $72 on Venmo in 2025.

- 87% of all Venmo transactions occur in U.S. dollars in 2025, with euro and pound use rising for cross-border trades.

Businesses, Small and Large, See Higher Conversion with Venmo at Checkout

- Businesses saw a 17% higher checkout completion rate after enabling Venmo at payment gateways in 2025.

- Venmo’s “Pay Later+” feature boosted high-ticket retail sales by 28%, especially in fashion and electronics.

- Small businesses cut payment processing time by 22%, improving checkout flow and satisfaction ratings in 2025.

- Venmo ranks third with a 16.2% market share at U.S. e-commerce checkouts in 2025.

- Large retailers running Venmo ads gained a 14% uptick in loyalty program registrations and repeat purchases in 2025.

The Continued Rise of Social Commerce

- 30% of Venmo users purchased products directly from social media ads linked to Venmo payment options in 2025.

- Influencer-driven sales leveraging Venmo saw a 25% higher conversion rate than traditional payment methods in 2025.

- Small businesses on social platforms using Venmo saw a 35% growth in monthly revenue in 2025.

- Venmo’s “Pay with Venmo” button on Etsy increased sellers’ sales by 15% year-over-year in 2025.

- Social media-linked Venmo transactions now represent 20% of the platform’s total payment volume in 2025, highlighting its growing e-commerce impact.

- Peer-to-peer payments tied to group events and crowdfunding campaigns grew by 28% in 2025, showing Venmo’s popularity for communal payments.

Venmo User Demographics & Behavioral Insights

- 26% of Venmo’s active users are aged 25–34, making this the single largest age group in Venmo’s user base.

- 46–49% of users are male, while slightly more users (51–54%) are female, reflecting a balanced gender split in 2025.

- 32.6% of millennials report using Venmo to pay for drugs (including marijuana and prescription drugs), a finding from consistent multi-year surveys widely cited in the fintech sector.

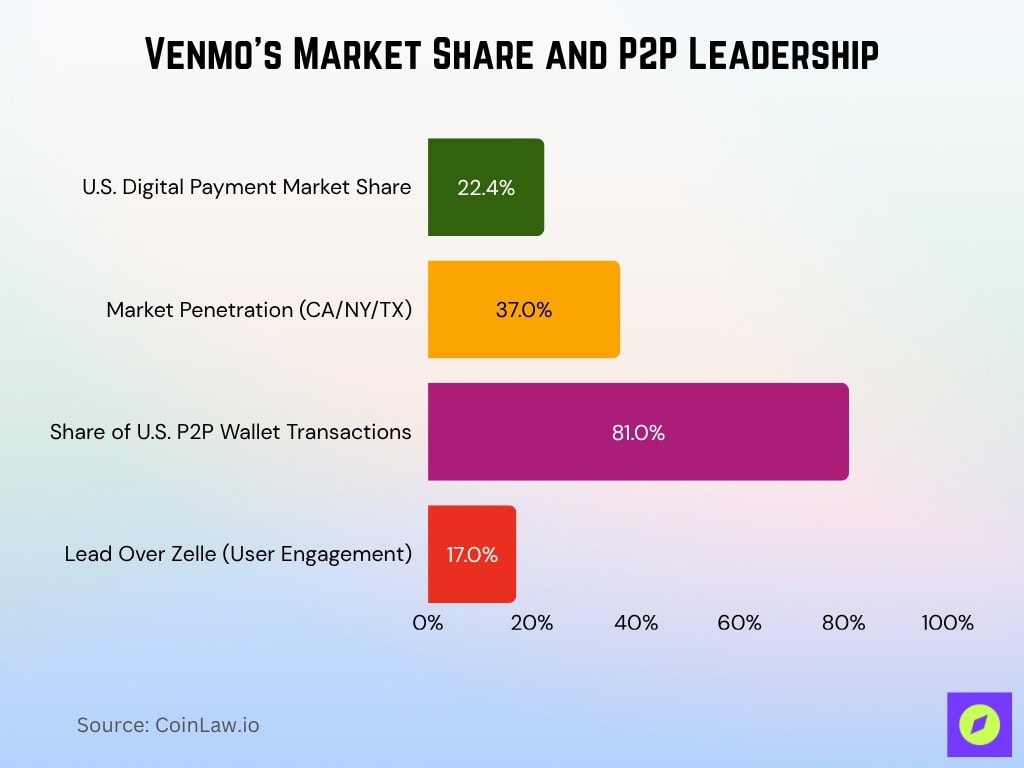

Venmo’s Market Position and Share in the U.S.

- Venmo holds a 22.4% share of the U.S. digital payment market in 2025, staying competitive with Apple Pay and PayPal.

- In California, New York, and Texas, Venmo leads with 37% market penetration, dominating urban digital wallet usage in 2025.

- Venmo commands an 81% share of all U.S. P2P digital wallet transactions in 2025, maintaining its leadership in peer payments.

- Venmo surpassed Zelle by 17% in monthly active user engagement as of Q2 2025, extending its lead in user activity.

Recent Developments

- Venmo expanded partnerships with Uber, Airbnb, and DoorDash, enabling seamless in-app payments across major lifestyle services in 2025.

- Venmo for Teens surpassed 1.6 million sign-ups in 2025, showing strong traction among younger users aged 13–17.

- Loyalty Rewards usage grew by 24% in 2025, driving more recurring transactions and user engagement.

- 48% of SMBs using Venmo reported revenue growth in 2025, boosted by new marketing automation tools.

Frequently Asked Questions (FAQs)

44%-47% of U.S. SMBs now accept Venmo in 2025.

Venmo’s transaction fee revenue hit $1.62 billion in 2025.

Social media-linked transactions represent 20% of Venmo’s total payment volume in 2025.

63% of transactions were peer-to-peer and 37% business-related in 2025.

Conclusion

Venmo’s journey from a simple peer-to-peer payment platform to a multi-faceted digital wallet exemplifies its dedication to innovation and adaptability. The company solidified its place as a market leader, bridging the gap between social and financial connectivity. With advancements in crypto adoption, integration with social commerce, and its growing presence in business transactions, Venmo continues to shape the future of digital payments. As it rides the wave of technological evolution, Venmo is not just keeping up; it’s defining the industry standard.